Additional accrual of insurance premiums for previous periods

Important In other words, if in the period for which additional insurance premiums are calculated, the tax base for income tax was unprofitable and the tax was not paid at all, then paragraph 1 of Article 54 of the Tax Code of the Russian Federation cannot be applied.

In this situation, you need to submit an updated tax return for the previous period with the amount of expenses increased by additional accrued insurance premiums. If last year the tax base for income tax was positive and the amount of tax was paid to the budget, then an updated declaration may not be submitted, but an additional assessment may be taken into account in the current year when the audit report was drawn up (or the organization independently identified an error in the calculation of insurance premiums) . At the same time, in the letter of the Federal Tax Service of Russia dated August 17, 2011 No. AS-4-3/13421, a different approach was voiced. Figure 38 In the second quarter, the organization calculated contributions at this “preferential” tariff and submitted the corresponding reports, while it did not have the right to apply such a tariff. Figure 39 This error was discovered in the third quarter. Corresponding changes are made to the accounting parameters setting - the correct tariff “Organizations using the simplified tax system, except those specified in paragraph 8 of part 1 of Article 58 of the Federal Law of July 24, 2009 No. 212-FZ” is indicated, which has been in force since April. The date when changes were recorded is the date when the error was actually detected.

Figure 40 During the next calculation of insurance premiums in July, additional charges for previous periods are made. Figure 41 When generating reports for the 3rd quarter, the recalculation amount will be taken into account in section 4, and also section 2.1 will be additionally formed with the “old” tariff code 07 and filled in indicators “from the beginning of the billing period”.

Correcting errors in the RSV: in words and in deeds

→ Article from the magazine “MAIN BOOK” is current as of August 25, 2017.

They are also not subject to the increased tariff rate of 10%.

E.A.

Sharonova, leading expert The procedure for completing it says quite succinctly about submitting an updated calculation of contributions. In this regard, the Federal Tax Service in June issued two clarifications on how to provide clarifications in case of errors in the personal data of employees and in total indicators. But it turns out that in reality everything does not happen exactly as it is written in the instructions.

Attention: If before submitting the clarification you pay the amount of arrears in contributions and penalties, then you will not face a fine. According to the Tax Code, you are required to submit an updated calculation of contributions only if, due to an error, the amount of contributions payable is underestimated.

Then the clarification must be submitted for the period in which the error was made, , , .

And this happens, in particular, when: •contributions were not calculated due to the fact that some payments were not included in the taxable object, or Section 3 was not submitted as part of the calculation for the employee receiving the payments, and, as a consequence, his contributions did not fall into section 1; •contributions were not calculated due to the fact that in non-taxable amounts they took into account something that should not have been there, for example, the entire amount of daily allowance, while excess amounts are now included in the object of taxation; • in Appendix 2, where the amount of VNiM contributions to be paid is determined, when filling out on paper, when filling out the monthly breakdown, the sign “2” (to be reimbursed) was erroneously indicated instead of the sign “1” (to be paid). If, due to an error, the contributions turned out to be overestimated or, after making corrections, the amount of contributions did not change, then submitting an update is your right, not your obligation. Although there is hardly an organization that wants to donate money to the budget.

Therefore, in case of overpayment, as a rule, an amendment is also provided.

Attention: If the calculation of contributions reflects incorrect amounts that do not result in underpayment of contributions, there will be no penalty for inaccurate information.

In what cases and by what procedure are additional insurance premiums calculated in 2021?

Additional accrual: what is it like? How is it regulated and how is it produced? You will learn about all this from this article.

Still looking for an answer? It's easier to ask a lawyer!

Write your question using the form (below), and our lawyer will call you back within 5 minutes with a free consultation.

Additional calculation of insurance premiums is required if for the previous reporting period the premium base was mistakenly underestimated by the policyholder. This usually happens due to inexperience and ignorance of the law, although some citizens deliberately avoid paying insurance premiums. For example, when determining the size of the base, the policyholder forgot to include in the calculations any payment on which contributions are supposed to be calculated and the documents were transferred to the Pension Fund in an incomplete amount.

The following actions are required, in this order:

- Transfer them to the Pension Fund account.

- Submit to the local branch of the Pension Fund of Russia, where reports are usually submitted (Article 17 Part 1 of Federal Law No. 212 of July 24, 2009).

- Add additional contributions that were not previously taken into account.

- On 01/01/2021, Law No. 243 of 07/03/2021 came into force, according to which Part 2 of the Tax Code of the Russian Federation was supplemented with Chapter 34 “Insurance contributions in the Russian Federation”.

The law provides for fines in such cases.Now the Tax Inspectorate must administer insurance premiums.

- But those produced before the beginning of 2021 are still the same (Article 20 of Federal Law 250 of 07/03/2016). They also retained control over the correctness of expenses for temporary disability insurance and maternity benefits.

- If the updated data is transmitted before the money is transferred, the employer will have to pay a fine for non-payment (clause

1, part 4, article 17, part 1, article 47 of the Federal Law-212 of July 24, 2009).

Therefore, it is the insurance funds that decide which payments should be taxed and which should not.

right now through the form (below), and our specialists

Amounts of additionally accrued insurance premiums – other expenses

And the values in completed line 120 in RSV-1 must be equal to the corresponding values in the “Total” line in section 4. Separately, line 121 indicates contributions to compulsory pension insurance, additionally accrued from payments after exceeding the maximum base value.

How to fill out section 6.6 of RSV-1 Additional accrued amounts of contributions must be reflected not only in section 4 and in line 120 of section 1, but also in sections 6, which are issued separately for each employee. After all, additional charges appeared due to unaccounted payments in favor of specific individuals.

Info This means that unreliable personalized information was also provided on them previously. In this regard, in the calculation of DAM-1, corrective section 6 must be drawn up. In it, in subsection 6.3, the type of adjustment is noted - “corrective” and subsection 6.6 is filled in, which indicates the directly accrued amounts of contributions from payments of this individual (clause 35 of the Procedure for filling out DAM -1).

Since not all operations can be performed with the current date. Some difficulties may arise when making additional charges in 1C 8.2, since there are some peculiarities in performing this operation.

What period to take into account? The tax period for contributions to extra-budgetary funds is recognized as one calendar year. The reporting periods are:

- one block;

- half year;

- 9 months.

In this case, the rate for each period is set depending on the following factors:

- tax payer category;

- the type of fund to which transfers are made;

- the amount of income of the employee from whose salary payments are made.

Situations often arise when, for some reason, contributions are not paid not just for some individual reporting periods, but for years.

In this case, it is necessary to reflect the profits of previous years in the accounting records for the current year. In addition, a permanent negative difference is formed in accounting, as a result of which a permanent tax asset (PTA) is formed.

Changes in accounting and tax accounting at the same time are rare. Sometimes amounts are reduced only in tax accounting. For example, these include payments to unrealistic suppliers, whom inspectors considered to be fly-by-night companies.

Then there will be no changes in accounting. Example 2. In 2014, Xenon2 LLC had an on-site tax audit.

As a result, the inspectors considered that the company worked with unrealistic suppliers in 2013, and withdrew their payment for the products in the amount of 65,000 rubles. On this amount, an additional income tax of 65,000 * 20% = 13,000 rubles was assessed. In addition, a clear overestimation of depreciation in the amount of 14,000 rubles was revealed.

Recalculation of contributions for previous years is not reflected in the RSV

For example, when calculating the base for one of the past periods for which reports have already been submitted to the Pension Fund, you did not take into account any payment subject to contributions.

As a result, contributions based on the results of that “erroneous” period were accrued to the funds in an incomplete amount. Now the policyholder must add additional premiums from the unaccounted amount, pay them and submit the updated RSV-1 to his Pension Fund branch (Part 1, Article 17 of Law No. 212-FZ of July 24, 2009). Moreover, the procedure should be exactly this - first payment of fees, then submission of clarification. This way you can avoid a fine (clause 1, part 4, article 17, part 1, article 47 of Law No. 212-FZ of July 24, 2009). Submitting an update and an alternative option The policyholder can submit updated information on contributions in two ways:

- or submit exactly the updated RSV-1 for the “erroneous” period and in full.

If any errors occur during the operation of the program, you should contact your system administrator. In most cases, the reluctance of the program to work as required is caused by the actions of the accountant himself. In case of violation of the current legislation regarding contributions to extra-budgetary funds, the following sanctions are imposed on violators: The payment procedure is violated. Arrears are collected. The procedure for payment for social insurance for disability is violated. The procedure for payment for social insurance for disability is violated. Understatement of the base used for calculating contributions. Collection of a fine (20% of amount) Failure to submit required documents within the deadline RUB 200.

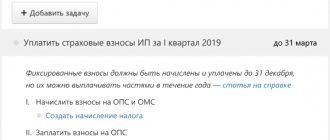

The individual entrepreneur prepares and submits reports to the Pension Fund on a quarterly basis. The sequence of actions for additional accruals is as follows: first, contributions are transferred, then proper reporting is submitted (updated RSV-1, etc.). If he doesn’t have employees, then he doesn’t need to report to anyone.

1.1 to pr.1 to r.1; sub.1.2 to pr.1, appendix 2 to r.1) and 3. BCCs are written for each type of insurance (section 1 of the form). A number of new BCCs have been approved for 2021 (in accordance with Order of the Ministry of Finance No. 230n dated December 7, 2016 .).

Insurance premiums are often not paid, and some individuals have been doing this for many years in a row. This should not be done, as this may lead to the imposition of penalties on the employer.

In addition, subsequent additional payments of insurance premiums for previous years to the budget will still need to be carried out, this is inevitable. Even if the transfer of the corresponding amounts in favor of the funds is carried out on time and without violations, it is imperative to first understand the following important points:

- when generating a report for past periods – what exactly to take into account;

- relating to inspection reports;

- process of reflection in financial statements (posting);

- work in the 1C program.

It is especially important to correctly display reporting in accounting programs.

Summoning for questioning to the tax office: tips to ensure everything goes smoothly. Would a SIMPLE taxpayer win in this situation?? I think this is the “only” one... The Pension Fund of Russia lost the case of a fine from the tax inspectorate for failure to submit the SZV-M. One of the recipes for fighting poverty: you need to transfer some from the consumer basket to the consumer goods... How they will reduce poverty Just today I was watching TV at breakfast.

But the court is on the side of the taxpayers, if you really are a thief, compliance with these recommendations, nerves of iron and the ability to bluff will be very...

- Additional accrual of insurance premiums for previous periods

- Recalculation of contributions for previous years is not reflected in the RSV

- Contributions as of January 1: arrears and overpayments

- Bad request

- Accounting for additional charges of insurance premiums

- Reflection of receivables for insurance premiums for the previous period.

- Accounting in 1C for arrears in the Pension Fund for the past period in 2021

How are additional insurance premiums calculated for past periods in 2021? Important: This can be done in one of the following ways:

- Submit the full corrected version of RSV-1 for the period where the error was made.

- Show additional accruals in sections 1 (line 120) and 4 for the current period (used when an error is detected after the first day of the third month following the expired reporting period).

Sample RSV-1 From January 1, 2017. After transferring information about it to the Federal Tax Service, will the Federal Tax Service be able to count it against upcoming contributions payments? — Neither the Tax Code of the Russian Federation nor the Law of 07/03/2016 No. 250-FZ contains direct provisions that tax authorities can offset overpaid amounts of insurance premiums for periods before 01/01.

2017 towards upcoming payments. For now, such an overpayment can only be returned. The policyholder must submit a refund application to the Pension Fund or Social Insurance Fund. The Fund will make a decision and send it to the Federal Tax Service for execution. — The policyholder has arrears in premiums as of 01/01/2017. In 2017, he submitted an updated calculation for 2021, the amount of contributions payable became less.

Therefore, if any inaccuracies were made when reflecting additional charges, then such precedents do not threaten the taxpayer with anything terrible. Working in the 1C program Sometimes some difficulties arise due to the need to reflect additional accruals in the special accounting program 1C ZUP - salary and management. Data entry in accordance with the drawn up inspection report is carried out for each employee, this operation looks like this:

- open the application;

- we find an employee whose income should be subject to additional accrual;

- open the menu in the “accrual” section;

- A new window will appear - click on the “tax” tab;

- click on “Taxable, income code”;

- select the type of deductions (name of the extra-budgetary fund).

Thus, all necessary data is entered into the 1C program.

In this case, it is necessary to make transfers on all grounds. Thus, if an individual entrepreneur conducts private practice and has entered into employment contracts with individuals, then he is obliged to make transfers both for himself and for his employees. It must be remembered that the employer is obliged to generate quarterly reports, which are subsequently transferred to the Pension Fund of Russia. Moreover, if the total number of employees is more than 50 people, then this must be done only electronically.

At the same time, individual entrepreneurs carrying out work without employees should not submit any reports. Legal grounds The very existence of various extra-budgetary funds, as well as the mandatory transfer of contributions to them, is enshrined at the legislative level.

If the fact of the existence of debt is not confirmed, submit to the tax authority an information letter from the funds about the absence of debt for reporting periods before 01/01/2017.

For what period should contributions be taken into account? As for the tax period in which the specified additionally accrued insurance premiums can be included in expenses for the purposes of calculating income tax, the Russian Ministry of Finance proposes to do this on the date of accrual of contributions. In this case, officials refer to subparagraph 1 of paragraph 7 of Article 272 of the Tax Code of the Russian Federation: the date of incurring other expenses in the form of taxes (advance payments for taxes), fees and other obligatory payments is the date of accrual of taxes (fees). The fact that insurance premiums are calculated for past periods, according to officials, does not matter.

In our opinion, we can agree with this position if we take into account the provisions of Article 54 of the Tax Code of the Russian Federation. After all, additional assessment of insurance premiums means that in previous tax (reporting) periods the taxpayer underestimated the amount of expenses accepted when calculating income tax. That is, he overpaid the tax.

Since not all operations can be performed with the current date. Some difficulties may arise when making additional charges in 1C 8.2, since there are some peculiarities in performing this operation. What period to take into account? The tax period for contributions to extra-budgetary funds is recognized as one calendar year. The reporting periods are:

- one block;

- half year;

- 9 months.

Organization of accounting for account 69

An enterprise that makes payments to employees in accordance with concluded employment contracts is obliged to record the accrual of insurance premiums for their subsequent transfer to an extra-budgetary fund. The law provides for compulsory medical, social and pension insurance for employees. The employer must also ensure payment of insurance premiums in case of occupational diseases and accidents at work.

To reflect the amounts of accrued and paid contributions to extra-budgetary funds, account 69 is used. To analyze and control the amounts of contributions, the organization can open sub-accounts in accordance with the types of transfers made.

Regulatory documents provide that account 69 can be used to reflect the following transactions:

- calculation of the amount of contributions (including fines, penalties);

- payment of the amount of contributions (fines, penalties);

- reflection of expenses for contributions to extra-budgetary funds.

It should be noted that on account 69 not only the amounts of obligations to the funds are recorded, but also credits coming from the Social Insurance Fund are made.

Subaccounts 69 accounts

- 69.01 – Social insurance payments

- 69.02.1 — Insurance part of the labor pension

- 69.02.2 — Cumulative part of the labor pension

- 69.02.3 — Contributions to supplement pensions for flight crew members

- 69.02.4 — Contributions to supplement pensions for employees of coal industry organizations

- 69.02.5 - Additional contributions to the insurance part of the pension for employees engaged in work with hazardous working conditions

- 69.02.6 - Additional contributions to the insurance part of the pension for employees employed in jobs with difficult working conditions

- 69.02.7 - Compulsory pension insurance

- 69.03.1 — Federal Compulsory Medical Insurance Fund

- 69.03.2 — Territorial Compulsory Medical Insurance Fund

- 69.04 - Unified Tax in the part transferred to the Federal Budget

- 69.05.1 - Contributions at the expense of the employer

- 69.05.2 - Contributions withheld from employee income

- 69.06.1 — Contributions to the Pension Fund (insurance part)

- 69.06.2 — Contributions to the Pension Fund (funded part)

- 69.06.3 — Contributions to the Compulsory Medical Insurance Fund

- 69.06.4 — Contributions to the Social Insurance Fund

- 69.06.5 - Compulsory pension insurance for entrepreneurs

- 69.11 — Calculations for compulsory social insurance against accidents at work and occupational diseases

- 69.12 — Calculations for voluntary contributions to the Social Insurance Fund for employee insurance in case of temporary disability

- 69.13.1 — Settlements using Social Insurance Fund funds for policyholders paying UTII

- 69.13.2 — Settlements using Social Insurance Fund funds for policyholders using the simplified tax system

Table of typical transactions for account 69

The basis for calculating the amount of insurance premiums is the amount of remuneration that is paid to the employee according to the employment contract. The amount of accrual of contributions is carried out according to Kt 69, transfers to extra-budgetary funds are reflected in Dt 69. Also, according to Kt 69 the amount of receipts of contributions credited from extra-budgetary funds in favor of the organization can be carried out.

Basic transactions on account 69 are reflected in accounting with the following entries:

| Dt | CT | Description | Document |

| 69 | 51 | Insurance premiums are transferred to an extra-budgetary fund | Payment order |

| 20 | 69 | Insurance premiums accrued to an employee of the main production | Payroll |

| 44 | 69 | Insurance premiums have been accrued to the employee who ensures the process of selling goods | Payroll |

| 99 | 69 | Accrual of fines and penalties for insurance premium payments | Accounting certificate-calculation |

| 51 | 69 | Refund of funds overpaid to extra-budgetary funds | Bank statement |

Example of postings for account 69

On January 31, 2016, Start LLC made a payment to K.R. Sazonov, an employee of the economic department:

- salary - 41,300 rubles;

- sickness benefit - 7,500 rubles. (including for the first 2 days at the expense of the organization - 2,350 rubles).

When paying Sazonov’s salary, the accountant at Start LLC calculated the amount of insurance premiums:

- Pension Fund for the insurance part of the labor pension: 41,300 rubles. x 14.0% = RUB 5,782;

- Pension Fund for the funded part of the labor pension: 41,300 rubles. x 6.0% = 2478 rub.;

- FSS for insurance premiums: 41,300 rubles. x 2.9% = 1198 rub.;

- Social Insurance Fund for contributions to insurance against accidents and occupational diseases: 41,300 rubles. x 0.2% = 83 rub.;

- FFOMS: 41,300 rub. x 1.1% = 454 rubles;

- TFOMS: 41,300 rub. x 2.0% = 826 rub.

The accountant at Start LLC reflected the payment of wages to Sazonov and the accrual of insurance premiums with the following entries:

| Dt | CT | Description | Sum | Document |

| 91.2 | 70 | The salary of K.R. Sazonov has been accrued. | RUB 41,300 | Payroll |

| 91.2 | 70 | Sickness benefits accrued (at the expense of Start LLC) | RUB 2,350 | Payroll |

| 69.01 | 70 | Sickness benefit accrued (at the expense of the state) | RUB 5,150 | Payroll |

| 91.2 | 69.01 | The amount of insurance contributions to the Social Insurance Fund has been calculated | 1198 RUR | Payroll |

| 91.2 | 69.01 | The amount of insurance premiums accrued (accidents and occupational diseases) | 83 rub. | Payroll |

| 91.2 | 69.02.1 | The amount of insurance premiums has been calculated (the insurance part of the pension) | 5782 rub. | Payroll |

| 91.2 | 69.02.2 | The amount of insurance contributions has been accrued (the funded part of the pension) | 2478 rub. | Payroll |

| 91.2 | 69.03.1 | The amount of insurance premiums accrued (FFOMS) | 454 rub. | Payroll |

| 91.2 | 69.03.2 | The amount of insurance premiums accrued (TFIF) | 826 rub. | Payroll |

| 69.01 | 51 | The amount of insurance contributions (accidents and occupational diseases) was transferred to the extra-budgetary fund. | 83 rub. | Payment order |

| 69.02.1 | 51 | The amount of insurance contributions (the insurance part of the pension) was transferred to the extra-budgetary fund | 5782 rub. | Payment order |

| 69.02.2 | 51 | The amount of insurance contributions (the funded part of the pension) was transferred to the extra-budgetary fund. | 2478 rub. | Payment order |

| 69.03.1 | 51 | The amount of insurance contributions was transferred to the extra-budgetary fund (FFOMS) | 454 rub. | Payment order |

| 69.03.2 | 51 | The amount of insurance contributions was transferred to the extra-budgetary fund (TFIF) | 826 rub. | Payment order |

Arrears on insurance contributions to the Pension Fund, Social Insurance Fund, Federal Compulsory Medical Insurance Fund: calculation of penalties." Posting penalties to the Pension Fund of the Russian Federation (to the Federal Tax Service): when to make the posting The day on which transactions to accrue the amount of penalties should be reflected is selected depending on whether the accountant paid the penalties himself or whether the obligation to pay them was discovered after an audit:

- when the accountant himself corrected the error and paid the penalty, the transactions are posted on the day of their calculation (and the day must be indicated in the calculation certificate);

- if a notice was received to remind you to pay penalties, the accountant makes an entry for the day when the decision to accrue them after the audit came into force.

Legislative acts on the topic It is recommended to study in advance: Document Title Federal Law of July 24, 1998 No. 125-FZ “On Compulsory Social Insurance” Norms for insurance premiums in cases of injury p.

Possible fines

Fines for violations when submitting the 4-FSS report for 9 months of 2018 are established by Art. 26.30 of Law No. 125-FZ.

Failure to submit a report for the 3rd quarter of 2021 is punishable by a fine of 5% of the amount of insurance premiums for the last three reporting months for each full or partial month of delay. The minimum fine is 1000 rubles, the maximum is 30% of the specified amount of contributions.

Also, the policyholder may be fined for submitting a report “on paper” if he is required to submit the form electronically.

Arrears on insurance contributions to the Pension Fund, Social Insurance Fund, Federal Compulsory Medical Insurance Fund: calculation of penalties." Posting penalties to the Pension Fund of the Russian Federation (to the Federal Tax Service): when to make the posting The day on which transactions to accrue the amount of penalties should be reflected is selected depending on whether the accountant paid the penalties himself or whether the obligation to pay them was discovered after an audit:

- when the accountant himself corrected the error and paid the penalty, the transactions are posted on the day of their calculation (and the day must be indicated in the calculation certificate);

- if a notice was received to remind you to pay penalties, the accountant makes an entry for the day when the decision to accrue them after the audit came into force.

Legislative acts on the topic It is recommended to study in advance: Document Title Federal Law of July 24, 1998 No. 125-FZ “On Compulsory Social Insurance” Norms for insurance premiums in cases of injury p.

Basic entries when paying penalties on insurance premiums

What are penalties and how are they calculated Methods for collecting penalties and the negative consequences of their late payment Reflection of penalties on insurance premiums in accounting Results What are penalties and how are they calculated Since 2021, insurance premiums have been divided in relation to the legislative norms establishing the rules for working with them:

- the bulk of contributions (for compulsory health insurance, compulsory medical insurance, compulsory health insurance for disability and maternity) began to be subject to the Tax Code of the Russian Federation and the requirements that apply to tax payments;

- contributions for injuries remained under the provisions of the Law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ.

However, the requirements for their payment have remained unchanged: insurance premiums must be paid by the payer on time and in full. If due to any circumstances they are not paid or not paid in full, not only the arrears are collected from the payer, but also a sanction for late payment, which is called a penalty. Please note that arrears in contributions cannot be repaid using overpayments incurred before 2021.

Info A return of the overpayment to the current account is possible only after the arrears have been repaid. For more details, see “Offsetting overpayments on contributions for periods before 2021 is not possible.” Attention The basis for payment of penalties (if they are not paid voluntarily) are the requirements imposed on the payer by the body supervising the relevant contributions (IFTS or Social Insurance Fund). Thus, penalties are the estimated amount that must be paid by a payer who has violated the deadline for paying contributions. They are calculated as a percentage for each day of delay, starting from the day following the payment deadline, which is established by law.

How to reflect arrears on insurance premiums in accounting

- D 26 K 69 - fear. contributions are determined for personnel belonging to general business units;

- D 28 K 69 - fear. contributions are calculated for employees involved in operations to correct defective products;

- D 29 K 69 - fear. contributions are calculated based on personnel employed in service farms;

- D 44 K 69 - fear. contributions are calculated based on personnel involved in the sale of products to consumers;

- D 70 K 69 - the cost of the voucher received from the Social Insurance Fund is deducted from the salary;

- D 51 K 69 - insurance premiums that were overpaid earlier and returned to the budget were credited to the current account;

- D 99 K 69 - reflects the amount of penalties or fines for insurance premiums.

- When carrying out any transactions on insurance premiums, the following entries are generated in the debit of the account.

Peculiarities of reflecting tax penalties in accounting To display penalties in accounting, you can use two accounts - 91 or 99. To display accrued penalties, it is recommended to use account 99, which allows you to avoid a permanent tax liability, since when generating an income tax return, the accrued penalty for insurance contributions are not included in the calculation of the tax base.

It is recommended to consolidate the use of account 99 in the accounting policy of the enterprise. List of possible entries for accrual of penalties for income taxes, VAT, personal income tax and insurance contributions Account Dt Account Kt Posting amount, rub.

How to reflect arrears on insurance premiums in budget accounting

In this case, the calculation basis is the wages and other employee benefits paid to them by the employing company. Each type of contribution has certain calculation features and an interest rate, as well as a limit on the base used for calculation. Until 2021, control over the calculation of insurance premiums was carried out directly by extra-budgetary funds, and starting from January 1, 2017, these powers were transferred to the tax authorities. Now the transfer of contributions, as well as reporting on them, must be sent to the Federal Tax Service at the place of registration of the company. However, this in no way affects the accounting and postings that are compiled in the organization, and, therefore, the correspondence and rules for calculating contributions remain the same.

Charges are generated from the next day after the delay. The penalty is accrued daily until the date of payment of the debt and penalties. If the debtor does not pay the debt in full, a fine is collected by force. That is, through the court. The debt amount is written off from bank accounts. If there are no funds, the property is seized. If a lot of time has passed, no coercive measures apply to the debtor, and the debt is considered uncollectible. In this case, it is written off. IMPORTANT! Refunds from the tax authority for overpayment of taxes can lead to the formation of arrears. Arrears on insurance premiums There are the following types of arrears on insurance premiums:

- According to the FSS. Occurs when there is a debt to the Social Insurance Fund. There is a certain procedure for calculating the amount of arrears: contributions already paid are deducted from the total amount of debt.

Insurance premiums in 1C 8.3 Accounting

The 1C 8.3 Accounting 3.0 program has some functionality for maintaining personnel records and payroll.

It is certainly not as advanced as in 1C: Salaries and HR Management, but still, in small organizations it is quite sufficient. Documentation and reporting complies with the law and is constantly maintained and updated.

In this article we will look at the main aspects of accounting for insurance premiums in 1C 8.3 and recommendations on what to do if they are not charged.

Pre-setting

Before you start calculating insurance premiums, you need to do a little setup of the program. The correctness of the calculations depends on it. Insurance premiums are a serious matter, so do not neglect the settings and be careful.

If you have not previously indicated the taxation system of your organization, be sure to do so in your accounting policy.

Accounting setup

First of all, let's start setting up accounting for our contributions. They are set up in the same place as the salary. In the “Salary and Personnel” menu, select “Salary Settings”.

By clicking on the “Insurance Premiums” hyperlink in the “Classifiers” section, you can view the parameters for calculating premiums. We will not focus on them, since the data in these registers is already filled in in the standard configuration delivery according to current legislation.

Now let's move on to setting up accounting for our contributions. In the salary settings form, select “Salary accounting procedure”.

At the very bottom of the form that opens, follow the link to set up insurance premiums.

In the window that opens, go to the “Insurance Premiums” section and fill in the required fields.

The tariff for NS and PP is set depending on the main type of activity for the previous year. The minimum tariff is 0.2 percent. It is approved by the FSS, to which documents are submitted every year to confirm the main type of activity.

Here you can also set up additional contributions for those professions who are entitled to them, and indicate whether there are employees with hazardous working conditions. At the very bottom you can put a mark on the transfer of additional insurance contributions for a funded pension in accordance with Federal Law No. 56 of April 30, 2008.

Expenditures

To correctly reflect insurance premiums in accounting, you need to make one more setting. In the salary setup form, select “Cost items for insurance premiums.” This is where the procedure for reflecting mandatory contributions from the payroll fund on accounting accounts is set up.

A list already filled in by default will open in front of you. If necessary, it can be supplemented or adjusted.

By default, the debit account will be 26, the credit account will be 69.

Accruals

There are many different types of accruals. This includes salary, sick leave, vacation and others. For each of them, you need to configure whether insurance premiums should be paid from them.

Let's return to the salary settings form. In the “Payroll calculation” section, select the “Accruals” item.

A list of all charges will appear in front of you. They can be edited or new ones added.

Open any accrual. You will see the “Type of Income” field. It is the value indicated in it that will determine whether insurance premiums will be calculated on it or not. In our example, we opened one of the standard accruals, so everything is already filled in here, but when adding new ones, do not forget to indicate the type of income.

Calculation of insurance premiums in 1C 8.3

Insurance premiums are calculated simultaneously with salary calculations. They are located on the “Contributions” tab of the relevant document. They are calculated automatically and subject to manual adjustment.

Let's see what contribution postings this payroll document generated.

Everything turned out as planned. We left the debit account as 26 by default, but if necessary, it can be changed in the salary settings (item “Salary accounting methods”).

Watch also a short video tutorial about payroll calculation in 1C 8.3:

Reports

All reports discussed below will be generated from the “Salaries and Personnel” menu, “Salary Reports” item.

“Analysis of contributions to funds”

This report provides a detailed and summary summary of data on the amounts of contributions by type, indicating charges. The report generation period is specified by the user.

“Taxes and fees (briefly)”

This report is very convenient for monthly generation. It is displayed by employee.

“Insurance premium accounting card”

This report is recommended by the FIU. It is very convenient for checking the accrual of contributions every year. Contribution amounts are broken down monthly.

Recalculation of insurance premiums

There are situations when it is necessary to adjust previously accrued insurance premiums. To do this, in the 1C: Accounting program, use the document “Recalculation of insurance premiums”.

In the header of the document, fill in the accrual month and billing period. In the case where additional accrual needs to be made without affecting previous periods, set the flag in the first field (see the figure below). If changes must be made retroactively, then set the flag in the second field (if it is necessary to generate an updated RSV-1 for the previous period).

Next, click on the “Calculate” button and the data will be filled in automatically.

Arrears and its role in tax accounting

Russian Pension Fund. This structure is a financial administrator that distributes funds, which subsequently go to:

- for the payment of pensions upon reaching a certain age;

- to pay for services provided to citizens of the Russian Federation under the compulsory health insurance system.

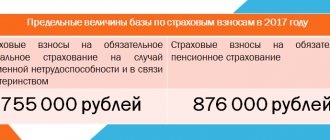

Payment of insurance premiums is carried out in the following order: Until the 15th day of each month following the reporting month If this date falls on a non-working day, then the last day of reporting is the next working day 22% Rate for pension insurance contribution Rate increases by 10% If the size of the insurance premium base the employer has more than a certain amount 5.1% Rate of contributions to the compulsory medical insurance system There is a certain category of employers who are exempt from paying insurance contributions. They are also not subject to the increased tariff rate of 10%.

Info In order for all mandatory payments to be made on time and in the required amount, it is necessary to pay special attention to the following points:

- what exactly to consider when drawing up a report;

- information regarding inspection reports;

- the process of posting, that is, reflecting information in the financial statements;

- work in the 1C program.

Due to the fact that not all transactions can be carried out on the current date, displaying reporting in accounting programs is important. Difficulties arise when additional charges are made in 1C 8.2, since this operation has its own specifics.

Postings All entries related to the reflection of additional amounts of taxes, contributions, fines and penalties accrued based on the results of audits are made on the date when the audit decision comes into force. For what period is it taken into account? The reporting period for contributions to pension contributions is considered to be 1 year.

On this page:

- What is arrears?

- How is arrears identified?

- Collection procedure

- Statute of limitations for collection

- Summary

Arrears is a term that can be found in legal documents dating back to the 19th century. Then taxes were collected from the peasants, but most did not have the means to pay.

Arrears arose. That difficult period for ordinary people has ended, but the term is still used now. What is arrears? According to the Tax Code, arrears are taxes or mandatory payments that have not been paid.

Simply put, it is debt. Arrears are collected from both individuals and legal entities. The funds paid are sent to the state budget. Tax arrears Tax payments require a set date for payment. If the company does not make payments, then arrears are accrued.

The following categories of employers are required to pay insurance premiums:

- All kinds of organizations with employees who are paid wages or working with contractors who are individuals.

- Individual entrepreneurs who work with hired employees or individual contractors.

- Individuals who do not have the status of an individual entrepreneur, but enter into employment contracts with other individuals and contractors.

- Individual entrepreneurs working under the patent system and conducting private practice - this category includes all kinds of notaries, lawyers, as well as other individuals.

Sometimes it happens that an employer simultaneously falls into several categories that are required to make appropriate contributions to extra-budgetary funds.

Until January 1, 2017, the Pension Fund of Russia was responsible for monitoring contributions to compulsory pension and health insurance. When a debt was incurred by the policyholder, the Pension Fund had the right to collect arrears, penalties and fines from him, in accordance with Law No. 212-FZ dated July 24, 2009. But today, insurance contributions, including “pension” ones, are supervised by the tax service, and it also has the right to collect debts. We will tell you in this article how you now need to repay the arrears in contributions that arose before and after the entry into force of the new Chapter 34 of the Tax Code of the Russian Federation.

How to add additional contributions to 1s8 3 for previous periods

Accounting for additional accruals of insurance premiums If before the update the production calendar was not filled out, then after updating to version 2.5.84 the calendar for 2015 will be filled out in accordance with the Resolution, i.e.

Attention The organization did not challenge this decision and agreed with the arguments set out in the on-site inspection report. Figure 49 Additional accruals based on the results of a desk or on-site inspection can be registered with a new document, Insurance Premium Verification Report.

In addition to the information specified directly in the act, the document can reflect the reversal of income with the wrong type. This will allow you to generate reports automatically, without making changes manually.

Figure 50 The contributions registered by this document are taken into account when filling out section 4 of the RSV-1 calculation for the quarter that includes the month of registration of the act.

Personnel accounting and payroll calculation in 1s 8.3 zup 3.1

It is also necessary to RE-CONVERT (but not recalculate) the document Calculation of salaries and contributions for JUNE. What is this for? The fact is that when we accrue some income to an employee, the status of this income is recorded in the program in a special register, Income Accounting for Calculating Insurance Premiums, for the purposes of accounting for insurance premiums.

Let's open the document Calculation of salaries and contributions for JUNE and see what we have recorded in this register. So, an income amount of 30,000 rubles (column “Amount”) is entirely subject to insurance contributions (column “Type of income”), but is not subject to contributions for those employed in jobs with early retirement.

The column “Subject to contributions for those employed in jobs with early retirement” is not filled in.

Additional accrual of insurance premiums for previous periods based on the inspection report

Important

- for the adjusting report for the previous period. In this case, recalculations will be registered “retroactively” - as if the changes were made directly to documents of previous periods. However, the history of recalculation will be saved - the database will contain separately the initially registered documents and amounts, and separately the newly recalculated ones.

With this method of registering the result of recalculation, it is necessary to generate an updated calculation for the previous period in which the error was made (in the example, the 2nd quarter), and the Pension Fund should still be able to accept it.

To generate it, you should select the Copy as correcting option in the report for the 2nd quarter already marked as accepted by the Pension Fund. Figure 15 Then reformat the copied report so that the recalculation amounts registered “retrospectively” are automatically included in it.

Salary corrections and recalculations

With ZUP 3.1 (3.0), a RSV-1 report is generated, you can read the article How to prepare a RSV-1 report in ZUP 3. So, in the generated report we will open general sections 1-5, information on the calculation of insurance premiums for additional tariffs and the base from which they are calculated and reflected in section 2.2-2.3.

As we see in our example, contributions have not been calculated; all lines are empty. After submitting reports for the 2nd quarter, it turned out that it was necessary to calculate insurance premiums at additional rates from the employee hired for this position. What needs to be done in the ZUP 3 program.

1 (3.0), so that in July, when calculating salaries, additional contributions for June will be accrued? First, you need to open the document that approved this staffing unit (Approval of staffing dated 01.06.

2016) and on the “Additional” tab, check the box - Contributions are collected for those employed in jobs with early retirement.

Accounting for fines and penalties for taxes and insurance premiums

Debit Credit Additional accrual of FFOMS The decision based on the results of the control carried out comes into force 10 days from the date of its presentation to the person being inspected. Accounting shows additional accrual transactions on the date when the decision took effect.

Typical errors: incorrect application of insurance rates, false accrual of the taxable amount of profit, inaccurate indication of disability data, etc. Minor miscalculations made in past periods and identified after the submission of financial statements are corrected in the month in which they were discovered.

For this purpose, proper accounting entries are made, and the resulting income and damage are shown as part of other income and expenses of the reporting period from the account. For example, an employer awarded benefits to an employee based on a false medical certificate.

The erroneous accrual on the fake sick leave was not discovered immediately, but after some time. The payment was made in violation, therefore, the FSS will not accept it for credit.

As a result, an inspection report is drawn up with instructions for.

From January 1 of the year, Federal Law No. The final settlement of funds with the Federal Tax Service must be made by April 1 of the year. Debts on contributions that the organization has on January 1 of the year will need to be transferred in the year according to the new BCC.

The funds themselves recommend transferring December payments for contributions in December of the year according to the old BCC. It is better to do this without waiting until the last days of December so that the funds see your payment on time.

Debts and overpayments for past periods The main rule that comes into force in the year: debts of past years, incl.

How to reflect additional assessments of contributions for previous years in accounting

In the second quarter, the employee went on vacation, and he was accrued vacation pay in the amount of 29 rubles. The contribution to the Pension Fund was 6 rubles. Figure 19 Reports for the second quarter were generated and submitted at the very beginning of the reporting campaign.

Are you really human?

Indicate the additional accrued contributions in the line of section 1 and section 4. In the line of section 1 and section 4, provide the amount of recalculation of insurance premiums. Complete sections 6 for those employees for whom information has been adjusted. In subsection 6. In subsections 6.

How to adjust RSV-1, deadlines, type of adjustment

For example, if you are submitting the first clarification for a given period, in case of a repeated correction, etc. You also need to fill out sections 1 and 2.

Provide correct information in them, taking into account that the amounts of accrued contributions will be greater than in the original DAM. The same value for the reason for clarification is established if it is necessary to adjust both accrued and paid contributions to the Pension Fund.

In addition, the adjustment of RSV-1 is carried out in section 6, which must be completed in relation to those employees whose payments were accrued less than the required percentage.

Before the entry into force of Law No. Federal Law, the form of calculation for accrued and paid insurance premiums, hereinafter referred to as RSV-1, the procedure for filling it out, as well as the procedure for submitting an updated calculation in the form of RSV-1 in the event of changes in indicators relating to the payment of insurance premiums for compulsory pension insurance or changes in the amounts of accrued insurance contributions for compulsory pension insurance, including individual information regarding insured persons, the data for which are adjusted, are provided for by the resolution of the PFR Board dated

Let's figure out who and how will check insurance premiums for the current and past periods. Payers of insurance premiums report calculated and paid insurance premiums to the tax authorities at the place of their registration, starting with the submission for the first accounting reporting period of the year.

To the territorial bodies of the Pension Fund of the Russian Federation, payers of insurance premiums are required to submit only personalized accounting information about insured persons, insurance experience, additional insurance contributions for funded pension, paragraphs.

Control over the correct calculation and timely payment of insurance contributions for compulsory pension and health insurance for reporting billing periods starting from the year, as well as ensuring the fulfillment of the obligation to pay them is carried out by the tax authorities.

The Pension Fund of the Russian Federation provided the tax authorities with information about registered payers of insurance premiums, as well as about the amounts of arrears, penalties and fines on contributions accrued as of January 1 of the year. Their further collection is carried out by the tax authorities, art.

The powers of the Pension Fund continue to include the functions of assigning and paying pensions, as well as monitoring the reliability of personalized accounting information submitted by policyholders to the Pension Fund. Also, in the same manner, it is necessary to submit to the funds calculations in the form of RSV-1 Pension Fund for the year and updated calculations for the reporting billing periods that expired before January 1 of the year Art.

Arrears on insurance contributions to the Pension Fund

Calculation of insurance premiums in the year Before When the policyholder formed a debt, the Pension Fund had the right to collect arrears, penalties and fines from him, in accordance with the law from How now it is necessary to repay arrears in contributions that arose before and after the entry into force of the new Chapter 34 of the Tax Code of the Russian Federation, we will tell you in this article.

The Russian Federal Social Insurance Fund also charges contributions for expenses not accepted for offset in cases of temporary disability.

How to reflect such additional charges in accounting and tax accounting? Is it legal to include them in the expenses of the current period, and not attribute them to the profits and losses of previous years in tax accounting, and reflect them in cost accounts 20, 25, 26, and not other expenses in accounting? Accounting is maintained on the basis of primary documents that document the facts of economic life. A fact of economic life is a transaction, event, operation that has or is capable of influencing the financial position of the organization, the financial result of its activities and or cash flows. In the situation under consideration This fact will be the additional accrual of insurance premiums based on the results of the inspection. The documentary basis for additional charges is the decision made by the head of the regulatory body based on the results of the inspection of paragraph.

According to the inspection report, it is necessary to charge additional insurance premiums to the OPS for the payment of insurance premiums for periods of up to a year.

In the second quarter, the employee went on vacation, and he was accrued vacation pay in the amount of 29 rubles. The contribution to the Pension Fund was 6 rubles. Figure 19 Reports for the second quarter were generated and submitted at the very beginning of the reporting campaign.

Insurance premiums who is now responsible for what Insurance premiums who is now responsible for what How can accountants live in the new reality? What to remember, what to pay attention to so as not to make mistakes? To questions BUKH.

Source: https://zakon-akt.ru/strahovie-vznosi/donachislenie-strahovih-vznosov-za-proshlie-periodi-po-aktu-proverki.php

Pension contributions: payment of arrears in 2017

The information from the tax service “On the administration of insurance premiums from January 1, 2021” lists the functions that will be transferred to tax authorities in 2021, these are:

- control over the calculation and timely payment of contributions,

- acceptance of “insurance” reporting, starting with reports for the 1st quarter of 2017,

- offset of overpayments for insurance premiums and excessively collected amounts,

- providing deferment and installment payments,

- collection of arrears, as well as debts on penalties and fines.

This means that now debt for pension and other insurance contributions (except for contributions for “injuries”) is collected according to the rules established by tax legislation (letter of the Ministry of Finance of the Russian Federation dated October 21, 2016 No. 03-02-08/61943). Moreover, the Federal Tax Service equally collects both “insurance” debts for 2021 and previous periods.

Arrears in insurance contributions to the Pension Fund arise if an entrepreneur or organization:

- have not paid the accrued insurance premiums in full,

- violated the deadlines established for payment of contributions.

The tax office may discover arrears during an audit, or after receiving a calculation of insurance premiums for the corresponding reporting period. Transfer of pension and other insurance contributions is carried out no later than the 15th day of the month following the month of their accrual (Article 431 of the Tax Code of the Russian Federation). By comparing the Calculation indicators and the amounts received into the budget, tax authorities determine whether the payer has any arrears or overpayments.

Calculation of insurance premiums to extra-budgetary funds

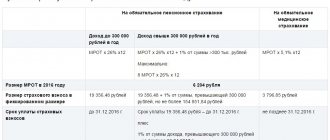

Calculate insurance premiums on the last day of each month separately for each insured person and each type of contribution. In 2021, insurance premiums are paid for:

- compulsory pension insurance (OPI) at a rate of 22%;

- compulsory health insurance (CHI) at a rate of 5.1%;

- compulsory social insurance (OSI) for temporary disability and in connection with maternity (VNIM) – 2.9%.

Above are the basic contribution rates. For some policyholders, reduced and additional rates are provided. For details, see the material “Insurance premium rates in the table.”

From April 2021, the part of the salary that is above the minimum wage is subject to insurance contributions at reduced rates. These tariffs are available only to those taxpayers who belong to small and medium-sized businesses. ConsultantPlus experts spoke in more detail about the new tariffs for insurance premiums. Get trial access to the K+ system and upgrade to the Ready Solution for free.

The employer pays insurance premiums at his own expense to the tax office no later than the 15th day of the month following the month in which insurance premiums are calculated.

In addition to the above contributions, the employer pays insurance premiums against accidents at work to the Social Insurance Fund. The rate varies from 0.2% to 8.5% and depends on the main type of activity of the policyholder.

How to determine the tariff size, see here.

To calculate contributions, use the formula:

ATTENTION! When calculating the contribution base, take into account the approved limits. In 2021, the limits for VNIM are 966,000 rubles, for OPS – 1,465,000 rubles. Read more about applying limits here.

Employers must keep records of contributions for all funds separately.

To obtain information about contributions, account 69 “Social insurance payments” is divided into three sub-accounts, namely:

- 69.1 - information on contributions to OSS;

- 69.2 - information on contributions to compulsory pension insurance;

- 69.3 - information on contributions to compulsory medical insurance.

Subaccount 69.1 is further divided into second-order accounts (69.1.1 - social insurance for VNIM; 69.1.2 - injury insurance) or an additional subaccount of account 69 is used (for example, 69.11) to account for contributions for injuries.

This grouping by accounts allows you to track all movements of funds for each fund.

Request of the Federal Tax Service for payment of arrears on insurance premiums of the Pension Fund of Russia

Having discovered arrears, tax authorities send the debtor a demand for payment of insurance premiums.

No longer than three months from the date of detection of arrears in insurance contributions (to the Pension Fund of the Russian Federation, the Compulsory Medical Insurance Fund, the Social Insurance Fund) - this period is given to the tax authorities to send a claim to the payer. But if the contribution is arrears, and the amount of penalties and fines accrued on it does not exceed 500 rubles, the tax authorities have up to 1 year from the date of discovery of the debt to issue a claim (Clause 1, Article 70 of the Tax Code of the Russian Federation).

If the arrears are identified by tax authorities as a result of an audit, then the demand for repayment will be sent to the payer within a shorter period of time - 20 days from the moment the decision on this comes into force (clause 2 of Article 70 of the Tax Code of the Russian Federation).

The demand specifies not only the amount of debt, the amount of penalties accrued at the time of sending the demand, and the period during which the payer must fulfill this demand, but also the penalties that apply to the debtor in case of evasion of such requirements of the Federal Tax Service (Article 69 Tax Code of the Russian Federation).

If the text of the request does not indicate a longer period, then the payer must repay the debt specified in it within 8 days after receiving the document by mail, electronic communication channels, or in the taxpayer’s personal account. At the same time, a claim sent to the debtor by registered mail is automatically considered received 6 days from the date of its dispatch, which means that unscrupulous payers will not be able to avoid liability by simply ignoring the postal notification for receiving a claim for arrears (Clause 6 of Article 69 of the Tax Code of the Russian Federation ).

If the demand for payment of arrears is not fulfilled, the Federal Tax Service may send a decision to the bank to suspend operations on the debtor’s bank accounts, and then all expense transactions, except mandatory ones, will be impossible until the debt is fully repaid on demand (Article 76 of the Tax Code of the Russian Federation).

Method 2. Using special documents for contributions

To update register data on income for contributions, you can use one of the special documents for accounting for contributions:

- Recalculation of insurance premiums (Taxes and contributions – Recalculation of insurance premiums);

- Contribution accounting transaction (Taxes and contributions – Contribution accounting transactions).

The difference in using documents is that in the Recalculation of Insurance Premiums you can not only enter information on income, but also recalculate contributions automatically. In the Contribution Accounting Transaction, the contribution amounts will have to be entered manually.

Let's use the document Recalculation of insurance premiums and on the Income Information we will “transfer” the amounts of income from the completed Working Conditions Class to the unfilled one. At the same time, in the column Subject to contributions for those employed in jobs with early retirement, the values will be the same.

In our example, income amounts are “rolled over” in December 2020 to February 2021.

Based on the Month of Registration (in the example this is December 2020), the month will be determined in which the following will fall:

- entries for recalculated contributions,

- the amount of contributions in the report Analysis of contributions to funds .

The month the income was received affects the period in which the data is reflected in the DAM (in our case, in February 2021)

On the Calculated contributions the Calculate command in the document, contributions for February 2021 are automatically recalculated.

However, you do not have to recalculate contributions in the document Recalculation of insurance premiums . In this case, the recalculation will automatically occur in the document Calculation of salaries and contributions during the next payroll calculation. The same will happen when using the document Transaction of Contributions Accounting , if you “transfer” only income into it and do not enter information on contributions on the Contributions to the Pension Fund of the Russian Federation at home tariff tab .