The procedure for calculating and paying tax upon liquidation of a separate division

If an organization has decided to terminate the activities of its separate division, and the head has signed an order for its liquidation, then the tax authorities must be notified of the decision within 3 working days (clause 3.1, clause 2, article 23, clause 6, art. 6.1 Tax Code of the Russian Federation).

The application is submitted in form No. S-09-3-2 (approved by order of the Federal Tax Service of Russia dated 06/09/2011 No. ММВ-7-6 / [email protected] ) to the Federal Tax Service inspectorate with which the organization is registered at the location of the liquidated unit . In “1C: Accounting 8 CORP” (rev. 3.0), this form is available as part of 1C-Reporting (section Notifications - Separate divisions - Closing of separate divisions).

Within 10 days from the date of filing such an application (but not earlier than the end of the on-site tax audit, if one is carried out), the inspection is obliged to deregister the organization (clause 5 of Article 84 of the Tax Code of the Russian Federation). From this moment on, the separate division is considered liquidated.

If a responsible separate division is liquidated (through which income tax is paid and which submits an income tax return for a group of separate divisions located on the territory of one constituent entity of the Russian Federation), then a new responsible division must be selected and within 10 days after the end of the reporting period notify the tax authorities about this (clause 2 of Article 288 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated December 30, 2008 No. ШС-6-3/986). The notification forms are given in the Appendices to the said letter.

The specifics of calculating and paying income tax by a taxpayer who has separate divisions are defined in Article 288 of the Tax Code of the Russian Federation. Let us recall that for the reporting (tax) period, the tax base for income tax is determined by the cumulative total for the organization as a whole, and then distributed between the parent organization and separate divisions in proportion to the share of each division, which is calculated on the basis of 2 indicators:

- the share of the residual value of depreciable property of this division in the residual value of depreciable property throughout the organization;

- the share of the average number of employees of a given division in the average number of employees of the entire organization, or the share of expenses for remuneration of employees of a given division in the total amount of expenses for remuneration of employees of the entire organization (in “1C: Accounting 8 KORP” only this option is supported).

At the same time, the rules for calculating and paying income tax upon liquidation of separate divisions are not explained in Article 288 of the Tax Code of the Russian Federation.

Let us turn to the procedure for filling out a tax return for corporate income tax (approved by order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/ [email protected] , hereinafter referred to as the Procedure). According to clauses 10.2 and 10.11 of the Procedure, when closing separate divisions during the tax period:

- in subsequent reporting and current tax periods after the closure, the tax base determined for the organization as a whole is reduced by the tax base attributable to closed separate divisions;

- the share of the tax base attributable to a closed separate division and its size are determined for the reporting period preceding the quarter in which the division was closed.

Thus, the last reporting period when the share of the tax base (profit share) for the liquidated division is determined is (letter of the Federal Tax Service of Russia dated October 1, 2009 No. 3-2-10 / [email protected] , Federal Tax Service of Russia for Moscow dated July 12, 2010 No. 16-15/073317):

- for quarterly reporting taxpayers - the quarter preceding the quarter in which the separate division was liquidated;

- for monthly reporting taxpayers - the period from the beginning of the year to the last day of the month preceding the month of liquidation of the separate division.

When closing a separate division, updated declarations, as well as declarations for subsequent (after closure) reporting periods and the current tax period for the specified separate division, are submitted to the tax authority at the location of the parent organization (clause 2.7 of the Procedure).

| 1C:ITS For more information on the procedure for calculating and paying income tax upon liquidation of a separate division, see the reference book “Organizational Income Tax” in the “Taxes and Contributions” section. |

Step-by-step instructions for closing a separate division

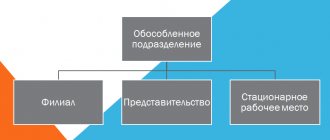

Parts of the enterprise located on the territory of different municipal districts and urban districts are considered different territorially separate divisions.

As a rule, the head unit is indicated as a territorially separate unit where the administration of the enterprise is located or whose location corresponds to the registered legal address.

If employees of a territorially separate unit carry out activities outside its location and this place of activity of a legal entity is not classified as a territorially separate unit, then the results of the activities of such units must be taken into account in Section 9 for the territorially separate unit to which they belong.

Line 901 shows the indicators as a whole for the head unit and line 903 for each other territorially separate unit. Data on line 903 are reflected not as of a specific date, but for the entire reporting period, even if a territorially separate unit operated for one month. In this case, its data is shown on line 903, and the territorially separate division itself is included in line 401.

Free lines 902 and 904 reflect indicators for each type of activity carried out by this division in accordance with the list given in Appendix No. 1 to these Instructions.

Column A indicates the name of the type of activity, and column B indicates its code according to the All-Russian Types of Economic Activities (OKVED). Columns 1 - 4 provide the relevant indicators for this type of activity.

The sum of data on types of activities allocated on free lines 902 and 904 must be equal to data on the corresponding indicators as a whole for this territorially isolated unit (lines 901 and 903).

The amount of data given in Section 9 for the corresponding type of activity for territorially separate divisions must be equal to the data for this type of activity for the enterprise as a whole, shown in Section 8 on free line 802.

If the number of geographically separate divisions of an enterprise exceeds the availability of positions in the section, then it is necessary to include additional sheets in the report.

Columns 1 - 4 indicate, respectively, information on the average number of employees, the accrued wage fund, and the organization's turnover (for the reporting and previous years).

If an organization has a territorially separate division that is engaged in the sale of products produced, in turn, by another division, then the “Turnover” indicator is reflected for the territorially separate division that produces these products, while the average number and payroll of the separate division that engages in the sale of products and is accounted for by the production code of the product.

Organizations that have territorially separate divisions in their structure that have suspended their activities or are in the process of liquidation (that is, at the time of reporting on Form N 1-enterprise there is no decision made in the prescribed manner), must reflect in Section 9 the available data on these territorial separate divisions (for example, fill in the “turnover” for the previous year, the attributable part and the corresponding columns of lines 903 and 904), while in line 401 the total number of territorially separate divisions, including those indicated, is entered.

The indicators “Average number of employees” (column 1) and “Wage fund” (column 2)” for existing territorially separate divisions, as well as those created in the reporting year and not started to carry out their activities, must be filled out without fail.

The number of territorially separate divisions listed in section 9, including the head office, must be equal to the data indicated in line 401, column 1.

<*> The definition is provided solely for the purpose of filling out form N 1-enterprise.

Calculation of income tax in “1C Accounting 8 CORP” (rev. 3.0)

Starting from version 3.0.52, 1C:Accounting 8 CORP (rev. 3.0) supports automatic calculation of income tax when deregistering separate divisions due to:

- moving - changing the address at which the activity is carried out;

- termination of the division's activities.

To reflect these events in the program, you should use the commands available from the Divisions directory element form (from the card of a separate division or branch) - see Fig. 1:

- Deregister;

- Register at the new address.

Rice. 1. Separate unit card

When calculating income tax and filling out the declaration, the requirements of clauses 2.7, 10.2 and 10.11 of the Procedure are taken into account.

The tax base has increased

Let's look at how the 1C: Accounting 8 CORP program, edition 3.0, automatically calculates profit shares and generates tax returns if one of the separate divisions is closed during the year.

Example 1

| The organization Comfort-Service LLC applies OSNO, the provisions of PBU 18/02, and at the end of the reporting period pays only quarterly advance payments. The organization Comfort-Service LLC is registered in Moscow, and has two separate divisions, which are located in St. Petersburg and in Anapa (Krasnodar Territory) and are registered with the Federal Tax Service at their location. Transfer of advance payments (tax) to the budget of a constituent entity of the Russian Federation is carried out by the parent organization (Moscow). At the end of the first half of 2021, the tax base for income tax for the organization as a whole amounted to RUB 381,370. Over 9 months, the tax base increased and amounted to RUB 1,262,645. The income tax rates for the budgets of the constituent entities of the Russian Federation do not differ and amount to 17%. In August 2017, a separate division located in St. Petersburg was deregistered (liquidated). Data for the first half of 2017 are shown in Table 1 (indicators in lines 1 and 2 are rounded). Table 1 Tax base and calculated income tax for budgets and constituent entities of the Russian Federation for the first half of 2021 No.

|

Since the separate division in St. Petersburg was liquidated in August 2021, the last reporting period for it will be the first half of 2021. Figure 2 shows a fragment of Appendix No. 5 to Sheet 02 of the income tax declaration (hereinafter referred to as the Declaration) for the first half of 2021, compiled for a separate division in St. Petersburg.

Rice. 2. Appendix No. 5 to Sheet 02 of the Declaration for a separate division in St. Petersburg for the six months

In July 2021, when carrying out the regulatory operation Calculation of income tax included in the processing of Closing the month, standard actions are performed in relation to each separate (including the head) division:

- the share of profit (share of the tax base) is automatically calculated based on labor costs and the residual value of depreciable property;

- based on the calculated share of profit, the tax base is determined;

- Based on the tax base and the tax rate established for a specific constituent entity of the Russian Federation, the amount of tax is calculated;

- Postings are generated in the context of budgets and inspections of the Federal Tax Service of Russia.

In August 2021, the separate division located in St. Petersburg will close.

Therefore, when performing the regulatory operation Calculation of income tax for August, in addition to standard actions with existing divisions, special actions are performed in relation to a closed separate division:

- the share of the tax base (profit share) is fixed in the amount calculated for the reporting period preceding the quarter in which the separate division was closed (clause 10.11 of the Procedure), that is, for the first half of 2021 (33.0256%). The specified share remains unchanged (“frozen”) until the end of the tax period, that is, until the end of 2021;

- the tax accrued for July is adjusted and fixed in the amount calculated for the first half of 2021 (RUB 21,412). The amount of accrued tax does not change until the end of the year, provided that the tax base for the organization as a whole does not decrease.

Starting from August 2021, in the reference calculation Distribution of profit according to the budgets of the constituent entities of the Russian Federation, the fixed share of the profit of a closed division is indicated separately - in the group Activities ceased (Fig. 3).

Rice. 3. Help-calculation of profit distribution according to budgets for September 2021

According to the calculation certificate, the share of the tax base (profit share) for operating divisions for 9 months of 2021 was:

- at the head office in Moscow - 93.2203%;

- for a separate division in Anapa - 6.7797%.

We will generate a set of tax returns for 9 months of 2021 in the 1C-Reporting service.

When creating a new version of the Income Tax Declaration report, the default title page sets the details of the head office (Moscow), namely:

- in the Submitted to the tax authority (code) field—indicate the code of the tax authority in which the head office is registered (7718);

- in the field at the location of the registration (code) - indicate the code: 214 (At the location of the Russian organization that is not the largest taxpayer).

The main sheets and indicators of the Declaration, including Appendix No. 5 to Sheet 02, are filled out automatically according to tax accounting data (Fill button).

The income tax declaration, which is submitted at the location of the head office, includes Appendix No. 5 to Sheet 02 in the amount of 3 pages, corresponding to the number of registrations with the Federal Tax Service from the beginning of the year (for the head office and 2 separate units, including closed ones).

Let us first consider how the program fills out Appendix No. 5 for a closed, separate division in St. Petersburg (Fig. 4).

Rice. 4. Appendix No. 5 to Sheet 02 of the Declaration for 9 months for a closed separate division

In the Calculation compiled (code) field, the value will be indicated: 3 - for a separate division closed during the current tax period. The following line indicators are filled in automatically:

- The tax base for the organization as a whole (line 030) is RUB 1,262,645;

- including without taking into account separate divisions closed during the current tax period (line 031) - RUB 1,136,695. This indicator corresponds to the difference between lines 030 for 9 months of 2017 and 050 for the first half of 2021 of Appendix No. 5 to Sheet 02 for a closed separate division (RUB 1,262,645 - RUB 125,950);

- Share of the tax base (%) (line 040) - 33.0256% (the fixed share of the tax base for a closed separate division corresponds to line 040 of Appendix No. 5 to Sheet 02 for the first half of 2021);

- Tax base based on share (line 050) - RUB 125,950. The difference between the indicators on lines 030 and 031 must correspond to the indicator on line 050 for a closed, separate division (clause 10.2 of the Procedure);

- Tax rate to the budget of a constituent entity of the Russian Federation (%) (line 060) - 17%;

- Tax amount (line 070) - 21,412 rubles. This indicator corresponds to the indicator in line 070 of Appendix No. 5 to Sheet 02 for the first half of 2021.

Line 080 (Tax accrued to the budget of a constituent entity of the Russian Federation) is filled in manually by the user - RUB 21,412. (line 070 of Appendix No. 5 to Sheet 02 for the first half of 2021). Under the conditions of Example 1, the amount of tax to be paid additionally (line indicator 100) is zero.

Appendix No. 5 to Sheet 02 Declarations drawn up for the head division and for a separate division in Anapa are filled out based on the tax base for the organization as a whole, excluding closed separate divisions and the share of the tax base calculated for 9 months. Figure 5 shows a fragment of Appendix No. 5 to Sheet 02 of the Declaration drawn up for the head unit. In the Calculation compiled (code) field, the value 1 will be indicated - for the organization without its separate divisions. The field assigning the obligation to pay tax to a separate division must be filled in manually (specify the value 1 - assigned).

Rice. 5. Appendix No. 5 to Sheet 02 of the Declaration drawn up within 9 months for the parent unit

The indicators of lines 030-070 are filled in automatically as follows:

| Line of Appendix No. 5 to Sheet 2 of the Declaration | Data |

| 030 | RUB 1,262,645 |

| 031 | RUB 1,136,695 (tax base for 9 months of 2021 minus the indicator of line 050 of Appendix No. 5 to Sheet 02 for the first half of 2017 for a closed separate division: RUB 1,262,645 - RUB 125,950) |

| 040 | 93,2203 % |

| 050 | RUB 1,059,631 (line 031 indicator multiplied by line 040 data) |

| 060 | 17 % |

| 070 | RUB 180,137 (line 050 indicator multiplied by line 060). The sum of lines 070 of Appendix No. 5 for the parent organization and for each separate division is transferred to line 200 of Sheet 02 (clause 10.4 of the Procedure) |

Line 080 is filled in manually by the user and must correspond to the indicator in line 070 of Appendix No. 5 to Sheet 02 for the first half of 2021 for the parent division. Line 100 (Amount of tax to be paid additionally) is calculated automatically as the difference between lines 070 and 080.

Appendix No. 5 to Sheet 02 for a separate subdivision in Anapa is filled out in the same way.

Subsection 1.1 of Section 1 of the Declaration for the head unit will be automatically filled in according to the declaration data.

Line 010 of Subsection 1.1 of Section 1 indicates the OKTMO code of the municipality in whose territory the head office is located.

Now it is necessary to fill out declarations for separate divisions: active (Anapa) and closed (St. Petersburg).

When filling out a tax return, which is submitted at the location of a separate division in the city of Anapa, on the Title Page, the user must indicate the appropriate code of the tax authority, selecting it from the list of registrations, and the code for the place of submission of the declaration: 220 (At the location of the separate division of the Russian organization) .

By clicking the Fill button, the program will automatically generate a set of Declaration sheets for a separate subdivision in Anapa.

Appendix No. 5 to Sheet 02 is filled out similarly to the corresponding page of Appendix No. 5 to Sheet 02 of the Declaration, which is submitted at the location of the head unit.

Filling out an income tax return for a closed division has its own peculiarities.

When creating a new version of the Income Tax Declaration report on the title page, the user must perform the following sequence of actions:

- in the Submitted to the tax authority (code) field - indicate the code of the tax authority of the closed separate division by selecting it from the list of registrations (7801);

- in the field at the location of the accounting (code) - indicate the code: 223 (At the location (accounting) of the Russian organization when submitting a declaration for a closed separate division);

- confirm your actions (the Yes button) to the program warning (Attention! Before entering the filling mode for separate departments, all sections (sheets) of the report will be cleared. Continue the operation?).

As a result, the details on the Title Page (Sheet 01) of the Declaration are dynamically refilled and take on the following values in accordance with clause 2.7 of the Procedure:

- in the field Submitted to the tax authority (code) - indicate the code of the tax authority of the head division (7718), where it is now necessary to submit a declaration for a closed separate division;

- in the checkpoint field - indicate the checkpoint of a closed separate subdivision (780132001).

By clicking the Fill button, the program will automatically generate a set of Declaration sheets for a closed, separate division.

Appendix No. 5 to Sheet 02 is filled out similarly to the corresponding page of Appendix No. 5 to Sheet 02 of the Declaration, which is submitted at the location of the head unit.

On line 010 of subsection 1.1 of Section 1, the 1C: Accounting 8 CORP program, edition 3.0, will indicate the OKTMO code of the municipality on the territory of which the closed, separate division was located (clause 4.1.4 of the Procedure).