Legal entities operating on the general taxation system must apply PBU 18/02. However, there are exceptions. Thus, small enterprises, non-profit companies, as well as Skolkovo residents have the right to maintain simplified accounting and not apply the above provisions and a number of other accounting standards in their work, such as:

- PBU 2/2008 “Accounting for construction contracts”;

- PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets”;

- PBU 11/2008 “Information about related parties”;

- PBU 16/02 “Information on discontinued activities”;

- PBU 12/2010 “Information by segments”.

Let us remind you that the financial department has adjusted PBU 18/02 (Order No. 236n dated November 20, 2018). The legislative innovation must be applied from the annual reporting for the current year.

Thus, when starting to prepare the annual report for 2020, the accountant must take into account the following innovations:

- the terms “permanent tax expenditure” and “permanent tax income” were introduced (they replaced the concepts of PNO and PNA);

- the concept of “temporary differences” has been adjusted and their list expanded;

- the term “income tax expense (income)” has been added;

- adjustments have been made to the definition of “current income tax”;

- rules for filling out certain indicators of the financial results report have been established;

- The composition of the information that needs to be reflected in the accounting reports has been changed.

The rules for reflecting income and expenses in tax and accounting differ. The reason for the deviations is that the indicators are formed according to different rules. The information that the company enters in the profit declaration is formed on the basis of the provisions of Chapter. 25 Tax Code of the Russian Federation. The financial results statement data is determined according to accounting standards.

As a result, deviations arise. PBU 18/02 distinguishes between permanent and temporary differences. Fixed expenses or income that are recorded only in accounting. Because of these differences, constant tax expenses and constant tax revenues arise.

Temporary differences are expenses or income that are recorded both in accounting and tax accounting. The difference is that the amounts are recognized in different periods.

Income tax: what are we talking about?

In the Russian system of fees, the main and one of the largest is the profitable one. This is due to the wide range of its payers - all Russian firms, concerns, companies, as well as “foreign” offices operating on the territory of the Russian Federation are required to pay income taxes. This is a direct tax, its size depends on the monetary result brought by the company’s labor efficiency.

The rules according to which profits are subject to tax are contained in the country's Tax Code. The object of taxation is profit; in fact, the duty is charged on the funds that the entrepreneur has in the difference between the money received and the money spent. When figuring out the figure for the profit tax to pay to the budget, the values of conditional income and expense are needed. When filling out financial performance reports, entrepreneurs must fill out line 2300, which displays the overall financial result. Conditional expenses and income are formed from this result, multiplied by the profit tax rate (the base rate is twenty percent).

How to take into account conditional expense

For UR, a special sub-account 99.2.2 or 99.3 is opened, which reflects one transaction per month or quarter. In the case of profit, according to accounting, it is carried out as follows: DT 99 (sub-account for UR) – KT 68 (sub-account “Calculations for income tax”). In case of loss, reverse posting: DT 68 - CT 99.

You can check the correctness of calculations and accounting by comparing the income tax in the declaration and the balance of the subaccount for it - they must match. The formula is:

NB * sn = UR + PNO – PNA + SHE – IT,

where NB is the taxable base, calculated according to tax accounting rules; other indicators are disclosed in the paragraph above.

In tax accounting for the reporting month, the taxable base (NB) in LLC XXX, in addition to 200 thousand rubles. BP includes 25 thousand rubles. the difference between advertising costs in accounting and tax accounting (in the latter - within the framework of the standard) and does not include 50 thousand rubles. differences in depreciation of the building (accounting at the company is carried out using different methods for taxation and its own needs). The current tax on the declaration will be:

TN = (200 + 25 – 50) * 20% = 35 thousand rubles.

The following entries will be reflected in accounting:

DT 99 – KT 68 – The conditional consumption calculated above is equal to 40 thousand rubles;

DT 99 – KT 68 – PNO from the difference between advertising expenses: PNO = 25 * 20% = 5 thousand rubles;

DT 68 – KT 77 – ONO from the difference for depreciation: ONO = 50 * 20% = 10 thousand rubles.

The current tax according to accounting or the balance in the income tax subaccount of account 68 will be:

TN = 40 + 5 – 10 = 35 thousand rubles.

The data in accounting and tax accounting coincides, which means that the conditional expense is calculated correctly.

Conditional income for income tax

First, let's look at what UDNP is - conditional income. This is considered to be the negative financial result of the company, multiplied by the base rate of twenty percent. Simply put, if accounting has determined that a company has incurred a loss, conditional income will be calculated for profit tax. In other words, UDNP is the amount of “savings”.

How will conditional income be reflected in the accountants' report? The posting will look like this: Kt99, to which the subaccount “Conditional income for collection on profit” will be opened - Dt68. The loss incurred by the firm is considered a deductible temporary difference. This difference results in a deferred tax asset. As a result, the accounting entry will be as follows: Dt09 – Kt68 in case of accrual. If the loss is written off, the posting will change: Dt68 - Kt09.

Example. LLC "Nobody Knows" in the third quarter received a loss of one hundred thousand rubles, which is reflected in the accounting records. We calculate using the above formula - UDNP x 20%. This means that the conditional income tax expense for this quarter will be twenty thousand rubles. The loss entails a deferred tax asset and the postings will be as follows: Dt09 – Kt68. For the third quarter, the transactions of Nobody Knows LLC look like this:

Table 1. Postings for the third quarter

| Wiring | Sum |

| Dt99.1 – Kt90.9 | 100 thousand rubles (company loss) |

| Dt68 – Kt99.2 | 20 thousand rubles (UDNP) |

| Dt09 – Kt68 | 20 thousand (tax deferred act) |

Tax loss: postings, calculation, reflection

When finding the income tax, its tax base will be equal to the production profit in monetary terms. By calculating other payments on profit, the tax base for each tax will change. Determining the basis for calculating income tax begins in January - on an accrual basis.

In cases where the tax base has become a negative value—a loss has been incurred—the tax base will be equal to zero. According to Article No. 283 of the Tax Code, the resulting loss in transactions can be distributed over subsequent years, for a period of no more than 10 years.

Reflection of tax loss in accounting

In cases where the company operated at a loss during the reporting period, this amount must still be recorded. In other words, it is necessary to record the tax on this negative profit.

This indicator is called conditional income tax and is calculated using the following formula:

Conditional income for profit tax = loss received by the enterprise * rate for profit tax

Conditional income will always be reflected in the subaccount of the same name in account No. 99 (99.02.2).

A few basic rules for conditional income:

- In accounting, no calculations are made from tax losses.

- If the amount of expenses exceeds the amount of income, then there is nothing to calculate the tax from.

- With conditional income, the tax base is zero.

- The loss can be spread over the next 10 years, thereby reducing the profit.

Such norms are not provided for in accounting, so some temporary differences appear. Once the conditional income has been determined, the amount of VVR can be calculated and displayed in ONA.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 68.04.2 | 99.02.2 | Displaying the accrual of conditional income for the reporting tax period | Amount of loss | Accounting certificate-calculation |

| 09 | 68.04.2 | Displaying a tax asset from a loss that will be repaid in subsequent periods | Amount of part of loss - asset | Accounting certificate-calculation |

| 68.04.2 | 09 | Displaying the write-off of a deferred tax asset from an already settled loss | Asset size | Accounting certificate-calculation |

saldovka.com

Conditional income tax expense

URNP is a mirror image of UDNP. That is, the accounting profit received by the company and multiplied by the base rate will be the conditional expense for the tax in question.

Let's look at the example further. Nobody Knows LLC made a profit of two hundred thousand rubles in the fourth quarter of 2021. The loss for this quarter will also be written off by posting Dt68 - Kt09.

Table 2. Postings for the quarter

| Wiring | Sum |

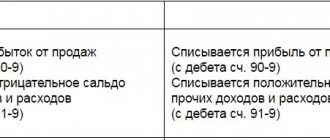

| Dt 90.9 – Kt99.1 | 200,000 rubles (company profit) |

| Dt99.2 – Kt68 | 40,000 rubles (100,000 x 20% rate = URNP) |

| Dt68 – Kt09 | 20,000 rubles (the deferred tax asset was repaid for the third quarter) |

Accurate calculations – no problems with the tax authorities!

Calculation

Conditional expense (UR) is equal to the product of the amounts of profitability (BN) (accounting indicator for the reporting period) and the tax rate (SN) (in 2021, calculated as 20%). The calculation formula looks like this: UR=BN*SN.

The value of UR is typical for the calculation of tax data for the current period (TN), calculated on deferred and permanent tax liabilities and assets (PNA, PNO, ONA, ONO). In the absence of additional indicators, UR and TN will be the same.

You can check the correctness of the calculation of UR using the formula: UR+PNO-PNA+ONA-ONO=NB*sn.

Where NB is the tax base.

Let's give a short example.

The income of enterprise “X” for the 1st quarter amounted to 100,000 rubles. The tax rate is 20%, as determined by law. The calculation of the UR will be as follows: 100,000*20%=20,000 rubles.

Next, let’s calculate the technical load of enterprise “X”. In addition to 100,000 rubles, the tax base includes another 15,000 rubles, which amounted to discrepancies between the costs of the advertising campaign in terms of tax and accounting indicators. And excludes 30,000 rubles, which made up the difference in depreciation values. This is how TN is determined: (100,000+15,000-30,000)*20%=17,000 rubles.

PNO from the difference in costs for an advertising campaign is calculated: 15,000*20%=3,000 rubles. IT is calculated from the difference in depreciation rates: 30,000*20%=6,000 rubles.

Accounting reflects these calculations with the following entries:

Dt 99 – Kt 68 amount 20,000 rubles (UR)

Dt 99 – Kt 68 amount 3,000 rubles (PNO)

Dt 68 – Kt 77 amount 6,000 rubles (ONO)

The balance on account 68 will be equal to 20,000+3,000-6,000=17,000 rubles, which coincides with the current tax (TN) indicator. This means that the calculation of the conditional flow rate was carried out correctly.

Similar articles

- How to calculate income tax: example

- Advance payments on profits

- How to calculate income tax

- Conditional income and income tax expense

- How to calculate income tax on an accrual basis?

Who is interested in these calculations?

The law requires many organizations, both Russian and not, to pay profit tax. First of all, the list includes all legal entities of our country operating under OCHO: limited liability companies, open and closed joint-stock companies and others. Foreign firms receiving income in our country or companies operating in Russia with permanent representative offices are also included in the number of payers.

The fee is also paid by foreign companies that have signed an agreement regarding taxation issues and have the status of Russian residents for taxes. Foreign companies, whose place of management is in fact Russia, also pay income tax to the treasury of our state. Consequently, all listed legal entities should have an idea of PBU 18/02, and therefore of URNP and UDNP.

General provisions PBU18/02

PBU 18/02 does not apply:

- Municipal (state) offices.

- Credit institutions.

- Firms operating under “simplified”, ECXH or “imputed”.

Note: small enterprises and non-profit enterprises have the right to refuse PBU18. To do this, information must be reflected in the company's accounting policies.

Video - PBU 18/02, accounting for income tax expenses

Concept

In addition to tax calculations, individual enterprises are required to submit reports reflecting information on indicators that affect the amount of tax for future reporting. The following may not apply the rules and regulations of PBU 18/02:

- small business firms;

- non-profit institutions;

- companies that have the status of participants in the Skolkovo Innovation Center project.

Other organizations not listed above are required to report to the tax authority.

So, let’s give an explanation of what the conditional income tax expense means - this is an indicator obtained as a result of the initial calculations of the amount of taxation. Tax base reporting data and accounting data, as a rule, are not the same. The difference in these indicators is caused by different accounting standards for individual items of profit and loss. This is where the meaning of contingent loss arose. In accounting it is reflected in the Debit of account 99 and the Credit of account 68.

Where account 99 is “Deferred income”, and account 68 is “Calculations for taxes and fees”.

Above we gave a definition of conditional tax income, the value of which is used in the unprofitable activities of the organization. In other words, this is the relative value of tax “savings” due to the formed loss ratio. It is reflected in the Debit of account 68 and the Credit of account 99. And the second posting is immediately formed, Debit of account 09 and Credit of account 68 - thus, the amount of the deferred tax asset (DTA) is taken into account.

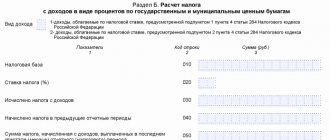

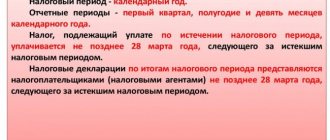

Deadlines for filing income tax returns

Let's sum it up

Navigating the complexities of taxation is not easy, especially when it comes to the traditional corporate tax system. It is not for nothing that this mode is considered the most complex and time-consuming in calculations. In order to calculate the profit tax correctly and accurately, it is better to act as a professional - that’s why LLCs first of all hire employees of the accounting department.

Many beginning businessmen consider taxation issues at the stage of business plans, and this is the right decision. In this text we have highlighted the main provisions on conditional income and expenses. We hope the information was useful to you or helped you refresh your memory of missed moments.

PBU 18/02: how to take into account the differences between accounting and tax accounting data

Details Category: Selections from magazines for accountants Published: 03/12/2015 00:00

Source: Glavbukh magazine

| Free access for 3 days |

The accrual and payment of income tax must be reflected in accounting, like any other fact of economic life. This must be done taking into account the requirements of PBU 18/02. This is the only way to eliminate the discrepancies that exist in accounting and tax accounting.

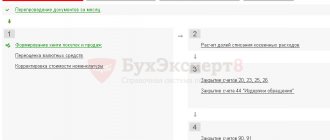

Income tax in accounting

Organize accounting for accrued and paid amounts of income tax, as well as advance payments for it, in account 68. To do this, open a separate sub-account “Calculations for income tax.” If you are required to apply PBU 18/02, then you cannot simply take and reflect in accounting the income tax recorded in the declaration. You will receive this value, but only after you have summed up the values of the following indicators for the period on account 68:

- conditional income tax expense calculated based on accounting profit;

- conditional profit tax income, which is calculated from the accounting loss;

- permanent tax assets and liabilities from permanent differences;

- deferred tax assets and liabilities from temporary differences.

The amount of profit in accounting and tax accounting may not be the same. This means that simply multiplying the profit received by the tax rate is not enough. This will not show in accounting the amount of the organization's real tax liabilities.

Permanent differences, tax assets and liabilities

A permanent difference arises every time any income or expense is taken into account in whole or in part only in accounting or only for tax purposes. Here's an example of when this happens:

- In accounting, expenses are taken into account in full, but in tax accounting only in the established amount. This applies, for example, to standardized costs;

- costs associated with the transfer of property (goods, works, services) for free use are recognized only in accounting;

- the loss is carried forward to the future, but after a certain period (10 years) it can no longer be taken into account for tax purposes.

In the same reporting period in which the permanent differences arise, record the corresponding tax assets or liabilities. That is, those amounts by which the tax in accounting will be reduced or increased. To account for permanent tax liabilities and assets, open subaccounts of the same name for account 99.

The reason for the constant differences

Type of tax assets and liabilities

How does it affect income tax in accounting?

Postings

| Income is taken into account only for tax purposes | Permanent tax liabilities (PNO) | Increase the tax amount | DEBIT 99 subaccount “Permanent tax liabilities” CREDIT 68 subaccount “Calculations for income tax” – permanent tax liability is reflected |

| Expenses that are not recognized for tax purposes | |||

| Income is reflected only in accounting | Permanent tax assets (PTA) | Reduce tax amount | DEBIT 68 subaccount “Calculations for income tax” CREDIT 99 subaccount “Permanent tax assets” – a permanent tax asset is reflected |

| Expenses are recognized only for tax purposes |

Determine the size of PNA and PNA using the formula:

| PNA/PNO size | = | Amount of permanent difference | × | Income tax rate effective at the reporting date |

Continuous tax liabilities and assets are not satisfied during the year. They can be written off from account 99 only as part of net profit or loss when reforming the balance sheet.

Temporary differences, tax assets and liabilities

A temporary difference arises if any income or expense is taken into account in accounting in one period, and when taxed in another. There are two types of temporary differences - deductible (DVR) and taxable (TVR).

A deductible temporary difference (DTD) arises, for example, in the following situations:

- when I calculate depreciation differently in accounting and tax accounting. Alternatively, in tax accounting it is calculated linearly, and in accounting – using the reducing balance method;

- if there is a loss carried forward, which will be taken into account for taxation before the expiration of 10 years;

- if expenses are taken into account differently in the cost of production in accounting and taxation.

Taxable temporary difference (TDT) is formed, in particular, as a result of:

- application of different methods of depreciation in accounting and tax accounting. For example, in tax accounting it is calculated linearly, and in accounting – using the reducing balance method;

- when the cash method is used in tax accounting, and in accounting they reflect income and expenses based on time certainty.

In the same reporting period in which temporary differences arose or were settled (in whole or in part), reflect the deferred tax assets or liabilities. That is, those amounts by which tax will be reduced or increased in accounting in subsequent reporting periods and which are not taken into account in the current one.

To account for deferred tax assets, use account 09, and for liabilities - account 77. In subsequent periods, as income and expenses converge in accounting and tax accounting, pay off deferred tax liabilities and assets (PBU 18/02).

Here's how to record the creation and settlement of deferred tax assets and liabilities:

Reason for temporary differences

Type of tax assets and liabilities

How does it affect income tax in accounting?

Postings

| Income that is not reflected in the accounting of the current reporting period | Deferred tax assets (DTA) | Reduce the amount of tax for future reporting periods. The current period tax is increased | DEBIT 09 CREDIT 68 subaccount “Calculations for income tax” - reflects the deferred tax asset; DEBIT 68 subaccount “Calculations for income tax” CREDIT 09 – deferred tax asset is repaid (in whole or in part) |

| Expenses that are not recognized for taxation in the current reporting period | |||

| Income that is not taken into account for taxation in the current reporting period | Deferred tax liabilities (DTL) | Increase the tax amount for future reporting periods. The current period tax is reduced | DEBIT 68 subaccount “Calculations for income tax” CREDIT 77 – deferred tax liability is reflected; DEBIT 77 CREDIT 68 subaccount “Calculations for income tax” - the deferred tax liability is repaid (in whole or in part) |

| Expenses that are not reflected in the accounting of the current reporting period |

Determine the size of SHE and IT using the formula:

| Size SHE/IT | = | Amount of temporary difference | × | Income tax rate effective at the reporting date |

Conditional income tax expense

It is necessary to calculate and reflect in accounting the conditional income tax expense if a balance sheet profit is recorded at the end of the reporting (tax) period.

Calculate the conditional consumption using the formula:

| Conditional income tax expense | = | Profit before tax according to accounting data | × | Income tax rate effective at the reporting date |

Reflect the conditional income tax expense on the subaccount of the same name in account 99:

DEBIT 99 subaccount “Conditional income tax expense” CREDIT 68 subaccount “Calculations for income tax” – accrued conditional income tax expense for the reporting (tax) period. Conditional income tax income.

Conditional income for income tax

Even if the organization, according to accounting data, incurred a loss in the reporting (tax) period, record income tax on this amount. This is called deemed income for income taxes. This indicator is the product of the current income tax rate and the amount of loss reflected in accounting. That is, it should be calculated like this:

| Conditional income for income tax | = | Loss according to accounting data | × | Income tax rate |

Reflect the conditional income tax on the subaccount of the same name in account 99:

DEBIT 68 subaccount “Calculations for income tax” CREDIT 99 subaccount “Conditional income for income tax” – conditional income for income tax is accrued for the reporting (tax) period.

In tax accounting, nothing is considered from the loss. So, if there are more expenses than income, there is no profit, then there is nothing to calculate the tax from. The basis for calculating income tax is zero. However, in future periods the loss may reduce taxable income.

The accounting rules do not provide for similar norms. Consequently, a deductible temporary difference arises. Therefore, after the conditional income for income tax is determined in accounting and it is possible to accurately determine the size of the income tax, reflect it in the accounting.

In the period in which the tax loss was determined, make an entry in accounting:

DEBIT 09 CREDIT 68 subaccount “Calculations for income tax” - reflects a deferred tax asset from a tax loss, which will be repaid in the following reporting (tax) periods.

As the loss is carried forward, repay the deferred tax asset:

DEBIT 68 subaccount “Calculations for income tax” CREDIT 09 – the deferred tax asset is written off from the repaid loss.

otchetonline.ru