Payers and object of taxation

Payers of personal income tax are individuals who, for tax purposes, are divided into two groups:

- persons who are tax residents of the Russian Federation (actually staying on the territory of Russia for at least 183 calendar days within 12 consecutive months);

- persons who are not tax residents of the Russian Federation, in case of receiving income in Russia.

April 30 is the deadline for individual categories of taxpayers required to independently declare income to submit personal income tax returns.

Persons who are not required to submit a tax return have the right to submit such a return to the tax authority at their place of residence throughout the year.

Question #3: How do I determine the date before a 12 month period?

Determining the date that is taken as the final reference point (it is preceded by a 12-month period), depending on the procedure for paying personal income tax, can go in two ways:

- If personal income tax is withheld and paid into the budget by the tax agent until the tax period has expired, then this date will coincide with the date the income was received. A similar conclusion was made in letters of the Ministry of Finance of Russia dated July 14, 2011 No. 03-04-06/6-170, Federal Tax Service of Russia dated August 30, 2012 No. OA-3-13/ [email protected] , Federal Tax Service of Russia for Moscow dated July 24, 2009 No. 20-15/3/ [email protected] The tax status, as follows from the letter of the Ministry of Finance of Russia dated March 19, 2013 No. 03-04-06/8402, should be determined at the end of the year.

- If an individual pays personal income tax independently at the end of the tax period, then residence is determined at the end of the tax period. In such circumstances, the period of stay of an individual in the Russian Federation is not taken into account both before the beginning of the tax period and after its end. This decision is supported by letters from the Ministry of Finance of Russia dated April 25, 2011 No. 03-04-05/6-293 and the Federal Tax Service of Russia dated August 30, 2012 No. OA-3-13 / [email protected]

Example

Employees often go on business trips abroad of varying durations. Moreover, some of them stay outside the Russian Federation for more than 183 days within a 12-month period.

Based on the results of the first quarter, on April 17, 2021, the company pays a bonus to all personnel. Since the company in the above circumstances acts as a tax agent, its accounting department should divide all employees into residents, whose income is taxed in accordance with paragraph 1 of Art. 224 of the Tax Code of the Russian Federation at a tax rate of 13%, and non-residents, whose income is taxed in accordance with clause 3 of Art. 224 of the Tax Code of the Russian Federation at a rate of 30%.

Status is determined on the date of payment of the bonus, which is considered income. That is, the company must count the number of calendar days that each employee spent in the Russian Federation during a 12-month continuous period. The period begins on April 16, 2021, and ends on April 16, 2019.

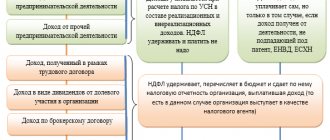

Persons required to independently declare income

- individual entrepreneurs;

- notaries, lawyers, other persons engaged in private practice;

- individuals for remuneration received other than from tax agents;

- individuals for amounts received from the sale of property;

- individuals, residents of the Russian Federation for income received from sources located outside the Russian Federation;

- individuals, for income on receipt of which tax was not withheld by tax agents;

- individuals receiving winnings paid by the organizers of lotteries and other risk-based games;

- individuals receiving income in the form of remuneration paid to them as heirs of the authors of works of science, literature, art, as well as authors of inventions;

- individuals receiving income from individuals by way of gift.

Example: Income received by individuals from teaching activities and conducting consultations is subject to personal income tax.

In accordance with Article 217 of the Tax Code of the Russian Federation, not all income of individuals is subject to personal income tax

For what income are non-residents recognized as personal income tax payers?

Those persons who do not have the status of tax residents of the Russian Federation are recognized as personal income tax taxpayers only if their income is received from sources located in the Russian Federation. This provision is contained in paragraph 1 of Art. 207, art. 209 of the Tax Code of the Russian Federation. This leads to the obvious conclusion that there is no need to pay personal income tax on income of foreign origin. At the same time, the Ministry of Finance, in letters dated March 15, 2012 No. 03-04-06/6-63 and dated December 8, 2011 No. 03-04-06/6-341, decides to once again confirm this right.

Example

A foreign specialist came to Moscow to one of the scientific institutes to share his experience. He received a reward for giving lectures and conducting practical classes. Undoubtedly, such income has a source in the Russian Federation, and, therefore, from the entire amount of income such a specialist will have to pay in accordance with subsection. 6 clause 1 art. 208 of the Tax Code of the Russian Federation to pay personal income tax.

You can learn about the specifics of calculating and withholding personal income tax for employees who often travel abroad in the material: “How to calculate personal income tax if your contractor is abroad almost all the time”

Generally, when determining the 12 months required to determine whether a person is a resident, some questions arise. We will present them with answers.

Income not subject to personal income tax

- income from the sale of property owned for more than three years;

- income received by inheritance;

- income received under a gift agreement from a family member and (or) close relative in accordance with the Family Code of the Russian Federation (from a spouse, parents and children, including adoptive and adopted parents, grandparents and grandchildren, full and half-blooded (having a common father) or mother) brothers and sisters);

- other income.

The reporting period is one year. The tax period is one year.

The procedure for paying personal income tax in the form of a fixed advance payment is extended to foreign citizens who arrived in the Russian Federation in a visa-free regime and work on the basis of a patent not only for individuals (as was the case before 2015), but also in organizations, individual entrepreneurs or engaged in private practice persons (for example, lawyers who have established a law office).

Personal income tax in the form of fixed advance payments is paid for the period of validity of the patent in the amount of 1,200 rubles per month, with the payment indexed by a deflator coefficient established for the corresponding calendar year and a coefficient reflecting the regional characteristics of the labor market, established for the corresponding calendar year by the law of the constituent entity of the Russian Federation (Federal Law of November 24, 2014 No. 368-FZ).

(Information on the amount of monthly advance payments payable in 2015 by foreign individuals engaged in employment activities on the basis of a patent in accordance with Article 2271 of the Tax Code of the Russian Federation is posted on the official website of the Federal Tax Service of Russia in the “Individuals” section).

Tax rate

The Tax Code of the Russian Federation provides for five tax rates for personal income tax. Different tax rates are established both for types of income and for categories of taxpayers.

Tax rate for personal income tax of 9%

is carried out in the following cases:

- receiving dividends until 2015;

- receiving interest on mortgage-backed bonds issued before January 1, 2007;

- receipt of income by the founders of trust management of mortgage coverage. Such proceeds must be derived from the purchase of mortgage participation certificates issued by the mortgage manager prior to January 1, 2007.

Tax rate of 13%

If an individual is a tax resident of the Russian Federation, most of his income will be taxed at a tax rate of 13%. Such income, for example, includes wages, remuneration under civil contracts, income from the sale of property, as well as some other income.

Please note: from 01/01/2015 dividends are taxed at a rate of 13%, and not 9%, as was previously the case. At the same time, tax deductions provided for in Articles 218 - 221 of the Tax Code of the Russian Federation are not applied to income (dividends) from equity participation in an organization (clause 3 of Article 210 of the Tax Code of the Russian Federation).

In addition, the income of individuals who are not tax residents of the Russian Federation is taxed at a rate of 13% in the following cases:

- from carrying out labor activities;

- from carrying out labor activities as a highly qualified specialist in accordance with the law “On the legal status of foreign citizens in the Russian Federation”;

- from the implementation of labor activities by participants in the State Program for Assisting the Voluntary Resettlement to the Russian Federation of compatriots living abroad, as well as members of their families who jointly moved to permanent residence in the Russian Federation;

- from the performance of labor duties by crew members of ships flying the State Flag of the Russian Federation.

Tax rate of 15%

Dividends received from Russian organizations by individuals who are not tax residents of the Russian Federation are taxed at a rate of 15%.

Tax rate of 30%

All other income of non-resident individuals is taxed at a rate of 30%.

Tax rate of 35%

Is maximum and applies to the following income:

- the cost of any winnings and prizes received in competitions, games and other events for the purpose of advertising goods, works and services, insofar as they exceed the established amounts;

- interest income on deposits in banks in terms of excess of the established amounts;

- the amount of savings on interest when taxpayers receive borrowed (credit) funds in excess of the established amounts;

- in the form of payment for the use of funds of members of a credit consumer cooperative (shareholders), as well as interest for the use by an agricultural credit consumer cooperative of funds raised in the form of loans from members of an agricultural credit consumer cooperative or associated members of an agricultural credit consumer cooperative, insofar as they exceed the established amounts.

Features of determining residence

Citizenship of the Russian Federation is not a determining condition for establishing the status of a Russian tax resident. This means that a Russian citizen may not be a tax resident of the Russian Federation, and vice versa, not only a foreigner, but even a person without citizenship can be recognized as a tax resident of the Russian Federation. Supervisory authorities have spoken out on this issue more than once, for example, in letters from the Ministry of Finance of Russia dated November 15, 2012 No. 03-04-05/6-1305, Federal Tax Service of Russia dated September 23, 2008 No. 3-5-03/ [email protected] , Federal Tax Service of Russia in Moscow dated February 29, 2008 No. 28-10/019821.

From all that has been said, a particular conclusion follows that in determining the status, the place of birth of an individual and his address of residence are of no importance.

However, there are also persons who, according to paragraph 3 of Art. 207 of the Tax Code of the Russian Federation does not apply to the time limit of 183 days. That is, regardless of the duration of stay in the Russian Federation, the following should be considered tax residents of the country:

- Russian military personnel serving abroad;

- state and municipal employees, as well as employees on business trips abroad.

But in relation to family members of government employees, tax status should be determined in a general manner. The same rule applies to persons working in diplomatic and trade missions and consular offices. The Ministry of Finance of Russia, in a letter dated August 26, 2009 No. 03-04-05-01, separately addressed this issue.

In addition, the Tax Code in Art. 7 determined: if the Russian Federation has international agreements that establish norms other than those in the Tax Code of the Russian Federation, then the provisions from international treaties must apply. This also applies to the procedure for establishing residency. Letter of the Federal Tax Service of Russia dated October 1, 2012 No. OA-3-13 / [email protected] confirms this. In particular, it contains references to the following acts:

- Agreement dated December 5, 1998, concluded by the Governments of the Russian Federation and the Republic of Cyprus on the avoidance of double taxation.

- Agreement dated 02/08/1995, concluded by the Governments of the Russian Federation and Ukraine on the avoidance of double taxation and the prevention of tax evasion.

About the rules for determining residence, read the material: “How to correctly determine the period required to give a citizen the status of a tax resident”

The tax base

The tax base is determined separately for each type of income, for which different tax rates are established:

Tax calculation by tax agents.

Tax on the income of lawyers is calculated, withheld and paid by bar associations, law offices and legal advice centers.

Tax amounts are calculated by tax agents on an accrual basis from the beginning of the tax period based on the results of each month in relation to all income in respect of which a tax rate of 13% is applied.

The tax amount in relation to income for which other tax rates are applied is calculated by the tax agent separately.

The tax amount is calculated without taking into account the income received by the taxpayer from other tax agents and the tax amounts withheld by other tax agents.

Tax agents are required to withhold the accrued tax amount directly from the taxpayer’s income upon actual payment.

The tax agent withholds the accrued amount of tax from the taxpayer at the expense of funds paid to the taxpayer, and the withheld amount of tax cannot exceed 50% of the payment amount.

If it is impossible to withhold from the taxpayer the calculated amount of tax, the tax agent is obliged, no later than 1 month from the date of the end of the tax period in which the relevant circumstances arose, to notify the taxpayer and the tax authority at the place of his registration in writing about the impossibility of withholding the tax and the amount of tax.