To which reporting period should “carrying over” vacation pay be attributed (clause 7 of Article 255 of the Tax Code of the Russian Federation)?

Let's look at an example.

Manager Ivankov S.S., who works at , is going on vacation from 06/29/2020 to 07/26/2020. As it should be according to the norms of the Labor Code of the Russian Federation, vacation pay was paid until the employee went on vacation on June 25, 2020 in the amount of 25,000 rubles. The frequency of filing profit declarations at Clarisa LLC is quarterly. This means that 2 days of vacation pay fall in the 2nd quarter of 2021, and 26 days in the 3rd quarter. That turns out to be 26 days of “rolling over” vacation pay. To what period for profit taxation should they be classified?

In accordance with paragraph 7 of Art. 255 of the Tax Code of the Russian Federation, labor costs taken into account in the tax base include vacation pay payments in the form of average earnings. This means that vacation pay in the amount of 25,000 rubles. Ivankova S.S. should be provided for when calculating the base as part of expenses. But in what period to take them into account, the letter of the Federal Tax Service dated 03/06/15 No. 7-3-04/ [email protected]

According to these explanations, expenses in the amount of 25,000 rubles. must be taken into account during the period of their formation and payment, i.e. in the profit tax return for the 2nd quarter of 2021. According to the fiscal authority, there is no need to divide vacation pay, although the Ministry of Finance of the Russian Federation has a different opinion.

We recommend that you read the material “On the eve of summer, the Ministry of Finance spoke about how to take into account “rolling” vacations for profit .

Are annual remunerations under Article 255 of the Tax Code of the Russian Federation included in taxable expenses?

Consider the following situation.

Gloria LLC plans to provide annual rewards. What should be the company's action algorithm?

1. In accordance with paragraph 1 of Art. 324.1 of the Tax Code of the Russian Federation, Gloria LLC must establish in a document such as an accounting policy an equal method of reserving for the payment of annual remuneration, set a limit on such a reserve and the subsequent percentage of monthly deductions. To do this, an estimate is drawn up, in which the size of the annual reserve is determined, based on the ratio of the annual payroll and the percentage deduction from it to the reserve for the annual remuneration. Next, the annual reserve is broken down monthly (in the monthly amounts it is also necessary to take into account payments for insurance premiums in the amount of the annual remuneration).

Let's say that Gloria LLC has planned that labor costs in 2021 will be 7,000,000 rubles, and the percentage of reservation for annual remuneration will be 10% of them. At the same time, the amount of insurance premiums (including contributions for “injuries”) is 30.2%. This means that the estimated annual reserve limit for annual remuneration will be: 7,000,000 × 1,302 × 10% = RUB 911,400.

ATTENTION! From April 1, 2020, the organization has the right to apply reduced insurance premium rates. See here for details.

2. At the second stage, a reserve is directly formed in a monthly format for the annual remuneration. To do this, the amount of labor costs and accrued insurance premiums should be multiplied by the established monthly percentage of contributions to the reserve. The received reserve amounts should be taken into account in expenses for income tax in accordance with clause 24 of Art. 255 Tax Code of the Russian Federation.

IMPORTANT! The amount of the reserve accumulated during the year using the calculation method should not exceed the limit that was specified in the accounting policy.

Please note: compliance with the reserve limit for annual remuneration should be monitored by year. Let’s say that from January to December 2021, Gloria LLC’s labor costs amounted to 6,890,000 rubles. This means that during this period a reserve was formed: 6,890,000 × 1,302 × 10% = 897,078 rubles. That is, in December the reserve will be formed in the amount of: 911,400 – 897,078 = 14,322 rubles, so as not to exceed the limit.

3. An inventory of the annual remuneration reserve should be made at 31 December 2021. This means that you need to compare the amount of the formed reserve for the year with the amount of remuneration accrued to employees, taking into account insurance premiums, and identify any shortfalls or overruns.

Free food for employees under clause 1 of Art. 255 of the Tax Code of the Russian Federation - are these taxable expenses?

Next example.

Lira LLC organized free meals for its employees. The organization does not have a specialized canteen, but all the necessary conditions have been created in the room for meals, and food is also purchased, from which lunches are prepared by a specially hired employee. Can such expenses be included in the item “Payment”?

In order to include such expenses in the “Payment” item, you need to reflect the conditions for providing free food in employment contracts with employees. After all, in accordance with Art. 131 of the Labor Code of the Russian Federation, you have every right to partially pay wages in kind. Free meals for employees in this case will be qualified as payment of wages in kind.

In this case, the salary will consist of the accrued salary (piece rate) and the cost of organized free meals. The basis for attributing the costs of free food to wages in such a situation will be clause 1 of Art. 255 of the Tax Code of the Russian Federation, according to which such costs can include amounts accepted from the employer in accordance with various types of settlements with employees. However, according to the Ministry of Finance of the Russian Federation, it is possible to take into account the cost of free food in labor costs only on the condition that the organization keeps records of the income received by each employee, and personal income tax is withheld from the employee from the cost of food (letter of the Ministry of Finance of Russia dated January 09, 2017 No. 03 -03-06/1/80065, dated 02/11/2014 No. 03-04-05/5487).

Article 255 of the Tax Code of the Russian Federation. Labor costs (current version)

In this regard, employment contracts with employees must stipulate that they are covered by the incentive system in force in the organization.

Attention!

When applying paragraph 7 of Article 255 of the Tax Code of the Russian Federation, the following must be taken into account.

According to the Ministry of Finance of Russia, set out in letter No. 03-03-06/2/206 dated December 3, 2010, when calculating income tax, the taxpayer has the right to include expenses for wages retained by employees during the vacation provided for by the legislation of the Russian Federation for the entire period provided in the manner approved by the vacation schedule or agreement between the employee and the employer, vacation as an expense on the basis of paragraph 7 of Article 255 of the Tax Code of the Russian Federation, regardless of the period of occurrence of the employee’s right to vacation.

As the Ministry of Finance of Russia indicated in letter dated November 8, 2010 N 03-03-06/1/697, a collective agreement or local regulatory legal act may establish a procedure according to which the organization pays the cost of an employee’s travel to the place of vacation and back more often than one once every two years. Such expenses, in our opinion, can be included in labor costs when determining the tax base for income tax on the basis of paragraph 7 of Article 255 of the Tax Code of the Russian Federation.

In addition, in the letter of the Ministry of Finance of the Russian Federation dated January 10, 2012 N 03-03-06/1/1, it is noted that in the case of providing employees with additional paid leaves provided for in employment agreements (contracts) and (or) collective agreements, in accordance with the provisions of the article 128 of the Labor Code, the costs of paying them do not reduce the tax base for corporate income tax on the basis of paragraph 24 of Article 270 of the Tax Code of the Russian Federation.

With regard to compensation for the cost of travel tickets to the place of use of vacation and back for persons working in branches of the organization located not in the regions of the Far North and equivalent areas, we inform you that for the purposes of taxation of the profits of organizations, expenses related to wages are taken into account as part of labor costs with payment for travel of employees and persons dependent on these employees to the place of vacation use and back (including expenses for baggage transportation), only for employees of organizations located in the Far North and equivalent areas.

According to para. 3 of Article 9 of the Law of the Russian Federation dated 01.04.1993 N 4730-1 “On the State Border of the Russian Federation”, a checkpoint across the State Border means a territory (water area) within a railway, automobile station or station, sea (commercial, fishing, specialized), river (lake) port, airport, military airfield open for international communications (international flights), as well as another specially designated area in the immediate vicinity of the State Border where, in accordance with the legislation of the Russian Federation, persons and vehicles are allowed to cross the State Border , cargo, goods and animals. The limits of checkpoints across the State Border and the list of checkpoints across the State Border, specialized by the types of cargo, goods and animals being transported, are determined in the manner established by the Government of the Russian Federation.

As indicated in the letter dated 02/17/2011 N 03-03-06/1/105 by the Ministry of Finance of Russia, if collective, labor agreements or local regulations of the organization in which the regional coefficient and percentage increase in wages are calculated, but not attributed to those located in regions of the Far North and equivalent areas, compensation is provided for the cost of travel of employees to the place of vacation and back, the costs of these payments can be included in the tax base for income tax.

It should also be noted the position of the Ministry of Finance of Russia, set out in letter No. 03-04-06-01/300 dated November 18, 2009, based on which it follows that expenses for travel to and from the place of vacation of working family members of an employee are not taken into account as part of payment expenses labor, reducing the tax base for corporate income tax.

The Ministry of Finance of Russia, in letter dated March 31, 2011 N 03-03-06/4/26, takes the position that expenses for free provision of food to employees can be taken into account for tax purposes if such free food is provided in accordance with the legislation of the Russian Federation or provided for by labor contracts.

Attention!

When carrying out activities, an economic entity may need to invite an employee of a third-party organization to temporarily fill a vacant position, and there are often cases when the organization has employees who have the appropriate qualifications and knowledge to fill a vacant position, but due to certain circumstances, for example, carrying out activities in other location or filling other positions, these employees cannot fill a vacant position in the organization.

In this case, as follows from letter dated 04/05/2007 N 03-03-06/1/222, the Ministry of Finance of Russia believes that the organization’s costs for services for the provision of personnel under an outsourcing agreement can reduce the tax base for income tax as part of other expenses related to production and sales, if the organization does not have such specialists on staff.

However, the courts take a different point of view: the Resolution of the Thirteenth Arbitration Court of Appeal dated December 21, 2010 N A56-24683/2010 states that expenses incurred to pay the cost of providing employees to a third-party organization are subject to accounting when calculating the tax base for corporate income tax, if they are not expenses incurred directly to pay these employees; The Ninth Arbitration Court of Appeal in Resolution No. 09AP-15137/2010-AK dated July 26, 2010 indicated that the costs provided for in subparagraph 8 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation include costs for services for the provision of workers (technical and managerial personnel) by third-party organizations to participate in the production process, production management or to perform other functions related to production and (or) sales.

Attention!

Situations are not uncommon when an employer provides its employees with branded clothing; in these situations, it must be borne in mind that in letter dated 01.11.2005 N 03-03-04/2/99, the Ministry of Finance of Russia takes the position from which it follows that any payments payments made in favor of the employee must be stipulated in the employment or collective agreement. Otherwise, the organization does not have the right to include expenses associated with the production (purchase) of uniforms as labor costs, since paragraph 21 of Article 270 of the Tax Code of the Russian Federation prohibits excluding remuneration from taxable income that is not provided for in employment contracts. In addition, in a letter dated 06/07/2006 N 03-03-04/1/502, the financial department indicated that in the case when uniforms are not transferred into the ownership of the employee, their cost is not taken into account as part of expenses that reduce the tax base for the tax on profit, even if the employer’s obligation to pay the costs of purchasing uniforms is fixed in an employment or collective agreement.

Accordingly, for the legality of accounting for the purposes of taxation of the organization's profit, expenses on branded clothing must be provided as the property of the organization's employees, and the employer's obligation to provide it must follow from the provisions of the employment contract.

Attention!

In practice, situations may arise when organizations that use in their activities the labor of workers engaged in labor relations on a rotational basis, in accordance with the terms of the employment contract, undertake to provide employees with free food both in the rotational camp and while traveling to the place of work. At the same time, employees are given individual meal kits, since it is not possible to prepare food. In such a situation, the organization can reduce taxable income by the amount of expenses incurred due to the provision of individual meal kits.

This conclusion is confirmed by letter of the Ministry of Finance of Russia dated March 31, 2011 N 03-03-06/4/26, in which the financial department indicated that the costs of providing free food to employees can be taken into account for tax purposes if such free food is provided in accordance with legislation of the Russian Federation or provided for in employment contracts.

Attention!

When carrying out activities, many organizations enter into labor relations with foreign citizens. Often, employment contracts with these persons stipulate that the employer provides these workers with housing and also pays the cost of renting the provided residential premises. In this situation, the Ministry of Finance of Russia believes that the costs of these costs do not fall under paragraph 4 of part 2 of Article 255 of the Tax Code of the Russian Federation and, in accordance with Article 131 of the Labor Code of the Russian Federation, they can be taken into account when calculating the tax base for corporate income tax as part of labor costs in an amount not exceeding 20% of the salary. This position is set out in letter dated January 17, 2011 N 03-04-06/6-1.

However, the courts take a different point of view: in the Resolution of the Federal Antimonopoly Service of the Far Eastern District dated December 6, 2006, November 29, 2006 N F03-A51/06-2/4410, the court determined that the expenses incurred by the organization for the provision of housing to foreign employees are subject to accounting for tax purposes, since the specified expenses are economically justified and documented, related to the production activities of the organization; In the Resolution of the Federal Antimonopoly Service of the Moscow District dated July 30, 2010 N KA-A41/8336-10, the court stated that the organization lawfully took into account the costs of paying rent for housing rented to foreign workers who have an employment relationship with this organization.

In a letter dated 31.03.2011 N 03-03-06/1/196, the Ministry of Finance of Russia indicated that if medical examinations are not provided for by law, then the costs associated with them are not taken into account when determining the tax base for income tax.

In a letter dated 12.05.2010 N 03-03-06/1/323, the Ministry of Finance of Russia came to the conclusion that when determining the tax base for corporate income tax, the amount of accrued vacation pay for annual paid leave is included in expenses in proportion to the days of vacation falling on each reporting period.

As the Ministry of Finance of Russia indicated in letter dated May 13, 2010 N 03-03-06/4/55, for the purposes of calculating income tax, the costs of wages retained by employees during vacation when it is transferred from the previous year are taken into account in cases provided for by law RF.

At the same time, if the leave was not provided to the employee in a timely manner, the organization remains obligated to provide the employee with all unused paid leave. Annual leave for previous working periods can be provided either as part of the leave schedule for the next calendar year, or by agreement between the employee and the employer. During a calendar year, an employee can use several vacations for different working years.

Considering that the employing organization has an obligation to provide the employee with leave for previous years, by virtue of paragraph 7 of Article 255 of the Code, it has the right to include expenses for wages retained by employees during such leave as expenses when calculating income tax.

As the Ministry of Finance of Russia explained in letter dated October 25, 2010 N 03-03-06/1/658, according to Article 137 of the Labor Code, deductions from an employee’s salary to pay off his debt to the employer can be made upon dismissal of an employee before the end of the working year for which he has already received annual paid leave for unworked vacation days. Such deduction is also allowed by paragraph 1 of paragraph 2 of the Rules on regular and additional leaves, approved by the People's Commissariat of Labor of the USSR dated April 30, 1930 N 169.

Based on Article 138 of the Labor Code of the Russian Federation, the total amount of all deductions for each payment of wages cannot exceed 20 percent, and in cases provided for by federal laws - 50 percent of wages due to the employee.

If, taking into account this limitation, the employer was unable to withhold the entire amount of debt from the employee upon dismissal, the employee can voluntarily deposit the remaining amount into the cash register or transfer to the employer’s bank account. Moreover, if the employee does not agree to the voluntary return of excess amounts received, then the employer, in accordance with the provisions of Article 391 of the Labor Code of the Russian Federation, has the right to recover them in court.

Attention!

When applying paragraph 8 of Article 255 of the Tax Code of the Russian Federation, the following must be taken into account.

The Federal Antimonopoly Service of the West Siberian District, in Resolution dated September 17, 2007 N F04-6344/2007 (38138-A27-26), indicated that Article 126 of the Labor Code of the Russian Federation does not allow the replacement of a part of vacation not exceeding 28 calendar days with monetary compensation. Payment of such compensation in accordance with paragraphs 7 and 8 of Article 255 of the Tax Code of the Russian Federation cannot be classified as labor costs.

The Federal Antimonopoly Service of the North-Western District, in Resolution No. A44-1709/2006-7 dated March 19, 2007, established: during the verification of the correctness of the calculation of taxable profit, the tax authority established that the company unreasonably took into account, as expenses reducing taxable profit, compensation payments made to its employees for unused vacation days. In accordance with Article 126 of the Labor Code of the Russian Federation, part of the vacation exceeding 28 calendar days, upon a written application from the employee, can be replaced by monetary compensation. Since the taxpayer, when paying compensation for unused vacation days, used one of the permissible methods of compensation payments, it should be recognized that he had the right, on the basis of paragraph 8 of Article 255 of the Tax Code of the Russian Federation, to include them in labor costs that reduce taxable profit.

Attention!

When applying paragraph 9 of Article 255 of the Tax Code of the Russian Federation, the following must be taken into account.

The Ministry of Finance of Russia, in letter dated July 14, 2009 N 03-03-06/1/464, indicated that an employment or collective agreement may provide for other cases of payment of severance pay, as well as establish their increased amounts. If, when concluding an employment contract, no conditions were included in it, they may be determined by a separate appendix to the employment contract or by a separate agreement of the parties, concluded in writing and forming an integral part of the employment contract (Article 57 of the Labor Code of the Russian Federation).

Based on the foregoing, the financial department came to the conclusion: payments in the form of severance pay provided for by an additional agreement to an employment contract or an agreement on its termination (termination) can be taken into account as part of expenses that reduce the tax base for corporate income tax, regardless of the grounds for termination employment contract.

The Ministry of Finance of Russia in a letter dated 04/16/2009 N 03-03-06/2/86 explained that payments in the form of severance pay provided for in an agreement on the termination (termination) of an employment contract can be taken into account as part of expenses that reduce the tax base for the tax on profit of organizations, regardless of the grounds for termination of the employment contract.

The Ministry of Finance of Russia, in letter dated January 23, 2008 N 03-03-06/2/5, came to the conclusion that expenses in the form of a one-time remuneration for length of service (additions for length of service in a specialty) can be taken into account for profit tax purposes, provided that the procedure, amount and conditions for its payment are provided for in employment agreements (contracts) and (or) collective agreements, as well as local regulations.

Attention!

When considering labor costs, it should be noted that the list of expenses established by Article 255 of the Tax Code of the Russian Federation is not closed.

As the Ministry of Finance of Russia noted in letter dated 02/09/2011 N 03-03-06/2/30, on the basis of paragraph 25 of Article 255 of the Tax Code of the Russian Federation, other types of expenses made in favor of the employee can also be recognized as labor costs, provided that they are provided for by an employment or collective agreement, with the exception of the expenses specified in Article 270 of the Tax Code of the Russian Federation.

Let's look at how this rule applies to specific costs.

As indicated in the letter of the Ministry of Finance of Russia dated December 3, 2010 N 03-03-06/2/205, expenses associated with incentive, incentive, and compensation payments to employees of the organization, carried out on the basis of an employment contract, local regulations (regulations on the procedure for remuneration) , can be taken into account as expenses for profit tax purposes, provided that such expenses comply with the requirements of Article 252 of the Tax Code of the Russian Federation.

If these types of labor costs are not related to the production results of employees and do not meet the criteria of Article 252 of the Tax Code of the Russian Federation, then, regardless of their name, they cannot be taken into account as expenses for profit tax purposes.

The letter of the Ministry of Finance of Russia dated December 3, 2010 N 03-03-07/40 states that if a collective agreement, an employment contract or a local regulatory legal act provides for compensation for expenses for an employee’s travel to the place of vacation and back, then such expenses, in our opinion , can be included in labor costs when determining the tax base for income tax on the basis of paragraph 7 of Article 255 of the Tax Code of the Russian Federation.

A one-time payment to an employee made after signing an employment contract may be taken into account as part of labor costs on the basis of paragraph 25 of Article 255 of the Tax Code of the Russian Federation, if such payment is provided for by an employment and (or) collective agreement and complies with the requirements of Article 252 of the Tax Code of the Russian Federation (see, for example, letter of the Ministry of Finance of Russia dated November 18, 2010 N 03-03-06/1-735).

The Ministry of Finance of Russia in a letter dated October 28, 2010 N 03-03-06/1/671 indicated that the costs of insuring the housing of employees, as well as paying for social insurance of an employee abroad, if they do not meet the criteria of Articles 255, 263 and 291 of the Tax Code of the Russian Federation , for tax purposes, profits are not taken into account.

Expenses for education of employees' children, transportation expenses when traveling employees and members of their families are not taken into account when determining the tax base for income tax.

The organization has the right to take into account expenses for the rental of residential premises reimbursed by an organization to its employee for tax purposes of the profits of organizations in an amount not exceeding 20 percent of the amount of wages.

When qualifying amounts accrued in favor of an employee as wages, one should proceed from the fact that the amount of remuneration is considered established if it is possible to reliably determine from the terms of the employment contract what amount of wages is due to the employee for the amount of work actually performed. In other words, the amount of payment is considered established if the employee, having not received the remuneration due under the terms of the employment contract in cash or in kind, can, based on the terms of the employment contract, demand the employer to pay a specific amount of money for the amount of work performed.

Expenses associated with obtaining visas and obtaining work permits are taken into account for profit tax purposes, provided they comply with the provisions of Article 252 of the Tax Code of the Russian Federation.

The Federal Tax Service of Russia, in a letter dated August 31, 2010 N ShS-37-3/ [email protected], explained that, within the meaning of Article 255 of the Tax Code of the Russian Federation, labor costs are only those cash payments that are provided for by the legislation of the Russian Federation, labor legislation, labor agreements (contracts) and (or) collective agreements. Moreover, these payments must be made for the employee’s performance of official functions (job responsibilities), that is, for labor, and the incurrence of such expenses is the responsibility of the employer in accordance with labor legislation.

As the tax authorities have indicated, for the purposes of Article 255 of the Tax Code of the Russian Federation, when qualifying amounts accrued in favor of an employee as labor costs, one should proceed from the fact that the amount of payment is considered established if it is possible to reliably determine from the terms of the employment contract what amount of wages is due to him for the amount of work actually completed. In addition, the amount of payment is considered established if the employee, having not received the remuneration due under the terms of the employment contract in cash or in kind, can, based on the terms of the employment contract, demand that the employer pay a specific amount of money for the amount of work performed.

As the Ministry of Finance of Russia explained in letter dated December 13, 2010 N 03-03-06/1/775, the organization’s expenses in the form of additional payments for the standard time of movement of workers in the mine from the shaft to the place of work and back, calculated based on the amount established by the Decree of the Government of the Russian Federation dated May 15, 1998 N 452 “On additional payment to employees of organizations in the coal, shale industry and mine construction, constantly engaged in underground work, for the standard time of their movement in the mine from the shaft to the place of work and back”, can be taken into account as part of labor costs for based on paragraph 25 of Article 255 of the Code as other types of expenses made in favor of the employee, if such payments are provided for in labor and (or) collective agreements and comply with the requirements of Article 252 of the Tax Code of the Russian Federation.

Are uniform costs included in labor costs?

Let's look at another example.

plans to buy uniforms for employees and give them to them free of charge. How to factor this into labor costs?

In paragraph 5 of Art. 255 of the Tax Code of the Russian Federation states that the cost of uniforms given to employees free of charge and remaining for their personal use can be taken into account as part of labor costs for tax purposes. But remember that in this case you will have to pay VAT on the gratuitous transfer, as well as personal income tax (since this will be considered a payment to the employee in kind) and insurance premiums. Agree that these are significant additional costs.

IMPORTANT! To account for uniform costs as part of labor costs, the following conditions must be met:

- issuing uniforms for employees once has an economic justification;

- by uniform you can determine affiliation with the company;

- the issuance of such clothing is provided for by a collective or labor agreement or other local document of the company;

- expenses for the purchase of clothing are documented.

As an alternative, we propose to use the provisions of Art. 254 of the Tax Code of the Russian Federation and try to reclassify clothing from uniform to special clothing. To do this, you need to conduct an assessment of working conditions. If it is impossible to classify clothing as special clothing, then it is worth transferring it not into ownership, but only for temporary use, in order to avoid the above-mentioned burdensome additional costs.

Composition of funds for wages.

Home Favorites Random article Educational New additions Feedback FAQ⇐ PreviousPage 8 of 11Next ⇒

Let's consider the structure of the wage fund

(FOT).

The wage fund includes wage payments.

In accordance with current legislation, labor costs include the following payments:

1. Payment of wages for work actually performed.

2. Payment in kind to employees.

3. Payments under bonus systems for workers.

4. Compensatory payments related to work hours and working conditions.

5. The cost of items issued free of charge in accordance with current legislation, including uniforms, uniforms, remaining for personal use, or the amount of benefits in connection with their sale at reduced prices. The norms established by law for the free issuance of items apply to enterprises of all forms of ownership.

6. Payment of annual and additional vacations.

7. Payments to laid-off employees.

All of the listed payments that make up the wage fund are included in the cost of products, works, and services.

In addition to the wage fund, the wage fund includes the amount of labor and social benefits provided by the company, including financial assistance paid from profits. These payments, in accordance with the current regulations, are not included in the cost of products, works, and services.

Not included in the wage fund

the following payments to company employees in cash and in kind, as well as costs associated with their maintenance.

1. Bonuses paid from special funds and targeted revenues, as well as payments under bonus systems for workers and employees for production results, in excess of the amounts provided for by law.

2. Rewards based on the results of work for the year.

3. Payment of additionally provided holidays to employees, including women raising children, in addition to those provided for by law.

The cost also does not include the most important component of funds allocated for consumption - dividends, interest on shares of members of the labor collective and income from contributions of members of the labor collective to the property of the enterprise.

For ease of planning, it is advisable to divide the wage fund into two parts: the basic and additional wage fund.

The

basic salary

includes payment for work performed.

Additional wages

include various additional payments, usually not related to the amount of work performed. For example, additional payment for night work, additional payment for leading a team.

Payroll planning.

In the process of planning the wage fund, it is necessary to solve the following tasks :

• choose the forms and systems of wages that best correspond to the objectives of the strategic and tactical plan;

• choose methods for determining the planned wage fund;

• calculate the amount of the planned wage fund. Let's look at them in more detail.

Selection of forms and systems of remuneration.

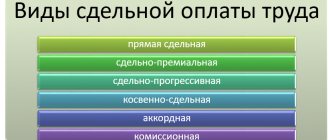

The following forms of remuneration are currently most widespread in domestic and foreign practice.

Piecework,

in which payment is made for each unit of product, work, or service.

Conditions for applying piecework wages:

• there are indicators for measuring the amount of work performed by each employee;

• it is possible to accurately record the volume of work performed;

• the amount of work performed depends on the employee’s efforts;

• the plan provides for an increase in the output of products, works, and services in the division where piecework wages are provided;

· there is the possibility of technical standardization of labor.

Time-based form of remuneration

applies in the following cases:

• there is no possibility of increasing production output, labor productivity is not related to the efforts of the worker or, due to production conditions, it is not necessary to increase the volume performed;

• the production process is strictly regulated;

• the worker’s functions are reduced to monitoring the progress of the technological process;

• functioning of flow and conveyor types of production with a strictly specified rhythm;

• an increase in product output may lead to defects or deterioration in its quality.

2. Methods for determining the planned wage fund.

To determine the planned wage fund (wage fund), the following methods are used:

• according to the achieved level of the basic wage fund;

• based on average wages;

• normative;

• element-by-element (direct counting).

Planning of consumption fund funds.

The basis of the wage fund is the wage fund. In addition to this, the wage fund includes payments from the consumption fund, formed from net profit.

Paying wages only from the wage fund, planned in accordance with the current regulations, has significant disadvantages. Firstly, low wages, which do not provide a living wage. Secondly, an equal approach to wages for various categories of workers. Thirdly, the existing tariff system does not ensure the dependence of the level of remuneration on the final results of the company's activities. Therefore, connecting profit as a source of remuneration allows you to mitigate the effect of these shortcomings, create higher motives and incentives for work, restore the functions of wages for the expanded reproduction of labor, bring the level of wages into line with the real cost of labor in the labor market, and eliminate deformations prevailing wages for all categories of workers.

Based on the net profit remaining at the disposal of the enterprise, a consumption fund is created, which is used for collective needs, for example, financing healthcare facilities, culture, as well as for individual consumption (remuneration based on the results of work for the year, financial assistance, payment for vouchers to sanatoriums and holiday homes and so on.).

The size of the consumption fund and the direction of its use are established in the financial plan of the company. Part of the consumption fund is allocated to wages. This part can be spent in various ways. Firstly, it should be placed at the disposal of the structural divisions of the company to encourage their work teams. Secondly, remain at the disposal of the company’s top management and be used to stimulate the company’s employees.

The relationship between these parts is fixed by the estimate for the use of the consumption fund. There are no regulations on this issue. Each company approaches the choice of areas for using the consumption fund individually based on the goals and objectives facing it, the current level of wages, the availability of social infrastructure, the region in which the company is located, etc.

The following ratio of special funds created from net profit is considered optimal: accumulation fund and reserve fund - 60%, consumption fund - 40% of the net profit remaining at the disposal of the enterprise. Considering that a dividend fund is created from the consumption fund, which is accrued not to all employees of the enterprise, but only to shareholders and is not essentially wages, and also that part of the consumption fund goes to the formation of shares of members of the labor collective, it is spent on wages on average, about 8-80% of the net profit remaining at the disposal of the enterprise.

An important problem that arises when planning funds for wages is the distribution of the consumption fund between the structural divisions of the company. Domestic practice shows that the funds of the consumption fund, as a rule, are accumulated at the level of senior management and paid centrally. This approach cannot be considered justified, since it creates “equalization” and insufficient material interest in the results of the activities of the company’s divisions. Therefore, a more preferable approach seems to be in which part of the consumption fund is distributed among the divisions of the company and included by them in the planned wage fund. This approach is typical for Western companies, in which each structural unit has its own budget, including, among other things, deductions from net profit.

Analysis of domestic and foreign experience shows that from the centralized part of the consumption fund

It is advisable to make the following payments:

• remuneration based on the results of work for the year;

• payment for additional vacations provided in excess of those provided for by law under the collective agreement;

• pension supplements, one-time benefits for labor veterans retiring;

• payments in connection with price increases made in excess of the income indexation;

• compensation for the increase in the cost of food in public catering establishments owned by the company;

• price differences in products (work, services) provided to company employees or sold by subsidiary farms for public catering.

From the consumption fund of a structural unit

It is advisable to make the following payments:

• bonuses for production results in excess of the amounts attributable to cost;

• financial assistance;

• payment for housing, vouchers for treatment and recreation, visits to cultural and sporting events, etc.

PLANNING REQUIREMENTS

IN MATERIAL AND TECHNICAL

RESOURCES

10.1. Goals, objectives and content of planning the need for material and technical resources.

The purpose of developing a logistics plan is to optimize the enterprise’s need for material and technical resources, since saving on resources can lead to a deterioration in the quality and competitiveness of products, and the desire to create excess reserves and irrational use of resources can lead to the “destruction” of working capital and a decrease in the effectiveness of their use, which will ultimately affect the final results of the enterprise.

The main objectives of the logistics plan (MSP) are:

• timely and complete satisfaction of the enterprise's needs for material and technical resources;

• ensuring high quality of supplied resources;

• minimizing costs for the acquisition, delivery and storage of inventory items;

• determination of optimal delivery times and sizes of transport lots of purchased material resources;

• determination of the optimal level of inventories of material and technical resources;

Currently, enterprises organize logistics based on the current market conditions, the capabilities of potential partners, information on price fluctuations by purchasing resources on the market for goods and services. The acquisition of resources in the market for goods and services is carried out by enterprises under direct contracts, in wholesale trade, including at fairs, auctions and from logistics organizations, as well as from other intermediary organizations.

In market conditions, the needs for material and technical resources must be determined by the supply service on the basis of orders from production departments acting as consumers. Only production departments can know what is required, where and by when.

The logistics service studies the market for raw materials and supplies with a view to the possibility of purchasing cheaper material and technical resources; it can accumulate orders from production departments in order to purchase materials in economically feasible quantities and receive discounts when purchasing large quantities.

The initial data for developing a logistics plan are the planned production volumes, the volume of work on technical and organizational development, capital construction, as well as the regulatory framework, taking into account tasks to reduce material consumption rates.

The logistics plan is drawn up in physical and monetary terms for the year and broken down by quarter.

During the development of the logistics plan, the maximum possible savings in capital goods, achieved as a result of:

• reducing the weight of products without compromising their quality characteristics, which, in addition to saving raw materials and materials, entails a reduction in the labor intensity of their production, an increase in equipment throughput, a reduction in the volume of transportation, fuel consumption, etc.; this saving depends on accurate calculation of structures, selection of optimal safety margins, correct choice of brands, sizes and profiles of materials, etc.;

• reducing waste and losses through the introduction of new progressive technological processes - precision casting methods, replacing forging with stamping, special non-standard profiles and sizes, rational cutting of materials, integrated use of raw materials;

• replacement of expensive and scarce materials with cheaper ones, use of plastics instead of ferrous and non-ferrous metals, reinforced concrete as a structural material, etc., as well as reuse of lubricating oils, waste paper, containers, rubber, glass.

The logistics plan consists of calculations of the need for material and technical resources and a procurement plan.

The need for material and technical resources is determined taking into account the industry characteristics of enterprises in the form of separate calculation tables, classified according to the nature of the materials used:

a) the need for raw materials and materials;

b) the need for fuel and energy;

c) the need for equipment.

The logistics plan for an enterprise (firm) is drawn up in four stages (Fig. 10.1).

On the first

stage, a draft plan is developed in the form of applications containing calculations of the need for certain types of material resources. The starting point for this is:

• strategic plan of the enterprise;

• achieved indicators of resource consumption in the year preceding the planned one.

Rice. 10.1. Algorithm for planning logistics.

On the second

stage, an analysis of the efficiency of use of material resources is carried out, a draft plan of material and technical

provision is adjusted on the basis of an updated production program, updated tasks for the introduction of new equipment and experimental work, adjusted standards for the consumption of materials and inventories.

On the third

stage, an analysis of the market for raw materials and materials is carried out, the feasibility of purchasing a particular resource or producing it at the enterprise on its own is assessed, and a decision on purchase is made.

On the fourth

At this stage, balances of material and technical resources and procurement plans are drawn up.

Let's consider the content of the stages of logistics planning.

⇐ Previous8Next ⇒

Is financial assistance for vacation an expense?

The following situation:

Igrostek LLC pays its employees financial assistance for vacation according to the applications received from them. Is it possible to take such a payment into account as part of salary costs in accordance with Art. 255 of the Tax Code of the Russian Federation?

In accordance with the provisions of paragraph 23 of Art. 270 of the Tax Code of the Russian Federation, an organization has no reason to take into account the costs of paying financial assistance to employees as part of the costs that take part in the formation of income tax. However, the Ministry of Finance of the Russian Federation spoke on this matter in a letter dated 09/02/2014 No. 03-03-06/1/43912, indicating that these expenses should be taken into account under Art. 255 of the Tax Code of the Russian Federation is prohibited only if they do not relate to the fulfillment of labor obligations. According to the department, the payment of financial assistance for vacation is precisely related to the employee’s fulfillment of work obligations. Only here you need to take into account compliance with the conditions for classifying financial assistance as labor costs:

- this type of material support must be enshrined in one of the documents: an employment or collective agreement;

- the amount of assistance depends on the amount of wages;

- payment must be interconnected with the implementation of labor discipline.

How to create a cost item

To create a new cost item, click the “Create” button.

How to fill out:

- Enter the title of the article.

- Specify a folder if necessary.

- In the “Type of expense” field, select the type of expense for tax accounting. This field affects the completion of the “Income Tax Return” report. If the cost item is not an expense for tax accounting, indicate the type of expense “Not taken into account for tax purposes.”

- In the “Use as default” field, specify the document into which the cost item should be automatically inserted.

- Save the article using the “Save and Close” button.

Is it possible to include the payment of an anniversary bonus as an expense?

One more example.

One of the employees, engineer T.R. Krusov, turns 50 years old. In connection with the anniversary, the management decided to pay him a bonus for the anniversary. Is it possible to take such a payment into account as part of the taxable labor costs under Art. 255 of the Tax Code of the Russian Federation?

According to Art. 255 of the Tax Code of the Russian Federation, expenses include bonus payments that are directly related to the employee’s labor obligations and work activities. The anniversary is in no way connected with the employee’s fulfillment of his labor powers (obligations).

In Art. 252 of the Tax Code of the Russian Federation clearly states that only bonus payments for production results, achievement of target indicators and excellent work can be associated with labor obligations. An anniversary does not fit any of these formulations. Therefore, the anniversary bonus cannot be classified as a labor cost for income tax purposes.

Accrual method

As for the procedure for recognizing labor costs, if a company is engaged in production and uses the accrual method, then such expenses are taken into account when calculating income tax as finished products are sold, provided that labor costs are considered direct expenses (clause 2 Article 318 of the Tax Code of the Russian Federation).

Labor costs, which are classified as indirect expenses, can be included by an enterprise in calculating the tax base at the time of their accrual (clause 2 of Article 318 of the Tax Code of the Russian Federation).

Companies that provide services can take into account both direct and indirect expenses at the time of their accrual (paragraph 3, paragraph 2, article 318 of the Tax Code of the Russian Federation).

In trade organizations, labor costs are classified as indirect expenses, which means they are taken into account at the time of accrual (paragraph 3 of Article 320 of the Tax Code of the Russian Federation).

Can gym memberships for employees be included in expenses?

Let's look at the following situation.

compensates employees for purchasing gym memberships. Can these expenses be classified as taxable labor costs in accordance with Article 255 of the Tax Code of the Russian Federation?

By compensating employees for the cost of gym memberships, the organization can spend these costs under Art. 255 of the Tax Code of the Russian Federation (wages) or under Art. 264 of the Tax Code of the Russian Federation (ensuring normal working conditions). As for accounting for such expenses as taxable expenses, there is a direct prohibition in paragraph 29 of Art. 270 of the Tax Code of the Russian Federation, which states that such expenses are not taken into account for tax purposes. The same opinion is expressed in letters of the Ministry of Finance of the Russian Federation dated December 16, 2016 No. 03-03-06/1/75464, dated December 1, 2014 No. 03-03-06/1/61234 and dated October 17, 2014 No. 03-03-06/ 1/52376.

Is remuneration under civil contracts included in expenses?

Liros LLC entered into a contract for commissioning of production equipment with E. N. Efremov. Is it possible to include these payments in taxable costs in accordance with Art. 255 of the Tax Code of the Russian Federation?

We turn to clause 21 of Art. 255 of the Tax Code of the Russian Federation, which states that payments to individuals who are not on the company’s staff if they perform work under contract agreements can be taken into account as part of labor costs. But at the same time the conditions of Art. 252 of the Tax Code of the Russian Federation stating that such expenses must be confirmed and that they are aimed at generating income from the organization’s business activities.

At the same time, the concluded contract must fully comply with the established norms of the Civil Code of the Russian Federation. Another significant circumstance is that all expenses included in the article “Payment” (Article 255 of the Tax Code of the Russian Federation) must imply the performance of certain work by an individual. In this case, the rental or use of machinery and equipment is excluded. If such expenses are present, then they should be included in the item “Other expenses” (Article 264 of the Tax Code of the Russian Federation).

Do additional payments up to average earnings during a business trip count as expenses?

And the last situation.

Technologist Ivashkin G.N. was sent on a business trip, and his actual earnings for this period were below average. Is it possible to make an additional payment up to the average salary of an employee and take it into account as part of the salary costs involved in taxation?

When an employee goes on a business trip, then according to Art. 167 of the Labor Code of the Russian Federation, he is guaranteed an average salary. In accordance with paragraph 25 of Art. 255 of the Tax Code of the Russian Federation, other expenses that were provided for by the organization in the labor or collective agreement are recognized as part of labor costs. Therefore, in order to make such additional payments to the employee and take them into account in taxable expenses, the employer must stipulate these payments in the employment contract with the employee, and best of all, in the collective agreement. Then there will be no problems if the actual earnings on a business trip turn out to be lower than the employee’s average earnings, and the employer decides to compensate for this difference.

ConsultantPlus has answers to certain taxpayer questions:

If you don't have access to the system, get a free trial online.

One-time payment to a new employee

The organization, in accordance with the employment contract concluded with the new employee, undertakes to make a one-time payment to this employee after signing the employment contract.

Can an organization take such a payment into account as part of labor costs when calculating income tax on the basis of clause 25 of Art. 255 of the Tax Code of the Russian Federation? According to Art. 255 of the Tax Code of the Russian Federation, the taxpayer’s expenses for wages include any accruals to employees in cash and (or) in kind, incentive accruals and allowances, compensation accruals related to working hours or working conditions, bonuses and one-time incentive accruals, expenses associated with the maintenance of these employees, provided for by the norms of the legislation of the Russian Federation, labor agreements (contracts) and/or collective agreements.

According to the norms of paragraph 25 of Art. 255 of the Tax Code of the Russian Federation, the taxpayer’s expenses for remuneration may include other types of expenses incurred in favor of the employee and provided for by labor and/or collective agreements. Thus, a one-time payment to an employee made after he signs an employment contract can be taken into account as part of labor costs.

Results

This article examined a number of topical issues regarding labor costs for tax purposes. The main conclusion arising from the presented materials is that many payments in favor of employees can be justified and taken into account under the article “Wages” as participating in taxation.

It is very important to correctly process such payments and pay special attention to documents such as labor and collective agreements, as well as other local acts of the organization. Remember that even if the norms of Art. 255 of the Tax Code of the Russian Federation allows expenses to be included in labor costs, it is worth carefully studying the conditions under which this will be legal and justified.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Payroll or payroll?

Remuneration involves not only the regular receipt of wages by employees. In enterprises that care about their staff, employees usually receive not only the amounts intended to be paid according to the salary or tariff schedule, but also additional funds provided for by the internal policy and/or industry characteristics of the organization.

Thus, the wage fund includes all types of payments that the entrepreneur makes in favor of employees, that is, all expenses provided for the organization’s personnel in the planned, current or past period, regardless of the reasons for the accrual. If we compare this totality with the wage fund (WF), then the latter will be part of the payroll.

The main difference between the FW is that this fund includes only those payments that are directly related to the labor operations performed by employees and their results.

NOTE! These funds will match if the organization's employees do not receive any payments other than salaries. But in practice this happens quite rarely.

FW and payroll are calculated using identical algorithms.

How to analyze the efficiency of using the wage fund ?