Decoding checkpoint

KPP is an acronym.

Its decoding sounds like “Registration reason code”. We are talking about tax accounting, and it is the tax authorities who assign this code. In general, it consists of nine digits.

- The first and second characters indicate the code of the subject of the Russian Federation in which the inspectorate that assigned the checkpoint is located. So, for the capital's Federal Tax Service, the first two digits are 77, for those near Moscow - 50, etc. If the code was assigned by the interregional inspectorate for the largest taxpayers, then the first two digits will be 99;

- The third and fourth characters indicate the number of the Federal Tax Service that assigned the code. For example, for inspection No. 23 in Moscow, the third and fourth signs will be 23;

- The fifth and sixth digits show the actual reason why tax authorities register the company. According to the SPPUNO directory, if accounting occurs at the location of the organization, then the fifth and sixth digits will be 01; by location of separate units - 02, 03, 04, 05, 31, 32; by property location - 06, 07, 08; at the location of the vehicles - from 10 to 29. To register an organization as the largest taxpayer, the fifth or sixth digits will be 50. There is also a letter from the Federal Tax Service dated 06/02/08 No. CHD-6-6 / [email protected] which reads: branches are assigned a value of 43, representative offices - 44, OP - 45. In practice, tax authorities are guided by this letter;

- the seventh, eighth and ninth digits represent the serial number of the organization’s registration with the tax office on the appropriate basis.

Fill out a payment form for free in the accounting web service

Where is the checkpoint assigned?

The company receives the reason code for registration simultaneously with the TIN, immediately upon tax registration with the territorial tax service to which the founder of the organization applies. In cases where an enterprise moves to another administrative district, under the jurisdiction of a different tax office, the checkpoint must be changed, that is, you must independently contact the tax office at the new location of the company with an application to assign a new checkpoint. The same must be done when moving a branch or separate division of a company - they also have their own reason codes for registration and they must also change when changing the territory of commercial activity.

For your information! The reason code for registration with several completely different companies may well coincide. This means that these organizations are included in the same territorial Federal Tax Service on the same basis.

Important! When changing the details of the tax office, including its relocation, the checkpoint for taxpayers belonging to a given department of the tax service does not change.

Why do you need a checkpoint?

A legal entity can be registered simultaneously with several Federal Tax Service Inspectors: one - at its location, another - at the location of its unit, a third - at the location of the real estate, etc. To reflect information about a particular reason, each of them is assigned a separate code.

IMPORTANT. The company always has only one TIN, and it remains unchanged. But there may be several checkpoints, and under certain circumstances they will change. For example, if a change of legal address entails a transfer to another Federal Tax Service, tax authorities will assign a new checkpoint to the legal entity to replace the previous one.

What is checkpoint

When filling out various documents, for example, employment contracts with employees, invoices, contracts with counterparties, organizations and entrepreneurs (IP) must indicate their details.

These include many different codes:

- OGRN;

- TIN;

- checkpoint;

- OKVED, etc.

KPP is a letter abbreviation that indicates the reasons for registering a legal entity as a taxpayer with the Federal Tax Service of the Russian Federation. It is assigned by tax service specialists. All organizations, enterprises, and firms that have a stamp have such a code.

When registering an individual entrepreneur, only a taxpayer identification number is issued; a checkpoint is not issued. To conduct the activities of an individual entrepreneur, only a TIN is enough.

In many documents for conducting business activities there is a column with a checkpoint mark. Since most documents have certain forms established by law, when filling them out, the individual entrepreneur often faces the question “what should I enter in this column?”

The entrepreneur should not fill out the column with the value of the checkpoint, since there is none. He can put a dash or zeros. These could be documents for the Federal Tax Service, any reporting, payment orders.

To whom is the checkpoint assigned, in what documents is it indicated?

The Federal Tax Service assigns a reason code for registration only to legal entities. Individual entrepreneurs do not have this requisite.

Legal entities must indicate the checkpoint (as well as the tax identification number) in all documents related to taxes and insurance premiums. Among these papers:

- Declarations and calculations, income certificates in form 2-NDFL.

- Payment orders for the payment of taxes, fees, insurance premiums, as well as penalties and fines for them. In such payments, the checkpoints of the payer and the recipient are mandatory bank details. If money is transferred to a counterparty, this code does not need to be specified.

- Invoices, sales books, purchase books, journals of received and issued invoices. Here it is necessary to indicate the checkpoints of both the supplier and the buyer.

ATTENTION. For legal entities that have several checkpoints, it is important to choose the right code. In particular, when issuing an invoice by a separate division, it is necessary to indicate the code of this division. If an employee is registered in a branch, the 2-NDFL certificate for such an employee must indicate the branch code.

Fill out and submit 2‑NDFL online for free with new codes

Who is assigned the checkpoint (does the individual entrepreneur have one)

The checkpoint is assigned to legal entities and is an integral part of the mandatory details. The natural question is: “Does the individual entrepreneur have a checkpoint or not?”

According to the Procedure for Registration of Individual Entrepreneurs and the Tax Code of the Russian Federation, individual entrepreneurs should not receive a checkpoint.

One legal entity may have several checkpoints. This is due to the fact that the company has the right to have several separate divisions, land plots (other real estate), and transport in various constituent entities of the Russian Federation.

For example, the head office of a coal mining company is located in Moscow, and the coal mines themselves are in Kuzbass. This organization will have a checkpoint for the head office and a checkpoint for the coal mines.

If a company or its divisions, in the course of its business activities, change location, acquire and register new property or vehicles in other (different from the place of main registration) constituent entities of the Russian Federation, then it must also change the checkpoint.

Changing the checkpoint is of a declarative nature. This means that the founder (founders) of a legal entity must personally contact the Federal Tax Service of the administrative entity where the new location of the company (division, property, etc.) is located and submit an application to replace the checkpoint.

The code is entered into the Certificate of Registration issued by the Federal Tax Service. The checkpoint is also recorded in the unified state register of legal entities - the Unified State Register of Legal Entities (you can learn about this register from another article on our website).

Important: the checkpoint of a legal entity is not a unique code. It happens that the checkpoints of different companies are the same. This happens because these organizations are registered with the same Federal Tax Service on the same basis. Accurate identification of legal entities. persons is possible only in combination (TIN + KPP).

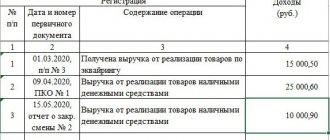

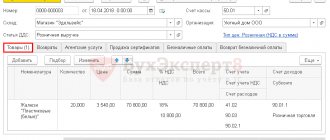

*click on the picture to open it full size in a new window

How to find out the checkpoint of an organization

The reason code for registration can be found from the certificate or notification issued by the inspectorate. In addition, the checkpoint is indicated in the entry sheet of the Unified State Register of Legal Entities (USRLE). The company receives this sheet upon registration.

To summarize, we note: an accountant needs to understand what a checkpoint is in an organization’s details and how to decipher it. This will help you avoid mistakes when preparing important documents, such as invoices and bank payment orders.

Errors when filling out payment slips can be eliminated if payment documents are generated automatically. Some web services for submitting reports (for example, “Kontur.Extern”) allow you to generate a payment in 1 click based on data from the declaration (calculation) or the request for payment of tax (contribution) sent by the inspectorates. All necessary data (recipient details, including checkpoint, current budget classification codes - KBK, account numbers of Federal Treasury departments, codes for payer status) are promptly updated in the service without user participation. When filling out a payment slip, all current values are entered automatically.

Is it possible to invent a checkpoint yourself?

Many entrepreneurs, wanting to please their counterparties, independently come up with a checkpoint, which is subsequently fixed in the contract. When generating the code yourself, you need to find out the code of the region where the business activity is carried out and the tax service branch number corresponding to the registration address. Next, as a rule, the combination of numbers “01001” is indicated, which is assigned to most companies.

It is important to pay attention to the fact that this act is considered a gross violation of the rules established by the control authorities. Independent formation of a checkpoint by an individual entrepreneur may result in penalties . This procedure is fixed in the fourteenth article of the Federal Law. This means that in order to comply with the requirements of regulatory authorities, the entrepreneur must make a dash in the appropriate column.

The KPP is assigned by the tax authority upon registration of a legal entity, including along with the TIN, any legal entity also receives a KPP

It should also be mentioned that a self-generated digital value is invalid. This means that fixing invented codes in a document can deprive the official form of legal force . Thus, an attempt to satisfy the demands of the counterparty may result in the conclusion of an illegal transaction.

It is necessary to pay special attention to the fact that the tax registration reason code for individual entrepreneurs is not provided for by regulatory authorities. This means that the entrepreneur has the legal right to refuse to include it in the contract and other documents. Private entrepreneurs are also given the right to request the provision of this information from counterparties registered as legal entities. This step allows you to obtain insurance that guarantees the integrity of the agreement.

What do you need to know about checkpoints?

Credit institutions often do not indicate checkpoints in their documents.- Individual entrepreneurs do not have a checkpoint.

The Federal Tax Service and banks know about this and do not require you to fill out the checkpoint, but sometimes misunderstandings arise between counterparties. In this case, you need to refer to the registration procedure for individual entrepreneurs and the Tax Code.

- The largest taxpayers are assigned an additional tax at the place of registration as the largest taxpayer.

The first digits of this checkpoint are 99, they show that the company is registered with the interregional inspectorate for the largest taxpayers.

The checkpoint of the largest taxpayer is indicated in documents related to federal tax payments.

VAT is a federal tax, so invoices indicate the KPP of the largest taxpayer. If the checkpoint at the location of the organization is indicated on the invoice, this will not be an error and will not prevent the receipt of a deduction from the counterparty.

The checkpoint at the location of the organization is indicated in documents related to other payments to the budget and other settlements.

In what cases does the gearbox need to be replaced?

Since the checkpoint includes information about the company’s affiliation with a particular tax office and the reason for registration, it can be identical for many organizations that are registered with the same tax authority and have the same grounds for this registration. If the company moves to another territorial district of the Russian Federation, the registration code will be replaced with another one, since in the new location you will have to go through the entire registration procedure again.

On a note! The TIN is a unique number that belongs to only one organization and cannot be replaced (TIN can only be changed if a regulatory act is adopted that changes the structure of the company).

What is the difference between checkpoint and tax identification number?

All business entities without exception must have both details. The TIN indicates that the legal entity is registered with the local tax office, and the checkpoint additionally explains the reason for this registration.

One enterprise can be assigned one TIN, but several checkpoints at once. This is due to the fact that some legal entities have to register with different branches of the Federal Tax Service: at the location of branches, offices or other structural units, real estate, etc.

Thus, the TIN allows you to unambiguously identify an organization, and the TIN and KPP together are its structural unit.

The TIN is assigned once and does not change during the entire existence of the legal entity. The checkpoint is a changeable detail: for example, it will be reassigned if the organization has changed its place of registration and moved to another branch of the Federal Tax Service.

What is a checkpoint and where to find it

In order for an entrepreneur to start his own business, he needs to register his activities with the tax authority (without this action, the business is considered illegal). As a result of submitting an application for registration, the entrepreneur is assigned: TIN, OGRNIP and OKTMO. In addition to these details, the Federal Tax Service assigns organizations another one - KPP, which is a designation of the reason code for registration with a tax organization.

According to the Russian Tax Code, only legal entities receive this code. But individual entrepreneurs are not such (they are individuals): therefore, if someone continues to be tormented by the question of whether individual entrepreneurs have a checkpoint, then we can responsibly assert that they do not have such a code. Well, unless they invent it for themselves. But be warned: this is illegal.

Despite this, many counterparties sometimes require mandatory indication of the individual entrepreneur’s checkpoint, which puts the individual entrepreneur in a difficult position. Disputes arise due to legal illiteracy. What can I recommend here? If someone requires you to indicate the checkpoint of an individual entrepreneur, then advise him to educate himself and more carefully study the issue of registering an individual. It would not hurt to also familiarize yourself with the documents that are issued. In this case, conflicts will be eliminated. We hope we have provided comprehensive information about whether an individual entrepreneur (individual entrepreneur) has a checkpoint.

What do the numbers in the code mean?

Gearbox is a combination of nine numbers:

- The first two digits are the code of the region of the Russian Federation in which the business entity was registered.

- The next two are the number of the tax organization that registered the taxpayer.

On a note! As a result, the first four digits, as a rule, have a complete match with the first digits of the TIN.

- Two more digits are the reason code for registration (the list of these codes is given in the directory - SPPUNO). Previously, the official website of the Federal Tax Service provided the opportunity to familiarize yourself with this directory, but now this code classifier is intended only for internal use: therefore, it will not be easy to find it.

- The three digits that complete the code are an indicator of how many times a particular company has registered for a given reason in a given division of the Federal Tax Service.

For example, checkpoint 781501001 is deciphered as follows: the organization is located in St. Petersburg; registration was carried out with the Federal Tax Service of Russia No. 15 for St. Petersburg and the Leningrad Region; the taxpayer is registered at the place of his registration.

On a note! If the number is not 01, then this means that the business entity is registered at the place of work of its branch or at the location of its main office, real estate or vehicle. By the way, mining companies receive a code based on the location of natural resources.

What to do if you need to specify it

However, in documentation for individual entrepreneurs there is often a special field in which a checkpoint must be entered. This situation is associated with the use of uniform forms of documents for businessmen and companies.

In reports for tax authorities and extra-budgetary funds, businessmen should enter zeros or dashes in the checkpoint field. In forms, contracts, certificates and payment orders, this section may be left blank.

If business partners are interested in why the entrepreneur did not fill out the checkpoint field, the easiest way is to refer to the Tax Code, as well as the rules for registering legal entities and individual entrepreneurs and the explanations of the Ministry of Finance on this matter. However, some counterparties are not satisfied with such explanations, so businessmen resort to cunning. They draw up the checkpoint themselves, indicating the region code, then the encrypted designation of the Federal Tax Service where they were registered, and supplement all this with the code that is valid for registering legal entities - 01001.

Important! Such codes cannot be written in official documentation for government agencies.

To whom and how is it given?

The checkpoint is assigned only to organizations that apply to the Federal Tax Service in order to register themselves.

This recording of information is carried out:

- In the place where the organization was registered, the checkpoint is assigned simultaneously with the assignment of the TIN.

- In the event that there is a change in the legal and actual address of the organization, the assignment of the checkpoint takes place in the new Federal Tax Service, which has jurisdiction over the territory where the company is now located.

- In the place where each individual separate firm of this legal organization is registered.

- In the event that a subordinate organization subsequently also changes its place of registration, it again applies to the subordinate tax authority in order to obtain a checkpoint.

- At the location of real estate and transport owned by a legal entity by right of ownership.

- In other cases provided for by the tax legislation of the Russian Federation.