Those filling out a payment order often come across field No. 22, and the question immediately arises: what is this “UIN code” and where can I get it from? We would like to reassure you right away - it is not always needed (or rather, in many cases it is set to zero). So, UIN is a unique accrual identifier. It must be registered when making payments through the bank.

Where can I get the UIN for field 22 of the payment order ?

What is UIN

UIN is a digital code that is needed to control payments to the state budget from individuals and legal entities. This is a value that includes 20 digits. Numbers are separated from other information by the symbol “///”.

The identifier is a component of the Information System (GIS GMP). The code is set for all types of payments sent to the budget. The UIN allows you to determine the type of payment and facilitate the receipt of funds at the destination.

What UIN should I indicate in the payment order for tax payment ?

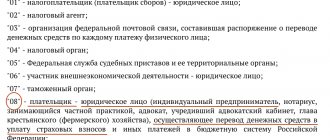

The identifier is entered in the “Code” field. This field is designated by the numbers 22. It is necessary to indicate the UIN code in payment documents. Without this, it is impossible to direct funds to the country's budget. Those. even if there is no UIN, you need to enter zero. The field cannot be left empty. For example, these could be payments:

- Taxes.

- State duties.

- Fines.

- Peni.

- Various debts.

What UIN should I indicate in the payment order for payment of insurance premiums ?

Bank employees will not accept payments without specifying the code. It also needs to be registered when transferring funds through terminals.

FOR YOUR INFORMATION! For each type of payment, the UIN code will be different. Therefore, confusion very often arises. Payers do not know which numbers to indicate on their payments.

What do the codes in the payment order mean?

Since the letter designation is very capacious and takes up a lot of space on the form, it was replaced with special, purely digital codes. Or, to clarify, just a few letters are added to them. For example, when transferring currency, two letters are first written - VO (currency transactions), after which immediately, without a space, a series of numbers is indicated for a specific type of currency banknote.

UIN code designations were introduced not so long ago and you need to remember that if there is an error in even one digit, the payment will be misdirected. If this is payment of taxes, then there will automatically be a delay, which entails fines and penalties. Government authorities do not accept any explanations for the mistake made and strictly punish for inattention.

That’s why fields 22 and 23 were introduced, which are considered reserve fields, to be filled out only at the direction of the bank or if there is a payment order requested by government agencies. If these conditions are not present, as, for example, when paying a state duty, then the number 0 must be entered in these fields, since if the field is left blank, the payment will be blocked.

Nowadays, many codes are automatically checked by the bank when sending a payment, and if there are major errors, the money transfer operation is immediately canceled. In this case, you will be asked to check that the form is filled out correctly. Also, money will not be able to leave the account due to insufficient funds or seizure of your savings.

The meaning of the identifier components

Each number included in the identifier has its own meaning:

- The first three numbers. Assigned by the Treasury.

- The fourth number. Indicates the department from which the request for funds transfer came.

- Fifth number. Represents the payment code.

- Sixth and seventh numbers. Date of payment.

- Numbers from 8th to 12th. Series and number.

- The twentieth. Needed to increase the uniqueness of the identifier. Assigned to a specific payment card.

What UIN should I indicate in the payment order for payment of state duty ?

The identifier is approved by the recipient of the funds. Its formation is an automatic process. The code must be unique for each payment document.

IMPORTANT! The payer cannot generate the code independently using arbitrary numbers. If the UIN code is simply invented, the funds will not reach their recipient.

ATTENTION! Sometimes, if a person does not know his or her ID, you can enter “0”. In some cases, the UIN code is supplemented with letter designations. These can be Russian or Latin letters.

What does the ID on the receipt mean?

The code serves to identify the payment. It contains this information:

- Who issues the payment?

- Payment addressee.

- What exactly are the funds paid for?

The bank employee can decipher the code, after which he sends the payment to its recipient. All accruals to the budget are recorded in the GTS GMP system. The presence of the code allows you to immediately record the payment.

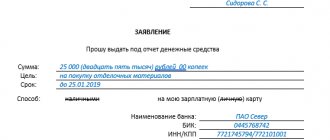

Where is it indicated on the payment order?

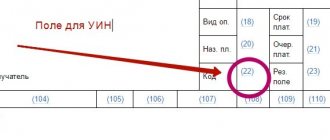

The UIN value is entered in the payment order field with code 22:

Where to get?

UIN is a special digital combination that cannot be created independently.

The need to fill out column 22 in a payment order appears only when the taxpayer (individual, legal entity or individual entrepreneur) receives a special notification of a request from the tax authority about the presence of tax debts.

This requirement specifies a unique identifier, which must be rewritten when filling out a payment order in field 22.

If the payer does not know the UIN and at the same time fills out a payment slip to pay the arrears, penalties or fines identified by the Federal Tax Service, then you need to clarify and obtain the identifier from the tax service.

If the subject has no debts on taxes, contributions, fees and makes all payments on time, then the question of where to get the UIN does not arise.

If payment is made on time, “0” is filled in field 22 of the payment order, and the indicators of other fields of the payment order (KBK, INN) are used to identify the payment.

Decoding the numbers in the UIN code

As a rule, the UIN consists of 20 digits, each of which has its own meaning.

Decoding the numbers in the UIN:

- from the first to the third - three digits indicate the institution to which the payment is intended (182 - for tax payments);

- fourth - 0 is put, since the value of this number does not indicate anything;

- from fifth to nineteenth - the payment number assigned to it by the tax office corresponds to the document index;

- The twentieth is a control number, the calculation of which is carried out in a special order.

Legal basis

The use of the identifier was established by Order of the Ministry of Finance No. 106n dated November 24, 2004. This was the first document that approved the use of UIN as details. However, when only this document was in effect, the code was used in a recommendatory manner. The need for its use arose after the release of Order No. 107 of the Ministry of Finance of November 12, 2013. The corresponding obligation is associated with the formation of the GIS GMP system.

Until March 31, 2014, the identifier was indicated in the “Destination of funds” field. After this date, the code began to be entered in the “22” field.

Another regulatory document is Federal Law No. 210 “On the provision of public services” dated July 27, 2010. He approved the payment identifier, which is needed for the rapid delivery of funds to their destination.

UIN and individuals

If the basis for payment of taxes by individuals is notifications and payment documents attached to them, then the necessary fields are filled in exclusively by the tax authorities.

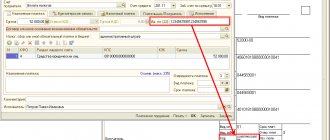

The taxpayer must generate a payment order himself using the electronic services of the website of the Federal Tax Service of Russia if he wishes to make a payment without notification. In this case, the service automatically assigns a UIN to the document.

When paying taxes using the Sberbank organization, the UIN is not assigned or indicated to the payment, which means the value zero is entered in field “22”. When issuing a payment order in another organization that has the right to do so, either zero or the value of the code, if available, is indicated.

According to the rules approved by the Ministry of Finance of the Russian Federation, when individuals transfer funds to the budget system of the Russian Federation, it is necessary to indicate the TIN or UIN, therefore, there is no need to have these two details at the same time. However, indicating the UIN will allow the tax authority to identify and account for the payment as quickly as possible.

Why do you need a UIN?

UIN is required for quick and efficient distribution of funds. Representatives of banks and budgetary structures, based on this code, determine to whom the funds are intended. Since the code serves as identification, it will be unique for each payment document.

The UIN system serves to simplify the system of budget payments and fees. It allows you to exclude the appearance of payments with an undefined purpose. Specifying the identifier allows you to be sure that the funds will definitely reach their addressee.

What to do if a mistake was made?

What actions should the sender of funds and their recipient take if the specified code turned out to be erroneous or was not specified when necessary? Obviously, the bank is not able to check the entered value for correctness, since it does not have the necessary information. It can only point to blank field 22 if it doesn't even contain a "0".

Therefore, the payment will go to the recipient even with the wrong UIP. If such an error is detected, the recipient of the money must be informed about it as quickly as possible, especially if we are really talking about tax arrears paid at the request of the Federal Tax Service. In this case, most likely, you will have to write an application to a government agency asking for the return or redirection of funds as erroneously deposited. At the same time, the algorithm for returning money is different in all situations; it depends on the purpose of the payment itself. For example, if funds with an incorrect UIN went to the account of a budgetary or autonomous institution, this issue will be much easier to resolve.

It is much easier to check the UIP if the payer and recipient of the money are serviced by the same bank. In this case, the credit institution may independently identify the erroneous value and not accept the payment for processing. However, in most cases, if the UPI is indicated incorrectly in the payment order, the payer’s bank is obliged to accept and execute the order to transfer funds.

Non-cash payments using payment cards have become widespread throughout the Russian Federation. By virtue of the requirements of the civil legislation of Russia, this form represents an order to the bank to transfer money to a third party. The recipient of funds can also be the budget. The procedure for generating the described documents is regulated in some detail and, as a rule, is known to accounting staff. However, when filling out some sections, for example code 22, in a payment order in 2021, there are some peculiarities.

How to get an ID

To obtain a UIN you need to do the following:

- Receiving demands from budgetary structures for the payment of funds (fines, penalties, taxes).

- It is in this requirement that you can find the required identifier.

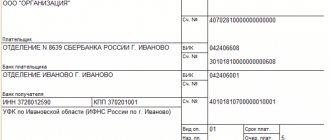

- All the numbers contained in the request are entered into the payment document. They need to be entered in code “22”. This field is located in the lower block of the payment order.

ATTENTION! The codes are not contained in any tables or directories for the simple reason that they are unique. For this reason, a list of identifiers simply cannot exist. Each payment is assigned its own number. The UIN can only come from the controlling structure. It is indicated in the request on the basis of which the payment is made.

IMPORTANT! The UIN code is relevant only for payments the addressee of which is government and budgetary structures.

When to look for code 22 in a payment order

This set of numbers, consisting of twenty or twenty-five characters, is assigned only by the Russian Pension Fund (PFS), Social Insurance Fund (FSS) and the Federal Tax Service Inspectorate (IFTS).

This code is indicated only in case of late payment of state taxes and only in payment requests from the Federal Tax Service, Social Insurance Fund, Pension Fund. They reflect the amount of fines, penalties or arrears that are assessed by these services. Useful: How can you return VAT to an individual

If you independently discover errors in the accruals or payment of such contributions to the budget, then check the tax code. Usually the UIN is not indicated in this column, but they must put the number 0 in order for the payment to go through.

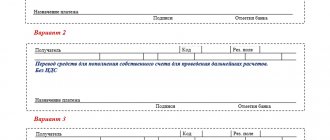

Rules for filling out the PP after receiving a document on fines, penalties, arrears:

1. At the bottom of the requirement you need to find the UIN code. 2. In the upper right corner of the form there is a field with the number 22, where you need to enter the numbers. There is a sample for filling out this column on the Internet.

When the UIN code is not necessary

In some cases it is not necessary to enter an identifier. In particular, the code is not needed when transferring current payments. Individual entrepreneurs and legal entities themselves calculate the amount of taxes and pay them based on the tax return.

Let's look at an example. The legal entity pays VAT. The requisite in this case may be the KBK. It is indicated in field 104. Individual entrepreneurs and individuals can use the TIN as a code. However, if nothing is indicated on line 22, the payment will not be accepted. Therefore, you need to write “0” in this line.

What is the risk of an error in PP?

UIN is a special code that helps to automatically recognize the purpose of the payment. It must be recorded in the State Information System when receiving state or municipal taxes. If the order of the numbers is incorrect, such a payment may not be identified, and then the payment deadline will be missed. In this case, there will be more work, since this is a debt for which penalties are assessed.

When filling out documents, it is better to double-check them several times to make sure they are correct.

Features of specifying the code for various types of payments

The nuances of specifying the UIN depend on the specific type of payment.

Taxes

The required UIN is contained in the requirement index. This is relevant if the payer is issued a payment invoice. If he pays the current tax himself, the identifier is not required. In field 22 the code “0” is entered. Reason – Letter of the Social Insurance Fund No. 17-03-11/14-2337 dated February 21, 2014. You can also replace the details with an INN (letter of the Federal Tax Service No. 3N-4-1/6133 dated April 8, 2021). However, you can indicate both UIN and Taxpayer Identification Number (TIN) in payment documents.

State duty

The state duty is paid based on the received receipt. If it was received at the place of application, the required identifier is the receipt index. However, usually the payer does not apply to the authorities for the document. That is, there is no place for him to find out the code. In this case, line 22 indicates “0”.

Payment for kindergarten services

When paying for kindergarten services, you must also indicate the ID. The nuance of obtaining a code is that kindergartens usually do not make any written demands to parents. Where can I get a UIN? You can contact the garden accounting department for this. The code includes the designation of the child. You only need to apply for a UIN once. In the future, payments will be made using the previously received code. Payments for tuition in fee-paying schools are also carried out.

Traffic police fines

Traffic police fines are paid according to a document that serves as the basis for assigning payment. The UIN is indicated in the same document. The code contains this information:

- Protocol number.

- The date of this paper.

Let's look at the decryption of the identifier:

- The first three numbers. Manager number. The number for the traffic police is 188.

- Fourth character. Addressee – 1.

- Fifth character. Purpose of funds. If a fine is paid, the number 1 is entered.

- Sixth and seventh characters. The date of execution of the paper on the basis of which the payment is made.

- The rest of the numbers. Serial number.

If there is a resolution on the basis of which a fine is paid, the payer does not have to indicate the UIN. A bank employee can do this for him.

How to pay by UIN through Sberbank Online

It is not difficult to transfer the required amount using the identifier. You just need to determine where to enter the code electronically to issue a standard payment order. In addition, you should know what to do if you don’t have a UIN.

Therefore, using the example of paying a fine according to UIN in Sberbank Online, we will provide the order of steps:

- Get access to your Sberbank Online personal account and log in there.

- Click on the “Transfers and Payments” tab.

- In the window that opens for counterparty organizations, click on “State Traffic Safety Inspectorate”.

- A special payment form will open, where you must provide all the necessary information.

- As soon as the payment document is provided, you should select only the card to write off the money and continue.

Funds are received almost instantly, but it happens that payments are made within 3 days, the banking organization provides information about this in advance.

Important! In a similar way, it is possible to transfer money for kindergarten, pay off debts on taxes and other contributions to the state budget. The whole process takes no more than 10-15 minutes, taking into account the time for data entry.