The essence of accounting objects: definition by the Ministry of Finance

There are quite a few interpretations of the term “accounting objects”. Let's consider its official definition given in paragraph 4 of Order No. 34n of the Ministry of Finance of the Russian Federation dated July 29, 1998.

According to this document, accounting objects should be understood as the property of enterprises, their obligations, as well as business operations carried out in the process of economic activity.

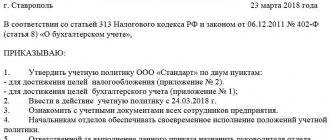

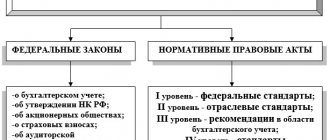

A specific list of accounting objects at the legislative level is determined by the provisions of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

Accounting methods

Accounting methods are a system of special techniques and methods carried out through documentation, balance sheet, inventory, calculation and assessment of property. In the course of a company's activities, the subject and method of accounting are inextricably linked. Only through the application of methods, the economic functioning of an enterprise becomes reflected in documents and programs.

The list of accounting methods includes:

- Double entry through accounting accounts used in recording the means and processes of activities.

- Full reflection of operations in programs and subsequent generation of reports based on them.

- Periodic inventory of funds, consisting of checking the availability of valuables with the available data.

- Formation and maintenance of balance sheets of liabilities and assets of the company. Through the balance sheet, economic assets and processes are grouped for a certain period.

- Valuation of production assets and calculation of the monetary value of work, goods and services.

The use of any method occurs in accordance with current legislation, in accordance with instructions and regulations. The methods used are determined by the company's management and reflected in its accounting policies.

So, the subject of accounting is the entire economic activity of a company, consisting of individual elements - objects. And to document the process of development and functioning of the organization, special methods are used.

What are the objects of accounting?

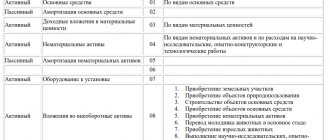

In accordance with the provisions of Art. 5 of Law No. 402-FZ, accounting objects are :

- facts of the economic life of the enterprise;

- assets and liabilities of the enterprise;

- sources of financing;

- income and expenses of the company;

- other objects specified by federal legislation.

A fact of economic life should be understood as any transaction, operation or other significant event that has or could potentially have an impact on the financial condition of the enterprise, the results of its activities or the flow of capital (Article 3 of Law No. 402-FZ).

A company's assets and liabilities can be presented in a wide range of varieties: their correct classification can be important when drawing up a balance sheet - one of the key sources of financial statements.

This classification can be studied in detail by reading the provisions of Section IV of Order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n (PBU 4/99).

Sources of financing the company's activities can be represented by:

- authorized capital;

- income (including revenue);

- credit funds;

- investments;

- budget revenues.

In accordance with paragraph 2 of PBU 9/99, income should be understood as an increase in the economic benefits of the enterprise not caused by the actions of the founders (owners):

- receipt of assets (in the form of cash or other property);

- repayment of obligations, as a result of which the capital of the enterprise increases.

In accordance with paragraph 2 of PBU 10/99, expenses should be understood as a reduction in the economic benefits of the enterprise not caused by the actions of the founders (owners):

- disposal of assets;

- the emergence of obligations that lead to a decrease in the capital of the enterprise.

Assets, Liabilities and Sources of Funding

Definition 1

Assets are the property or resources of an enterprise that it owns and manages to carry out its activities in order to achieve the goal of making a profit. Considering the principles of Russian accounting, we are talking only about assets that belong to the enterprise as a property.

Liabilities are the debt of an enterprise to its counterparties and creditors, which must be repaid by a certain period of time.

The main difference between these concepts is that assets imply the inflow of funds, and liabilities imply their outflow. Depending on the urgency of circulation, assets and liabilities are classified into short-term, up to 12 months, and long-term, more than a year. The dependence of obligations on ownership divides them into own and borrowed. Assets and liabilities are reflected in the balance sheet of the enterprise.

Do you need proofreading or review of academic work? Ask a question to the teacher and get an answer in 15 minutes! Ask a Question

Sources of financing the activities of an enterprise are the very first financial resources from which the formation of the enterprise itself begins; they are necessary initially for the creation, and subsequently for its existence and functioning. Subsequently, they are the subject of innovative development and investment.

There are many classifications - we list the main types of sources of financing: external, internal, attracted, borrowed, short-term and long-term. Balances in bank accounts or in the cash register of an enterprise as of a certain date are a monetary form of expression of the company’s financial resources.

Valuation of accounting objects as a necessary condition for accounting procedures

The most important operation performed within the framework of accounting with accounting objects is their evaluation. It is a procedure, the result of which is the reflection of the cost of an object in rubles (Article 12 of Law 402-FZ).

The need for assessment arises due to the fact that all information about the noted accounting objects is reflected in accounting documents, as well as in reporting, in monetary terms.

The basic principles by which the value of accounting objects should be assessed are enshrined in clause 23 of Order No. 34n of the Ministry of Finance of the Russian Federation dated July 29, 1998, as well as in PBUs regulating the features of accounting for certain accounting objects.

1.1. Evolution of historical development of accounting

The history of economic accounting goes back about six thousand years. Accounting arose gradually, so it is impossible to accurately determine the date of its origin.

The advent of writing and the development of arithmetic created the basis for the emergence of accounting, and human economic activity contributed to its widespread distribution. The system of continuous and systematic observation and reflection of the facts of economic activity led to the emergence of the so-called simple accounting.

Simple accounting made it possible to control the material assets of the economy in physical terms, and its calculations in monetary units. Orderly accounting registers and books appeared, and the concepts of “receipt and expense” and “inventory” arose. The accounting was only registration in nature.

Double-entry bookkeeping marked a new stage in the development of accounting. Practical double-entry bookkeeping originated in Italy. The first authors to describe double-entry bookkeeping were the merchant Beneditto Contrugli and the mathematician Luca Pacioli. Pacioli's postulates, expressing the essence of double entry, sound like this:

- the sum of debit turnover is always identical to the sum of credit turnover of the same system of accounts;

- the sum of debit balances is always identical to the sum of credit balances of the same system of accounts.

Following the emergence of double entry, a balance appeared. According to L. Pacioli, he is the main picture that the accountant “paints”.

Double entry and balance made it possible to control the movement of invested capital and identify profits.

The period of origin and spread of double entry is called the first period of development of accounting and dates back to the end of the 18th century.

The main directions in the science of “accounting”, which led to the further development of accounting, were determined at the second stage of the development of accounting in the period from the end of the 18th to the end of the 19th century. At this time, a large number of works on forms of bookkeeping were published, and various theories of bookkeeping arose: legal, materialistic, cameral.

The third period of the evolution of accounting (the end of the 19th – the beginning of the 20th century) became the period of the formation of accounting as a branch of scientific knowledge: the goals and the most important definitions of accounting were formed. Various definitions of accounting expressed by scientists of this time made it possible to abandon the narrow view of accounting as one of the forms of practical activity. The most prominent scientists of this time were the Italian Francesco Villa and the Russian scientist A.P. Rudanovsky.

Since the beginning of the 20th century. The fourth period of accounting formation continues to this day. It is characterized by the development of the main goal of accounting in a market environment: providing users with information for making management decisions.

The main direction in the development of accounting today is the harmonization of approaches and standardization of accounting and reporting methods.

With the development of production, social and economic relations, the need arose to take into account national wealth. Mass events were monitored: enterprises were registered, production was monitored. These were the prerequisites for the development of statistical accounting.

At the turn of the XIX-XX centuries. Due to the increasing complexity of the structure of production processes, the emergence of large enterprises and the need to manage such enterprises, operational accounting arose.

The modern economic accounting system includes three components: accounting, statistical and operational accounting.

Results

Accounting, like any other areas of activity related to the management of an organization, has objects. Their essence is defined at the legislative level - in Law No. 402-FZ, as well as in the provisions of Order No. 34n of the Ministry of Finance.

You can find other useful information about accounting in the following articles:

- “Accounting in 2015–2016 (chart of accounts and principles)”;

- "Accounting in budgetary institutions."

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Income and expenses

Note 1

Income and expenses of an enterprise are the most complex and controversial aspect in accounting and tax accounting. After all, it is the rules and principles of their accounting and reflection in the system that determine the financial result of the entire enterprise, and ultimately the amount of money flowing into the state budgets. The difference between these accounting elements forms profit, the main economic goal of the creation and existence of an economic entity.

Income – an increase in benefits as a result of the receipt of assets. Consumption is, accordingly, the opposite. Income, like expenses, have a general classification; they are divided according to sources of formation into income and expenses:

- From ordinary activities – revenue for income; expenses include costs related to ordinary, main activities in the production of goods, provision of work, services

- Operating - from the sale of property, and interest from the use, provision of loans, credits; funds for patents, intellectual property

- Non-sales – fines, penalties for failure to comply with the terms of contracts; losses and profits of previous years; gratuitous receipt/transfer of an asset

- Emergency – elements of economic activity that arose as a result of extraordinary circumstances (natural disasters, fire, accidents.

Do you need to select material for your study work? Ask a question to the teacher and get an answer in 15 minutes! Ask a Question