Will Article 381 of the Tax Code of the Russian Federation help you save money?

The dream of any person engaged in commercial activities is to earn more without extra costs. There are not many ways to help companies, without violating established norms and rules, save themselves from unnecessary material expenses. This opportunity is provided, in particular, by Art. 381 Tax Code of the Russian Federation. From its contents it becomes clear when you can save on paying property taxes.

This is achievable only if the property (cars, machines, equipment) belongs to the company and is recognized in its accounting as depreciable property. So if the company uses only a rented office and transport, the provisions of Art. 381 of the Tax Code of the Russian Federation will not help you save money.

If you have property, it would be a good idea to check the list of organizations that are legally allowed not to pay taxes on it. What if you get lucky too?

Who is exempt from paying property tax, see here.

But unfortunately, most commercial firms are not included in this list and will not be able to be completely exempt from the tax. So, in the list of beneficiaries under Art. 381 of the Tax Code of the Russian Federation includes institutions of the penal system, religious organizations, public organizations of disabled people, etc.

This article does not apply to individuals.

Next, we will consider issues related to the specific application of clause 25 of Art. 381 of the Tax Code of the Russian Federation in 2017-2018.

According to this clause, movable property registered with a legal entity after 01/01/2013 is exempt from tax, with the exception of those received:

- from a related party;

- as a result of liquidation or reorganization.

From 01/01/2017, these exceptions do not apply to railway rolling stock manufactured after 01/01/2013.

From 2021, the application of clause 25 of Art. 381 of the Tax Code of the Russian Federation is influenced by the new art. introduced into the code in 2021. 381.1, transferring the right to decide on the application of tax exemption on movable property to the regions.

Read more about this change in the article “Tax on movable property of organizations from 2021”.

In this regard, if a decision on such an exemption had not been made in the region at the beginning of 2021, then movable property registered with the taxpayer after 01/01/2013 should be subject to property tax.

See, for example: “Abolition of the tax on movable property - Moscow is already doing this.”

And about how the property tax for legal entities has changed in recent years, read: “Latest changes in the Tax Code of the Russian Federation on property tax .

Article 381 of the Tax Code of the Russian Federation. Tax benefits.

Commentary on Article 381

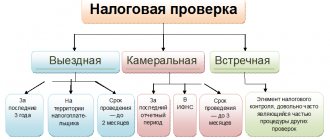

Chapter 30 of the Tax Code of the Russian Federation provides for 2 types of tax benefits:

- benefits established by the laws of the constituent entities of the Russian Federation in accordance with paragraph 2 of Article 372 of the Tax Code of the Russian Federation;

— benefits provided for in Article 381 of the Tax Code of the Russian Federation.

When using a specific benefit enshrined in Article 381 of the Tax Code of the Russian Federation, one should take into account the provisions of the Law of the Russian Federation dated July 21, 1993 N 5473-1 “On institutions and bodies executing criminal penalties in the form of imprisonment”, Resolution of the Government of the Russian Federation dated February 1, 2000 N 89 , which approved the List of types of enterprises, institutions and organizations included in the penal system, Federal Law of September 26, 1997 N 125-FZ “On Freedom of Conscience and Religious Associations”, Federal Law of May 19, 1995 N 82-FZ “On public associations", Federal Law dated November 24, 1995 N 181-FZ "On social protection of disabled people in the Russian Federation", Rules for recognizing a person as disabled, which are established by Decree of the Government of the Russian Federation dated February 20, 2006 N 95, Federal Law dated June 22, 1998 N 86 -FZ “On Medicines”, Federal Law of September 17, 1998 N 157-FZ “On Immunoprophylaxis of Infectious Diseases”, Federal Law of June 25, 2002 N 73-FZ “On Cultural Heritage Objects (Historical and Cultural Monuments) of the Peoples of the Russian Federation” , Regulations on especially valuable objects of cultural heritage of the peoples of the Russian Federation, approved by Decree of the President of the Russian Federation of November 30, 1992 N 1487, Federal Law of November 21, 1995 N 170-FZ “On the Use of Atomic Energy”, Federal Law of January 10, 2003 N 18-FZ “Charter of Railway Transport of the Russian Federation”, Decree of the Government of the Russian Federation dated December 24, 1991 N 61 “On the Classification of Highways in the Russian Federation”, Federal Law dated March 26, 2003 N 35-FZ “On Electric Power Industry”, Rules for the Protection of Main Pipelines approved by the Ministry of Fuel and Energy of the Russian Federation 04/29/1992, Resolution of the State Gortechnadzor of Russia dated 04/22/1992 N 9, Decree of the Government of the Russian Federation dated 09/30/2004 N 504 “On the List of property related to public railways, public federal roads, main pipelines, power transmission lines, as well as structures , which are an integral technological part of the specified objects, in respect of which organizations are exempt from taxation on the property of organizations", Order of the Government of the Russian Federation dated December 30, 2004 N 1731-r, which approved the List of federal state unitary enterprises (section I) and federal government institutions (section II), under the jurisdiction of Rosavtodor, Law of the Russian Federation of August 20, 1993 N 5663-1 “On Space Activities”, the All-Russian Classifier of Fixed Assets (OKOF), Regulations on licensing activities for the manufacture of prosthetic and orthopedic products according to orders of citizens, approved by the Decree of the Government of the Russian Federation Federation of November 4, 2006 N 647, Federal Law of May 31, 2002 N 63-FZ “On advocacy and the legal profession in the Russian Federation”, Federal Law of August 23, 1996 N 127-FZ “On science and state scientific and technical policy”, Decree of the President of the Russian Federation dated 06/22/1993 N 939 “On state scientific centers of the Russian Federation”, Federal Law dated 07/22/2005 N 116-FZ “On special economic zones in the Russian Federation”, Merchant Shipping Code of the Russian Federation and Rules for registration of ships and rights on them in sea trade ports approved by Order of the Ministry of Transport of Russia dated July 21, 2006 N 87.

What is movable property?

Before talking about the benefits hidden for a legal entity in Art. 381 of the Tax Code of the Russian Federation, let’s understand the term “movable property”, because it is precisely this that is the subject of the benefit.

In the ordinary understanding, we call movable objects that move in space - either themselves (for example, vehicles) or someone carries them (things, objects). However, for the norms of paragraph 25 of Art. 381 of the Tax Code of the Russian Federation, such a description will not be accurate.

An attempt to characterize movable items was made by officials of the Russian Ministry of Finance (letter dated February 25, 2013 No. 03-05-05-01/5322). They came to the conclusion that if things can be moved without damaging their condition and other objects from which they are removed will not be damaged, we can talk about movable property.

Read about the Federal Tax Service's approach to classifying objects into movable and immovable here.

The accuracy of the property tax amount depends on how correctly you differentiate your assets into movable and real estate.

For example, difficulties may arise when classifying water supply and sewerage systems located indoors. Essentially, these are pipelines and other structural elements that can be disassembled and moved to another location. But the Ministry of Finance thinks differently and does not recognize them as movable (letter dated 08/15/2013 No. 03-04-06/33238). Another example is cable lines. Judges and officials classify them as movable objects (clause 5 of the Government of the Russian Federation Resolution No. 68 dated February 11, 2005, letter of the Russian Ministry of Finance dated March 27, 2013 No. 03-05-05-01/9648).

Not everything is clear with regard to the air conditioning and alarm systems often used by most legal entities. If their structural elements are built into the walls of the room, this is real estate, but if they can be disassembled without causing damage to the building, these are movable objects (letter of the Ministry of Finance of Russia dated April 11, 2013 No. 03-05-05-01/11960).

Read more about the principles of property tax formation in the material “What is the procedure for calculating property tax for organizations?” .

See also: “The benefit for movable property during a chamberlain will be asked to be documented.”

Commentary on Article 381 of the Tax Code of the Russian Federation

In accordance with the provisions of the Tax Code of the Russian Federation, two types of tax benefits are established for the property tax of organizations: tax benefits provided at the federal level in the form of complete tax exemption; tax benefits established by the constituent entities of the Russian Federation, which are mainly provided for in legislative acts on the introduction of the tax into effect on the territory of the corresponding constituent entity of the Russian Federation.

Federal benefits for paying property tax for organizations are established by Art. 381 Tax Code of the Russian Federation.

First of all, it is worth mentioning what changes have occurred in the list of federal property tax benefits.

From January 1, 2006, benefits for the property tax of organizations are canceled (clause 3 of article 4 of the Federal Law of November 11, 2003 N 139-FZ):

- in relation to housing facilities and engineering infrastructure of the housing and communal services complex, the maintenance of which is fully or partially financed from the budgets of constituent entities of the Russian Federation or local budgets (clause 6 of Article 381 of the Tax Code of the Russian Federation);

- in relation to objects of the socio-cultural sphere used by them for the needs of culture and art, education, physical culture and sports, healthcare and social security (clause 7 of Article 381 of the Tax Code of the Russian Federation);

- for scientific organizations of the Russian Academy of Sciences, the Russian Academy of Medical Sciences, the Russian Academy of Agricultural Sciences, the Russian Academy of Education, the Russian Academy of Architecture and Construction Sciences, the Russian Academy of Arts (in relation to property used by them for the purposes of scientific (research) activities) ( clause 16 of article 381 of the Tax Code of the Russian Federation).

In addition, benefits have been established for residents of special economic zones. In connection with changes in the Federal Law “On Special Economic Zones in the Russian Federation”, a tax benefit on the property of organizations has been established for residents of a special economic zone. These organizations are exempt from paying property tax in respect of property recorded on the organization’s balance sheet for 5 years from the date of registration of the property (clause 17 of Article 381 of the Tax Code of the Russian Federation).

According to the wording of the Tax Code of the Russian Federation, an organization that is a SEZ resident can use this benefit not only in relation to property that was acquired after receiving the status of a SEZ resident, but also for all property that it has on its balance sheet, subject to the condition that it has passed from the moment the property was accepted for registration. no more than 5 years.

Another new benefit for corporate property tax is provided for in clause 18 of Art. 381 of the Tax Code of the Russian Federation - organizations are exempt from property tax in relation to ships registered in the Russian International Register of Ships.

When applying this benefit, shipowners need to consider the following. Federal Law No. 168-FZ of December 20, 2005, which amended the Tax Code of the Russian Federation, was published in the Parliamentary Gazette and Rossiyskaya Gazeta on December 23, 2005. According to paragraph 2 of Art. 4 of this Law, the changes introduced by it to the Tax Code of the Russian Federation come into force on January 1, 2006, but not earlier than after one month from the date of their official publication. Thus, these changes cannot be applied before January 23, 2006.

At the same time, the general rules for the entry into force of acts of legislation on taxes and fees are contained in Art. 5 Tax Code of the Russian Federation. According to paragraph 1 of Art. 5 of the Tax Code of the Russian Federation, acts of tax legislation come into force no earlier than one month from the date of their official publication and no earlier than the 1st day of the next tax period for the corresponding tax. That is, changes made to the Tax Code of the Russian Federation by Federal Law N 168-FZ can come into force only after January 23, 2006 and with the beginning of a new tax period for each specific tax.

In relation to the property tax of organizations, the tax period is established as a calendar year (Clause 1, Article 379 of the Tax Code of the Russian Federation). Therefore, the new property tax benefit can be used by organizations only from January 1, 2007.

It should be especially noted that these changes do not have retroactive effect and cannot be applied from January 1, 2006. According to paragraph 4 of Art. 5 of the Tax Code of the Russian Federation, acts of legislation on taxes and fees that cancel taxes and (or) fees, reduce the rate of taxes (fees), eliminate the obligations of taxpayers, payers of fees, tax agents, their representatives or otherwise improve their position, may have retroactive effect, but only if they explicitly provide for this. However, paragraph 2 of Art. 4 of Federal Law N 168-FZ, which talks about the entry into force of changes to the Tax Code of the Russian Federation, does not contain any provisions giving these changes retroactive effect. The Law does not say that the new provisions apply to legal relations from January 1, 2006. Therefore, the new rules do not have retroactive effect and come into force in the manner specified above.

As for previously existing benefits, organizations and institutions of the penal system of the Ministry of Justice of the Russian Federation are completely exempt from paying tax. This benefit applies only to those types of property owned by these bodies that are used to carry out the functions assigned to these bodies.

Religious organizations are exempt from taxation. In this case, all property used for religious activities is subject to tax exemption. A religious organization is a voluntary association of citizens permanently residing in the territory of the Russian Federation and united for the joint professing and dissemination of faith, provided that this association is registered in the manner prescribed by law as a legal entity. Religious organizations may own land, buildings, structures, and other property. Any property used by these organizations to carry out religious activities is exempt from taxation.

All-Russian organizations of disabled people are exempt from taxation on property owned by them. All-Russian organizations of disabled people can own any property, including business partnerships and societies. Disabled people's societies are exempt from taxation on the property (including business partnerships and societies) that they use to carry out the types of activities specified in the charter of such organizations (statutory activities). Enterprises whose authorized capital consists entirely of contributions from all-Russian public organizations of disabled people are exempt from paying property tax. A prerequisite for the exemption of such organizations from paying tax is the following: the number of disabled employees of such enterprises is at least 50 percent of the total number of employees of these enterprises, and the share of disabled people working in the organization in the wage fund of this organization is at least 25 percent.

Organizations whose main activity is the production of pharmaceutical products are exempt from taxation on the property that they use for the production of veterinary immunobiological drugs intended to combat epidemics and epizootics.

Tax is not paid on property owned by enterprises in cases where the said property is classified as federal historical and cultural monuments in accordance with the procedure established by law. In accordance with the law, monuments and places of interest are recognized as monuments of history and culture. Monuments are considered to be individual buildings, buildings, structures with historically established territories (memorial apartments, mausoleums, etc.). Cultural and natural landscapes, creations of man or nature, associated with the history of the formation of peoples and ethnic communities, are considered noteworthy places. In order for a particular object to be recognized as a historical or cultural monument, it must be included in the Unified State Register of Cultural Heritage Objects. The decision to include an object in the specified register is made by the Government of the Russian Federation or the authorized state body of the corresponding subject of the Russian Federation.

Organizations are exempt from paying taxes on the following types of property owned, economically managed or operationally managed: nuclear installations used for scientific purposes, storage facilities for nuclear materials and radioactive substances, radioactive waste storage facilities, icebreakers, ships with nuclear power plants, nuclear power plants -technological services, public railways, public federal highways, main pipelines, energy transmission lines, spaceships, as well as technological structures that are an integral part of these objects.

State scientific centers, which include state scientific research, scientific and technical (engineering), scientific testing, scientific and production centers, are exempt from paying property tax. It should be added that state research centers are completely exempt from paying property taxes.

As mentioned above, additional tax benefits for corporate property tax may be provided for in regional legislation. Laws on property tax of organizations are adopted by the representative bodies of the constituent entities of the Federation and only after that are put into effect on the territory of the corresponding constituent entity of the Federation. The same laws also contain provisions on tax benefits for property taxes for individuals.

How does interdependence interfere with benefit?

Clause 25 Art. 381 of the Tax Code of the Russian Federation indicates that if a company bought a movable object from a related party, then its value must be taken into account when calculating property tax. Art. is dedicated to interdependent persons. 105.1 of the Tax Code of the Russian Federation, from clause 1 of which it becomes clear that their main feature is the ability to influence the conditions and (or) results of transactions between them.

The list of such persons is given in paragraph 2 of Art. 105.1 Tax Code of the Russian Federation. It is very important to scrupulously evaluate the party transferring the objects, because this directly determines whether it will be possible to take advantage of the tax break under clause 25 of Art. 381 Tax Code of the Russian Federation. Thus, the participation of Russia and its constituent entities, as well as municipalities in Russian companies does not mean that these companies are interdependent (Letter of the Ministry of Finance dated May 28, 2015 No. 03-05-05-01/30848). The main thing is whether the parties were such at the time of transfer of movable objects.

Read more about the taxation of property received from interdependent persons in the articles:

- "When Interdependence Matters for Property Tax";

- “The property moves to the interdependent company and back - the right to the benefit is lost”.

Cancellation of corporate property tax benefits from 2021: detailed description of changes

As of January 1, 2021, payments for movable property will no longer be collected. The legislative act regulating this was signed by V.V. Putin. What is considered real estate and why is taxation removed from enterprises and business projects?

Cancellation of corporate property tax benefits from 2021

About cancellation of benefits

Today, taxation (VAT) has been increased for business organizations from 18 to 20%, a legislative act confirming this was signed by the President of the Russian Federation, but the Government approved the decision that taxation on movable property should be abolished. Russian President V.V. Putin signed Federal Law No. 302 dated August 3, 2018, with many changes to the Tax Code of the Russian Federation.

Among these amendments was included the most expected for accounting employees of companies - the elimination of taxation of movable property values of legal entities.

It is important to know! Adjustments have been introduced to Article 374 of the Tax Code of the Russian Federation; now the phrase “movable property” is completely absent from it.

Excerpt from Article 374 of the Tax Code of the Russian Federation

Now only real estate that is on the balance sheet as an object of basic income, as well as real estate acquired under a concession agreement, is subject to taxation.

However, what is considered to be movable property value is not specified in the Tax Code of the Russian Federation. The Federal Tax Service of the Russian Federation helped with clarifications, promptly posting a letter dated August 2, 2021 No. BS-4-21 with specific explanations of the types of property objects in order to use the provisions of Chapter 30 of the Tax Code of the Russian Federation.

Historical development of the issue

Not all countries subject movable property to taxation. Even the terms of movable and immovable objects are different for the Russian Federation and foreign countries. For example, in the Russian Federation, airplanes are considered immovable property, but abroad, even taking into account the impressive cost of airplanes, they are usually considered movable property, so there is no tax on them.

It is important to know! Attracting investment due to the absence of taxation of movable property was identified in the following countries: Croatia, Cayman Islands, Cook Islands, Seychelles, Bahrain, Liechtenstein, Dominican Republic, Fiji, Sri Lanka, Oman, Malta, Turks and Caicos Islands, Qatar, Monaco and Israel . Colombia, Costa Rica, Ecuador and Nicaragua are familiar with the concept of property taxes, but these obligations are actually very small.

In Russia, foreign practice was used, and the movable property tax was abolished

Foreign practice was used when the decision to abolish taxation on movable property was developed. In fact, in 2013, preferential conditions were introduced for this tax levy.

Then in 2015, amendments were made to prevent the use of benefits for related parties. Prescribed in paragraph 25 of Art.

381 of the Tax Code of the Russian Federation, the benefit paid for movable property is not taken into account when receiving (purchasing) property from an interdependent person.

Persons have the status of interdependent (according to clause 1 of Article 105.1 of the Tax Code of the Russian Federation), if the nuances of their relationships have the ability to influence the conditions and (or) results of transactions carried out by these persons, and (or) the results of the economic activities of these persons or the activities of persons by their representation.

Excerpt from Article 105.1 of the Tax Code of the Russian Federation

Typically, interdependent persons are considered to be:

- enterprises, in a situation where one enterprise directly and (or) indirectly participates in the activities of another enterprise, and this participation constitutes a share of more than 25%;

- an individual and an organization when this individual directly and (or) indirectly participates in such an organization, and this participation constitutes a share of more than 25%;

- organizations in a situation where the same person directly and (or) indirectly participates in these organizations, and the share of such participation for each organization is more than 25%;

- an enterprise and a person who has the rights to appoint (elect) a sole executive body of this enterprise or to appoint (elect) at least 50% of the composition of a collegial executive body or board of directors (supervisory board) of this enterprise; other persons established by current law.

Previously, the benefit paid for movable property is not taken into account when receiving (purchasing) property from an interdependent person

In 2021, taxation on movable objects has returned. The tariff on the basis of which tax payments are collected is 1.1%, but regional governments have the right to change the interest rate at their discretion, without exceeding the specified rate.

In some places taxation has been abolished, in others the percentage has been reduced for everyone, but usually local organizations are divided into certain categories. As a result, some pay the tax in full, others are exempt from payments, and still others pay the tax at a reduced rate.

It can be concluded that tax collection takes place differently in different regions. The disadvantages of returning taxation on movable property include the loss of relevance of fundamental organizational funds and lack of investment.

The same economic result is a consequence of the limitation on the transfer of losses to the future in the amount of 50%. It was expected that in 2020 the interest rate of this taxation would double.

It is important to know! The increase in the tax amount ultimately had a great negative impact on taxation.

That is why, from 2021, taxation on movable property has been completely abolished, which has greatly simplified the life of accounting employees of large Russian companies. The main disadvantage of the tax on movable property is its extremely complex calculation - in 2021 this problem has been eliminated.

From 2021, taxation on movable property has been completely abolished

What is meant by movable property?

Tax officials noted that the legislative grounds for recognizing one or another object as movable or immovable property must be determined by the norms of civil legislation on the conditions for assigning a thing the status of movable or immovable, in particular by the regulations of Articles 130-131 of the Civil Code of the Russian Federation.

Movable material value is property whose characteristics cannot classify it as real estate. A distinctive feature of such property values is the possibility of their transfer from one individual to another.

Source: https://posobie-expert.com/otmena-lgoty-po-nalogu-na-imushhestvo-organizatsii-s-2020-goda/

Does movable property of the 1st and 2nd groups suffer from the interdependence of persons?

The answer to this question is obvious. In sub. 8 clause 4 art. 374 of the Tax Code of the Russian Federation establishes that property of the 1st and 2nd depreciation groups is not taken into account when calculating property tax. The Ministry of Finance does not argue with this (letters dated January 16, 2015 No. 03-05-05-01/676, dated April 6, 2015 No. 03-05-05-01/19071, dated March 27, 2015 No. 03-05-04-01 /17031). The interdependence of persons in this case does not matter.

IMPORTANT! In order to legally save money by applying subclause. 8 clause 4 art. 374 of the Tax Code of the Russian Federation, it is necessary to correctly classify property as a depreciation group in accordance with the Classification of fixed assets approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1.

Read more about the nuances of calculating tax on movable property in the material “Taxation of movable property: changes in 2017, 2018” .

What codes should be indicated in 2021 for a taxpayer applying for a benefit under clause 25 of Art. 381 of the Tax Code of the Russian Federation?

To answer this question, let us turn to the explanations of the controllers. In their letters, they advise writing code 2012000 in line 130 of section 2 of the advance calculation for property tax. After a fraction after this code, you need to enter the number, paragraph and subparagraph of the article of the law of the subject of the Russian Federation, in accordance with which the benefit is provided (letters of the Federal Tax Service dated May 24, 2018 No. BS-4-21/9062, dated 03/14/2018 No. BS-4-21/ [email protected] ).

We talked in more detail about how to correctly fill out reports on movable property here, and here you will find an example of filling out a preferential line.

IMPORTANT! In 2021, the form and format for submitting an electronic tax return and calculating advance payments for property tax, approved. by order of the Federal Tax Service of Russia dated March 31, 2017 No. ММВ-7-21/ [email protected] And with reporting for the 1st quarter of 2021, new reporting forms are being introduced.

For information on how to correctly fill out a property tax return, read the article “Nuances of filling out a property tax return .

Article 381. Tax benefits

Exempt from taxation:

- 1) organizations and institutions of the penal system - in relation to property used to carry out the functions assigned to them;

- 2) religious organizations - in relation to property used by them to carry out religious activities;

- 3) all-Russian public organizations of disabled people (including those created as unions of public organizations of disabled people), among whose members disabled people and their legal representatives make up at least 80 percent - in relation to the property used by them to carry out their statutory activities;

- organizations whose authorized capital consists entirely of contributions from the specified all-Russian public organizations of disabled people, if the average number of disabled people among their employees is at least 50 percent, and their share in the wage fund is at least 25 percent, in relation to the property used by them for production and (or) sale of goods (except for excisable goods, mineral raw materials and other minerals, as well as other goods according to the list approved by the Government of the Russian Federation in agreement with all-Russian public organizations of disabled people), works and services (except for brokerage and other intermediary services );

- institutions, the only owners of whose property are the specified all-Russian public organizations of disabled people - in relation to the property used by them to achieve educational, cultural, medical and recreational, physical education and sports, scientific, information and other purposes of social protection and rehabilitation of disabled people, as well as to provide legal and other assistance to disabled people, disabled children and their parents;

lost its power. — Federal Law of November 11, 2003 N 139-FZ;

lost its power. — Federal Law of November 11, 2003 N 139-FZ; - the property is located in the internal sea waters of the Russian Federation, in the territorial sea of the Russian Federation, on the continental shelf of the Russian Federation, in the exclusive economic zone of the Russian Federation or in the Russian part (Russian sector) of the bottom of the Caspian Sea;

- the property is used in carrying out activities to develop offshore hydrocarbon deposits, including geological study, exploration, and preparatory work.

If during the tax period the property is located both within the boundaries of the territories (water areas) specified in paragraph two of this paragraph and in other territories, the tax exemption is valid provided that the specified property satisfies the requirements of paragraphs one to three of this paragraph for at least 90 calendar days within one calendar year;

25) has become invalid. — Federal Law of August 3, 2018 N 302-FZ;

26) organization - in relation to property recorded on the balance sheet of an organization - a participant in a free economic zone, created or acquired for the purpose of fulfilling an agreement on the conditions of activity in a free economic zone and located on the territory of this free economic zone, for ten years from the month following the month of registration of the specified property. In the event of termination of the agreement on the conditions of activity in the free economic zone by a court decision, the amount of tax is subject to calculation and payment to the budget. The tax is calculated without taking into account the application of the tax benefit provided for in this paragraph for the entire period of implementation of the investment project in the free economic zone. The calculated amount of tax is payable upon the expiration of the reporting or tax period in which the agreement on the conditions of activity in the free economic zone was terminated, no later than the deadlines established for the payment of advance payments of tax for the reporting period or tax for the tax period;

27) organizations recognized by funds, management companies, subsidiaries of management companies in accordance with Federal Law of July 29, 2021 N 216-FZ “On innovative scientific and technological centers and on amendments to certain legislative acts of the Russian Federation”;

28) organizations that received the status of a project participant in accordance with Federal Law of July 29, 2021 N 216-FZ “On innovative scientific and technological centers and on amendments to certain legislative acts of the Russian Federation” - in relation to property recorded on their balance sheet and located on the territory of an innovative scientific and technological center, for ten years starting from the month following the month of registration of the specified property. Such organizations lose the right to exemption from taxation in the cases provided for in paragraph 2 of Article 145.1 of this Code. To confirm the right to tax exemption, such organizations are required to submit to the tax authority at the place of registration documents confirming their status as a project participant in accordance with Federal Law of July 29, 2021 N 216-FZ “On innovative scientific and technological centers and on the introduction of amendments to certain legislative acts of the Russian Federation" and provided for by the said Federal Law, as well as income (expense) accounting data.

Can a JSC take advantage of the benefit under clause 25 of Art. 381 of the Tax Code of the Russian Federation after re-registration?

Clause 25 Art. 381 of the Tax Code of the Russian Federation not only gives tax relief to organizations, but also limits them in its application. For example, the benefit is not given if the property came to the taxpayer after the reorganization or liquidation of the legal entity.

The question rightfully arises: if, as required by law, an organization is obliged to transform from an OJSC into a public JSC, is it possible to continue to apply the relaxation under clause 25 of Art. 381 of the Tax Code of the Russian Federation?

IMPORTANT! In accordance with Art. 66.3 of the Civil Code of the Russian Federation, in order for a JSC to acquire public status, it must either include in its charter and corporate name an indication that it is such, or publicly place securities.

The position of the officials will please you.

The letter of the Ministry of Finance dated 02/09/2015 No. 03-05-05-01/5111 states that the fact of bringing the constituent documents and name of a company created before the entry into force of the law dated 05/05/2014 No. 99-FZ is not a reorganization (liquidation) of legal entities “On amendments to Chapter 4 of Part 1 of the Civil Code of the Russian Federation and on the recognition as invalid of certain provisions of legislative acts of the Russian Federation”, in accordance with the norms of Chapter 4 of the Civil Code of the Russian Federation. Therefore, there is no reason to refuse the benefit. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

St. 381 p 25 Tax Code of the Russian Federation with mi

» September 22, 2021

Svetlana View profile Find messagesNovosel In accordance with the provisions of the Federal Law of November 24, 2015, which entered into force on January 1, 2015.

2014 N 366-FZ On amendments to part two of the Tax Code of the Russian Federation and certain legislative acts of the Russian Federation, Article 381 of the Tax Code of the Russian Federation is supplemented with paragraph 25, according to which organizations are exempt from taxation with the property tax of organizations in relation to movable property accepted on registration from January 1, 2013 as fixed assets, with the exception of the following movable property items registered as a result of:

—

Article 381 of the Tax Code of the Russian Federation. Tax benefits

> > > The following are exempt from taxation: 1) organizations and institutions of the penal system - in relation to property used to carry out the functions assigned to them; 2) religious organizations - in relation to property used by them to carry out religious activities; 3) all-Russian public organizations of disabled people (including those created as unions of public organizations of disabled people), among whose members disabled people and their legal representatives make up at least 80 percent - in relation to the property used by them to carry out their statutory activities; organizations whose authorized capital consists entirely of contributions from the specified all-Russian public organizations of disabled people, if the average number of disabled people among their employees is at least 50 percent, and their share in the fund

Article 381 of the Tax Code of the Russian Federation.

Tax benefits (current version)

Tax Code, N 117-FZ | Art.

381 of the Tax Code of the Russian Federation The following are exempt from taxation: 1) organizations and institutions of the penal system - in relation to property used to carry out the functions assigned to them; 2) religious organizations - in relation to property used by them to carry out religious activities; 3) all-Russian public organizations of disabled people (including those created as unions of public organizations of disabled people), among whose members disabled people and their legal representatives make up at least 80 percent - in relation to the property used by them to carry out their statutory activities; organizations whose authorized capital consists entirely of contributions from the specified all-Russian public organizations of disabled people, if the average number of disabled people among their employees is at least 50 percent, and their share in the wage fund is at least 25 percent, in relation to the property used by them for production and (or) sale of goods (except for excisable goods, mineral raw materials and other minerals, as well as other goods according to the list approved by the Government of the Russian Federation in agreement with all-Russian public organizations of disabled people), works and services (except for brokerage and other intermediary services );

Article 381.

Tax benefits

The following are exempt from taxation: 1) organizations and institutions of the penal system - in relation to property used to carry out the functions assigned to them; 2) religious organizations - in relation to property used by them to carry out religious activities; 3) all-Russian public organizations of disabled people (in including those created as unions of public organizations of disabled people), among whose members disabled people and their legal representatives make up at least 80 percent - in relation to the property used by them to carry out their statutory activities; organizations whose authorized capital consists entirely of contributions from the specified all-Russian public organizations disabled people, if the average number of disabled people among their employees is at least 50 percent, and their share in the wage fund is at least 25 percent,

P 25 Article 381 Tax Code of the Russian Federation property tax

The following are exempt from taxation: 1) organizations and institutions of the penal system - in relation to property used to carry out the functions assigned to them; 2) religious organizations - in relation to property used by them to carry out religious activities; 3) all-Russian public organizations of disabled people (including those created as unions of public organizations of disabled people), among whose members disabled people and their legal representatives make up at least 80 percent - in relation to the property used by them to carry out their statutory activities; organizations whose authorized capital consists entirely of contributions from the specified all-Russian public organizations of disabled people, if the average number of disabled people among their employees is at least 50 percent, and their share in the wage fund is at least 25 percent, in relation to the property used by them for production and (or) sale of goods (except for excisable goods, mineral raw materials and other minerals, as well as other goods according to the list approved by the Government of the Russian Federation in agreement with all-Russian public organizations of disabled people), works and services (except for brokerage and other intermediary services );

Art. 381 Tax Code of the Russian Federation. Tax benefits

>>>>Article 381.

Tax benefits The following are exempt from taxation: 1) organizations and institutions of the penal system - in relation to property used to carry out the functions assigned to them; 2) religious organizations - in relation to property used by them to carry out religious activities; 3) all-Russian public organizations of disabled people (including those created as unions of public organizations of disabled people), among whose members disabled people and their legal representatives make up at least 80 percent - in relation to the property used by them to carry out their statutory activities; organizations whose authorized capital consists entirely of contributions from the specified all-Russian public organizations of disabled people, if the average number of disabled people among their employees is at least 50 percent, and their share in the wage fund is at least

Article 381. Tax benefits

The following are exempt from taxation: 1) organizations and institutions of the penal system - in relation to property used to carry out the functions assigned to them; 2) religious organizations - in relation to property used by them to carry out religious activities; 3) all-Russian public organizations of disabled people (including those created as unions of public organizations of disabled people), among whose members disabled people and their legal representatives make up at least 80 percent - in relation to the property used by them to carry out their statutory activities; organizations whose authorized capital consists entirely of contributions from the specified all-Russian public organizations of disabled people, if the average number of disabled people among their employees is at least 50 percent, and their share in the wage fund is at least 25 percent, in relation to the property used by them for production and (or) sale of goods (except for excisable goods, mineral raw materials and other minerals, as well as other goods according to the list approved by the Government of the Russian Federation in agreement with all-Russian public organizations of disabled people), works and services (except for brokerage and other intermediary services );