Calculation of insurance premiums to extra-budgetary funds

Calculate insurance premiums on the last day of each month separately for each insured person and each type of contribution. In 2021, insurance premiums are paid for:

- compulsory pension insurance (OPI) at a rate of 22%;

- compulsory health insurance (CHI) at a rate of 5.1%;

- compulsory social insurance (OSI) for temporary disability and in connection with maternity (VNIM) – 2.9%.

Above are the basic contribution rates. For some policyholders, reduced and additional rates are provided. For details, see the material “Insurance premium rates in the table.”

From April 2021, the part of the salary that is above the minimum wage is subject to insurance contributions at reduced rates. These tariffs are available only to those taxpayers who belong to small and medium-sized businesses. ConsultantPlus experts spoke in more detail about the new tariffs for insurance premiums. Get trial access to the K+ system and upgrade to the Ready Solution for free.

The employer pays insurance premiums at his own expense to the tax office no later than the 15th day of the month following the month in which insurance premiums are calculated.

In addition to the above contributions, the employer pays insurance premiums against accidents at work to the Social Insurance Fund. The rate varies from 0.2% to 8.5% and depends on the main type of activity of the policyholder.

How to determine the tariff size, see here.

To calculate contributions, use the formula:

ATTENTION! When calculating the contribution base, take into account the approved limits. In 2021, the limits for VNIM are 966,000 rubles, for OPS – 1,465,000 rubles. Read more about applying limits here.

Employers must keep records of contributions for all funds separately.

To obtain information about contributions, account 69 “Social insurance payments” is divided into three sub-accounts, namely:

- 69.1 - information on contributions to OSS;

- 69.2 - information on contributions to compulsory pension insurance;

- 69.3 - information on contributions to compulsory medical insurance.

Subaccount 69.1 is further divided into second-order accounts (69.1.1 - social insurance for VNIM; 69.1.2 - injury insurance) or an additional subaccount of account 69 is used (for example, 69.11) to account for contributions for injuries.

This grouping by accounts allows you to track all movements of funds for each fund.

Contributions listed: what kind of postings are made?

Insurance premiums are transferred monthly no later than the 15th day of the month following the month of accrual (clause 3 of Article 431 of the Tax Code of the Russian Federation and clause 4 of Article 22 of the Law “On Mandatory Social Insurance” dated July 24, 1998 No. 125-FZ). When transferring funds to pay contributions, indicate the subaccount number of the corresponding fund in debit, and account 51 in credit, which reflects the current accounts of the company. The posting for payment of contributions (using the example of a pension fund) is as follows: Dt 69.2 Kt 51. Postings are made similarly for other subaccounts of each fund.

The accountant of Smiley LLC transferred the contributions untimely.

How to make a payment for insurance premiums, see here.

She reflected the following entries in accounting:

Dt 69.2 Kt 51 - 19,340.16 rubles;

Dt 69.3 Kt 51 – 6,708.58 rub.;

Dt 69.1 Kt 51 – RUB 1,483.88;

Dt 69.11 Kt 51 – 264 rub.

Transfer of insurance premiums for each fund must be carried out in separate payment orders. When paying contributions to funds, you need to pay special attention to the timing of their payment. For late payment of insurance premiums, organizations are charged penalties. Penalties are calculated for each day of late payment from the day following the payment due date until the day of payment inclusive. The amount of the penalty interest is taken at the rate of 1/300 of the Central Bank refinancing rate, and for companies - 1/300 for the first 30 days of delay and 1/150 of the refinancing rate starting from 31 days.

Also, the accountant of Smiley LLC calculated the penalties using our calculator and transferred them to the budget. She reflected the following entries in accounting:

Dt 99 Kt 69 (for subaccounts) - penalties accrued.

Dt 69 (for subaccounts) Kt 51 – penalties are transferred to the budget.

See also “Accounting entries when calculating penalties for taxes.”

If the policyholder does not also provide a calculation of contributions to the relevant fund, an additional fine will be issued. It will be 5% for each month of delay. It is calculated from the amount of accrued contributions for the last 3 months. The maximum fine is 30% of this amount, the minimum is 1,000 rubles.

The entry when calculating a fine or penalty will be Dt 91 Kt 69.1. Account 91 “Other income and expenses” is used here. True, there is another opinion that in this case you need to use account 99. The choice of account depends on the accounting procedure for such expenses adopted in accounting, which is enshrined in the accounting policy of the organization.

The material “Basic entries when paying penalties on insurance premiums” will help you figure out which account should be used to calculate penalties on insurance premiums.

Accrued penalties and fines do not reduce taxable profit (clause 2 of Article 270 of the Tax Code of the Russian Federation).

For information on what sanctions and fines are provided for non-payment of premiums, see the material “What is the responsibility for non-payment of insurance premiums?”

Find out about liability for late payment of taxes and contributions in the Ready-made solution from ConsultantPlus. If you don't have access to the system, get a free trial online.

When an accountant needs to accrue temporary disability benefits, they use the following entry: Dt 69.1 Kt 70 (for regular sick leave) or Dt 69.1.2 (69.11) Kt 70 (for benefits due to an industrial injury).

ATTENTION! Since 2021, all regions of the Russian Federation have joined the FSS pilot project “Direct Payments”. Our experts have prepared a guide for accountants. To avoid making mistakes in your calculations, study this material.

As for temporary disability benefits, the first 3 days are paid for by the organization, the rest - by the Social Insurance Fund. For the calculation, data on earnings for 2 years before the occurrence of the insured event is used. The benefit amount for a calendar month should not be less than calculated from the minimum wage (RUB 12,792 in 2021).

Accounting and tax accounting of contributions

According to the provisions of Article 264 of the Tax Code of the Russian Federation, as amended, in force from January 1, 2011, expenses in the form of insurance contributions for compulsory pension, social and medical insurance are taken into account as part of other expenses on the basis of subparagraph 1 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation.

Letters from the Russian Ministry of Finance issued in 2010 provide explanations regarding the procedure for calculating and recording insurance premiums. By letter dated April 13, 2010 No. 03-03-06/1/258, the Ministry of Finance of Russia draws the attention of accountants to the fact that the date of expenses in the form of insurance premiums is the date of their accrual.

At the same time, as stated in the letter, insurance premiums accrued for payments that, when recognized for profit tax purposes, are distributed over different reporting (tax) periods (for example: for vacation pay accrued in relation to vacations falling on different reporting (tax) periods) , are taken into account in the tax base for corporate income tax at a time at the time of their accrual.

Thus, when reflecting insurance premiums accrued for vacation pay of a future period in tax accounting for income tax, these amounts, unlike accounting, are not credited to account 97 “Deferred expenses”, but are immediately taken into account in cost accounts.

We suggest you read: I can activate a VTB insurance policy

If the organization applies PBU 18/02, the occurrence of temporary differences must be recorded (in account 97.01 and cost accounting account).

Example

An employee works in an organization with a salary of 15,000 rubles.

The costs of employee wages are charged to account 26 “General business expenses”.

From October 25, 2010 to November 3, 2010, the employee is on vacation.

Accrual of vacation pay in the amount of 5,102 rubles. (RUB 3,571.4 for October; RUB 1,530.6 for November) produced in October. In addition, the salary payment for October amounted to 11,428.57 rubles.

In October, insurance premiums were calculated in the amounts shown in Table 1.

Table 1.

| Period | Accrued, rub. | FSS of the Russian Federation, rub. | FFOMS, rub. | Pension Fund, insurance part, rub. |

| TFOMS, rub. | Pension Fund, funded part, rub. | |||

| October | 14 999,97 | 435,00 | 165,00 | 2 100,00 |

| 300,00 | 899,99 | |||

| November | 1 530,60 | 44,39 | 16,84 | 214,28 |

| 30,61 | 91,84 | |||

| Total | 16 530,57 | 479,39 | 181,84 | 2 314,28 |

| 330,61 | 991,83 |

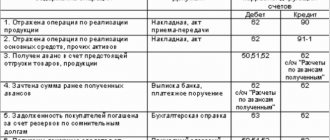

When reflecting wages in accounting, the following entries must be generated:

- reflection of accruals for October on the cost account (26);

- reflection of accruals for November in the deferred expenses account;

- reflection of calculated personal income tax;

- reflection of insurance premiums from accruals for October;

- reflection of insurance premiums from accruals for November.

Let's take a closer look at the last two points. To reflect October insurance premiums in the accounting records, five entries are created: - Debit 26 Credit 69.01 in the amount of 435 rubles; - Debit 26 Credit 69.02.1 in the amount of 2,100 rubles; - Debit 26 Credit 69.02.2 in the amount of 899, 99 rubles; - Debit 26 Credit 69.03.1 in the amount of 165 rubles; - Debit 26 Credit 69.03.2 in the amount of 300 rubles.

Five corresponding entries are also generated in tax accounting Debit 26.02 Credit 69.ХХ.Х.

To reflect insurance premiums in November, the following entries must be created.

There are five entries in accounting: Debit 97.01 (RBP for insurance premiums) Credit 69.ХХ.Х for the amount of each premium.

In tax accounting, if PBU 18/02 is not used, there are five entries: Debit 26.02 Credit 69.ХХ.Х for the amount of each contribution. If PBU 18/02 is used, then five sets of transactions are generated: Debit 26.02 Credit 69.ХХ.Х for the amount of each contribution, Debit 97.01 BP for the amount of each contribution and Debit 26.02 BP in red for the amount of each contribution.

For example, for social insurance expenses (contributions to the Social Insurance Fund of the Russian Federation), the following group of transactions will be created: - Debit 26.02 Credit 69.01 in the amount of 44.39 rubles; - Debit 97.01 (BPR for insurance contributions) BP in the amount of 44.39 rubles; - Debit 26.02 BP in the amount of 44.39 rubles.

Next month (November), in addition to all other accounting entries, it will be necessary to record the write-off of deferred expenses for insurance premiums and wages. We are interested in the reflection of insurance premiums.

It will look like this. In accounting, an entry is created Debit 26 Credit 97.01 (RBP for insurance premiums) for the entire amount allocated in October to the RBP for insurance premiums, that is, in the amount of 397.96 rubles. In tax accounting:

- if PBU 18/02 is not used, then there should be no postings in the NU;

- if PBU 18/02 is used, the NU will post Debit 26.02 VR Credit 97.01 (RBP for insurance premiums) VR in the amount of 397.96 rubles.

Reflection of the results of payroll calculations in accounting and tax accounting in the 1C: Salaries and Personnel Management 8 program is carried out by the document Reflection of salaries in regulated accounting. The document is automatically filled in with data on charges, deductions and taxes, on the basis of which a table of transactions is generated, displayed on the first tab of the Transactions document.

To automatically fill in data on transactions relating to insurance premiums from future accruals, the program uses a predefined algorithm, which is not customizable in user mode, since the legislation interprets this situation quite categorically: in tax accounting, the amounts of insurance premiums are charged to the account of labor costs in month of accrual.

The user can influence the result of automatic completion of this document only by manually changing the generated transaction table.

The algorithm is that the Tax Accounting Account (TA) to which the accrual itself is attributed is automatically indicated as a Tax Accounting Debit account in the entry reflecting insurance premiums from accruals for future periods.

In the “Salaries and Personnel Management” configuration, the document Reflection of salaries in regulated accounting is actually used only so that the information contained in it about the postings can be uploaded to the accounting program, so the document does not move through any accounting registers.

All transactions in the usual form and sense are generated in the accounting program after loading data from “1C: Salaries and Personnel Management 8”. The exception is the “Manufacturing Enterprise Management” configuration, which combines in one document the functions of its “namesakes” from the “payroll” and “accounting” programs.

Let's consider the options when the 1C: Accounting 8 program is used as an accounting program. At the moment, two editions of the program are relevant: 1.6 and 2.0, so we will consider both options.

We suggest you read: How long does it take to contact an insurance company for compulsory motor liability insurance after an accident to submit an application and documents?

In the settings of the 1C: Salaries and Personnel Management 8 program, you specify which accounting program is used. Depending on the specified version of the accounting program, the screen view of the document Reflection of salaries in regulated accounting will look different, but the result of posting documents in accounting and tax accounting will be identical.

After uploading to “1C:Accounting 8” (rev. 1.6), tax accounting entries will be generated (for PBU 18/2) - see fig. 1.

Rice. 1

The write-off of RBP for insurance premiums in November in the document Reflection of wages in regulated accounting is displayed only by an accounting entry (tax accounting accounts are not indicated in the document for this entry).

The analysis of whether it is necessary to make a tax accounting entry is already made in the accounting program, depending on the settings installed there (whether PBU 18/02 is applied or not).

In Fig. Figure 2 shows the posting of the write-off of RBP for insurance premiums in the accounting program when using PBU 18/02.

Rice. 2

If you use the program “1C: Accounting 8” (rev. 2.0), the document Reflection of salaries in regulated accounting will look different.

This is due to the peculiarities of the implementation of tax accounting for income tax in the new version: tax accounting is carried out not on a separate chart of accounts, but on the chart of accounts, indicating the amounts of NU, VR and PR for each posting.

As for the accounting principles themselves, everything remains the same, in accordance with current legislation.

In the case of using PBU 18/02, temporary differences are reflected in accounting, however, it looks more clearly than in edition 1.6 - see Fig. 3.

Rice. 3

The write-off of deferred expenses with the corresponding reflection in tax accounting in edition 2.0 of “1C: Accounting 8” is illustrated in Fig. 4.

Rice. 4

After accruing wages to the employees of the enterprise, its owner or accountant calculates and accrues insurance premiums for them, the amount of which is calculated on the basis of the rules established by law.

Most often, account 69 is used for these purposes, on the basis of which a number of auxiliary sub-accounts are opened, corresponding to a separate type of payment. When setting the amount of deductions, cost accounts must be taken into account. They can be designated by numbers from 20 to 26 and 44.

The company accrued a salary of 550 thousand rubles for December 2021, including 300 thousand rubles for production workers. and for the management department - 150 thousand rubles.

According to the above conditions, transfers were made for social needs with a total value of 80 thousand rubles to the Pension Fund of the Russian Federation, including for workers in production - 60 thousand rubles and for the management department - 30 thousand rubles. Additionally, the social insurance fund amounted to 4200 and 2100 rubles.

As a result, insurance premiums were calculated, the posting of which shows the expenses for each department of the company:

- Dt 20 - Kt 69.01 - 60 thousand in the Pension Fund of the Russian Federation for workers in the production workshop

- Dt 26 - Kt 69.01 - 30 thousand in the Pension Fund of the Russian Federation for the salary of the management department

- Dt 20 - Kt 69.01 - 4200 transfers for injuries and danger to persons working in production

- Debit 26 - Credit 69.11 - 2100 transfers for injuries to employees of the company management department

- Debit 69.01 - Credit 51 - 90 thousand insurance payments are transferred to the state budget, the total amount to be transferred to the Pension Fund is reflected in the accounting documentation

- Debit 69.11 - Credit 51 - 6300 insurance transfers are transferred to the state budget, the posting reflects the amount of accruals to the Social Insurance Fund.

Results

Attribute insurance premiums to cost accounting accounts 20,23,25,26,44, etc. To break down insurance premiums by type, use account 69 and various subaccounts. When transferring contributions to the budget, record the posting Dt 69 (for subaccounts) Kt 51. If during the reporting period there was sick leave paid for from the Social Insurance Fund, reflect it with the posting Dt 69 Kt 70.

Sources:

- tax code

- Law “On the Fund’s Budget...” dated December 2, 2019 No. 384-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

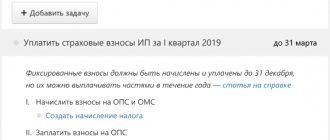

Postings for fixed payments of individual entrepreneurs

Individual entrepreneurs have the right not to keep accounting records. Accordingly, such an operation as the calculation of fixed payments does not require the individual entrepreneur to prepare transactions. If an entrepreneur nevertheless makes entries for his own accounting of income and expenses, the easiest way is to use the general rules. That is, when calculating fixed payments, the individual posting generates the following:

- Dt 20, 26, 44 - Kt 69.02.7 - fixed contributions to the Pension Fund;

- Dt 20, 26, 44 - Kt 69.03.1 - fixed contributions to the FFOMS.

Entrepreneurs are not required to transfer payments to other extra-budgetary funds.