Insurance premiums for individual entrepreneurs - what's new in the service?

Kontur.Accounting has accounts for accounting for insurance premiums of individual entrepreneurs:

- 69.pfip - insurance contributions of individual entrepreneurs for themselves for compulsory pension insurance, including 1% over 300,000 rubles;

- 69.omsip - insurance premiums of individual entrepreneurs for themselves for compulsory health insurance.

On the “Home” tab, a function has become available for paying a fixed portion of individual entrepreneurs’ contributions quarterly.

Also, import from 1C and bank statements is configured so that the amounts of individual entrepreneurs’ contributions for themselves are immediately displayed on the corresponding accounts 69.pfip and 69.omsip.

Fixed part of individual entrepreneur contributions - how to calculate and pay?

1. “Home” tab - open the task “Pay insurance premiums for individual entrepreneurs for ... quarter”:

2. Click on the “Create tax accrual” link.

3. An accounting certificate will open; you need to check the data filled in by the service. Edit if necessary.

4. Click "Save".

5. Open the task “Pay individual entrepreneur insurance premiums for... quarter” again on the “Home” tab.

6. Click on the “Create payment order” link.

7. Enter the information in the opened payment order.

Checking settlements with the budget for fixed insurance contributions to the Pension Fund

To check the calculations with the budget for insurance premiums in a fixed amount credited to the Pension Fund, you can create the report Account Analysis 69.06.5 “Mandatory Pension Insurance for Entrepreneurs”, section Reports - Standard Reports - Account Analysis.

We see that the debt on insurance premiums of individual entrepreneurs has been repaid.

See also:

- Payment of fixed contributions by an individual entrepreneur on income over 300 rubles.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Payment of contributions to the Pension Fund for income over 300 thousand rubles. individual entrepreneur Insurance premiums for an entrepreneur are divided into two parts. One is fixed...

- Payment of income tax on dividends Payment of income tax on dividends to the budget by a tax agent...

- Accounting and calculation of penalties Let's consider the procedure for calculating penalties for legal entities and individual entrepreneurs. From…

- When does an individual entrepreneur have the right not to pay fixed insurance premiums? ...

Variable part of individual entrepreneur’s contributions for himself - how to calculate and pay

The variable portion of contributions is 1% over income of 300,000 rubles. The calculation of the variable part is automated and is created based on the results of each quarter. This happens when the next payment is calculated from the constant part of the contributions.

Accounting is based on data on income and payments made on an accrual basis from the beginning of the year. If income for a quarter exceeds 300 thousand rubles, the service calculates a contribution of 1% of the excess amount for the previous quarter. This contribution is summed up with the next payment from the constant part, and a payment order is generated with the amount received. The contribution will appear in accounting after payment.

If you wish, the amounts of contributions payable calculated by the service can be edited. In this case, at the end of the year the service will generate the amount remaining to be paid.

Generate an accounting certificate (“Documents” → “Accounting certificate” → “Accounting certificate” button) and a payment order (“Documents” → “Bank” → “Tax payment” button → “Payment of taxes and contributions”) by analogy with fixed contributions according to the instructions above. The calculation method and payment details are the same.

Payment of a fixed contribution to the Pension Fund

After paying insurance premiums to the budget, based on the bank statement, you need to create a document Write-off from current account transaction type Tax payment. A document can be created based on a Payment Order using the link Enter document debited from current account . PDF

Basic data will be transferred here from the Payment order .

It can also be either downloaded from the Client-Bank , or directly from the bank if the 1C: DirectBank service is connected.

It is necessary to pay attention to filling out the fields in the document:

- Date - the date of payment of contributions, according to the bank statement.

- According to document No. and from - the number and date of the payment order.

- Tax - Fixed contributions to the Pension Fund , selected from the Taxes and Contributions directory and affects the automatic completion of the Debit Account .

- Type of obligation - Contributions, constant part .

- Reflection in accounting : Debit account - 69.06.5 “Compulsory pension insurance for entrepreneurs.”

- Types of payments to the budget - Tax (contributions): accrued / paid .

Postings according to the document

The document generates the posting:

- Dt 69.06.5 Kt - payment of insurance premiums for individual entrepreneurs in a fixed amount.

2019, 2021 - what amounts of contributions must be paid?

In 2021, the fixed part of the individual entrepreneur’s contributions for himself is equal to 36,238 rubles, of which:

- RUB 29,354 — for compulsory pension insurance;

- RUB 6,884 - for compulsory health insurance.

In 2021, the fixed part is RUB 40,874, of which:

- RUB 32,448 — for compulsory pension insurance;

- RUB 8,426 - for compulsory health insurance.

Add to this amount 1% on income exceeding RUB 300,000.

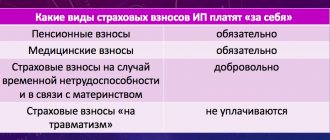

Insurance for individual entrepreneurs

If individual entrepreneurs attract hired workers, then they are insurers on two grounds: in relation to themselves (in a fixed amount) and in relation to the persons they hire.

In relation to hired employees, individual entrepreneurs are required to pay contributions to the Pension Fund, the Federal Compulsory Medical Insurance Fund, and the Social Insurance Fund (for compulsory insurance in case of temporary disability and in connection with maternity, as well as contributions for injuries). Tariffs for insurance premiums in favor of individuals are established by Article 12 of Federal Law No. 212-FZ of July 24, 2009 (hereinafter referred to as Law No. 212-FZ).

Individual entrepreneurs are required to pay contributions for themselves only to the Pension Fund and the Federal Compulsory Medical Insurance Fund (Part 1, Article 5, Part 1, Article 14 of Law No. 212-FZ). They can pay contributions to the Social Insurance Fund for insurance in case of temporary disability and in connection with maternity on a voluntary basis (Article 4.5 of the Federal Law of December 29, 2006 No. 255-FZ). It should be taken into account that voluntary insurance contributions to the Social Insurance Fund do not reduce taxes - neither the simplified tax system, nor the UTII.

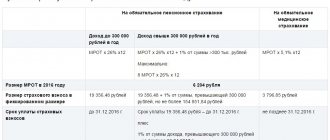

Minimum wage x 5.1% x 12.

Note:* We remind you that from July 1, 2021, the minimum wage is 7,500 rubles. (Federal Law dated June 2, 2016 No. 164-FZ). In 1C:Enterprise 8 solutions, the new minimum wage value is supported with the release of subsequent updates. For deadlines, see “Monitoring Legislative Changes.”

The fixed amount of contributions to the Pension Fund depends on the amount of income received by the entrepreneur for the year and is determined as follows:

- Minimum wage x 26% x 12 - if annual income does not exceed 300,000 rubles;

- Minimum wage x 26% x 12 1% x amount of income exceeding 300,000 rubles - if the income for the year is more than 300,000 rubles. At the same time, the fixed amount of contributions to the Pension Fund of the Russian Federation cannot exceed the limit value calculated according to the formula: 8 x minimum wage x 26% x 12.

Income must be determined according to the rules provided for by the Tax Code of the Russian Federation, depending on the taxation system applied by the individual entrepreneur:

- STS - in accordance with Article 346.15 of the Tax Code of the Russian Federation;

- UTII - in accordance with Article 346.29 of the Tax Code of the Russian Federation;

- for the patent taxation system (PTS) - in accordance with Articles 346.47 and 346.51 of the Tax Code of the Russian Federation;

- when combining different taxation systems, income determined according to the rules of the Tax Code of the Russian Federation is summed up.

In “1C: Accounting 8” edition 3.0, the constant and variable part of fixed insurance contributions to the Pension Fund are taken into account separately. For convenience, we will use the following terms adopted in the program:

- the contribution to the Pension Fund is fixed - for contributions calculated from the amount of income not exceeding 300,000 rubles;

- contribution to the Pension Fund from income - for contributions calculated from an amount of income exceeding 300,000 rubles.

https://www.youtube.com/watch?v=ytpolicyandsafetyru

In accordance with Part 2 of Article 16 of Law No. 212-FZ, fixed insurance premiums (contributions for oneself) for a calendar year must be paid within the following terms:

- the contribution to the Pension Fund is fixed and the contribution to the FFOMS is no later than December 31 of the corresponding year;

- contribution to the Pension Fund from income - no later than April 1 of the following year.

Insurance coverage for individual entrepreneurs (in relation to themselves) differs significantly from the norms provided for employers. Thus, for the reporting year, a businessman is obliged to transfer fixed payments to the budget:

- 29,354 rubles in 2021 - for OPS;

- 6884 rubles - for compulsory medical insurance.

We suggest you familiarize yourself with: OSAGO for a car older than 10 years, insurance of old cars, which cars are not insured.

However, if his income exceeds 300,000 rubles per year, then from the excess amount he will have to additionally transfer 1% to the Federal Tax Service for compulsory pension insurance. For more information about mandatory payments of individual entrepreneurs for themselves, read the article “What contributions should individual entrepreneurs pay for themselves in 2021.”

How to make postings? If the individual entrepreneur does not resort to hiring employees, then there is no need to reflect the calculation of insurance premiums of the individual entrepreneur for himself with postings. Why? Small businessmen are exempt from the obligation to maintain accounting records according to general rules. They have the right to keep simplified accounting, complete accounting, or completely abandon accounting. Therefore, it is not necessary to reflect the SV with postings.

However, if the individual entrepreneur decided to conduct accounting according to generally accepted standards and enshrined such a decision in his accounting policy, then the accrual of fixed payments to the individual entrepreneur (postings) is drawn up in a similar way, using accounting account 69 and the corresponding subaccount to it.

Calculation of insurance premiums: postings

The calculation and payment of insurance contributions to the budget is a direct obligation of all Russian employers. Reflection of these transactions is an integral part of payroll accounting and its taxation. In this article we will tell you how to organize the accounting of payments for insurance coverage: which accounts to reflect on, which transactions to make. We will reflect the calculation of insurance premiums and postings with current examples.

Before moving directly to the rules for compiling accounting records and reflecting deductions for social needs in accounting entries, let’s look at the key aspects regarding insurance coverage for employed citizens.

Accounts

To reflect the transaction “insurance contributions for wages have been accrued,” the entry is drawn up using a special accounting account 69 “Calculations for social insurance and security” (Order of the Ministry of Finance No. 94n).

To detail the data for each type of insurance coverage, the chart of accounts provides special subaccounts:

- 69.1 - to reflect operations on social security of citizens (VNiM and NS and PZ).

IMPORTANT!

It is necessary to provide additional analytics for subaccount 69.1, for example:

- 69.1/1 - accruals in favor of VNiM;

- 69.1/2 - data on payments to the Social Insurance Fund in favor of insurance against accidents and occupational diseases.

- 69.2 - for calculating SV in terms of compulsory pension insurance;

- 69.3 - information on accrued SV under compulsory medical insurance.

The credit of these accounting accounts reflects the accrual of SV, and the debit reflects their payment.

It is worth noting that the employer accrues IC only to the payroll, that is, from the amount of taxable payments and remuneration for labor. No deductions are made from citizens' earnings when calculating SV.

Let us remind you that when creating a vacation reserve in the budget, it is necessary to provide for similar deductions to the reserve fund, transactions and calculation features - in the article “How to calculate the vacation reserve in 2021.”

Typical wiring

Let's consider the key algorithm for calculating CBs and reflecting them in accounting using a specific example.

VESNA LLC is an OSNO company that applies generally established tariffs for insurance coverage for citizens. The contribution rate for injuries is 0.2%. In September 2021, salaries of key personnel were accrued in the amount of 1,000,000 rubles. The accountant recorded the following actions:

| Operation | Debit | Credit | Amount, in rubles | Note |

| Salaries of key personnel accrued | 20 | 70 | 1 000 000,00 | Basis document: salary slips for September |

| Insurance premiums accrued, posting for VNiM | 20 | 69.1/1 | 29 000,00 (1 000 000 × 2,9 %) | |

| Accrual of SV on OPS | 20 | 69.2 | 220 000,00 (1 000 000 × 22 %) | |

| SV reflected on compulsory medical insurance | 20 | 69.3 | 51 000,00 (1 000 000 × 5,1 %) | |

| SV accrued for injuries (NS and PP) | 20 | 69.1/2 | 2 000,00 (1 000 000 × 0,2 %) | |

| Insurance premiums listed, posting: | ||||

| VNiM | 69.1/1 | 51 | 29 000,00 | Basis document: payment orders, extract from a banking organization on the status of the current account |

| OPS | 69.2 | 220 000,00 | ||

| Compulsory medical insurance | 69.3 | 51 000,00 | ||

| NS and PZ | 69.1/2 | 2000,00 | ||

In September 2021, VESNA LLC received from the Federal Tax Service a requirement to pay arrears in the amount of 5,000 rubles and a penalty in the amount of 135.55 rubles. The accountant made the following entries:

| Operation | Debit | Credit | Amount, rub. | A document base |

| Postings for calculating penalties on insurance premiums | 99 or 91 (depending on the method specified in the accounting policy) | 69 (according to the corresponding subaccount) | 135,55 | Requirement of the Federal Tax Service |

| Penalty payment reflected | 69 (according to the corresponding subaccount) | 51 | 135,55 | Payment order |

| Accrual of arrears on insurance premiums (postings) | 20 - if the arrears were accrued for the current year 91.2 - if the arrears were billed for previous reporting periods | 69 (according to the corresponding subaccount) | 5000,00 | Requirement of the Federal Tax Service |

| Payment of arrears | 69 (sub-account) | 51 | 5000,00 | Payment order |

IMPORTANT!

Fix the method of reflecting penalties in accounting in your accounting policy. It is permissible to assign penalties to 91 or 99 accounts. We talked about which account to choose in the article > “Tax Penalties: Postings”.

Features of taxation

Back in 2021, the insurance coverage of citizens has undergone significant reforms. Thus, the Federal Tax Service became the single administrator of revenues. Let us recall that previously payments for insurance coverage were credited directly to extra-budgetary funds (PFRF, FFOMS, Social Insurance Fund).

Now the main regulatory act regulating the taxation procedure and tariffs for insurance premiums (IC) is Chapter 34 of the Tax Code of the Russian Federation. Generally established tariffs are the same for all economic entities:

- Mandatory pension insurance - 22%.

- Compulsory health insurance - 5.1%.

- Temporary disability and maternity insurance - 2.9%.

However, officials have provided benefits for some categories of taxpayers. These privileges are expressed in reduced tariffs for SV. More details: >“Who is eligible for reduced SV tariffs in 2020.”

Please note that insurance against industrial accidents and occupational diseases (injuries) should also be transferred to the Social Insurance Fund. That is, contributions for injuries were not transferred to the jurisdiction of the Federal Tax Service. The amount of payments varies from 0.2 to 8.5% depending on the hazard class of the company’s main activity.

IMPORTANT!

According to the SV, a limit has been set on the OPS (2020 - 1,115,000 rubles). If the amount of taxable income for an employee exceeds the specified limit, then the tariff is reduced to 10%. An acceptable limit has also been approved for VNiM (2020 - 865,000 rubles). However, if this limit is exceeded, the rate is reduced to 0%, that is, the SV for VNIM does not pay if the limit is exceeded.