The business transaction “cash withdrawal” can take place in absolutely any organization. In this article we will look at the features of accounting and recording in 1C the operation of withdrawing cash by check.

You will learn:

- what document in 1C reflects the withdrawal of cash from the bank and its posting to the cash desk;

- what settings affect cash withdrawal transactions.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Step-by-step instruction

On August 9, accountant Svetlana Borisovna Petrova withdrew cash from the current account by check in the amount of 50,000 rubles. to pay wages and transferred them to the organization's cash desk. The bank provided a statement of the transaction.

Let's look at step-by-step instructions for creating an example. PDF

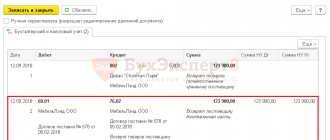

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Receiving cash from the bank | |||||||

| 09 August | 50.01 | 51 | 50 000 | Receipt of cash at the cash desk | Cash receipt - Receiving cash from the bank | ||

| — | — | 50 000 | Cash withdrawal | Debiting from a current account - Cash withdrawal | |||

Receiving cash from the bank

Regulatory regulation

In an organization that is not a paying agent, cash received by check can be spent on (clause 1 of the Directive of the Bank of the Russian Federation dated December 9, 2019 N 5348-U):

- salary and social benefits;

- payment of insurance compensation under insurance contracts to individuals who paid insurance premiums in cash;

- payment for goods (except for securities), works, services;

- issuing money to employees;

- refund of cash payment for returned goods, uncompleted work (services);

- personal (consumer) needs of an individual entrepreneur not related to his business activities, etc.

There is no administrative penalty for misuse of cash, but the banking agreement may establish a fine for cash violations.

If the funds were not capitalized in full or the cash limit at the end of the day was exceeded, the following fines are provided (Article 15.1 of the Code of Administrative Offenses of the Russian Federation):

- from 4,000 to 5,000 rubles. - on officials;

- from 40,000 to 50,000 rub. - for legal entities.

The receipt of cash at the cash desk is reflected according to Dt 50.01 “Organizational cash register” (chart of accounts 1C).

Accounting in 1C

Receipt of cash at the bank by check is documented in the document Receipt of cash transaction type Receipt of cash at the bank in the section Bank and cash desk - Cash desk - Cash documents.

The document states:

- Type of operation - Receiving cash from a bank ;

- Bank account - the account from which the cash was withdrawn;

- Payment amount - the amount of cash withdrawn from the bank;

- Credit Account - “Settlement Accounts”: When cash is withdrawn by check, the funds are debited from the checking account.

If the posting of cash to the cash desk does not occur on the same day as its debiting from the account, then in the accounting policy settings you must check the box Use account 57 “Transfers in transit” when moving funds . PDF

Then, when posting the Cash Receipt , the Cash Receipt at Bank transaction type in the Loan Account and the posting will be generated:

- in the section Details of the printed form : Accepted from - the employee who deposits cash at the cash desk. It is also recommended to indicate the account and bank from which the cash was received.

- The basis is the content of the business transaction, in our case - Receiving cash from the bank to pay wages for July using check No. 809 dated 08/09/2018 .

- The application is not filled out, because when withdrawing cash from a check, the counterfoil from it is not attached to the cash receipt order, but remains in the checkbook.

Postings according to the document

The document generates the posting:

- Dt 50.01 Kt - cash withdrawal from the bank.

Documenting

Cash received at the cash desk is reflected in the cash book.

Individual entrepreneurs from 06/01/2014 may not draw up cash documents and not keep a cash book (clauses 4.1, 4.6 of the Directive of the Central Bank of the Russian Federation dated 03/11/2014 N 3210-U), but only if they keep records of physical indicators, expenses and income from their activities. Entrepreneurs independently decide in what order to carry out cash transactions - in general and simplified.

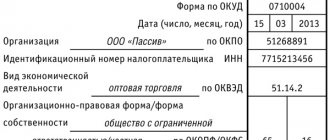

For the amount of cash received at the bank, it is necessary to issue a cash receipt order (KO-1), approved by Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 N 88 (clause 6.5 of the Directive of the Bank of the Russian Federation dated March 11, 2014 N 3210-U).

The form can be printed using the Cash receipt order (KO-1) the Cash receipt document . PDF

Bank statement

Reflection of the debiting of funds from the current account when withdrawing cash by check must be registered with the document Debiting from the current account transaction type Cash withdrawal in the Bank and cash desk - Bank - Bank statements section.

It is also necessary to keep in mind that if you use the download of bank statements, then this document will be downloaded to the database automatically.

The document states:

- Amount - the amount of withdrawal by check, according to the bank statement.

The document does not generate postings; the posting for debiting money from the current account is generated in the Cash receipt document.

But it is recommended to create the document Write-off from the current account , since if you change the accounting policy settings and re-post documents, the cash and bank balances will not match.

If the Use account 57 “Transfers in transit” checkbox when moving funds is selected in the accounting policy settings PDF, then the document Write-off from the current account will generate a posting for writing off money from the current account through account 57:

To access the section, log in to the site.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

attachments_07-09-2012_21-05-55 / Accounting entries for DS transactions

Accounting entries for completed transactions:

| № | Contents of business transactions | Account correspondence | Primary document | |

| Debit | Credit | |||

| Cash transactions | ||||

| 1 | Cash received from the bank by check | 50-1 | 51 | PKO |

| 2 | Salaries issued to employees of the organization | 70 | 50-1 | RKO, Payroll |

| 3 | Issued to report to driver Ivanov I.I. for fuels and lubricants | 71 | 50-1 | RKO |

| 4 | Issued to the supplier for shipped goods and materials, services | 60 | 50 | RKO, power of attorney |

| 5 | Issued to the buyer for unshipped GP | 62 | 50-1 | RKO, power of attorney |

| 6 | The shortage of funds in the cash register, identified during the inventory, is reflected | 94 | 50-1 | Inventory report |

| 7 | Shortage of funds attributed to the cashier | 73-2 | 94 | Order on organization |

| 8 | The cashier deposited funds into the organization's cash desk to cover the shortfall. | 50-1 | 73-2 | PKO |

| 9 | Deducted from the cashier's salary to cover the shortfall | 70 | 73-2 | Order on organization |

| 10 | Reflects surplus cash in the cash register identified during inventory | 50-1 | 91-1 | Inventory report |

| Current account transactions | ||||

| 11 | Payment was made to the supplier for received materials, including VAT | 60-1 | 51 | Payment order, bank statement |

| 12 | The costs of paying for bank services for settlement and cash services are reflected | 91-2 | 76 | Bank statement, bank account agreement |

| 13 | Paid to the bank for cash management services | 76 | 51 | Bank statement |

| 14 | Received payment from the buyer for previously shipped products, including VAT | 51 | 62-1 | Copy of the buyer's payment order, bank statement |

| 15 | Current income tax transferred to the budget | 68 | 51 | Payment order, bank statement |

| 16 | Insurance contributions to extra-budgetary funds are transferred | 69 | 51 | Payment order, bank statement |

| 17 | Amounts written off in the form of economic sanctions | 99-2 | 51 | Collection order, bank statement |

| 18 | Overpayment of taxes and fees credited to account | 51 | 68 | Bank statement |

| 19 | Wages transferred to plastic cards | 70 | 51 | Bank statement |

| Receipt of export foreign exchange earnings | ||||

| 20 | The receipt of export proceeds for products shipped under the contract into the transit currency account of the organization is reflected | 52-1 | 62-11 | Bank statement |

| 21 | The transfer of incoming foreign currency earnings from a transit foreign currency account to a current foreign currency account is reflected | 52-2 | 52-1 | Bank statement |

| 22 | A negative exchange rate difference is reflected in the balances on the current foreign exchange account | 91-2 | 52-2 | Bank statement |

| 23 | A positive exchange rate difference is reflected in the balances on the current foreign exchange account | 52-2 | 91-1 | Bank statement |

| 24 | Paid for bank services for settlement services of a foreign currency account | 91-2 | 52-2 | Bank statement |

| Selling foreign currency | ||||

| 25 | Foreign currency to be sold is debited from the current foreign exchange account | 57 | 52-2 | Application for sale of currency, bank statement |

| 26 | The positive exchange rate difference that arose due to changes in the exchange rate of foreign currency on the date of its debit from the current foreign exchange account and on the date of its sale is reflected | 57 | 91-1 | Bank statement |

| 27 | Ruble funds from the sale of foreign currency were credited to the current account | 51 | 91-1 | Bank statement |

| 28 | Paid expenses related to the sale of foreign currency | 91-2 | 51 | Bank statement |

| 29 | The cost of sold foreign currency has been written off | 91-2 | 57 | Bank statement |

| 30 | Profit (loss) from the sale of currency is reflected | 91-9 99-1 | 99-1 91-9 | Accounting information |

| Purchasing foreign currency | ||||

| 31 | Funds were transferred for the purchase of foreign currency for settlements with foreign suppliers | 76 | 51 | Bank statement |

| 32 | A commission was accrued to the bank for services related to the purchase of foreign currency. | 91-2 | 76 | Invoice |

| 33 | Commission paid from current account | 76 | 51 | Bank statement, Memorial Order |

| 34 | The receipt of purchased foreign currency into the foreign exchange account is reflected at the exchange rate of the Central Bank of the Russian Federation on the date of receipt | 52 | 76 | Bank statement |

| 35 | The excess of the foreign currency purchase rate over the rate of the Central Bank of the Russian Federation has been written off | 91-2 | 76 | Bank statement |

| 36 | The excess of the Central Bank of the Russian Federation exchange rate over the foreign currency purchase rate has been written off | 76 | 91-1 | Bank statement |

| Reflection of foreign currency at the cash desk | ||||

| 37 | Received foreign currency from a current foreign currency account to the cash desk for travel expenses | 50-11 | 52-2 | Bank statement |

| 38 | A positive exchange rate difference is reflected in the balance of cash in foreign currency at the cash desk | 50-11 | 91-1 | Bank statement |

| 39 | Negative exchange rate differences are reflected in cash balances in foreign currency at the cash desk | 91-2 | 50-11 | Bank statement |

| Collection operations | ||||

| 40 | The receipt of cash proceeds to the organization's cash desk is reflected | 50-1 | 90-1 | PKO |

| 41 | The issuance of cash to the bank's collection service is reflected | 57-1 | 50-1 | RKO, announcement |

| 42 | The crediting of cash to the organization's current account is reflected | 51 | 57-1 | Bank statement |

| 43 | The cost of the bank's services for cash collection excluding VAT is reflected. | 91-2 | 76 | Invoice |

| 44 | The amount of VAT is reflected on the cost of cash collection services | 19-3 | 76 | Invoice |

| 45 | Paid for bank services for collection of funds | 76 | 51 | Bank statement |

| 46 | The amount of VAT paid on the services provided for the collection of funds has been submitted for deduction (based on an invoice issued by the bank) | 68 | 19-3 | Invoice |

| Transfers on the way | ||||

| 47 | Money transfers have been made from the cash register but have not yet been received for their intended purpose. | 57-1 | 50-1 | PKO, announcement |

| 48 | Ruble funds were debited from the current account for the purchase of foreign currency | 57-2 | 51 | Bank statement |

| 49 | The write-off of foreign currency for its sale is reflected | 57-2 | 52-2 | Bank statement |

| 50 | The receipt of a money transfer from the buyer for previously shipped goods is reflected | 57-1 | 62-1 | Bank statement |

| 51 | Receipt of remittances from other debtors is reflected | 57-1 | 76 | Bank statement |

| 52 | The receipt of funds in transit to the current account is reflected | 51 | 57-1 | Bank statement |

| 53 | The receipt of funds in transit to the foreign currency account is reflected | 52-2 | 57-2 | Bank statement. |

| Operations under letters of credit | ||||

| 54 | The opening of a covered letter of credit at the expense of the buyer's funds against accounts and railway is reflected. invoices | 55-1 | 51 | Application for opening a letter of credit, bank statement. |

| 55 | The security issued to the seller is reflected in the amount of the letter of credit | 009 | Accounting certificate | |

| 56 | The used letter of credit is written off | 60-1 | 55-1 | Bank statement. |

| 57 | The unused balance of the letter of credit is credited to the current account | 51 | 55-1 | Bank statement. |

| 58 | Paid bank services for servicing a letter of credit | 76 | 51 | Bank statement. |

| 59 | The cost of bank services for servicing a letter of credit is reflected | 91-2 | 76 | Bank statement. |

| Deposit transactions | ||||

| 60 | The transfer of funds to the deposit account is reflected | 55-3 | 51 | Bank statement. |

| 61 | Recognized income (interest) for the month | 76 | 91-1 | Buh. certificate - calculation |

| 62 | Interest credited to settlement | 51 | 76 | Bank statement. |

| 63 | Received funds from a credit institution upon expiration of the deposit period | 51 | 55-3 | Bank statement. |

| Targeted financing operations | ||||

| 64 | The allocation of targeted budget funding is reflected | 76 | 86 | Contract |

| 65 | Receipt of targeted budget funding is reflected | 55-4 | 76 | Bank statement. |

| 66 | Equipment requiring installation has been registered | 07 | 60 | TTN |

| 67 | The amount of VAT presented by the seller of the equipment is reflected | 19 | 60 | Invoice |

| 68 | Transferred to the equipment seller, including VAT | 60 | 55-4 | Bank statement. |

| 69 | Transfer of equipment for installation reflected | 08-3 | 07 | Certificate of acceptance and transfer of equipment for installation |

| 70 | The costs of auxiliary production for equipment installation are reflected in capital investments | 08-3 | 23 | Calculation |

| 71 | Reflects the commissioning of a fixed asset facility | 01 | 08-3 | OS acceptance certificate |

| 72 | The use of targeted funding is reflected | 86 | 98 | Buh. certificate - calculation |

| 73 | The amount of VAT paid to the equipment seller is written off from targeted financing funds | 86 | 19 | Buh. certificate - calculation |

| 74 | Monthly depreciation charge for fixed assets, starting from the month following the month the equipment was put into operation | 20 | 02 | Depreciation calculation |

| 75 | Deferred income is reflected in other income | 98 | 91-1 | Buh. reference-calculation |

Documents confirming payment for banking services are bank statements of current accounts, memorial orders, invoices (for collection services).

BASIC REGULATIVE DOCUMENTS

- Federal Law of December 10, 2003 No. 173-FZ “On Currency Regulation and Currency Control” (as amended on February 7, 2011)..

- Federal Law dated December 8, 2003 No. 164-FZ “06 Fundamentals of State Regulation of Foreign Trade Activities” (as amended on December 8, 2010).

- Federal Law dated May 22, 2003 No. 54-FZ “On the use of cash register equipment when making cash payments and (or) payments using payment cards” (as amended on July 27, 2010).

- The procedure for conducting cash transactions in the Russian Federation: established by letter of the Bank of Russia dated October 4, 1993 No. 18 (as amended on February 26, 1996).

- Regulations of the Bank of Russia dated October 3, 2002 No. 2-P “On non-cash payments in the Russian Federation” (as amended on January 22, 2008).

- Regulations on the rules for organizing cash circulation on the territory of the Russian Federation dated January 5, 1998 No. 14-P, approved. Board of Directors of the Bank of Russia 12/19/1997, minutes No. 47. (as amended on 10/31/2002).

- Directive of the Bank of Russia dated June 20, 2007 No. 1843-U “On establishing the maximum amount of cash settlements in the Russian Federation between legal entities for one transaction” (as amended on April 28, 2008 No. 2003-U).

- Order of the Ministry of Finance of the Russian Federation dated November 24, 2004 No. 106n “On approval of the rules for indicating information in the fields of payment documents for the transfer of taxes, fees and other payments to the budget system of the Russian Federation” (as amended on October 1, 2009).

- Guidelines for inventory of property and financial obligations, approved. by order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49 (as amended on November 8, 2010).

- Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88 “On approval of unified forms of primary accounting documentation for recording cash transactions and recording inventory results” (as amended by Resolution No. 36 dated March 27, 2000).

- Resolution of the State Statistics Committee of Russia dated January 05, 2004 No. 1 “On approval of unified forms of primary accounting documentation for recording labor and its payment.”

- Labor Code of the Russian Federation (as amended on October 29, 2010).

- Tax Code of the Russian Federation (as amended on 03/07/2011).

- Accounting Regulations “Accounting for assets and liabilities, the value of which is expressed in foreign currency” PBU 3/2006, approved. By Order of the Ministry of Finance of the Russian Federation dated November 27, 2006 No. 154n (as amended on December 24, 2010).