In the daily activities of an organization, the number of different payments can be quite large, so the most important of them from the point of view of the law should be carried out before others. Mandatory payments are the most significant. Namely, payment of taxes and contributions to extra-budgetary funds. Therefore, in field 21 of the order to transfer money, a special detail is provided - the order of payment. Let's figure out how to set the order of payment in a payment order in 2021 and why this indicator is needed in general.

Why is it necessary?

First, you should understand what the order of payment in a payment order for transferring money means.

As a general rule, the bank is obliged to fulfill an order from a client to transfer tax to the budget within the next day after such an order is issued by virtue of clause 2 of Article 60 of the Tax Code. If there is not enough money in the client’s account to transfer taxes, then the client’s funds will be written off in a strictly defined manner, which is established by Art. 855 of the Civil Code of the Russian Federation.

It follows from the legislation that the order of payment in a payment order depends on whether payment must be made voluntarily or compulsorily.

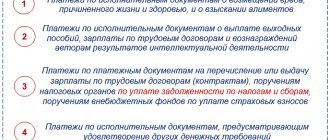

The specified article of the Civil Code defines the following order of cash write-offs:

| 1 | Payments that occur under executive acts on compensation for harm caused to health or life Payment of alimony |

| 2 | Transfers in accordance with writs of execution for the payment of severance pay upon dismissal or salary arrears Payment of royalties |

| 3 | Payment of debts on taxes, fees and contributions Issuance of wages to employees |

| 4 | Cash payments for other executive acts |

| 5 | All other payment documents in the calendar sequence of their receipt |

As you can see, the order of alimony in the payment order is always number one and has priority over other demands and orders to the payer’s account. In fact, this is one of the ways to protect family values.

Mandatory payments of the 1st, 2nd, 4th and partially 3rd priority can be made by the bank without the client’s consent, since the basis for the transfer of money is an executive document. Therefore, in the generated payment order, the organization can only indicate the 3rd or 5th priority.

The general principle of the queue is this: all payments that belong to one queue are executed in the calendar order of their receipt by the bank.

What is the order of payment in a payment order?

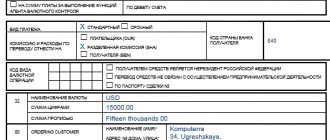

One of the fields that the payer must fill out when drawing up a payment order is called “payment order” and has the number 21. As follows from the explanations for the procedure for filling out payment orders (Appendix 1 to the Bank of Russia regulation dated June 19, 2012 No. 383-P), in the props “Och.

payment." The number indicates the order of payment in accordance with federal law. The general sequence of writing off funds from the account is established in paragraph 2 of Article 855 of the Civil Code of the Russian Federation (note that part two of the Civil Code of the Russian Federation was put into effect by Federal Law No. 14-FZ of January 26, 1996).

According to this norm, payments are made first of all on the basis of writs of execution, which order the withholding (collection) of alimony or funds for compensation for harm to life and health.

Calculate your salary for free with deduction of alimony and standard deductions for personal income tax

The second stage of payments are transfers within the framework of executive documents for the transfer of wages, severance pay or royalties.

“Ordinary” wages (including debts paid voluntarily, and not under a writ of execution) are transferred from the account in third place. Also, in the third place, money will be written off based on collection orders from the Federal Tax Service, Pension Fund and Social Insurance Fund.

The fourth priority consists of payments under enforcement documents providing for any other penalties (debt under contracts, fines, penalties, etc.).

All other payments are transferred in fifth place.

IMPORTANT. Within one queue, payment orders are executed in the order they are received by the bank.

Fill out a payment form for free in the accounting web service

How to put it down correctly

As for taxes, the order of payment in the 2019 payment order for their transfer in the corresponding line of the payment is “5” when there is a voluntary payment without any receipts from the Federal Tax Service. In turn, payment of taxes based on the requirements of the inspection must be carried out by the bank in third place. Forced payment of penalties based on instructions from the tax authority is also carried out in third place.

Thus, the bank carries out all tax payments that are made on the basis of the client’s order only in the fifth place.

Personal income tax

For example, for personal income tax, the order of payment in the 2019 payment order in most cases has the value “5”. That is, the payer or tax agent does not violate the deadlines established by law for transferring income tax to the treasury, and there are no old debts to the budget for this tax.

Also see “What to indicate in the “Payment order” field in a personal income tax payment order.”

VAT

With regard to VAT, the order of payment in the 2019 payment order follows the general approach:

- when transferring independently, you must indicate the 5th queue;

- when collecting this tax forcibly - 3rd stage (clause 2 of the letter of the Ministry of Finance dated January 20, 2014 No. 02-03-11/1603).

Also see “Payment order at the request of the Federal Tax Service: details of filling out”.

Insurance premiums

The order of payment in the payment order for insurance premiums in 2019 will be similar. Due to recent global changes in legislation, these mandatory contributions have become similar in status to taxes. If there are no claims against you regarding the deduction of contributions, then put “5”.

Salary

According to the above gradation, the order of the salary in the payment order depends on whether the employer previously delayed its payment or not. Thus, the current wages (for the past month, etc.) are assigned to the 3rd stage, and its payment from the enterprise’s account according to the writ of execution goes as the 2nd stage.

Help

What is the order of payment in the financial assistance payment order? In our opinion, the logic should be this: if a company/individual entrepreneur is not obliged by law to issue it, then this is definitely the 5th priority. In other situations, you need to look at the document that provides the basis for which a person should receive financial assistance.

Also see “Who is entitled to financial assistance for vacation”.

Fine

The exact order of the fine in the payment order depends not on its type (tax/administrative, etc.), but on the order in which it is entered into the budget. If a person pays it of his own free will and the controllers have not received a corresponding order or receipt, then this will be the 5th stage. In the opposite situation - 4th line.

State duty

As for the state duty, the order of payment in the payment order is almost always “5”. The fact is that it is impossible to receive any government service without first confirming that the fee has already been paid to the budget on an initiative basis.

Also see “Payment order for payment of state duty to the arbitration court: sample”.

Dividends

If we are talking about the distribution of profits between business owners, then for dividends the order of payment in the payment order is set to the latest - fifth. From the state's point of view, they do not have priority over any other payments.

Also see “Dividend Payment Period”.

The order of transfers in bankruptcy

The provisions of paragraph 2 of Article 855 of the Civil Code of the Russian Federation apply not only when filling out payment documents. When the bankruptcy procedure begins, a sequential queue of payments in debt repayment is also used to create a register of creditors’ claims against the debtor. Bankruptcy consists of the inability to satisfy all monetary claims of creditors. External management is introduced to evaluate and sell the debtor's property and satisfy creditors' claims. The bankruptcy trustee appointed by the court creates a register of creditors' claims in accordance with the order of priority established by clause 2 of Art. 855 of the Civil Code of the Russian Federation, and after the sale of the debtor’s property, it pays the debts.

Legal documents

- 07/05/2017 No. 4449-U

- Art. 855 Civil Code of the Russian Federation

- Resolution of the Constitutional Court of December 23, 1997 No. 21-P

- Art. 57 of the Constitution of the Russian Federation

What to do if the order is incorrect

If there are enough amounts in the client’s current account to make all requested and necessary payments, then the queue specified in the order does not play a fundamental role. All payment orders will be executed by the bank in the order they are received. If there is not enough money in the account to fulfill all orders, the bank will write off the amounts in the order established by law (see above).

The bank has no right to refuse to transfer money to a client using a payment document that incorrectly indicates the order of payment.

If this detail is specified incorrectly, there are 2 options for correcting this error:

- Bank employees may ask the client to redo the payment document, since it is the bank that the inspection authorities will make complaints about the order of payments.

- The bank will make an independent decision to make the payment in accordance with the queue determined by law.

In any case, incorrect indication of the details in question in the payment will not affect the receipt of the transferred amounts into the budget.

Read also

02.01.2019

What is listed last?

For the bank employee who received the payment, what does payment order 5 mean in field 21 of the order? That if there is a shortage of funds in the client’s account, transfers according to the document are done last.

Such transfers include payments for goods, works and services. Another last order of payment for state duties, current transfers of taxes and fees. When the servicing bank receives several instructions to write off funds that are subject to execution in one turn, the bank executes them sequentially in calendar order. That is, the rule applies: first, the order that was received earlier than others will be paid.

How are salaries paid?

From the list above it follows that before paying wages for the past month, the employer is obliged to pay off arrears of wages and severance pay. However, it means debt for which there are enforcement documents.

Are you calculating your salary? Find out how to properly pay for non-working days.

What is paid in advance: salary or tax debt?

In the third priority there are wages and arrears of taxes and contributions. The question often arises: which of these should be paid first? In fact, the mentioned payments do not have priority over each other. The fact that they are in the same queue implies the following: the payment will be made in advance, the order for the transfer of which was received by the bank earlier.

If the order to pay wages was made earlier than a collection order was received from the tax authority to write off the debt, then the wages will be paid first, and then the tax debts. If an order from the tax office was received earlier, then this payment will go forward.

The order of deductions according to writs of execution

As soon as the company receives writs of execution from bailiffs, the employee must be notified of the upcoming deductions. Then the accountant must familiarize himself with the grounds for issuing and transferring writs of execution and determine the order of deduction:

| Queue | Type of debt |

| 1st | Alimony payments; compensation for moral damage; compensation for damage resulting from criminal acts; compensation for damages associated with the death of the breadwinner; compensation for damage caused to someone’s health (including cases of road accidents). |

| 2nd | Payment for the work of people who worked on the basis of an employment agreement; severance pay; payment of remuneration to the authors of the results of intellectual activity. |

| 3rd | Mandatory contributions to the state budget and extra-budgetary funds |

| 4th | Other debts (for example, bank loans, fines, legal costs) |