Employee tax status

A tax resident for tax purposes is a person who stays in Russia for more than 183 days over the next 12 consecutive months.

Accordingly, citizens who stay in Russia for less than 183 calendar days over the next 12 consecutive months are considered tax non-residents. Even though a Russian citizen is initially considered a tax resident, when determining residency, a person’s citizenship does not matter (letter of the Russian Ministry of Finance dated March 19, 2012 No. 03-04-05/6-318). A Russian citizen can be a tax non-resident, and a foreigner can be a resident. Moreover, the tax status may change several times during the tax period.

An employee may lose his tax resident status if he was on a long business trip abroad. Therefore, it is in the interests of the employer to check the status of any person when hiring, even if he is a Russian citizen.

Personal income tax on the income of foreigners. How to calculate a resident

Since January 1, 2007

The rules for recognizing an individual

as a tax resident

of the Russian Federation have changed.

These changes are especially relevant for companies that hire foreigners

the personal income tax rate

depends on whether the employee is a tax resident , and therefore the amount of tax that the employer must calculate, withhold from the employee’s salary and transfer to the budget.

Let us remind you that in accordance with paragraphs 1

and

3 tbsp.

224 of the Tax Code of the Russian Federation , in relation to all income received by individuals who

are not

tax residents of the Russian Federation, the personal income tax rate is set at

30%

, and in relation to the income of individuals who are tax residents of the Russian Federation -

13%

.

As it was

Previously (before January 1, 2007) according to paragraph 2 of Art.

11 of the Tax Code of the Russian Federation, a tax resident

of the Russian Federation was recognized as an individual who was actually located on the territory of the Russian Federation for at least 183 days

in a calendar year

.

That is, the period of stay of an individual on the territory of the Russian Federation had to be calculated within each calendar year

separately: from January 1 of each new year, the countdown began anew, “last year’s” days of stay in the Russian Federation were

not taken into account

.

For example, citizen of Ukraine Prikhodko I.N. was on the territory of the Russian Federation from September 12, 2005 to April 10, 2006, that is, only 210 days

.

Duration of stay Prikhodko I.N. on the territory of the Russian Federation amounted to 110 days in 2005 and 100 days in 2006, that is, in 2005 and 2006 separately, Prikhodko spent less than 183 days

.

Consequently, in accordance with the previous rules, Prikhodko did not acquire the status of a tax resident of the Russian Federation

neither in 2005 nor in 2006, despite the fact that he was continuously on the territory of the Russian Federation for more than 183 days.

Therefore, all income he received during this time (including the salary paid to him) was subject to personal income tax at a rate of 30%

.

What happened

Since January 1, 2007

The definition of the concept of “tax resident” is contained in

paragraph 2 of Art.

207 of the Tax Code of the Russian Federation : a tax resident is an individual who is actually in the Russian Federation for at least 183 calendar days

over the next 12 consecutive months

.

That is, now there is no need to determine the period of stay of an individual on the territory of the Russian Federation in each calendar year

separately.

In letter dated March 29, 2007 No. 03-04-06-01/94, the Ministry of Finance of the Russian Federation explained that when considering the tax status of an individual, any continuous 12-month period

, determined as of the date of receipt of income, including those that began in one calendar year and continued in another calendar year.

Officials indicated that the time a foreigner spent in Russia in 2006 is taken into account

when calculating the period required to acquire tax resident status in 2007.

For example, if Prikhodko I.N. had been continuously in the Russian Federation since September 1, 2006, then in March 2007 he acquired the status of a tax resident, since over the past 12 months he had been in the Russian Federation for more than 183 days

.

And if Prikhodko acquired the status of a tax resident at the end of 2006, then from the beginning of 2007 he will continue to be considered a resident, and his income will be subject to personal income tax at a rate of 13% from January 2007.

If the employee's status changes during the calendar year

According to Art. 216 Tax Code of the Russian Federation

The tax period for personal income tax is

a calendar year

.

change during the calendar year.

: a foreigner can either acquire the status of a tax resident of the Russian Federation or, conversely, lose this status.

Lose your resident status at the end of the tax period

(calendar year) cannot only be applied to those employees whose

during the calendar year

(for example, 7 months).

From the moment of acquisition or, conversely, loss of tax resident status, the personal income tax rate of 13% or 30% should be applied to the employee’s income, respectively.

Moreover, each time from the moment the employee’s tax status changes, it is necessary to apply a new personal income tax rate not only to income paid to the employee after

changes in status, but also recalculate

personal income tax

at a new rate in relation to

all income

paid to the employee since the beginning of the tax period (calendar year).

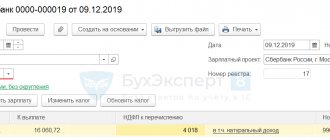

This is due to the fact that, in accordance with Art. 226 Tax Code of the Russian Federation

The employer company, as a tax agent

during the calendar year

calculates and withholds the accrued amount of personal income tax from employees' salaries upon actual payment of wages and transfers the withheld amounts of personal income tax to the budget.

In this case, the tax agent calculates the amount of personal income tax on an accrual basis.

from the beginning of the tax period, that is, the firm makes the final calculation of the amount of personal income tax in relation to the income of each of its employees

at the end of the tax period

(calendar year).

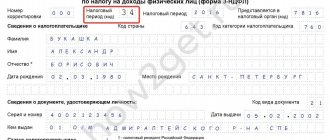

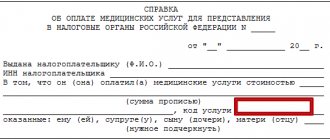

Information about this final calculation, namely information about the income of individuals

for the tax period and the amounts of personal income tax accrued and withheld in this tax period, the employer-tax agent submits to the tax authority at the place of his registration annually no later than April 1 of the year following the expired tax period,

in form No. 2-NDFL

, approved by order of the Federal Tax Service of the Russian Federation dated 10/13/2006 No. SAE-3-04/ [email protected] (

clause 2 of article 230 of the Tax Code of the Russian Federation

).

Moreover, in section 2

“Data about the individual - recipient of income” of the Certificate in Form No. 2-NDFL

in line 2.3

“Status” the employer - tax agent must indicate

the status of the employee

(resident or non-resident) at the end of the tax period - on December 31.

Thus, despite the fact that during the year the employee’s status and, accordingly, the current personal income tax rate (13% or 30%) may change, the final calculation

Personal income tax amounts in relation to the income of an individual at the end of the tax period must be paid at a rate corresponding to the “final” status of the individual (

as of December 31

of the calendar year).

cannot be applied to the income of the same individual based on the same tax period (for example, 30% from January to March and 13% from April to December)

.

Please note that an employee’s tax status may change even twice

for the tax period (calendar year).

Suppose Prikhodko I.N. has been in the Russian Federation since September 1, 2006.

This means that at the beginning of 2007 he was not a tax resident of the Russian Federation, but in March 2007 he acquired resident status.

After this, the employer company sent him on a business trip abroad from April to November 2007, that is, while he was abroad (in September 2007), Prikhodko would lose his status as a tax resident of the Russian Federation.

As a result, Prikhodko’s “resident” status will change twice during 2007: non-resident (January - March) - resident (March - September) - non-resident (September to December).

Consequently, the personal income tax rate in relation to the income of Prikhodko I.N. during 2007 will change twice: 30% – 13% – 30%.

Twice during 2007, personal income tax will be recalculated in relation to income paid to Prikhodko since the beginning of 2007 (in March and September 2007).

As of December 31, 2007 Prikhodko I.N. will not be recognized as a tax resident, therefore the final calculation of the personal income tax amount in relation to Prikhodko’s income based on the results of the tax period (2007) will be carried out by the employing company at a rate of 30%

.

The following situation may also arise: a foreign resident worker quit and returned abroad, as a result of which he lost his resident status

.

Since the company - the former employer no longer pays income to its former employee (no longer a non-resident), then the underpayment of personal income tax should be withheld from him

(due to the recalculation of personal income tax at a rate of 30% after changing its status) she

cannot

.

According to paragraph 9 of Art. 226 Tax Code of the Russian Federation

payment of taxes at the expense of tax agents (in this case, at the expense of the former employer)

is not allowed

.

In a letter dated March 19, 2007 No. 03-04-06-01/74, the Ministry of Finance explained to “former employers” how to act in this case. In accordance with paragraph 5 of Art. 226 Tax Code of the Russian Federation

it is necessary, within

a month

from the moment the former employee loses the status of a tax resident of the Russian Federation,

to notify in writing

the tax authority at the place of his registration about the impossibility of withholding personal income tax and the amount of debt of the taxpayer (former employee).

Belarusians are a special case

In accordance with paragraph 1 of Art. 21 of the Agreement between the Government of the Russian Federation and the Government of the Republic of Belarus on the avoidance of double taxation and the prevention of tax evasion in relation to taxes on income and property dated April 21, 1995, citizens of the Republic of Belarus should not be subject to more burdensome taxation

than citizens of the Russian Federation in similar circumstances.

In this regard, in past years (before January 1, 2007), the Ministry of Finance has repeatedly explained that if an organization has an employment contract with a citizen of the Republic of Belarus, providing for the presence of this citizen in the territory of the Russian Federation for at least 183 days in a calendar year, such a Belarusian citizen is recognized as a tax resident

, regardless of the length of his stay in Russia at the time of concluding the employment contract (see, for example, letter dated August 15, 2005 No. 03-05-01-03/82).

That is, citizens of the Republic of Belarus were granted tax resident status “in advance” in the expectation that they would subsequently confirm this status (spend at least 183 days in the Russian Federation during the calendar year).

In 2007, special rules are also provided for Belarusians.

In a letter dated March 29, 2007 No. 03-04-06-01/94, the Ministry of Finance explained that if a company entered into an employment contract

with a citizen of the Republic of Belarus, which involves staying on the territory of the Russian Federation

for at least 183 days

in a calendar year, then personal income tax should be withheld from the salary of such an employee immediately at a rate of 13%.

Moreover, in the event of termination of the employment contract

Before the expiration of 183 days of stay of a citizen of the Republic of Belarus on the territory of the Russian Federation during the tax period (calendar year), the employing company is obliged to

recalculate personal income tax

in relation to income paid to this employee

at a rate of 30%

, since he has not “earned” his status as a tax resident of the Russian Federation.

How to set a 12 month period

The 12 consecutive months required to establish a person's tax status are not the calendar year from January 1st to December 31st. This period may begin in one tax period and continue in another. So, if tax status is determined on August 30, 2021, then the 12-month period begins on August 30, 2018, and ends on August 29, 2021.

During the calendar year, the organization must monitor the tax status of employees. When paying wages - on each date of its accrual, that is, on the last day of the calendar month. On the day of payment of income - for other types of income, for example, vacation pay.

The procedure for reflecting non-resident status in the financial statements of a Russian employer.

In this case, it is necessary to decide how the work is carried out (remotely or not). In accordance with Art. 312.1 of the Labor Code of the Russian Federation, remote work is the performance of a labor function determined by an employment contract outside the location of the employer, its branch, representative office, other separate structural unit (including those located in another area), outside a stationary workplace, territory or facility directly or indirectly under the control of the employer , subject to the use of public information and telecommunication networks, including the Internet, to perform this job function and to carry out interaction between the employer and employee on issues related to its implementation.

Income from performing work outside the Russian Federation refers to income from sources outside the Russian Federation (clause 6, clause 3, article 208 of the Tax Code of the Russian Federation). Therefore, such income received by non-residents is not taxed in the Russian Federation, regardless of who made the payment (Letter of the Ministry of Finance of Russia dated October 16, 2015 N 03-04-06/59439). At the same time, it should be taken into account that this position is not confirmed (or refuted) by established judicial practice.

If the work is not carried out remotely, then such income is recognized as paid from sources in the territory of the Russian Federation and is subject to taxation (personal income tax) according to the general rules.

In this case, the employee, a foreign citizen, receives from the Russian organization only income in the form of wages (wages). The date of his actual receipt of such income is recognized as the last day of the month for which he was accrued income for work duties performed in accordance with the employment contract (clause 2 of Article 223 of the Tax Code of the Russian Federation). Accordingly, the organization determines the tax status of an employee on the last day of each month.

You may be interested in: Obtaining a work permit for a HQS.

As long as the employee is recognized as a tax resident, personal income tax is withheld at a rate of 13%; after the employee becomes a non-resident, tax is paid at a rate of 30%, and amounts previously paid in a given calendar year are also recalculated.

On the other hand, the Ministry of Finance explains that if the status of an employee changes during the current tax period, then the recalculation of personal income tax amounts cannot be done immediately, but:

- after the date from which the employee’s tax status in the current year (tax period) cannot change (for example, if the employee has been outside the Russian Federation since January 1, 2021, then this date will be July 1, 2021);

- at the end of the year (as of December 31);

- on the date of dismissal of the employee.

Accordingly, the status may constantly change during the calendar year depending on the movement of an individual outside the Russian Federation and back. In this regard, it is necessary to determine the status at the time of payment of income, at the time of termination of the employment relationship, at the end of the calendar year. In this case, the tax is paid (recalculated) depending on the result obtained.

You may be interested in: Preparation of a legal opinion on tax issues.

How to calculate 183 days

The number of days an employee stays in the Russian Federation is determined by summing up all calendar days in which he was in Russia during this period. When calculating them, days are taken into account - calendar dates of entry and exit, since on these days the person is actually on the territory of Russia.

183 days should not flow continuously (letter of the Federal Tax Service of Russia dated August 30, 2012 No. OA-3-13 / [email protected] ). They may be interrupted for periods of vacations, business trips, etc.

When calculating 183 days of stay in Russia, the time spent abroad is not included in their number, except for short-term (less than six months) trips for treatment and training - they are included. Mandatory condition: immediately after completing training or treatment, the employee must return to the Russian Federation.

But if, under an agreement with a foreign educational institution, training lasts more than six months, when calculating the days a person is in Russia, the entire period of his training is not taken into account (letter of the Ministry of Finance of Russia dated October 8, 2012 No. 03-04-05/6-1155).

All days when a person was treated abroad or underwent training must be documented: copies of passports with border control marks, contracts with medical or educational organizations or certificates from them. The certificates must indicate the time of treatment or training.

An important condition for periods of short-term treatment or training to be counted during a person’s stay in the Russian Federation is the purpose of the trip. If he traveled abroad for another purpose, but while abroad underwent treatment or training, these days cannot be included in the period confirming residence (letter of the Ministry of Finance of Russia dated September 26, 2012 No. 03-04-05/6- 1128).

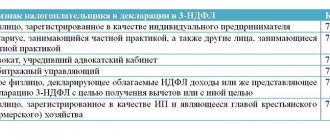

Who are residents and non-residents and what does it affect?

The procedure for recognizing individuals as tax residents is given in paragraph 2 of Art. 207 of the Tax Code of the Russian Federation. Citizens of the Russian Federation acquire this status automatically, but lose it after a long (more than six months) stay abroad.

Non-residents are foreigners who have recently arrived in the country. A non-resident foreigner with a residence permit or temporary permit who wishes to obtain Russian resident status must confirm it by writing a corresponding application to the Federal Tax Service of the Russian Federation. The application form is given in Appendix No. 1 to the Federal Tax Service order No. ММВ-7-17 / [email protected] dated November 7, 2017.

In 2021, reduced deadlines for obtaining residency apply. Federal Law No. 265-FZ of July 31, 2020 introduced clause 2.2 into Article 207 of the Tax Code, which makes it possible to recognize as residents persons who are in Russia in 2021 from 90 to 182 calendar days inclusive, when submitting a simplified application. A sample of the simplified application is given in the appendix to the letter of the Federal Tax Service No. ВД-4-17/15732 dated September 28, 2020.

In addition, international agreements on the elimination of double taxation signed with other states may contain a different residence procedure.

The status of a citizen affects the taxation of his income.

Whether a foreigner with a temporary residence permit or a residence permit is a resident or non-resident of the Russian Federation depends on:

- income on which tax is paid (Article 209 of the Tax Code of the Russian Federation);

- tax rate (Article 224 of the Tax Code of the Russian Federation);

- the opportunity to receive a tax deduction (clauses 3, 4 of Article 210 of the Tax Code of the Russian Federation).

The exception is stateless persons and certain categories of foreigners (HQS, participants in the resettlement program, residents of EAEU countries, refugees) - for them the personal income tax rate is set at 13%, regardless of whether they are tax residents or not.

On the subject: All personal income tax rates for foreigners in Russia - detailed information

For legal entities, tax residence is determined depending on where their activities and actual management are conducted.

Definition and status

Resident is an individual or legal entity registered with government agencies at the place of residence, location and, in connection with this, obliges to obey the current legislation.

A non-resident is an individual or legal entity who performs a certain type of action on the territory of one state, but at the same time is responsible for his actions before the legislation of another state, chosen by him as his place of permanent residence.

This status is also acquired by organizations operating on the territory of the Russian Federation on the basis of the legislation of a foreign state. Such organizations usually include international representative offices and branches of foreign companies.

They become residents and non-residents when an individual or legal entity fulfills certain conditions:

- presence in the country for a certain time;

- regular presence in the country (all the time, or with short-term visits);

- acquiring a document giving the right to live and work on the territory of a foreign state (residence permit, work, study visa);

- fulfillment of other points specified in the legislation.

These terms are present in the legislation of most countries of the world, therefore the ability to distinguish them and use them for one’s benefit will greatly brighten up a foreigner’s stay on the territory of a foreign state.

The same applies to citizens who do not have information about the legislative norms of their own country and therefore find themselves in unpleasant situations related to non-payment of taxes or the inability to carry out the necessary banking procedure.

Who will know that you are a non-resident

The depositary and the broker have no way of knowing on their own that you have left Russia. In their eyes, you will remain a tax resident, and your income will be taxed at resident rates - 13%, as you write.

This does not mean that now the tax office will not be able to find out about your move abroad.

You will probably need to open a bank account there in the first six months after arriving in the EU. At this moment, you will still be considered a resident, therefore, according to the rules, you will have to report the opening of an account to your tax office. After this, the tax office may ask you to confirm the period of your stay in the Russian Federation in order to charge you additional tax.

On the one hand, the law does not oblige you to report that you are now a non-resident. There is also no liability for failure to report. On the other hand, the obligation to file a declaration and independently pay the tax not withheld by the tax agent follows from paragraphs. 4 clause 1 and clause 3 of Article 228 of the Tax Code. The exception is the case when the tax agent himself informed the tax office about the impossibility of fully withholding the tax and reflected this in the 2-NDFL certificate - then you do not have the obligation to file a declaration. If the Federal Tax Service finds out that you have actually become a tax non-resident, and paid taxes as a resident, you may be assessed additional personal income tax, as well as penalties and a fine.

Therefore, it is better to declare a change in your status yourself.