Advance checks: changes to 54-FZ

The inscription “advance” in the fiscal document was conceived to formalize transactions in which the client pays for a product or service in advance and receives it a little later.

Thus, after July 2021, when receiving money in advance, a check must be issued at least twice:

- at the time of transfer of money (for each transfer of money, if there were several tranches);

- when issuing the goods (after full provision of the service).

In the first case - an example of a check for an advance, in the second - a check for offset of an advance.

However, 54-FZ presupposes several features of a calculation method with similar functions:

- prepaid expense;

- prepayment;

- prepayment 100%.

At the online checkout, 100% prepayment is indicated as “1”, prepayment – “2” and advance payment – “3”.

We will discuss the details in which cases it is necessary to write “advance payment” on the check, and in which cases it is necessary to write “prepayment” below.

What is a refund via online checkout?

Refunding money when using a new type of cash register consists of generating a special check that changes the amount of turnover. There are several reasons for returning money via online checkout:

- a visitor to a retail outlet at the time of purchase decided to refuse to purchase part of the goods;

- the client took the paid goods, received services, but their quality does not meet the criteria stated by the seller or manufacturer, or the products did not suit the client (the buyer’s right to a refund is stipulated in articles 18, 25 and 29 of regulation No. 2300-1 of 02/07/1992);

- issuance to the buyer of a previously made advance or prepayment (the procedure is similar to the previous paragraph);

- A store employee entered incorrect data on the quantity or price of a product or service into the receipt and immediately discovered the error.

In these cases, the operation is confirmed by documents and a check with the sign “return of receipt”

Subscribe to our channel in Yandex Zen - Online Cashier! Be the first to receive the hottest news and life hacks!

Checks for advance and prepayment: what is the difference

With what type of payment method a check should be issued depends on the situation.

For example, if the organization and the buyer know exactly what goods and services the funds are being transferred for, then it is better to make an advance payment.

If the product has not yet been fully selected, the service has not been generated, you must select a command on the cash register with the attribute for calculating an advance payment.

More details about this are in the table below.

Table 1. Difference between a cash advance check and a prepayment check

| Name | brief information | In what cases is it formed? |

| Prepayment 100% | Full payment for goods and services, while the goods are transferred to the buyer (the service is provided) not at the time of payment, but later. | Both the buyer and the seller can clearly define the product and service (that is, a specific product model or a specific service with a specific price in the price list). The price of goods and services will not change. |

| Prepayment | Partial prepayment before delivery of goods or provision of services. | The buyer and seller can clearly name the product or service (specific product model, service). The price of goods and services does not change. |

| Prepaid expense | Transferring money before receiving goods and services. | At the time of this calculation, it is impossible to accurately determine the product model or list of services. Price may change. |

How to process returns via online checkout

If a product or service is of inadequate quality (Article 4 of the Law on the Protection of Consumer Rights), then the consumer has the right to return the product or refuse the service on any day convenient for him. At this moment, the cash register may not have the required amount. It is established by law (Articles 22 and 31) that 10 days are given to pay the money. During this time, the seller collects the required amount as a result of receipts from new clients or withdraws money from the current account.

Base

If the buyer, for objective reasons, wants to refuse a product or service, then the basis for issuing money and carrying out the operation will be his written statement.

If an employee of a retail outlet incorrectly entered the quantity of goods or the price and noticed the error before paying the visitor, then the adjustment is made immediately and a check is generated with the details “return of receipt” (the basis will be an explanatory note from the guilty employee).

1. Ask our specialist a question at the end of the article. 2. Get detailed advice and a full description of the nuances! 3. Or find a ready-made answer in the comments of our readers.

Documentation

To return money to the buyer, it is not enough to simply make an adjustment at the cash register. The seller collects the following package of documents:

- Application from the client (written in any form indicating the details: personal data of the client (full name, passport number and series, address), cost of the product, reason for the product being returned to the store, date of the transaction, signature of the buyer).

- The original fiscal document with the attribute “receipt” or a copy thereof.

- A document that confirms the buyer has returned the goods: invoice, act. Drawed up in two copies and signed by the client.

The application, check and primary accounting document are signed by the business owner or a responsible employee (for example, a manager).

If the cashier made a mistake, then the following documents are needed:

- Service note. Written by the guilty employee in any form. The note must indicate the number of the incorrect check and the fact that an adjustment and a new fiscal document have been generated.

- Initial check.

- Fiscal document confirming the issuance of money to the buyer.

You can attach a copy of a correctly formed check for the receipt of funds to the listed documents.

- Atol 91F

20 reviews

6 700 ₽

6700

https://online-kassa.ru/kupit/atol-91f/

OrderMore detailsIn stock

- PTK MSPos-K

101 reviews

13 900 ₽

13900

https://online-kassa.ru/kupit/ptk-mspos-k/

OrderMore detailsIn stock

- Evotor 7.2

156 reviews

16 700 ₽

16700

https://online-kassa.ru/kupit/evotor-7-2/

OrderMore detailsIn stock

Check

The fiscal document for issuing money upon return contains a number of mandatory details (the full list is specified in Article 4.7 No. 54-FZ), just like the check generated by the cash register during the initial sale of products:

- date and number;

- Name;

- name and TIN of the organization, business owner;

- device and storage data, etc.

An important point: in the adjustment, the calculation indicator “return of income” is entered, and not income or expense.

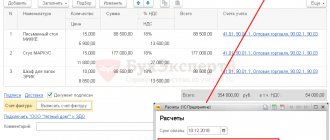

Sample check for advance payment: details

The photo above shows a classic check for an advance payment, which in terms of details is practically no different from a standard sales check.

The main difference is the indication instead of the product - ADVANCE. Attribute of the subject of payment (product, service, work - not indicated in the check).

Standard details that must be present on the check, regardless of the payment method:

- calculation sign;

- Seller's TIN;

- Name of the organization;

- place of settlement;

- amount (without and with VAT);

- form of payment (non-cash and cash), etc.

A complete list of details of fiscal documents, including in checks for advance payments, is specified in Appendix 2 of Order No. ММВ-7-20 dated March 21, 2017/ [email protected] >>

Will it be possible to issue a check for prepayment (advance payment) according to the old rules?

Article 7 of Law No. 290-FZ, which amended Law No. 54-FZ, provides for a gradual transition to online cash registers. Thus, on the basis of clause 3 of this article, entrepreneurs and organizations can use cash register equipment registered before January 31, 2021 (inclusive), in the manner that was in effect in Law No. 54-FZ until July 15, 2021. Moreover, the specified procedure can be used until June 30, 2021 (inclusive).

The old procedure for using cash register equipment:

- Applies only to cash payments and (or) using payment cards.

- The new edition of No. 54-FZ allows you to work.

- Allows the use of old cash registers that do not provide for the transmission of fiscal documents to the tax authorities online.

- Obliges to punch a cash receipt (if this obligation is provided for by the old version of Law No. 54-FZ) upon receipt of payment, including in the form of an advance payment (or advance payment).

- Allows the issuance of old-style cash receipts. In other words, such checks must have the following mandatory details (based on Decree of the Government of the Russian Federation No. 745 of July 30, 1993):

- name of the enterprise (or full name of the entrepreneur indicating his status) and his TIN;

- serial number of the cash register used in calculations;

- serial number of the check itself (it is assigned automatically);

- date and time of purchase (the time indicated on the cash register receipt should not deviate greatly from real time - that is, it should not exceed it by 5 minutes) (Letter of the Federal Tax Service of the Russian Federation dated July 10, 2013 No. AS-4-2/ [ email protected] );

- cost of the paid purchase;

- a sign of the fiscal regime - it is printed on the check with the indication “FP”, and next to or below the EKLZ number is indicated, without which the cash register according to the old version of Law No. 54-FZ cannot be used.

In addition, according to the old rules, a cash receipt must be printed on paper and issued regardless of the client’s desire to receive this document. Additionally, other details may be provided on the check itself. And this procedure will remain in effect until July 1, 2017.

Those. Until this moment, at least 2 types of checks will be valid:

- cash receipts that meet the requirements of the new edition of No. 54-FZ (its article 4.7);

- cash receipts that meet the requirements of the old edition No. 54-FZ (Resolution of the Government of the Russian Federation No. 745 of July 30, 1993, which was canceled as of November 17, 2021 and is not valid in relation to the new edition No. 54-FZ).

For ordinary citizens, having two types of checks is not a problem, including for the purpose of protecting their rights as consumers. But for organizations and entrepreneurs, the presence of 2 types of cash receipts may raise some doubts when accepting expenses if they paid them in cash and (or) using electronic means of payment.

Cases when an advance check is used and when it is not

To understand the peculiarities of issuing advance checks, we will describe two standard situations.

- A furniture store sold a table and four chairs to a customer with free delivery. Received money for the goods in the morning, delivery will be in the evening. What indicator of the calculation method should I set?

If it is clear what exactly the buyer pays for (a table and four chairs), then we are talking about an advance payment, not an advance payment. And in this situation, we are not talking about “full payment”, since the client pays before the furniture is handed over to him (delivery in the evening).

In general, there is only one option - prepayment.

- The furniture salon makes custom-made kitchens. The price of 100,000 rubles includes the kitchen furniture itself, plus delivery and installation. The buyer pays 50% at the time of signing the contract. The remaining 50% is after installation in the house. Is the first check for an advance payment or for an advance payment?

Since at the time of signing the contract you are not going to write down in the check what it is for (for the furniture itself or for the furniture and delivery), you need to punch out a check for the advance payment.

After installing the kitchen, you need to close it - punch a document on the cash register to offset the advance payment. The money that the buyer will pay after installation (50%) will be reflected at the checkout as a full payment.

Sales receipt or delivery note. Difference

Packing list:

- compiled only for sales to legal entities.

Sales receipt:

- can be issued to both legal entities and individuals.

Both documents decipher the name, quantity and cost of goods sold. The organization has the right to use form No. TORG-12 instead of a check - it contains all the details of the primary documentation.

Below are answers to the main questions about preparing a sales receipt.

Is a sales receipt a strict reporting form for an individual entrepreneur on UTII with a small store without employees?

- Yes, if it is filled out correctly. A sales receipt can be BSO if it contains all the necessary details, is issued in two copies, and has a non-repeating continuous numbering. You can issue it even if you are not using the cash register. A sample of how to properly issue a sales receipt without a cash receipt is here >>

How can an individual entrepreneur fill out a sales receipt without a stamp?

- The same way as filling out a stamped sales receipt. The rules are listed above. For an individual entrepreneur, it is not necessary to put a stamp, but it provides additional guarantees: for example, when returning a product, you can see where it was purchased.

Do I need a sales receipt if the name of the product is indicated in the cash register?

— If the cash register receipt contains a list of names of goods with prices and quantities, it is not necessary to write out a sales receipt - it contains all the necessary information.

Do I need to issue a sales receipt for services?

- Yes. It is issued upon the client's request. By the way, Government Resolution No. 55 states that the sales receipt, if necessary, indicates information about the shortcomings of the service provided.

Is it possible to use a sales receipt instead of a cash receipt under 54-FZ?

— Entrepreneurs who received a deferment for online cash registers can issue strict reporting forms instead of a check. BSOs are allowed to form independently. The document is required if you trade without a cash register.

Other questions regarding prepayment (advance payment) in a check

In what cases is it necessary to make one check for all advances?

Companies and individual entrepreneurs that accept a large number of advances may not be able to cope with the flow of cash advance receipts that they are required by law to issue. Imagine how much time it takes for the conductor to count all the advance checks at the end of the trip and issue a check for payment?

For some companies there are concessions - they can issue one general check for the advance payment for the billing period, in which all cash receipts for the advance payment can be combined. Unfortunately, the list does not include trade organizations.

It is allowed to generate one (final) check that covers the advance:

- organizers of cultural events;

- carriers of various types;

- companies providing communication services;

- organizations in the field of electronic services (from Article 174.2 of the Tax Code of the Russian Federation);

- management companies and utilities (housing and communal services);

- private security companies and organizations in the field of security systems;

- companies from the educational sector.

Organizations on this list have 10 days after the service is provided to generate a check for the advance payment.

What to put in the name of a product (service) if it is impossible to accurately determine the model (list of services)?

We recommend writing “advance payment” in the name of the product (service) on the cash register receipt. Similarly, indicate the attribute of the calculation method -.

In the receipt for the advance payment, write down the name of the product (service) specifically.

Buying a wardrobe in a furniture showroom. The package has been agreed upon, but at the buyer’s request, we will negotiate with the supplier for a discount on components. The price may be lower in the end. What payment indicator should be on the check - advance or prepayment?

Insure yourself against potential problems and indicate that you received an advance from the client. However, write in the contract that the client gives you money in advance and that the final cost may change.

Is it possible to cancel a knocked out advance check? The client changed his mind and took the money an hour after the check was generated. Didn't receive the goods.

You need to cancel an advance check (including an erroneous one) using a refund. It is necessary to punch the return check (a special command at the online cash register), and indicate in the payment attribute that this is a refund of the advance payment.

How to indicate the amount in a check for an advance payment if the company is paid by a foreign client (payment in dollars)?

According to 54-FZ, it is necessary to indicate the price of the goods in the receipt only in rubles, that is, at the time of payment you will have to convert dollars into rubles (the exchange rate of the Central Bank or the bank in which you hold an account).

You can indicate the cost of a product (service) in dollars only in the form of additional details (in a free field).

When receiving payment for a trip, a travel agency is required to draw up a document indicating which method of payment? Closing time of the advance check: on the day of departure or on the last day of the tourist’s vacation?

Since at the time of payment the tourist and the agent know what the trip will be like (tickets, hotel, etc.), it is necessary to issue a check for prepayment. We recommend not to select the “100% prepayment” option, but to make a regular prepayment, since before the trip the tourist’s ideas may change and the payment will increase. It is allowed to make several checks for prepayment (regular).

A general, single check with all prepayments offset should be issued on the last day of the tourist’s vacation.

Link to full version:

https://www.business.ru/article/2497-chek-na-avans-zachet-i-vozvrat-avansa-nyuansy-i-pravila

Is it necessary to run a cash register receipt if the client makes an advance payment (advance payment) for the goods?

First of all, Article 487 of the Civil Code of the Russian Federation provides for the possibility of making an advance payment under any purchase and sale agreement. Thus, an advance payment (or advance payment) can be made, including for the purposes of a retail purchase and sale agreement.

And for the implementation of such calculations, the new edition of No. 54-FZ does not provide for preferential exceptions in the event of an obligation to use cash registers.

In other words:

- on the basis of clause 1 of Article 1.2 of the new edition of No. 54-FZ, cash register equipment must be used throughout the entire territory of the Russian Federation. This requirement applies to any organizations and entrepreneurs, except in cases where No. 54-FZ itself provides for exceptions (in accordance with its Article 2);

- The obligation to use cash register systems applies only to cash payments and (or) payments using electronic means of payment. Moreover, the calculations themselves must be made only in the currency of the Russian Federation - in rubles. As for payments in foreign currency, based on Article 14 of the Federal Law of the Russian Federation No. 173-FZ of December 10, 2003. “On Currency Regulation and Currency Control”, currency transactions are carried out only in non-cash form, with some exceptions, which are also specified in Article 14 of the same law;

- the new edition of No. 54-FZ (Article 1.1) clarifies what kind of calculations cash register equipment should always be used for, in particular, for goods sold, work performed and services provided. Except for certain cases in which the use of CCT is not required;

- In addition, the new edition of No. 54-FZ clearly indicates the presence of exceptions for which the right not to apply CCP is provided - through Article 2 of the law. And this article does not mention the possibility of not punching a cash receipt in case of making an advance payment (advance payment).

Thus, you need to punch a cash receipt regardless of whether the payment is accepted as an advance (or prepayment) or is paid in full after the actual provision of the service, completion of the work, or upon receipt of the goods (Letter of the Federal Tax Service of the Russian Federation dated November 11, 2016 No. AS-4-20/ [email protected] ).

Subscribe to our channel in Yandex Zen - Online Cashier! Be the first to receive the hottest news and life hacks!

However, the question arises: what to do with a cash receipt? After all, with the transition to online cash registers from 2021, the content of this document changes significantly. And among its new details there is a “Calculation Attribute” (clause 1 of Article 4.7 of the new edition of Law No. 54-FZ). This detail indicates the status of the operation for the calculation being performed:

- “receipt” is the receipt of funds from the client;

- “return of receipt” is a return of funds previously received from the client;

- “expense” is the operation of issuing money to the client;

- “refund of expenses” is the receipt of funds from the client previously issued to him.

But what should be the “Settlement Sign” when receiving money from the buyer in the form of an advance payment or advance payment? The Federal Tax Service of the Russian Federation has an answer to this matter, which is not yet in Law No. 54-FZ itself!

1. Ask our specialist a question at the end of the article. 2. Get detailed advice and a full description of the nuances! 3. Or find a ready-made answer in the comments of our readers.