When is it not necessary to charge VAT?

If the costs of goods (services) transferred for one’s own needs can be taken into account as expenses that reduce taxable profit, VAT does not need to be charged.

There is also no need to charge VAT:

- when holding corporate events prepared by third parties;

- when transferring goods (work, services) listed in paragraphs 2 and 3 of Article 149 of the Tax Code of the Russian Federation.

In addition, VAT should not be charged when transferring goods (performing work, providing services) for one’s own needs:

- organizations applying special tax regimes. They are not VAT payers on all transactions, except for the importation of goods into Russia, transactions under joint activity agreements, trust management of property, as well as under concession agreements (clause 2 of article 346.11, clause 3 of article 346.1, paragraph 3 of clause. 4 Article 346.26 of the Tax Code of the Russian Federation);

- organizations that transfer goods (work, services) to structural units located in member states of the Customs Union (letter of the Ministry of Finance of Russia dated February 28, 2013 No. 03-07-08/5906).

Situation: is it necessary to charge VAT on the cost of transferred goods (work performed, services rendered) that were not taken into account when calculating income tax? According to the Tax Code, such expenses can reduce taxable profit

No no need.

The object of VAT taxation is transactions involving the transfer of goods (work, services) for one’s own needs, the costs of which are not taken into account when calculating income tax (subclause 2, clause 1, article 146 of the Tax Code of the Russian Federation). From this definition it follows that the obligation to charge VAT is directly related to the impossibility of including expenses for such operations as expenses that reduce taxable profit.

Taxable profit is reduced by any economically justified and documented expenses associated with activities aimed at generating income (clause 1 of Article 252 of the Tax Code of the Russian Federation). A closed list of expenses that are not taken into account when taxing profits is given in Article 270 of the Tax Code of the Russian Federation.

If expenses arising from the transfer of goods (work, services) for one’s own needs meet the criteria of Article 252 and are not specified in Article 270 of the Tax Code of the Russian Federation, then they should be included in the costs that reduce taxable profit. And this excludes the attribution of such expenses to the object of VAT taxation provided for in subparagraph 2 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation, even if the organization did not use the legal right to reduce taxable profit and incorrectly reflected expenses in tax accounting.

Thus, if an organization mistakenly did not include in expenses the cost of goods (work, services) transferred for its own needs, it is not obliged to charge VAT on this operation.

The validity of this approach is confirmed by the Presidium of the Supreme Arbitration Court of the Russian Federation in Resolution No. 75/12 dated June 19, 2012.

It should be noted that, in fact, the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 19, 2012 No. 75/12 is a precedent. It says that previously adopted judicial acts in similar cases can be revised on the basis of paragraph 5 of part 3 of Article 311 of the Arbitration Procedure Code of the Russian Federation (based on newly discovered circumstances).

Situation: is it necessary to charge VAT on the cost of defective products (irreparable defects) transferred to another structural unit of the organization for processing (use as industrial raw materials)?

No no need.

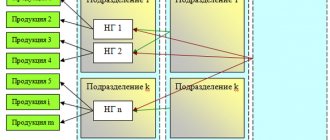

VAT on the transfer of goods (performance of work, provision of services) for one’s own needs must be accrued only if two conditions are simultaneously met:

- there was an actual transfer of goods (performance of work, provision of services) to the structural divisions of the organization, including service industries and farms or separate divisions (letter of the Ministry of Finance of Russia dated June 16, 2005 No. 03-04-11/132 and the Ministry of Taxes of Russia dated January 21 2003 No. 03-1-08/204/26-B088);

- costs for the acquisition of transferred goods (works, services) cannot be taken into account as expenses that reduce taxable profit.

If an organization uses its own products as raw materials, spare parts, components, semi-finished products and other material costs (for example, incorrigible internal defects), it can be taken into account as part of material costs (clauses 1 and 4 of Article 254 of the Tax Code of the Russian Federation). Therefore, it is not necessary to charge VAT in accordance with subparagraph 2 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation in this case.

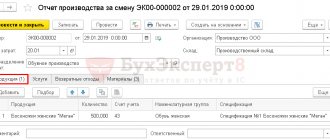

An example of calculating and reflecting VAT in accounting when identifying defective products. Some of the products are transferred for processing to another structural unit, some are used for the organization’s own needs

LLC "Proizvodstvennaya" (woodworking plant) sells its own products - furniture and interior doors.

Specialists from the technical control department (QCD) discovered that some of the finished products (20 door panels) were irreparably damaged due to equipment failure. This finished product was found to be an irreparable internal defect. There are no culprits for the marriage.

By decision of the production director in the first quarter, the rejected finished products were transferred to:

- 18 door panels – to the auxiliary production workshop for processing as materials for the manufacture of chipboards;

- 2 door leaves – to a kindergarten, which is on the balance sheet of “Master”. Parents who are employees of the woodworking plant are not charged for keeping children in kindergarten.

The cost per unit of finished product (interior door) is 6,000 rubles.

In the fourth quarter of last year, the selling price (excluding VAT) of one door leaf sold externally by the plant was 10,000 rubles/piece.

The plant's accountant did not charge VAT on the cost of the door panels transferred to the auxiliary production workshop for processing, since the material costs of auxiliary production reduce the income tax base (clause 1 of Article 254 of the Tax Code of the Russian Federation).

The costs of maintaining a kindergarten do not reduce the income tax base, since they are not related to activities aimed at generating income (clause 1 of Article 252 of the Tax Code of the Russian Federation). Therefore, Master’s accountant charged VAT on the cost of the finished products donated to the kindergarten.

The organization's accountant determined the VAT tax base for the transfer of finished products for its own needs, based on the selling prices of the same batches of door panels sold externally by the plant in the previous quarter.

On the transaction of transferring finished products for own needs, VAT was charged in the amount of 3,600 rubles. (RUB 10,000/piece × 2 pieces × 18%).

In the first quarter, the plant’s accountant made the following entries:

Debit 28 subaccount “Irreparable marriage” Credit 20 – 120,000 rub. (RUB 6,000/piece × 20 pieces) – the cost of defective finished products is written off;

Debit 10 Credit 28 subaccount “Irreparable marriage” – 120,000 rubles. – defective finished products were credited to the warehouse;

Debit 23 Credit 10 – 108,000 rub. (6000 rub./piece × 18 pieces) – rejected products were transferred to the workshop for processing;

Debit 29 Credit 10 – 12,000 rub. (6000 rub./piece × 2 pieces) – rejected products were transferred to the kindergarten, which is on the balance sheet of the plant;

Debit 91-2 Credit 68 subaccount “VAT calculations” – 3600 rubles. – VAT payable to the budget has been accrued.

Situation: is it necessary to charge VAT on the cost of materials written off as a result of damage?

No no need.

VAT on the transfer of goods (performance of work, provision of services) for one’s own needs must be accrued only if two conditions are simultaneously met:

- there was an actual transfer of goods (performance of work, provision of services) to the structural divisions of the organization, including service industries and farms or separate divisions (letter of the Ministry of Finance of Russia dated June 16, 2005 No. 03-04-11/132 and the Ministry of Taxes of Russia dated January 21 2003 No. 03-1-08/204/26-B088);

- costs for the acquisition of transferred goods (works, services) cannot be taken into account as expenses that reduce taxable profit.

When materials are written off due to their damage, the transfer of material assets to structural units, as a rule, does not occur. Therefore, there is no need to charge VAT.

If the organization transfers part of the damaged materials to a structural unit for its own needs, then VAT will need to be charged only on the cost of damaged materials that are not included in tax expenses.

This procedure follows from subparagraph 2 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation.

An example of calculating and reflecting VAT in accounting when damage to materials is detected. Some of the damaged materials are written off due to unsuitability, and some are used for the organization’s own needs.

During the inventory, Alpha LLC discovered that some of the paint and varnish materials stored in the warehouse were damaged due to long-term storage. The materials were purchased from a supplier using simplified materials. The actual cost of damaged paints and varnishes is 12,000 rubles.

Completely damaged paints and varnishes worth RUB 10,000. were destroyed. The rest of the materials (worth 2,000 rubles) were used to prepare the heating system of the kindergarten, which is on the balance sheet of Alpha, for conservation for the summer. Children of Alpha employees attend kindergarten for free.

The costs of maintaining a kindergarten do not reduce the income tax base, since they are not related to activities aimed at generating income (clause 1 of Article 252 of the Tax Code of the Russian Federation). Therefore, Alpha’s accountant charged VAT on the cost of damaged materials donated to the kindergarten.

Alpha did not have operations for the sale of identical (homogeneous) goods. The market value of the paints and varnishes used was 2,500 rubles.

Alpha's accountant made the following entries in accounting:

Debit 94 Credit 10 – 10,000 rub. – the cost of damaged paints and varnishes is written off;

Debit 29 Credit 10 – 2000 rub. – the cost of paint and varnish materials transferred to the kindergarten was written off;

Debit 91-2 Credit 68 subaccount “VAT calculations” – 450 rubles. (RUB 2,500 × 18%) – VAT payable to the budget is calculated based on the market value of the transferred materials;

Debit 91-2 Credit 29 – 2000 rub. – the cost of used paints and varnishes is included in other expenses.

Situation: is it necessary to charge VAT on the cost of a furniture set purchased for resale, but transferred to the office for its own needs? The cost of the headset is more than 100,000 rubles.

No no need.

Pieces of furniture (from 2021 - costing more than 100,000 rubles per unit) used by an organization in its own office for management needs are recognized as fixed assets that are used in activities aimed at generating income (clause 1 of Article 257 of the Tax Code of the Russian Federation). For profit tax purposes, such objects are included in depreciable property (Clause 1, Article 256 of the Tax Code of the Russian Federation). The organization takes their cost into account by calculating depreciation (subclause 3, clause 2, article 253 of the Tax Code of the Russian Federation). Consequently, there are no grounds for charging VAT in accordance with subparagraph 2 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation (when transferring for one’s own needs).

Situation: is it necessary to charge VAT on the cost of property (household appliances, etc.) purchased for joint use by employees and visitors of the organization? The cost of property is not taken into account in expenses that reduce taxable income

No no need.

Sharing (consumption) by employees and visitors of an organization of property acquired by it can be classified as:

- or as a sale (free transfer) of goods (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation);

- or as the transfer of goods for the organization’s own needs (subclause 2, clause 1, article 146 of the Tax Code of the Russian Federation).

The object of VAT taxation is the sale or gratuitous transfer of goods, during which their owner changes (subclause 1, clause 1, article 146, clause 1, article 39 of the Tax Code of the Russian Federation). From letters of the Ministry of Finance of Russia dated December 13, 2012 No. 03-07-07/133 and dated May 12, 2010 No. 03-03-06/1/327 it follows that with a gratuitous transfer, the object of VAT taxation arises only if the ownership the acquired property is transferred to specific persons. If the property is acquired for the needs of the organization, the ownership of this property is not transferred to specific individuals, and the nature of its use is not related to production and sale, there is no need to charge VAT on the cost of the property.

As for the transfer of goods for one’s own needs, the obligation to charge VAT when transferring goods (performing work, providing services) for one’s own needs can arise only if two conditions are simultaneously met:

- there was an actual transfer of goods (work, services) to the structural divisions of the organization, including service industries and farms or separate divisions (letter of the Ministry of Finance of Russia dated June 16, 2005 No. 03-04-11/132 and the Ministry of Taxes of Russia dated January 21, 2003 No. 03-1-08/204/26-B088);

- costs for the acquisition of transferred goods (works, services) cannot be taken into account as expenses that reduce taxable profit.

In arbitration practice there are examples of court decisions confirming the legality of this approach (see, for example, decisions of the FAS Volga-Vyatka District dated July 16, 2010 No. A29-8359/2009, Moscow District dated April 6, 2009 No. KA-A40/ 2402-09).

In the situation under consideration, the acquired property is not transferred to structural units - it goes into joint impersonal use (consumption) by employees and visitors of the organization, that is, by an indefinite circle of persons. Since the first of the mandatory conditions is not met, the organization has no grounds for charging VAT in accordance with subparagraph 2 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation. Despite the fact that the value of this property does not reduce taxable income.

Considering that the acquired property is not used in transactions subject to VAT, in the situation under consideration the organization has no grounds for deducting “input” VAT on this property (letter of the Ministry of Finance of Russia dated December 13, 2012 No. 03-07-07/133) .

Situation: is it necessary to charge VAT on the cost of finished products transferred to the sales department of a manufacturing organization for the design of a sample room?

No no need.

Expenses for participation in exhibitions, fairs, expositions, for the design of shop windows, sales exhibitions, sample rooms and showrooms are classified as advertising expenses and are included in other expenses associated with production and (or) sales in full (clause 4 Article 264 of the Tax Code of the Russian Federation). Thus, if the finished product is transferred for the design of a sample room, if all necessary conditions are met, its value can be taken into account when taxing profits. Consequently, there are no grounds for charging VAT in accordance with subparagraph 2 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation (when transferring for one’s own needs).

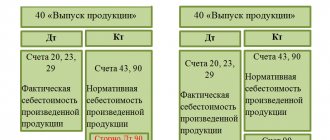

Write-off of raw materials for production: procedure and rules

There is a special standard devoted to the nuances of working with inventories, and every accountant must be guided by its instructions in his work. Before wondering how to write off raw materials for production in 1C, refer to the document.

You shouldn’t reinvent the wheel, but refer to the standard, where you will read about existing methods for writing off raw materials:

- FIFO, that is, first in terms of purchase;

- Average price;

- Cost of an individual unit.

Tax accounting also contains information about the above write-off options. Don’t forget to choose the option that works for both accounting options, and write down your choice in the accounting policy. Don't complicate your life and stick to the common option for two types of accounting. The method based on the average price of raw materials has become widespread. Separate material assessment is not suitable for every business and is applicable where each raw material is unique and different from each other.

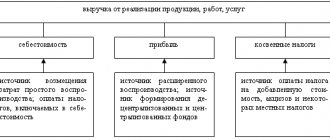

Determination of the tax base

The rules for determining the tax base when transferring goods (work, services) for one’s own needs are established in paragraph 1 of Article 159 of the Tax Code of the Russian Federation. In this case, two options are possible:

- in the previous quarter, the organization sold identical (or, in their absence, homogeneous) material assets (similar work, services);

- in the previous quarter, the organization did not sell identical and homogeneous material assets (similar work, services).

If in the previous quarter the organization sold identical (homogeneous) material assets (similar work, services), then VAT must be calculated based on their price (clause 1 of Article 159 of the Tax Code of the Russian Federation).

An example of calculating and reflecting VAT in accounting when transferring goods for one’s own needs. In the previous quarter, the organization sold identical material assets

Alpha LLC (confectionery factory) sells both its own products (confectionery) and purchased goods (food). Goods are accounted for at purchase prices.

In the second quarter, for a corporate holiday - the anniversary of the organization - the following were transferred to the factory canteen:

- from the finished product warehouse - a batch of confectionery products with a cost of 6,000 rubles, subject to VAT at a rate of 18 percent;

- from a warehouse of purchased goods - a batch of food products (pasta, cereals, vegetable oil) with a cost of 2,000 rubles, subject to VAT at a rate of 10 percent (subclause 1, clause 2, article 164 of the Tax Code of the Russian Federation).

In the first quarter, the selling price (excluding VAT) of the same batches of confectionery and food products sold externally by the factory was:

- for confectionery products – 15,000 rubles;

- for food – 3000 rub.

The organization's accountant determined the VAT tax base for the transfer of finished products and goods for their own needs, based on the selling prices of the same batches of confectionery and food products sold by the factory externally in the previous quarter.

On transactions of transfer of finished products and goods for own needs, VAT was charged in the amount of 3,000 rubles, including:

- for confectionery products – 2700 rubles. (RUB 15,000 × 18%);

- for food – 300 rub. (RUB 3,000 × 10%).

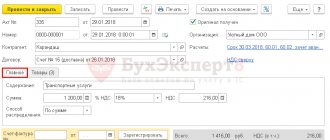

In the second quarter, the factory accountant made the following accounting entries:

Debit 29 Credit 43 – 6000 rub. – a batch of own-produced products was transferred to the canteen;

Debit 29 Credit 41 – 2000 rub. – a batch of purchased goods was transferred to the canteen;

Debit 91-2 Credit 68 subaccount “VAT calculations” – 3000 rubles. – VAT payable to the budget has been accrued;

Debit 91-2 Credit 29 – 8000 rub. (6,000 rubles + 2,000 rubles) – the cost of food and confectionery products used for own needs is taken into account as part of other expenses.

If in the previous quarter the organization did not sell identical (homogeneous) material assets (similar work, services), then VAT must be calculated based on the market prices of such goods (work, services) without including tax (clause 1 of Article 159 of the Tax Code of the Russian Federation) .

An example of calculating and reflecting VAT in accounting when transferring goods for one’s own needs. In the previous quarter, the organization did not sell identical (homogeneous) material assets

Alpha LLC (confectionery factory) sells both its own products (confectionery) and purchased goods (food). Goods are accounted for at purchase prices.

In the second quarter, for a corporate holiday - the anniversary of the confectionery factory - the following were handed over to the factory canteen:

- from the finished product warehouse - a batch of confectionery products with a cost of 6,000 rubles, subject to VAT at a rate of 18 percent;

- from a warehouse of purchased goods - a batch of food products (pasta, cereals, vegetable oil) with a cost of 2,000 rubles, subject to VAT at a rate of 10 percent (subclause 1, clause 2, article 164 of the Tax Code of the Russian Federation).

In the first quarter, the factory did not sell identical (homogeneous) confectionery products and food products. According to the financial service of the factory in the first quarter, the market value (excluding VAT) of the same batches of identical confectionery and food products sold by other manufacturers was:

- confectionery products – 15,000 rubles;

- food – 3000 rub.

Alpha's accountant determined the tax base for VAT when transferring finished products and goods for their own needs, based on market prices.

The total amount of VAT payable to the budget for this operation will be 3,000 rubles, including:

- for confectionery products – 2700 rubles. (RUB 15,000 × 18%);

- for food – 300 rub. (RUB 3,000 × 10%).

In the second quarter, the factory accountant made the following accounting entries:

Debit 29 Credit 43 – 6000 rub. – a batch of own-produced products was transferred to the canteen;

Debit 29 Credit 41 – 2000 rub. – a batch of food products was transferred to the canteen;

Debit 91-2 Credit 68 subaccount “VAT calculations” – 3000 rubles. – VAT payable to the budget has been accrued;

Debit 91-2 Credit 29 – 8000 rub. (6,000 rubles + 2,000 rubles) – the cost of food and confectionery products used for own needs is taken into account as part of other expenses.

Options for using raw materials

Any materials at the disposal of the company, it has the right to direct to the purposes necessary for the business and use it at its own discretion. The main thing is to write them off correctly in accordance with the accounting norms and rules of internal accounting policies. Thus, I offer an incomplete list of how a company has the right to dispose of its property;

- Packaging of finished goods;

- Interrogator in the manufacture of goods;

- The basis of the manufactured product;

- Construction and construction of new fixed assets;

- Use of fixed assets in the process of disposal of liquidated objects;

- Application for management procedures by the company's management;

What this or that material was used for influences what accounting records the machine will make as a result.