What is account 20 “Main production” intended for?

To summarize the amounts of company expenses that are associated with the main activity, the 20th account (“Main production”) is used in accounting.

This refers to the costs incurred by the organization in the production process, when selling services or carrying out work. In the future, we will use the abbreviation TRU to designate goods, works and services. In accordance with the accounting rules, the debit of the 20th account collects direct costs incurred by the enterprise in the production of products, losses resulting from defects, expenses of auxiliary and service production. To the credit of this account, the cost of goods and services is written off.

For a list of costs that form the cost of production, see the tax guide from ConsultantPlus. Study the material by getting trial access to the K+ system for free.

A description of the 20th account, as well as an example of accounting for the expenses of an organization carrying out work for a customer, can be found in the material “Account 20 in accounting (nuances)”.

Let's consider the process of writing off the 20th account under various circumstances.

Understanding indirect costs

In accounting

Expenses are recognized in the reporting period in which they arose, regardless of the intention to receive revenue or other income (Clause 17, 18 PBU 10/99 “Expenses of the organization”).

Note Many accountants doubt the correctness of writing off expenses from account 26 to account 90 in a situation where there is no revenue. After all, expenses must be written off to the debit of account 90 simultaneously with the recognition of revenue on the credit of this account. Therefore, sometimes they use another option - they write off expenses as a debit to account 91 “Other income and expenses.” There is no mistake in this, but note that administrative expenses are expenses for ordinary activities, not other expenses, and the fact that the organization does not yet receive revenue does not change their qualification. The option you choose must be stated in the accounting policy (Clause 7 of PBU 1/2008).

By not reflecting expenses in accounting in a timely manner, you risk that your company will be held accountable for a gross violation of the rules for keeping records of income and expenses (Article 120 of the Tax Code of the Russian Federation; Article 15.11 of the Code of Administrative Offenses of the Russian Federation). Previously, many experts, and even the tax authorities themselves, in oral recommendations advised collecting expenses in the absence of income in account 97 “Future expenses” and writing them off to the financial result as revenue is received. Many accountants did this, writing it down in their accounting policies. Accordingly, in the period when there was no income, expenses were not taken into account and losses were not generated.

For reference For gross violation of the rules for keeping records of income and expenses, your organization may be fined (Article 120 of the Tax Code of the Russian Federation): (if) the violation was committed during one tax period - 10 thousand rubles; (if) the violation was committed during several tax periods - by 30 thousand rubles; (if) the violation led to an understatement of the tax base - by 20% of the amount of unpaid tax, but not less than 40 thousand rubles. In addition, for gross violation of accounting and reporting rules, your manager may be fined in the amount of 2 thousand to 3 thousand rubles. (Article 15.11 of the Code of Administrative Offenses of the Russian Federation).

But using account 97 to disguise losses is wrong. After all, by reflecting expenses on it, you violate the requirement for timely reflection of facts of economic activity and create a hidden reserve, which contradicts the requirement of prudence (Clause 6 of PBU 1/2008). This leads to distortion of financial statements (in this situation it looks like break-even) and misleads users. In the same year, due to changes made to the Accounting Regulations, in the situation considered, account 97 cannot be used at all.

In tax accounting

In tax accounting, indirect expenses are included in the expenses of the current period in full (Clause 2 of Article 318 of the Tax Code of the Russian Federation; Letter of the Ministry of Finance of Russia dated July 28, 2009 N 03-03-06/1/495). As a result, in the absence of income, a loss will be formed - a negative difference between income and expenses. The loss is reflected in the income tax return and carried forward to the future. The Ministry of Finance also agrees with this (Paragraph 2 of the Letter of the Ministry of Finance of Russia dated 08/25/2010 N 03-03-06/1/565; Letters of the Ministry of Finance of Russia dated 05/21/2010 N 03-03-06/1/341, dated 04/21/2010 N 03 -03-06/1/279, dated July 17, 2008 N 03-03-06/1/414). However, tax authorities often remove expenses when there is no income, but the courts do not support them. They believe that what matters is not the result of the activity - profit or loss, but the focus of the activity on generating income (Clause 9 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 N 53; clause 3 of the Definition of the Constitutional Court of the Russian Federation dated June 4, 2007 N 320-O-P ). If you do not reflect your expenses in tax accounting, there will be no claims against you. However, keep in mind that including these expenses in the declaration of another period will be quite problematic. When checking, they may be removed due to the fact that they do not relate to the current period (Clause 1, Article 54, Article 272 of the Tax Code of the Russian Federation). The Ministry of Finance has repeatedly stated that expenses not included in the “unprofitable” declaration cannot be taken into account as current expenses in the following periods (Letters of the Ministry of Finance of Russia dated 05/07/2010 N 03-02-07/1-225, dated 04/23/2010 N 03 -02-07/1-188). Therefore, if the tax authorities deduct expenses for you that you did not reflect earlier, you can only take them into account by submitting clarifications for the periods to which they relate, and then you will still have to show the losses.

Advice If the loss is small, it may actually make sense to file a break-even return to save yourself the hassle. And accounting should be done correctly. But if the amounts of loss are significant, then it is better to declare them so that you can then take them into account in the future.

Writing off costs from account 20 during production

In order to write off manufacturing expenses, the taxpayer must first select the method by which finished goods (FP) will be accounted for. The chosen method should then be approved in the text of the accounting policy (AP). Let us describe the possible methods from which an enterprise can choose.

In accordance with PBU 5/01 “Accounting for inventories”, approved. By order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n, finished products are classified as that part of the inventory that is intended for sale.

IMPORTANT! From 2021, PBU 5/01 will no longer be in force. It was replaced by FSBU 5/2019 “Reserves”.

ConsultantPlus experts explained what will change in inventory accounting when applying FAS 5/2019. Get free demo access to K+ and go to the Ready Solution to find out all the details of the innovations.

What are the main provisions of PBU 5/01, the procedure for assessing inventories and what the regulations for maintaining records on inventories look like can be found out from the material “PBU 5/01 - accounting for inventories”.

In the Guidelines for accounting of inventories, approved. By order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, it is recommended to use 1 of the following methods for assessing GP:

- Based on the actual cost (actual).

- Planned cost, that is, formed on the basis of standards.

- Negotiable price.

Here there are clarifications under what circumstances it is worth using one or another method. Thus, the first method is recommended to be used if we are talking about the production of goods in small batches, the second - with large batch production, the third - with stable, unchangeable prices. It is clear that constant prices for market relations are impossible. For this reason, the third method has currently lost its relevance and is not used.

Accounting and taxation of expenses in the absence of income

There are quite a lot of situations when a business entity generates expenses, but for one reason or another does not receive income. There can be many reasons for this: crisis phenomena in the economy, high competition, a conscious strategy for entering the market, the development of a new direction in business, etc. Despite the existence of objective prerequisites for such phenomena, the situations under consideration are perceived quite negatively by the tax authorities, who most often take an inflexible position, being suspicious of such expenses and refusing to accept them for tax accounting. What is the best way to take these costs into account, what motivations are preferable to use in discussions with inspectors, and what do courts pay attention to?

Let's start with the main postulate, which was suffered through various legal battles and which is now recognized by the fiscal authorities themselves. The ability to recognize expenses does not depend on the availability of income in the same period . The Tax Code does not contain such provisions. The main condition for the recognition of such expenses is their compliance with the norms of Chapter. 25 “Profit Tax” of the Tax Code of the Russian Federation - economic justification and focus of the taxpayer’s activities on making a profit .

Initially, the Constitutional Court of the Russian Federation, in Resolution No. 3-P dated February 24, 2004, indicated that judicial control is not intended to check the economic feasibility of decisions made by business entities, which in the business sphere have independence and wide discretion, since due to the risky nature of the activity there are objective limits on the ability of courts to identify the presence of business miscalculations.

Then the Plenum of the Supreme Arbitration Court of the Russian Federation, in Resolution No. 53 dated October 12, 2006, “On the assessment by arbitration courts of the validity of a taxpayer receiving a tax benefit,” came to the conclusion that the validity of expenses taken into account when calculating the tax base should be assessed taking into account the circumstances indicating the taxpayer’s intentions to obtain an economic benefit as a result of real business or other economic activity. In this case, we are talking specifically about the intentions and goals (direction) of this activity, and not about its result. At the same time, the validity of obtaining a tax benefit cannot be made dependent on the efficiency of capital use. The taxpayer carries out its activities independently at its own risk and has the right to independently and solely assess its effectiveness and expediency.

And finally, generalizing the above norms, the Constitutional Court of the Russian Federation in its Determination dated 06/04/2007 N 320-O-P formulated the following conclusion. The norms contained in paragraph. 2 and 3 clauses 1 art. 252 of the Tax Code of the Russian Federation, require the establishment of an objective connection between the expenses incurred by the taxpayer and the focus of his activities on making a profit, and the burden of proving the unfoundedness of the taxpayer’s expenses rests with the tax authorities. Thus, any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income.

Currently, representatives of the financial department take the same position. For example, Letter of the Ministry of Finance of Russia dated April 21, 2010 N 03-03-06/1/279 recognizes the taxpayer’s right to recognize expenses (including wages, rental payments, etc.) that have been incurred since its state registration, even if he is not yet making a profit. Moreover, this opinion, which has changed compared to 2006, when letters with opposite conclusions were issued, has not changed since 2008. A similar conclusion was made in the Letter of the Ministry of Finance of Russia dated July 17, 2008 N 03-03-06/1/414, etc. Tax authorities do not object to this approach (see Letter of the Federal Tax Service of Russia for Moscow dated July 3, 2007 N 20 -12/062179).

Example 1. Columbus LLC was registered on June 15 of the current year. From the moment of registration, the company incurred expenses for the payment of wages and deductions from them, rent payments, communication and advertising expenses (standardized and non-standardized), etc. But due to strong competition (potential consumers had not yet learned about the opening of a new organization), the organization was unable to generate income in the reporting period.

The expenses incurred will be accepted in tax accounting when calculating income tax for the first half of the current year as economically justified and related to the production process. However, tax accounting will not accept standardized advertising expenses, since they are taken into account as a percentage of revenue received, which the company does not have.

The simplified taxation system is no exception. Thus, the Letter of the Ministry of Finance of Russia dated January 23, 2009 N 03-11-06/2/5 states that expenses (within the list of costs provided for in paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation) incurred by the newly formed organization must be taken into account in tax period for their payment. If the company has not started business activities in this period, the expenses incurred form the amount of losses for the tax period, the accounting of which can be carried out in subsequent tax periods in the manner established by clause 7 of Art. 346.18 Tax Code of the Russian Federation.

In what order can the expenses under consideration be accepted when calculating the taxable base for income tax? The answer to this question can be found, in particular, in Letter of the Ministry of Finance of Russia dated July 17, 2008 N 03-03-06/1/414, etc. Accounting for these expenses will depend on what expenses (direct or indirect) these will relate to amounts. So, in accordance with Art. 318 of the Tax Code of the Russian Federation, for the purpose of taxing the profits of organizations, the amount of indirect expenses for production and sales incurred in the reporting (tax) period is fully included in the expenses of the current reporting (tax) period.

Direct expenses refer to the expenses of the current reporting (tax) period as products, works, and services are sold in the cost of which they are taken into account. In this case, taxpayers providing services have the right to attribute the amount of direct expenses incurred in the reporting (tax) period in full to the reduction of income from production and sales of this reporting (tax) period without distribution to the balances of work in progress.

Thus, indirect expenses incurred by the organization due to the lack of income from production and sales in the current reporting period will ultimately represent losses for profit tax purposes in accordance with the procedure provided for in Art. 283 Tax Code of the Russian Federation .

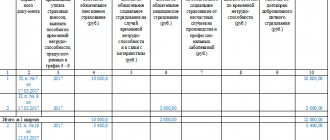

Example 2. in the reporting period incurred the following expenses aimed at generating income:

— purchased and released into production materials in the amount of 313,000 rubles;

— calculated salaries and made corresponding deductions in the amount of 108,102 rubles;

— accrued rental payments in the amount of 17,000 rubles.

In accordance with the accepted accounting policy of the organization, materials are classified as direct expenses, and all other expenses are indirect. Thus, in the reporting period, the enterprise will have indirect expenses in the amount of 125,102 rubles, which will be reflected in the income tax return and will form a loss for the enterprise, and the amount of costs in the amount of 313,000 rubles, representing direct expenses, will be taken into account when calculating the tax base in subsequent periods as products, works, and services are sold, in the cost of which they are taken into account.

The described procedure will change if we are talking about the cash method of determining income or in relation to a “simplified” taxpayer. In such a situation, only paid expenses will be accepted.

Write-off of costs at actual cost

Having organized the accounting of GPs at actual cost, the accountant in charge of production must make the following entry: Dt 43 Kt 20.

The essence of this entry is that the cost price is written off directly and in the actual amount generated from the account that records expenses to the account in which GP records are kept.

Despite the simplicity and attractiveness of this method, there are limitations in its use. The point is that the actual cost can only be calculated at the end of the reporting period. In circumstances where products are shipped continuously, it is better to take the planned cost as a basis.

There are 2 options for organizing accounting: write off expenses using account 40 ( “ Release of finished products”), or do without it.

There are expenses, but no revenue: what should an accountant do?

It often happens that an organization is created*, carries out some expenses (calculation of wages, servicing bank accounts, etc.), but for a certain time, for various reasons, has no income from sales of products, works and services.

There is no direct answer to the question of how to take such expenses into account in accounting. In the proposed article by V.V. Patrov, Doctor of Economics, Prof. St. Petersburg State University, expresses its point of view on this issue.

Note:

* According to paragraph 2 of Article 51 of the Civil Code of the Russian Federation legal.

a person is considered created from the moment of its state registration, i.e. entry into the Unified State Register of Legal Entities (author's note).

Accounting for expenses will mainly depend on what the organization does (production, performance of work, provision of services, trade, etc.).

Accounting for costs associated with production of products

Let's consider the cost accounting methodology using the example of an ordinary product manufacturing enterprise that does not have auxiliary and service industries.

All costs associated with production are divided into two types: direct and indirect.

Direct expenses are those that can be immediately attributed to some type of product* (salary of a worker engaged in the production of one type of product; consumption of materials for a specific type of product, etc.).

Note:

* Cost accounting separately for each type of product is necessary for cost calculation, i.e. calculating costs per unit of production.

Indirect expenses are those that cannot be immediately attributed to any type of product (chief accountant’s salary, telephone subscription fee, office expenses, etc.).

Direct expenses during the month are immediately written down to the debit of account 20 “Main production” (to the corresponding analytical accounts by type of product) with crediting to accounts for materials accounting, settlements with personnel for wages, etc.

Indirect costs are divided into two groups:

- Maintenance of main production.

- For management needs not directly related to the production process.

Indirect expenses of the first group during the month are reflected in the debit of account 25 “General production expenses”, and of the second group - in the debit of account 26 “General business expenses”. At the same time, accounts for accounting for materials, settlements with personnel for wages, etc. are also credited.

At the end of the month, indirect costs collected on account 25 are distributed between types of products produced in proportion to some base (the sum of direct costs, wages of production workers, equipment operating time, etc.). The distribution base is determined by the organization itself and is recorded in the accounting policy order.

After distribution to the total amount of expenses collected on account 25, an entry is made:

Debit 20 (analytical accounts by type of product) Credit 25

Indirect expenses collected in account 26 are also completely written off from this account at the end of the month. However, unlike expenses of the first group, they can be written off in two ways.

The first method (traditional) is similar to writing off expenses recorded on account 25 (the distribution base is also selected), account 20 is debited (analytical accounts by type of product) and account 26 is credited.

The second method is based on the premise that general business expenses do not have a direct connection with the production process, are conditionally constant, and, as a result, are reflected in full on the financial results of the reporting period. In other words, they are written off without any distribution by type of product by posting:

Debit 90 “Sales” Credit 26 “General expenses”

The method of writing off general business expenses is chosen by the organization itself and is recorded in its accounting policies.

The result of the work of most manufacturing enterprises is the production of finished products, which are delivered to the warehouse. This records the following:

Debit 43 “Finished products” or 40 “Release of products (works, services)”* Credit 20 “Main production”

Note:

* The use of accounts 43 or 40 is determined by the accounting policy of the organization

After this entry, the balance of account 20 represents the amount of costs related to products that have not gone through all stages of the production cycle (work in progress).

As soon as the finished product (or part of the product) is sold, the expenses related to this product are written off by posting:

Debit 90/2 “Cost of sales” Credit 43 “Finished products”

Before sales begin (before revenue appears), the organization's expenses are listed in accounts 20 (related to work in progress) and 43 (related to products released but not sold, stored in the warehouse).

When compiling the balance sheet, the balance of these accounts is reflected respectively in the articles “Costs in work in progress” (indicator code 213) and “Finished products and goods for resale” (indicator code 214).

Based on the foregoing, in the absence of revenue from the sale of products (goods, works, services), the section “Income and expenses from ordinary activities” of the profit and loss statement is not filled out.

If, according to the accounting policy, general business expenses collected on account 26 are written off to the debit of account 90, this write-off is not carried out until the organization has revenue.

Some experts believe that choosing in the accounting policy the option of writing off expenses from account 26 to the debit of account 90 means recognizing these expenses as conditionally fixed. Conditionally fixed expenses are expenses that should reduce the financial result of the reporting period in which they were incurred.

The presence of these expenses is in no way related to the volume of production and/or the fact of its sale. It follows from this that, in accordance with the assumption of temporary certainty of the facts of economic activity (clause

6 PBU 1/98) if there is no revenue from the sale of products in a specific period, the amounts of such expenses reflected in account 26 should be written off as a decrease in the profit of the current reporting period by recording:

Debit account 91 “Other income and expenses” subaccount 2 “Other expenses” Credit account 26 “General business expenses”

From account 91-2, the amount of these expenses is written off to account 99 “Profits and losses”. As a result, the amount of these expenses will be shown in the balance sheet and in the income statement as a loss on operating activities.

We believe that the amount of such a loss should be determined taking into account all income and expenses from ordinary activities, and not just semi-fixed expenses. Nevertheless, the above point of view has a right to exist, and each organization must choose its own option for writing off general business expenses, enshrining it in its accounting policy.

In our opinion, when drawing up a balance sheet, the amount of these general business expenses, recorded on account 26, is added (without posting) to the balance of account 20 and shown under the item “Costs in work in progress.”

When revenue is subsequently received, these expenses, depending on the accounting policy, are written off to the debit of account 90 either immediately in full or in parts over several reporting periods (in proportion to the volume of products sold in the total volume of its output at the time the revenue begins to be received).

Cost accounting when performing work, providing services, trading activities

Account 20 “Main production” is also used to account for expenses associated not only with the production of products, but also with the performance of work and the provision of services.

At the same time, in accordance with the Instructions for the use of the Chart of Accounts, “Organizations whose activities are not related to the production process (commission agents, agents, brokers, dealers, etc., except for organizations engaged in trading activities), use account 26 “General business expenses” for generalization of information on the costs of conducting this activity.”

To account for expenses associated with trading activities, organizations use account 44 “Sales expenses”. In these cases, in the absence of revenue, the balance of accounts 26 and 44 should, in our opinion, be reflected in the balance sheet under the item “Other inventories and costs” (indicator code 217).

In these organizations, accounting for expenses on accounts 20 and 26 is similar to the accounting procedure in organizations engaged in production, given above.

Cost accounting of auxiliary and service production

Some organizations, in addition to their main production, have auxiliary production (repair of fixed assets, production of various types of energy, transport services, etc.) and/or service industries and facilities (housing and communal services, catering establishments, preschool institutions, holiday homes, etc. .).

In these industries and farms, the functions of account 20 “Main production” are performed by accounts 23 “Auxiliary production” and 29 “Service production and farms”, respectively.

The costs recorded in the debit of these accounts are subsequently written off to the accounts for accounting for the costs of those divisions of the organization that consume the services of the above-mentioned industries and farms (20, 25, 26, etc.), as well as to the accounts for accounting for inventories and finished products produced auxiliary industries, as well as service industries and farms (10, 43, etc.).

The balances of accounts 23 and 29 show the balances of unfinished auxiliary and servicing production, respectively.

Other income and expenses

Even in the absence of revenue from the sale of products (goods, works and services), organizations may have other income and expenses in the form of other income and other expenses.

Other income includes operating, non-operating and extraordinary income. Other expenses include operating, non-operating and extraordinary expenses. The procedure for recognizing other income and other expenses is disclosed in sections IV, respectively, PBU 9/99 “Income of the organization” and PBU 10/99 “Expenses of the organization.”

Operating and non-operating income and expenses are recorded on account 91 “Other income and expenses”, and extraordinary income and expenses on account 99 “Profits and losses”.

These income and expenses should always (even in the absence of revenue from the sale of products, goods, works and services) be reflected in the corresponding indicators of the profit and loss statement.

A positive difference between other income and other expenses will represent profit before tax, and a negative difference will represent loss before tax.

Source: https://buh.ru/articles/documents/13755/

Write-off of costs at planned cost through account 40

If the 40th account is used, then the entire difference between the actual and planned cost amounts appears here.

The debit of the 40th account reflects the actual generated cost of the GP: Dt 40 Kt 20.

On the credit of this account, the cost calculated according to the standards is written off: Dt 43 Kt 40.

At the end of the month, a balance may form on the 40th account, which is nothing more than the difference between the actual and planned cost. Using the resulting amount, the cost of sales is adjusted on the 90th account:

- if the actual indicator is greater than the planned one, an entry is made: Dt 90.2 Kt 40;

- if the planned indicator turns out to be more than the actual one - reversal Dt 90.2 Kt 40.

Check whether you are accounting for production costs correctly using the Typical Situation from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Write-off of costs at planned cost without using account 40

This method of accounting implies that the planned cost should be reflected on the 43rd account immediately after the GP is entered into the incoming documents: Dt 43 Kt 20.

When the GP is shipped, the same amount is reflected on the 90th account: Dt 90.2 Kt 43.

As soon as the reporting period ends, the actual cost of the GP and the difference in the actual and planned cost indicators will appear on the 20th account. You will need to make adjustments to account 43 for the amount received:

- upward, if the actual indicator is greater than the planned one, with the following entry: Dt 43 Kt 20.

- downward if the planned indicator turns out to be greater than the actual one: reversal Dt 43 Kt 20.

You can learn more about accounting for SOEs from the material “How are finished products reflected in the balance sheet?”

Expenses without income

Let's consider the cost accounting methodology using the example of an ordinary product manufacturing enterprise that does not have auxiliary and service industries.

All costs associated with production are divided into two types: direct and indirect.

Direct expenses are those that can be immediately attributed to some type of product* (salary of a worker engaged in the production of one type of product; consumption of materials for a specific type of product, etc.).

Note: * Cost accounting separately for each type of product is necessary for cost calculation, i.e. calculating costs per unit of production.

Indirect expenses are those that cannot be immediately attributed to any type of product (chief accountant’s salary, telephone subscription fee, office expenses, etc.).

Direct expenses during the month are immediately written to the debit of account 20 “Main production” (to the corresponding analytical accounts by type of product) with crediting to accounts for materials accounting, settlements with personnel for wages, etc.

Indirect costs are divided into two groups:

- Maintenance of main production.

- For management needs not directly related to the production process.

Indirect expenses of the first group during the month are reflected in the debit of account 25 “General production expenses”, and of the second group - in the debit of account 26 “General business expenses”. At the same time, accounts for accounting for materials, settlements with personnel for wages, etc. are also credited.

At the end of the month, indirect costs collected on account 25 are distributed between types of products produced in proportion to some base (the sum of direct costs, wages of production workers, equipment operating time, etc.). The distribution base is determined by the organization itself and is recorded in the accounting policy order.

After distribution to the total amount of expenses collected on account 25, an entry is made:

Debit 20 (analytical accounts by type of product) Credit 25

Indirect expenses collected in account 26 are also completely written off from this account at the end of the month. However, unlike expenses of the first group, they can be written off in two ways.

The first method (traditional) is similar to writing off expenses recorded on account 25 (the distribution base is also selected), account 20 is debited (analytical accounts by type of product) and account 26 is credited.

The second method is based on the premise that general business expenses do not have a direct connection with the production process, are conditionally constant, and, as a result, are reflected in full on the financial results of the reporting period. In other words, they are written off without any distribution by type of product by posting:

Debit 90 “Sales” Credit 26 “General expenses”

The method of writing off general business expenses is chosen by the organization itself and is recorded in its accounting policies.

The result of the work of most manufacturing enterprises is the production of finished products, which are delivered to the warehouse. This records the following:

Debit 43 “Finished products” or 40 “Output of products (works,

Note: * The use of accounts 43 or 40 is determined by the accounting policy of the organization

After this entry, the balance of account 20 represents the amount of costs related to products that have not gone through all stages of the production cycle (work in progress).

As soon as the finished product (or part of the product) is sold, the expenses related to this product are written off by posting:

Debit 90/2 “Cost of sales” Credit 43 “Finished products”

Before sales begin (before revenue appears), the organization's expenses are listed in accounts 20 (related to work in progress) and 43 (related to products released but not sold, stored in the warehouse).

When compiling the balance sheet, the balance of these accounts is reflected respectively in the articles “Costs in work in progress” (indicator code 213) and “Finished products and goods for resale” (indicator code 214).

Based on the above, if there is no revenue from the sale of products (goods, work, the profit and loss statement is not filled out.

If, according to the accounting policy, general business expenses collected on account 26 are written off to the debit of account 90, this write-off is not carried out until the organization has revenue.

Some experts believe that choosing in the accounting policy the option of writing off expenses from account 26 to the debit of account 90 means recognizing these expenses as conditionally fixed. Conditionally fixed expenses are expenses that should reduce the financial result of the reporting period in which they were incurred.

The presence of these expenses is in no way related to the volume of production and/or the fact of its sale. It follows from this that, in accordance with the assumption of temporary certainty of the facts of economic activity (clause

6 PBU 1/98) if there is no revenue from the sale of products in a specific period, the amounts of such expenses reflected in account 26 should be written off as a decrease in the profit of the current reporting period by recording:

Debit account 91 “Other income and expenses” subaccount 2 “Other expenses” Credit account 26 “General business expenses”

From account 91-2, the amount of these expenses is written off to account 99 “Profits and losses”. As a result, the amount of these expenses will be shown in the balance sheet and in the income statement as a loss on operating activities.

We believe that the amount of such a loss should be determined taking into account all income and expenses from ordinary activities, and not just semi-fixed expenses. Nevertheless, the above point of view has a right to exist, and each organization must choose its own option for writing off general business expenses, enshrining it in its accounting policy.

In our opinion, when drawing up a balance sheet, the amount of these general business expenses, recorded on account 26, is added (without posting) to the balance of account 20 and shown under the item “Costs in work in progress.”

When revenue is subsequently received, these expenses, depending on the accounting policy, are written off to the debit of account 90 either immediately in full or in parts over several reporting periods (in proportion to the volume of products sold in the total volume of its output at the time the revenue begins to be received).

How to take into account expenses and input VAT if there is no income

The article from the magazine “MAIN BOOK” is current as of May 13, 2011.

magazine No. 10 for 2011 V.A. Polyanskaya, economist

It happens that an organization has no income in any reporting or tax period, but has expenses. It would seem that no questions should arise. After all, neither accounting nor tax legislation provides for any special features for accounting for expenses in the absence of income.

However, many are afraid that the losses reflected in the income tax return or in the simplified taxation system return will attract the attention of the tax authorities: the accountant may be called to the loss-making commission, request clarification on the issue of the occurrence of losses, offer to submit an updated “break-even” declaration, etc.

Source: https://velereya.ru/rashody-bez-dohodov/

Other operations affecting the credit of the 20th account

Here are a few more situations when the 20th account credit entry is used:

- A company engaged in the sale of services or production of work writes off the expenses collected on the 20th account to the sales account as soon as the customer has accepted the results. To reflect revenue and write off costs, the following entries are made:

- Dt 62 Kt 90.1;

- Dt 90.3 “VAT on sales” Kt 68;

- Dt 90.2 Kt 20.

- If a company uses its own products for its own purposes, the entry will look like this: Dt 10 “Materials” Kt 20.

- Large industries with large volumes of output prefer to account for semi-finished products produced by themselves in a separate account. The posting of such materials must be accompanied by the following entry: Dt 21 “Semi-finished products of own production” Kt 20.

- When recording defective products, the corresponding amounts are reflected as follows: Dt 28 “Defects in production” Kt 20.

- If a shortage is identified during the inventory process of the main production, the following entry is made: Dt 94 “Shortages and losses from damage to valuables” Kt 20.

- When terminating a contract under which products have already been produced, expenses are incurred, reflected as follows: Dt 91.2 “Other expenses” Kt 20.

No idea what to do with expenses

1 2 3 4 5 6 7 8

Basis for writing off expenses in accountingI read it in the article “Accounting. Taxes. Law.” Question: Is it possible to take into account expenses if there are no expenses? (activities are not carried out). Answer of the Federal Tax Service of Russia - Expenses associated with the preparation and organization of activities can be taken into account when calculating the tax base in the period to which they relate. Date of recognition of expenses accrual method. However, you are not yet operating in the period in which these expenses can be recognized. Therefore, you do not reflect them on your tax return. When confirming receipt of income, you can take it into account for tax purposes. |

Enter the site

profit costs associated with its receipt. But in the period to which they belong. those. submit an updated declaration for the period in which these expenses arose. The organization is engaged in Construction and Installation Work (CEM). Direct 20 account - materials, salary. production..Indirect 26 account - License, software, stationery, salary. AUP.

clause 2 art.

318 of the Tax Code of the Russian Federation In this case, the amount of indirect costs for production and sales incurred in the reporting (tax) period is fully included in the expenses of the current reporting (tax) period, taking into account the requirements provided for by this Code. Non-operating expenses are included in the expenses of the current period in a similar manner. There are probably also non-operating expenses - banking services (cash and settlement services)

Direct expenses relate to expenses of the current reporting (tax) period as products, works, and services are sold, in the cost of which they are taken into account in accordance with Article 319 of this Code.

Art. 319 The procedure for assessing balances of work in progress, balances of finished products, goods shipped, it turns out that no, in any case, in accordance with the Tax Code of the Russian Federation, you must take into account indirect and non-operating expenses in the current reporting period.

After all, if we consider a similar situation with VAT. There is no revenue, the deduction has been accrued (the activity has just begun). I think it would be wiser not to submit a declaration with a VAT refund from the budget, but to wait for the proceeds, an advance payment according to the calculation. account. And the same with income tax.

As for accounting, in 9 months I have not even received materials for installation, while only contract agreements have been concluded. Therefore, there is no work in progress, account 20 balance is “0”.

And what also confuses me is that they say the costs should be written off to account 97, and then written off, but I immediately wrote them off from account 20 to 90. I don’t know, maybe I’m wrong.

There are expenses, but no revenue

This situation is often encountered by companies with seasonal activities. However, ordinary enterprises also sometimes experience a temporary lull in sales. What then should you do with expenses that cannot be avoided?

“The costs you listed are indirect. Such expenses must be collected on account 26 “General business expenses”. They can be written off only when the company receives income. If there is no income, then indirect expenses are taken into account in account 97 “Deferred expenses”.

Indirect costs are not directly related to the production of products. They include administrative and commercial expenses.

“Prepaid expenses can be written off in two ways. Firstly, you can include them in expenses completely at the moment when your company begins to rent out equipment. Another option is to spread it over several periods. The chosen option must be reflected in the director’s order.”

“How to correctly reflect expenses in tax accounting if the company does not receive income?”

“It depends on what method you use to calculate profits. Our company, for example, uses the cash method. We take into account expenses in the period when they were paid (Article 273 of the Tax Code of the Russian Federation). It does not matter whether the organization received income or not.

Expenses incurred are simply written off as a loss. For profit tax purposes, losses of the reporting year and previous years are allowed to be carried forward for a period of no more than ten years. That is, the tax base in the new year can be reduced by all or part of the amount of the loss.

The rules for carrying forward losses are described in Article 283 of the Tax Code.”

If the company uses the accrual method, then all expenses are divided into:

- costs associated with production and sales;

- non-operating expenses.

Non-operating expenses reduce taxable income in the period in which they are incurred. The order in which they are written off does not depend on whether the company has income or not.

Source: https://bookerlife.ru/net-realizacii-kuda-devat-rashody/

Account balance 20 “Main production”

At the end of the reporting period, the organization identifies and writes off the cost of production on account 20 “Main production”. As a result of these activities, a debit balance may be formed. This indicator reflects how high the cost of the work in progress is. The resulting amount on the 20th account should be transferred to the next month.

How to properly organize accounting of work in progress and how its indicators are entered into the balance sheet, you can learn from the material “Main production in the balance sheet (nuances).”

if there is no revenue, where should expenses be attributed?

Next, move on to the next step of the recommendation.

Step - 2 Expenses for ordinary activities are all expenses that an enterprise incurs in the process of production and (or) sale of products, goods, and services. These include expenses for the purchase of materials, wages of employees, cost of renting premises, etc. These expenses must be written off in the period of time in which they occurred (clauses 17 and 18 of PBU 10/99). Next, move on to the next step of the recommendation.

How to take into account expenses if there is no sales - lack of sales, general business... 01/04/2012

Step - 3 The specific procedure for displaying expenses in accounting in the absence of revenue

depends on the type of activity of the enterprise. Firms that produce their own products purchase materials, raw materials, calculate depreciation and wages, and reflect expenses in the usual manner, on the debit of account 20 “Main production”. General business expenses (maintenance of the management apparatus, etc.) are recorded first in account 26 “General business expenses”, and then also written off to account 20. Next, move on to the next step of the recommendation.

Step - 4 DEBIT 20 CREDIT 10 subaccount “Raw materials and materials”; DEBIT 20 CREDIT 70 – payroll for production workers; DEBIT 20 CREDIT 02 - depreciation on equipment for production; DEBIT 26 CREDIT 70 - salaries of management staff have been accrued; DEBIT 20 CREDIT 26 – general business expenses are written off. Next, move on to the next step of the recommendation.

How to reflect deferred expenses - deferred expenses, reporting... 01/03/2012

Step - 5 A new, newly opened company often has no income or revenue for some time. Therefore, all expenses for the purchase of equipment, depreciation, and maintenance of the management staff before the start of production until 2011 were charged to account 97 “Future expenses”, then, when the enterprise began producing products, they were written off to the debit of account 20. However, according to the new edition of clause 65 of the Regulations, “costs incurred by the organization in the reporting period, but relating to subsequent reporting periods, are reflected in the balance sheet in accordance with the conditions for recognition of assets established by regulatory legal acts on accounting, and are subject to write-off in the manner established to write off the value of assets of this type.” Next, move on to the next step of the recommendation.

How to write off the costs of a license - Purchasing a license, expenses of future ... 03/18/2012

Step - 6 In other words, the rule that costs,

incurred in the reporting period, but related to the next, must be clearly recognized as expenses of future periods. The document refers to regulatory legal acts on accounting, that is, to PBU. If any accounting regulations do not oblige expenses to be considered expenses of future periods, the company has the right to recognize them immediately upon accrual.

We recommend that you pay attention to the following tips from a financial advisor:

Remember that the system of writing off expenses as expenses - completely or gradually over some time - is determined by the accounting policy of the enterprise.

Additional information and useful advice from a financial expert

We hope the answer to the question - How to write off expenses if there is no revenue - contained useful information for you. Good luck to you! To find the answer to your question, use the form - Site Search.

Key tags: Finance

All articles Recognition of expenses without income: accounting and taxation (Sysoev N.I., Kharchenko S.V.)

The article discusses how to legally recognize expenses associated with organizing a business aimed at generating income, if in the corresponding period of their implementation the income itself was not received. A comparative analysis and explanations are given on the most pressing issues related to the procedure for recognizing expenses without income in tax and accounting.

The features of recognition of expenses in tax and accounting are considered using the example of three situations: 1) when the organization does not carry out activities; 2) when an organization opens a new enterprise or a new type of activity; 3) when the organization operates, but did not receive income in a given period. The results of the work can be applied both at the development stage and during the work of commercial organizations. The practical significance of the article lies in recommendations for improving the accounting process for recognizing expenses in accounting and tax accounting in various commercial organizations, regardless of the field of activity, legal status and form of ownership.

The Tax Code of the Russian Federation determines the composition of income and expenses and what does not apply to income and expenses. All this leads to contradictions with financial accounting. The Tax Code of the Russian Federation implements the rule of the American engineer H. Gant, which states: “Everything that is expediently spent is an expense.” The meaning of H. Gantt's rule sharply contrasts with the traditional opinion expressed by D. Nicholson and D. Rohrbach: “The cost of production should include all the costs of running an enterprise if they want to get the actual cost.” The appearance of ch. 25 of the Tax Code of the Russian Federation “Organizational Profit Tax”, effective from 01/01/2002, finally separated the accounting of financial results and the accounting of the same results for profit tax purposes. The legality of such a division poses a major practical problem. On the one hand, the composition of expenses recognized for tax purposes, with the entry into force of Ch. 25 of the Tax Code of the Russian Federation is initially not limited, but, on the other hand, the list of costs that are not recognized for corporate income tax purposes is also not limited. In practice, this has led to significant problems, from resolving fundamental issues related to Art. 252 of the Tax Code of the Russian Federation, the taxpayer’s ability to recognize expenses in each specific case will depend. According to paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, in order to be recognized for profit tax purposes, expenses must simultaneously satisfy three main criteria: - expenses must be incurred to carry out activities aimed at generating income; — expenses must be economically justified; — expenses must be documented.

It is important to answer the question whether it is possible to recognize expenses associated with organizing a business aimed at generating income if in the corresponding period of their implementation the income itself was not received. The position of official bodies on this issue is ambiguous. Thus, in Letter of the Ministry of Finance of Russia dated October 13, 2006 N 03-03-04/1/691, financiers came to the conclusion that during the period of absence of statutory activities, the organization does not have the right to write off expenses to reduce taxable profit. According to financiers, all expenses incurred should be compensated from contributions (contributions) of the founders (participants). The opposite position is expressed in Letters of the Ministry of Finance of Russia dated December 8, 2006 N 03-03-04/1/821 and the Federal Tax Service of Russia dated April 21, 2011 N KE-4-3/6494, which state that Ch. 25 “Organizational Profit Tax” of the Tax Code of the Russian Federation does not make the procedure for recognizing expenses dependent on whether the organization had sales income in the current reporting period or not. An organization has the right to take into account expenses for profit tax purposes both in the period of receipt of income and in the period in which the organization does not receive income, provided that the activities carried out are generally aimed at generating income. The Tax Code of the Russian Federation allows an organization to independently distribute costs associated with production into direct and indirect (Clause 1, Article 318 of the Tax Code of the Russian Federation). The order of distribution of costs affects the amount of expenses that can be taken into account when calculating income tax in a specific reporting or tax period. Thus, direct costs are included in the cost of production and are written off as they are sold. In turn, indirect costs are fully taken into account in the current reporting period (clause 2 of article 318 of the Tax Code of the Russian Federation). Methods for allocating expenses in Ch. 25 of the Tax Code of the Russian Federation is not contained, therefore the organization has the right to use the method that is most beneficial to it. Some federal courts, for example, the Federal Antimonopoly Service of the Northwestern District (Resolution dated October 4, 2011 N A56-55568/2010), come to this conclusion. However, there is another point of view. Back in 2010, the Supreme Arbitration Court of the Russian Federation recalled that “The Tax Code of the Russian Federation does not consider the distribution of expenses as a process that depends solely on the will of the company’s management.” That is, expenses cannot be attributed to direct or indirect without any justification. This approach worked to the advantage of the tax authorities; they began to limit the composition of indirect costs in the production of products. They justified their position by the fact that “the right to independently determine the list of expenses requires the taxpayer to justify the decision” (Letter of the Federal Tax Service of Russia dated February 24, 2011 N KE-4-3 / [email protected] ). In particular, according to tax authorities, direct expenses include: - fuel and electricity; - package; - work and services performed by auxiliary units. Some types of raw materials are difficult to distribute between main and auxiliary production. Therefore, organizations enshrine in their accounting policies the provision that specific types of raw materials are taken into account monthly as part of indirect costs in the amount of actual costs. A situation may arise when, from the beginning of the year, the organization decided to change the list of direct expenses, fixing it in its accounting policies. Due to these changes, part of the costs that were previously direct will be considered indirect from the beginning of the year. According to the Ministry of Finance, costs that fall on work in progress and unsold products will not be taken into account. In the new tax period, they will also have to be written off as goods (work) are sold. And you can write off at a time only those expenses that have been incurred since the beginning of the new tax period (Letters of the Ministry of Finance of Russia dated 09.15.2010 N 03-03-06/1/588, dated 05.20.2010 N 03-03-06/1/336).

The organization determines independently whether costs are classified as direct or indirect for each production cycle. If certain resources, according to technological regulations, are not included in the production cycle and are not an integral part of it, then the costs for them can be taken into account as part of indirect costs. An organization has the right to write off direct expenses for profit tax purposes only in the period when revenue is reflected in taxable income, therefore it will not be possible to recognize direct expenses without sales, and therefore without revenue (Letter of the Ministry of Finance of Russia dated 04/09/2010 N 03-03-06/ 1/246). But the Tax Code of the Russian Federation allows indirect and non-operating expenses to be written off at a time in the period in which they were incurred (clause 2 of Article 318 of the Tax Code of the Russian Federation). That is, in the absence of revenue, indirect expenses are recognized as losses, which will reduce the income received later (Letter of the Ministry of Finance of Russia dated 03/06/2008 N 03-03-06/1/153). The Letter of the Federal Tax Service of Russia dated April 21, 2011 N KE-4-3/6494 states that expenses are recognized as any economic expenses confirmed by documents drawn up in accordance with the legislation of the Russian Federation, provided that they were incurred to carry out activities aimed at generating income . In response to the question about a newly created organization, the main activities of which are production and transmission of thermal energy, but currently has no income, due to the norm of paragraph 5 of Art. 270 Tax Code of the Russian Federation, expenses associated with the creation of depreciable property, as well as its reconstruction, are not taken into account when determining the tax base for corporate income tax. No matter how well the norms of Ch. 25 of the Tax Code of the Russian Federation, problems with its application in practice would still arise. This is due to the unlimited variety of activities and business transactions, and to the interpretation of the same words in different ways. Unfortunately, Ch. 25 of the Tax Code of the Russian Federation is another example of insufficient elaboration. In accounting, the problem is different. The Russian Ministry of Finance issued Order No. 33n, which put into effect the Accounting Regulations “Organization Expenses” PBU 10/99 from 01/01/2000. This Regulation not only replaced the concept of “cost” with the term “expenses”, but also marked a revolution in views on the costs of an organization in the domestic theory of accounting. According to clause 2 of PBU 10/99, expenses are understood as a decrease in economic benefits as a result of the disposal of assets (cash, other property) and (or) the occurrence of liabilities leading to a decrease in the capital of this organization, with the exception of a decrease in contributions by decision of participants (owners of property) .

To recognize expenses in accounting, the conditions established by clause 16 of PBU 10/99 must be met: - the expense must be made in accordance with a specific agreement, the requirements of laws and regulations, and business customs; — the amount of expense can be determined; - there is confidence that as a result of a particular transaction there will be a decrease in the economic benefits of the organization. Please note that in order to recognize an expense, all of the above conditions must be met. If at least one of the conditions is not met, then the organization’s accounting records recognize not an expense, but a receivable. Paragraph 17 of PBU 10/99 establishes that expenses are subject to recognition in accounting, regardless of the intention to receive revenue, operating or other income and the form of the expense (cash, in kind and other). In accounting, all expenses of an organization, depending on the nature, conditions of implementation and directions of its activities, in accordance with paragraph 4 of PBU 10/99, are divided into expenses from ordinary activities and other expenses. Other expenses, in turn, are divided into expenses: - operating; - non-operating; - emergency. Even before receiving income, the newly created organization incurs expenses for renting office space, expenses for paying salaries to officials and employees of the organization, producing seals, letterheads, purchasing office furniture and equipment. If an organization plans to begin its activities in the month of its registration, then it must take into account these expenses in its account. 26 “General business expenses”, and if it is a trading organization, then on the account. 44 “Sales expenses”. If the organization does not receive income in the month of its registration, then these expenses must be written off as a debit to the account. 97 “Future expenses”, since in the debit of the account. 90 “Sales”, such expenses cannot be written off, or if there is no connection with income, they can be debited to the account. 91 “Other income and expenses.” If the enterprise carries out production activities, then in the accounting policy for accounting purposes it is necessary to indicate the procedure for accounting and writing off direct (account 20 “Main production”) and indirect expenses (costs of general production and general economic purposes, which are reflected in the debit of account 25 “General production expenses " and 26 "General expenses" respectively), as well as the cost calculation method (custom, standard, etc.). According to the Chart of Accounts for accounting the financial and economic activities of organizations, the expenses recorded on the account.

Results

The credit of the 20th account shows the cost of the finished product, whether it is intended for sale or for one’s own needs, the cost of services sold, work performed.

This amount is transferred to the 40th, 43rd, 90th or other account, as required by the accounting policy of the enterprise and the nature of the transaction performed. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Categories

In the article you will learn about planning and cost management in the overall budgeting process in an enterprise. Methods for rationing raw materials, materials and labor resources in each industry and at each enterprise are different, so we will not talk about the rationing methodology, but about the methodology of planning and cost management.

An income and expense budget (IBB) is a document with a planned and actual breakdown of the main items of income and expenses, which allows the owner and management of the company to see how much money needs to be invested in order for the enterprise to be profitable and to be able to develop successfully in the future, what kind of financial the situation has developed today.

A detailed and thorough analysis of the BDR in the context of articles and divisions will allow us to identify weaknesses in management and make the necessary management decisions to change the situation. To do this, the budget of income and expenses must, first of all, be formed by competent and responsible people. play a big role here :

- proper motivation of the performer;

- competent selection of a budgeting specialist.

This article will help specialists who are not indifferent to their profession and their business, cope with the task assigned to them and competently build a budgeting system for the enterprise.

Before proceeding with the budgeting regulations, you need to familiarize yourself with a short preface that will explain the need to form a budget of income and expenses .

The author first had to create a budget for income and expenses at a small metallurgical enterprise in 1999. Private business had just begun to develop; there were no formats for budgets of income and expenses yet, much less there were no recommendations on the procedure for forming planned and actual budgets. But even then there was a need to create internal documents regulating the optimal level of income of the enterprise and the corresponding level of costs that the enterprise had to incur in order to ensure a sufficient level of profit for normal activity and development.

According to accounting data, it was quite difficult to form a budget, so the task was set to plan such a budget of income and expenses in which the volume of output and sales of products would not only allow uninterrupted supply of production with raw materials and energy resources, pay wages to workers, but would also cover impressive fixed costs of the enterprise, taking into account the personal costs of the owner and the profit he needs. At the same time, the entrepreneur’s requirements for the expenditure side of the budget were very strict; all expenditure items of the planned budget, except personal ones, were formed based on the question: “How to correctly account for expenses?” Let's look at an example.

Example

To deliver raw materials, the company used the services of the railway. As is known, wagons and containers with raw materials or finished products, waiting for a locomotive or car delivering cargo directly from the station to the recipient, stand idle at stations, and a fee is charged for the laying of wagons, which depends on the time of laying. The fee is reflected in the invoice ; in the accounting report it is classified as a cost that affects taxable profit. In the income and expenditure budget, these costs are classified as transportation costs .

Often the downtime exceeds the calculated time due to the sluggishness of the logisticians of the enterprise receiving the raw materials. For idle time of wagons and containers beyond the time established by the contract, fines are charged, which relate to non-operating costs, that is, costs that do not affect the amount of taxable profit. Nevertheless, fees and fines in the BDR should be reflected as the amount of overexpenditure of actual expenses compared to planned ones (the culprits must be punished).

In the planned budget, the entrepreneur demanded that only the amount of necessary expenses be recorded, which would not include costs incurred due to the negligence and sluggishness of the enterprise’s employees or for other subjective reasons.

Planned expenditure budgets for many items are often formed based on the facts of the previous month or as an average actual figure for a certain period, that is, formally. Form a planned budget according to the principle “how much should it be?” - a very labor-intensive job, since you need to process primary documents, know all the tariffs for cargo delivery, fuel consumption standards, raw material consumption standards, energy consumption standards, auxiliary materials consumption standards and much more. Therefore, in many enterprises, the budget of income and expenses is simply a tribute to fashion, and some business managers, having not received the desired effect in saving resources and increasing the profitability of production, generally abandon the budgets of income and expenses, being content with financial statements. But the manager’s responsibility is to correctly set the task for the head of the planning department and get the result he requires.

If the head of an enterprise has decided that a budget of income and expenses is needed, then to begin the budgeting process the following is required :

1) an order for the enterprise regulating the budgeting procedure, which should include:

- list of budget items with coding;

- a list of departments for which coding records will be kept;

- list of responsible persons for collecting and providing information;

- emphasizing that not a single program and not a single reporting table at the enterprise was created or provided without BDR coding;

- responsibility of persons for collecting and providing information without a BDR code or for untimely provision of such information;

2) execution of an order or collection and provision of information on budget items at the required time by responsible persons.

An example of coding budget items is presented in table. 1.

| Table 1. Coding of budget items | |

| Code | Article |

| 1 | Output, kg |

| 2 | Income from the issue excluding work in progress |

| 3 | Expenses (total) |

| 3.1 | Direct costs (total), including: |

| 3.1.1 | raw materials |

| 3.1.2 | · transport for the delivery of raw materials and materials |

| 3.1.3 | · wage |

| 3.1.4 | · contributions to extra-budgetary funds |

| 3.1.5 | · electricity |

| 3.1.6 | water |

| 3.1.7 | · gas for drying products |

| 3.1.8 | · packaging and auxiliary materials |

| 3.2 | General shop expenses (total), including: |

| 3.2.1 | · depreciation of fixed assets |

| 3.2.2 | · costs for repairs and maintenance of equipment, including: |

| 3.2.2.1 | · materials and spare parts |

| 3.2.2.2 | · third-party equipment repair services |

| 3.2.5 | · general shop staff salaries |

| 3.2.6 | · contributions to extra-budgetary funds |

| 3.2.7 | · IBP, stationery |

| 3.2.8 | · maintenance of buildings and structures (total), including: |

| 3.2.8.1 | · costs for current repairs |

| 3.2.8.2 | · electricity |

| 3.2.8.3 | · heat energy |

| 3.2.8.4 | water |

| 3.2.3 | Fare |

| 3.3 | General plant expenses (total), including: |

| 3.3.1 | · depreciation of fixed assets |

| 3.3.2 | · salary of general plant personnel |

| 3.3.3 | · contributions to extra-budgetary funds |

| 3.3.4 | · fuels and lubricants |

| 3.3.5 | · maintenance of vehicles (repairs, maintenance) |

| 3.3.6 | · IBP, stationery |

| 3.3.7 | · maintenance of buildings and structures (total), including: |

| 3.3.7.1 | · costs for current repairs |

| 3.3.7.2 | · electricity |

| 3.3.7.3 | · heat energy |

| 3.3.7.4 | water |

| 3.3.8 | taxes included in the cost |

| 3.3.9 | · duties |

| 3.3.10 | · banking services |

| 3.3.11 | · transport services |

| 3.3.12 | · communication services |

| 3.3.13 | · advertising |

| 3.3.14 | · information Services |

| 3.3.15 | · travel expenses |

| 3.3.16 | · commercial expenses |

| 3.3.17 | · personnel selection |

| 3.3.18 | · other services |

| 3.3.19 | · repayment of interest on the loan |

| 3.3.20 | · other expenses |

| 4.1 | Marginal income, rub. |

| 4.2 | Marginal income, % |

| 4.3 | Profit |

| 4.4 | Profitability |

| 4.5 | Income tax (20%) |

| 4.6 | Profit to be distributed |

| 4.6.1 | Final defect (returns from buyers) |

| 4.6.2 | Fines and penalties |

| 4.6.3 | Dividends |

| 4.6.4 | Other distribution |

| 4.6.4.1 | Development Fund |

| 4.6.4.2 | Social Needs Fund |

| 4.6.4.3 | Material reward |

In table 2 shows an example of encoding the divisions of an enterprise.

| Table 2. Coding of enterprise divisions | |

| Code | Subdivision |

| 1 | Administration |

| 2 | Secretariat |

| 3 | Accounting |

| 4 | Planning department |

| 5 | Purchase department |

| 6 | Sales department |

| 7 | Legal department |

| 8 | Financial department |

| 9 | Information Technology Department |

| 10 | Labor and Salary Department |

| 11 | Human Resources Department |

| 12 | Repair service |

| 13 | Workshop No. 1 |

| 14 | Workshop No. 2 |

| 15 | Workshop No. 3 |

| 16 | Workshop No. 4 |

| 17 | Warehouse of workshop No. 1 |

| 18 | Warehouse of workshop No. 2 |

| 19 | Warehouse of workshop No. 3 |

| 20 | Warehouse of workshop No. 4 |

| 21 | central warehouse |

| 22 | Transport service, garage |

| 23 | Security |

| 24 | Housekeeping service |

The most difficult thing in creating budgets is creating a planned budget . As for the fact, now few people do it manually. Various programs allow you to generate reports in the following context:

- articles;

- divisions;

- materials.

To do this, it is necessary that the encoding corresponds to a single established encoding of articles and divisions. Modern budgeting programs are compatible with the 1C accounting program. The Axapta program is very convenient and easy to use, which allows you to combine accounting, production accounting and budgeting. Regulations for submitting financial statements force performers to timely and carefully distribute almost all the information necessary for the actual budget of income and expenses. As for direct variable costs, such as raw materials, auxiliary materials and packaging, it is better to use data from production reports .

Actual data on the consumption of electricity and other energy resources in production also need to be adjusted based on the output of finished products. This is due to work in progress, since accounting writes off all materials received from warehouses into production according to primary documents, and to compile the BDR, the accrual principle is used, that is, expenses are reflected only for the production of finished products in the period to which they relate.

An example of a production report on product output for a month is presented in table. 3.

| Table 3. Production report on product output for the month, kg | ||||||||

| Index | Order number | Total with “work in progress” for accounting | Total without “unfinished work” for BDR | |||||

| 1231 | 1232 | 1233 | ||||||

| Semi-finished product code (p/f) | p/f No. 1 | p/f No. 2 | p/f No. 3 | p/f No. 4 | p/f No. 5 | p/f No. 6 | ||

| Finished product code | 1050 | 4040 | 5005 | |||||

| Buyer's order | 5100 | 890 | 5600 | 5990 | ||||

| Pereditel | extrusion | extrusion | extrusion | extrusion | extrusion | |||

| Incoming raw materials, including: | 3050 | 2817 | 540 | 489 | 3584 | 3015 | 13 495,00 | 6896,00 |

| raw material No. 1 | 1069 | 988 | 169 | 26 | 1451 | 1176 | 4879,00 | 2252,00 |

| raw material No. 2 | 201 | 185 | 11 | 402 | 250 | 370 | 1419,00 | 799,00 |

| raw material No. 3 | 405 | 374 | 120 | 18 | 301 | 440 | 1658,00 | 917,00 |

| raw material No. 4 | 325 | 300 | 0 | 0 | 42 | 49 | 716,00 | 625,00 |

| raw material No. 5 | 1050 | 970 | 240 | 43 | 1540 | 980 | 4823,00 | 2303,00 |

| Waste | 200 | 187 | 65 | 43 | 289 | 309 | 1093,00 | 495,00 |

| Output of semi-finished product | 2850 | 2630 | 475 | 446 | 3295 | 2706 | 12 402,00 | 6401,00 |

| Pereditel | seal | no stamp | seal | seal | seal | |||

| Incoming semi-finished product | 2850 | 3295 | 6145,00 | 2850,00 | ||||

| Waste | 141 | 115 | 256,00 | 141,00 | ||||

| Paint consumption in commercial form (with solvent) | 12 | 30 | 42,00 | 12,00 | ||||

| Losses | 10 | 25 | 35,00 | 10,00 | ||||

| Dry paint residue | 2 | 5 | 7,00 | 2,00 | ||||

| Output of semi-finished product | 2711 | 3185 | 5896,00 | 2711,00 | ||||

| Pereditel | lamination | lamination | lamination | lamination | lamination | |||

| Incoming semi-finished product | 2711 | 2630 | 475 | 446 | 3185 | 2706 | 12 153,00 | 6262,00 |

| Waste | 141 | 53 | 11 | 10,5 | 115 | 114 | 444,50 | 215,50 |

| Glue consumption in commercial form (with solvent) | 5 | 1 | 10 | 16,00 | 6,00 | |||

| Losses | 4,5 | 0,8 | 9 | 14,30 | 5,30 | |||

| Dry glue residue | 0,5 | 0,2 | 1 | 1,70 | 0,70 | |||

| Output of semi-finished product | 5147,50 | 899,70 | 5663,00 | 11 710,20 | 6047,20 | |||

| Pereditel | cutting | cutting | cutting | cutting | cutting | |||

| Incoming semi-finished product | 5145 | 899,5 | "unfinished" | 6044,50 | 6044,50 | |||

| Waste | 43 | 11 | 54,00 | 54,00 | ||||

| Actual output of finished products | 5102 | 888,5 | 0 | 5990,50 | 5990,50 | |||

From the table 3 shows that the write-off of raw materials according to accounting for the month is 13,495 kg, the write-off of paints - 42 kg, the write-off of glue - 16 kg, since in the budget of income and expenses without taking into account “work in progress” the write-off of raw materials for finished products amounted to 6896 kg, paints - 12 kg, glue - 6 kg.

An example of calculating the cost of raw material consumption for an actual budget for a month is presented in table. 4.

| Table 4. Calculation of the cost of raw material consumption for the actual budget for the month, kg | |||

| Index | Total without “unfinished work” for BDR | Average price per 1 kg, rub. | Actual cost of raw material consumption, rub. |

| Buyer's order | 5990 | 200 | 1 198 000,00 |

| Raw material consumption for production: | 6896,00 | 612 836,00 | |

| raw material No. 1 | 2252,00 | 104 | 234 208,00 |

| raw material No. 2 | 799,00 | 99 | 79 101,00 |

| raw material No. 3 | 917,00 | 98 | 89 866,00 |

| raw material No. 4 | 625,00 | 95 | 59 375,00 |

| raw material No. 5 | 2303,00 | 62 | 142 786,00 |

| Paint consumption in commercial form (with solvent) | 12,00 | 450 | 5400 |

| Glue consumption in commercial form (with solvent) | 6,00 | 350 | 2100 |

| Actual output of finished products | 5990,50 | 200 | 1 198 100,00 |

Planning and managing costs in manufacturing is much more complex than collecting actual cost data. There is a lot of manual labor here. Collection, verification and consolidation of all norms and regulations in the context of nomenclature, workshops, processing areas, services and departments and the entire enterprise as a whole, processing of primary documents in order to find out how necessary and justified certain expenses are, is the task of the planning department . However, other services and departments in the enterprise must learn to plan their expenses and learn to save their costs.

Formation of a planned expenditure budget includes two stages. This is due to the fact that, when forming the initial budget, we calculate all income and expenses based on the planned volumes of production and sales of products. To answer the question: “How to correctly take into account expenses?”, all planned standards relate to the actual production of finished products in the period. As a result, not only deviations from the desired initial plan are visible, where only the level of implementation of the release plan can be seen as a reason.

When analyzing a plan adjusted for the actual output volume, it is possible to track and analyze savings and overexpenditures for all budget items, provided that the output volume remains unchanged by actual item.