Invoice for the balance of the advance - at the end of the tax period?

| Can an organization, having shipped part of the goods on account of the received advance payment (five days after receiving the advance payment), issue an invoice for the remaining advance amount at the end of the tax period, if all operations were carried out in the same tax period? Experts from the Legal Consulting Service GARANT Nadezhda Vasilyeva and Olga Monaco answer. |

The organization received an advance, then part of the goods was shipped against the received advance amount. In this case, the shipment was carried out after five calendar days, counting from the date of receipt of the advance amount. These transactions were carried out in one tax period. Does the organization have the right to issue an invoice for the remaining advance amount at the end of the tax period?

Clause 1 of Article 167 of the Tax Code of the Russian Federation determines that the moment of determining the VAT tax base for the seller is the earliest of the following dates (unless otherwise provided by the Tax Code of the Russian Federation):

— day of shipment (transfer) of goods (works, services), property rights;

- the day of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights.

Consequently, upon receipt of an advance payment (advance), the taxpayer is obliged to calculate VAT on this amount and, on the basis of paragraph 3 of Article 168 of the Tax Code of the Russian Federation, no later than five calendar days from the date of receipt, draw up the corresponding invoice. The amount of tax in this case is calculated in the manner established by paragraph 4 of Article 164 of the Tax Code of the Russian Federation (clause 1 of Article 168 of the Tax Code of the Russian Federation).

According to paragraph 14 of Article 167 of the Tax Code of the Russian Federation, if the moment of determining the tax base was the day of receipt of advance payment on account of upcoming deliveries of goods (performance of work, provision of services, transfer of property rights), then on the day of shipment of these goods (performance of work, provision of services, transfer of property rights) rights) against the previously received prepayment, the moment of determining the tax base also arises.

Invoices issued and (or) issued upon receipt of payment (partial payment) for upcoming deliveries of goods (work, services) or transfer of property rights are registered by the taxpayer in the sales book in accordance with paragraphs 3 and 17 of the Rules for maintaining the sales book used in calculations for value added tax, approved. Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137.

Based on a literal reading of the norms of paragraph 14 of Article 167 of the Tax Code of the Russian Federation, there are no exceptions to the general rule for cases where prepayment and shipment take place in the same tax period.

This opinion is shared by the tax authorities, explaining that upon receipt of payment (partial payment) for the upcoming delivery of goods (work, services), an invoice for the amount of such advance payment must be issued without fail, even if the shipment of goods (work, services) made no more than within five days after making advances (letters of the Federal Tax Service of Russia dated March 10, 2011 No. KE-4-3/3790, dated February 15, 2011 No. KE-3-3/354).

However, according to the Ministry of Finance of Russia, if the shipment of goods (work, services) is carried out within five calendar days, counting from the day of receipt of the advance payment (partial payment), invoices for such advance payment are not required to be issued to customers (letters from the Ministry of Finance of Russia dated 12.10. 2011 No. 03-07-14/99, dated 03/06/2009 No. 03-07-15/39). When using these clarifications, it must be taken into account that such a conclusion does not follow from paragraph 3 of Article 168 of the Tax Code of the Russian Federation, but is based on the fact that upon shipment, the supplier will in any case issue an invoice, so issuing an advance invoice at the same time does not make sense , but only increases and complicates document flow. In addition, letters from the Ministry of Finance of Russia are advisory in nature, do not contain legal norms or general rules specifying regulatory requirements, and are not regulatory legal acts.

The opinion of the judiciary on this issue is fundamentally different from the position of the regulatory authorities.

Arbitration courts, in the case where prepayment and shipment occur in the same tax period, generally do not recognize such payments as advance payments for the purpose of calculating VAT, while they rely on the position of the Supreme Arbitration Court of the Russian Federation, which is that an advance payment cannot be recognized , received by the taxpayer in the same tax period in which the shipment took place (Resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 10, 2009 No. 10022/08, dated February 27, 2006 No. 10927/05, resolutions of the Federal Antimonopoly Service of the Volga District dated December 22, 2008 No. A55-3598/08 , FAS Moscow District dated January 23, 2013 No. F05-15410/12, dated April 23, 2010 No. KA-A40/3908-10, dated July 17, 2008 No. KA-A41/5427-08, FAS Far Eastern District dated November 28, 2008 No. F03 -4597/2008). If you follow this position, the seller must issue invoices for the received advance payment only if the shipment of the goods for which it was received will take place in the next tax period.

Thus, in our opinion, the above position of the Federal Tax Service of Russia is the most consistent with the norms of Chapter 21 of the Tax Code of the Russian Federation, which do not make the obligation of taxpayers to charge VAT and issue invoices upon receipt of an advance payment dependent on the period (terms) of subsequent shipment of goods (works, services) ).

If an organization adopts a different procedure for issuing invoices for advances received, different from that recommended by the Federal Tax Service of Russia, namely, it issues an invoice for the remaining amount of the advance at the end of the tax period, then with a high probability this approach may cause a tax dispute. And in this case, there is a high probability that the organization will have to defend its position in court.

The texts of the documents mentioned in the experts’ response can be found in the GARANT legal reference system.

The payer may be fined for failure to issue an ESCF from January 1, 2020

Igor Skrinnikov recalled that in accordance with the Tax Code of Belarus, from January 1, 2021, only electronic invoices will be used to make VAT calculations and apply tax deductions. Administrative penalties may be applied to payers who do not issue (send) ESFF.

Payers who do not issue (send) ESFF from January 1, 2021 may be subject to administrative penalties in accordance with Article 13.8 of the Administrative Code. This was announced at the press conference “Taxation 2020: the most important changes in legislation” in the BelTA press center, the head of the main department of taxation methodology for organizations of the Ministry of Taxes and Duties of Belarus, Igor Skrinnikov, answering a question from a GB.BY correspondent.

We recommend reading: Article 228 Part 2 of the Criminal Code of the Russian Federation in a new edition with comments 2020

Invoice for advance payment

At the end of last year, a letter from the Ministry of Finance of the Russian Federation dated November 30, 2006 No. b/n was issued, which sets out the position of the financial department on this issue, taking into account the opinion of the tax authorities and established judicial practice. The position of the Ministry of Finance is as follows: In accordance with paragraph 1 of Art. 154 of the Tax Code of the Russian Federation, when a taxpayer receives payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), the tax base is determined based on the amount of payment received, taking into account tax, with the exception of payment, partial payment received by the taxpayer applying the moment of determining the tax base in accordance with paragraph 13 of Art. 167 Tax Code of the Russian Federation. In accordance with paragraph 3 of Art. 168 of the Tax Code of the Russian Federation, when selling goods (work, services), transferring property rights, the corresponding invoices are issued no later than five days counting from the date of shipment of the goods (performance of work, provision of services) or from the date of transfer of property rights. The procedure for maintaining a log of received and issued invoices, a purchase book is established by Decree of the Government of the Russian Federation dated December 2, 2000 N 914 “On approval of the Rules for maintaining logs of received and issued invoices, purchase books and sales books when calculating value added tax” (hereinafter referred to as the Rules). Clause 18 of the Rules, when receiving funds in the form of advances and other payments on account of upcoming deliveries, provides for the preparation by the seller of an invoice, which is registered in the sales book. Clause 17 of the Rules obliges the seller to register “advance” invoices in the sales book in chronological order in the period when the advance payment was received, and clause 13 of the Rules - in the purchase book in the period in which the advance payment is “closed” by shipment. At the same time, the seller’s obligation to draw up an invoice upon receipt of advance payments by the said Rules is not related to the VAT tax period established by Art. 163 Tax Code of the Russian Federation. Neither the Tax Code of the Russian Federation nor the Rules stipulate a specific deadline for drawing up an “advance” invoice. According to Letter of the Ministry of Finance of Russia dated August 25, 2005 N 03-04-11/209, even if the prepayment and shipment of goods occurred within one month, that is, in one tax period, then an invoice for the advance received must still be issued, since there are no exceptions in The Rules do not provide for such cases. A similar point of view is expressed in the Letter of the Federal Tax Service of Russia for Moscow dated 02/11/2005 N 19-11/9796. At the same time, the position of the financial department and tax authorities on this issue is at odds with established arbitration practice. According to arbitration courts, payments for goods shipped in the same tax period cannot be considered advances, including if the funds were received before the goods were shipped. This means that such payments cannot increase the tax base in the manner provided for in Art. 162 of the Tax Code of the Russian Federation. At the same time, the judges proceed from the fact that in relation to VAT in accordance with Art. 163 of the Tax Code of the Russian Federation, the tax period is a month or a quarter, therefore, the tax base for this tax must be determined at the end of each calendar month or quarter. Consequently, for the purposes of calculating VAT, advance and other payments received on account of the upcoming supply of goods will be funds received by the taxpayer from buyers of goods in tax periods preceding the period in which the relevant goods are sold. This conclusion is contained, for example, in the Resolution of the FAS Moscow District dated 03/06/2006 N KA-A40/894-06 in case N A40-41215/05-107-318, the Resolution of the FAS Volga District dated 01/24/2006 N A72-6633/04 -7/498, Resolutions of the Federal Antimonopoly Service of the East Siberian District dated January 24, 2006 N A33-16072/05-F02-7021/05-S1, dated September 15, 2004 N A19-5169/04-30-F02-3783/04-S1 , Resolutions of the Federal Antimonopoly Service of the West Siberian District dated 02.13.2006 N F04-233/2006(19490-A03-31), dated 09.22.2004 N F04-6802/2004(A46-4924-31), Resolutions of the Federal Antimonopoly Service of the Ural District dated 03.02. 2004 N F09-50/04-AK. Thus, payment received earlier than the shipment of goods (performance of work, provision of services), but within the same tax period, is not an advance, therefore, the requirements of the said Rules do not apply to such payments and there is no need to prepare an invoice. If the shipment of goods (performance of work, provision of services) took place partially in the same tax period in which payment was received for the upcoming delivery of these goods (work, services), then an invoice can only be drawn up at the end of the tax period for the received payment only for the amount for which the shipment of goods (work, services) was not made before the end of the given tax period. However, taking into account the position of the financial department and tax authorities, the taxpayer may have to prove the legality of such a position in arbitration court. __________________ Olga Matteis, Director of the Audit Department of AKG “SV-Audit”

Mass Media about us

Why control buyer advances?

Tatyana Anatolyevna Savchenko, financial director of Retail Service Group of Companies.

Accounts payable from customers are perceived by most entrepreneurs as a free monetary resource, but they forget that this resource is given for a very short time and also costs money, because All advances will be subject to either VAT or a single tax. Meanwhile, the buyer's advance is rather an unreported profit of the division. Therefore, if at the end of the month we have advances, then on the balance sheet we have a loss in the amount of accrued (on the entire amount) VAT (for OSNO) or EN (for simplified tax system). But the buyer’s accounts payable may then not be used by the buyer to cover future sales, and therefore may not be profit at all.

In addition, if you do not control the timing of fulfillment of obligations, then overdue advances carry other commercial risks, which seem quite difficult to assess. After all, untimely closing of advances is accompanied by the risk of losing the client’s trust and developing a negative reputation in the market. On the other hand, untimely processing of the advance carries the risk of non-acceptance of the services provided by the buyer and the return of the advance for the services provided, which leads to a decrease in the financial result and an additional burden on the accounting department for accounting for claim transactions and filing updated tax returns.

And is it worth keeping such a liability on the balance sheet? Let's try to calculate the diversion of funds for tax expenses for the short-term period, in which we have unclosed advances from buyers:

Let's simulate the situation using the example of sales of goods worth 100,000 rubles. (including VAT) with a cost of RUB 59,300. (without VAT):

If the shipment is not completed, then you will have to pay VAT on the advance - 100,000 / 118 * 18 = 15,254 rubles, and we will not see income from this transaction in the profit and loss statement.

If an organization that has overdue an advance payment is taxed under the simplified tax system, then the budget will need to pay the same amount as when making a sale (6% of 100,000 rubles = 6,000 rubles), only the profit will also not be generated, and the risk of return of funds will be big enough.

Thus, it turns out that at the end of this reporting period, taxes will need to be paid to the budget by 5,585 rubles more under the TSNO, and 6,000 rubles more under the simplified tax system. you must pay before the transaction is completed. It may turn out that in the next quarter you will have to pay these taxes and return the funds to the buyer in full... and then, perhaps, wait for the return of these taxes from the budget. The period for which these funds are diverted is determined by the turnover period of the buyer's accounts payable (the deadline for fulfilling the obligation to supply the goods) plus the period before filing a declaration for this tax. In conditions of cash shortages, such operations are extremely undesirable for the organization.

Of course, receiving an advance is insurance for the transaction and, in this situation, it is within our power to fulfill obligations in a timely manner, avoiding delays and interruptions in supplies.

Such a calculation forces you to treat the advances you receive with more attention than to enjoy the “free” resource. To do this, you need to understand the reasons for the occurrence of overdue advances. The reasons may be the untimely fulfillment of obligations on the part of our company, and the erroneous transfer by clients of amounts in an increased amount, and the inattention of the accountant when closing sales in advance (if the company keeps records of obligations under the contract in the context of each document), and even untimely written implementation (especially if the organization provides monthly maintenance services, and under the terms of the contract, the client pays the subscription fee in advance).

To minimize the risks associated with the occurrence of overdue accounts payable, it is necessary to clearly identify the incoming payment at the time of payment and timely take steps to process advances. For this purpose, it is advisable to regulate this process. And since customer accounts payable are closely related to accounts receivable, it is better to regulate work with accounts payable together with the regulation of work with accounts receivable in one document.

To control advances from buyers, the regulations on control of accounts receivable were supplemented with provisions on working with advances from buyers and the form of the debt register was changed.

Excerpts from the regulations for working with receivables and payables

1. GENERAL PROVISIONS

1.1. These regulations are subject to execution in all divisions of the Retail Service Group of Companies.

1.2. Responsible for the implementation of these regulations are the heads of the main business areas, who appoint specific executors responsible for monitoring advances from among the employees subordinate to them.

1.3. The chief accountant is responsible for the timely implementation of offsets to close accounts receivable.

1.4. The financial director is responsible for agreeing and updating these regulations.

2. OBJECTIVES OF CONTROL OF ADVANCES RECEIVED FROM BUYERS:

2.1. Timely closure of customer accounts receivable;

2.2. Timely fulfillment of the company’s obligations to supply goods and provide services or return excess amounts transferred.

3. Rules for monitoring buyer advances

3.1. Advances received are accounts payable and are taken into account as liabilities on the balance sheet of a specific business area in the context of contracts at the time of their formation (receipt of payment from the buyer).

3.2. In the case of receipt of funds without reference to an order or sale, the funds are accounted for as an advance payment under the specified agreement and are subsequently subject to offset against payment for sales using the FIFO method.

3.3. If there is no sales document or Order for this counterparty, then such a document must be created by the manager within 4 days from the date of receipt of the advance, or a letter must be prepared regarding the offset of this amount under another agreement and agreed upon with the buyer, otherwise such advances are considered to have been transferred incorrectly and, after reconciliation, are subject to return to the sender of funds.

3.4. The accountant who records the relevant bank statement is responsible for determining the department that receives the funds.

3.5. If upon receipt of funds it is impossible to determine the department receiving the funds, then such advances received are accounted for in a separate subaccount to account 76. A reconciliation is made and signed with the sender of the funds by the accountant, possible debts with other organizations are identified for offset, otherwise the amount of overpayment is subject to returned to the counterparty by his letter, or independently after 1 month from the date of receipt. The chief accountant is responsible for the timely return of amounts received, erroneously transferred by counterparties.

3.6. Time limits for monitoring advances received. The critical closing date for advances received is:

3.6.1. If the advance payment was received according to the “Buyer’s Order” - the date specified in the “Shipment” field;

3.6.2. If the advance payment was received without a “Buyer’s Order”, or the date is not specified in the “Shipment” field, then the date of receipt of the advance payment plus 30 days is taken.

3.7. To monitor the timeliness of closing accounts receivable from customers, the report “Register of accounts receivable and payable by customers” is used.

3.8. Accounts receivable managers are responsible for the timely use of the buyer's advance to close its receivables.

3.9. The report “Register of accounts receivable and payable by customers” with comments on overdue debts is provided by e-mail (Excel format) to the financial director weekly, on Thursdays until 14-00.

The developed register of receivables and payables of customers allows you to simultaneously group both receivables and payables of customers in the context of different divisions and legal entities of the company:

Moreover, if the advance payment is overdue, then the closing date of the advance payment is highlighted in red.

The report grouped in this way allowed us to see in one place the picture of mutual settlements for all buyer contracts. Working with this report made it easier to find information about unclosed sales documents and immediately eliminated questions about the timeliness of incoming payments for them. Since the report allows you to see information in the context of all legal entities of the company, it has become much easier to prepare documents for offset of counter obligations.

Regulations for the control of advances allowed the company's accountants to more accurately and unambiguously classify the incoming payment: now the accounting department accounts for excessively transferred funds in a separate subaccount to account 76 and does not charge VAT payable on them, which allows us not to divert funds to pay VAT or the single tax ( under the simplified tax system) according to them. And this is especially true in conditions of a shortage of free funds.

As a result of the implementation of this regulation, the measures taken to inventory accounts payable and return excessively transferred amounts previously taken into account in advances on account 62, made it possible to simultaneously reduce VAT payments to the budget by almost 70 thousand rubles.

Altai Financial Consulting Center

How to prepare an invoice for advance payment?

There are no approved requirements for filling out the document. However, this does not mean that each manufacturer or seller fills it out differently. The invoice for advance payment should indicate

:

- information about the company: name, legal address, details and contact details;

- details of the seller of goods or services;

- buyer data: full name, passport, address and telephone number;

- what product or service is being purchased;

- quantity (if the product is sold in bulk);

- unit price;

- total price;

- the date the invoice was issued and the period within which it must be paid.

Attention! Additionally, you can specify the name of the payment, which must be indicated during the transfer of funds.

The document must be signed by an accountant or other person who has a power of attorney to do so. In addition to the signature, the full name of the signatory is included. Everything is secured with a seal.

It is important to consider that the advance amount must be recorded in the sales book. After receiving the funds, issue an invoice

. In this case, a separate invoice must be drawn up for each advance received.

Advance and tax accrual

According to the law, if the seller has received an advance from the buyer, he must remember to charge VAT on it.

So, on the basis of paragraph 2 of Art. 153 of the Tax Code of the Russian Federation, when determining the tax base for VAT, revenue from sales (sales) is determined based on all income of the payer associated with settlements for payment for goods (work, services) received by him in cash or in kind.

Moreover, as a general rule, the law considers the earliest of the following dates to be the moment of determining the tax base (clause 1 of Article 167 of the Tax Code of the Russian Federation):

- day of shipment or transfer of goods/works/services;

- the day of payment or partial payment for upcoming deliveries of goods/performance of work/provision of services.

Simply put, having received an advance payment for the supply of goods, performance of work or provision of services, the seller must charge VAT for payment to the budget. The calculated rate will be 20/120 or 10/110 (clause 4 of article 164 of the Tax Code of the Russian Federation).

The choice of tax rate (0%, 10% or 20%) depends on the rate at which the law (Article 164 of the Tax Code of the Russian Federation) applies to the sale of specific goods, performance of work or provision of services for which the seller (supplier) received an advance .

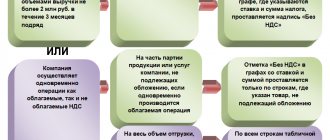

Issuing advance invoices

Many people are interested in the question in what cases is it possible to issue an invoice for an advance payment. The basis for the formation of a document is any fact of prepayment for services, work or goods that are subject to VAT. But there are three exceptions to this general rule:

- The advance payment is paid for the supply of goods that are included in a special list of the Government of the Russian Federation as goods with a long production cycle.

- Advances that are classified as export shipments.

- The advance goes to the company, which has been released from its duties as a tax payer. Exemption is granted to companies whose activities record revenues not exceeding 2 million rubles for three months in a row.

Deadline for issuing an advance invoice

But when is the invoice issued for the advance payment due? According to the law, when selling goods, performing work or providing services, an invoice is issued no later than 5 calendar days, counting the day of shipment of goods (performance of work, provision of services).

Accordingly, an “advance” invoice must also be issued within 5 calendar days from the date of receipt of the advance payment. This is stated in paragraph 3 of Art. 168 Tax Code of the Russian Federation.

When the last day of the period for issuing an advance invoice falls on a weekend or a non-working holiday, it must be issued no later than 1 working day following such a day (clause 7, article 6.1 of the Tax Code of the Russian Federation).

Example:

Issue an advance invoice no later than five calendar days from the date of receipt of the advance payment (clause 3 of Article 168 of the Tax Code of the Russian Federation). For example, the advance payment was received on January 29, 2021. You can issue an invoice on any of the following days: January 29, January 30, January 31, February 1 or 2, 2020.

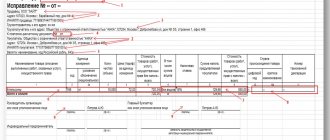

How to fill out an advance invoice

- It is recommended to include the serial numbers of these documents in letter No. 03-07-11/427 of the Ministry of Finance of the Russian Federation in one list with shipping documents.

- If an advance payment is made when the contract has not yet been concluded, it is better to reflect the generalized (aggregated) name of the supplied products in the invoice, and indicate the VAT rate as 18/118 - another recommendation in letter No. 03-07-15/39 of the Ministry of Finance.

- For ease of storage and use, advance invoices can be marked with certain marks, such as the name of a specific supplier. This will not make the documents invalid.

- The advance invoice must be signed by the head of the organization and its chief accountant (or persons replacing them). An individual entrepreneur signs the document personally and at the same time indicates information about its state registration. The same rules apply to shipping invoices, and adjustments are made in the same way.

Sometimes the contract provides for a number of deliveries. Then the partial prepayment can be offset in installments against payment for subsequent deliveries. This ensures the interests of the seller in the event that any delivery remains unpaid. And he can take into account the “unused” amount remaining from the advance in repayment of the debt. Only in this case may difficulties arise with advance VAT for each of the contracting parties.

When it is not necessary to issue an invoice for an advance payment

An invoice for an advance payment for a transaction is not issued if the advance is received against future supplies of goods (performance of work, provision of services) that satisfy one of the following conditions (paragraph 3 of clause 17 of the Rules, approved by Decree of the Government of the Russian Federation dated December 26. 2011 No. 1137):

- have a production and manufacturing cycle duration of more than six months;

- are taxed at a VAT rate of 0%;

- are not subject to taxation (exempt from VAT).

According to the Russian Ministry of Finance, it is also not necessary to issue an invoice for prepayment if the shipment occurred within 5 calendar days from the date of receipt of the advance payment for this shipment (letter dated November 10, 2016 No. 03-07-14/65759).

Thus, the deadlines for issuing advance invoices have not changed recently.

If you find an error, please select a piece of text and press Ctrl+Enter.

Advances for utilities without an invoice

If the supplier, after receiving the advance payment, does not issue an invoice to the buyer, this is a violation of the procedure established in paragraphs 1 and 3 of Art. 168 Tax Code of the Russian Federation. But to hold the supplier liable under Art. 120 of the Tax Code of the Russian Federation, the tax inspectorate can do so only if he did not issue an invoice at all when receiving the advance payment. If the supplier followed the procedure that was in force before January 1, 2009 (when receiving an advance payment, he wrote out an invoice in one copy and took it into account in the Sales Book), it will not be possible to attract him under this article. After all, he will have an invoice for the advance payment in his hands. And for the fact that he did not send another copy to the buyer, the current legislation does not provide for liability.

The organization makes prepayments to suppliers for communication services, gas, electricity, etc. However, prepayment invoices have not been received from all suppliers. Is failure to issue invoices for advances received a violation? How is this situation reflected in the buyer’s accounting?

08 Feb 2021 juristsib 2301

Share this post

- Related Posts

- Article 228 as amended for 2021

- What Subsidies Are Available to Large Families in 2021?

- Calculation of housing and communal services compensation for large families in 2021

- Inflation coefficient for compensation for health damage to Chernobyl victims 2020 2020

Actions after receiving ASF from the supplier

An invoice for an advance payment received by the buyer must be registered in the prescribed manner (for details about what an advance invoice is and what it is needed for, read, and from this article you will learn in what cases it is issued and what is the time frame for issuing this document) . To do this, you must register it in the purchase book, where you should note the appropriate information about the account.

If you work with documents in electronic form, you can register an account using the appropriate programs. This can be done either manually or automatically.

Then, at the end of the current period in which the document was drawn up, it must certainly be submitted to the local inspectorate for its registration and the possibility of exercising the rights to the necessary deductions. No other actions are required with issued advance invoices.

When a seller receives money from a client, he must do the following:

- Subtract VAT from the received amount and make an entry for accrual for payment (examples of entries below).

- Prepare an invoice in 5 days (you can find out how to fill out the ASF correctly and within what time frame, and we talked about how to use indexes and prefixes to number various types of invoices).

- Record this account in the sales ledger in the quarter in which the money is received.

- On the day of actual shipment, issue the s/f again on account of the advance payment accepted earlier.

- Send the previously accrued VAT for the shipment for payment.

- And the VAT calculated upon receipt of the prepayment amount is sent for deduction.

- Record the advance invoice in the appropriate purchase ledger.

The buyer needs:

- accept for deduction the VAT noted in the advance invoice received from the supplier;

- allocate VAT on accepted goods and materials invoiced before the payment was made and send it for deduction;

- restore advance tax.

In Moscow and the region they will not refuse a deduction without an advance invoice

We interviewed tax inspectorates in Moscow and the Moscow region to find out how local inspectors resolve the most popular issues regarding advance invoices. In the territorial tax inspectorates, we found out, firstly, whether it is possible to deduct VAT on a shipment invoice if the seller did not issue an advance invoice. And secondly, will the inspection fine a seller who has not issued an advance invoice (for example, if prepayment and shipment occurred within five days).

Lucky companies that are registered with the capital's Federal Tax Service No. 14, 17

and

21

.

Here, failure to issue an advance invoice when the difference between shipment and payment is five days is not considered a violation. But the most advanced inspectors work in the capital’s inspections No. 1, 5, 13, 21

and in the Moscow Region

Inspectorate of the Federal Tax Service for the city of Dmitrov

. Here they believe that advance invoices are not needed at all if shipment and payment occurred during the same tax period and the lack of documents did not result in a reduction in the tax base.

We recommend reading: How to get a certificate for a social scholarship in 2021

In what reporting documents is it recorded?

After the prepayment for the transaction has been made and the ASFs have been created, they need to be registered.

For this purpose, as already mentioned, purchase/sales books held by the buyer and supplier are used.

Also, instead of using books, it is possible to register accounts using electronic programs (for example, 1C). How to reflect the receipt of these documents will be described below.

At the same time, regardless of the method used to prepare invoices, the period for their registration should not exceed five days from the date of receipt (in some cases determined by law - within a month).

Registration options

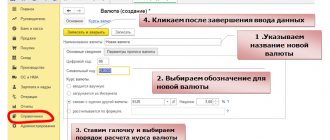

When registering an account in the 1C program, there are several ways to register it.

- Always register when receiving an advance. If you select this option, all advance invoices received will be recorded automatically for each accrued amount, with the exception of advances that were offset on the day of receipt.

- Do not register credits within 5 days. In this case, invoices will be created only for those amounts that were not credited within five days from the date of receipt. This method helps to implement the requirement in the Tax Code to register accounts within 5 days (Article 168).

- Amounts credited before the end of the month are not recorded. This registration option is not suitable for all cases (otherwise you may receive a fine for late registration).

You need to choose it only in situations where the supply of goods or services occurs continuously in relation to the same person.It is suitable for advance payment for Internet access, communication, electricity services, as well as in other similar situations.

The fact that such a practice is not a violation was clarified in a letter from the Ministry of Finance dated March 6, 2009. In this case, invoices of this kind must be issued no later than the 5th day of the month following the month of transfer of the advance.

For example, the services of an Internet provider were paid in advance for July. In such a situation, the advance invoice will need to be issued no later than July 5 of the same year.

- Do not register accounts offset until the end of the tax period. The use of this clause is quite controversial and may cause disagreements with the tax authorities. It should be used only by those companies that are ready to defend their position.

The ability to choose this option is due to the following: there is an opinion that the name “advance payment” should not apply to payments accrued in the same period in which the shipment occurs, since then they do not correspond to the very concept of “advance payment”.And if so, then there is no need to prepare advance accounts for the current period. However, it should be said once again that if you choose this option, disputes with the tax service will be ensured.

- Do not register incoming payments as advance payments at all. It is suitable only for organizations designated in the Tax Code in Article 167. These include companies with a long production cycle of final products exceeding 6 months.

Failure to issue invoices for advance payments can lead to consequences

Suppliers of electricity, oil, gas, communication services (that is, when there are continuous long-term supplies to the same buyer) can draw up invoices for advances received during the month once a month no later than the 5th day of the next month.

Is it necessary to issue an invoice for the advance payment?

But I still adhere to the norms of the Tax Code of the Russian Federation in order to avoid disputes with tax authorities. Moreover, the letters are of a private explanatory nature. And I wouldn’t want complex legal proceedings.

- The invoice is issued again on the day the shipment is made.

- VAT calculated on the amount is sent for payment.

- Direction to deduct VAT calculated upon receipt of prepayment.

- Registers issued shipping documents in the sales book.

- Registers an advance invoice in the purchase book.

In manual mode

There are two main ways to register ASF in the 1C program. The first one is the manual method. It is suitable when you have to register a small number of accounts. Instructions:

- In order to draw up a document in this way, you need to select the button in the documents for advance payment section: create based on. From the options that appear, select “invoice issued.”

- Once this item is selected, a separate account window will appear.

- After this, you only need to check that all the data is filled out correctly and click on the “conduct” icon, after which the document will be completed.

Automatically

In a situation where there are a lot of incoming invoices, registering them manually becomes inconvenient and time-consuming. In this case, it is better to set automatic registration. Instructions:

- To do this, you need to go to the “banks and cash desks” subsection, where you can find “advance accounts.” After selecting this item, a window will appear in which you should select the period for which documents will be generated.

- Then you need to click the “fill in” button and select all unregistered accounts. At the same time, the list can be easily adjusted and, if necessary, delete unnecessary ones or add new documents.

- When all the necessary advance invoices from the supplier have been selected, all that remains is to click on the “execute” button, after which they will be processed - this way all the rules of ASF offset will be observed. The list of all completed documents can be opened at any time by clicking on the link: “ open a list of advance accounts."

Which transactions correspond to the issued document?

When an advance payment is received, a transaction is generated that records the funds received in the account of the service provider (seller). Then, after the advance invoice is prepared by the seller and received by the buyer, the completed invoices are posted when they are registered.

This can be done either on an individual account basis or in a generally automated manner (as explained earlier).

The seller's wiring will be something like this:

- debit 51 Credit 62ав – advance money received from the buyer;

- debit 62av. Credit 68 – the accrual of added tax, which is allocated from the advance payment, is noted;

- debit 62 Credit 90.1 – income from the sale of inventory and materials is noted in the advance account;

- debit 90.3 Credit 68 – VAT is charged on the sales transaction;

- debit 68 Credit 62av. – advance VAT is accepted for deduction;

- debit 62av. Credit 62 rub. – prepaid money is counted.

And in accounting:

- Deb. 60 av. Credit. 51 – receiving an advance.

- Deb. 68 Cred. 60 Av – tax on prepayment is deductible.

- Deb. 19 Cred. 60 rubles – tax is allocated according to the goods and materials received.

- Deb. 68 Cred. 19 – income tax is accepted as a deduction.

- Deb. 60 av Cred. 68 – advance VAT restored.

- Deb. 60 RUR Credit. 60 Av – advance payment is counted.

As can be seen from the content of this article, the use of electronic programs for registering various accounts (including advance accounts) is preferable. It allows you to store all the necessary information in one place, and due to the interconnectedness of documents, the possibility of making errors in them is minimal.

In addition, mass automatic filling of documents allows you to significantly save working time.