Who should report for 2021

Organizations and individual entrepreneurs are required to submit to the Federal Tax Service at the end of each year information on the average number of employees for the past year. However, individual entrepreneurs who did not hire employees last year do not have to submit such reports (paragraph 6, paragraph 3, article 80 of the Tax Code of the Russian Federation).

Thus, the following are required to submit a report to the tax office on information about the average headcount in 2021:

- all organizations, regardless of whether they have employees;

- Individual entrepreneurs who hired at least one employee under an employment contract in 2021.

Where is the calculation procedure established?

The average number of employees is indicated in reports to various regulatory authorities:

| Supervisory authority | Report | Deadline |

| Inspectorate of the Federal Tax Service | Information on the average number of employees for the previous year | Until January 20 |

| FSS | 4-FSS | Quarterly until the 20th (on paper) or 25th (electronically) of the month following the reporting quarter |

| Rosstat | P-4 | Quarterly until the 15th of the next month |

| 1-T (annual) | Until January 20 next year |

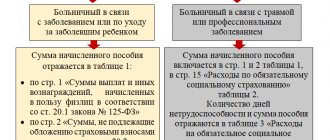

But the procedure for calculating the indicator is established by Rosstat in Order No. 772 dated November 22, 2017. Information on the 4-FSS report - the average number of employees of the organization - will be considered further below.

Report due date 2021

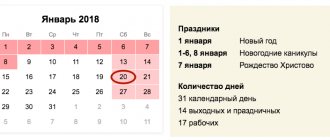

The deadline for submitting information for 2021 is 01/21/2019.

Thus, after returning to work in January 2021, accountants will have 8 working days to fill out and submit reports on the average headcount for 2021. Moreover, this information can be submitted directly on January 21, 2021 - this will not be considered a violation (paragraph 6, paragraph 3, article 80 of the Tax Code of the Russian Federation).

How part-time employees are counted

There are nuances to accounting for those employees who work part-time. Thus, those for whom part-time work is established by law (disabled people employed in hazardous or difficult working conditions) are taken into account in the calculation as full units.

But if an employee works part-time by agreement with the employer, then he must be taken into account in a special way. For such employees, the average number of part-time employees is calculated:

In this case, both the days you go to work and the days you are on vacation and sick leave are taken into account. In this case, for the day of absence, the number of hours equal to those worked on the last day of work is taken into account.

Example.

Manager Ivanov Ivan Ivanovich, in agreement with the employer, works on Monday, Wednesday and Friday for three hours. Similar positions in the organization have a typical five-day work schedule. Timesheet of Ivanova I.I. for January looks like this:

According to the usual five-day schedule in October 2021, there are 184 hours. The employee worked 39. In calculating the average number of employees, it is necessary to include:

To avoid confusion about how and who to include in the calculation, use our hint table:

| Employee category | How is it included in the calculation? |

| Full time | Like a whole unit |

| The employee was on sick leave for the entire month, but according to the employment contract he works full time | Like a whole unit |

| The employee was on vacation for half a month, but according to the employment contract he works full time | The whole month is like a whole unit |

| The employee did not work due to maternity and child care leave | The entire period of maternity leave and childcare is not included in the calculation. |

| An employee on maternity leave works part-time | Like a whole unit |

| External part-time worker | Not included in calculation |

| The employee works in two positions: one at his main place of work, and the second as an internal part-time worker | As one whole unit, internal part-time work is not taken into account |

| Individuals who performed work under a contract | Not included in calculation |

| The employee has a reduced working day in accordance with the law | Like a whole unit |

| The employee has a reduced working day in agreement with the employer | Proportional to time worked (see calculation above table) |

Which employees should be included in the headcount?

Recommendations for filling out information on the average number of employees are in the letter of the Federal Tax Service dated April 26, 2007 No. CHD-6-25/353. The categories of employees that need to be taken into account in the calculation are presented in the table. Do not count employees who are not on the list.

| Employee category | How is the number taken into account? | |

| Regular full-time employees (including probationary employees) | The number of such employees is fully taken into account | |

| Employees hired to replace absent employees (for example, a woman on maternity leave) | The number of such employees is fully taken into account | |

| Employees with fixed-term employment contracts | The number of such employees is fully taken into account | |

| Internal part-timers | Counted as one unit when calculating | |

| External part-timers | When calculating the average headcount, this indicator is not taken into account | The average number of such employees is determined in terms of full-time employment (by dividing the person-days worked by the number of working days according to the calendar in the reporting month) |

| Employees on sick leave | The number of such employees is taken into account in full (regardless of the actual time worked) | |

| Employees on leave (annual or additional) | The number of such employees is taken into account in full (regardless of the actual time worked) | |

| Employees who are on leave without pay (regardless of the length of leave) | The number of such employees is taken into account in full (regardless of the actual time worked) | |

| Employees who are: – on maternity leave; – on leave in connection with the adoption of a newborn child; – on maternity leave | Do not take into account the number of such employees when calculating. Exception: employees who are on parental leave if they work part-time or from home while maintaining the right to receive benefits | |

| Seconded employees, if they maintain average earnings (including for short-term business trips abroad) | The number of such employees is fully taken into account | |

| Homeworkers | The number of such employees is fully taken into account | |

| Employees who are required by law to have reduced working hours (minors, disabled people of groups I and II, employees of hazardous industries, etc.) | The number of such employees is fully taken into account | |

| Employees who are employed part-time or part-time (in accordance with the employment contract or with their consent) | When calculating the average headcount, such employees are taken into account in proportion to the time worked | The average number of such employees is determined in terms of full-time employment (by dividing the person-days worked by the number of working days according to the calendar in the reporting month) |

| Employees transferred to part-time work at the initiative of the administration (without written consent) | The number of such employees is fully taken into account | |

| Employees temporarily sent from other organizations (if they do not retain the average salary at their main place of work) | The number of such employees is fully taken into account | |

| Full-time employees with whom civil law contracts have additionally been concluded | When calculating the average headcount, such employees are taken into account once | When calculating the average number, such employees are not taken into account |

| Freelance employees with whom contracts and other civil contracts have been concluded | When calculating the average headcount, such employees are not taken into account | When calculating the average number, such employees are taken into account for each calendar day as whole units throughout the entire period of the contract, regardless of the period of payment of remuneration |

| Entrepreneurs with whom contracts for construction, paid services and other civil law contracts have been concluded | Do not take into account the number of such employees when calculating | |

| Employees who combine work and study and are on study leave while maintaining their average earnings | The number of such employees is fully taken into account | |

| Employees who combine work with training and are on vacation at their own expense | Do not take into account the number of such employees when calculating | |

| Employees who have been granted leave at their own expense in connection with passing entrance exams to a university, college, etc. | Do not take into account the number of such employees when calculating | |

| Employees sent for training (upgrading their qualifications, acquiring a new profession) outside of work (if they maintain average earnings) | The number of such employees is fully taken into account | |

| Citizens (military personnel and persons serving sentences of imprisonment) recruited for work under special contracts with government organizations for the provision of labor and included in the average number of employees | When calculating the average number of employees, such employees are taken into account as whole units based on the days they report to work. | When calculating the average number, such employees are not taken into account |

| Employees transferred to work in another organization if their salary is not maintained, as well as those sent to work abroad | Do not take into account the number of such employees when calculating | |

| Citizens with whom a student agreement for vocational training has been concluded (with a scholarship) | Do not take into account the number of such employees when calculating | |

| Employees who submitted a letter of resignation and stopped working before the expiration of the notice period or stopped working without warning the administration | When calculating, do not take into account the number of such employees from the first day of absence from work. | |

| Owners of an organization who do not receive a salary | Do not take into account the number of such employees when calculating | |

| Members of the cooperative who have not concluded employment contracts with the organization | Do not take into account the number of such employees when calculating | |

| Lawyers | Do not take into account the number of such employees when calculating | |

| Military personnel in the performance of military service duties | Do not take into account the number of such employees when calculating | |

| Owners of an organization receiving a salary | The number of such employees is fully taken into account | |

| Full-time employees who actually showed up for work (including those who did not work due to downtime) | The number of such employees is fully taken into account | |

| Employees who did not show up for work due to the performance of state or public duties | The number of such employees is fully taken into account | |

| Employees with special titles | The number of such employees is fully taken into account | |

| Students and students of educational institutions working in organizations during practical training, if they are enrolled in jobs (positions) | The number of such employees is fully taken into account | |

| Employees who were: – idle (both at the initiative of the employer and for reasons beyond the control of him and the employee); – on unpaid leaves at the initiative of the employer | The number of such employees is fully taken into account | |

| Employees who took part in strikes | The number of such employees is fully taken into account | |

| Employees working on a rotational basis | The number of such employees is fully taken into account | |

| Employees under investigation pending a court decision | The number of such employees is fully taken into account | |

| Employees temporarily absent from work due to the fact that the administration granted them time off for overtime | The number of such employees is fully taken into account | |

| Employees temporarily absent from work due to absenteeism | The number of such employees is fully taken into account | |

Calculation of the average number of employees

The formula for the average number of employees is as follows:

Per month:

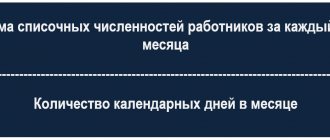

SCHR (per month) = ∑SCR days / K days, where SCR (per month) is the average number of employees per month, ∑SCR days is the amount of SCR days (for each calendar day of the month) K dn is the number of calendar days of the month.

In a year:

The average number of employees for the year is calculated by adding the average number of employees (for all months) and dividing the resulting amount by 12:

NBR (per year) = (∑NBR month) / 12, where NHR (per year) is the average number of employees per year, ∑NBR month. — the amount of cash reserves (for all months of the reporting period).

Calculation of the average number of employees must be made taking into account the following features:

- number of employees on a day off (holiday) = list number of employees for the previous working day;

- the calculation of the average number of employees should be based on the daily accounting of the social worker (with clarification of orders for the transfer or hiring of employees, as well as in the event of termination of the employment contract);

- the number of employees on the payroll in the presence of two or more days off (holidays or non-working days) in a row = the number of employees on the payroll for the previous day off.

How to calculate the average number of employees who worked part-time

The average number of employees who worked part-time is calculated in proportion to the time worked.

The calculation procedure is as follows:

1. The total number of man-days worked by the employee is calculated. To do this, the total number of man-hours (for example, for the reporting month) is divided by the length of the working day (which is established in the organization - 8 hours, 4.8 hours, etc.).

Kchdn = ∑Kchh / Trab, where

Kchdn - total number of man-days worked ∑Kchhour - total number of man-hours for the reporting month Trab - duration of the working day

2. The average number (for the reporting month) of part-time workers is calculated, taking into account the conversion to full employment.

Thus, the number of person-days worked is divided by the number of calendar working days (in the reporting month).

SChR (incomplete) = Kchdn/Krdn, where

SChR (part-time) - the average number of part-time workers (for the reporting month) Kchdn - the number of calendar working man-days Krdn - the number of calendar working days (in the reporting month).

It must be taken into account that:

- employees who have reduced working hours according to the legislation of the Russian Federation (including disabled people) are taken into account in the average number of employees as whole units;

- employees who were transferred by the enterprise administration to part-time work (at the initiative of the administration) are taken into account in the average number of employees as whole units.

Sample of filling out a report in 2021 (number for 2021)

Now, using an example, we will show a specific example of filling out information on the average number of employees for 2021, which must be submitted no later than January 21, 2021. In your report, show:

- TIN and checkpoint;

- company name or full name individual entrepreneur;

- average number of employees (persons);

- data as of January 01, 2021;

- data of the manager or representative;

- date and signature.

A sample of filling out the main part of the form for information on the average number of employees for 2021 will look like this:

Certificate of average number - example

The form is placed on one sheet and includes a minimum of indicators. Externally, the form resembles the title page of any reporting declaration or calculation. Recommendations for specifying data are contained in Letter No. CHD-6-25 / [email protected] dated April 26, 2007. What information is reflected in the form?

List of required data in the certificate of average headcount:

- INN and KPP of the taxpayer - information is entered in accordance with the registration documentation of the enterprise or individual entrepreneur. Entrepreneurs do not fill out the checkpoint.

- Line “Submitted in...” – you should fill in the exact name of the Federal Tax Service and the inspection code.

- Name of organization/individual entrepreneur – this line provides the full exact name of the legal entity or full name of the businessman.

- Line “Average headcount” - here indicates the headcount indicator (average) calculated according to regulatory rules as of 01.01 of the calendar year that precedes the current delivery period. In some cases, the calculation is performed on the 1st day of the month preceding the creation of a business or its reorganization.

- Block confirming the accuracy of the data - here the report is signed by the director of the legal entity or entrepreneur, and the date of generation of the document is indicated.

- Block with data for employees of the Federal Tax Service Inspectorate - this section is not compiled by the taxpayer, since it is intended to be filled out by specialists of the territorial division of the Federal Tax Service Inspectorate.

Note! For more information on how to correctly determine the average number of personnel, see Order of Rosstat No. 498 dated 10.26.15, Instructions dated 09.17.87.

and a sample certificate of average number - here:

(Form) Certificate of average number of employees

(Sample of completion) Certificate of average number of employees

Methods for submitting a report in 2019

Information on the number of employees – special reporting. There are no mandatory requirements for the method of submitting such information. In 2019, you can submit them to the tax office:

- or on paper (through a representative, by mail);

- or in electronic form via telecommunication channels.

This follows from paragraph 3 of Article 80 of the Tax Code. The electronic format of information on the number was approved by order of the Federal Tax Service dated July 10, 2007 No. MM-3-13/421.

Read also

21.08.2018