Dismissed employees are included in the DAM

Section 3 of the DAM is filled out by the payer for all insured persons in whose favor payments and other remunerations were accrued during the reporting period, including those dismissed in the previous reporting period. Such explanations are given by the Federal Tax Service in a letter. At the same time, the attribute of the insured person is indicated, including for dismissed persons, “1” - is the insured person and the corresponding category code of the insured person, for example “NR”. If the personalized information about the insured persons does not contain data on the amount of payments and other remuneration accrued in favor of an individual over the last three months of the reporting (calculation) period, subsection 3.2 of section 3 of the calculation is not completed.

Consequently, for insured persons who have not received payments or other remuneration for the last three months of the reporting (calculation) period, the payer fills out section 3 of the calculation, with the exception of subsection 3.2.

RSV 2021 section 3 dismissed employees

The DAM is drawn up in accordance with the form approved by order of the Federal Tax Service of Russia No. ММВ-7-11 / [email protected] dated October 10, 2021. The same document also contains the procedure for filling out the form.

Instructions for entering information into the RSV form:

- The title page must be completed by all policyholders. Information about the employer is indicated (TIN of the organization, KPP (for legal entities), organizational and legal form, OKVED-2, contact phone number), document correction number, reporting period code, calendar year, number of pages of the document. In the second part of the title page, information about the official who signs the form is entered. Indicate full name, personal signature, date of filling out the DAM;

- The first section is completed. This displays information about insurance premiums that the employer calculates from the salaries of his subordinates. The budget classification code is indicated;

- The third section is completed. Personalized information is provided separately for each employee. The employee’s TIN, SNILS, citizenship, gender, date of birth, series and passport number are indicated. A note is made as to whether the subordinate is insured or not. Completing section 3 for resigned employees has some features. Information is not entered into subsection 3.2 if no accruals were made for the reporting period. In this case, only information is provided that allows the identification of employees with whom the employment contract was terminated.

We invite you to familiarize yourself with: Rules for vehicle insurance of Rosgosstrakh

When filling out the document, you should adhere to the following rules:

- number the pages by putting “001”, “002”, “003”, etc. in the corresponding cells;

- text fields should be filled in from left to right in block letters;

- write decimal fractions in two genders;

- At the end of each page put a date and signature.

23.07.2018

It is important to remember the fact that due to the transfer of powers to administer insurance contributions to the tax services, from the beginning of 2021 all enterprises, their separate divisions and individual entrepreneurs must report to the territorial tax authorities.

The current form, in each specific case, may include only 3 sections.

In this case, the attribute of the insured person is indicated - “1” (is an insured person), in column 200 the category code of the insured person is entered (for example, “NR”).

But here another question arises: is it necessary to fill out section 3 of the calculation for those employees who were dismissed in the previous reporting period, and in the current reporting period the company did not accrue or pay anything to them? In the commented letter, the tax authorities said that in such a situation, section 3 still needs to be completed, with the exception of subsection 3.2.

Calculation of contributions: indicate former employees in section 3 or not. Attention

The Federal Tax Service of the Russian Federation, in its letter dated March 17, 2019 No. BS-4-11/4859, reported how to fill out calculations for insurance premiums in relation to dismissed workers. Let us remind you that from January 1, 2021, the Federal Tax Service administers insurance

Does this mean that the tax authorities insist on including former employees who were not paid after their dismissal in the calculation?

It must reflect all payments accrued to the employee in January, February and March. If, after dismissal, the employee received payments in April, then Section 3 must be filled out for him and submitted as part of the calculation of contributions for the half-year of 2019.

And reflect in it all payments accrued to the employee in April. If the payer of contributions has not done this, he must submit an updated calculation of contributions for the reporting (calculation) period in which payments were made.

One of these principles is the existence of a period (the Tax Code of the Russian Federation calls it a settlement period - clause 1 of Article 423), during which data is entered into the interim reports in increasing amounts.

It is equal to a year. Reporting periods in it occur quarterly and each have their own length, counted from the beginning of the year.

Due to the uniform rule for displaying data generated in increasing amounts during the billing period, dismissed employees are also included in the DAM.

The fact is that this subsection is not compiled if the personalized information about employees does not contain data on the amount of payments and other remunerations accrued in their favor for the last three months of the reporting (calculation) period (clause

Calculation of contributions: indicate former employees in section 3 or not

From the clarifications issued by the Ministry of Finance (, ), it is only clear that subsection 3.2 “Information on the amounts of payments and other remuneration calculated in favor of individuals...” for such employees does not need to be filled out.

Which is logical, since since there were no payments, there is nothing to include. But it remains unclear whether such dismissed persons should be indicated in subsection 3.1 “Data about the individual recipient of the income.” Recently, the Federal Tax Service issued an explanation (), which states the following: “... in cases of failure to include in the calculation of insurance premiums for the reporting (calculation) period, employees who resigned in the previous reporting period and who did not receive payments in the reporting (calculation) period must be submitted to the tax authority by place of registration, an updated calculation of insurance premiums for the reporting (calculation) period, indicating in section 3 of the calculation of all insured persons in whose favor payments and other remunerations were accrued in the reporting (calculation) period, including those dismissed in the previous reporting period.” .

RSV for the 3rd quarter of 2021 - sample filling

RSV stands for calculation of insurance premiums.

Employers must complete this form regularly and submit it to government agencies. Many managers are interested in whether to include dismissed employees in the DAM. The answer to this question can be found in letter of the Federal Tax Service No. BS-4-11/4859 dated March 17, 2021. This document states that the third section indicates all insured persons in whose favor payments or other benefits were made in the reporting quarter, half-year or year. Information about employees who were dismissed in the previous period is also provided.

For example, if during the reporting quarter the company’s accounting department awarded a bonus to an employee with whom the employment relationship ceased in an earlier period, then information about him must be reflected in the DAM. The fact that the civil law or employment contract with this employee was terminated does not matter.

If the employee was dismissed in the previous reporting period, and after that no payments were made in his favor by the company’s management, then there is no need to include such an employee in the third section of the DAM. For example, the employment relationship with a subordinate was terminated in January. Until the end of six months there were no payments in his favor. Information about such an employee will not be displayed in the half-year report.

Since insurance premiums in such a situation turned out to be just part of tax payments, rational actions in relation to the reporting generated on them were:

- creating a summary report form that combines the data that was previously entered into 4 forms:

- RSV-1 in relation to contributions to the Pension Fund and the Compulsory Medical Insurance Fund accrued by the majority of employers;

- RSV-2 in terms of payments to the same funds, but accrued by the heads of farms;

- RSV-3 in relation to contributions aimed at additional social security for employees of certain categories;

- 4-FSS regarding social security contributions for disability and maternity insurance;

- unification of deadlines for submitting the new form, which turned out to be “average” between the deadlines previously in force for submitting RSV-1 and 4-FSS reports to their respective funds.

- RSV-2 in terms of payments to the same funds, but accrued by the heads of farms;

- RSV-3 in relation to contributions aimed at additional social security for employees of certain categories;

- 4-FSS regarding social security contributions for disability and maternity insurance;

- RSV-1 in relation to contributions to the Pension Fund and the Compulsory Medical Insurance Fund accrued by the majority of employers;

There is little new in the content of the consolidated DAM compared to the reports made for the funds.

The reporting periods for insurance premiums are 1 quarter, half a year, nine months and a calendar year.

The calculation we submit in January includes indicators from January 1 to December 31, 2021.

When sending by telecommunications - the day on which your TCS operator recorded the sending of the calculation.

Organizations and separate divisions that pay salaries to employees or performers report at their location. The calculation is submitted on paper “by hand” at the tax office or by mail, but only if the average number of employees for 2021 is not higher than 25 people.

The company employs 16 people.

During the first 6 months of 2021, employees did not take sick leave, no one was fired or hired. All members of the workforce are registered under employment contracts and are insured persons in the pension, social and health insurance systems.

The company submitted the calculation of insurance premiums for the 2nd quarter to the Federal Tax Service on July 20, 2021. Compulsory medical insurance, rub. 22% 2.90% 5.10% 1,525,450.45 115,599.10 15,238.06 26,797.97 2,600,041.85 132,009.21 17,401.21 30,602.13 3,499,895.45 109 977.00 14,496.97 25,494.67 Total for the 1st quarter 1,625,387.75 357,585.3 47,136.24 82,894.78 4,524,782.33 115,452.11

You can conduct a preliminary check of SNILS and TIN using our online service.

The notice states that the divisions are deprived of the authority to accrue payments and other remuneration in favor of individuals. Then the organization submits reporting on insurance premiums only to the tax authority at its location.

The calculation in electronic form is submitted in accordance with the format approved by order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/

“On approval of the form for calculating insurance premiums, the procedure for filling it out, as well as the format for submitting calculations for insurance premiums in electronic form”

If an employment contract with an employee provides for the payment of premiums, allowances, bonuses, then for the specified period the employer should calculate, accrue and pay the remuneration due to the employee.

Attention Insurance premiums in this case are calculated in accordance with the general procedure.

Kulikov’s salary is 17,320 rubles. Which is logical, since since there were no payments, there is nothing to include. But it remains unclear whether such dismissed persons should be indicated in subsection 3.1 “Data about the individual recipient of the income.”

“...in cases of non-inclusion in the calculation of insurance premiums for the reporting (calculation) period of employees who resigned in the previous reporting period and did not receive payments in the reporting (calculation) period, it is necessary to submit an updated calculation of insurance premiums for the reporting period to the tax authority at the place of registration ( calculation) period, indicating in section 3 of the calculation all insured persons in whose favor payments and other remunerations were accrued in the reporting (calculation) period, including those dismissed in the previous reporting period"

In this case, the amount of information about insured persons for the reporting section 3 of the DAM is taken into account in the corresponding columns of line 010 of subsection 1.1 of Appendix 1 to Section 1 of the calculation.

Thus, in cases of failure to include in the calculation of insurance premiums for the reporting period employees who resigned in the previous reporting period and who did not receive payments in the reporting period, it is necessary to submit an updated DAM to the tax authority at the place of registration, indicating in section 3 of the calculation of all insured persons, in to whose benefit payments and other remunerations were accrued in the reporting period, including those dismissed in the previous reporting period.

23.07.2018

We suggest you read: Choosing an insurance or funded pension

Based on the results of 9 months of 2021 and for the entire 2021, policyholders must report to the Pension Fund of Russia using the familiar RSV-1 form (form). But starting from 2021, reporting on contributions will need to be submitted to the tax authorities using a different form, which, by the way, has not yet been approved.

- Full name and SNILS of the individual (in subsection 6.1);

- the amount of payments and remuneration accrued in his favor (in subsection 6.4);

- the amount of contributions accrued from his payments to the compulsory pension insurance (in subsection 6.5);

- the start and end dates of the individual’s work period for the last 3 months of the reporting/billing period (in subsection 6.8). Based on this information, the Pension Fund of Russia will determine the employee’s length of service (clause 37 of the Procedure for filling out the RSV-1).

The RSV-1 report must be submitted to organizations and individual entrepreneurs paying insurance premiums for their employees. The abbreviation itself stands for quite simply – “calculation of insurance premiums”. Previously, this report was required to be submitted to the Pension Fund of the Russian Federation, but after the transfer of insurance premiums to the management of the Federal Tax Service, the reporting must be sent to the tax office.

The Ministry of Finance came to the same conclusion in its letter No. 03-15-07/17273 dated March 24, 2019. The Ministry emphasizes that submitting a zero RSV-1 is a guarantee that a given economic entity will not be classified by the Federal Tax Service as a violator of tax laws, and no penalties will be applied to it.

However, since accruals are no longer made to employees dismissed before the beginning of the last quarter of the reporting period, subsection 3.2 is not filled out for them (clause 22.2 of Appendix 2 to the order of the Federal Tax Service of Russia dated October 10, 2019 No. ММВ-7-11 / [email protected] ). That is, from the data on those dismissed in section 3, only information will be present that allows you to identify this person (subsection 3.1).

Due to the uniform rule for displaying data generated in increasing amounts during the billing period, dismissed employees are also included in the DAM. Information about them will have to be reflected in each of the reports generated for the corresponding period of the year in which the employee quit.

Of course, it is necessary to formulate section 3 for persons in whose favor in the last three months of the reporting period there were payments and remunerations under employment or civil law contracts (clause 22.1 of the Procedure for filling out calculations for insurance premiums, approved by order of the Federal Tax Service of Russia dated October 10, 2021 No. MMV -7-11/551).

What is the procedure for filling out section 3 of the calculation of insurance premiums in 2021, submitted to the Federal Tax Service? How many sections 3 should I fill out? Do I need to fill out 3 for each employee? You will find answers to these and other questions, as well as an example of filling out Section 3, in this consultation.

- title page;

- section 1 (to be completed by all companies);

- section 2 (to be completed by all companies);

- section 3 (filled out by companies that apply reduced insurance premium rates);

- section 4 (information on additional accrued insurance premiums reflected in lines 120 and 121 of section 1 of the RSV-1 Pension Fund form);

- section 5 (it indicates payments and other remuneration that are accrued for activities carried out in the student team under labor and civil law contracts);

- Section 6 (it reflects individual information for each employee of the company).

In 2021, all policyholders report accrued and paid insurance premiums every quarter. The report is filled in with a cumulative total. Therefore, RSV-1 for the 2nd quarter of 2021 must be filled out especially carefully so that errors do not pass from quarter to quarter. To do this, we have prepared instructions for filling out RSV-1 for the 2nd quarter of 2021, how to fill out a report with examples and tips, and a current form.

Here, a separate line must be filled in for each month being adjusted. Moreover, the amounts in columns 6, 7 and 14 may have a minus sign if the taxable amounts have decreased. Be precise, the totals will be transferred to section 1 lines 120 and 121.

We include everyone whose data must be corrected in the list of insured persons. We fill out the data monthly for each employee, do not forget to fill out the field “Incl. additionally accrued”, where we must indicate the difference between the previously accrued and the new value. If the amount has decreased, the field will have a minus sign.

DAM adjustment for the 1st quarter of 2021

> > > Tax-tax February 13, 2021 All materials for the story will be required if in the original version of this report sent to the Federal Tax Service, the tax authority or the report submitter himself discovers errors in calculations or inaccuracies in information about employees.

Read about how to make and submit a DAM with corrective data without negative consequences in our material. Errors of all kinds may occur in the reporting submitted to the tax authority: from typos that do not interfere with understanding what exactly was meant when writing, to data not taken into account in calculations that affect the total of tax payments due.

We recommend reading: Is the owner’s consent required when registering a child?

Insurance premiums, the calculation process of which is reflected in the DAM report, are also included in the latter category starting from 2021. The extension of the provisions of the Tax Code of the Russian Federation to contributions led to the fact that Art.

Section 3 is included in the DAM, even if it is a “null” and a non-profit organization

Until recently, many accountants, reporting for companies where salaries are not calculated, did not take the SZV-M and SZV-STAZH, and passed the DAM without the 3rd section.

Meanwhile, recently the Pension Fund of the Russian Federation, which was previously quite happy with this state of affairs, at the instigation of the Ministry of Labor, spoke out against it. And the other day the Federal Tax Service also took up the “zeros”.

In the letter “On certain issues related to filling out and submitting the DAM,” the fiscal officials explained how NPOs can fill out calculations that do not include salary accruals and contributions. We'll tell you who the Federal Tax Service wants to see in Section 3 of the RSV. At the beginning of April, the Pension Fund of Russia began to announce the need to submit SZV-M and SZV-STAZH to the sole founder of the company, who is its director, who is not paid a salary.

It is noteworthy that previously some branches of the Pension Fund of Russia not only did not insist on this, but, on the contrary, demanded that accountants cancel SZV-M for the founding director without salary. The vector changed after the release of a letter from the Ministry of Labor, which, in general, did not report anything new.

Should the dismissed person be included in section 3 of the ERSV?

Hello! Opinions on this issue are divided. The letter specified in the request contains: a) the first phrase: “Taking into account the above, section 3 of the calculation is filled out by the payer for all insured persons in whose favor payments and other remunerations were accrued in the reporting period, including those dismissed in the previous reporting period " It turns out that we must include in the report those fired, but for whom there are accruals in the reporting period. b) phrase two: “In accordance with clause 22.1 of the procedure, section 3 of the calculation is filled out by payers for all insured persons for the last three months of the billing (reporting) period, including in whose favor payments and other remunerations were accrued during the reporting period.” The same letter provides a link to the definition of an insured person: “Article 7 of the Federal Law of December 15, 2001 N 167-FZ “On Compulsory Pension Insurance in the Russian Federation” determines that insured persons are persons who are covered by compulsory pension insurance in accordance with this Federal Law, including those working under an employment contract or under a civil law contract, the subject of which is the performance of work and the provision of services.” It turns out that the filling must be for all insured persons for the last three months . Employees dismissed in the last quarter no longer work for the organization under an employment contract and are not insured persons of the organization. c) phrase three: “According to clause 22.2 of the procedure, if the personalized information about the insured persons does not contain data on the amount of payments and other remunerations accrued in favor of an individual for the last three months of the reporting (calculation) period, subsection 3.2 of section 3 of the calculation is not filled out.” . Already selected insured persons may not have accruals. For example, this could be an employee on long-term leave without pay. He is our employee, which means he is an insured person, and he has no accruals in the reporting period. A link to the ITS for the algorithm for filling out the report, according to which those fired without accruals are not included in the report - https://its.1c.ru/db/strahrep#content:34765:zup30 But the letter is also interpreted differently. The Chief Accountant proposes to include those dismissed in the report (https://www.1gl.ru/#/document/11/17547/bssPhr720/?of=copy-72beb03a82), although it is written below that it is not necessary to include the dismissed in section 3. The Russian tax courier on the ITS website - https://its.1c.ru/db/buhmag#content:20950:hdoc writes that it is safer to include in Section 3 all employees from the beginning of the year, incl. fired because the report is submitted for six months (see Rule 4. Include resigned employees in the DAM).

What opinion to adhere to and argue or not with the tax office is up to you to decide.

To be or not to be fired in section 3 of the calculation of contributions?

→ The article from the magazine “MAIN BOOK” is current as of December 8, 2021.

E.A. Sharonova, leading expert We spoke in

, . The conclusion was this: there are no payments after dismissal - there is no section 3 for former employees.

But from the latest letters from the Ministry of Finance and the Federal Tax Service, one can draw the opposite conclusion. Let us recall that from the Procedure for filling out the calculation of contributions it follows that section 3 must be completed for the last 3 months of the reporting period (in other words, for the last quarter) for all insured persons who in these months payments and other remuneration were accrued. If no payments were accrued to the insured persons in the reporting quarter, then subsection 3.2 of section 3 does not need to be filled out for them.

How to fill it out correctly?

The DAM is drawn up in accordance with the form approved by order of the Federal Tax Service of Russia No. ММВ-7-11 / [email protected] dated October 10, 2021. The same document also contains the procedure for filling out the form.

Instructions for entering information into the RSV form:

- The title page must be completed by all policyholders. Information about the employer is indicated (TIN of the organization, KPP (for legal entities), organizational and legal form, OKVED-2, contact phone number), document correction number, reporting period code, calendar year, number of pages of the document. In the second part of the title page, information about the official who signs the form is entered. Indicate full name, personal signature, date of filling out the DAM;

- The first section is completed. This displays information about insurance premiums that the employer calculates from the salaries of his subordinates. The budget classification code is indicated;

- The third section is completed. Personalized information is provided separately for each employee. The employee’s TIN, SNILS, citizenship, gender, date of birth, series and passport number are indicated. A note is made as to whether the subordinate is insured or not. Completing section 3 for resigned employees has some features. Information is not entered into subsection 3.2 if no accruals were made for the reporting period. In this case, only information is provided that allows the identification of employees with whom the employment contract was terminated.

When filling out the document, you should adhere to the following rules:

- number the pages by putting “001”, “002”, “003”, etc. in the corresponding cells;

- text fields should be filled in from left to right in block letters;

- write decimal fractions in two genders;

- At the end of each page put a date and signature.

Filling out the DAM form for dismissed employees

If during the reporting quarter payments were accrued to individuals, including those who were dismissed or those whose employment was terminated in the previous quarter, then information about them is included in section 3 of the calculation of insurance premiums. If during the reporting quarter payments were accrued to individuals, including dismissed or those with whom the employment contract was terminated in the previous quarter, then information about them is included in section 3 of the calculation of insurance premiums. The form of calculation of insurance premiums on the DAM and the procedure for filling it out were approved by order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11 / (hereinafter referred to as the Order). The tax period for insurance premiums is a calendar year.

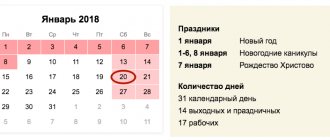

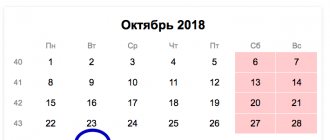

Reporting periods – I quarter, I half of the year, 9 months. The calculation is submitted no later than the 30th day of the month following the billing (reporting) period, taking into account the rule for postponing the date if it coincides with weekends or holidays (clause

We recommend reading: Letter to correct the text in the application

7 tbsp. 431 of the Tax Code of the Russian Federation). Section 3 is intended to reflect the personal data of insured persons in the DAM calculation.

Is it necessary to show in the DAM employees who were laid off in the last quarter or half of the year?

RSV stands for calculation of insurance premiums. Employers must complete this form regularly and submit it to government agencies. Many managers are interested in whether to include dismissed employees in the DAM.

The answer to this question can be found in letter of the Federal Tax Service No. BS-4-11/4859 dated March 17, 2021. This document states that the third section indicates all insured persons in whose favor payments or other benefits were made in the reporting quarter, half-year or year. Information about employees who were dismissed in the previous period is also provided.

For example, if during the reporting quarter the company’s accounting department awarded a bonus to an employee with whom the employment relationship ceased in an earlier period, then information about him must be reflected in the DAM. The fact that the civil law or employment contract with this employee was terminated does not matter.

If the employee was dismissed in the previous reporting period, and after that no payments were made in his favor by the company’s management, then there is no need to include such an employee in the third section of the DAM. For example, the employment relationship with a subordinate was terminated in January. Until the end of six months there were no payments in his favor. Information about such an employee will not be displayed in the half-year report.

Fill out the DAM for the first quarter of 2021 using convenient tools in Externa

April 22, 2021 From January 1, 2021, there were changes in legislation that affected the completion of the calculation of insurance premiums for the first quarter of 2021.

So that you can timely and correctly report to the Federal Tax Service and avoid fines and account blocking, Externa has new features: zero DAM report, quick addition of new employees, convenient filtering and tips on the recommendations of the Federal Tax Service.

— Loading data from SZV-M In the DAM form, section 3 is filled out for each employee, where you must indicate all his details: full name, INN, SNILS, date of birth and gender, as well as the code of the country of citizenship and the code of the type of identification document.

The number of insured persons in section 1 depends on the number of sections 3 with the attribute “insured” in lines 160-180.

DAM: should former employees be included in the calculation?

If during the reporting quarter payments were accrued to individuals, including those who were fired or whose employment was terminated in the previous quarter, then information about them is included in section 3 of the calculation of insurance premiums.

The form for calculating insurance premiums on the DAM and the procedure for filling it out were approved by Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/ [email protected] (hereinafter referred to as the Order).

The tax period for insurance premiums is a calendar year. Reporting periods – I quarter, I half of the year, 9 months. The calculation is submitted no later than the 30th day of the month following the billing (reporting) period, taking into account the rule for postponing the date if it coincides with weekends or holidays (clause 7 of Article 431 of the Tax Code of the Russian Federation).

How to reflect personal information in the RSV

Section 3 is intended to reflect the personal data of insured persons in the DAM calculation.

Data on income paid to an individual and pension contributions accrued on them are indicated in subsection 3.2 in relation to the months of the last quarter of the tax period - the reporting period for which the calculation is provided (clause 22.1 of Appendix No. 2 to the Order).

Subsection 3.2 of Section 3 also includes data from employees who were dismissed in the previous quarter, but to whom payments were accrued in the reporting quarter. Officials have pointed this out more than once.

Is it necessary to show in section 3 former employees who were not accrued any payments after their dismissal?

Let's answer this question based on the following.

The general procedure for completing the DAM calculation provides that throughout the tax period (year), data is entered into interim reporting on an accrual basis.

Therefore, dismissed employees also fall into the DAM. Data on such employees must be included until the end of their separation year.

If there were no payments in their favor in the reporting quarter, subsection 3.2 for them is no longer filled out. Section 3 will contain only information that allows you to identify this person - subsection 3.1.

And payments that were accrued to those who resigned during the year should be included in subsection 1.1 of Appendix 1 to Section 1 along the lines “Total from the beginning of the billing period.”

For SZV-M, the fact that the contract is valid is important

As for filling out the monthly form SZV-M, we recommend that in deciding whether to include information in the report, proceed from the following:

- what type of contract was concluded - labor or civil law for the performance of work (provision of services);

- whether the contract was valid in the reporting month.

If the contract was in force, then information about the insured person must be included in the SZV-M report. The fact of accrual and payment of remuneration and calculation of insurance premiums under this agreement does not matter.

Calculation of insurance premiums for the 1st quarter of 2021: form, example of filling

In 2021, the DAM is represented by all organizations and individual entrepreneurs who pay contributions for their employees without exception to the Federal Tax Service.

In Externa, it became possible not only to update the personal data of employees already in the system, but also to quickly add new employees for the entire reporting period by downloading SZV-M files.

We will tell you which form to use to submit calculations for insurance premiums for the 1st quarter of 2021, and also provide a sample for filling out the report.

All organizations and individual entrepreneurs that transfer payments and rewards to individuals under contracts submit to the tax office a calculation of insurance premiums for the 1st quarter of 2021. The Federal Tax Service has developed an order with changes to the form. Certain calculation indicators will change, and the electronic format will also be clarified.

It was assumed that the DAM for the 1st quarter of 2021 will be submitted in a new form, but the document has not yet been adopted (published on regulation.gov.ru). Obviously, the changes will come into force with the reporting for the 2nd quarter.

Stay tuned for changes. Thus, a new DAM form is not provided for submitting a report

How to report for fired employees

We will only talk about IP. First, an LLC cannot operate without employees. Secondly, even if there are none, you still need to submit almost all zero reports, because LLC is the employer by default. We talked about this before.

Even if you fired all your employees in the middle of the year and deregistered with the Social Insurance Fund, continue to submit RSV, 6-NDFL to the tax office and 4-FSS to the Social Insurance Fund until the end of the year. These reports are built on a cumulative basis, so it is important not to interrupt it. 2-NDFL, SZV-STAZH at the end of the year will also need to be sent. Only SZV-M can not be submitted to the Pension Fund.

But you don’t have to submit reports for the next year. Of course, if you continue to work without employees.

⚠️ The SZV-TD report must be submitted no later than the next working day after the employee’s dismissal.

The individual entrepreneur fired all employees in 2021, but did not deregister with the Social Insurance Fund. Do I need to submit zero reports in 2021?

There is no clear answer to this question and no clear explanations from regulatory authorities. Call your branch of the Federal Tax Service, the Pension Fund of the Russian Federation and the Social Insurance Fund and find out whether it is possible not to send zeros for 2021. If you do not plan to hire employees in the near future, it is better to deregister as an employer. Then there will definitely be no questions for you. Moreover, this can be done remotely, using the government services portal.

How to fill out section 3 of the RSV form for dismissed employees?

Unified calculation of insurance premiums Expand the list of categories Subscribe to a special free weekly newsletter to keep abreast of all changes in accounting: Join us on social media.

networks: VAT, insurance premiums, simplified tax system 6%, simplified tax system 15%, UTII, personal income tax, penalties We send letters with the main discussions of the week > > > Tax-tax January 07, 2021 DAM for dismissed employees regarding personal information must be filled out until the current one ends billing period. However, entering data on them in those reporting periods when employees have already been dismissed is carried out taking into account special requirements.