What is an account

Every commercial company is created for the purpose of making a profit.

At the same time, she makes various transactions every day, the accounting of which is very easy to get confused without a clearly organized accounting structure. Moreover, according to Art. 2 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, all legal entities are required to maintain accounting records. It is organized through continuous documentation of each business transaction and carries several functions:

- informational;

- control;

- feedback;

- analytical.

Find out who is responsible for organizing accounting here.

Accounting provides information about the financial and economic state of affairs to both internal (managers, management, founders, etc.) and external users (controlling, fiscal and other government agencies).

One of the accounting methods is double entry using accounts approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n (for commercial structures).

You can familiarize yourself with the chart of accounts in this article.

Double entry is an accounting entry that reflects a business transaction using 2 offsetting accounts. Each account has a specific number, structure and characteristics. In this case, the same amount is recorded in both accounts.

Example 1

Consider the operation “Cash in the amount of 20,000 rubles. handed over from the cash desk to the bank.”

Based on its economic meaning, we select the appropriate corresponding accounts: 50 “Cash”, 51 “Settlement accounts”.

Funds are sent from the credit of account 50 to the debit of account 51. This operation is recorded by a cash receipt order, a bank statement, the counterfoil of an advertisement for cash deposits and the entry: Dt 51 Kt 50 - in the amount of 20,000 rubles.

This means that the balance at the bank servicing the enterprise increased, but at the cash desk decreased by the same amount (RUB 20,000).

To use accounts correctly, you must not only choose them correctly, but also know what type they are.

Accounts can be active, passive and active-passive.

Active accounts reflect the assets (property, debts, etc.) of the enterprise and have only a debit (positive) balance. An increase in assets is recorded as a debit to the corresponding account, a write-off is recorded as a credit.

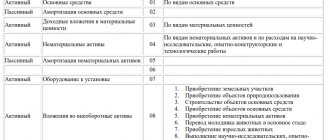

The main active accounts are presented in the table:

| Check | Definition |

| 01 | Fixed assets |

| 04 | Intangible assets |

| 10 | Materials |

| 11 | Animals in production |

| 20 | Production |

| 21 | Semi-finished products |

| 41 | Goods |

| 43 | Finished products |

| 50 | Cash register |

| 51 | Current accounts |

| 52 | Currency accounts |

| 81 | Own shares |

Liability accounts indicate the sources of the company's assets and have only a credit balance. These include, in particular:

| Check | Definition |

| 02 | Depreciation of fixed assets |

| 05 | Depreciation of intangible assets |

| 42 | Extra charge |

| 66/67 | Loans |

| 70 | Settlements with personnel |

| 80 | Authorized capital |

| 82 | Reserve capital |

| 83 | Extra capital |

Active-passive accounts include accounts that have both a debit and a credit balance. For example, if account 60 “Settlements with suppliers” has a credit balance, it means that the company owes the counterparty for supplies or services supplied. If we paid an advance to the supplier, it means that the counterparty already owes our company. This transaction has a debit balance.

| Check | Definition |

| 60 | Settlements with suppliers |

| 62 | Settlements with customers |

| 68/69 | Taxes and fees |

| 71 | Accountable persons |

| 84 | Retained earnings (loss) |

| 99 | Profit/loss |

On account 62, an unpaid receivable may arise, which in some cases is considered doubtful, because may not be paid by the buyer. In order to correctly reflect such debt on the balance sheet, each organization is required to create a reserve for doubtful debts.

Find out how to correctly record entries for doubtful debts in the ConsultantPlus ready-made solution by getting trial access to the system for free.

Accounts also have analytics for subaccounts. For example, for account 10 these will be accounts 10.1 “Raw materials”, 10.2 “Purchased semi-finished products”, 10.3 “Fuel”, etc.

Preparation of accounting entries

People who have chosen the accounting profession and begin to study theory and practice should remember the following:

- Accounting is a harmonious scientific system.

- For accounting at any level, the principle of double entry is used, that is, any transaction in total terms is reflected simultaneously in two accounts.

- The work uses a system of accounting entries, which are, in essence, accounts reflecting the amounts of business transactions based on actual documents.

A double entry must contain information about the same amount reflected in the debit and credit of a pair of accounts that are a common related structure. This structure is called correspondent debt, and the accounts involved in it are called correspondent accounts. Students studying the theory of accounting operations should master the features of maintaining accounts:

- The active side reflects the volume of material assets of the enterprise;

- Liability – accounts payable of a legal entity;

- Active-passive type accounts simultaneously show debt of a debit and credit nature.

Accounting entries can be simple or complex. In the first case, the amounts are reflected in the DT of one account and the CT of another account; in the second case, the reflection of the operation can be combined, when the DT of an account is used in a configuration with the CT of several accounts or several DT collect amounts from the CT of different accounts:

Table of transactions for business transactions in accounting

There are a great variety of wiring. In this case, a business transaction can be reflected in 1 entry (simple entries) or several (complex entries).

For example, goods were received with VAT in the amount of 50,000 rubles. This fact must be reflected in 2 entries:

- goods and materials arrived at the warehouse: Dt 41 Kt 60 - 42,372.88 rubles;

- Input VAT is allocated: Dt 19 Kt 60 - 7,627.12 rubles.

Find typical accounting entries for VAT accounting here.

Let's look at the basic entries in accounting.

Accounting for fixed assets and intangible assets:

| Operation | Dt | CT |

| OS arrived | 08 | 60 (71, 75, 76) |

| OS put into operation | 01 | 08 |

| Depreciation of fixed assets | 20 (23, 25, 26, 44) | 02 |

| Received intangible assets | 08 | 60 (71, 75, 76) |

| Intangible assets accepted for accounting | 04 | 08 |

| Depreciation of intangible assets | 20 (23, 25, 26, 44) | 05 |

Read more about fixed asset accounting in the article “Accounting for fixed assets - accounting entries” .

Inventory accounting:

| Operation | Dt | CT |

| Materials received | 10 | 60 (75, 76) |

| Production waste accepted | 10 | 20 (23, 29) |

| Materials written off as expenses | 20 (23, 25, 26, 44) | 10 |

| Materials sold | 90 (91) | 10 |

| Animals purchased | 11 | 60 (75, 76) |

| Transfer of young animals to the main herd | 08 | 11 |

| Animal slaughter costs | 20 (23, 29) | 11 |

For detailed entries for materials accounting, see the article “Accounting entries for materials accounting .

Cost accounting:

| Operation | Dt | CT |

| Depreciation accrued | 20 (23, 25, 26, 44) | 02 (05) |

| Materials have entered production | 20 (23, 29) | 10 |

| General business and general production expenses are distributed to the main products (on accounts 25 and 26, expenses are collected as a whole, and at the end of the month they are distributed among the products produced) | 20 | 23 (25, 26) |

| Own semi-finished products entered production | 20 | 21 |

| Works (services) performed by third-party companies | 20 (23, 25, 26, 44) | 60 (76) |

| Taxes and contributions accrued | 20 (23, 25, 26, 44) | 68 (69) |

| Salaries accrued to employees | 20 (23, 25, 26, 44) | 70 |

| Manufactured products released | 21 (43) | 20 |

| Trading expenses written off to cost | 90 | 44 |

Examples of cost accounting entries can be found in this article.

Accounting for goods and finished products:

| Operation | Dt | CT |

| Items for sale have arrived | 41 | 60 (71, 75) |

| Trade margin reflected | 41 | 42 |

| Manufactured products have arrived | 43 (21) | 20 (23, 29) |

| Sales of goods and materials | 90 | 41 (21, 43) |

| Shortage of inventory items taken into account | 73 (94) | 41 (21, 43) |

The algorithm for accounting for goods is reflected in the article “Postings Dt 41 and Kt 41, 60 (nuances)” .

Cash accounting (hereinafter referred to as DS):

| Operation | Dt | CT |

| DS received from buyers | 50 (51) | 62 |

| Revenue | 50 | 90 |

| Return of accountable funds | 50 (51) | 71 |

| A contribution has been received to the management company | 50 (51) | 75 |

| Payment to the supplier | 60 (76) | 50 (51) |

| Issue on record | 71 | 50 (51) |

| Salary payment | 70 | 50 (51) |

| Transfer of taxes and contributions | 68 (69) | 51 |

More detailed information can be found in the section “Bank, cash desk” .

Accounting for settlements:

| Operation | Dt | CT |

| Receipt of goods and materials | 10 (41) | 60 |

| Receipt of services | 20 (23, 25, 26, 44) | 60 (76) |

| Payment to the supplier | 60 (76) | 50 (51) |

| Receipt of DS from the buyer (or debtor) | 50 (51) | 62 (76) |

| Sales to the buyer | 62 | 90 |

| Taxes (contributions) accrued | 20 (25, 26, 44, 90, 91, 99) | 68 (69) |

| Salary accrued | 20 (23, 25, 26, 44) | 70 |

| Taxes (contributions) paid | 68 (69) | 50 (51) |

| Salary paid | 70 | 50 (51) |

| Received credit (loan) | 50 (51) | 66 (67) |

| Loan repayment (interest) | 66 (67) | 50 (51) |

| Interest accrued on the loan | 20 (25, 26, 44) | 66 (67) |

| Money issued against advance report | 71 | 50 (51) |

| Advance report reflected | 07 (08, 10, 20, 25, 26, 41, 44) | 71 |

| A loan was issued to an employee | 73 | 50 (51) |

| The shortage is attributed to the person at fault | 73 | 94 |

| Repayment of a loan by an employee | 50 (51) | 73 |

| Compensation for shortage of goods | 41 | 73 |

| AC accrued | 75 | 80 |

| Dividend payment | 75 | 50 (51) |

| Introduced by the Criminal Code | 08 (10, 11, 41, 50, 51) | 75 |

For the procedure for accounting for mutual settlements with suppliers and customers, see the articles:

- “Account 60 in accounting (nuances)”;

- “Account 62 in accounting (nuances)”;

- “Keeping records of accounts receivable and payable.”

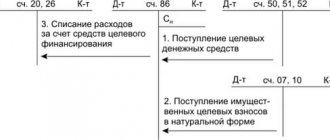

Capital Accounting:

| Operation | Dt | CT |

| AC accrued | 75 | 80 |

| Buying shares | 81 | 50 (51) |

| Replenishment of reserve capital | 84 (75) | 82 |

| Covering losses using reserve capital | 82 | 84 |

| Increase in share price | 75 | 83 |

| Decrease in the cost of fixed assets due to revaluation | 83 | 01 |

| Distribution of additional capital between owners | 83 | 75 |

| Special-purpose financing | 50 (51) | 86 |

For the main entries for capital accounting, see the article “Procedure for accounting for an organization’s own capital (nuances)” .

Financial results:

| Operation | Dt | CT |

| Cost of sold inventories | 90 | 10 (21, 41, 43) |

| Revenue | 50 (51, 57) | 90 |

| Implementation | 62 | 90 |

| VAT charged on sales | 90 | 68 |

| Expenses written off | 90 | 20 (44) |

| Positive financial sales result | 90 | 99 |

| Negative sales result (loss) | 99 | 90 |

| Write-off of materials donated free of charge | 91 | 10 |

| Bank services | 91 | 51 |

| Write-off of shortage | 91 | 94 |

| Excess materials have been identified | 01 (10, 21, 41, 43) | 91 |

| OS implementation | 91 | 01 |

| Interest accrued (state duty, legal expenses) receivable by court decision | 76 | 91 |

| A shortage of supplies and DS has been identified | 94 | 10 (11, 21, 41, 43, 50) |

| The amount of the shortfall is attributed to the perpetrators | 73 | 94 |

| Accrual of reserve for future expenses | 20 (23, 25, 26, 44, 91) | 96 |

| Deferring costs | 97 | 10 (21, 41, 43, 60, 76) |

| Future expenses are written off as current expenses | 20 (23, 25, 26, 44) | 97 |

| Accrued deferred income from leasing activities | 98 | 90 |

| Receipt of money as deferred income | 50 (51) | 98 |

| Losses due to emergency situations (hereinafter referred to as emergencies) | 99 | 07 (08, 10, 11, 20, 21, 41, 43) |

| Profit tax accrued | 99 | 68 |

| Determination of financial results | 99 (90, 91) | 99 (90, 91) |

| Uncovered losses identified | 84 | 99 |

| The profit received is attributed to distribution | 99 | 84 |

We talked about the entries for accounting for retained earnings on account 84 here.

How to compile them? Basic principles

When conducting accounting, specialists will use three types of accounts: active, passive and active-passive . Active enterprises must reflect cash, inventory, fixed assets and non-current assets, inventory balances, etc. Passive legal entities reflect all their obligations to the state, business partners, employees, and creditors.

Active-passive accounts are also designed to display business transactions, but differ in that they can simultaneously contain both a credit and a debit balance. An example is the debt (prepayment) that a particular supplier has to a company in parallel with the debt (goods received without payment) that the same company has to the same supplier.

When preparing accounting entries, you need to remember the following nuances:

- active accounts can only have a debit balance, while passive accounts can only have a credit balance;

- the increase in passive accounts occurs only by credit, and active accounts - by debit;

- the balance on active-passive accounts can be reflected simultaneously in both liabilities and assets of the balance sheet;

- when compiling a balance sheet, the balances of passive accounts are displayed on the right side, and the balances of active accounts on the left;

- to reduce an active account, you need to make entries on its credit, and to reduce a passive account, you need to make debit entries.

Posting is a way of expressing the correspondence of accounts, the basis for which is a completed business transaction. When compiling them, it is recommended to adhere to the following scheme:

- It is necessary to determine which accounts and accounting objects are affected by the transaction being processed (its economic content is taken into account).

- It is necessary to establish which accounts will be involved in the posting (passive or active).

- The account to be credited or debited must be determined. To do this, the sources of origin of the operation and all related factors are taken into account.

When making simple entries, two accounts are affected, for example, when money is received at the company's cash desk from the current account, the following entry is made: Kt 51 Dt 50. When making complex entries, several accounting accounts are involved.

You can clearly see the procedure for making transactions in the following video:

Double entry principle

Reflection of business transactions on accounting accounts by specialists is carried out using the double entry method.

The essence of this method is as follows: for each operation, the accountant makes a corresponding entry simultaneously on the debit of one account and on the credit of another account .

Examples of accounting entries for analyzing changes in the balance sheet under the influence of business transactions

Let's look at examples of basic accounting entries using the example of Alliance LLC.

Example 2

In June Gordienko A.V. decided to create a company for the production of custom-made furniture. He had his own savings of 100,000 rubles. and a machine worth 55,000 rubles. This property was contributed by him as a contribution to the authorized capital.

The very first entry in any company is the reflection of the authorized capital. Selecting the corresponding accounts:

- 75 “Settlements with founders”;

- 80 “Authorized capital”.

According to the constituent documents, Gordienko A.V. must contribute 155,000 rubles to Alliance LLC. We record this fact by writing: Dt 75 Kt 80 - 155,000 rubles.

Of these, 100,000 rubles. were deposited into a bank account. Current accounts are account 51. We send funds from Gordienko A.V. to the company's account with the following posting: Dt 51 Kt 75 - 100,000 rubles.

According to sub. 5 clause 1 PBU 6/01 property worth no more than 40,000 rubles. can be taken into account as part of inventories (inventories). If an asset is valued at a higher cost, it is classified as depreciable property. Thus, we record the receipt of fixed assets as a contribution to the management company with the entry: Dt 08 Kt 75 - 55,000 rubles.

If a company applies PBU 18/02, it is obliged to reflect temporary differences between accounting and tax accounting (BU and NU), since in tax accounting assets with a cost of 100,000 rubles are included in fixed assets. and more. What transactions should be used to display temporary differences between accounting and financial accounting and what changes in PBU 18/02 apply from 2021? The answers to these and other questions are in the ConsultantPlus ready-made solution; get trial access to the system for free.

We put the OS object into operation by wiring: Dt 01 Kt 08 - 55,000 rubles.

At the end of the month, it will be necessary to calculate depreciation according to the method prescribed in the accounting policy. Since the machine is directly involved in production, we select account 20 to account for depreciation costs.

According to the accounting policy, the company uses the straight-line method of calculating depreciation. The useful life of the machine is 60 months (55,000 rubles divided by 60 months and we get 900 rubles of depreciation per month).

For examples of calculating depreciation using the FIFO and LIFO methods, see the article “Example of calculation using the FIFO and LIFO methods in accounting.”

This fact is reflected by the entry: Dt 20 Kt 02 - 900 rub.

Cash in the amount of 70,000 rubles. were used to purchase materials.

Let's make the wiring:

- Dt 60 Kt 51 - 70,000 rub. (materials paid to the supplier, primary document - bank statement);

- Dt 10 Kt 60 - 59,300 rub. (materials received, primary material - TORG-12, invoice);

- Dt 19 Kt 60 - 10,700 rub. (input VAT included).

The company submitted input VAT for deduction, reflecting it in the purchase book and recording it with the following posting: Dt 68 (VAT subaccount) Kt 19 - 10,700 rubles.

During the month, the company produced 2 orders:

- wardrobe with a cost of 25,000 rubles. (including materials for 15,000 rubles and payroll 10,000 rubles, including contributions);

- kitchen set costing 45,000 rubles. (including materials for 35,000 rubles and payroll 10,000 rubles, including contributions).

Thus, materials in the amount of 50,000 rubles. (15,000 + 35,000) were written off for production.

| Dt | CT | Amount, rub. | Content | Document |

| 20 | 10 | 15 000 | Materials transferred for cabinet production | Request-invoice |

| 20 | 10 | 35 000 | Materials transferred for the production of kitchen sets | |

| 20 | 70 | 15 400 | Salary accrued | Payslip |

| 20 | 69 | 4 600 | Payroll contributions accrued | |

| 43 | 20 | 25 000 | The finished cabinet is transferred to the warehouse | Production report |

| 43 | 20 | 45 000 | The finished kitchen set has been delivered to the warehouse |

The cabinet was sold for 42,000 rubles, and the kitchen set for 70,000 rubles. Payment for the cabinet was received in the amount of 20,000 rubles. The balance is 22,000 rubles. The buyer, according to the agreement, will transfer until July 10. Payment for the kitchen has been received in full.

| Dt | CT | Amount, rub. | Content | Document |

| 51 | 62 | 10 000 | Payment has been received for the wardrobe | Bank statement |

| 62 | 90 | 42 000 | Wardrobe sold | TORG-12, invoice |

| 90 | 43 | 25 000 | The cost of the cabinet has been written off | |

| 90 | 68 | 6 400 | VAT charged | |

| 51 | 62 | 70 000 | Received payment for kitchen | Extract |

| 62 | 90 | 70 000 | Kitchen sold | TORG-12, invoice |

| 90 | 68 | 10 700 | VAT charged | |

| 90 | 43 | 45 000 | The cost of the kitchen has been written off |

On June 15, the bank received DS in the amount of 15,000 rubles: Dt 50 Kt 51 - 15,000 rubles.

Of this, an advance was paid to employees in the amount of 12,000 rubles: Dt 70 Kt 50 - 12,000 rubles.

An accountant works at Alliance LLC. On June 30, he received a salary of 5,000 rubles, and contributions from the payroll amounted to 1,500 rubles:

- Dt 26 Kt 70 - 5,000 rub.;

- Dt 26 Kt 69 — 1,500 rub.

On the same day, contributions were transferred from the salaries of all employees: Dt 69 Kt 51 - 6,100 rubles. (4,600 + 1,500).

Since the employer is a tax agent, he is obliged to withhold and transfer personal income tax from the income of employees. For residents it is 13%. That is, for June, Alliance LLC needs to transfer 2,600 rubles to the budget. (20,400 × 13%).

These operations are recorded by postings:

- Dt 70 Kt 68 (personal income tax subaccount) - tax accrued;

- Dt 68 Kt 51 - tax transfer.

On the last day of the month, it is necessary to close cost accounts to identify financial results. During the month, all general production and general business expenses are collected in Dt account 25 (26).

At the end of the month, the balance is distributed among the products produced and is recorded as follows: Dt 20 Kt 26 - 6,500 rubles.

The balance of account 20 is closed to the debit of account 90 in the absence of work in progress: Dt 90.2 Kt 20 - 7,400 rubles.

To compile a summary SALT, and then prepare to submit the balance, let’s consider the turnover for each account involved.

| Decoding | 01 | |||

| Turnover | Balance | |||

| Dt | CT | Dt | CT | |

| OS put into operation | 55 000 | 55 000 | ||

| Turnover | 55 000 | 0 | 55 000 | 0 |

| Decoding | 02 | |||

| Turnover | Balance | |||

| Dt | CT | Dt | CT | |

| Depreciation accrued | 900 | 900 | ||

| Turnover | 0 | 900 | 0 | 900 |

| Decoding | 08 | |||

| Turnover | Balance | |||

| Dt | CT | Dt | CT | |

| Introduced the Criminal Code in the form of an OS object | 55 000 | |||

| OS put into operation | 55 000 | |||

| Turnover | 55 000 | 55 000 | 0 | 0 |

| Decoding | 10 | |||

| Turnover | Balance | |||

| Dt | CT | Dt | CT | |

| Materials received | 59 300 | |||

| Materials written off for cabinet production | 15 000 | |||

| Materials written off for kitchen production | 35 000 | |||

| Turnover | 59 300 | 50 000 | 9 300 | 0 |

| Decoding | 19 | |||

| Turnover | Balance | |||

| Dt | CT | Dt | CT | |

| Input VAT received from the supplier | 10 700 | |||

| VAT is deductible | 10 700 | |||

| Turnover | 10 700 | 10 700 | 0 | 0 |

| Decoding | 20 | |||

| Turnover | Balance | |||

| Dt | CT | Dt | CT | |

| Depreciation accrued | 900 | |||

| Cost of materials for cabinet production | 15 000 | |||

| Cost of materials for making a kitchen | 35 000 | |||

| Assembly wages | 15 400 | |||

| Contributions from payroll | 4 600 | |||

| Ready-made cabinet released | 25 000 | |||

| Ready-made kitchen produced | 45 000 | |||

| Closing account 26 | 6 500 | |||

| Closing of the month (Dt 90.2 Kt 20) | 7 400 | |||

| Turnover | 77 400 | 77 400 | ||

| Decoding | 26 | |||

| Turnover | Balance | |||

| Dt | CT | Dt | CT | |

| Accountant's salary paid | 5 000 | |||

| The salary amount is distributed to the main production | 5 000 | |||

| Contributions from an accountant's salary | 1 500 | |||

| The amount of contributions is distributed to the main production | 1 500 | |||

| Turnover | 6 500 | 6 500 | ||

| Decoding | 43 | |||

| Turnover | Balance | |||

| Dt | CT | Dt | CT | |

| Closet | 25 000 | 25 000 | ||

| Kitchen | 45 000 | 45 000 | ||

| Turnover | 70 000 | 70 000 | ||

| Decoding | 50 | |||

| Turnover | Balance | |||

| Dt | CT | Dt | CT | |

| Received DS from the bank | 15 000 | |||

| Salary payment | 12 000 | |||

| Turnover | 15 000 | 12 000 | 3 000 | |

| Decoding | 51 | |||

| Turnover | Balance | |||

| Dt | CT | Dt | CT | |

| Contribution to the management company | 100 000 | |||

| Payment to the supplier for materials | 70 000 | |||

| Receipt of advance payment for the cabinet from the buyer | 20 000 | |||

| Receipt of DS from the buyer for the kitchen | 70 000 | |||

| DS transferred to the cashier | 15 000 | |||

| Contributions from payroll have been transferred | 6 100 | |||

| VAT payment | 6 400 | |||

| Personal income tax payment | 2 600 | |||

| Turnover | 190 000 | 100 100 | 89 900 | 0 |

| Decoding | 60 | |||

| Turnover | Balance | |||

| Dt | CT | Dt | CT | |

| Payment for materials | 70 000 | |||

| Receipt of materials | 59 300 | |||

| Input VAT taken into account | 10 700 | |||

| Turnover | 70 000 | 70 000 | ||

| Decoding | 62 | |||

| Turnover | Balance | |||

| Dt | CT | Dt | CT | |

| Received DS for the closet | 20 000 | |||

| Realization of the cabinet | 42 000 | |||

| Received DS for the kitchen | 70 000 | |||

| Implementation of kitchen | 70 000 | |||

| Turnover | 112 000 | 90 000 | 22 000 | |

| Decoding | 68 | |||

| Turnover | Balance | |||

| Dt | CT | Dt | CT | |

| Personal income tax | 2 600 | 2 600 | ||

| Personal income tax withheld | 2 600 | |||

| Personal income tax paid | 2 600 | |||

| VAT | 17 100 | 17 100 | ||

| VAT charged | 17 100 | |||

| Input VAT credited | 10 700 | |||

| VAT paid | 6 400 | |||

| Turnover | 19 700 | 19 700 | ||

| Decoding | 69 | |||

| Turnover | Balance | |||

| Dt | CT | Dt | CT | |

| Contributions from the payroll of collectors | 4 600 | |||

| Contributions from the accountant's payroll | 1 500 | |||

| Payment | 6 100 | |||

| Turnover | 6 100 | 6 100 | ||

| Decoding | 70 | |||

| Turnover | Balance | |||

| Dt | CT | Dt | CT | |

| Collector salary | 15 400 | |||

| Accountant salary | 5 000 | |||

| Salary payment | 12 000 | |||

| Personal income tax | 2 600 | |||

| Turnover | 14 600 | 20 400 | 5 800 | |

| Decoding | 75 | |||

| Turnover | Balance | |||

| Dt | CT | Dt | CT | |

| AC accrued | 155 000 | |||

| DS deposited into the bank | 100 000 | |||

| The machine was contributed as a contribution to the management company | 55 000 | |||

| Turnover | 155 000 | 155 000 | ||

| Decoding | 80 | |||

| Turnover | Balance | |||

| Dt | CT | Dt | CT | |

| AC accrued | 155 000 | 155 000 | ||

| Turnover | 155 000 | 155 000 | ||

| Decoding | 90 | |||

| Turnover | Balance | |||

| Dt | CT | Dt | CT | |

| Realization of the cabinet | 42 000 | |||

| VAT charged | 6 400 | |||

| Cabinet cost | 25 000 | |||

| Implementation of kitchen | 70 000 | |||

| VAT charged | 10 700 | |||

| Kitchen cost | 45 000 | |||

| Closing account 20 | 7 400 | |||

| Closing the month | 17 500 | |||

| Turnover | 112 000 | 112 000 | ||

| Decoding | 99 | |||

| Turnover | Balance | |||

| Dt | CT | Dt | CT | |

| Financial result | 17 500 | |||

| Turnover | 17 500 | 17 500 | ||

Thus, in June Alliance LLC earned 17,500 rubles.

Consolidated SALT for June Alliance LLC

| Check | Account name | Revolutions | Balance | ||

| Dt | CT | Dt | CT | ||

| 01 | Fixed assets | 55 000 | 55 000 | ||

| 02 | Depreciation of fixed assets | 900 | 900 | ||

| 08 | Investments in non-current assets | 55 000 | 55 000 | ||

| 10 | Materials | 59 300 | 50 000 | 9 300 | |

| 19 | VAT on purchased assets | 10 700 | 10 700 | ||

| 20 | Primary production | 77 400 | 77 400 | ||

| 26 | General running costs | 6 500 | 6 500 | ||

| 43 | Finished products | 70 000 | 70 000 | ||

| 50 | Cash register | 15 000 | 12 000 | 3 000 | |

| 51 | Current accounts | 190 000 | 100 100 | 89 900 | |

| 60 | Settlements with suppliers | 70 000 | 70 000 | ||

| 62 | Settlements with customers | 112 000 | 90 000 | 22 000 | |

| 68 | Calculations for taxes and fees | 19 700 | 19 700 | ||

| 69 | Social insurance calculations | 6 100 | 6 100 | ||

| 70 | Payments to personnel regarding wages | 14 600 | 20 400 | 5 800 | |

| 75 | Settlements with founders | 155 000 | 155 000 | ||

| 80 | Authorized capital | 155 000 | 155 000 | ||

| 90 | Sales | 112 000 | 112 000 | ||

| 90.1 | Revenue | 112 000 | 95 000 | ||

| 90.2 | Cost of sales | 77 400 | 77 400 | ||

| 90.3 | VAT | 17 100 | 17 100 | ||

| 90.9 | Profit/loss from sales | 17 500 | 17 500 | ||

| 99 | Profit and loss | 17 500 | 17 500 | ||

| Turnover | 1 028 300 | 1 028 300 | 179 200 | 179 200 | |

The article “Accounting and analysis of financial results” will help to analyze the company’s performance in more detail and determine the impact of business transactions on the balance sheet.

Posting examples

Currently, a large number of methodological manuals are regularly published for accountants, which indicate the most common entries for a particular type of activity.

Using existing examples, specialists will be able to avoid the most common mistakes when compiling correspondence accounts and posting them to the appropriate accounting registers.

By salary

When preparing entries for operations, the essence of which is to carry out settlements with employees, specialists must make the following account correspondence:

| Debit | Contents of a business transaction | Credit |

| 20, 23, 26, 92 | Salary accrued | 70 |

| 70 | Salary issued from cash register | 50 |

| 68 | Mandatory taxes charged | 70 |

| 51 | Escrow payment (unpaid) | 50 |

| 50 | Received money in the cash register to pay salaries | 51 |

Renting premises

When renting out space or a building, entries are made by both the owner of the fixed asset and the tenant. They prepare correspondence accounts for any action related to the leased property.

The main ones are shown in the table:

| Debit | Contents of a business transaction | Credit |

| 01 (sub-account “Assets leased out”) | Leased premises | 01 |

| 20 | Depreciation has been calculated on the transferred premises | 02 |

| 50, 51 | Rent received | 62 |

| 90 (sub-account 2) | Depreciation and other rental expenses written off | 20 |

| 001 | The tenant received the premises | |

| 76 | Rent transferred | 51 |

| 44, 29, 26, 25, 23, 20 | Rent arrears | 76 |

Wholesale and retail trade

When carrying out business activities related to the sale of goods, finished products, works or services, legal entities make many transactions.

To reflect transactions in this area in accounting, the following entries must be made:

| Debit | Contents of a business transaction | Credit |

| Money transferred: | ||

| 62 | refund of advance payment to buyers | 51, 50 |

| 61 | suppliers | 51, 50 |

| 45 | Products shipped to customers | 41/1 |

| 41/1,41/2 | Received goods from suppliers | 60 |

| VAT reflected | ||

| 19 | on goods received | 60 |

| 41/2 | in retail | 60 |

| 90/03 | by goods shipped | 68 |

| 90/03 | in retail | 68/02 |

| 62 | Implementation reflected | 90/01.1 |

| 92.R | retail | 90/01.1 |

| 91/02.1 | The cost of shipped products is reflected | 45 |

| 91/02.1 | in retail | 41/1 |

Assignment agreement

When drawing up this agreement, the accountant of any commercial organization carrying out economic activities in the status of a legal entity must draw up correspondence accounts.

For such operations the following transactions are used:

| Debit | Contents of a business transaction | Credit |

| 58 | The cost of all rights acquired by the company under the assignment agreement previously signed between the parties is reflected. | 76 |

| 76 | The debt that arises to the assignor is repaid in full or in part | 51, 50 |

| 50, 51 | The debt was received from the debtor to the current account or to the company's cash desk | 76 |

| 76 | The amount of all repaid debts is taken into account as part of income | 91/1 |

| 91/2 | Accounting for acquired rights of claim as expenses | 58 |

Cash transactions

Business entities must document cash transactions in accordance with the CCP in force on the territory of the Russian Federation.

To compile correspondence, the accountant uses the following accounts:

- 50 – cash register;

- 51 – current account;

- 70 – payroll calculations;

- 73 – other calculations;

- 62 – settlements with customers;

- 75 – replenishment of the authorized capital;

- 71 – settlements with accountable persons;

- 91 – reflection of exchange rate differences;

- 94 – reflection of shortages;

- 76 – other payments.

| Debit | Contents of a business transaction | Credit |

| 71 | Money issued to accountable persons | 50 |

| 50 | Unused imprest amounts were returned to the cash desk | 71 |

| 70 | Salary issued | 50 |

| 50 | Received money from current account | 51 |

| 50 | Buyers paid for the goods | 62 |

| 50 | The founders replenished the authorized capital | 75 |

| 94 | Shortage written off | 50 |

| 91 | Exchange rate differences reflected | 50 |

How inventory is accounted for at an enterprise - see this article. You can find all the necessary information about business transactions in accounting here.

Provision of services

When providing services, business entities draw up acceptance certificates. If a legal entity is a value added tax payer, it is obliged to issue an invoice according to which VAT is deducted.

The following entries are made in accounting:

| Debit | Contents of a business transaction | Credit |

| 26 | Service provided to the client (excluding VAT) | 76, 60 |

| 19 | VAT is reflected | 76, 60 |

| 50, 51 | Payment for services received | 60, 76 |

| 68 | VAT amount submitted for deduction | 19 |

| 90 | Expenses are written off to cost of sales | 26 |

With fixed assets

If a business entity has fixed assets on its balance sheet that it uses in carrying out business activities, it must draw up correspondence accounts as follows:

| Debit | Contents of a business transaction | Credit |

| 01 | Fixed assets received from suppliers were added to the balance sheet | 60 |

| 60 | Invoices paid | 51 |

| 07 | Related expenses reflected | 60, 76 |

| 07,19/1 | All taxes and fees reflected | 68 |

| 91/2 62 | Fixed assets sold | 01 91/1 |

| 51 | Funds transferred from buyer | 62 |

| 91/2 | VAT charged | 68 |

| 02 | Accrued depreciation written off | 01 |

Closing of the year

At the end of each reporting year, the accountant is required to make special entries that will allow some accounts to be closed. This procedure is called balance sheet reformation , it represents the zeroing of some accounting accounts.

It is mandatory for specialists to close accounts 90, 91, 99 and prepare the following correspondence:

| Debit | Contents of a business transaction | Credit |

| 90/9 90/1 | Account No. 90 is closed | 90/2, 90/4, 90/8 90/9 |

| 84 | Received loss | 99 |

| 99 | Profit received at the end of the year | 84 |

| 91/9 99 | Account No. 91 is closed | 91 91/9 |

Taxes and state duties

Each business entity, when conducting business, is faced with the need to accrue and transfer taxes, mandatory payments and fees to the budget. Also, legal entities have to pay a state fee when preparing documents or receiving any services from government agencies.

In accounting, they are required to reflect every business transaction related to taxes, fees and duties:

| Debit | Contents of a business transaction | Credit |

| 68 | Transfer of state duty | 51 |

| 99 | Profit tax calculation | 68 |

| 70 | Personal income tax withheld | 68 |

| 68 | Transfer of taxes to the budget | 51 |

| 91/2 | Transport tax charged | 68 |

| 90/3, 91/2 | VAT charged on sale | 68, 76 |

| 68 | VAT paid | 51 |

Loans issued

When accounting for loans, which have recently begun to be actively issued to both full-time employees and business partners, the following entries are made:

| Debit | Contents of a business transaction | Credit |

| 58 | Short-term or long-term loans are issued | 51 |

| 51 | Interest received on current account | 58 |

| 50 | Interest received at the company's cash desk | 58 |

| 58 | Interest accrued | 91 |

| 51 | Loan repayment is reflected in accounting | 58 |

Acquiring

In recent years, Russian companies have increasingly begun to use acquiring in their work, which allows them to accept bank cards from buyers (when paying for goods, works or services sold). When carrying out this type of calculation, accountants may encounter various problems that relate to the process of preparing entries.

Using standard invoice correspondence, they will be able to minimize the risk of making errors, which often cause penalties:

| Debit | Contents of a business transaction | Credit |

| 62 | Sales of goods | 90/1 |

| 90/3 | The amount of VAT is taken into account | 68/3 |

| 57 | Settlements with the buyer are closed (documents are transferred to the acquiring bank) | 62 |

| 57 | The revenue received from the buyer who paid for the goods with a payment card is reflected. | 90/1 |

| 51 | Received money from the acquiring bank | 57 |

| 91 | Related expenses written off | 57 |

| 96 | Purchase returns | 62 |

| 20/1 | The bank received an application from the buyer | 57 |

| 57 | Funds transferred | 51 |

| 57 | The commission charged by the bank is adjusted | 91 |

Results

The main purpose of accounting is to inform all interested users about the state of affairs in the company. In order to generate reliable and complete information, continuous accounting of transactions using the double entry method is used.

To record a business transaction, you must select current accounts from the working chart of accounts approved in the company's accounting policy. Possible correspondence of accounts are also given in order No. 94n.

Sources:

- Federal Law of December 6, 2011 N 402-FZ “On Accounting”

- Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.