Electronic requirements for payment of taxes and contributions: new referral rules

Recently, tax authorities updated forms for requests for payment of debts to the budget, incl. on insurance premiums. Now it’s time to adjust the procedure for sending such requirements through the TKS.

It is not necessary to print payslips

Employers are not required to issue paper payslips to employees. The Ministry of Labor does not prohibit sending them to employees by email.

"Physicist" transferred payment for the goods by bank transfer - you need to issue a receipt

In the case when an individual transferred payment for goods to the seller (company or individual entrepreneur) by bank transfer through a bank, the seller is obliged to send a cash receipt to the “physician” buyer, the Ministry of Finance believes.

The list and quantity of goods at the time of payment are unknown: how to issue a cash receipt

The name, quantity and price of goods (work, services) are mandatory details of a cash receipt (CSR). However, when receiving an advance payment (advance payment), it is sometimes impossible to determine the volume and list of goods. The Ministry of Finance told what to do in such a situation.

Medical examination for computer workers: mandatory or not

Even if an employee is busy working with a PC at least 50% of the time, this in itself is not a reason to regularly send him for medical examinations. Everything is decided by the results of certification of his workplace for working conditions.

Changed electronic document management operator - inform the Federal Tax Service

If an organization refuses the services of one electronic document management operator and switches to another, it is necessary to send an electronic notification about the recipient of the documents via TKS to the tax office.

Special regime officers will not be fined for fiscal storage for 13 months

For organizations and individual entrepreneurs on the simplified tax system, unified agricultural tax, UTII or PSN (with the exception of certain cases), there is a restriction on the permissible validity period of the fiscal drive key of the cash register used. Thus, they can only use fiscal accumulators for 36 months. But, as it turned out, this rule does not actually work so far.

Update: July 1, 2015

With the object “income minus expenses”, the tax base can be reduced by the amount of labor costs and sub. 6 clause 1 art. 346.16 Tax Code of the Russian Federation. For the purposes of simplification, only those payments to employees that are named in Art. 255 Tax Code and paragraph 2 of Art. 346.16 Tax Code of the Russian Federation.

This, in particular, is the salary itself, vacation pay, bonuses, various allowances - regional and northern, for work at night or on weekends, compensation for unused vacation upon dismissal.

The list of payments to employees given in Art. 255 of the Tax Code of the Russian Federation, not closed. It allows you to take into account in “simplified” labor costs any economically justified payments in favor of employees provided for by the labor and (or) collective agreement, clause 25 of Art. 255 Tax Code of the Russian Federation.

Labor costs are included in expenses at the time of their actual payment. 1 item 2 art. 346.17 of the Tax Code of the Russian Federation and are reflected in the Book of Income and Expenses when applying the simplified tax system on one of the following dates:

salary is issued in cash - on the date of payment from the cash register;

- salaries are transferred to employees’ bank cards - on the date the money is written off from the current account;

- the salary is paid in kind - on the date of transfer of property.

- in cash from the cash register - personal income tax must be paid on the same day when the cash was withdrawn by the employer by check;

- in cash from the cash register at the expense of cash proceeds - the tax must be paid no later than the day following the day the cash is issued to employees x clause 6 of Art. 226 Tax Code of the Russian Federation; Letter of the Ministry of Finance dated July 10, 2014 No. 03-04-06/33737.

It will not be a mistake if you recognize the expense in the form of accrued and paid wages for the month as a lump sum - a total amount that includes both the advance and the second part of the salary - on the day the latter is paid.

The personal income tax payment date depends on the method of salary payment:

non-cash - the tax must be paid on the day the money is transferred to the employee’s bank cards in paragraph. 4. 6 tbsp. 226 Tax Code of the Russian Federation;

In the Income and Expense Accounting Book (KUDiR), it is better to reflect the payment of wages and the transfer of personal income tax separately, even if these transactions occurred on the same day.

Here is a sample of filling out the KUDiR.

I. Income and expenses

Accounting for bank commissions and interest under the simplified tax system

The costs allowed to reduce the “simplified” tax base are fixed in paragraph 1 of Art. 346.16 Tax Code of the Russian Federation.

Costs under the simplified tax system associated with banking interaction include the costs recorded in subparagraph. 9 paragraph 1 of the above article:

In this case, expenses for bank services are taken into account in the manner applied by Art. 254, 255, 263, 264, 265 and 269 of the Tax Code of the Russian Federation for calculating income tax. Art. 264 classifies payment for services of credit institutions as other expenses. As for expenses for creditor services, the letter of the Ministry of Finance of the Russian Federation dated July 14, 2009 No. 03-11-06/2/124 provides a clear explanation of what banking operations they should be associated with. These operations are mentioned in Art. 5 of the Law of December 2, 1990 No. 395-1 “On Banks and Banking Activities”.

Banking transactions expensed

In accordance with the above-mentioned law, the following are related to the costs caused by banking transactions:

In addition to basic banking operations in Art. 5 of Law No. 395-1 provides a list of services of credit institutions, which, according to the same letter from the Ministry of Finance, are allowed to be accepted for expenses:

Accepted costs must be confirmed by the corresponding primary source. They are taken into tax accounting at the time of payment (clause 2 of Article 346.16 of the Tax Code of the Russian Federation).

All other expenses that arise during interaction with banks, not mentioned above, cannot be taken into account for calculating the “simplified” tax. Let us dwell on individual services of creditors that raise questions when accepted as costs for the simplified tax system.

Bank expenses for salary payments on cards

According to the letter of the Ministry of Finance dated July 14, 2009 No. 03-11-06/2/124, the commission for transferring salaries to employee cards is considered a banking transaction and reduces the base for calculating the tax on the simplified tax system. To accept these costs, it is necessary to indicate in the employment contract that the salary is transferred not through the cash register, but by bank transfer.

At the same time, the costs for opening cards for employees, in the opinion of the Ministry of Finance, expressed in this letter, cannot be taken as a credit for tax accounting. But according to the letter of the tax service dated 02.06.2005 No. 20-12/40107, it is possible to take into account in the expenses for calculating income tax bank commissions for issuing cards to employees of the organization for the purpose of transferring employer payments to them, but on the condition that these expenses under the contract are borne by itself organization. Since bank commissions for the simplified tax system are applied as expenses in accordance with the provisions of Art. 264 and 265 of the Tax Code of the Russian Federation, the conclusions of the above letter from the tax service are also applicable for the “simplified” tax. As we can see, the positions of the Ministry of Finance and the Tax Service of the Russian Federation are different.

Amounts to be reduced

As already said, along with charges, there is also the opportunity to reduce the amount of tax. By the way, the reduction is already applied to the calculated tax amount. What can you reduce by? The amount of payments to the funds from employee salaries, which is set at 30% of the salary. This reduction can be applied by both organizations and entrepreneurs who have employees. There is a limitation - you can reduce the amount of tax by no more than 50% from the amounts paid to the Pension Fund and compulsory medical insurance. Example. Income for the period amounted to 50,000 rubles, salary 25,000 rubles. Tax amount = 50000*6%=3000 rubles, amount of payroll payments 25000*30% = 7500 (this amount can be reduced), now let’s check whether the condition is met. We have 3000/2 – 7500 = 1500 – 7500<0, then we take half of the tax amount of 1500 (50%). If the difference were greater than zero, then we would subtract the amount of the reduction from these 3000, for example, if the reduction were equal to 1000 rubles instead of 7500, then the tax would be 3000-1000 = 2000 payable.

If there are employees, the tax on the simplified tax system can be reduced by amounts paid to the funds for employees, but by no more than 50 percent.

Another option applies only to an entrepreneur who has no employees. In this case, the tax can be reduced by the amount of contributions paid to the Pension Fund and Compulsory Medical Insurance without limitation, i.e. can be reduced by the entire payment amount - by 100%.

Compensation for “client-bank”

With the development of information systems, the use of “client-bank” seems to be a natural process. For operational work, bankers provide similar services. There is no doubt about their economic justification. Art. 346.16 of the Tax Code of the Russian Federation indicates the permissibility of taking banking services into account in the manner specified in Art. 265 Tax Code of the Russian Federation. Subp. 15 paragraph 1 of this article literally indicates the admissibility of accepting bank services as expenses arising from the use of electronic systems for transmitting documents from bankers to the customer and back.

Collection and cash settlement

Costs arising from the support of ongoing settlements, as well as those associated with the collection and recalculation of received money, their delivery to the bank branch are costs that reduce the base for the simplified tax system. To recognize this type of expense, the cost of collection and settlement services is fixed in an agreement concluded with a banking institution.

The buyer's payment for acquiring is credited to the simplifier's income in full, taking into account the bank commission at the time the funds are credited to the seller's current account. Is it possible to count this commission as an expense for the simplified tax system? Yes, you can. Basis - sub. 24 clause 1 art. 346.16 of the Tax Code of the Russian Federation (as commissions, agency fees).

The list of costs that reduce the base for the “simplified” tax is set out in paragraph 1 of Art. 346.16 Tax Code of the Russian Federation. Expenses for banking services are given in sub. 9 clause 1 art. 346.16 of the Tax Code of the Russian Federation - they are presented in the form of interest paid for loans and credits, or commissions for the services of credit institutions.

The services of bankers who reduce the base for the “simplified” tax are given in Art. 5 of the law of December 2, 1990 No. 395-1. Banking services include them, but in a specific list. Bank commissions under the simplified tax system are included as expenses at the time of actual payment based on the confirming primary receipt.

Personal income tax and insurance premiums

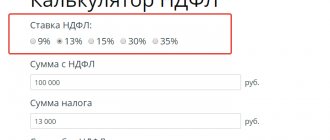

Let's start with income tax. Its rate for salary payments is 13%. The tax itself is withheld from payments to the employee, so the businessman does not directly bear the fiscal burden.

However, the employer is entrusted with performing the functions of a tax agent, i.e. the obligation to calculate, withhold and transfer personal income tax to the budget. Consequently, for this you need to allocate a specialist (and in large companies, an entire department), equip workplaces, pay salaries and incur other personnel-related expenses.

For errors and violations of deadlines, tax agents are subject to fines, and if large sums are involved, criminal prosecution. Therefore, personal income tax also refers to the tax burden on business, although formally the employer does not spend his funds to pay it.

Compulsory insurance contributions are charged for payments to employees. For this category of payments there are a number of benefits and “special” options, but in general the following rates apply (Article 425 of the Tax Code of the Russian Federation):

- Pension insurance – 22%.

- Compulsory social insurance – 2.9%.

- Compulsory health insurance – 5.1%.

In general, the rate on transferred insurance premiums is 30%.

In addition to them, there is a “specific” type of mandatory contributions - insurance against accidents at work. It is regulated by a separate law dated July 24, 1998 No. 125-FZ. Tariffs of “accident” insurance premiums significantly depend on the type of activity. Depending on how dangerous the production or other processes associated with the business are, the rate can range from 0.2% to 8.5%. But for most industries its value does not exceed 1-2% (law of December 22, 2005 No. 179-FZ).

In further calculations, for simplicity, we will use only the “basic” rate of insurance premiums - 30% of the wage fund (payroll).

Is it possible to recognize salary expenses under the simplified tax system (income minus expenses)

Companies and entrepreneurs using a simplified approach with the object “income minus expenses” can take into account for tax purposes expenses, the list of which is given in paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation. Here, among other things, labor costs are named - subparagraph 6 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation. Labor costs under the simplified tax system “income minus expenses” are recognized according to the rules of Article 255 of the Tax Code of the Russian Federation, that is, as for income tax (clause 2 of Article 346.16 of the Tax Code of the Russian Federation).

Personal income tax paid to the budget cannot be written off as expenses. It is not provided for in paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation. However, it cannot be written off on a separate basis. After all, it is included in the “dirty” salary, which is recognized in full.

When personal income tax is considered an expense under the simplified tax system

It is not enough to know whether personal income tax is included in expenses under the simplified tax system. You also need to understand at what point simplifiers can recognize costs. According to paragraph 2 of Art. 346.17, companies using the simplified tax system have the right to recognize expenses only after they have actually been paid. In relation to expenses for personnel wages, the moment of repayment of obligations is considered to be the day the accrued amounts are issued from the cash register or written off from the employer’s current account. Consequently, personal income tax when calculating the simplified tax system “Income minus expenses” can be taken into account in the amount of labor costs after actual settlements with employees and transfer of income tax to the state treasury (Letter of the Federal Tax Service of the Russian Federation for Moscow No. 16-15 / [email protected] dated 14.09 .10).

Note! When filling out the KUDiR, taxpayers should separately reflect the amounts for wages minus personal income tax and the amount of transferred personal income tax. If these transactions occurred on the same day, the summation of indicators is allowed.

What employee benefits can be taken into account?

Labor costs include any accruals to employees in cash or in kind, incentive bonuses, compensation, and bonuses. The main thing is that such amounts are provided for in labor or collective agreements. The Russian Ministry of Finance also drew attention to this in a letter dated April 29, 2015 No. 03-11-11/24865. Therefore, if the salary is paid to the head of the organization, who is its sole founder, it will not be possible to recognize the amount as expenses - letter of the Ministry of Finance of Russia dated February 19, 2015 No. 03-11-06/2/7790. And all because in this case it is impossible to conclude an employment contract. After all, an employment contract involves two parties - the employee and the employer (Article 56 of the Labor Code of the Russian Federation). So the manager – the only founder – cannot sign an agreement with himself.

Insurance contributions from wages can also be included in expenses - subparagraph 7 of paragraph 1 of Article 3246.16 of the Tax Code of the Russian Federation.

All salary taxes in 2021 as a percentage - full table

We support the state with our taxes, and this is not a beautiful pretentious expression, but an economic reality. From the salary of an ordinary Russian worker alone, the budget receives a significant amount - much more than the 13% income tax that is usually discussed. Let’s summarize in one table all taxes and contributions as a percentage that will be paid from a Russian’s salary in 2021.

What taxes and contributions are paid on wages of Russians?

From a formal point of view, we are really talking about only one tax - income tax. Or about the personal income tax (NDFL), as it is called in the Tax Code.

The vast majority of ordinary working Russians pay this tax at a rate of 13% of earnings.

In 2021, for some Russian citizens the rate will be increased to 15%. True, not for the entire annual income, but for that part of it that exceeds five million rubles. For example, with an annual income of six million rubles, a person will pay 13% income tax for the first five million - 650 thousand. And for a million that exceeds this threshold - 15% tax, or 150 thousand rubles. A total of 800 thousand versus 780 thousand on the flat personal income tax scale, which is living out its last months in 2021.

A more tangible measure for the budget should be the introduction of an income tax on deposits of more than a million rubles. The country's budget for 2021-2023 talks about plans to increase treasury revenues in the form of personal income tax thanks to this measure from 60 billion rubles. up to 171.5 billion rubles. More than 100 billion rubles. will give precisely income tax on deposits. However, it has nothing to do directly with wages.

But the numerous contributions that are formally paid for them by the employer are related to the salaries of Russians.

It is clear that the payment of these contributions by the employer is just a formality. For any organization, the direct salary of employees and related contributions are the wage fund. When hiring an employee for a flat salary of 40 thousand rubles, the company understands that it will incur much higher costs for paying the person. And this is also money actually earned by the employee.

Here are the taxes and contributions actually paid to the treasury from the earnings of all (or almost all - some of the contributions apply to some workers) employed Russians:

income tax (NDFL);

pension contributions;

contributions for “free” medicine;

social insurance contributions;

contributions for injuries - for workers in hazardous work.

Image: pixabay.com

Image: pixabay.com

Taxes and contributions from wages in 2021 - full table

This is what the table of all taxes and contributions paid from the salaries of Russians will look like in 2021:

All salary taxes in 2021 as a percentage - full table

Three types of insurance contributions - pension, compulsory medical insurance and social insurance - amount to 30% of the earnings of every Russian.

This should not be forgotten in the same state clinics and hospitals, which are far from free. They cost all working citizens as much as five percent of their monthly income.

What does this look like in a clear example?

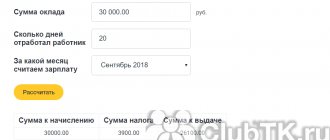

In fact, as you can see from the table, Russians pay up to half of their earnings in taxes and contributions. To make it clear, let’s calculate the actual expenses of the employer for an employee who receives 30 thousand rubles every month.

First of all, in order for the salary that an employee receives in hand to be equal to 30 thousand, officially it should be equal to approximately 34,483 rubles. After deducting 13% income tax, the required 30 thousand rubles are obtained from this amount.

From these 34,483 rubles, the employer will make the following contribution amounts to the treasury:

7,586 rubles - for social insurance;

1,000 rubles - for social insurance;

1,759 rubles - for compulsory medical insurance.

Even without possible contributions for injuries, it comes out to 4,483 rubles in income tax and another 10,345 rubles in the form of social contributions. The man received 30 thousand rubles in his hands, and another 14,828 rubles were received by the country’s budget.

In fact, the budget will earn even more. Even if the employee from our example leads a healthy lifestyle and does not drive a car, the price of any product purchased by him will include from 10 to 20 percent VAT. And if he buys alcohol and tobacco, fills the car with gasoline, he also pays considerable excise taxes included in the cost of such goods.

We really support the state as taxpayers. And this is not at all a figure of speech that came to us from the West. This is an economic reality that we just don't think about very often.

Read more >>>

When to write off expenses

Under the simplified tax system, the cash method is used - expenses are recognized after they have been paid. This is stated in paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation. The same is discussed in the letter of the Ministry of Finance of Russia dated November 24, 2014 No. 03-11-06/2/59509. Therefore, you can write off the paid salary as an expense, and not just the accrued salary.

It happens that a company or individual entrepreneur calculated wages (for December) when they used the “income” object. The payment came in January, when the company (IP) changed the object of taxation to “income minus expenses.” In such a situation, it is impossible to take into account the salary in the new year, because it refers to the previous year, when the “income” object was in effect. The financiers provided such explanations in a letter dated May 26, 2014 No. 03-11-06/2/24949.

Special modes

Labor costs under the simplified tax system

To classify any payments as labor costs under the simplified tax system, it is first necessary that they be provided for in employment agreements (contracts) and (or) collective agreements. And since all simplifications use the cash method of accounting for income and expenses, the tax base can be reduced only after certain payments are issued to employees. How labor costs are formed when applying the simplified tax system and what you need to pay attention to when taking into account certain types of additional payments and payments to employees is described in this article.

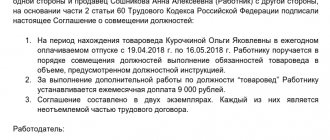

Remuneration system for individual entrepreneurs

Entrepreneurs, like legal entities, when concluding legal relations with an employee, must draw up an employment contract. In it, in addition to basic information (personal data of the employee, position, etc.), it is necessary to indicate the amount of the salary, as well as the amount of bonuses, if any. In addition, the contract must describe the remuneration system applicable to the employee. It can be piecework and depend on the volume of production, or time-based (based on the number of hours worked). Individual entrepreneurs and small businesses, as a rule, use time-based wages.

Employee compensation costs

Firms using the simplified tax system with the object “income minus expenses” recognize labor costs in the manner established for income tax payers, that is, in accordance with Article 255 of the Tax Code (clause 6, clause 1, article 346.16 of the Tax Code of the Russian Federation). According to this article, expenses for remuneration of employees include any types of expenses in their favor, if they are provided for in an employment or collective agreement.

List of labor costs

Such expenses include, in particular:

- salaries accrued to the company's personnel;

- bonuses for performance;

- additional payments related to working hours and working conditions (for night work, multi-shift work, for combining professions, etc.);

- labor costs during forced absence;

- compensation for unused vacation;

- average earnings retained by the employee in cases provided for by labor legislation;

- accruals to employees released due to the reorganization of the company, as well as reduction of its staff;

- one-time rewards for length of service;

- regional coefficients and allowances for work in difficult climatic conditions;

- expenses for remuneration of employees who are not on the company's staff for performing work under civil contracts (for example, a contract or an assignment);

- payments under compulsory and voluntary insurance contracts for employees;

- reimbursement to employees of the cost of paying interest on loans (credits) for the purchase or construction of housing, but not more than 3% of the amount of labor costs.

The standard for recognizing interest on voluntary health insurance is 6% of the amount of labor costs.

Payment of wages in goods

Employers can pay wages not only in cash, but also in kind (products or goods) (Article 131 of the Labor Code of the Russian Federation). But such payment should be no more than 20% of accrued wages.

Issued goods are considered sold; they are simply paid not in money, but through offset (remuneration for labor). Expenses on purchased goods that were sold in this way can be taken into account for taxation (clause 23, clause 1, article 346.16 of the Tax Code of the Russian Federation). This means that remuneration in kind can be reflected as part of “simplified” expenses.

Advance payment of wages

Employees must be paid wages at least every half month (Article 136 of the Labor Code of the Russian Federation). There are two options for accounting for salary advances as expenses.

- Advances on wages are reflected in expenses on the date of payment from the cash register or transfer to employee accounts. Since simplifiers recognize labor costs at the time of debt repayment, then by issuing an advance, the company pays off its debt for the first half of the month. Tax authorities agree with this accounting option (letter of the Federal Tax Service of the Russian Federation for Moscow dated December 31, 2004 No. 21-14/85240).

- The salary advance is taken into account in expenses on the last day of the month. Since wage arrears arise only after wages are accrued, advances issued to employees are recognized as expenses on the day the wages are accrued (the last day of the month).

Since both options for accounting for advances on wages do not contradict the norms of the Tax Code, the company has the right to choose the option that is more convenient for it.

Personal income tax from employee income

Organizations and entrepreneurs with the object “income minus expenses” have the right to take into account personal income tax withheld from employee income as part of the accrued amounts of wages. This opinion was expressed by the Ministry of Finance in a letter dated November 9, 2015 No. 03-06/2/64442.

The fact is that “income-expenditure” simplifiers can write off as expenses the amounts of taxes and fees paid in accordance with the legislation of the Russian Federation (clause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation).

At the same time, the Tax Code does not exempt simplifiers from the duties of tax agents when paying remuneration to individuals (clause 6 of Article 346.11 of the Tax Code of the Russian Federation). In particular, when paying income to their employees, they are obliged to withhold the accrued amount of personal income tax from the income of employees (Article 226 of the Tax Code of the Russian Federation).

Moreover, personal income tax must be withheld from any funds that are paid to individuals or on their behalf to third parties. But paying personal income tax at the expense of the tax agent’s own funds is unacceptable.

Consequently, personal income tax from the income of employees cannot be reflected as part of the expenses of the simplified tax system of the company (entrepreneur) on the basis of subparagraph 22 of paragraph 1 of Article 346.16 of the Tax Code.

However, the provisions of subparagraph 6 of paragraph 1 and paragraph 2 of Article 346.16 of the Tax Code allow “simplified workers” to take into account labor costs when calculating the single tax according to the rules of Article 255 of the Tax Code. That is, in the manner prescribed for calculating income tax.

In turn, Article 255 of the Tax Code states that labor costs include any accruals to employees provided for by the laws of the Russian Federation, labor agreements (contracts) and (or) collective agreements.

And since personal income tax is taken into account as part of accrued wages, the Ministry of Finance concludes that the amount of this tax can also be taken into account as part of labor costs.

Let us note that in its earlier letter dated February 22, 2007 No. 03-11-04/2/48, the Ministry of Finance already stated that personal income tax from employee salaries can be taken into account in “simplified” labor costs.

Arbitration practice also confirms this position. For example, the Federal Antimonopoly Service of the Moscow District, in resolution dated February 22, 2005 No. KA-A41/775-05, invalidated the decision of the tax authorities to hold the company accountable for including personal income tax in expenses. The arbitrators indicated that the payment of the tax was a labor expense because it was withheld from the wages accrued to employees. A similar conclusion was made by the judges of the Federal Antimonopoly Service of the Moscow District in a resolution dated December 17, 2009 No. KA-A40/13654-09.

Also, a simplifier can take into account as expenses payments under civil contracts (for example, under a work contract) to employees who are not on the payroll (clause 21 of Article 255 of the Tax Code of the Russian Federation).

Entrepreneur salary

Entrepreneurs using the simplified tax system cannot act as employers in relation to themselves. Therefore, they do not have the right to accrue and pay wages to themselves and, therefore, do not have the right to include the costs of paying them into “simplified” expenses (letter of the Ministry of Finance of Russia dated January 16, 2015 No. 03-11-11/665).

Paying salaries: stages and calculation example

The procedure for paying salaries to individual entrepreneurs is as follows:

Stage 1. We pay the employee an advance

This month you must pay employees an advance. The payment amount can be calculated based on the number of days worked. You can also fix the advance amount as a percentage of the total rate. There is no need to charge and withhold personal income tax and contributions from the advance payment. Pay the advance on the day fixed by internal regulations (for example, an employment contract).

Stage 2. Calculate wages before deductions

Before payday, find out how many days the employee actually worked. If an employee was at work on all working days of the month, then the basis for calculating taxes and fees will be the rate in accordance with the employment contract.

Payment of temporary disability benefits

Simplified employees pay temporary disability benefits to their employees in the manner established by Federal Law No. 255-FZ of December 29, 2006.

The benefit for the first three days of illness of the employee is paid at the expense of the employee’s own funds, and from the fourth day - at the expense of the Social Insurance Fund (clause 1, part 2, article 3 of Law No. 255-FZ). For persons who voluntarily pay contributions to the Social Insurance Fund, the fund pays benefits for all days of incapacity for work.

The amount of temporary disability benefits depends on the employee’s insurance length. It is calculated using the formula:

Employee earnings subject to contributions to the Federal Social Insurance Fund of the Russian Federation for two accounting years

The principle of “income minus expenses”

Individual entrepreneur organizations that in 2021 apply the “simplified tax system” (STS) and pay a single tax on the difference between income and expenses have the right to reduce the tax base by the amount of expenses incurred (clause 2 of Article 346.18 of the Tax Code of the Russian Federation).

Having chosen the object of taxation “income reduced by the amount of expenses”, the payer of the simplified tax system in 2021 must keep records of income received and expenses incurred in the book of income and expenses. And based on this book, determine the final amount of tax to be paid.

What “gets” into income

As part of the “simplified” income, it is necessary to take into account income from sales and non-operating income (Article 346.15 of the Tax Code of the Russian Federation). In this case, income under the simplified tax system is recognized using the “cash” method. That is, the date of receipt of income is the day of receipt of funds, receipt of other property or repayment of debt by other means (clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

What is included in expenses

The list of expenses that can be taken into account on a simplified basis is given in Article 346.16 of the Tax Code of the Russian Federation and is closed. This means that not any costs can be taken into account, but only justified and documented costs listed in the specified list. This list includes, but is not limited to:

- expenses for the acquisition (construction, production), as well as completion (retrofitting, reconstruction, modernization and technical re-equipment) of fixed assets;

- costs of acquiring or independently creating intangible assets;

- material costs, including costs for the purchase of raw materials and materials;

- labor costs;

- the cost of purchased goods purchased for resale;

- amounts of input VAT paid to suppliers;

- other taxes, fees and insurance premiums paid in accordance with the law. An exception is the single tax, as well as VAT allocated in invoices and paid to the budget in accordance with paragraph 5 of Article 173 of the Tax Code of the Russian Federation. These taxes cannot be included in expenses (subclause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation).

- costs for maintenance of CCP and removal of solid waste;

- expenses for compulsory insurance of employees, property and liability, etc.

USN. Accounting for personal income tax from employee salaries

We work on the simplified tax system (income minus expenses). Personal income tax is not included in expenses. But this is part of the salary, which, when paid, is included in expenses. How about the program automatically includes personal income tax in expenses when payments are made to the current account?

In accordance with paragraphs 22 clause 1 art. 346.16 Tax Code of the Russian Federation

when determining the object of taxation, a taxpayer applying the simplified tax system with the object of taxation in the form of income reduced by the amount of expenses,

has the right to reduce the income received by the amount of taxes and fees paid

in accordance with the legislation of the Russian Federation on taxes and fees.

Organizations using the simplified tax system are not exempt from performing the duties of tax agents

provided for by the Tax Code of the Russian Federation (

clause 5 of Article 346.11 of the Tax Code of the Russian Federation

).

Art. 226 Tax Code of the Russian Federation

It has been established that the calculation of amounts and payment

of personal income tax

are carried out in relation to all income of the taxpayer, the source of which is

the tax agent

.

Tax agents are required to withhold the accrued tax amount directly from the taxpayer’s income

upon actual payment.

The tax agent withholds the accrued amount of personal income tax from the taxpayer at the expense of any funds paid by the tax agent to the taxpayer upon actual payment of the specified funds to the taxpayer.

Payment of personal income tax at the expense of tax agents is not allowed

.

In this regard, the amounts of personal income tax withheld from the income of employees by the organization

applying the simplified tax system

cannot be included in the expenses

provided for

in paragraphs.

22 clause 1 art. 346.16 Tax Code of the Russian Federation .

This opinion is expressed by the Ministry of Finance of the Russian Federation (letters dated November 24, 2009 No. 03-11-06/2/246, dated June 25, 2009 No. 03-11-09/225).

According to paragraphs 6 clause 1 and clause 2 art. 346.16 Tax Code of the Russian Federation

Taxpayers using the simplified tax system, when determining the tax base, can

reduce the income received for labor costs

in the manner prescribed by

Art.

255 Tax Code of the Russian Federation .

In accordance with Art. 255 of the Tax Code of the Russian Federation to labor costs

include

any accruals to employees

provided for by the laws of the Russian Federation, employment agreements (contracts) and (or) collective agreements.

Personal income tax amounts are taken into account as part of accrued wages.

.

Art. 346.17 Tax Code of the Russian Federation

It has been established that

expenses

of the taxpayer are recognized

after their actual payment

.

Labor costs are taken into account

at the time of repayment of the debt by writing off funds from the taxpayer’s current account, payment from the cash register, and in the case of another method of repayment of the debt - at the time of such repayment.

Expenses for paying taxes and fees are taken into account in the amount actually paid by the taxpayer.

Thus, personal income tax amounts are taken into account in labor costs

under the simplified tax system

after the actual payment

of income to the employee and the transfer of tax to the budget (

clauses 1, 3, clause 2 of Article 346.17 of the Tax Code of the Russian Federation

) (letter from the Federal Tax Service for Moscow dated September 14, 2010 No. 16-15/ [email protected ] ).

Since the transfer of wages and personal income tax is not always carried out on the same day, on the basis of different primary documents, these transactions have different contents, it is advisable to reflect these transactions in the Income and Expenses Accounting Book separately

.

Breakdown of expenses: table

Some novice accountants are surprised: “How can one accurately understand from Article 346.16 of the Tax Code of the Russian Federation whether it is possible to reduce the simplified tax system for a particular expense or not?” Yes, indeed, some of the expenses described in this article raise questions. What exactly, for example, is included in labor costs? Or what costs should be attributed to solid waste removal in 2017? As a rule, the Ministry of Finance or the Federal Tax Service comes to the rescue on such issues and gives their explanations. Based on the Tax Code of the Russian Federation and official explanations, we have prepared a breakdown of expenses that in 2017 can be attributed to expenses under the simplified tax system with the object of taxation “income minus expenses.” Here is a table with expenses, which are expenses that are not directly named in article 346.16, but which can be taken into account in expenses:

Explanation of expenses according to the simplified tax system for 2021