Characteristics of account 84

Account 84 “Retained earnings” is one of the most important financial accounts of any organization. It is to this account that the final entries from the account are written off. 99, depending on the result obtained for the reporting year - profit (income exceeds costs) or loss (costs exceed income). In addition, from the account 84 money is used to pay income to the founders - both employees of the enterprise and third parties.

84 accounting account allows you to obtain aggregate information about the amount of profit/loss after tax for all types of company activities that have not yet been distributed for various purposes. Analytical accounting is organized in order to monitor the performance of individual commercial areas. At the same time, you can divide the unused profit and the profit already spent on the development of the enterprise, and also see what part of the financial result was formed from the current year’s activities and what part relates to previous periods.

How to transfer money to an individual entrepreneur’s current account and reflect it in accounting

Analytical accounting of uncovered losses in account 84 is organized in such a way as to ensure the generation of information in all areas of the use of loss funds.

The chart of accounts requires showing on account 84 the presence and movement of amounts of undistributed finances (uncovered losses). It is necessary to close the year, so information on transactions is reflected on it cumulatively, allowing you to generate information for the period of the company’s economic activity.

Application exempts individual entrepreneurs from the obligation to pay personal income tax. When determining the tax base in connection with the payment of the simplified taxation system, only income from sales from sales and non-operating income are taken into account.

Count 84 – active or passive?

Account 84 “Retained Earnings” is a striking example of active-passive accounts, it is included in Section VII of the Chart of Accounts by order of the Ministry of Finance No. 94n dated October 31, 2000, and is often a significant specific part of the entire capital of the organization. The cumulative method of reflecting data on account 84 (the entries are given below) serves to generate information for the period of operation of the enterprise - from the date of registration to the liquidation of the business.

To the question, is credit 84 of the account a profit or a loss, the answer option will, of course, be the first one - profit, since replenishment or increase of the account, that is, the write-off of profit is carried out on the credit of the account. 84 in correspondence with accounts 99, , , , , 84, , 82. In this case, the debit of account 84 shows a decrease in financial. result, that is, writing off the loss in correspondence with accounts - 99, 70, 75, 80, 83, 82, as well as , , 52.

Thus, the credit balance on account 84 means the net profit of the enterprise, which can be spent on various purposes - from paying income to the founders to investing in business development. And the debit balance on account 84 means an uncovered loss in activity.

84 account in accounting - subaccounts:

- 84.1 – for profits that are subject to distribution.

- 84.2 – for loss subject to coverage.

- 84.3 – for profit in circulation.

- 84.4 – for profits already used.

Accounting entries involving account 84

In accordance with the current Chart of Accounts, which was approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n, accounting account 84 can be used in the following correspondence:

- Dt 84 Kt 51-52, 55, 70, 75, 79-80, 82-84, 99;

- Dt 73, 75, 79-80, 82-84, 99 Kt 84.

When reforming the balance sheet at the end of December of the reporting year, a posting must be made involving accounts 84 and 99. If there is a profit - Dt 99 Kt 84, a loss - Dt 84 Kt 99. The direction of profit for the payment of dividends is displayed as follows: Dt 84 Kt 75, dividends to employees - Dt 84 Kt 70.

To learn how such profit is reflected in the balance sheet, read the article “Retained earnings in the balance sheet (nuances).”

The distribution of NRP among on-farm reserves and funds is displayed as follows:

- Dt 80 Kt 84 - reducing the size of the enterprise’s capital to the value of its net assets;

- Dt 84 Kt 80 - direction of the NRP to increase the capital;

- Dt 82 Kt 84 - covering losses from reserve capital;

- Dt 83 Kt 84 - covering losses through additional capital;

- Dt 75 Kt 84 - the company’s loss was repaid through contributions from its owners;

- Dt 84 Kt 83 - direction of NRP to increase additional capital;

- Dt 84 Kt 84 - internal movement of NRP across subaccounts (for example, creation of an accumulation fund, reserving funds for a planned acquisition).

You will find more entries for accounting for non-distributed income in the article “Accounting for retained earnings on account 84 (entries).”

Closing account 84 at the end of the year - postings

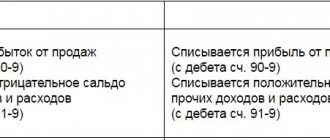

Monthly postings to the account. 84 are performed to write off the results of the enterprise’s activities. The accountant closes profit/loss like this:

- D 90.9 K 99 or D 99 K 90.9 – profit (or loss) from the main activity is reflected.

- D 99 K 84 – the state of emergency is written off (net profit). Accordingly, the credit 84 of the account shows a profit, and the debit (entry D 84 K 99) shows a loss.

At the end of the year, the balance sheet is reformed, meaning the corresponding accounts are consistently reset to zero. How is account 84 formed when disposing of funds ? Postings are made depending on the purpose of the write-off:

- D 84 K 75 – money was allocated to accrue annual dividends.

- D 84 K 80 – to increase the authorized capital.

- D 84 K 82 – for the formation of reserve capital.

- D 84.3 K 84.2 – part of the accumulated loss is covered.

Conclusion - we found out that the answer to the question, Kt 84 account - is profit or loss, in any case, means the company’s net profit, which remains after taxation and can be used for the necessary purposes according to Law No. 208-FZ of December 26, 1995. and 14-FZ dated 02/08/98

Using account 84 in postings

The amount of net profit (loss) is determined based on the results of the reporting year when reforming the balance sheet. When determining profit, its amount is recorded according to Kt 84 in correspondence with Dt 99. If a loss is identified in the reporting year, then its indicator is reflected according to Dt 84.

The amount of net profit on account 84 can be distributed:

- between shareholders (accounts 70, );

- for the formation of reserve capital (account 82);

- to increase the authorized capital (account 80);

- to increase the size of capital investments (account 08).

The loss, the amount of which is formed on accounting account 84, can be covered from the shareholders’ own funds, as well as from reserve capital:

| Dt | CT | Description |

| 82 | 84 | The loss is covered by the reserve fund |

| 84 | 83 | Profit is used to form additional capital |

Net profit and financial statements

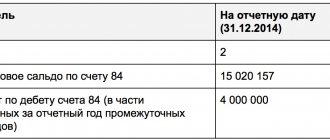

The balance of account 84 is reflected in the balance sheet in section. III “Capital and reserves” on line 1370 “Retained earnings (uncovered loss)”.

Retained earnings (credit balance of account 84) are indicated without parentheses, and uncovered losses (debit balance of account 84) are indicated in parentheses.

In the income statement, line 2400 “Net profit (loss)” reflects the amount of the organization’s net profit for the reporting period.

The indicator for line 2400 of the Report should be equal to the final balance in account 99 “Profits and losses”, which, when closing the annual balance sheet, is written off to account 84 “Retained earnings (uncovered loss)”.

Account 84 in accounting. retained earnings uncovered loss

(RUB 100,000 * 9%) - personal income tax is withheld from the founders’ income;

Dt 84 Kt 75 – 100,000 rub. – the accrual of interim dividends is reversed;

Dt 91.2 Kt 75 - 100,000 rub. — payments to participants were reclassified into other expenses;

Dt 99 Kt 91.9 - 100,000 rub. — the paid amounts of interim dividends are added to the losses of the reporting year.

Accountant “X” must inform the tax office about the impossibility of withholding personal income tax from the income of participants based on a rate of 13% in the amount of 4,000 rubles. (100,000 rubles * (13% - 9%)) (clause 5 of article 226 of the Tax Code of the Russian Federation).

Covering losses using reserve capital

Covering the loss using reserve capital is reflected by posting:

Dt 82 Kt 84 - the loss of the reporting year was repaid from the reserve capital (fund).

Example.

As of January 1 of the reporting year, LLC “U” has reserve capital in the amount of 30,000 rubles. Last year “U” received a loss of 20,000 rubles.

On March 15 of the reporting year, the meeting of participants decided to cover the loss using reserve capital funds.

Postings:

December 31 last year (during balance sheet reform):

Dt 84 Kt 99 - 20,000 rub. - reflected uncovered loss;

April 15 of the reporting year:

Dt 82 Kt 84 — 20,000 rub. — last year’s loss was repaid using reserve capital funds.

In the balance sheet as of December 31 of the year preceding the reporting year, line 1360 “Reserve capital” will show the amount of 30 thousand rubles, and line 1370 “Retained earnings (uncovered loss)” - the amount of 20 thousand rubles. in parentheses.

Covering losses through targeted contributions from founders

If the organization does not have sources to repay losses, then the founders of the company may decide to cover them through additional contributions.

This operation is reflected by posting:

Dt 75 Kt 84 - the loss of the reporting year was repaid at the expense of the founders.

Example.

As of January 1 of the reporting year, the uncovered loss of LLC X was 50,000 rubles. The founders decided to allocate additional funds to cover the resulting loss.

The funds were deposited into the society's cash register.

Accountant "X" must make the following entries:

Dt 50 (51) Kt 75 - 50,000 rub. — funds were received from the founders to cover the loss;

Dt 75 Kt 84 - 50,000 rub. — contributions from the founders are used to cover the loss.

The charter of a limited liability company may provide for the obligation of its participants to make contributions to the company’s property (Clause 1, Article 27 of the Law “On Limited Liability Companies” dated February 8, 1998 No. 14-FZ). The legislator has not provided for such an opportunity for joint-stock companies. Contributions to property do not change the size and nominal value of the shares of company participants in its authorized capital.

The Russian Ministry of Finance explains (Letters dated January 29, 2008 No. 07-05-06/18, dated April 13, 2005 No. 07-05-06/107) that such deposits are reflected separately - on account 83 “Additional capital”. There is no opportunity to use these funds to directly pay off losses. However, additional capital is one of the components of equity capital. Therefore, investments in property will prevent the formation of negative net assets.

Date added: 2015-10-13; ;

Accounting for retained earnings on account 84 (postings)

The amount of the net loss of the reporting year is written off with the final turnover of December to the debit of account 84 “Retained earnings (uncovered loss)” in correspondence with account 99 “Profits and losses”.

The direction of part of the profit of the reporting year to pay income to the founders (participants) of the organization based on the results of approval of the annual financial statements is reflected in the debit of account 84 “Retained earnings (uncovered loss)” and the credit of accounts 75 “Settlements with founders” and 70 “Settlements with personnel for wages” " A similar entry is made when paying interim income.

The write-off of the loss of the reporting year from the balance sheet is reflected in the credit of account 84 “Retained earnings (uncovered loss)” in correspondence with accounts 80 “Authorized capital” - when the amount of the authorized capital is brought to the value of the organization’s net assets; 82 “Reserve capital” - when funds from reserve capital are used to pay off losses; 75 “Settlements with founders” - when repaying the loss of a simple partnership at the expense of targeted contributions of its participants, etc.

Analytical accounting for account 84 “Retained earnings (uncovered loss)” is organized in such a way as to ensure the generation of information on the areas of use of funds. At the same time, in analytical accounting, funds of retained earnings used as financial support for the production development of the organization and other similar activities for the acquisition (creation) of new property and not yet used can be divided.

Account 84 “Retained earnings (uncovered loss)” corresponds with the following Plan accounts:

by debit

- 51 “Current accounts”

- 52 “Currency accounts”

- 55 “Special bank accounts”

- 70 “Settlements with personnel for wages”

- 75 “Settlements with founders”

- 79 “Intra-economic settlements”

- 80 “Authorized capital”

- 82 “Reserve capital”

- 83 “Additional capital”

- 84 “Retained earnings (uncovered loss)”

- 99 "Profits and losses"

on loan

- 73 “Settlements with personnel for other operations”

- 75 “Settlements with founders”

- 79 “Intra-economic settlements”

- 80 “Authorized capital”

- 82 “Reserve capital”

- 83 “Additional capital”

- 84 “Retained earnings (uncovered loss)”

- 99 "Profits and losses"

Account 84 in the hands of an accountant

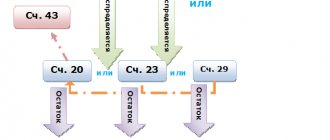

Accounting entries when closing a financial year for legal entities are drawn up in the following sequence:

- Closing accounts for cost accounting (including indirect costs).

- Closing 90 accounts, calculating company profits.

- Balance sheet reformation: closing the main accounts for accounting for the company’s income and expenses, analyzing the financial condition of the enterprise, the efficiency of business activities, obtaining an indicator of the organization’s net profit or net loss.

Closing the year is a summary of the financial results of the organization as of December 31 of the reporting year.

Before closing, it is necessary to double-check all basic data and carry out mandatory regulatory operations:

- Reconcile settlements with counterparties, analyze accounting documentation, restore the sequence of displaying business activities (analysis of accounts 50, 51, 60, 62, 76, etc.).

- Calculate employee wages, taxes and insurance contributions at the end of the year (accounts 70, 68, 69).

- Analyze the balances of goods and inventories (accounts 41, 10, 43). Conduct a warehouse inventory and adjust data if necessary.

- Calculate depreciation on fixed assets and carry out revaluation (accounts 01, 02).

- Check the costs incurred (monitoring accounts 20, 29, 25, 26, 44, etc.).

- Calculate all received income and expenses of the company (balances from accounts 90 and 91 are written off in account 99).

Something to keep in mind! According to the legislation of the Russian Federation, the submission of financial statements to the tax authorities is carried out before March 31 of the year following the reporting year. However, all verification activities before the end of the year should be carried out gradually throughout the 4th quarter.

After the preparatory procedures are completed, the year is closed - the balance sheet is reformed, in which the company's net profit or net loss is revealed.