Regulatory regulation

The traffic police fine is taken into account for accounting purposes in other expenses (clause 12 of PBU 10/99) and is reflected in account 91.02 (Chart of Accounts 1C).

Fines for violating traffic rules cannot be taken into account in tax expenses as they are not economically justified (Article 252 of the Tax Code of the Russian Federation). In addition, they are directly listed as expenses not taken into account for tax purposes (clause 2 of Article 270 of the Tax Code of the Russian Federation).

The amount of compensation for damage in the event of withholding it from the guilty person is included in income for income tax purposes (STS) on the date of recognition by the debtor or the date of entry into force of the court decision (clause 3 of Article 250 of the Tax Code of the Russian Federation, clause 1 of Article 346.15 of the Tax Code of the Russian Federation , paragraph 4, paragraph 4, article 271 of the Tax Code of the Russian Federation).

Labor legislation

In settlements with the employee, two options are possible:

- withhold the amount of the fine (Article 238 of the Labor Code of the Russian Federation),

- do not withhold the amount of the fine (Article 240 of the Labor Code of the Russian Federation).

Recovery of damages from the guilty person is carried out by order of the employer, which he must issue no later than a month from the date the amount of damage is established (Article 248 of the Labor Code of the Russian Federation).

Debt can only be collected through legal proceedings if:

- the month period has expired;

- the employee does not agree to voluntarily compensate for the damage caused to the employer;

- the amount of damage caused to be recovered from the employee exceeds his average monthly earnings;

- the employee undertook to compensate the damage voluntarily, but quit before the debt was fully repaid and refused to pay the debt.

The employee must provide written consent to reimburse the amount of the fine to the organization.

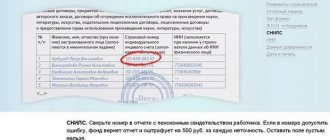

Personal income tax and insurance premiums

The organization may decide to forgive the employee for the damage, in which case the question arises about the need to impose personal income tax on the amount of damage.

There are two opposing opinions of regulatory agencies regarding the withholding of personal income tax from an employee in the event that the organization forgives the damage caused to it:

- The employee receives an economic benefit (income in kind) in the form of exemption from the obligation to compensate for direct actual damage in the amount of the undeducted fine (Article 41 of the Tax Code of the Russian Federation). Income is subject to personal income tax (Letters of the Ministry of Finance of the Russian Federation N 03-04-05/1660 dated 01/20/2016, dated 08/22/2014 N 03-04-06/42105, dated 04/12/2013 N 03-04-06/12341, dated 10.04. 2013 N 03-04-06/1183, dated 08.11.2012 N 03-04-06/10-310).

- The employee does not have any income, since the organization is held liable as the owner of the vehicle (Letter of the Federal Tax Service of the Russian Federation dated April 18, 2013 N ED-4-3 / [email protected] ).

If you decide to withhold tax, then for personal income tax accounting purposes:

- date of receipt of income - the day of forgiveness of the damage (date of the order, order for forgiveness) (clause 2, clause 1, article 223 of the Tax Code of the Russian Federation);

- date of personal income tax withholding - the date of the first cash payment in favor of the employee (clause 4 of article 226 of the Tax Code of the Russian Federation);

- the deadline for transferring personal income tax is the day following the day of payment to the employee (clause 6 of article 226 of the Tax Code of the Russian Federation).

The forgiven fine is not subject to insurance contributions, since no payments were made in favor of the employee (Article 420 of the Tax Code of the Russian Federation).

All comments (3)

Good afternoon, Irina! Payment of a fine, like any payment to the budget, must be registered in 1C as a tax payment, since a type of payment order with KBK is required. Therefore, fill out a payment order in the transaction type Tax payment . You can create a special expense item if fines are not uncommon for you, or choose one that makes sense from the ones you have. The main thing is that the type of movement should be - Other payments for current transactions . There is no special document in 1C for calculating the obligation to pay a fine. Use the document Manually Entered Transaction . The postings depend on whether you are going to collect a fine from the guilty employee or pay it at the expense of the organization. If the fine is at the expense of the organization, its amount cannot be accepted as an expense for tax accounting purposes as an economically unjustified expense (clause 1 of Article 252 of the Tax Code of the Russian Federation).

This is interesting: How to find a traffic police fine for a pedestrian in 2021

Thank you very much for the quick and accurate answer. Irina

Always happy to help!

You can ask more questions

Access to the “Ask a Question” form is only possible if you have fully subscribed to BukhExpert8. Submit an application on behalf of Legal Entity. or Phys. faces you can here >>

By clicking the “Ask a Question” button, I agree with the BukhExpert8.ru regulations >>

Rules for accounting for fines on taxes and agreements

The company may be fined by the tax authorities, for example, for late submission of reports. Counterparties may impose fines for violating the terms of contracts. The opposite may also happen - the organization itself will receive monetary compensation from a supplier who did not ship the goods on time. Accounting for sanctions in each specific case has its own characteristics. Let's look at them in more detail.

Penalty under a supply agreement

A fine can be imposed on both the buyer and the supplier of goods in the following situations:

1. The supplier violated the terms of delivery of goods specified in the contract.

2. The buyer did not pay for the goods within the terms specified in the delivery agreement.

Most often, the violator pays penalties calculated for each day of late payment. If the terms of the contract are violated, the guilty party must pay a penalty in accordance with the contract. The company whose rights have been violated submits a written demand (claim) to the guilty organization for payment of a penalty (Article 331 of the Civil Code of the Russian Federation). The parties can agree to postpone the payment of the fine by signing an additional agreement.

Often the violator of the contract refuses to pay the fine. In this case, you can file a lawsuit. If the court makes a positive decision, the counterparty will be required to pay a fine. Most likely, the violator will be required to reimburse court costs and the state fee paid by the plaintiff for the consideration of the case in court.

Accounting with the injured party

In tax accounting, the penalty received by the injured party is reflected in non-operating income (clause 3 of Article 250 of the Tax Code of the Russian Federation). In accounting, the amount of the penalty is recognized as other income (clause 8 of PBU 9/99 “Income of the organization”).

The postings will be like this:

Debit 76 Credit 91.01 - the amount of the penalty is reflected in the accounting

Debit 91.02 Credit 68 - reflects the state fee for considering a claim in court

Debit 76 Credit 91.01 - the amount of state duty, by court decision, was presented for reimbursement by the violator

Debit 51 Credit 76 - the amount of the penalty was credited to the current account

Violator's account

In tax accounting, the party to the contract who committed the violation includes the penalty as part of non-operating expenses (subclause 13, clause 1, article 265 of the Tax Code of the Russian Federation).

In accounting, the amount of the penalty is recognized as other expenses (clause 12 of PBU 10/99).

The postings will be like this:

Debit 91.02 Credit 76 - penalty accrued

Debit 76 Credit 51 - the amount of the penalty was transferred to the injured party.

Globus LLC shipped a power plant to Mech LLC in the amount of 826,000 rubles, including VAT - 126,000 rubles. According to the terms of the contract, Mech LLC must pay for the goods until May 15, 2017 inclusive. The money was transferred to the account of Globus LLC on May 25, 2017. The amount of the penalty is 0.3% of the contract amount for each day of delay. The accrual of penalties will begin on May 16, 2017. Penalty = 826,000 x 0.3% x 10 days = 24,780 rubles. Globus LLC will reflect the penalty as part of non-operating income: Debit 76 Credit 91.01 - 24,780 Mech LLC will reflect the penalty as non-operating expenses: Debit 91.02 Credit 76 - 24,780

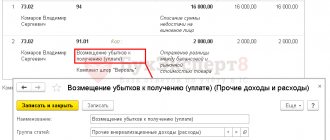

Reflection of an administrative fine in the program

A fine can be entered into the 1C program as follows. Go to the “Operations” menu and select the “Operations entered manually” view. Click on the “Create” button and a form will open for you to fill out. You need to enter information about the name, date of the document, correspondence of accounts (debit and credit of accounts), the amount of the transaction and subaccount. Debit subconto is the counterparty, credit subconto is an item of other income and expenses from the directory “Directory of Items of Income and Expenses”. In this directory, select the article “Fines, penalties and penalties for receipt (payment)”. The amount of the fine is indicated in the document “Receipt to the current account” indicating the type of transaction “Other receipt”. Now you can post the document and the 1C program will display the transactions.

This is interesting: Where are traffic police fines from cameras going in 2021?

Try asking your teachers for help

The operation for accounting for a fine is carried out through the operation “Operation entered manually”, but when filling out changes in the corresponding account and analytics appear. The changes occur due to the fact that fines and penalties are accepted for tax accounting. Therefore, the amount when posting a document will be reflected in both accounting and tax accounting.

Tax fines and penalties

The postings will be like this:

Debit 99 Credit 68 (69) - a penalty has been charged for tax (insurance contributions).

Debit 68 (69) Credit 51 - the tax penalty (insurance contributions) is transferred.

Important! Tax penalties are not taken into account when determining the tax base for income tax (clause 2 of Article 270 of the Tax Code of the Russian Federation).

In addition to penalties, for late payment, regulatory authorities may charge penalties based on 1/300 of the refinancing rate of the Central Bank of the Russian Federation (Article 75 of the Tax Code of the Russian Federation). Penalties = Tax arrears x Number of calendar days of delay x 1/300 of the refinancing rate. Penalties begin to accrue from the next day after the tax payment deadline.

According to the Federal Tax Service, penalties should be accrued until the day of repayment of arrears on taxes, including this day itself (Explanations of the Federal Tax Service of Russia dated December 28, 2009). The courts and the Ministry of Finance do not agree with this approach (letter of the Ministry of Finance of Russia dated July 5, 2016 No. 03-02-07/2/39318). Arbitrators and financiers believe that it is unlawful to charge penalties on the day the debt is repaid.

Important! From October 1, 2017, if there is a delay of more than 30 days, penalties are calculated based on 1/150 of the refinancing rate (Federal Law No. 401-FZ dated November 30, 2016).

Most often, accountants write off penalties on account 99:

Debit 99 Credit 68 - penalties accrued.

Some experts believe that penalties should be attributed to account 91.

The organization will have to independently choose the accounting option and consolidate the corresponding rules in its accounting policies. Please note that penalties are similar in economic essence to fines. And account 99 is intended for accounting for fines. But if the company accounts for penalties in account 91, then it is necessary to reflect a permanent tax liability (according to the requirements of PBU 18/02).

The Federal Tax Service issued a demand to Mech LLC to pay penalties in the amount of 620 rubles. The accounting policy of Mech LLC stipulates that penalties are reflected in account 91. The company will reflect the transaction with the following entries: Debit 91-2 Credit 68,620 - penalties are accrued and reflected in the accounting records; Debit 99 Credit 68,124 - permanent tax liability calculated (620 x 20%).

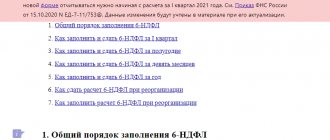

To which account in the postings should penalties and fines for taxes be attributed in 1C 8.3

In accounting, the amounts of fines and penalties for property tax, VAT, income tax, etc. are reflected by the entry: Dt 99 Kt 68 subaccount Calculations for fines and penalties - tax penalties and fines for property and profit taxes are accrued or other taxes:

Reflecting an operation in accounting is similar to accounting for administrative fines, only the accounting analytics changes. The registration is carried out based on the requirements of the Federal Tax Service. We recommend opening separate sub-accounts for account 68, where the amounts of penalties and fines for taxes will be shown.

This is interesting: Can you be jailed for unpaid traffic fines in 2021?

When transferring amounts to the budget: Dt 68 subaccount Calculations of fines and penalties Kt 51 - penalties and fines for tax are transferred to the budget, the balance on account 68 will be closed.

If an organization plans to challenge fines in court or in a higher authority, penalties and fines should still be accrued in accounting by posting: on the debit of account 99 and the credit of account 68. If the court decides positively in favor of the organization, make a reversing entry.

Due to the fact that in accounting all fines are written off to the financial result, no differences arise according to PBU 18/02.

Concept and types of penalties

This is a type of financial responsibility for committed illegitimate actions, expressed in a specific monetary amount.

All fines are divided into two categories:

- Civil law - established for violation by the parties of obligations under the contract (clause 7 of PBU 9/99).

- An administrative fine is a category of sanctions imposed by various government agencies and institutions. Administrative penalties include payments to the Federal Tax Service, State Traffic Safety Inspectorate, Rospotrebnadzor, etc.

Accounting for sanctions is carried out in accordance with the standards of PBU 10/99, according to the following accounts:

- in case of violation of legal norms - in account 99 “Profits and losses”;

- in case of violation of contractual terms and obligations and provisions of the Code of Administrative Offenses - under account 76 “Settlements with various debtors and creditors”.

The documentary basis for reflecting penalty payments is a decision to bring to administrative liability or a payment (collection) order confirming payment of the penalty.

The organization includes the costs of paying the penalty by decision of the judicial authorities and accepted by the debtor in non-operating expenses, thereby reducing the taxable base of the income tax (Article 265 of the Tax Code of the Russian Federation). Based on PBU 18/02, this type of cost is not an integral part of the income tax and is not included in the base that forms the income tax. Therefore, collection costs are written off at the end of the reporting period.

The violation was committed by the employee, but the fine was paid by the employer. Is there a subject to personal income tax?

The Russian Ministry of Finance believes that the fine paid by an organization for violating traffic rules is direct actual damage for it. And the driver who committed a violation is always obliged to compensate for it in accordance with the rules on financial liability. But, in our opinion, such a position has no judicial prospects.

LET'S CONSIDER THE SITUATION

The commentary letter deals with a very common situation. The company received by mail a resolution in the case of administrative liability for violating traffic rules (traffic rules). The offense was recorded on a CCTV camera. Perhaps this is exceeding the established speed (Article 12.9 of the Code of Administrative Offenses of the Russian Federation) or driving into oncoming traffic (Part 4 of Article 12.15 of the Code of Administrative Offenses of the Russian Federation). The fine was paid by the company from the current account. Officials are convinced that due to the payment of the fine, the company suffered direct actual damage in the form of a real decrease in funds. Obviously, the culprit of the damage is the driver who was driving the car. However, the company did not hold him financially liable, but exercised the right to refuse to recover damages from the employee (Article 240 of the Labor Code of the Russian Federation). But financiers regarded such actions by the employer as releasing the employee from a certain property obligation. In their opinion, in this regard, the latter received economic benefits (Article 41 of the Tax Code of the Russian Federation). This means that he has income subject to taxation. The ministry's position, of course, is beneficial to the budget, but unfavorable for the staff. After all, specific employees are actually behind the majority of penalties collected from companies. Moreover, it does not matter under what legislation the fine was paid - for economic, tax or administrative violations. And shifting fines onto workers is not widely practiced. More often than not, companies deprive workers of bonuses. But if the company, being obliged to withhold personal income tax (and having such an opportunity in relation to employees) and transfer it to the budget, did not do this, then it is liable under Article 123 of the Tax Code of the Russian Federation: it faces a fine of 20 percent of the corresponding personal income tax amount. GENERAL OBJECTIONS