Maintaining accounting areas

The need for services for maintaining accounting areas arises when there is a planned expansion of the organization. At this moment, new divisions and departments appear in its structure, the number of operations and concluded transactions increases. As a result, the workload on accountants increases and difficulties in servicing individual operations and processes are revealed.

offers to outsource the maintenance of certain areas of accounting.

Benefits from cooperation with a remote accounting operator:

- savings on payments to a new specialist;

- savings on the cost of connecting programs of the relevant focus;

- additional reduction in the workload falling on key specialists.

Organization of cash desk work in accounting (nuances)

The cash register occupies a significant place in accounting - after all, inspectors pay special attention to the correct display of cash transactions. How to properly organize the work of the cash register in the accounting of enterprises and individual entrepreneurs, read further in the article.

Cash and accounting - what are the rules of reflection?

Balance limit

Documentation of cash transactions

Results

Cash and accounting - what are the rules of reflection?

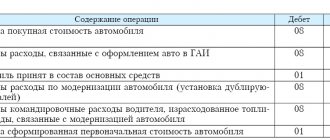

In accounting, cash transactions are reflected using account 50. Cash transactions are considered to be all actions performed with cash and monetary documents in a company and any entrepreneur.

What kind of operations these are, you will learn from our article “The concept and types of cash transactions (legal regulation).”

Account 50 is active, its debit reflects the receipt of assets, and its credit reflects the disposal. Depending on the type of business operation, account 50 can correspond with many accounting accounts.

So, for example, the posting of cash (withdrawal from a bank account) at the enterprise’s cash desk is reflected as follows: Dt 50 Kt 51. And vice versa, the delivery of cash to the bank from the enterprise’s cash desk is Dt 51 Kt 50.

The receipt of cash from the buyer in payment for goods/services is reflected as follows: Dt 50 Kt 62. Cash settlement with the supplier is formalized by posting Dt 60 Kt 50. In this case, it is necessary to comply with the limits for cash settlements between legal entities established by the Bank of Russia in paragraph 6 of the instructions from 10/07/2013 No. 3073-U.

Receipt of credit funds to the cash desk - Dt 50 Kt 66 (67), loan repayment by depositing cash from the cash desk - Dt 66 (67) Kt 50.

Payment of wages to employees from the cash register is Dt 70 Kt 50, and settlement in cash with the founders by paying dividends is Dt 75 Kt 50. The issuance of cash to the report is reflected by posting Dt 71 Kt 50, and the return to the cash register from the report of the balance of the unspent amount is reflected as follows: Dt 50 Kt 71.

The sale of fixed assets for cash is documented by posting Dt 50 Kt 62, and the receipt of proceeds from retail sales to the cash desk - Dt 50 Kt 90.

Details on conducting cash transactions in companies are contained in the BR Directive No. 3210-U dated March 11, 2014 (hereinafter referred to as the Directive).

Balance limit

In accordance with paragraph 2 of the Directive, any enterprise planning to carry out cash transactions must set a limit of funds for storage in a place specially established by management (cash desk).

The cash balance limit is displayed at the end of the working day by adding up the total in the cash book. At the same time, individual entrepreneurs and small businesses may not set limits at their cash registers.

Read about cash discipline for entrepreneurs in the article “What are the features of cash discipline for individual entrepreneurs?”

To determine the maximum allowable cash balance in the cash register (limit - Lim), data on the type of activity of the company is used, and the formula is also taken into account:

Lim = Vyr/RP × DSB,

Where:

Vyr - the volume of cash received during the billing period, received from the sale of goods/products, performance of work/services;

RP - settlement period, measured in working days, during which the enterprise will accumulate cash (for legal entities - no longer than 92 days);

DSB - frequency of depositing money into the bank (for example, if money is deposited every two days, then the indicator is 2).

See the second method for calculating the cash balance limit here.

Accumulation of money in the cash register in excess of the established limit is not allowed, except on days when salaries and social payments are paid.

To hand over money to the bank or to collectors for transportation to a banking institution, the enterprise appoints a special representative whose powers include the specified responsibilities. Such a representative, as a rule, receives authority after the head of the enterprise issues a corresponding order.

To carry out work at the cash desk, the head of the enterprise (or the individual entrepreneur himself) appoints special responsible employees - cashiers, whose responsibilities include working with cash and ensuring the fulfillment of all established cash norms. Each cashier gets acquainted with the list of his job responsibilities upon signature.

Documentation of cash transactions

When cash is received, cash orders are used, filled out according to f. 0310001; for expenses - expense orders according to f. 0310002. In this case, individual entrepreneurs may not draw up cash documents (orders) and registers (cash book), as mentioned in paragraphs. 4.1, 4.6 Instructions.

The preparation of cash documents is entrusted to the chief accountant, as well as to the accountant, cashier, or other person (official or individual entrusted with accounting), whose responsibilities include conducting cash transactions. The manager draws up cash documents if there is no chief accountant, cashier or other person authorized to conduct cash transactions on staff (at the workplace) (clause 4.2 of the Directive).

Cash register documents are signed by the chief accountant or an authorized accountant and cashier, and in their absence, by the head of the enterprise. The cashier must have his own seal with details confirming the conduct of cash transactions, and sample signatures of officials authorized to sign cash documents.

If there is a senior cashier on staff, then the fact of his transfer/acceptance of money to/from the cashier is reflected in the cash book according to f. 0310005. Each entry on the movement of funds between the senior cashier and cashiers is confirmed by their signatures.

A special place (room) is allocated for the cash register, in which the safety of both cash and cash documents can be ensured.

The responsibilities of the cashier include not only counting the cash received at the cash desk, but also checking the cash document for compliance with the sample, the presence of reliable signatures and the accuracy of the indicated amount.

In addition, the availability of supporting documentation listed in the order is checked.

Cash is accepted by counting, and the person depositing funds into the cash register must observe the counting process.

Accounting for cash received at the cash desk is kept in the cash book, prepared according to f. 0310004. In this case, each entry in this register is made by the cashier on the basis of each cash order (f. 0310001 and 0310002).

The cashier must withdraw the balance in the cash register at the end of each working day - the final entry is made in f. 0310004 and certified by his signature.

If there were no cash transactions during the day, then no entries are made in the book.

At the end of his working day, the cashier must verify all entries made in f. 0310004, with the available cash documents, withdraw the balance and put your signature. Also, the reconciliation must be carried out and signed in the book by the chief accountant or responsible accountant.

Cash documents and registers can be issued in paper or electronic form. In this case, paper documents can be drawn up using typewriting or filled out by hand. Signatures on paper documents must be affixed by hand.

Corrections cannot be made to cash documents. Corrections in registers are acceptable, but it is necessary that the date of the correction be indicated, as well as the initials and signature of the employee making the corrections.

To prepare cash documents and registers in electronic format, special technical means are used to ensure the protection of records from unauthorized corrections and distortions of information, as well as to identify the responsible person. Once such documents have been digitally signed, they cannot be corrected.

Results

Reflection of cash transactions in accounting is carried out using active accounting account 50. In this case, the receipt of cash (monetary documents) is recorded as a debit, and the disposal as a credit.

https://www.youtube.com/watch?v=G_1vQhDpEN8

Each enterprise and individual entrepreneur is required to comply with cash discipline and the rules prescribed in the Directive of the Central Bank dated March 11, 2014 No. 3210-U. This regulatory document also provides samples of unified forms, the use of which is mandatory for everyone except individual entrepreneurs (they are exempt from maintaining a cash book and receipt and expense orders).

Subscribe to our accounting channel Yandex.Zen

Subscribe

Source: https://nalog-nalog.ru/buhgalterskoj_uchet/vedenie_buhgalterskogo_ucheta/organizaciya_raboty_kassy_v_buhgalterskom_uchete_nyuansy/

Price

| Accounting for settlements with suppliers and contractors (60 account) | |

| Posting of goods, works/services: | |

| — checking incoming documents for compliance with legal norms — generating entries for the receipt of goods, works/services | from 450 rub. for 1 set |

| Capitalization of advance invoices for advances issued: | |

| — checking the received invoice for compliance with legal norms — generating the appropriate transactions | from 200 rub. for 1 document |

| Reconciliation with the counterparty - supplier (contractor) | from 900 rub. for 1 counterparty |

| Accounting for settlements with buyers and customers (62 account) | |

| Reflection in accounting of the fact of sale of goods, works/services: | |

| — preparation of documents for sale in accordance with legal norms — generation of transactions for the sale of goods, works/services | from 450 rub. for 1 set |

| Reflection in the accounting of received advance/prepayment: | |

| — generation of an advance invoice in accordance with legal norms — generation of appropriate transactions | from 200 rub. 1 document |

| Reconciliation with the counterparty – buyer (customer) | from 900 rub. for 1 counterparty |

| Accounting for payroll calculations (70 account) | |

| Keeping records of payroll calculations, calculating all deductions from the payroll in an organization with a staff: | |

| up to 10 people | from 7,500 rub. per month |

| from 11 to 50 people | RUB 7,500+ RUB 750 for each employee over 10 people |

| from 51 to 100 people | RUB 37,500 + 650 rub. for each employee over 50 people |

| over 100 people | negotiable |

Take advantage of the offer from legal and legal professionals and maintaining all areas of accounting will no longer be your problem. You can choose one of the busiest areas of work or subscribe to several at once, but for a limited period. The freed up time, human and financial resources can be used to solve current problems and further expand the scope of activities.

Order service

Accounting

Maintenance of individual areas of the accounting department includes:

- creation of document flow for the company's accounting department;

- developing the most appropriate accounting policies;

- drawing up job descriptions;

- constant staff support on all issues.

In addition, our company’s employees can take on all the responsibilities of the chief accountant, which will allow the customer to avoid problems with the selection of qualified personnel. We carry out high-quality tax and accounting accounting at a nominal price, based on the existing characteristics of the company, which allows us to minimize the tax burden and prevent errors in the accounting process.

Turning to our specialists for help will allow you to spend much more rationally the time that was previously spent communicating with counterparties and receiving accounting and tax documentation from them.

The work is being done:

- in contact with the customer;

- in compliance with all laws and regulations;

- quickly, clearly and accurately.

Job responsibilities of accountants by area, examples:

Main responsibilities of an accountant

Responsibilities of an accountant-cashier

Responsibilities of a Payroll Accountant

Responsibilities of an accountant for primary documentation

Responsibilities of Accounts Payable Accountant

Responsibilities of a materials accountant

An accountant is a specialist with a wide range of responsibilities involved in accounting for the finances of an organization in accordance with the requirements of the laws of the Russian Federation on accounting.

In large organizations, entire departments are created where ordinary accountants work in several areas - working with inventory items and maintaining a warehouse, accounting for production costs and estimating the cost of production, cash transactions and operations on bank accounts, accounting for payroll, working with accounts receivable. , tax accounting, etc.

The chief accountant is generally responsible for the accounting and financial activities of the company, develops economic policies, prepares tax and financial reports, and manages accounting departments. In small companies, all financial accounting responsibilities can be performed by a single accountant.

The main task of the accounting service is to build strategies for break-even business activities, taking into account and monitoring the financial condition of the organization, providing reliable information to managers and owners, as well as, if necessary, counterparties, partners, and lending banking organizations.

Main responsibilities of an accountant:

- accounting of the company’s property and business operations (production costs, operating results, settlements with partners, payment for services, fixed assets, etc.);

- processing of primary documents in accounting areas for further accounting processing;

- accounting for the cost of manufactured products, services provided, identifying sources of ineffective costs;

- distribution of cash flow transactions, organization property, fixed assets among accounting accounts;

- accrual and transfer of taxes and fees to federal and regional budgets, regular payments to banks, wages to employees, other payments, as well as the allocation of funds to pay bonuses to employees;

- preparation and provision of reports on areas of accounting at the request of the employer;

- development and implementation of effective regulations for effective document flow (cash flow planning, inventory accounting procedures, etc.);

- work with a database of accounting information (formation, timely adjustment);

- preparation and transfer of processed documents to the archive.

Job responsibilities of an accountant.docx

Depending on the direction in which an ordinary accountant works, his functions change. The job responsibilities of the most sought-after accounting professionals are provided below.

Responsibilities of an accountant-cashier:

- organization and accounting of cash transactions, operations for receiving, issuing and storing funds;

- maintaining a cash book and primary documentation for cash transactions, preparing documents for accounting processing;

- participation in inventory taking;

- ensuring the safety of funds in the cash register, cash registers and other material assets;

- receiving and checking primary documentation, ensuring its safety;

- work on accounting for the company's inventory, liabilities and business transactions, incoming fixed assets, entering information on property movements into accounting accounts.

Job responsibilities of an accountant-cashier sample.docx

Responsibilities of an accountant-cashier example.docx

Responsibilities of a payroll accountant:

- calculation of wages on the basis of time sheets, temporary disability certificates, and other documents relating to payments to employees of the organization;

- calculation and transfer of insurance premiums to government

- extra-budgetary social funds, employee remuneration, other payments and payments, as well as allocations of funds for material incentives for employees of the organization;

- preparation of periodic reports on taxes and contributions from the amount of payments

- employees in a timely manner, ensuring the storage of documents in their area, with their subsequent submission to the archive.

- preparation and provision of information, summary tables, payroll registers at the request of managers.

Job responsibilities of a payroll accountant sample.docx

Job responsibilities of a payroll accountant example.docx

Responsibilities of an accountant for primary documentation:

- receiving and processing primary documents for accounting of the organization’s economic activities, checking them for correct execution and completeness of filling in the details;

- monitoring the fulfillment by officials of deadlines for document flow in terms of providing accounting documents, informing the chief accountant about violations of deadlines;

- preparation of summary data on primary documentation for conducting an inventory of the company’s liabilities and assets;

- safety of primary accounting documents, systematization and storage of documents in accordance with the requirements of company regulations, with their subsequent submission to the archive.

Job responsibilities of an accountant for primary documentation sample.docx

Job responsibilities of an accountant for primary documentation example.docx

Responsibilities of a accounts payable accountant:

- maintaining accounting records for settlements with partners;

- acceptance and verification of primary documentation filled in during settlements with counterparties;

- preparation of registers of receivables and payables, which are formed during settlements with suppliers;

- maintaining and checking calculations, providing data about them to authorized officials;

- inventory of goods and materials accepted from suppliers, filling out related documentation;

- filling out a book of purchases and sales with reporting within the established time frame.

Job responsibilities of a accounts payable accountant.docx

Responsibilities of a materials accountant:

- accounting for inventory items, posting materials, calculating the actual cost of the organization’s materials in accordance with legal requirements;

- reception and processing of primary documentation in relation to this area of accounting, preparation for further accounting processing;

- entering data on material accounting transactions into accounting accounts;

- drawing up summary reports on the actual cost of materials, taking into account all costs;

- preparation of reports on your site, storage of primary documents, execution and preparation for transfer to the archive;

- analysis, compilation of summary tables and other information at the request of managers;

- formation and timely adjustment of the database of your accounting section.

Job responsibilities of a materials accountant example.docx

Job responsibilities of a materials accountant sample.docx

Calculate the cost of accounting services

Taxation system OSNO simplified tax system 15% simplified tax system 6% Number of documents per month Number of employees TOTAL 1,600 rub. / month*rub. The price is per quarter! For a more detailed calculation, contact the manager! The cost of services is approximate. Each organization has its own specifics, therefore, to accurately determine the cost of services, a preliminary analysis of your documents is necessary. The cost of services is approximate. Each organization has its own specifics, therefore, to accurately determine the cost of services, a preliminary analysis of your documents is necessary.

Accounting areas - preparing a list

May 06, 2015 Comments (0)

At one time, I sketched out for myself a small diagram of the accounting sections. I noticed that visualization helps to grasp the theory faster. So why not use this in our accounting teaching? Today we will “identify” some areas of accounting with you and draw a diagram. In this practical article we will solve two problems at once:

First task. We will start your thinking process. You yourself will begin to “get” the knowledge that you already have. We'll just tie them together.

Second task. You will see that the so-called specifics of an enterprise are far from what novice accountants “wind up” in their heads.

As always, let's start with the fact that we already know the names of some areas of accounting:

- site by suppliers

- plot by buyer

- loan area

- cash area - cash desk

- non-cash area - bank

Let's take, for example, any enterprise. Just look out the window or in the classifieds section of the newspaper, or just watch the advertisements on TV. You will see a lot of different business names. Whatever these companies do, there are several main points that unite them. Let's try to highlight these moments together. I will ask leading questions, you answer silently, and then I will write my answer and you can compare. Do you agree?

Who do we meet at companies?

Who do we encounter when we come to any company? Who do we see when, for example, we go to the checkout in a store? What if we go buy a ticket to a travel agency or call a real estate agency to find out about apartments for sale? Who are we meeting? Isn’t it with people who are representatives of the companies we contact? Do you agree?

It turns out that every enterprise, large or small, has people. No operating enterprise can carry out its activities without human participation. Such people in relation to. So, all companies have employees. Let's discuss further.

What do employees mean to a company? What does the company do in relation to its employees? Doesn't he use their time and knowledge to carry out his activities? If you agree with this, then I’m sure you’ll agree that work should be paid, right? By paying the labor of its Employees, the company incurs costs (expenses).

Of course, the amount for the work of Employees, the so-called Payroll Fund (WF) is not everything that is related to employees. With payroll, the enterprise itself also pays taxes to various funds: Social Insurance Fund, Pension Fund, Federal Compulsory Medical Insurance Fund. These amounts are directly related to conversations about pensions, benefits, social benefits, etc. Thus, any enterprise is made up of employees. Employees mean payment for labor and payment of taxes to the state from this payment (with payroll). Payroll and payroll taxes for an enterprise are considered costs (expenses).

You noticed that I write costs (expenses). This is a new term that I am gradually introducing into our accounting lexicon. We will leave the meaning and understanding of this term for future articles. Now it is important to note that there is such a term in accounting. Intuitively, I'm sure you understand what it means. More details to come.

Basics of accounting for funds in a current account (bank)

Let's start learning the basics of accounting with the cash section. One of its representatives is the accounting of funds in a current account. This is perhaps the easiest area to work on.

Accounting for funds in a current account - a minimum of theory

The main purpose of this area is to store part of the company’s funds and settle settlements with counterparties. Money stored in a current account is called non-cash money, or in common parlance – BezNal.

The most common mutual settlements via Non-Nala (according to a current account) occur for “payment to the supplier”, “receiving payment from customers”, “transfer of taxes”, “payment of wages to employee cards”, “repayment of loans, borrowings”, “withdrawal of money to the cash register” companies" .

A company may have more than one current account. He may have several current accounts in one bank, or he may open current accounts in different banks. As a rule, an enterprise opens current accounts in those banks where the terms of service are more favorable. Yes, yes, “for the work” of the current account, the bank issues a certain amount to our company every month.

The accounting account responsible for accounting for funds in the current account is 51 “Current accounts”. The essence of all actions on a current account is the arrival of money on it and the expenditure, in the sense of leaving it. All company events affecting the current account are documented in their own primary documents.

Primary documents for the bank site

The most basic primary documents in accounting for a current account are the Payment Order and Bank Statement . The purpose of a “payment order” is to give an order to the bank to transfer funds, for example “transfer taxes” or “payment to a supplier”, or “return of excess received”, “transfer of salaries to employees”, etc.

The bank, in turn, provides the company with a printed form of its document called “Statement” for each current account. This document displays information about the money in the current account: how much came in, how much went out.

Our company, in its accounting, draws up a primary document with a similar name, namely “Bank Statement”, where it records the receipts and expenses of money for a certain day.

If our company needs to deposit funds into a current account, then the bank issues a document “Announcement for cash deposit”

Examples of primary documents for working with a portion of funds in a current account

Interaction of cash accounting with other accounts

The main interactions of the current account occur with such areas of accounting as: mutual settlements with counterparties, with tax regulatory authorities, and with employees.

And now a little practical task. Detail these areas of accounting into specific ones, into those that we already know from the section “accounting terms”. Then give each site its own accounting account. For regulatory authorities, remember the names and find the required accounting accounts in the chart of accounts.

If you are subscribed to blog updates by email, enter the access code from the last mailing letter. To receive an access code, subscribe to blog news.

What it looks like in the chart of accounts

Now is the time to look at the chart of accounts and see what a current account looks like in the 1C Accounting program. Let's try to talk about the account and "predict" what we expect to see when we start working with it. OK?

Looking at the characteristics we see that 51 accounts:

- “Analytical”, since there are sub-accounts: “Bank accounts” and “Cash flows”

- “Active” - we see the letter “A”

Remember, the account is “Active” , which means the information from it in the Balance sheet will go to the Asset table. The account balance can only be in Debit or 0. The receipt of all money will be displayed in Debit, and the expense will go to Credit.

The subconto “Bank account” in the posting will substitute the specific bank account of the company selected by the user.

Subconto “Cash Flow” , why is it interesting to us? The fact is that this subconto divides the information on the current account into more detailed information, showing us how non-cash funds move. Look at the most common “Cash Flow” options that are available in the 1C Accounting program.

Example of a directory of a real enterprise

Another example of a directory of a real enterprise

Sample report

Additionally

At the beginning of the article, I said that a current account is not free for a company. Banks charge money for servicing a current account - it’s like rent for a month. They also take money for each payment order that the company gives to the bank to transfer money from the current account. The bank also charges money for withdrawing funds from the current account.

Our company registers all bank services as “other expenses” and assigns them to 91 accounts (here’s another account with which 51 interacts)

To work with a current account, there are several more primary documents: settlements under collection, under a letter of credit. You can already read about this in accounting textbooks.

The current account may be arrested (blocked) and the company will not be able to make payments: it will be able to receive payments to the current account, but not transfer them. This action occurs, for example, if there are tax debts. In this case, money in the required amount will be forcibly withdrawn from the current account, then it will be unblocked.

Currently, an accountant going to a bank with a payment order is an extremely rare occurrence. Banks everywhere are implementing their systems called “Bank-Client”.

Thanks to these programs installed on accountants' computers, the company can quickly make payments and receive statements.

To combine the 1C and Bank-client programs, mechanisms for uploading and downloading payment orders and bank statements between these programs are used.

Banking programs for working with current accounts impose certain requirements on accountants at the bank site. Now, in addition to the requirement for employment as an accountant, it will be a plus if you have experience in the Client-Bank program.

However, if you have no experience, it’s okay, since these programs are very simple. If you are familiar with a computer: you know how to create files, rename them, make archives, copy, and have a good command of MS Office, for example, then you will master Client-Bank in a couple of hours.

Strengthen your knowledge

If you are subscribed to blog updates by email, enter the access code from the last mailing letter. To receive an access code, subscribe to blog news.

Source: https://buhucheba.ru/uchet-deneg-v-banke/

Buildings as an image of enterprises

Remember one of the very first articles where I tried to represent the abstract term “enterprise” in the form of... remember? Of course the building! I said that any enterprise means either renting offices and premises, or having its own building. What does this idea tell us? What does it mean for businesses to have premises for rent or their own building? Let's try to come to an answer to these questions together.

What is rented space or own building for companies? Isn’t it the same when we live in our apartments and pay for utilities and electricity? And who rents an apartment pays rent? If you agree, then answer the following question: what do these utilities, electricity, and rent mean for your personal budget? Is it not costs? Here! The same goes for enterprises.

Enterprises either rent premises or have their own buildings. For “being” in the building, the enterprise pays rent, electricity, etc. The enterprise that owns the building pays utility bills, electricity and other payments for the maintenance of the building. Thus, it turns out that every enterprise has costs (expenses) for its “place in the sun.”

Why do companies work?

What more can we say about any enterprise, no matter what it does? Let's remember what the general purpose of any commercial enterprise is. Would you say to do something for the sake of the process itself? J no, of course. The goal is to make money. Any enterprise must take into account information about how much it earns while carrying out its activities.

I will note only one point: “how much one earns” is not money in the cash register or in the bank. We all know that selling doesn’t always mean getting money right away, don’t you agree?

And finally, I’ll say a couple more similarities. Agree that enterprises keep their premises and buildings clean, or at least strive to do so. In any case, for this, companies buy household supplies: mops, buckets, powders, etc.

The company also uses office supplies in its work: paper, pens, folders, etc. It doesn’t matter what the company does, it uses all this: issue a salary certificate to the employee, issue an order for the enterprise, print out a payroll for the payment of wages and many, many other things that are required for the operation of the company. All this is called stationery. Such values, material assets, are taken into account in the accounting section - Materials.

It's time to sum up a little. Our knowledge is increasing. Our task is to slowly systematize them, find connections and put them in our heads. If you have questions about the articles, please ask them or write them down to receive answers in the following materials.

At the moment, we are preparing to draw a diagram of the accounting areas. To do this, we do not try to memorize it, as if I showed it to you right away. No. We are preparing for the fact that before we can draw it on paper, it appears in our head. For this, we, based on the knowledge that we know in general from life and from previous articles, are gradually preparing ourselves. So, these are the areas of accounting that we already know.

- site by suppliers

- plot by buyer

- loan area

- cash area - cash desk

- non-cash area - bank

- wage section

- section of taxes with payroll

- area costs (expenses)

- Materials section (household supplies, office)

- section of the Financial result (how much the company earned or lost)

In the next article, we will talk a little about companies, but we will look at them from the point of view of types of activities. Let's learn about some features for each type of activity. Ultimately, we will draw a visual diagram of the accounting sections.

| Is there anything to clarify? write: 0 comments |

Accounting for land plots in accounting and tax accounting

Land is a special type of non-depreciable asset. It can be purchased, sold, resold, sold partially or completely; at the same time appear in accounting as a fixed asset or a product for resale. Land, as an asset, is not subject to depreciation (Article 256-2 of the Tax Code of the Russian Federation), since it does not lose its value during operation.

The plot is accepted for accounting in the amount of all actual costs for it, including state duties for registration of ownership rights (PBU 5/01 r. 2, 6/01 r. 2). Land tax is calculated based on the cadastral value of the plot.

Documenting

The purchase and sale of land plots are formalized by an agreement in 3 copies. Two of them - to the participants of the transaction, one - to Rosreestr for registration. A land lease agreement for a period of more than a year is also registered in Rosreestr (Article 609-2 of the Civil Code of the Russian Federation).

The legislation does not provide for special unified forms that take into account the diversity of land plots and their types. When registering a landowner, it is recommended to use the following documents:

- Act OS-1 “On the acceptance and transfer of fixed assets (except for buildings and structures).” The document contains a number of indicators that should be ignored (crossed out) when filling out: manufacturer, depreciation rates, useful use, residual value, etc. At the same time, there are no special columns containing the characteristics of the land plot. They can be reflected in the field (section) “Other characteristics”.

- Act 401-APK “On the registration of land”. It is intended for organizations and enterprises in the agricultural sector and contains information about the land plot, its book value, type, quality of land, etc.

- Inventory card OS-6 “Accounting for fixed assets”.