Accounting

For accounting purposes, the procedure for drawing up and the principles for forming in this part of the accounting policy in the simplified tax system “income” are exactly the same as in the general regime. Therefore, compiling this section usually does not cause any difficulties. It's quite simple. But there are several important aspects that need to be taken into account when creating the document. In particular:

- it is important to understand whether the company uses standardized document forms or generates their own samples;

- how the company determines the level of materiality (for example, when the accountant will have to take additional action);

- criterion for the value of objects as fixed assets;

- determine what method is used to calculate depreciation;

- methodology for assessing inventories for their write-off.

Also see “Accounting on the simplified tax system”.

Does the law require an individual entrepreneur to register an accounting policy for the simplified tax system (income)?

To answer this question, let's look at the legislation:

- Individual entrepreneurs are not required to keep accounting (subclause 1, clause 2, article 6 of the law on accounting dated December 6, 2011 No. 402-FZ) - in this regard, individual entrepreneurs, regardless of the taxation system used, no longer need to draw up an accounting policy for accounting purposes.

- In the Tax Code of the Russian Federation there is no requirement for individual entrepreneurs using the simplified tax system (income) to compulsorily draw up a tax accounting policy.

If the individual entrepreneur has not abandoned accounting, he will no longer be able to do without an accounting policy for accounting purposes. We will discuss the extent to which tax accounting policies are necessary below.

For individual entrepreneurs using the simplified tax system (income), at first glance, a document such as an accounting policy has no functional significance if it:

- decided not to do accounting;

- Income is accounted for in the book of income and expenses (KUDiR) - a tax register obligatory for individual entrepreneurs.

This conclusion is based on a combination of one definition and one condition:

- definition of tax accounting policy, deciphered in paragraph 2 of Art. 11 of the Tax Code as “selected by the taxpayer of the set of methods (methods) permitted by the Tax Code of the Russian Federation for determining income and (or) expenses, their recognition, assessment...”;

- the lack of possibility for individual entrepreneurs on the simplified tax system (income) to make the above choice of methods of accounting for income - in Art. 346.15 of the Tax Code of the Russian Federation, which is devoted to the procedure for determining income under the simplified tax system, there is no multivariance of such methods (methods).

However, despite the apparent simplicity and logic of the conclusions drawn by the individual entrepreneur on the simplified tax system (income), you still should not abandon the design of tax accounting policies. Why? We'll talk about this in the next section.

Tax accounting

Everyone who has chosen the simplified special mode enters the necessary data into the Income and Expense Accounting Book. Using it, both the owner of the company and inspectors can track changes in one direction or another.

Also see “New form of book for accounting income and expenses for the simplified tax system from 2021: what has changed.”

As is known, under the simplified tax system with the object “income,” the tax base is determined without taking into account expenses. They are not taken into account. Therefore, the accounting policy of the simplified tax system for this object in terms of tax accounting is not mandatory at all. After all, the Tax Code in this case clearly regulates the procedure for accounting for income. This means that freedom of choice and any maneuvers within the framework of tax accounting of income are practically impossible.

An accounting policy document is needed when:

- you can choose a tax accounting option;

- there are gaps in the legislation.

Also see “Changes to the simplified tax system: what an accountant needs to know.”

The opposite situation occurs when the simplifier simultaneously works on imputation. In this case, it is necessary to separate operations within different special regimes. Let us explain why: for example, in both special regimes the final tax can be significantly reduced by deducted insurance premiums. Among them:

- directly insurance premiums;

- sick pay (the one at the expense of the simplifier);

- funds for voluntary personal insurance of employees.

To then avoid confusion and double accounting of expenses, you need an accounting policy for the simplified tax system “income” .

Also see “How to maintain separate accounting when combining simplified tax system and UTII.”

From what is described above, it is clear that maintaining tax records is a necessity for entrepreneurs and firms if they work simultaneously on simplified and imputed systems.

Methods of accounting for income and expenses

Most organizations take into account income and expenses in their accounting on an accrual basis (Section IV of the Accounting Regulations “Income of the organization” (PBU 9/99) and “Expenses of the organization” (PBU 10/99), approved by Orders of the Ministry of Finance of Russia dated 05/06/1999 N 32n and N 33n respectively).

But there is an exception to this rule. Paragraph 9 clause 12 PBU 9/99, para. 2 clause 18 PBU 10/99 and sec. The 4 mentioned Model Recommendations allow small businesses to keep records of income and expenses using the cash method. Features of accounting under the cash method of accounting are explained in the Standard Recommendations.

For the purposes of calculating tax according to the simplified tax system ch. 26.2 of the Tax Code of the Russian Federation (Article 346.17) stipulates that “simplers” keep records of income and expenses only on a cash basis.

As you can see, regulatory legal documents allow the “simplified” to use the cash method in both accounting. However, such a choice will not reduce the accountant's work. The fact is that in some cases there are more differences between accounting using the same method than when using different methods of accounting for income and expenses.

So, for example, in accounting using the cash method, material expenses are recognized subject to their payment and write-off as expenses, and in tax accounting using the cash method, only the fact of payment is sufficient for their recognition.

Example document

Any accounting policy is based on direct norms of legislation - accounting and tax. Moreover: you can make direct references to the provisions of the Tax Code, orders of the Ministry of Finance, various PBUs, etc.

A standard sample accounting policy for the simplified tax system “income” should include:

- chart of accounts with which the accounting department will work;

- forms of primary accounting documents (own/established by law);

- internal control of business facts;

- accounting reporting forms;

- materiality criterion;

- determination of income, expenses and financial results;

- OS accounting;

- inventory accounting;

- accounting of goods, transportation and procurement costs and sales costs;

- accounting of administrative (general) costs.

on the correctness of drawing up the accounting policy of the simplified tax system . Basically, this responsibility lies with the chief accountant.

The following link provides a general example of an accounting policy for the simplified tax system “income” .

Read also

02.01.2018

What is impossible to do without when drawing up an accounting policy?

When registering NUP for individual entrepreneurs on the simplified tax system (income), the main section will be devoted to the algorithm for forming the taxable base for the simplified tax system and the features associated with the procedure for recognizing income.

At the same time, it is not at all necessary to copy verbatim from the Tax Code of the Russian Federation into this paragraph of the NUP the list of income to be taken into account when calculating tax. It is important to distinguish between sales income and non-operating income, as well as indicate non-accounted income based on the actual activities of the individual entrepreneur.

In the NUP, you can detail the nuances of income accounting in the context of the following analytics:

- by type of activity used;

- by methods of receiving income (receiving money at the cash desk, to a current account, income in kind, when paying with bills, etc.).

The NUP may also reflect:

- formulas for calculating advance payments and the amount of the final payment for the simplified tax system;

What expenses can be used to reduce the tax or advance payment under the simplified tax system with the object “income” are described in detail in ConsultantPlus. Get trial online access for free and go to the Ready-made solution.

- reporting procedure;

- tax payment deadlines;

- other nuances (features of tax calculation and registration of KUDiR when receiving money as a refund of erroneously transferred amounts, etc.).

How to fill out the book form for accounting income and expenses under the simplified tax system with the object “income”? Detailed recommendations from ConsultantPlus experts are available in the Ready Solution. Get a free trial of K+ and follow the instructions.

What is the accounting policy of the organization

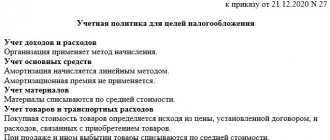

The concept of accounting policy is understood as an internal document containing the rules and procedures for maintaining records at the enterprise. As a rule, accounting policies are drawn up based on the requirements of the selected taxation regime. A document called “Accounting Policy for Tax Purposes” is drawn up for:

- approval of the selected tax regime (OSNO, simplified tax system, UTII, etc.), schemes within this regime (for the simplified tax system - “Income 6%” or “Income minus expenses 15%”). The document must also contain information regarding the combination of modes (STS + UTII), if any;

- descriptions of the accounting procedure based on the approved tax regime. The provisions of the accounting policy prescribe the features of accounting for income and expenses, the method of calculating depreciation of fixed assets, the procedure for calculating and paying taxes to the budget and contributions to extra-budgetary funds, etc.

As you can see, the primary goal of drawing up an accounting policy is to approve the taxation regime (STS or STS + UTII). The remaining provisions of the document are drawn up to approve the accounting features for the calculation and payment of taxes to the budget.

Change in accounting policy

You cannot change your accounting policy at your own request. The legislator has provided only three reasons for which changes are made to the document:

- changes in legislation - accounting policies cannot contradict the law;

- change of activity;

- development of new ways of organizing accounting - provided that the new method improves the quality of the disclosed organization.

Make changes by order. As a general rule, changes come into force from the beginning of the reporting year. If amendments are made due to changes in legislation or a new type of activity, the changes take effect from the date the law comes into force.

Significant changes that affect the company's financial results are reflected retrospectively. When changing policies, you must evaluate what impact the changes will have on the company's past performance since inception. This is an adjustment to retained earnings and other balance sheet items at the earliest date in the accounts if this can be done reliably. If reliability cannot be ensured, apply the new accounting policies from the date the amendments are introduced.

You can learn more about the procedure for making changes and additions to the accounting policy in our article.

Use ready-made accounting policy options for the simplified tax system “Income” and combining modes in the online service Kontur.Accounting. The program is convenient for maintaining accounting and tax records, paying salaries, and submitting reports. We give all newcomers a free trial period for 14 days.

How to compose a document

It should be noted that the structure of the simplified accounting policy is quite primitive and includes two large sections: tax and accounting.

As for tax accounting, an entrepreneur cannot use any individual calculation methods. That is why this part should reflect the main provisions of the Tax Code. In relation to the second section, it is necessary to be guided by Federal Law No. 402-FZ “On Accounting” and the Accounting Regulations PBU 1/2008 “Accounting Policy of the Organization”.

Since the law clearly defines whether the accounting policy of an individual entrepreneur is needed on the simplified tax system, you should definitely understand the meaning of the Federal Law and PBU regarding the necessary points and draw up your own document for further use.

What is included in the UE on the simplified tax system “Income minus expenses”

The accounting policy for any special regime differs from the UP of companies on OSNO. The list of items that need to be included in it is significantly reduced. But there are a number of points that cannot be ignored.

Here's what you need to indicate in the UP for accounting purposes:

1. List references to laws, regulations and articles that the company follows when keeping records. 2. Specify the programs that will be used to automate accounting. 3. Prepare and include in the text of the document or attachment the forms of the applicable primary documentation, accounting registers and internal reporting documents. 4. Develop and approve a working chart of accounts with analytical and synthetic accounts that will most fully correspond to the activities of the organization. 5. Include provisions on the procedure for conducting an inventory of liabilities and assets. 6. Approve methods for assessing assets and liabilities. 7. Describe the document flow procedure. 8. Reveal methods of internal control over the correctness and legality of business operations. 9. Establish criteria for determining the level of materiality.

This is what is indicated in the UE for tax accounting purposes:

1. The person or department responsible for maintaining tax records - accounting, chief accountant, etc. 2. The object of taxation is the difference between income and expenses. 3. The tax rate - if it differs from the generally accepted 15% in accordance with regional legislation. 4. The procedure for maintaining KUDiR and programs for accounting automation. 5. The procedure for accounting for depreciable property:

- indicate what property is recognized as a fixed asset;

- data from which accounting accounts are used to determine its value;

- how the initial cost of the operating system and its retrofitting are reflected in KUDiR.

6. The limit on fixed assets is 100,000 rubles for 2021. 7. Methods for evaluating goods. 8. Procedure for writing off OS. 9. Procedure for accounting for raw materials and supplies:

- what is included in inventory costs;

- how the cost of goods for sale is calculated;

- How sold goods are accounted for and written off.

10. Cost accounting procedure. 11. The procedure for accounting for losses and calculating the minimum tax. Here describe your right to recognize past losses in the current year.

To create a good accounting policy, take into account all changes in legislation. Use international standards, laws, and regulations as a guide. You can familiarize yourself with samples of accounting policies that are available on the Internet and are suitable for your taxation system and type of activity. For example, in the Kontur.Accounting service there are examples of UE suitable for different enterprises at a simplified tax rate of 15%.

Is accounting policy necessary for the simplified tax system?

Current legislation does not contain direct rules regarding the obligations of drawing up accounting policies for business entities using the simplified tax system. However, due to certain conditions, the simplifier still needs to draw up an accounting policy. For example, an accounting policy should be drawn up to approve the selected simplified tax system scheme (“Revenue 6%” or “Revenue minus expenses 15”), as well as to describe the accounting features within this scheme. In addition, it is advisable to draw up accounting policies in the following cases:

- Yours and UTII. In this situation, the document should describe the norms for separate accounting of income and expenses for each of the tax regimes, as well as the procedure for calculating and paying the “imputed” tax and the single tax of the simplified tax system;

- receives targeted funding. If your organization receives subsidies and subsidies from both public and private sources, then the procedure for their distribution and use must be prescribed in the accounting policy.

In practice, there may be additional situations when the “simplified” requires an accounting policy. In order to determine the need to draw up a document, take into account the specifics of the company’s work and field of activity.