The accounting policy (AP) is a “particularly important” document that contains aggregate information on the maintenance of accounting and tax accounting methods at the enterprise (primary observation, cost measurement, current grouping and generalization of the results of economic activity facts).

The purpose of creating a management program is to ensure the possibility of combining all accounting information about the situation in the company. The UP contains the financial and economic indicators of the company, the procedure for their formation and what these indicators reflect.

In trade, as well as for other industries, accounting policy is an important element of the system of internal control over activities.

The regulations of the legislation of the Russian Federation stipulate that the UE is formed by the chief accountant, or the person responsible for this area of work.

Each individual economic entity independently forms its own management system, which is based on the facts/conditions of conducting business activities.

When drawing up the UE, the following regulations must be applied:

| • Law “On Accounting” dated December 6, 2011 No. 402-FZ; • PBU 1/2008 “Accounting policy of the organization”, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n; • Tax Code of the Russian Federation (Article 313); • other regulations (Standard recommendations for organizing accounting for small businesses, approved by Order of the Ministry of Finance of Russia dated December 21, 1998 No. 64n, letters and clarifications of the Ministry of Finance, etc.); |

These regulations set out the basic principles and requirements for drawing up accounting policies necessary for carrying out activities.

Structure of the accounting policy of a trading company

Trade can be wholesale or retail; regardless of this, when developing accounting policies, the following important points must be taken into account:

- Application of the system for taxation;

- Methods of maintaining (organizing) accounting and tax accounting;

- Certain aspects (for example, maintaining simplified accounting for a small business entity, correcting errors, etc.)

- Application of a working chart of accounts, maintaining tax registers for tax accounting;

- Other important points for the correct conduct of tax and accounting records.

The nuances when forming the accounting policy of a trading company will be the following:

- the procedure for accounting for goods;

- the procedure for calculating trade margins;

-procedure for accounting for transportation costs, etc.

Many companies formulate accounting policies separately, i.e. on tax accounting and accounting, but the law does not prohibit the formation of a single UP, so it is possible to form one policy with tax and accounting sections.

Step-by-step instructions for the formation and development of an organization's accounting policy

Step 1. Taking into account the main assumptions when forming the accounting policy of the organization.

When forming an organization's accounting policy, it is necessary to focus on legal requirements and norms. In order not to miss this or that requirement, accountants use step-by-step instructions that prescribe not only the procedure for action, but also establish some verification boundaries. Otherwise, when creating a convenient and functional accounting system, inaccuracies may be made, which will subsequently lead to losses. A professional accountant cannot make mistakes and must be guided by serious facts when working with specific documentation and accounting systems in general.

The first step is to study and analyze the legislative system of the Russian Federation. It is important to know that the formation of an organization’s accounting policy is based on the “Accounting Policy of Organizations” (regulations dated October 6, 2008, Order of the Ministry of Finance).

In the Regulations you will find the assumptions and requirements that the accountant is guided by in the process of his work. In order to begin to formulate the organization's accounting policy, let's pay attention to the existing assumptions.

- The property is detached. Each company has its own assets and property.

At the same time, the company employs people who are its owners, managers, and employees. When formulating an organization's accounting policies, it is necessary to take into account the assumption that the company's assets and liabilities do not overlap with the personal assets and liabilities of its employees, as well as with the assets and liabilities of third-party companies. Thus, the company's property should not be used for personal purposes, just as the property of its employees should not be associated with the obligations that the organization has assumed. In order to ensure transparency related to assets, equipment and funds, the accountant must ensure that all document flow reflects the real situation, the equipment indicated in the reports is available and used for its intended purpose. It is important not to take the assumption literally. The company may have employees who are working from home due to health reasons or personal arrangements. In this case, the company has the right to provide them with the necessary equipment and give them the opportunity to build their work efficiently, despite the remoteness. Also an exception to the rule is leasing (Federal Law “On Financial Lease”). - The activity is continuous. This assumption indicates that the company for which the organization’s accounting policies are being developed plans to continue operations and fulfill obligations given to investors, creditors, partners, clients and employees. If there is no such intention, and the company will be liquidated (as planned), this must be declared. Such a statement is made when developing the organization’s accounting policies: in documentation, reports and explanatory notes, which are in addition to the annual report for the past year.

- Accounting policies are applied consistently. The development of an organization's accounting policies does not happen just like that. It is necessary not only to keep accounting records efficiently and legally, but also to compare data between reporting periods and make forecasts. This assumption indicates that the company intends not to deviate from the developed accounting system and plans to use it every new billing period. At the same time, this rule allows for changes in the accounting policies of the organization: this happens if laws or the specifics of the company’s business activities change.

- The facts of financial and economic activities are temporarily determined. This assumption suggests that the period of occurrence of the facts of economic activity is taken into account, and not the time when the funds were actually paid. For example, the period when wages were accrued, and not the period when they were directly paid to employees.

Step 2. Taking into account requirements and standards when developing the organization’s accounting policies.

- Completeness of documentation. It says that the company’s documentation must reflect every single fact of its economic and financial activities. This is exactly how the organization’s accounting policy should be formed: each operation must be reflected and documented.

- Timeliness of reports. Timely reports, declarations and other types of documents required by third-party organizations (tax service, social funds) are guarantors of efficient work and the absence of fines. Also, do not forget about the primary documentation, which is drawn up at the time of the transaction or immediately after it is completed.

- Prudence. Prudence is concerned with balancing income and expenses. On the one hand, the organization must be more enthusiastic about the possibility of new expenses and expenses than revenues and profits in general. This way, specialists will be prepared for unexpected losses and will be able to organize their work in such a way as to be prepared for their occurrence. At the same time, this approach should not be confused with the formation of hidden reserves and the desire to hide income and demonstrate expenses in order to avoid unnecessary tax payments. We are only talking about correctly reflecting the current situation in the balance sheet and being prepared for additional expenses.

- Content is more important than form. The point is that the content (the meaning of conducting financial activities) always takes precedence over the form (the fact of completing this or that documentation or performing a financial and economic action). For example, large loans can be issued to the heads of organizations, but not during a period when the company’s condition is unstable, it has outstanding debts and a large number of unfulfilled obligations.

- No contradictions. Analytical and synthetic accounting must be identical at least by the end of each calendar month.

- Rational approach. The development of an organization's accounting policy involves the use of an accounting system that is fully adequate to the size of the company, the characteristics of its activities and future plans.

Step 3. Taking into account the main features of the company.

In order to develop a unique, convenient, but not inconsistent with the laws of the Russian Federation, it is necessary to take into account all the features of the organization, namely:

- Organizational and legal form.

- Industry and type of activity.

- Number of employees, volume of activity, coverage of the client base.

- Features of the administrative apparatus.

- Financial plans and strategies.

- Basic component (initial capital).

- Qualification level of accountants.

Only after analyzing all of the above factors (there may be significantly more), an accountant will be able to create an organization’s accounting policy that will make the company’s work more convenient, efficient and revealing.

By taking into account these characteristics of the organization, a system will appear that will reduce risks, eliminate fines and increase the benefits of any company, be it a large international holding company or a small private firm.

Step 4: Verify compliance with key regulatory standards.

The development of the organization's accounting policies occurs in full compliance with existing standards and requirements. It should be based on legislative acts, decrees of the President of the Russian Federation, and all existing government resolutions. In addition, the accountant also relies on more specific laws relating to the direct conduct of accounting activities, namely: all standards and regulations related to accounting, comments from the Ministry of Finance, instructions, standards, templates and reporting forms.

Only by knowing all the existing provisions and understanding the system of their interaction with each other, can you formulate a convenient and effective accounting policy for the organization, which will help avoid risks and fines, and also provide the opportunity to conduct serious analytical work (within the organization) and make high-quality forecasts.

Determining the procedure for accounting for goods and trade margins

Goods in trading companies are taken into account:

- At cost (actual);

- At prices, for sale.

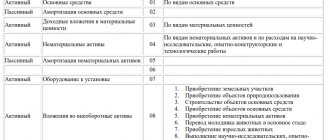

In accounting, accounting for goods is formed on “account-41-“Goods”. Companies (organizations) engaged in trading activities and using Account-41 take into account purchased packaging.

The following subaccounts can be opened for the “41-Goods” account:

“41-1-“Goods in warehouses”;

“41-2-“Goods in retail trade”;

“41-3-“Container under the goods and empty”;

“41-4-“Purchased products”, etc.

According to the “cost” method, goods are recorded on account “41” at the purchase price, according to the “selling prices” method, respectively, at the “sale” cost. The trade margin on goods accepted for accounting is reflected by the posting “D-t-41, K-t-42.

When selling goods wholesale, there are certain issues, for example, in the case of goods being shipped from a warehouse, but not yet delivered to the buyer, i.e. they are on the way with a transport company transporting this product, then in this case the goods are accounted for on account 45 “Goods shipped”. The posting upon the fact of release of goods from the warehouse is reflected by the posting “D-t -45, K-t-41”.

Write-off from account 45 occurs in the same way as write-off from account 41 “D-t-90, K-t-45”.

The cost of goods sold is written off using the following methods:

- "in FIFO";

- “average s/s;

- “according to the cost of each unit of goods.

The company (company), depending on the specifics of the goods sold, can use any of the methods; this method is subject to reflection in the accounting policy.

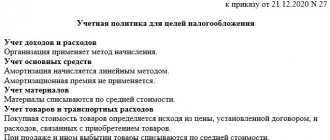

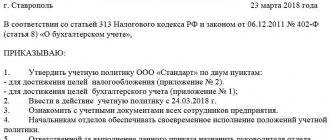

Accounting policy for tax purposes. Retail. OSNO and UTII

Limited Liability Company "Beta" LLC "Beta"

ORDER

12.12.2019 № 102

Moscow

On approval of the organization’s accounting policy for tax purposes when applying the general taxation system (OSNO) and the unified tax on imputed income for certain types of activities (special regime in the form of UTII)

I ORDER:

1. Approve the accounting policy for taxation purposes under OSNO and UTII in accordance with the appendix.

2. Entrust control over the execution of this order to the chief accountant Yu.V. Serebryakova.

Appendix: accounting policies for tax purposes within the framework of OSNO and UTII (on four sheets).

General Director _________________________ A.I. Petrov

M.P.

I have read the order:

| 12.12.2019 | ____________________ | Yu.V. Serebryakova |

| … | ____________________ | … |

Appendix to the Order of Beta LLC No. 102 dated December 12, 2019

APPROVED by Order of Beta LLC No. 102 dated December 12, 2019

M.P

Accounting policy for tax purposes within the framework of OSNO and UTII

The accounting policy of Beta LLC (hereinafter referred to as the Organization) was developed in accordance with Chapter. 26.3 of the Tax Code of the Russian Federation “Taxation system in the form of a single tax on imputed income for certain types of activities”, Ch. 25 of the Tax Code of the Russian Federation “Tax on profit of organizations”, Ch. 21 of the Tax Code of the Russian Federation “Value Added Tax”, Ch. 30 “Property tax of organizations”, Federal Law No. 402-FZ of December 6, 2011 “On Accounting”, Instructions for the Chart of Accounts.

Elements and principles of accounting policies:

1. General Provisions

1.1. The organization applies a special UTII regime in relation to the retail trade of clothing and footwear on the basis of an application submitted on December 10, 2017 to the Federal Tax Service No. 17 for the city of Lyubertsy.

1.2. For other activities, wholesale trade, the organization applies OSNO.

1.3. Accounting for property, liabilities, business transactions, as well as other indicators necessary for calculating taxes is carried out separately for each taxation regime (type of activity) using subaccounts and additional analytical features.

Income, expenses, property related to activities at OSNO are taken into account only when calculating the taxes provided for by this regime. Income, expenses, property related to activities subject to UTII do not affect the calculation of taxes paid under OSNO.

1.4. Responsibility for maintaining tax records, generating declarations, signing them and timely submitting them to the tax office lies with the chief accountant of the Organization.

2. Organization of tax accounting for taxation purposes under a special regime in the form of UTII

2.1. The organization carries out retail trade through a store with a sales area of no more than 150 sq.m. For this type of activity, the organization applies a taxation system in the form of UTII (clause 6, clause 2, article 346.26 of the Tax Code of the Russian Federation).

2.2. The physical indicator when calculating UTII is the area of the store's sales area, which is determined according to the data of the title (lease agreement, transfer and acceptance certificate) and inventory documents.

2.3. In the event of a change in the technical and quality characteristics of the store (its re-equipment, reconstruction, redevelopment, etc.), resulting in an increase or decrease in the area of the sales floor, the organization initiates a technical inventory (clause 6 of article 346.26, paragraph 22 of article 346.27, clause 3 Article 346.29 of the Tax Code of the Russian Federation).

2.4. The organization carries out retail delivery of clothing and footwear using a car. For this type of activity, the organization also applies the UTII taxation system.

2.5. When calculating UTII, the physical indicator is “the number of employees, including individual entrepreneurs.” It is determined in whole units, based on the average number of workers employed in distribution trade for each calendar month of the tax period.

2.6. To separately record workers engaged in retail trade through a store and in delivery trade, a time sheet and a delivery trade schedule approved by the director of the organization for each month are used.

2.7. The number of employees employed indirectly in all types of activities within the framework of UTII (for example, administrative and managerial personnel) is taken into account when calculating the single tax in full, without distribution.

3. Organization of tax accounting for tax purposes within the framework of OSNO

3.1. Documents drawn up in paper and (or) electronic form (subject to their certification by a qualified electronic signature) are accepted for registration.

3.2. Tax accounting is maintained only for the purposes of activities within the framework of OSNO. Tax accounting is carried out separately from accounting - in tax accounting registers developed by the Organization independently. The list of tax accounting registers and their forms are given in Appendix No. 1 to the accounting policy for tax purposes.

3.3. Accounting for income and expenses is carried out using the accrual method based on Art. 271 and 272 of the Tax Code of the Russian Federation.

3.4. Expenses in relation to property used in all types of activities are taken into account in the part that relates to a given taxation regime and are determined monthly in proportion to the income (revenue) received from each type of activity.

4. Tax accounting of depreciable property

4.1. For profit tax purposes, the organization maintains separate accounting of the value of property items that are used in activities taxed by UTII and activities taxed under OSNO in proportion to income (revenue) related to a particular type of activity.

4.2. The useful life of each fixed asset is determined by the commission within the time limits established for the depreciation group in which the fixed asset should be included based on the Classification of fixed assets, approved. By Decree of the Government of the Russian Federation No. 1 of January 1, 2002, after reconstruction, modernization or technical re-equipment of fixed assets, the useful life can be increased within the limits established for the depreciation group.

4.3. The useful life of fixed assets that have been in operation is determined equal to the period established by the previous owner, reduced by the number of years (months) of operation of these fixed assets by the previous owner.

4.4. For the following intangible assets, the useful life is set to three years: – the exclusive right of the patent holder to an invention, industrial design, utility model; – the exclusive right of the author and other copyright holder to use a computer program, database; – the exclusive right of the author or other copyright holder to use the topology of integrated circuits; – the exclusive right of the patent holder to selection achievements; – possession of know-how, secret formula or process, information regarding industrial, commercial or scientific experience; – exclusive right to audiovisual works.

For all other intangible assets, the useful life is determined based on the validity period of the patent, certificate (another document protecting the right to intellectual property).

For intangible assets for which the useful life cannot be determined, a period of 10 years is applied.

4.5. Depreciation is calculated using the straight-line method for all items of depreciable property (fixed assets and intangible assets).

4.6. The depreciation bonus for all fixed assets is applied in the amount of 10 percent of the original cost and (or) expenses for completion, retrofitting, modernization, technical re-equipment or partial liquidation of the fixed asset and is included in the expenses of the reporting period.

4.7. The depreciation rate for fixed assets that are the subject of a leasing agreement is determined taking into account an increasing factor of 3 (with the exception of fixed assets belonging to the first, second or third depreciation groups).

4.8. A reserve for repairs of fixed assets is not created. Expenses for the repair of fixed assets are recognized for tax purposes as part of other expenses in the reporting period in which they were incurred, in the amount of actual expenses.

5. Tax accounting of inventory items

5.1. The cost of materials used in business activities includes the price of their acquisition (excluding VAT and excise taxes), commissions paid to intermediary organizations, transportation costs, import customs duties and fees, amounts paid to organizations for information and consulting services related to purchasing materials.

5.2. Upon disposal, materials are valued using the average cost method.

5.3. The cost of purchasing goods is determined at the price established by the terms of the contract.

5.4. When selling purchased goods, the average cost valuation method is used.

5.5. The cost of property that is not recognized as depreciable, for the purpose of calculating income tax, is taken into account as expenses at a time at the time of commissioning.

6. Tax accounting of expenses

6.1. Direct expenses include: – price (cost) of purchasing purchased goods intended for resale; – costs of delivery (transportation costs) of purchased goods to the organization’s warehouse (if these costs are not included in the purchase price of the goods).

6.2. Transport costs (related to direct costs) are distributed at the end of the month at an average percentage of the balance of unsold goods.

6.3. Deductions to the reserve for doubtful debts are made quarterly. The inventory of accounts receivable for the purpose of creating a reserve is carried out as of the last day of the reporting quarter.

6.4. A reserve for warranty repairs and warranty service is not created.

6.5. In order to evenly account for costs, a reserve is created for future expenses to pay for employee vacations.

6.6. In order to evenly account for costs, a reserve is created for future expenses for the payment of annual remunerations for length of service and based on the results of work for the year.

6.7. Income and expenses relating to several reporting periods are distributed evenly over the term of the contract to which they relate. If the completion date of work (provision of services) under the contract cannot be determined, the period for distribution of income and expenses is established by order of the head of the organization.

6.8. Costs that can be equally taken into account for different reasons (items, groups) of expenses are recognized according to one of them in a manner that is determined each time individually based on the characteristics of the transaction performed.

7. Tax accounting of losses

7.1. The amount of loss from the assignment of the right of claim under an agreement, the repayment period of obligations under which has not yet expired, is determined based on the maximum interest rate established for the corresponding type of currency, clause 1.2 of Art. 269 of the Tax Code of the Russian Federation.

7.2. The base at the end of the tax period is reduced by losses received based on the results of previous tax periods. Such losses are transferred in the manner provided for in Art. 283 of the Tax Code of the Russian Federation.

8. Procedure for calculating advance payments for income tax

8.1. Payment of monthly advance payments for income tax is made based on the profit received in the previous quarter.

9. VAT

9.1. To differentiate the amounts of input VAT between transactions subject to and not subject to VAT, the following additional sub-accounts are opened to account 19 “Value added tax on acquired assets”: – for goods (works, services, property rights) that the Organization uses in transactions subject to VAT , – subaccount “For deduction”; – for goods (works, services, property rights) that the Organization uses in VAT-free transactions – subaccount “In cost”; – for goods (works, services, property rights) that the Organization uses in both taxable and tax-exempt transactions – subaccount “For distribution”.

9.2. The subaccount “For deduction” of account 19 takes into account the tax amounts presented by suppliers for goods (works, services) used in activities subject to VAT. Tax amounts recorded in this subaccount are accepted for deduction in the manner established by Art. 172 of the Tax Code of the Russian Federation, without restrictions.

9.3. Amounts of input VAT presented by suppliers when purchasing materials (work, services) classified as expenses for non-taxable activities are taken into account in the “In cost” subaccount of account 19.

10. Organizational property tax

10.1. The organization maintains separate records of property items that are used in activities subject to UTII and activities taxed under OSNO. The cost of such property is distributed in proportion to the area of the property.

10.2. When calculating property tax in relation to property objects that are used in activities subject to UTII, the tax base is determined as their cadastral value.

10.3. When calculating property tax in relation to property objects that are used in activities taxed under the OSNO, the tax base is determined based on: - the residual value of movable property and immovable property put into operation before 2013. If the residual value of the property includes a monetary assessment of future future costs associated with the surrendered property, its residual value for property tax purposes is determined without taking into account such costs; – cadastral value as of January 1 of the year of the tax period – in relation to individual real estate objects.

<…></…>

Transport cost accounting

| The procedure for accounting and distribution of TZR for accounting purposes is determined in the order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n. It also provides several possible options for accounting for TRP: • using a separate calculation and distribution account 15 “Procurement of materials and materials” for goods and materials; • using a subaccount on the accounts for recording incoming goods (for example, on account 41); • with the inclusion of TZR in the cost of goods. The trading company chooses the accounting method itself and necessarily reflects it in the UP. |

In tax accounting, the procedure for accounting for transport costs is carried out in accordance with Article 320 of the Tax Code of the Russian Federation.

General provisions of accounting policies in trade

Regardless of the specialization of a trading company (for example, wholesale or retail), the accounting policy (hereinafter - UP) must contain some introductory information:

- the applied taxation system;

- methods of organizing accounting and tax accounting;

- possible deviations from generally established accounting rules allowed by regulations (for example, small businesses can apply a simplified procedure for reflecting expenses on loans and borrowings in accounting and reporting, and also not apply retrospective adjustments if errors are detected);

- information about the used accounting accounts, accounting and tax registers;

- other similar provisions formulated on the basis of generally established accounting rules and methods.

In addition to the listed data, the UP of a trade organization should separately disclose the procedure and methods used by this particular organization for accounting for goods, trade margins, transportation and procurement costs (hereinafter referred to as TPP) and the nuances of taxation associated with them.

NOTE! For accounting and taxes, an enterprise can have two separate unitary enterprises or one common one. In the information below, the mandatory points for UE are considered taking into account both BU and NU.

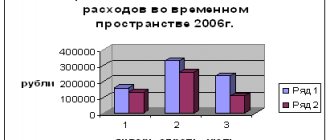

Accounting for expenses in a trading company

| The list of expenses for trading companies is larger than for manufacturing companies. Accounting for expenses should be specified in the accounting policy. For example, the costs of delivering goods to customers are recognized as expenses related to sales. Selling expenses are usually written off monthly: 1.According to the accumulated amount for the corresponding period in full; 2. Distribution of the accumulated amount to the actual goods sold. The remaining expenses are formed on the “44-account”, corresponding to the balance of goods in the warehouse. |

Nuances of VAT accounting

In terms of VAT, the UP of a trading enterprise should include at least:

1. Application (or non-application) of VAT exemption on the list of goods in accordance with Art. 149 of the Tax Code of the Russian Federation. As well as the procedure for maintaining separate accounting for groups of goods with different VAT taxation.

2. If there are transactions taxed at a rate of 0% (in particular, exports), the procedure for maintaining separate accounting for goods taxed at a rate of 0% and taxed at regular rates.

3. Basic aspects of document flow, for example:

• principle of numbering of invoices;

• the procedure for maintaining records of received and issued invoices, the purchase book and the sales book (for example, the method of entering data by department).

Certain questions regarding inventory

The nuances that will need to be included in the UE will depend on the specifics of the trading activity. For example,

• For those who sell food products, it is necessary to stipulate in the UP that the frequency of inventory is more frequent than for those who sell non-food products. It is necessary to provide for nuances associated with such specific issues as natural loss rates. In addition, it is necessary to establish a procedure for promptly identifying and writing off expired goods that have lost their consumer properties.

• For pharmacy organizations, it is necessary to provide in the UP both the procedure for identifying and writing off medical products by expiration date, and compliance with certain conditions for the storage and release of certain goods.