How to properly return accountable money to the organization’s account?

These days, almost every employee has a salary card.

It is to this card that money can be transferred to the account. It is more convenient for an individual to return the balance of unused funds to the organization’s account from the same card through online banking. How to do this in practice?

Firstly, the possibility of issuing and returning accountable money through a current account to or from employee salary cards or bank cards of persons involved under civil law contracts must be enshrined in a local act of the enterprise - for example, draw up a Regulation on settlements with accountable persons or include it in the Accounting Policy .

Secondly, it is necessary to return accountable funds to the current account by making an entry “return of unused accountable amounts” in the “payment name” field. This entry will allow you to avoid problems with the tax authorities and not include the amounts received in the tax base for profit tax, VAT and income when applying the simplified tax system. If, when making a payment, the accountant did not indicate that the money transferred is a return of the unused amount, it is better to formalize this with an explanatory note to the payment.

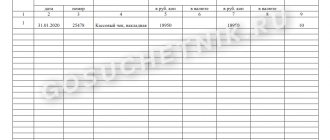

PKO return from an accountable person in 1C Accounting 3.0

The article will tell you how to use the document “Cash receipt order” to make a return from an accountable person in 1C: Accounting 3.0.

Let’s go to the “Bank and cash desk” tab and on the right side of the screen, in the “Cash desk” section, select “Cash receipt order”. The PQS journal will open; in order to create a new one, click the “Create” button, and the form for a new PQS document will open.

By default, the type of operation for a new cash receipt order is “Payment from the buyer,” but we will take the type of operation “Return from an accountable person,” so we will select it in the “Type of operation” field. Next, you need to select the accountable person who will return the money, the amount of the return, select the cash flow item (select “Return of funds by the accountable”), and in the basis field we will also write the line “Return of funds by the accountable.” In the “Application” field, write the document on which this operation is carried out (can be left blank).

All required fields have been filled in and you should now submit the document by clicking the corresponding button on the top panel. PKO with the transaction type “Return from an accountable person” makes entries 50.01 - 71.01 for the amount of the transaction. By clicking on the “Print” button, the document can be printed.

Video:

What to do with the transfer fee?

If a transfer fee was charged for a refund transaction, whether to reimburse it or not and accept it as expenses or not will depend on the wording in the organization’s local act on the procedure for reimbursement of travel expenses and in the local act on non-cash payments.

If the local regulations of the enterprise do not provide for a way to return an unspent advance through an online bank, as well as reimbursement of the bank’s commission for such a transaction, then the employer is not obliged to return to the employee the amount paid to the bank for the transaction.

Thus, a collective agreement or a local act of an organization may establish the types and amounts of reimbursable travel expenses, the procedure for their reimbursement, the procedure and method (cash and/or non-cash, including through online banking) of returning an unused advance, a list of documents accepted in confirmation of expenses (including in the form of a bank commission charged when returning an unspent advance through online banking).

An example of including in a local act a provision on the method of returning unused amounts to the organization’s current account:

The employer's local act may contain a provision on reimbursement to the employee for any expenses incurred with the permission or knowledge of the employer. In this case, the decision to reimburse the bank’s commission for returning money through online banking can also be made.

If reimbursement of the commission is provided for by local regulations, then the employer can take it into account in income tax expenses, like other expenses associated with production and (or) sales (clause 49, paragraph 1, article 264 of the Tax Code of the Russian Federation, Letters No. 03-03 -06/1/18005, No. 16-15/105572).

Accountable amounts: assignment, issue, return of unused amount

The moment of handing over a payment instrument to an employee does not constitute the issuance of money. Entries in the accounting system are made at the time of withdrawal of funds. From the statement of the credit institution you can find out the exact date of the transaction when the accountable amount was used.

Account 55 is used to display transactions on a corporate card. A sub-account of the same name is opened for it. On the date the funds are written off, the following entry is generated in the accounting system: DT71 KT55.

In the program, all these amounts are written off using the document “Advance report in the “Bank and Cash Desk” section. It consists of 5 tabs. The first is called “Advances”.

The documents on the basis of which funds were issued to the employee (PKO, bank statement) are listed here. On the “Products” tab, a list of areas for using funds is indicated. If necessary, the “Returnable container” is filled in. If, using the funds received, the employee paid for goods or services provided to the organization, then these amounts are reflected on the “Payment” tab. After posting the document for these transactions, posting DT60 KT71 will be generated.

All other expenses, including daily allowance, travel expenses and general business needs, are reflected in the “Other” tab. The fields filled in here do not generate transactions, but are used in the printed form of the document. According to Art. 137 of the Labor Code, in order to repay the unspent advance, the employer can withhold amounts from the employee’s salary within one month after the deadline for submitting reports. This provision applies if the employee does not dispute the grounds and amounts of deductions.

Such a decision is formalized in a separate order and must be confirmed in writing by the employee. The Labor Code of the Russian Federation stipulates that the maximum amount of deductions from each payment to an employee should be no more than 20% of the “net salary”. The application first goes to the accountant. He checks whether old settlements with accountable persons have been closed.

If an employee has not provided a report on previously used amounts, then new cash cannot be issued to him. Entertainment expenses, travel allowances, daily allowances – a document must be presented for all money spent. The results of report processing show who owes what and how much.

If there is a difference between the funds issued and the funds used, it means that the employer or employee owes a debt. Returning money from a sub-account to a posting account

Features of returning money to the cash desk by an accountable person

Organizations (IP) can issue funds on account in two ways:

- transfer to an employee’s account or corporate card (letter of the Ministry of Finance of the Russian Federation dated October 5, 2012 No. 14-03-03/728);

- issuing cash (directive of the Bank of Russia “On the procedure for conducting cash transactions...” dated March 11, 2014 No. 3210-U).

If an employee has not used all the accountable money issued to him, he must return it within the time period established for this by the employer (clause 6.3 of instruction No. 3210-U).

The amount of the refunded amount is determined based on the results of verification and approval of the advance report on the amounts spent. Such a report must be drawn up no later than 3 business days from the expiration date for which the money was issued (clause 6.3 of instruction No. 3210-U). The issuance period is fixed in the application drawn up by the employee for the issuance of an advance, or in the employer’s administrative document on the issuance of money on account. From 08/19/2017 (instruction of the Bank of Russia dated 06/19/2017 No. 4416-U), the completion of an application by an employee is no longer a mandatory condition for the payment of accountable amounts. It can be carried out on the basis of an administrative document of the head of the legal entity (or individual entrepreneur).

IMPORTANT! Directive No. 3210-U applies its rules only to the rules for issuing and returning funds in cash. For non-cash payments for accountable amounts, its provisions do not apply, and an employer using this method must approve the procedure for settlements with accountables by an internal document.

Is the return of the accountable amount to the current account included in income under the simplified tax system (6%)?

Quote (Magazine "Glavbukh" 08/13/2014): Many companies meet the cash balance limit without handing over excess cash to the bank. To do this, the director or another employee takes money on account, returns it the next day, and then receives an even larger amount. And so on every day. There is no violation in the endless issuance and return of accountables. But in practice this is risky. Local tax authorities may decide that the company has issued a new advance to an employee who has not yet accounted for the previous amount. This means that she violated cash rules (clause 6.3 of Bank of Russia Directive No. 3210-U dated March 11, 2014). Then the inspectors will add the illegally issued amount to the cash balance at the end of the day. And if it turns out that the total total exceeds the cash limit, the company will be fined from 40,000 to 50,000 rubles, the director - from 4,000 to 5,000 rubles. (Article 15.1 of the Code of Administrative Offenses of the Russian Federation). Moreover, there is a possibility that it will not be possible to cancel the fine even in court. Judges often agree that the law does not provide for liability for violation of the rules for issuing accountable persons (ruling of the Seventh Arbitration Court of Appeal dated March 26, 2014 in case No. A67-5875/2013). But there are also decisions in favor of the tax authorities. They draw the attention of judges to the fact that the manager does not prepare advance reports and does not spend accountable funds. The company simply periodically issues a receipt for the return of the advance, and then a consumable for issuing a new amount. According to inspectors, this means that the organization actually keeps excess amounts with the director. Although by law I must take them to the bank. In such a situation, judges sometimes recognize the fine as lawful (decision of the Moscow City Court of August 14, 2013 in case No. 7-1920/2013). During an on-site inspection, inspectors may consider significant sums of accountable amounts that the employee does not spend, but only increases, as income. And calculate personal income tax from it. And fund inspectors will quite possibly charge contributions from the same amount. There are several ways to avoid conflict. A small company has the right to issue an order that it no longer sets a cash limit on the cash register (see the article “The safest way to reset the cash register limit under the new rules”). Then you can store as much cash as you want in it. Other organizations may revise the cash limit more often, setting it at the maximum possible amount. To do this, you need to take into account the periods with the largest cash revenues or the largest expenses. Then you will need to issue extra money on account less often. As for debts that the director or other accountable has already accumulated, it is safer to reset them to zero.

The procedure for issuing funds for reporting

Giving an employee money for travel, business and other expenses related to the company’s activities is a common practice. The procedure for issuing funds for reporting is regulated by the Directive of the Central Bank of the Russian Federation dated March 11, 2014. No. 3210-U.

To minimize cash turnover, payments with employees are also transferred to non-cash form. The possibility of using bank cards of employees, including salary cards, for settlements of accountable amounts was confirmed by the Ministry of Finance back in 2013 in Letter No. 02-03-10/37209.

Quite often the question arises: if it is possible to transfer money against an account to an employee’s bank card, is it possible to return the accountable amounts to the company’s current account?

The employee must return the amounts received for travel or business expenses that were not spent by him within the following periods:

- on the day of expiration of the period for which the funds were issued;

- on the first day of returning to work after the end of a business trip, vacation, illness, etc., if the end of the period for which the money was issued on account falls within these periods.

Russian legislation does not contain any explanations on how an employee can return money received on account: by returning the accountable amounts to the cash desk or by wire transfer. Order of the Ministry of Finance No. 94n allows the correspondence of account 71 “Settlements with accountable persons” for the return of funds with accounts 50 “Cash” and 51 “Settlement accounts”. Thus, a return to the current account is possible, and if the organization has minimal or no cash handling, it is the only possible option.

Return by the accountable person of the amount of unspent advance

The content of the article

Increasingly, companies are abandoning cash circulation. This allows you not to spend money on cash register equipment, eliminates the need to receive and deposit cash at the bank, and with large cash turnovers, it significantly reduces the costs of maintaining cashiers, collectors and security services on staff. The procedure for issuing funds on account Issuing money to an employee for travel, business and other expenses related to the company’s activities is a common practice.

Establishing deadlines for which cash can be issued on account

Figure 1. ORDER FOR APPROVAL OF DEADLINES FOR ISSUING CASH ON ACCORDANCE

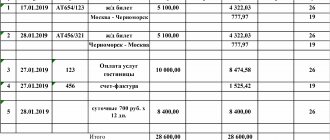

| Limited Liability Company "Yarilo" ORDER No. 4 On approval of the terms for which they can be issued cash on account Yaroslavl 01/11/2011 For the purpose of carrying out business expenses by employees of the enterprise I ORDER: Approve for 2011 the following terms for which cash can be issued on account: Purpose of issuing money | Deadlines in calendar days |

| Purchase of household equipment | 21 days from the date of issue |

| Purchasing office supplies | 7 days from the date of issue |

| Payment for minor repairs of office equipment | 28 days from the date of issue |

| Payment of postal and telegraph expenses | 7 days from the date of issue |

General Director A.A. Veselov Veselov

In addition to the order on employees who have the right to receive money on account, it makes sense for the head of the enterprise to issue an order approving the deadlines for which cash can be issued on account. After all, it is possible that one of the accountable persons will delay reporting on the amounts spent and making the final payment for them. And if the employee has not reported on the previously received advance, then, according to the above-mentioned paragraph 11 of the Procedure, he cannot receive the next amount of cash on account. This order helps organize work with cash and discipline the workforce.

Please note that the time period for which an employee can be given cash on account is determined by the head of the enterprise at his own discretion. There are no restrictions in the legislation.

Establishing the period for which employees are given accountable money is the right, and not the responsibility, of the head of the enterprise. However, if the specified period of time is not determined, then the employee must report on the day the accountable amounts are received. This follows from the letter of the Federal Tax Service of Russia dated January 24, 2005 No. 04-1-02/704.

Example 1

The head of JSC "Perun" did not establish the period for which the company's employees are given cash for business expenses.

On May 12, 2011, office manager of Perun CJSC V.P. Lastochkina received money to buy stationery. On the same day, she is obliged to complete the task, submit an advance report and return the unspent balance of accountable money to the cashier.

For organizations that do not review during the year the deadlines for which cash can be issued on account for business expenses, it is advisable to specify these deadlines in their accounting policies.

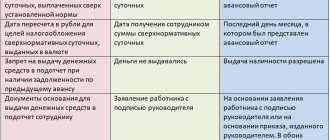

Limitations on Employee Reimbursement

By virtue of clause 2 of the Bank of Russia directive “On making cash payments” dated October 7, 2013 No. 3073-U, the organization’s revenue received in cash at the cash desk can only be spent on certain needs:

- social benefits and wages;

- payment of insurance compensation;

- for personal needs of individual entrepreneurs;

- payment for goods, works, services;

- issuance of money on account;

- issuing money for returned goods paid for in cash;

- payments by a bank payment agent.

Therefore, to reimburse expenses, employees should use another source of funds or specifically withdraw money from the account or transfer it to the employee’s bank card.

Plastic card fraud schemes and ways to combat them are described.

The reimbursements that we are talking about in the article do not fall under the issuance of money on account, since, as stated earlier, money is issued after the fact. In addition, the clause “Payment for goods, works, services” also cannot be applied, since the money is not given to the supplier’s representative.

Let's also consider the issue of cash payment limits. According to clause 5 of Directive No. 3073-U, settlements between individuals and organizations can be made for any amount. Limit of 100 thousand rubles. Clause 6 of the same instructions is introduced for legal entities and individual entrepreneurs. However, when we talk about the interaction of an employee with a legal entity when purchasing something for the needs of the employer, the employee acts as a representative of his organization. It is not for nothing that we mention a power of attorney as a document that can help avoid disputes with tax authorities when accepting expenses for income tax purposes, as well as when deducting input VAT. Therefore, when making a purchase on behalf of an organization, the limit of 100 thousand rubles must also be observed.

For more information about how much money can be issued against a report, see this article.

Retention of unspent imprest amounts

So, let’s say that an employee, from the funds received as an account, paid for the business expenses of the enterprise, while he still had a certain amount of money left unspent. Or, during the period for which he was given cash on account, he did not carry out or pay business expenses at all.

In the first case, the employee must submit a report to the organization’s accounting department on the amounts spent and make a final payment for them: return the remaining money to the company’s cash desk. In the second case, the employee must return to the company’s cash desk all the money he received on account. In this case, they do not prepare a report on the amounts spent.

Please note that the document confirming the employee’s return of unspent amounts and the acceptance of these amounts by the company’s accountant is a cash receipt order. Its unified form No. KO-1 was approved by Decree of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

An advance report is provided for settlements with accountable persons. Its unified form No. AO-1 was approved by Decree of the State Statistics Committee of Russia dated August 1, 2001 No. 55. To this document, the reporting employee must attach documents confirming the expenses incurred: travel certificate, business trip report, cash receipts, receipts and other documents for payment of business expenses. expenses.

Let us repeat that three working days are allotted for submitting a report on the amounts spent and making a final settlement on them. They should be counted either after the expiration of the period established by the head of the enterprise for which cash can be issued on account, or from the day the employee returns from a business trip.

The accountable person must return the unspent accountable amounts to the enterprise's cash desk simultaneously with the submission of an advance report to the accounting department.

If the employee does not return the unspent accountable amounts, they are withheld from his salary. Paragraph 2 of Part 2 of Article 137 of the Labor Code allows this to be done.

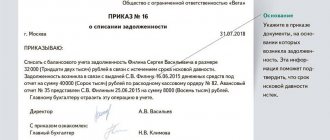

Holding order

According to Part 3 of Article 137 of the Labor Code, in order to repay an unspent and not timely returned advance previously issued to an employee for reporting, the employer has the right to decide to deduct from the salary of the specified employee no later than one month from the date of expiration of the period established for the return of the advance. Condition - the employee must not dispute the grounds and amounts of the withholding.

The employer makes and formalizes the decision, usually in the form of an order or instruction. Normative legal acts have not established a unified form for such an order. To deduct amounts from wages, his written consent must be obtained. Such conclusions are given in the letter of Rostrud dated August 9, 2007 No. 3044-6-0.

Please note that deductions from wages can be made in a limited amount. Unspent accountable amounts should be withheld for each payment of wages to an employee who has not returned them on time, in the amount of no more than 20 percent of the unpaid amount. The basis is Article 138 of the Labor Code.

Example 2

Manager of Yarilo LLC N.K. Razin received 4,000 rubles as a report on May 16, 2011. to pay for printer repairs in a specialized organization. Repairing the printer cost only 2,500 rubles.

At Yarilo LLC, cash on account for payment for minor repairs of office equipment based on the order of the manager is issued for a period of 28 calendar days from the date of issue. According to clause 11 of the Procedure, the amounts spent must be reported within three working days. Thus, submit the advance report to the accounting department and unspent accountable amounts to the cash desk of Yarilo LLC. Razin must until June 15, 2011 inclusive.

On June 15, 2011, Razin brought a repaired printer from a specialized organization to Yarilo LLC. On the same day, he submitted an advance report to the organization’s accounting department, to which he attached a cash receipt and an acceptance certificate for the work performed. In this case, the balance of the unspent accountable amount is 1,500 rubles. (4000 – 2500) — Razin did not return.

On June 27, 2011, Razin gave written consent to withhold 1,500 rubles. from his salary. On the same day, the head of Yarilo LLC issued an order to make the appropriate deductions.

Salary N.K. Razin for June 2011 amounted to 24,000 rubles. This means that the accountant of Yarilo LLC has the right to withhold 4,176 rubles from his salary for the specified month. . Since the unreturned balance of the unspent accountable amount (1,500 rubles) is less than this amount, the accountant withheld it in full from Razin’s salary for June 2011.

Figure 2. WRITTEN CONSENT OF THE EMPLOYEE TO RETENTION

to CEO

LLC "Yarilo"

A.A. Veselov

From the manager

N.K. Razin

Due to my failure to return unspent accountable amounts in the amount of 1,500 rubles within the prescribed period. I don’t mind their deduction from my salary.

June 27, 2011 Razin N.K. Razin

Limited Liability Company "Yarilo"

ORDER No. 61

About deduction from wages

unspent accountable amounts

Yaroslavl 06/27/2011

1. To repay the unspent and not returned timely advance payment issued for printer repairs, deduct from the salary of manager N.K. Razin a sum of money in the amount of 1500 rubles.

2. Accountant Z.P. Stepanova to deduct from the salary of the specified employee starting in June 2011.

General Director A.A. Veselov Veselov

Contractor accountant Stepanova Z.P. Stepanova

The order has been reviewed by: Razin N.K. Razin

Figure 3. HOLD ORDER

The following entries were made in the accounting records of Yarilo LLC:

DEBIT 94 CREDIT 71

— 1500 rub. — the accountable amount not returned on time is reflected;

DEBIT 20 CREDIT 70

— 24,000 rub. – salary accrued for June 2011 N.K. Razin;

DEBIT 70 CREDIT 68 SUB-ACCOUNT “PIT SETTLEMENTS”

— 3120 rub. (RUB 24,000 × 13%) – personal income tax withheld from N.K.’s salary. Razin;

DEBIT 70 CREDIT 94

— 1500 rub. — the accountable amount not returned on time is withheld;

DEBIT 70 CREDIT 50

— 19,380 rub. (24,000 – 3120 – 1500) – N.K.’s salary was paid. Razin.

Let’s say that the head of an organization missed the deadline allotted for making a decision on withholding from an employee’s salary an advance that was not spent and not returned in a timely manner. Or the employee disputes the grounds and amounts of the withholding. In this case, the organization will have to go to court.

If the employee repays the debt on the previously received accountable amount on his own, then the unspent and not returned on time accountable amount in accounting should also be written off to the shortage account by posting to the debit of account 94 and the credit of account 71. Then, when the amount of debt is returned, for example, to the cash desk of the enterprise it is necessary to make an accounting entry on the credit of account 94 in correspondence with the debit of account 73 subaccount “Settlements with personnel for shortages”.

What you can’t give out cash for from a cash register

What payments can be made in cash - only from the bank?

These are all those calculations that are named in line 2 of our table and paragraph 4 of the Central Bank Directive No. 3073-U dated 10/07/2013 (hereinafter referred to as Directive No. 3073-U).

Remember that the limit for cash payments between two organizations, as well as between an organization and an individual entrepreneur, is 100 thousand rubles. within the framework of one lease agreement, clause 6 of Directive No. 3073-U.

This is the maximum not for a month of rent, but for its entire term. And not only for rent, but for all payments under the lease agreement in total.

In this case, the rental of movable property can be paid from any money in the cash register. It is necessary to withdraw money from the account only for payments for real estate rental.

Please note that:

• settlements under a real estate lease agreement include any payments in pursuance of such an agreement. And this is not only the rent itself, but also a contractual penalty, compensation for inseparable improvements, payment to compensate the tenant for damage caused to the leased property, return to the tenant of the unused deposit for the last month of rent, etc.;

• settlements for transactions with securities include, among other things, both payment of bills of exchange purchased by your organization and payments on bills of exchange issued by your organization.

Please note that if the OP received cash proceeds and then transferred it to the cash desk of the head office or another division, then this money does not lose the status of cash proceeds. Their spending is limited to the list from line 1 of our table.

The purpose you state when you receive cash from the bank is not important. For example, you withdrew money from your account in advance to pay vacation pay. But they were not useful, since it was decided to postpone the vacation. You have the right to use this cash for the calculations indicated in line 2 of the table. And if there are enough of them, then there is no need to withdraw another amount from the bank specifically for this.

We spend cash proceeds strictly according to the list

Cash receipts for goods sold, work performed, services rendered (hereinafter referred to as cash proceeds) can be spent only for the purposes indicated in line 1 of our table, clause 2 of Directive No. 3073-U.

Formally, advances do not count as cash proceeds, since at the time of their receipt the goods have not yet been sold, the work has not been completed, and the services have not been provided. But it cannot be ruled out that tax authorities, when checking, will equate advances to revenue. Therefore, it is safer to spend them only according to the “target” list.

If you use cash proceeds to pay for the rental of real estate, then you may be able to fight off the fine, but only through the court

Let's go through those expenses from line 1, the possibility of paying for which from cash proceeds usually raises questions.

Social payments.

How to determine whether a particular payment is of a social nature? In the rules for cash payments themselves, in Directive No. 3073-U, this concept is not disclosed.

You can check the lists of payments that are and are not social according to the rules for filling out statistical forms, paragraphs. 90, 91 Procedure for filling out form P-4, approved. By Order of Rosstat dated October 26, 2015 No. 498 (hereinafter referred to as the Procedure). But you don’t have to limit yourself to just them. Firstly, I do not refer the rules for cash payments to these lists, clause 2 of Directive No. 3073-U (in contrast to the procedure for conducting cash transactions, paragraph 8, clause 2 of Central Bank Directive No. 3210-U dated March 11, 2014 (hereinafter referred to as the Directive No. 3210-U)). Secondly, the Rosstat list of social payments is not closed.

Therefore, if the payment is called social in any other legal act, then it can be issued from cash proceeds. An example is benefits for temporary disability, maternity benefits, and child care benefits. According to the rules for filling out statistical forms, they are not included in social payments and clause 90, sub. “b”, “c” clause 91 of the Procedure. But according to the Law, they relate to payments within the framework of compulsory social insurance, sub. 5-8 p. 2 tbsp. 8 of the Law of July 16, 1999 No. 165-FZ. This suggests that the payment of such benefits is of a social nature.

Be careful with material aid. Thus, one court declared unlawful the issuance of birthday aid from cash proceeds Resolution 9 of the AAS dated March 23, 2017 No. 09AP-7557/2017-AK. He decided that it is not a social payment, since “it is not aimed at meeting the employee’s needs for additional social protection and is not of a compensatory nature.” Therefore, it is safer to give out of cash proceeds only such financial assistance that should support a person in a difficult situation, etc. “y”, “h” clause 90 of the Procedure.

The court decisions mentioned in the article can be found:

They are often paid along with the salary, but do not belong to it or to social benefits and therefore cannot be issued from cash proceeds:

• compensation to the employee for the use of his property in his work (it is not a payment for services on which cash proceeds can be spent, since it is paid in accordance with the Labor Code, Article 188 of the Labor Code of the Russian Federation, and not with the Civil Code).

In our table, these payments fall into the category “All other cash expenses” (line 3).

Business trips.

They are not directly named in the list of expenses for which cash proceeds are allowed to be spent from the cash register. Because of this, one court decided that it was impossible to issue travel allowances from cash proceeds. Resolution 9 of the AAS dated October 25, 2016 No. 09AP-48317/2016. But this is a highly controversial conclusion. The payment of travel allowances is not mentioned separately because it falls into the category of “issuance to employees on account”, of course, if the money, as expected, is issued before the start of business trips and clause 10 of the Regulations, approved. Government Decree No. 749 dated October 13, 2008. And cash can be issued against the report from the proceeds.

Reimbursement of amounts spent in the interests of the company.

This is compensation to the director, other employee, founder:

• overexpenditure of accountable amounts based on the advance report approved by management;

• amounts spent by them in the interests of the organization when the money was not issued on account. This also includes reimbursement of travel expenses at the end of a business trip for which no advance was issued.

Here the situation is the same as with business trips.

On the one hand, there is a court decision that reimbursement of overspending to the accountant from cash proceeds is unlawful Resolution 9 of the AAS dated 10/18/2016 No. 09AP-46832/2016, 09AP-46905/2016. The court relied only on the fact that this type of payment was not directly indicated in the list of purposes for which proceeds can be spent and does not apply to issuance on account.

On the other hand, such compensation refers to the issuance of cash available on the list for the company to pay for the goods, works, and services it needs. The director, having decided to reimburse the employee (another individual) for the personal money he spent in the interests of the organization, thereby approves the transaction for the acquisition of goods, works, services on its behalf and clause 1 of Art. 182, paragraphs. 1, 2 tbsp. 183 Civil Code of the Russian Federation.

Special situation: reimbursement to an individual of expenses, cash for payment of which should be withdrawn from a bank account (line 2 of our table). If you do this from cash proceeds or from other (that is, not from the account) receipts to the cash desk, the inspectorate will certainly regard this as a violation.

Dividends (in LLC).

They do not fall under any of the spending areas in line 1 and belong to the group “All other cash receipts” (line 3 of the table). They cannot be paid from cash proceeds Resolution 3 of the AAS dated 04/01/2016 No. A33-27288/2015. You need to use other cash receipts or withdraw money from your account.

The amount is credited to the resigned employee

If an employee who did not return the accountable amounts was fired, then after the expiration of the statute of limitations, the organization may recognize his debt as uncollectible and write off as expenses in the amount in which it was reflected in the organization’s accounting records (clause 14.3 of PBU 10/99 ).

Debt with an expired statute of limitations must be written off:

- or through the reserve for doubtful debts (if the organization created such a reserve). In this case, a posting is made to the debit of account 63 and the credit of account 71;

- or on the financial results of the organization’s activities with an accounting entry on the debit of account 91 and the credit of accounts 71.

Then such debt is subject to reflection on the balance sheet in account 007 “Debt of insolvent debtors written off at a loss” within five years from the date of write-off (clause 77 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

Please note that the limitation period for accountable amounts that the employee has not returned begins to count at the end of the period for which the money was issued. This follows from paragraph 2 of Article 200 of the Civil Code. The limitation period is three years (Article 196 of the Civil Code of the Russian Federation). If there are grounds for interrupting the limitation period, the said period begins to count anew (Article 203 of the Civil Code of the Russian Federation).

Example 3

Yarilo LLC issued 3,000 rubles for reporting on May 18, 2011 to office manager Shorkina. for the purchase of household equipment. Let us recall that, according to the order of the head, in the specified organization, cash on account for the named purposes is issued for a period equal to 21 calendar days, starting from the day of issue.

May 25 M.A. Shorkina quit, did not report on the accountable amounts, and did not return the funds to the company’s cash desk.

Yarilo LLC began to count the limitation period for accountable amounts that the employee did not return at the end of the period for which the money was issued - from June 8, 2011.

On June 8, 2014, Yarilo LLC will finish counting the limitation period if there are no reasons for its interruption.

Accounting for settlements with accountable persons.

postings to account 71.

The application must be endorsed by the head of the company or an authorized person. A 3-day period has been established when the employee must account for the accountable amounts received, return the funds to the cash desk and submit a report.

If the employee does not report on time, then the amount received by him should be withheld from the employee’s income and personal income tax should be charged (Article 137 of the Labor Code of the Russian Federation). At the same time: Important: deductions from an employee can be made only upon written application and no more than 20% of wages (Article 138 of the Labor Code of the Russian Federation). If a debt (especially a large amount) of an accountable person has been registered for a long time, then the tax inspector, during an audit, can re-qualify such a payment as a loan or consider it income (paragraph 3 of Article 137 of the Labor Code of the Russian Federation) and charge additional personal income tax.

The maximum amount for reporting is not provided for by law, but it is worth considering that if an employee settles accounts with contractors on behalf of the enterprise, then under one agreement you can pay no more than 100,000 rubles.

The employee reflects all cash expenses in the advance report.

View more:

Materials Postings by Arrival MAIN PAGE TAX NEWS ACCOUNTING NEWS ACCOUNTING ANNUAL REPORT AND…

Is it often punished under paragraph 1 of Art. 126 Tax Code of the Russian Federation?P. 1 tbsp. 126 Tax Code of the Russian Federation...

Transactions with real estate for a fee or on a contract basis. Subclass 68.3 contains two groups of codes: ...

Double TaxationDouble taxation is the simultaneous imposition of the same taxes on income in different countries. Double taxation is caused by...

Department of Rosprirodnadzor for the Crimean Federal District, Kerch Selection of a territorial bodyCentral apparatus of Rosprirodnadzor02 Department of Rosprirodnadzor for…

Tax accounting

Issuing money on account does not lead to expenses for the organization, both general and special taxation systems (USNO and UTII). This follows from paragraph 14 of Article 270, paragraph 3 of Article 273, paragraph 2 of Article 346.17, paragraph 1 of Article 346.29 of the Tax Code.

Returned unspent accountable amounts do not increase taxable income, both when calculating income tax and the single tax under the simplified tax system or UTII. After all, accountable amounts do not become the employee’s property, but are his receivables until he reports on them and returns the unused amounts. The basis is Articles 41 and 346.29 of the Tax Code.

Uncollectible accounts receivable in tax accounting are subject to write-off as non-operating expenses. If a reserve for doubtful debts is created for non-operating expenses, the amounts of bad debts not covered by the created reserve should be written off (subclause 2, clause 2, article 265 of the Tax Code of the Russian Federation). An organization using the general taxation system can do this.

Please note that the expiration of the statute of limitations is one of the criteria for recognizing a debt as bad and, therefore, taking it into account as expenses for corporate income tax purposes. To include amounts of receivables for which the statute of limitations has expired, documents confirming the expiration of the statute of limitations are required as expenses. This is stated in the letter of the Ministry of Finance of Russia dated September 15, 2010 No. 03-03-06/1/589.

An organization that applies the simplified tax system, regardless of the chosen object of taxation, does not have the right to reduce the base for a single tax by the amount of written off bad receivables (letter of the Ministry of Finance of Russia dated November 13, 2007 No. 03-11-04/2/274).

The amount of written off bad receivables does not matter for organizations paying UTII. This follows from paragraph 1 of Article 346.29 of the Tax Code.

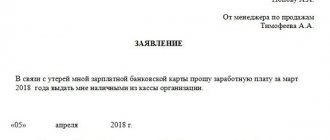

How to process reimbursement of expenses to an employee and avoid tax risks

The organization must have a general policy regarding the possibility of employees making such purchases. This may be an order that specifies the persons or positions who can make purchases on behalf of the organization. Or you can include such a clause in the accounting policy, personnel policy or cash circulation policy. These same internal acts can also describe the rules of document flow for the situation that is the topic of the article. The organization sets these rules independently. Below we will give some recommendations that may help when choosing to process an operation for reimbursement of expenses to an employee without reporting.

Since when purchasing goods at his own expense for work purposes, the employee can be said to act on behalf of the organization, then in accordance with paragraph 1 of Art. 183 of the Civil Code of the Russian Federation, it is necessary to draw up documents that will confirm that the organization has approved such a transaction. Such documents may be:

- An employee's application for reimbursement of expenses approved by the manager.

- A report on the funds spent with documents for purchase and payment attached to it (sales receipt, delivery note, invoice, etc.).

- An order on behalf of the manager to reimburse the employee’s expenses.

The organization must develop templates for these documents on its own (Clause 4, Article 9 of Law No. 402-FZ).

Also, a good way to avoid tax authorities’ quibbles regarding input VAT and recognition of income tax expenses may be to additionally issue powers of attorney for a number of employees to make sudden purchases on behalf of the organization. For expensive purchases, it is worth making sure that the seller, on the basis of a power of attorney, issues primary documents in the name of the organization, and not the employee.

On the content and structure of the power of attorney according to f. Find out M-2.

However, most often employees make spontaneous purchases for work needs for small amounts. This could be stationery, some consumables for household needs, payment for small household services. Therefore, tax risks in these cases are most often insignificant. In order not to provoke questions from the tax authorities, you should avoid such situations and take care of issuing funds to employees on account in advance.

In addition, the employee himself may come under the attention of inspectors, because they may want to recognize compensation for expenses as income of an individual. However, this is illegal, since the employee does not have any economic benefit when performing such an operation. Letter of the Ministry of Finance of the Russian Federation dated 04/08/2010 No. 03-04-06/3-65 confirms the fact that compensation for money that an employee spent for the needs of the organization does not entail the emergence of a tax base for personal income tax.

For questions that interest tax authorities when checking settlements with accountable persons, read the article “Tax audit of settlements with accountable persons (nuances)”.

Withholding personal income tax

When an employee is dismissed and has a debt in the form of a previously issued advance, the organization is recognized, on the basis of Article 226 of the Tax Code, as a tax agent for personal income tax and is obliged to calculate, withhold from the taxpayer and pay the amount of tax to the budget.

The organization must take all measures provided for by law to return the funds issued to the employee on account. If this turned out to be impossible due to, for example, the expiration of the statute of limitations or if the organization decided to forgive the employee’s debt, then the date the former employee of the organization received income in the form of unreturned amounts issued on account will be the date from which such collection became impossible, or the date of the relevant decision.

In accordance with paragraph 5 of Article 226 of the Tax Code, if it is impossible to withhold the calculated amount of personal income tax from the taxpayer, the tax agent is obliged, no later than one month from the date of the end of the tax period in which the relevant circumstances arose, to notify in writing the taxpayer and the tax authority at the place of his registration about the impossibility of withholding the tax and the amount of tax.

Similar explanations are given in the letter of the Ministry of Finance of Russia dated September 24, 2009 No. 03-03-06/1/610.

Practical encyclopedia of an accountant

All changes for 2021 have already been made to the berator by experts. In answer to any question, you have everything you need: an exact algorithm of actions, current examples from real accounting practice, postings and samples of filling out documents.

When an employee is sent on a business trip, he must be given money for rent, travel and funds for daily expenses, the amount of which is established on the basis of regulatory documents. How to determine the amount of the advance and how to issue and return the remaining amount of money, as well as how to deal with recalculation?

Purpose of payment when transferring to an accountable person

Cash register systems must be used when receiving cash for goods sold, work performed or services provided (Clause 1, Article 2 of Law No. 54-FZ of May 22, 2003).

But an agreement is only an intention; in itself it does not confirm the fact that a business transaction actually occurred. Therefore, it is no wonder that the accountant has a question: what documents must be available to confirm travel expenses?

What is worth remembering You need to require an employee to report on expenses for funds received only if he received money for expenses in advance. If he spent personal money, which the company later reimbursed by issuing accountable money, then he should not submit an advance report.

IMPORTANT! The Russian Ministry of Finance considers these claims from the tax service to be unlawful, as indicated in its letter dated 04/08/2010 No. 03-04-06/3-65.

Employees are forced to go on business trips, purchase inventory, fuel and lubricants, and in order to cope with the assigned tasks, they have to take funds on account from the organization.

Account 73 “Settlements with personnel for other operations” is intended to summarize information on all types of settlements with employees of the organization, except for settlements for wages and settlements with accountable persons.

Situations are also possible when the accountable person simply resigns at the same time, forgetting (or deliberately) to return the funds to the company’s cash desk. If settlement with this employee has not yet been made, you can withhold part of the money from his salary.

The previously issued letter was not canceled. Therefore, the organization must independently decide whether to be guided by this letter or not.

Determining the amount of advance for a business trip

The amount of the advance is determined independently by the organization, taking into account the duration of the business trip, the norms of expenses for renting housing, daily expenses, as well as the cost of travel to the destination and back. The amount of daily allowance and standards must be specified in a collective agreement or in the local regulations of the organization.

Currently, the daily allowance is set at 700 rubles for trips within Russia and 2,500 rubles for trips abroad. Please note that the organization has the right to set the amount either less or more than the established amounts. The question is about additional taxes on daily allowances, so if these amounts are exceeded, income tax will be charged to the employee.

What happens if the daily allowance is less than 700 rubles? Daily allowances can be set in a smaller amount; the organization has such a right. The established norms do not oblige them to be adhered to; the established value affects taxation. However, you should take a reasonable approach to determining the amount of daily allowance, because an employee leaves on a train to perform the organization’s tasks, and not of his own free will, and setting small amounts means that he will have to spend his personal money on food, travel, etc.

Read more about how to send an employee on a business trip under the new rules here.

Accounting for reimbursement of expenses to an employee

After the employee has received approval of the expenses from the manager and submitted all supporting documents, the transaction must be reflected in the accounting accounts. As already established above, reimbursement of expenses in the event of non-payment of an advance cannot be called settlements with accountable persons, therefore account 71 should not be used. In the chart of accounts approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, the next in order is account 73 “Settlements with personnel for other operations.” It is proposed to use it in the described situation:

Dt 10, 20, 26, 44 Kt 73 - goods, work, services paid for by the employee have been capitalized;

Dt 19 Kt 73 - incoming VAT has been taken into account;

Dt 73 Kt 50 - expenses incurred by the employee are reimbursed from the cash register.

Issuing an advance for a business trip

The procedure for issuing funds from the cash desk of an enterprise is determined by the Regulations on the procedure for conducting cash transactions, which was approved by the Bank of Russia No. 373-P dated October 12, 2011 (hereinafter referred to as the Regulations).

The advance is issued from the following funds:

- Receipts to the organization's cash desk for the sale of goods (Services, works).

- Received from the current account.

An advance is not issued from money received from citizens for payment in favor of third parties (for example, under an agency agreement in payment for communication services).

Important! A person who has no debt on previously received advances can receive money for a business trip on account.

Travel allowances are issued on the following grounds:

- If there is an order drawn up in form T-9 (collective form T-9a).

- Statements from the employee regarding the amount of the advance and the period of issue with the director’s visa.

Money is issued according to a cash receipt order, which is issued in one copy. In the “consumables”, the employee must write down the amount of money received by hand (rubles are written in words, and kopecks in numbers, for example, five thousand rubles 38 kopecks), and then sign the receipt. The money must be counted in the presence of the cashier, otherwise claims for missing amounts will not be accepted.

How to apply for a return of money from an account

Articles 13,19,20,21 of this document describe how to correctly fill out PKOs and tear-off receipts when accepting funds. The importance of confirmation signatures is also emphasized here. Thus, the cashier or other authorized person puts a personal signature on each receipt paper, thereby confirming its authenticity. For legal entities, it is mandatory to certify each PKO with a seal. As noted earlier, upon discharge, the PKO is registered in the account book under an individual serial number.

At the end of the year, it is against it that all inflows of funds into the enterprise are reconciled. After registration, all incoming documents are filed in a separate folder with a binder in chronological order. At the end of the folder, you should insert a final sheet, in which, signed by the accountant, it is indicated exactly how many papers were completed during the year and filed in the folder.

During the calendar year (or other period determined by the organization), the printed sheets of the cash book are numbered (usually numbering occurs automatically when printed from an accounting program), collected in a folder, and at least once a year stitched into a single book, sealed in the same way as the cash book, filled out by hand, certified by the signatures of the chief accountant and the head of the organization and the seal of the organization (if you use one).

- “Standard rules for the operation of cash registers when making cash settlements with the population (approved by the Ministry of Finance of the Russian Federation on August 30, 1993 No. 104, applied to the extent that does not contradict Law No. 54-FZ)

- “An album of unified forms of primary accounting documentation for recording cash settlements with the population when carrying out trade operations using cash registers (forms approved by Resolution of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132) - this document approved the form of the Cashier-Operator Journal KM-4.

How to transfer a sub-account to an employee’s card

Not a day without instructions × Not a day without instructions

- Services:

Let's look at how to correctly transfer accountable funds to an employee's bank card, what transactions to use to record the transaction, and how to draw up a payment order. January 28, 2021 Author: Natalya Evdokimova You can issue accountable money to an employee of an organization in three ways:

- from the cash register in cash; through a debit card issued by TOUFC for cash payments; through the employee’s personal bank card.

Moreover, it is important to comply with the intended purpose of accountable funds: expenses for the economic needs of the institution, travel or entertainment expenses. A report can be issued on a card or in cash only to an employee of an organization with whom an employment and civil law contract has been concluded.

The timing, maximum amount and reporting period must be established by a separate order of the manager.

The procedure for filing a report on an employee’s card from a current account: The employee prepares a written statement indicating the amount, purpose, justification and deadline for reporting. We forward the completed appeal to the manager.

The employer makes a decision on the submitted application.

The decision is formalized in a separate order (order) or an application is endorsed. The accountant, on the basis of an order or endorsed application, prepares a payment order for issuance on the employee’s card.

Payments on advance reports

The issuance of funds to an employee from the company's cash desk BEFORE performing an official task or in advance is carried out on the basis of an expense cash order in the KO-2 form. This document is filled out in a single copy by the accountant of the enterprise and contains the amount and period for which the advance is issued to the accountable person.

If an employee completed an official assignment WITHOUT receiving an advance or the funds issued were not enough for him, then the company makes a refund based on the advance report. The timing of reimbursement for the advance report depends on the company’s accounting policy, however, the report itself must be submitted to the accounting department within 3 days from the date of return from a business trip or making a production purchase. You can find more information about the deadlines for submitting the expense report in the material Deadlines for the expense report.

When paying for goods or services with his own money, the employee must also provide the company with documents evidencing the transaction and write a statement of compensation, which is then endorsed by the manager’s signature and seal. Reimbursement of funds spent is carried out after the entire package of documents has been checked by an accountant and approved by the manager.

Reimbursement of overexpenditure on an advance report on a card or in cash is carried out only if the employee provides the accounting department with a correctly executed package of documents, namely an advance report with all documents confirming expenses attached.

If the organization does not have a sufficient amount, then, by agreement with the employee, payments in installments are possible. However, the manager must remember that the employee may demand compensation for damages if deadlines are not met.