Is there a stamp on the invoice for payment?

In accordance with Federal Law No. 82-FZ dated 04/06/2020 amending certain legislative acts of the Russian Federation regarding the abolition of the mandatory seal of business entities, the use of round seals is not mandatory (except for affixing a seal on a limited list of documents). Forms of primary documentation that do not indicate “MP” - a place for printing, are not certified by a seal. An invoice for payment, as mentioned earlier, cannot even be included in the primary documentation, so the question of whether printing on an invoice for payment is mandatory can be answered in the negative.

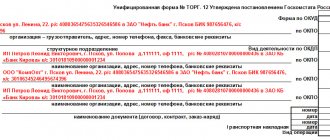

- invoice number and date;

- name of organizations (seller and buyer);

- addresses and details of both parties for the possibility of paying the invoice;

- list of goods or services sold;

- their number;

- units of measurement of goods (pieces, packages, kilograms, etc.);

- price;

- total invoice amount.

Invoice (Article 169 Tax Code)

The country of origin and the customs declaration number are indicated for goods whose country of origin is not the Russian Federation. The taxpayer selling the specified goods is responsible only for the compliance of the specified information in the invoices presented to him with the information contained in the invoices and shipping documents received by him.

Invoices are drawn up when performing transactions that are recognized as an object of taxation. The invoice must indicate:

- serial number and date of issue of the invoice;

- name, address and taxpayer and buyer identification numbers;

- name and address of the shipper and consignee;

- number of the payment and settlement document in case of receiving advance or other payments for upcoming deliveries of goods (performance of work, provision of services);

- name of the goods supplied (shipped) (description of work performed, services provided) and unit of measurement (if it is possible to indicate it);

- quantity (volume) of goods (work, services) supplied (shipped) according to the invoice, based on the units of measurement adopted for it (if it is possible to indicate them);

- price (tariff) per unit of measurement (if it is possible to indicate it) under the agreement (contract) excluding tax, and in the case of applying state regulated prices (tariffs) that include tax, taking into account the amount of tax;

- the cost of goods (work, services), property rights for the entire quantity of goods supplied (shipped) according to the invoice (work performed, services rendered), transferred property rights without tax;

- the amount of excise duty on excisable goods;

- tax rate;

- the amount of tax imposed on the buyer of goods (works, services), property rights, determined based on the applicable tax rates;

- the cost of the total quantity of goods supplied (shipped) according to the invoice (work performed, services rendered), transferred property rights, taking into account the amount of tax;

- country of origin of the goods;

- Number of customs declaration.

Is there a stamp on the invoice (nuances)

A businessman who last issued an invoice a decade and a half ago may today wonder whether to put a stamp on the invoice or not, since in the past a seal was a mandatory requisite for this document. Without her presence, drawing up an invoice was meaningless, and tax deductions were impossible. In those days, the status of any document without a seal was insignificant.

Modern requirements for stamping documents have changed radically. For example, now companies are allowed not to have a seal at all, if it is not mentioned in their charter. This became possible from 04/07/2020 (Clause 7, Article 2 of the Law “On Joint Stock Companies” dated December 26, 1995 No. 208-FZ, Clause 5 of Article 2 of the Law “On Limited Liability Companies” dated 02/08/1998 No. 14- Federal Law).

Rebus Company

Whether an invoice is stamped may be of interest to an accountant if he is drawing up this document for the first time (however, experienced specialists sometimes also have doubts about this). We will look at the nuances associated with stamping invoices in 2020-2020 in our article.

Even if a businessman, out of habit, stamped the invoice, the fate of the tax deduction will not change. First of all, you need to pay attention to the completeness and correctness of the required details, because otherwise problems with deductions cannot be avoided. For example, shortcomings and errors in the name, TIN of the buyer or seller (letter of the Ministry of Finance of the Russian Federation dated 05/02/2012 No. 03-07-11/130), incorrectly indicated name of the product (letter of the Ministry of Finance of the Russian Federation dated 08/14/2020 No. 03-03-06/ 1/47252), distorted tax amount or tax rate (letter of the Federal Tax Service of Russia dated April 11, 2012 No. ED-4-3/ [email protected] ), use of a facsimile signature (letter of the Ministry of Finance dated August 27, 2020 No. 03-07-09/49478 ) - all this can become a threat to deduction.

We recommend reading: Ramonny district benefits for veterans of labor

Do I need a stamp on the invoice for payment?

An invoice is a document presented to the buyer by the supplier. It includes a list of goods and services provided, as well as other mandatory details. Whether to put a stamp on an invoice for payment is often of interest to accountants of organizations. However, the law does not establish strict rules regarding printing on invoices.

According to Federal Law No. 82 of 04/06/2020 “On amendments to certain legislative acts of the Russian Federation regarding the abolition of the mandatory seal of business companies,” the use of round seals is not mandatory. The exception is a limited list of documents. Unified forms that do not have the abbreviation “MP” do not need to be stamped.

Invoice for payment in 2021

- the name of the selling company, up to the reflection of its organizational and legal form. If the seller is an entrepreneur, then his full name is indicated;

- legal or actual address;

- TIN (for individual entrepreneurs) and TIN and KPP (for LLC);

- the subject of the contract – goods, assets, work or services;

- its quantitative expression;

- unit prices and total transaction value;

- transaction currency – rubles (!).

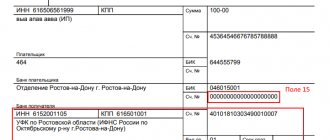

- the entrepreneur indicates only his TIN, and the organization - TIN and KPP;

- The organization is required to put a stamp on the account, but the entrepreneur may not have a seal. Therefore, he must indicate “B/P” in the space provided for printing, i.e. no stamp;

- Bank details also vary. In particular, the first 5 digits of the current account directly indicate the organization or entrepreneur: 40802 - this is how the account begins for an individual entrepreneur, 40702 - for a legal entity;

- The organization indicates its authorized name, usually abbreviated, in the invoice. For example, Sekundochka LLC. But the entrepreneur must indicate, for example, “IP Ivanova Anna Sergeevna.”

Changes to invoices from January 1, 2021

Although the general issuance procedure has not changed, changes to invoices from January 1, 2021 affected the form of the document. New details have appeared, the contents and design of some columns have changed. You can see what the new invoice looks like and a sample on this page. We will also tell you in detail how to fill out the document.

New invoices from January 1, 2021: sample filling >>

There are several changes in the document.

- In column 7 “Tax rate” you need to indicate new values: instead of the usual rate of 18%, indicate 20% - when selling goods, works or services,

- instead of the estimated rate of 18/118, indicate 20/120, for example, when receiving an advance payment for upcoming deliveries.

We will describe in detail below what to write in the fields of the document.

More than 1,500,000 companies already print invoices, invoices and other documents in the MyWarehouse service Start using

Instructions for filling out an invoice 2020

Filling the string part

Line 1 Number and date of the invoice. Documents are numbered in order, ascending.

Please note that as of October 1, 2021, new rules for storing invoices have been established. Now they should be stored in chronological order - by date of issue or date of receipt.

The storage period for invoices and delivery notes has not changed - it is still at least four years from the date of the last entry.

Lines 2, 2a and 2b Name, address, tax identification number and checkpoint of the seller. Be careful! The address from October 1, 2021 is indicated in the invoice according to the Unified State Register of Legal Entities, in detail, without abbreviations (which are acceptable in the constituent documents). Violation of this rule may be grounds for deduction.

Line 3 Information about the sender of the cargo. Indicated only when selling goods. When selling services or performing work, put a dash. If the seller is the sender of the goods, write “He” in this line.

Line 4 Information about the recipient of the cargo. The consignee and his address are indicated in the invoice only when selling goods. If you are submitting a document for services, work, property rights, put a dash.

Line 5 Payment order number - if there was an advance payment (that is, the invoice is drawn up for an advance payment). If not, put a dash. A dash is also placed if prepayment was made on the day of shipment.

Line 6 Name, address (from October 1 - strictly according to the Unified State Register of Legal Entities, without abbreviations), INN and KPP of the buyer.

Line 7 Currency and its code. The invoice is issued in the monetary unit in which prices and payments under the contract are expressed.

Line 8 Government contract number. The government contract identifier has been indicated in invoices since July 1, 2021, and everyone has managed to get used to the innovation. But be careful! From October 1, 2021, line 8 of the invoice itself is called differently: a clarification has appeared that it is filled out only if data is available. This is what it looks like:

Let us remind you that companies that work with contracts with treasury support are required to indicate in the invoice the number of the government contract (or agreement or agreement on the provision of subsidies, investments, contributions to the authorized capital from the federal budget). They receive a 20-digit code.

It is indicated in all contracts drawn up under government orders. You can find this code in the contract or in the Unified Information System.

If you do not need to write the IGK on the invoice (that is, you are not working with a contract to which an identifier is assigned), then do not leave the line empty - put a dash in it.

Government Contract ID on Invoices: Sample

Filling out the tabular part of the invoice

Column 1 Name of the product or description of works, services, transferred rights.

Column 1a Here, in the invoice from 10/01/2021, the code of the type of goods is indicated. This applies only to those products that are exported to the EAEU countries.

If you need to indicate a product type code on the invoice, select it from the HS reference book. If not necessary, put a dash.

Column 2 Unit code. The invoice is indicated in accordance with the all-Russian OKEI classifier. The codes in it are in sections 1 and 2.

Column 2a National symbol of the unit of measurement. For example, "pack". You can also check or find out this designation using OKEI.

Column 3 Quantity or volume of goods, works or services. If they cannot be identified, a dash is added.

Column 4 Price per unit of measurement excluding tax. Indicated in the case where it is possible to indicate it, otherwise a dash is placed.

Column 5 Cost of goods, works, services. Indicated excluding tax.

Column 6 Excise tax amount. If you sell non-excisable goods, you cannot put a dash. In this case, write here “No excise duty”.

Column 7 Tax rate.

Column 8 Tax amount in rubles and kopecks - full, without rounding.

Column 9 The cost of the entire quantity or volume of goods, taking into account the amount of tax.

Columns 10 and 10a Country of origin of the goods (in the invoice, both fields are filled in only for imported products). The digital code and short name are indicated here.

Both values are given in accordance with the All-Russian Classifier of Countries of the World. Do not write the digital code of Russia in the tenth column of the invoice: filling in is not required for domestically produced goods.

In this case, put a dash, as in the next column.

Column 11 Registration number of the customs declaration (indicated in the invoice only for imported goods, in other cases a dash is placed). This column is also new as of October 1, 2021. Previously, the invoice indicated the customs declaration number, but it was serial, but now the registration number is indicated. It looks like this:

Who signs the invoice?

The invoice must be signed by the manager and chief accountant of the organization or individual entrepreneur.

But this can also be done by other employees - those who, in accordance with the power of attorney and the order of the manager, receive such powers.

Since October 1, a new signature field has appeared in the invoice - an authorized person can sign instead of the entrepreneur. And the fields for signatures of representatives of the manager and chief accountant were in the document before.

Invoice 2021: free to fill out

Here's what the completed new invoice form looks like:

Invoice deadline

The procedure for issuing a document has not been affected by changes since January 1, 2021. An invoice is issued within 5 days from the moment of: a) shipment of goods, performance of work, provision of services, transfer of rights, or b) receipt of advance payment. Calendar days are counted.

The period is counted from the day following the day of shipment or receipt of advance payment. If the last day of the term falls on a non-working day, the expiration date of the term is considered to be the nearest next working day.

According to the law, there is no penalty for missing the deadline for submitting an invoice. An organization can be fined only for the absence of a document.

However, a violated procedure for issuing invoices at the junction of tax periods can still lead to a fine. Thus, late provision of a document may be considered as its absence.

For example, when an organization issues an invoice at the beginning of the current tax period that should have been issued at the end of the previous one.

The 20-digit government contract identifier can be found in the contract itself or on the website of the Unified Procurement Information System.

Stamping on the invoice: is it stamped or not?

It is not necessary to put a stamp on the invoice. If you think it necessary, you can install it. Then the seal will serve as an additional prop.

From what date are new invoices valid?

The new invoice form will apply from January 1, 2021.

What is the storage period for invoices and invoices in 2020?

Invoices must be stored for at least five years (according to the rules for storing primary documents). And invoices are stored for four years.

Code 796 on the invoice: what is it?

796 - piece code (as a unit of measurement of a product) according to OKEI. Be careful! It differs from the product code (657) and packaging code (778).

Should the item code be indicated on the invoice if the product is measured in hundreds?

OKEY provides separate codes for a dozen, a hundred, a thousand, etc. If necessary, you can clarify them in the online version of the directory.

Customs declaration number on the invoice: what is it?

CCD is a cargo customs declaration. Its registration number is a required detail for the invoice. However, it is indicated only in the case of shipment of imported goods or release of domestic consumption products after the end of the free customs zone procedure in the Kaliningrad SEZ from October 1, 2021.

The details are indicated in column 11 of the invoice. From October 1, 2021, it is called “Customs Declaration Registration Number”.

Consignee and his address on the invoice: legal or actual?

The law (Article 169 of the Tax Code of the Russian Federation) does not determine which address of the consignee should be indicated in the invoice: legal, actual, warehouse address. You can indicate the name of the recipient of the cargo according to the constituent documents and his postal address, including in cases where the goods are intended for several retail outlets of the buyer - instead of the address of a specific point.

The invoice period is 5 days. Calendar or work?

The invoice is issued within 5 calendar days from the date of shipment or receipt of advance payment.

Will numbering invoices out of order in 2020 result in a penalty?

The Tax Code of the Russian Federation in 2021 does not imply responsibility for numbering invoices out of order. A fine is possible only when the document was not issued at all.

Fill out an invoice in a few minutes

MyWarehouse is a convenient program for printing invoices

Source: https://www.moysklad.ru/poleznoe/formy-dokumentov/novaya-forma-scheta-fakturi/

An invoice for payment

An invoice for payment is a document that absolutely all entrepreneurs use in their work, regardless of what level they work at and what area of business they belong to. As a rule, an invoice for payment is issued after a written agreement is concluded between the parties, as an addition to it, but sometimes it can be issued as an independent document.

- The signature has not been decrypted. A painting alone is not enough: there must be information about who signed it. In the online version of the document, such an error cannot be made, since it requires an electronic signature.

- Missing invoice deadlines. The date of issue of the invoice must coincide with the date of issue of the invoice and not exceed 5 days from the date of release of the goods or provision of the service.

- Delay in receiving an invoice for VAT deduction. The tax deduction for tax purposes must be claimed in the same tax period in which the document confirming this, that is, the invoice, was received. To prevent this problem, it is necessary to store evidence of the date of receipt of invoices (mail notices, envelopes, receipts, entries in the incoming correspondence journal, etc.).

- The dates on the invoice copies are mixed up. Both parties to the transaction must have identical copies, otherwise the invoice does not prove the legality of the transaction.

- "Hat" with errors. If there are inaccuracies in the names of organizations, their tax identification numbers, addresses, etc. the document will be invalid.

Stamp on the 2-NDFL certificate

- TIN issued in Russia and abroad, last name, first name, patronymic, code designation of an identity document, address and information about place of residence in the Russian Federation, code of a subject of the Federation or a foreign state. The series and number of the passport are also imprinted.

- The income table indicates the month of receipt, the designation of the types of income and their amounts for each type. This also applies to deductions.

- In the final part, print or enter the total amount of income and taxes that were withheld. The certificate also includes the amount of accrued and over-withheld taxes.

- In the appropriate columns indicate the total cost of the fixed advance payments made. Information is also provided on the amount of taxes that were not subject to withholding.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

Invoice for payment: details of its completion

An invoice is required to document the agreement on the sale of goods or provision of services. During the sale of goods or services, this document is drawn up, which is sent to the buyer and is an important document for both parties to the transaction. The buyer will be able to confirm the fact of payment based on the invoice, and the seller will use it as the basis for accounting for goods in the warehouse.

We recommend reading: Certificate of state registration of rights to real estate

How to issue an invoice without breaking the rules? Russian legislation does not require invoices for payment to be certified with a personal signature and seal. Despite this, it is advisable to indicate them in order to avoid misunderstandings in the future. It is allowed to sign invoices that are sent to the buyer by fax or e-mail, with a facsimile copy of the signatures of authorized persons and the organization's seal. It’s even better if the invoice form is decorated with the logo of the organization.

Enter the site

The details required for the primary accounting document are listed in the Law of the Republic of Belarus “On Accounting and Reporting” dated October 18, 1994 No. 3321 – XII (as amended on May 17, 2021). By the way, this Law defines primary accounting documents as a document that confirms the fact of any business transaction (Part 1, Article 9). A business transaction is interpreted broadly by law and is defined as “an action or event that entails changes in the volume and (or) composition of the property and (or) obligations of the organization” (Part 13 of Article 2 of the Law). The law does not include a seal imprint among the required details. HOWEVER, there is no need to rush. Regarding the preparation of certain types of primary accounting documents, special regulations of direct effect have been adopted. Almost every one there states that the primary document is certified by a seal. Please note - If errors or inaccuracies are found in the completed invoice, it is allowed to make corrections in a way that does not interfere with the reading of the previous entry, with the obligatory affixing of the date and signature of the person who made the corrections, and certification of the corrections made with a seal (CLARIFICATION of the Ministry of Finance of the Republic of Belarus dated July 15, 2021 No. 15-9/338 “On the procedure for using goods, transport and delivery notes”).

We recommend reading: Where to apply for non-provision of benefits for utility bills to nuclear power plant liquidators

Minutes of general meetings of participants, decisions of owners of unitary enterprises. Neither the Law of the Republic of Belarus dated December 9, 1992 No. 2021-XII (as amended on July 30, 2021) “On joint stock companies, limited liability companies and additional liability companies”, nor the Law of the Republic of Belarus “On Business Companies” that has not yet entered into force (effective from 02.08.2021) do not contain a direct indication of the mandatory presence of a seal on these documents, with the exception of ballots for absentee voting.

Invoice for payment 2021: download sample

The invoice for payment is filled out manually or in the program. The second option is more convenient and faster: you can create a new document based on a similar one and quickly select a counterparty. By filling out an invoice in the program, you minimize errors: your and the buyer’s details are already in the system.

There is no unified form of the document. Therefore, organizations can either develop this form themselves or use the one offered by the accounting program. The main thing is that the invoice contains the following details: – date; – number; – information about the supplier and his bank details; – information about the buyer; – a list of goods, works, services indicating quantity and cost; – total amount payable and VAT; – signatures of the manager and accountant; – print.

Invoice for payment from individual entrepreneurs in 2021: sample and procedure for issuing

- The buyer contacts the entrepreneur and informs about his intention to purchase the product/service.

- The seller issues an invoice for payment and sends it to the buyer in the agreed manner: online, by mail or in person.

- The buyer transfers the invoiced amount of money to the seller's account.

- The seller waits for the funds to arrive and then proceeds to fulfill his obligations.

Sometimes an entrepreneur-seller has to issue invoices for payment for goods or services. The form and content of this document are not regulated by law , but over the course of long practice of its application, some uniform standards have emerged. Based on them, you can issue an invoice from an individual entrepreneur and from an LLC, since the only difference between the two papers is that only the entrepreneur signs the first, and the manager and chief accountant of the enterprise signs the second.

General information about accounts

The payment invoice must include the details used to transfer money from the customer to the supplier for goods or services. The seller issues an invoice and the buyer must pay it.

This document is important for both parties to the transaction. It confirms the validity of the transaction. The invoice is also a supporting document for debiting money from the buyer’s bank account. It can be issued for transactions:

- supply;

- purchase;

- provision of service;

- and so on.

Typically, an invoice is issued for prepayment.

This type of documentation does not have a strict unified form. Accounts are prepared in accordance with the organization's accounting policies.

If, when issuing invoices, there was a change in balance sheet positions or financial results, it would make sense to regulate the information in it.

Invoices for payment: why is it needed, in what case is it drawn up, sample filling, form

Quite often in practice there are situations where contractual relations are long-term in nature, and at specified intervals one party issues an invoice to the other, which is paid. After this, the first party fulfills its obligations, and the recipient of the payment, at the end of the month, prepares documents confirming the fact of its fulfillment.

Issuing an invoice involves the provision by the contractor or seller to the buyer or customer of a special document that reflects bank details, as well as a name list of goods, works, services with a breakdown of the unit of measurement, quantity, price per unit and total amount.