A simple accounting system for micro-enterprises

Situation: how to conduct accounting using a simple system, without using the double entry method.

Is the organization a micro-enterprise? Record every fact of economic life, that is, the amount of an operation or transaction, in a specially designed register (clause 6 of the Recommendations approved by the decision of the Presidential Council of the NP “Institute of Professional Accountants and Auditors of Russia” dated April 25, 2013 No. 4/13). There is no need to make accounting entries.

Clause 6.1 of PBU 1/2008 gives organizations with the status of micro-enterprises the right to conduct accounting using a simple system, without using the double entry method. However, at present, a clear methodology for this is not prescribed anywhere.

There are also no special registers for maintaining accounting using a simple system. Therefore, the organization can independently approve the accounting methodology and develop the necessary registers. For example, you can take as a basis:

- book of accounting of income and expenses - simplified;

- book (journal) of accounting of facts of economic life in form No. K-2MP;

- book of accounting of income and expenses - for entrepreneurs.

The main thing is to provide in your form all the necessary details established by paragraph 4 of Article 10 of the Law of December 6, 2011 No. 402-FZ. And let such a register be approved by the head of the organization (clause 5 of article 10 of the Law of December 6, 2011 No. 402-FZ). Similar explanations are contained in paragraph 6 of the Recommendations approved by the decision of the Presidential Council of the NP “Institute of Professional Accountants and Auditors of Russia” dated April 25, 2013 No. 4/13.

Fill out the balance sheet by taking data from such registers, as well as the results of a complete inventory of the organization’s property and liabilities.

A micro-enterprise has the right to charge depreciation:

- once a year (when preparing annual financial statements);

- when there is a need to determine the residual value of fixed assets and intangible assets (for example, when drawing up a balance sheet, determining net assets when a participant leaves the ownership (founders), if it is necessary to submit financial statements for obtaining a loan, etc.).

The chosen option must be provided for in the accounting policy.

This is stated in paragraphs 45–46 of the Recommendations, approved by the decision of the Presidential Council of the NP “Institute of Professional Accountants and Auditors of Russia” dated April 25, 2013 No. 4/13.

Situation: should small businesses be guided by Order of the Ministry of Finance of Russia dated December 21, 1998 No. 64n?

Small enterprises have the right to use this regulatory act to the extent that does not contradict current legislation.

In its activities, a small enterprise must be guided by all current regulatory documents. The exception is those acts that directly provide for the right of such organizations not to apply these documents. The standard recommendations approved by order of the Ministry of Finance of Russia dated December 21, 1998 No. 64n are still in force. Therefore, they can be used to the extent that does not contradict the Law of December 6, 2011 No. 402-FZ, accounting provisions, the Chart of Accounts and the Instructions for its application.

This follows from paragraphs 3 and 9 of the Regulations on Accounting and Reporting.

Procedures and algorithms that simplified accounting does without

SMP has the right to waive the following generally accepted accounting standards:

- forget about the accrual method and determine income and expenses using the cash method;

- apply a simplified system of accounting registers;

- refuse to maintain accounts 09 and 77, intended for accounting for deferred tax assets and liabilities (do not keep records of permanent and temporary differences);

- use one synthetic account instead of a group of accounts (for example, account 20 “Main production” instead of accounts 23, 25 and 26);

- do not form reserves;

- do not apply certain PBUs (for example, for construction SMP - PBU 2/2008 “Accounting for construction contracts”, approved by Order of the Ministry of Finance of Russia dated October 24, 2008 No. 116n);

- do not overestimate fixed assets and intangible assets, do not reflect the depreciation of intangible assets and financial investments in accounting;

- recognize commercial and administrative expenses in the cost of products (goods, works, services) in full in the reporting year of their recognition as expenses for ordinary activities;

- recognize all borrowing costs as other expenses (without inclusion in the value of the investment asset).

Organizations using the simplified tax system have the right to use simplified accounting. How to organize accounting under this special regime, read the material “Procedure for maintaining accounting records under the simplified tax system (2020).”

In addition to accounting concessions, SMEs have the right to reduce their costs when preparing reports:

- reduce the volume of reports by filling out only the balance sheet and income statement;

- refuse to detail indicators by article, generalizing them by group;

- disclose information to a lesser extent, without reporting related parties, discontinued activities, etc.;

- correct significant errors at the time they are discovered, without using retrospection.

At the same time, the accounting of a small enterprise must be organized in such a way that its reporting is reliable and useful for its users, truthfully reflecting in all material aspects the financial position of the enterprise and the financial results of its work.

Chart of accounts

A small business can reduce the number of synthetic accounts in its operating chart of accounts compared to the general Chart of Accounts. For example, you can group data in generalized synthetic accounts as shown in the table:

| Data that can be grouped | Where reflected in the general Chart of Accounts | Where can it be reflected in the accounting of small enterprises? |

| Productive reserves | counts 07, 10, 11, 15, 16 | account 10 “Materials” |

| Costs associated with the production and sale of products (works, services) | accounts 20, 21, 23, 25, 26, 28, 29, 44 | account 20 “Main production” |

| Finished products and goods, | accounts 41, 43, 45 | account 41 “Goods” |

| Accounts receivable and payable | accounts 62, 71, 73, 75, 76, 79 | account 76 “Settlements with various debtors and creditors” |

| Cash in banks | accounts 51, 52, 55, 57, | account 51 “Current accounts” |

| Capital | accounts 80, 81, 82, 83 | account 80 “Authorized capital” |

| Financial results | accounts 90, 91, 99 | account 99 “Profits and losses” |

Apply the remaining accounts in the generally established manner according to the rules established for the general chart of accounts.

This is stated in paragraph 13 of the Standard Recommendations, approved by order of the Ministry of Finance of Russia dated December 21, 1998 No. 64n and paragraphs 3, 3.1 and 3.2 of the information message of the Ministry of Finance of Russia No. PZ-3/2012, paragraphs 9–23 of the Recommendations approved by the decision of the Presidential Council of the NP “Institute of Professional Accountants and Auditors of Russia” dated April 25, 2013 No. 4/13.

Accounting policy

The accounting policy of a small enterprise must be drawn up and approved according to general rules. In it, fix the chosen methods of accounting.

At the same time, small enterprises, unlike others, also have the right to choose:

- method of recognizing income and expenses in accounting in accordance with PBU 9/99 and PBU 10/99;

- the procedure for recognizing borrowing costs in accordance with PBU 15/2008;

- the procedure for correcting significant errors in accounting in accordance with PBU 22/2010;

- the procedure for reflecting in the reporting the consequences of the changed accounting policy in accordance with PBU 1/2008.

And micro-enterprises and non-profit organizations have the right to decide how they will conduct accounting: without using double entry or in a general manner, using accounting entries.

This procedure is provided for by part 4 of article 6 of the Law of December 6, 2011 No. 402-FZ, paragraph 6.1 of PBU 1/2008 and is confirmed by paragraph 4 of the Recommendations approved by the decision of the Presidential Council of the NP “Institute of Professional Accountants and Auditors of Russia” dated April 25, 2013. No. 4/13.

Information about accounting policies in reporting

Small enterprises must disclose information about their accounting policies in the Explanations to the Balance Sheet and the Statement of Financial Results. They also need to decipher all changes in accounting policies that will be applied next year (clause 25 of PBU 1/2008).

As a general rule, the consequences of changes in accounting policies should be reflected retrospectively in the financial statements. That is, correct the accounting data for the entire recalculation period.

However, small enterprises have the right to reflect changes in accounting policies in their financial statements prospectively. This means that they are using the new method of accounting in the current and future periods. There is no need to correct statements for previous years. This right is granted by clause 15.1 of PBU 1/2008 and part 4 of article 6 of the Law of December 6, 2011 No. 402-FZ.

SMP accounting policy and its contents

Accounting and tax accounting policies

The methods of accounting are determined in the accounting policy of the organization, which is approved by order of the manager (clause 8 of the Accounting Regulations “Accounting Policy of the Organization”, approved by order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n, hereinafter referred to as PBU 1/2008). This document is governed by 2 groups of norms:

- Art. 8 of Law No. 402-FZ, PBU 1/2008 and other regulations of the Ministry of Finance of the Russian Federation - accounting policies that establish accounting methods;

- Art. 11, 313 of the Tax Code of the Russian Federation - accounting policy for taxation purposes, defining selected from among the acceptable options for accounting for indicators necessary for calculating taxes (determining the tax base).

There is no regulation on documentation. This can be a single document or 2 documents. Tax policy can be an annex to accounting policy. Its parameters in the form of a choice of options are entered into a computer accounting program if it is used by the organization.

Approval and change of accounting policies

The accounting policy is applied from the moment of creation of the organization, including if approved later than this moment. The deadline for approval is 90 days from the date of state registration of a legal entity (including those created through reorganization, clause 9 of PBU 1/2008).

This document does not need to be approved annually. Regarding the timing of introducing changes, there are two regulations:

- Methodological adjustments, which are made by the organization at its discretion, come into force from the next reporting period (from January 1 of the following year).

- Changes related to the opening of new divisions, changes in legislation must be made promptly - from the beginning of the division’s operation, the changes entering into legal force (clause 6 of Article 313 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated July 3, 2018 No. 03-03-06/1/ 45756).

According to clause 15 of PBU 1/2008, after significant adjustments to the accounting policy, the facts of economic life are reflected retrospectively, i.e. from the moment of their occurrence, as far as possible from the point of view of the reliability of the result.

If new economic phenomena arise in the activities of an organization that require adequate recording, the introduction of new accounting methods for this is not considered a change in accounting policy (clause 10 of PBU 1/2008). Accordingly, the requirements for the timing of making adjustments do not apply to such innovations; they are introduced as necessary.

Contents of SMP accounting policy

The accounting policy must approve the organizational and technical parameters of accounting:

- Accounting option:

- full - using accounting registers (journal-order or memorial-order form);

- simplified version - using statements;

- a simple form (for micro-enterprises) - without registers and double entry, using the Book (journal) for recording the facts of economic activity (see Appendix 1 to the Recommendations).

Simplification should not affect the reliability of accounting.

- Chart of accounts. It can be reduced by combining data from several close accounts (clause 3 of the information of the Ministry of Finance of the Russian Federation “On the simplified system...” dated June 29, 2016 No. PZ-3/2016).

- Forms of primary documents, which must comply with Art. 313 Tax Code of the Russian Federation. For use in electronic document management, the Federal Tax Service of the Russian Federation recommends formats approved. by orders of the Federal Tax Service of the Russian Federation dated November 30, 2015 No. MMV-7-10/ [email protected] , dated March 24, 2016 No. MMV-7-15/ [email protected]

- The choice of accounting methods and methods (formation of cost, cost accounting schemes, etc.), the procedure for carrying out control procedures, etc. (clause 4 of PBU 1/2008).

- Selecting an accounting reporting option (full or simplified).

Of the listed categories of documentation, only reporting requires a mandatory paper form (Clause 8, Article 13 of Law No. 402-FZ); for other types, an electronic form is possible.

Accounting policies for tax purposes

All accounting documents can serve as evidence during tax audits. The basis for calculating taxes is primary accounting documents, the requirements for details of which are the same for all business entities.

Unlike accounting, tax accounting aims to show the formation of the tax base, the methodology and results of calculating and paying taxes, including complex issues that are not reflected in the legislation.

As a rule, tax accounting policy includes 3 main sections:

- Principles of accounting (sequence, continuity, etc.), reflecting industry characteristics.

- Selected methods and methods of tax accounting (in particular, a list of direct and indirect expenses for calculating income tax, paragraph 10, paragraph 1, article 318 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated February 21, 2018 No. 03-07-07/11012) , creating reserves for vacations and doubtful debts, etc.).

- Forms of tax registers that meet the requirements of Art. 313 of the Tax Code of the Russian Federation requirements for details (name, period (date) of compilation, meters, etc.).

If accounting is carried out using software, developers often offer a ready-made order form for accounting policies, where you only need to select the necessary parameters that will be reflected in the program. At the same time, it is possible to sign all necessary documents with an electronic signature.

Recognition of income and expenses

As a general rule, revenue from the sale of finished products (works, services) is recognized in accounting only if the following conditions are met:

- there is an agreement or other document that gives the organization the right to receive revenue;

- the amount of revenue can be determined;

- the organization has received payment for the shipped products, or there is no doubt that it will receive it. For example, an organization has documents (agreement, invoice, letter of guarantee, etc.) on the basis of which it can demand payment for finished products (work, services);

- ownership of the finished product (results of work performed) has passed to the buyer (consumer), the services have already been provided;

- the expenses that have been or will be incurred in connection with this operation can be determined.

If at least one of the listed conditions is not met, then, as a general rule, it is necessary to recognize in accounting not revenue, but accounts payable. An advance received against future deliveries is also not considered revenue.

Such rules are established by paragraphs 3 and 12 of PBU 9/99.

At the same time, small businesses have the right not to recognize revenue until payment is received from buyers (customers). That is, use the cash method of accounting for income and expenses. Such organizations do not wait for ownership of the product (goods) to transfer from the organization to the buyer. This means that advances received must also be included in income. However, all other conditions for revenue recognition must be met.

If an organization recognizes revenue on a cash basis, then expenses must be accepted as the debt is repaid (clause 18 of PBU 10/99, part 4 of article 6 of the Law of December 6, 2011 No. 402-FZ). Meanwhile, such amounts affect the financial result in the general manner - with reference to the income received (clause 19 of PBU 10/99). Be careful: advances issued cannot be reflected in expenses at the time of issue. It is necessary to wait until the counterparty fulfills its obligations, that is, pays off the advance.

An example of how to recognize income and expenses for a small business in accounting

Alpha LLC is a small enterprise and provides consulting services. In March, the cost was 118,000 rubles. (including VAT – 18,000 rubles). . On March 25, the act of accruing VAT was signed.

The cost of services amounted to 70,000 rubles, including:

- salary – 35,000 rubles;

- insurance premiums – 11,970 rubles;

- rent – 23,030 rub. (without VAT).

On March 31, Hermes paid for the services partially - in the amount of 60,000 rubles. The buyer transferred the remaining amount (RUB 58,000) on April 17.

Alpha's accounting policy stipulates that revenue is determined as money is received from customers, expenses are recognized as they are paid and reduce the financial result of the current period (clause 7 PBU 1/2008, clause 12 PBU 9/99, clauses 18 and 19 PBU 10/99).

Alpha paid the expenses as follows:

- the rent amount was transferred to the landlord on March 28;

- the salary was issued and personal income tax was transferred to the budget on March 31;

- insurance premiums accrued from salaries are transferred to the funds on April 15.

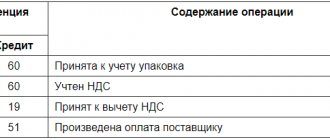

In accounting, Alpha's accountant made the following entries.

March 25:

Debit 76 subaccount “Calculations for VAT” Credit 68 subaccount “Calculations for VAT” – 18,000 rubles. (RUB 118,000 × 18/118) – VAT is charged on the sale of services.

March 28:

Debit 76 Credit 51 – 23,030 rub. – rental expenses have been paid;

Debit 20 Credit 76 – 23,030 rub. – rental expenses are reflected.

March 31:

Debit 20 Credit 70 – 35,000 rub. – labor costs are reflected;

Debit 70 Credit 68 “Calculations for personal income tax” – 4550 rubles. – personal income tax withheld;

Debit 68 subaccount “Personal Income Tax Payments” Credit 51 – 4550 rub. – personal income tax is transferred to the budget;

Debit 70 Credit 50 – 30,450 rub. - salary was issued;

Debit 51 Credit 62 subaccount “Calculations for work performed (services provided)” – 60,000 rubles. – payment received from the buyer;

Debit 62 subaccount “Calculations for work performed (services provided)” Credit 90-1 – 60,000 rubles. – revenue from sales of services is reflected;

Debit 90-3 Credit 76 subaccount “Calculations for VAT” – 9153 rubles. (RUB 60,000 × 18/118) – VAT is charged on the sale of services;

Debit 90-2 Credit 20 – 58,030 rub. (RUB 23,030 + RUB 35,000) – rental costs and labor costs are written off.

April 15:

Debit 69 Credit 51 – 11,970 rub. – insurance contributions to the funds are listed;

Debit 20 Credit 69 – 11,970 rub. – expenses for paying insurance premiums are reflected.

April 17:

Debit 51 Credit 62 subaccount “Calculations for work performed (services provided)” – 58,000 rubles. – payment received from the buyer;

Debit 62 subaccount “Calculations for work performed (services provided)” Credit 90-1 – 58,000 rubles. – revenue from the sale of services is reflected;

Debit 90-3 Credit 76 subaccount “VAT calculations” – 8847 rubles. (RUB 58,000 × 18/118) – VAT is charged on the sale of services;

Debit 90-2 Credit 20 – 11,970 rub. – expenses for paying insurance premiums are written off.

Accounting for inventories

Let's start with the changes that affected PBU 5/01 “Accounting for inventories”.

Small enterprises have the opportunity to take into account inventories at the supplier’s price.

All other costs directly related to the acquisition of inventories are now allowed to be included in expenses for ordinary activities in full in the period in which they were incurred. EXAMPLE 1. EVALUATING MPZ

Trading purchased goods in the amount of 100,000 rubles.

and spent 7,000 rubles on their delivery. According to generally established rules, goods should be received at actual cost, amounting to 107,000 rubles. (100,000 + 7,000). But based on the new simplified rules, the Parus accountant made the following entries: DEBIT 41 CREDIT 60

- 100,000 rubles.

– goods are capitalized; DEBIT 44 CREDIT 76

- 7000 rub. – expenses for delivery of goods are included in expenses.

The adopted simplified procedure for assessing industrial property applies to all types.

It is unlawful to apply a simplified procedure for some types (for example, materials), and a generally established procedure for others (for example, goods). The next innovation, truly revolutionary, is that micro-enterprises are allowed to write off inventories accepted for accounting as financial results, without waiting for their actual use in activities. EXAMPLE 2. WRITTEN OFF INVESTMENTS AT A MICRO ENTERPRISE

The production facility is a micro-enterprise.

When purchasing a batch of raw materials from a supplier in the amount of 50,000 rubles. RUB 2,000 spent on consulting services. According to simplified rules, the accounting records for these operations look like this: a) on the date of expenses - DEBIT 20 CREDIT 60

- 50,000 rubles.

– raw materials are capitalized; DEBIT 20 CREDIT 76

- 2000 rub.

– costs for consultant services are written off as expenses; b) at the end of the calendar month (irrespective of the consumption of materials in production) - DEBIT 90 subaccount “Cost of sales” CREDIT 20

- 52,000 rubles. (50,000 + 2000) – the costs of raw materials are written off to the cost of sales.

This method will lead to the fact that in the accounting and financial statements of a micro-enterprise there will be no residual inventories - raw materials, supplies, purchased goods and work in progress. And this type of materials production as finished products will not arise at all. There is simply “nothing” to form it from.

This method of cost accounting is known as the “boiler” method; it does not involve maintaining analytical accounting.

How to keep track of sales?

EXAMPLE 3. REFLECTING SALES

Let's use the conditions of example 2. Let's assume that raw materials were purchased in March 2021.

Vympel had no sales this month. In April, finished products were sold in the amount of 20,000 rubles. The accountant will make entries: in March - DEBIT 99 DEBIT 90 subaccount “Cost of sales”

- 52,000 rubles.

– expenses of the month are included in the financial result; in April - DEBIT 62 CREDIT 90 subaccount “Revenue”

- 20,000 rubles. – revenue is recognized.

Read also “Reducing the cost of inventories. What should I pay attention to?

As a result of such accounting policies, operational control over inventories will be lost. Management accounting will have to be kept separately. Meanwhile, simplified accounting has an important advantage.

Let us remember that microenterprises have the right to recognize revenue as funds are received (clause 12 of PBU 9/99 “Income of the organization”), and expenses - after repayment of debt (clause 18 of PBU 10/99 “Expenses of the organization”). Now imagine that there was no cash flow in March - April 2021: the raw materials were not paid for, no money was received from the buyer. Examples 2 and 3 relate to the accounting policy using the accrual method (paragraph 5, clause 5 of PBU 1/2008 “Accounting policy of the organization”). If Vympel decides to conduct accounting on a cash basis, then in the conditions of examples 2 and 3 no facts of economic life will arise at all (Clause 8 of Article 3 of the Federal Law “On Accounting”).

At first glance, this is exotic. However, under the conditions of applying the simplified taxation system, Vympel will not have entries in tax accounting (clause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation). After all, the simplified tax system is based on the cash method (paragraph 1, clause 1, article 346.17 of the Tax Code of the Russian Federation). As a result, there will be no discrepancies between Vympel’s tax and accounting records.

Thus, the simplified procedure for writing off raw materials and supplies is attractive for manufacturing micro-enterprises using the simplified tax system. For trade operations, there is no point in introducing a simplified procedure, since in tax accounting the cost of goods is expensed as the said goods are sold (subclause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation).

Remember: you have the right to establish the use of a simplified write-off procedure for inventories of only one type - say, for raw materials or supplies.

In this case, you will write off goods according to generally established rules - as they are sold. Another simplification has been introduced, which is very convenient for accounting departments. The Ministry of Finance of Russia allowed to write off as expenses the costs of purchasing industrial equipment intended for management needs in full amount as they were acquired. In practice, this means that accountants will no longer have to maintain burdensome control over the use of office supplies. EXAMPLE 4. WE CONSIDER “MANAGEMENT” MPZ

The small enterprise “Paritet” purchased paper for office purposes in the amount of annual needs in the amount of 30,000 rubles.

Instead of receiving paper and then gradually writing it off, Paritet’s accountant has the right to make a single entry: DEBIT 26 CREDIT 60

- 30,000 rubles. – printer paper has been written off.

And the last simplification of the work on accounting for inventories at small enterprises is that the obligation to annually revaluate inventories at current market value in the event of its decline has been abolished. In other words, it is no longer necessary to create reserves to reduce the value of material assets (clause 25 of PBU 5/01). However, until recently such reserves were formed by rare enthusiasts.

Accounting for interest on loans and borrowings

If a small enterprise acquired, constructed or manufactured fixed assets using borrowed funds, then the interest on them can be taken into account at its discretion:

- or as part of other expenses;

- or as part of the initial cost of the fixed asset.

As a general rule, interest on borrowed funds (targeted loans) strictly increases the initial cost of the fixed asset when the following conditions are simultaneously met:

- the property is an investment asset;

- interest accrued before the fixed asset was acquired, constructed and (or) created;

- interest is accrued before the start of using the investment asset in activities, if the work on its acquisition, construction and (or) creation is not completed.

In all other cases, interest is taken into account as part of other expenses (section II of PBU 15/2008).

However, if the organization is a small business, it can include all interest on loans and borrowings as other expenses. This procedure also applies to interest on those loans and borrowings that were raised for the purchase, construction or creation of investment assets. This procedure is established in paragraph 7 of PBU 15/2008 and part 4 of article 6 of the Law of December 6, 2011 No. 402-FZ.

SMP status, accounting, balance sheet and procedure for filling it out: legal regulation

Small business entity (SMB) is a legal entity or individual entrepreneur (IP) that meets the criteria provided for in Art. 4 of the Law “On the Development of Small and Medium Enterprises in the Russian Federation” dated July 24, 2007 No. 209-FZ (hereinafter referred to as Law No. 209) and the Decree of the Government of the Russian Federation “On Income Limits...” dated April 4, 2016 No. 265 adopted in accordance with it:

- number of employees - no more than 100 people;

- annual income - no more than 800 million rubles. etc.

This is described in more detail in the article “Who belongs to small and medium-sized businesses - criteria.”

The Federal Tax Service of the Russian Federation, guided by the submitted reports, enters SMP into the publicly accessible Unified Register of Small and Medium-Sized Enterprises (SMEs). The presence of SMP status is confirmed by a paper or electronic extract from it (see more in the article “Extract from the register of small businesses”).

SMPs are required to maintain both accounting (Article 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, hereinafter referred to as Law No. 402-FZ) and tax accounting (Article 313 of the Tax Code). They can choose either a general procedure or simplified and simple accounting options. In addition, there is a simplified balance sheet for small businesses and the procedure for filling it out, which are regulated by acts of the Ministry of Finance of the Russian Federation and the Federal Tax Service of the Russian Federation (electronic formats).

The most important aspects of accounting are enshrined in organizational documents, which determine the procedure for its conduct and the assignment of corresponding responsibilities. Next, we will consider options for organizing accounting for SMEs based on its tasks.

Correcting accounting errors

Correcting errors in accounting for small businesses is easier than in other organizations. Thus, as a general rule, significant errors found after the approval of the annual statements are corrected in the current period using account 84 “Retained earnings (uncovered loss)” (subclause 1, clause 9 of PBU 22/2010). And in current reporting it is necessary to recalculate comparable indicators of previous periods, that is, use the so-called retrospective method (subclause 2, clause 9 of PBU 22/2010).

However, small enterprises have the right to correct even significant errors of the previous year, identified after the approval of the financial statements, differently. Namely, in the current period using account 91 “Other income and expenses” and, importantly, without retrospective recalculation (paragraph 4, sub-clause 2, clause 9 of PBU 22/2010, part 4 of article 6 of the Law of December 6, 2011 No. 402-FZ, clause 22 of the Recommendations approved by the decision of the Presidential Council of the NP “Institute of Professional Accountants and Auditors of Russia” dated April 25, 2013 No. 4/13). That is, act by analogy with the rules provided for correcting minor errors.

For more information, see How to correct errors in Accounting

An example of how to correct a significant error (excessively reflected expense) in accounting and reporting for a small enterprise. A mistake was made last year, the reporting for which was signed and approved

Alpha LLC is a small enterprise. In March 2021, after the statements for 2015 were approved, Alpha's accountant identified an error made in the first quarter of 2015. The accounting reflected the cost of work performed by the contractor in March 2015 in the amount of 50,000 rubles. (without VAT). In fact, the act indicates the amount of 40,000 rubles. (without VAT). The contractor’s work was paid in full (RUB 40,000) in March 2015. Thus, as of December 31, 2015, Alpha had accumulated accounts payable in the amount of excess written off expenses - 10,000 rubles.

Since the reporting for 2015 has already been approved, no corrections are made to it. The error is corrected in the current year’s accounting, but is not reflected in tax accounting. But since Alpha does not apply PBU 18/02, permanent differences are not reflected in accounting.

Alpha's accounting policy states that significant errors from previous years identified after the approval of the financial statements should be corrected without retrospective recalculation and written off as other income and expenses.

The accountant recorded excessively written off expenses in the following way.

March 2021:

Debit 60 Credit 91-1 – 10,000 rub. – reflects the cost of the contractor’s work, erroneously attributed to expenses in the first quarter of 2015.

Unified tax on imputed income (UTII)

Taxes for small businesses changed significantly in 2013. Starting this year, as well as now, the transition to a single tax on imputed income has become voluntary. The calculation of UTII has also undergone changes - now it is calculated starting from the day of registration, based on the number of days that were actually worked in a given month.

It is calculated according to a formula that includes the amount of basic profitability established by the subject of the federation, coefficients that depend on the specifics of the enterprise and the tax rate. Online services will help you quickly calculate and pay taxes.

The maximum calculation of the number of hired personnel is calculated not as before, but from the average workforce. The number of employees, as before, should be no more than 100.

Advantages of UTII

Taxation of an enterprise's activities using UTII has the following advantages:

- exemption from paying the following taxes:

- for profit (legal entities);

- on the income of individuals (individual entrepreneurs);

- on property;

- for added value.

As noted earlier, the above taxes require maintaining rather complex accounting and tax records. Accordingly, replacing the specified number of tax payments greatly simplifies accounting and reduces document flow.

- ease of tax calculation;

- fixed tax amount;

- a tax that does not depend on the actual revenue of the enterprise, allows you to legally conduct business with various turnovers without fear of the tax authorities;

- ease of maintenance, simplicity of accounting for income and expenses.

Disadvantages of EVND

Features of collecting taxes from small businesses include the possibility of combining different taxation regimes, and this seemingly favorable opportunity, with UTII, turns into a significant disadvantage.

In this case, multi-industry enterprises are required to keep separate records for all types of activities, which significantly increases labor costs, since more detailed accounting of analytics is required. Accordingly, the number of taxes paid to the budget increases.

The disadvantages of this mode include the following:

- mandatory payment of a fixed amount, in the absence of the necessary revenue, may cause a loss to the enterprise;

- taxation of small businesses in Russia is imperfect, so there is confusion in the calculation of UTII in the regions.

Revaluation of fixed assets and intangible assets

For accounting purposes, a small enterprise has the right:

- not to revaluate fixed assets and intangible assets (clause 15 of PBU 6/01 and clause 17 of PBU 14/2007);

- do not reflect the impairment of intangible assets (clause 22 of PBU 14/2007);

- do not reflect the depreciation of financial investments if it is difficult to calculate (clause 6 of PBU 1/2008).

There are similar explanations in paragraphs 7–10 of the information of the Ministry of Finance of Russia dated June 3, 2015 No. PZ-3/2015, paragraphs 7–10 of the information message of the Ministry of Finance of Russia dated February 20, 2013 No. PZ-3/2012.