DEADLINES FOR SUBMISSION OF BASIC REPORTING TO THE IRS IN 2021

| Report type | Period | Due dates |

| Certificates 2-NDFL | For 2021 (if it is impossible to withhold personal income tax from income) | No later than 03/01/2019 |

| For 2021 (for all paid income with attribute 1) | No later than 04/01/2019 | |

| Calculation of 6-NDFL | For 2021 | No later than 04/01/2019 |

| First quarter of 2021 | No later than 04/30/2019 | |

| For the first half of 2021 | No later than 07/31/2019 | |

| For 9 months of 2021 | No later than 10/31/2019 | |

| Calculation of insurance premiums | For 2021 | No later than 01/30/2019 |

| For the first quarter of 2021 | No later than 04/30/2019 | |

| For the first half of 2021 | No later than 07/30/2019 | |

| For 9 months of 2021 | No later than 10/30/2019 | |

| Income tax return (for quarterly/monthly reporting) | For 2021 | No later than 03/28/2019 |

| For the first quarter of 2021 | No later than 04/29/2019 | |

| For January – February 2021 | No later than 03/28/2019 | |

| For January – March 2021 | No later than 04/28/2019 | |

| For January – April 2021 | No later than 05/28/2019 | |

| For January – May 2021 | No later than 06/28/2019 | |

| For January – June 2021 | No later than 07/29/2019 | |

| For January – July 2021 | No later than 08/28/2019 | |

| For January – August 2021 | No later than September 30, 2019 | |

| For January – September 2021 | No later than October 28, 2019 | |

| For January – October 2021 | No later than November 28, 2019 | |

| For January – November 2021 | No later than 12/30/2019 | |

| VAT declaration | For the fourth quarter of 2021 | No later than 01/25/2019 |

| For the first quarter of 2021 | No later than 04/25/2019 | |

| For the second quarter of 2021 | No later than July 25, 2019 | |

| For the third quarter of 2021 | No later than October 25, 2019 | |

| Journal of received and issued invoices | For the fourth quarter of 2021 | No later than 01/21/2019 |

| For the first quarter of 2021 | No later than 04/22/2019 | |

| For the second quarter of 2021 | No later than 07/22/2019 | |

| For the third quarter of 2021 | No later than October 21, 2019 | |

| Tax declaration under the simplified tax system | For 2021 (represented by organizations) | No later than 04/01/2019 |

| For 2021 (represented by individual entrepreneurs) | No later than 04/30/2019 | |

| Declaration on UTII | For the fourth quarter of 2021 | No later than 01/21/2019 |

| For the first quarter of 2021 | No later than 04/22/2019 | |

| For the second quarter of 2021 | No later than 07/22/2019 | |

| For the third quarter of 2021 | No later than October 21, 2019 | |

| Declaration on Unified Agricultural Tax | For 2021 | No later than 04/01/2019 |

| Declaration on property tax of organizations | For 2021 | No later than 04/01/2019 |

| Calculation of advances for corporate property tax (submitted if the law of the constituent entity of the Russian Federation establishes reporting periods) | For the first quarter of 2021 | No later than 04/30/2019 |

| For the first half of 2021 | No later than 07/30/2019 | |

| For 9 months of 2021 | No later than 10/30/2019 | |

| Transport tax declaration (submitted only by organizations) | For 2021 | No later than 02/01/2019 |

| Land tax declaration (submitted only by organizations) | For 2021 | No later than 02/01/2019 |

| Single simplified declaration | For 2021 | No later than 01/21/2019 |

| For the first quarter of 2021 | No later than 04/22/2019 | |

| For the first half of 2021 | No later than 07/22/2019 | |

| For 9 months of 2021 | No later than October 22, 2019 | |

| Declaration in form 3-NDFL (submit only individual entrepreneurs) | For 2021 | No later than 04/30/2019 |

Deadlines for submitting reports for the first quarter of 2020

For the first quarter of 2021, companies and individual entrepreneurs, depending on the taxation regime and the characteristics of their activities, must submit the following types of reports.

Calculation according to form 6-NDFL

It is submitted as reporting on the amounts of personal income tax calculated and withheld from employees’ wages. The report is required to be completed if the company or individual entrepreneur is registered as an employer and has made payments to employees at least one month from the beginning of the calendar year.

The standard due date for the first quarter is April 30, which has been postponed by three months. For the period from January to March, employers must report no later than July 31 .

Calculation of insurance premiums

The calculation reflects information on insurance contributions for compulsory pension, medical and social insurance. The document is submitted to the tax office, since starting from 2021 it is the administrator of insurance premiums.

In the calculation of insurance premiums, there is a special third section “Personalized information about insured persons”, in which personal data, information on payments and accrued insurance premiums are indicated for each employee.

The deadline for submitting calculations for insurance premiums to the tax office was postponed from April 30 to May 15 .

Income tax return

Rented by Russian legal entities that apply the general taxation regime, as well as by foreign companies that have representative offices in the Russian Federation or receive income in Russia. Reporting is generated based on information about the company's income and expenses for the reporting period.

The deadline for submitting the declaration for the first quarter of 2021 has been postponed by three months—from April 28 to July 28 .

VAT declaration

Submitted to business entities that are payers of this tax. Entrepreneurs are required to pay VAT when using the general taxation regime. In some cases, for example, when importing, taxpayers become entities that apply other taxation regimes.

Previously, the declaration had to be submitted by April 27, now - by May 15 .

Declaration on UTII (Unified tax on imputed income)

Rent by all single tax payers. This regime can be used for certain types of activities established by tax legislation.

Legal entities and individual entrepreneurs must submit a declaration for the first quarter no later than April 20, but this year the deadline has been postponed by three months - no later than July 20 .

Declaration on Unified Agricultural Tax (Unified Agricultural Tax)

Formed by taxpayers who produce agricultural products or provide services in this area.

The standard deadline for submitting the declaration is March 31, the new one is June 30 .

Calculation 4-FSS

Filled out regarding insurance premiums “for injuries” and submitted to the Social Insurance Fund. Based on the Letter of the Social Insurance Fund dated April 13, 2020 No. 02-09-11/06-06-8452, the deadline for submitting the calculation for the first quarter of 2021 was postponed from April 20 (for a paper report) and April 25 (for an electronic report ) on May 15th .

Deadlines for submitting reports to the Pension Fund for March 2021

Some types of reports must be submitted to the Pension Fund on a monthly basis, and the deadline for their submission for March 2021 falls on April 15, a day declared a non-working day. The Pension Fund posted official information on its website that the deadlines for submitting reports, despite the difficult epidemiological situation in the country, will not be postponed.

In accordance with this, employers had to submit SZV-M and SZV-TD no later than April 15 . However, if they did not do this and violated the reporting deadlines, the Pension Fund will not fine them. This is stated in the Letter dated April 17, 2020 No. NP-08-24/8051.

Deadlines for submitting reports to the Pension Fund in 2019

Here is a table with the deadlines for completing SZV-M in 2021 by month:

| The reporting month | Last day for submitting the report |

| December 2021 | 15.01.2019 |

| January 2021 | 15.02.2019 |

| February 2021 | 15.03.2019 |

| March 2021 | 16.04.2019 |

| April 2021 | 15.05.2019 |

| May 2021 | 15.06.2019 |

| June 2021 | 17.07.2019 |

| July 2021 | 15.08.2019 |

| August 2021 | 16.09.2019 |

| September 2021 | 15.10.2018 |

| October 2021 | 15.11.2018 |

| November 2021 | 15.12.2019 |

| December 2021 | 15.01.2020 |

For 2021, the SZV-STAZH report must be submitted no later than March 1, 2021.

TAX CALENDAR FOR 2021: TAX PAYMENT DEADLINES

| Payment of taxes in 2021 for individual entrepreneurs without employees and for individual entrepreneurs using hired labor | ||

| Tax system | Tax | Deadlines |

| OSN | VAT | Until January 25, 2019; 02/25/2019; 03/25/2019 for the 4th quarter of 2021. Further, in equal shares until the 25th day of each month based on the results of the previous quarter (04/25; 05/25; 06/25/07/25; 08/25; 09/25/10/25; 11/25; 12/25). |

| OSN | Personal income tax | Until July 15, 2019 for 2021 |

| simplified tax system | Advance payments and simplified tax system | Payment of advance payment for the 1st quarter of 2019 by 04/25/2019 Tax payment for 2021 is due by 04/30/2019 Payment of the advance payment for the 2nd quarter of 2019 by July 25, 2019 Payment of advance payment for the 3rd quarter of 2019 by October 25, 2019 |

| UTII | Tax on imputed income | Until January 25, 2019, payment of UTII for the 4th quarter of 2021 Until April 25, 2019, payment of UTII for the 1st quarter of 2021 Until July 25, 2019, payment of UTII for the 2nd quarter of 2021 Until October 25, 2019, payment of UTII for the 3rd quarter of 2021 |

| Unified agricultural tax | Unified agricultural tax | Tax payment for 2021 is due by March 31, 2019 Until July 25, 2019, payment of the advance payment of the Unified Agricultural Tax for 2019 |

Deadline for submitting financial statements in 2019

Annual financial statements must be submitted to the tax office no later than three months after the end of the reporting year (subclause 5, clause 1, article 23 of the Tax Code of the Russian Federation). At the same time, a mandatory copy of the annual reporting must be submitted to the statistics department (Part 2 of Article 18 of the Law of December 6, 2011 No. 402-FZ). That is, as a general rule, annual financial statements must be submitted no later than March 31 of the year following the reporting year.

If the deadline for submitting reports falls on a non-working (weekend) day, submit it on the first working day following it (clause 47 of PBU 4/99). For example, financial statements for 2021 must be submitted no later than April 1, 2021 inclusive (March 31 is a day off).

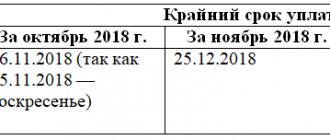

Deadlines for paying property taxes in 2021

Payers who own property, transport or land also calculate taxes for these objects.

Table of deadlines for paying property taxes for 2021

| Type of tax | For what period do they pay? | Deadline for payment according to the rules of the Tax Code |

Property tax | For 2021 | The deadline is set by the constituent entities of the Russian Federation by their law |

| For the first quarter of 2021 | The deadline is set by the constituent entities of the Russian Federation by their law. You can find out the exact dates for payments on the Federal Tax Service website. | |

| For the first half of the year or the second quarter of 2021 | ||

| For 9 months or Q3 2021 | ||

Transport tax | For 2021 | The deadline is set by the constituent entities of the Russian Federation by their law |

| For the first quarter of 2021 | The deadline is set by the constituent entities of the Russian Federation by their law. They pay if it is provided for by the law of the subject of the Russian Federation. You can find out the exact dates for payments on the Federal Tax Service website. | |

| For the second quarter of 2021 | ||

| For the third quarter of 2021 | ||

Land tax | For 2021 | The deadline is set by the constituent entities of the Russian Federation by their law |

| For the first quarter of 2021 | The deadline is set by local authorities by regulations. You can find out the exact dates for payments on the Federal Tax Service website. | |

| For the second quarter of 2021 | ||

| For the third quarter of 2021 |

Fines 2021

We list the main types of fines for violating reporting deadlines in 2021.

| Reporting | Fine/Sanction |

| Tax returns | For the tax period for any tax - 5% of the tax not paid on time, subject to payment according to the declaration, for each full or partial month of delay. The maximum fine is 30% of the tax not paid on time, the minimum is 1,000 rubles. (clause 1 of Article 119 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated August 14, 2015 No. 03-02-08/47033). Income tax return for the reporting period or calculation of advance payments for property tax - 200 rubles. (Clause 1 of Article 126 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service dated August 22, 2014 No. SA-4-7/16692). |

| Help 2-NDFL | 200 rub. for each certificate submitted late (clause 1 of Article 126 of the Tax Code of the Russian Federation). |

| Calculation of 6-NDFL | 1,000 rub. for each full or partial month of delay (clause 1.2 of Article 126 of the Tax Code of the Russian Federation). |

| Calculation of insurance premiums | 5% of unpaid contributions due for payment for the last three months, for each full or partial month of delay. The maximum fine is 30% of contributions not paid on time, the minimum is 1,000 rubles. (clause 1 of article 119 of the Tax Code of the Russian Federation, Letters of the Ministry of Finance dated March 24, 2017 No. 03-15-07/17273 (clause 1), Federal Tax Service dated December 30, 2016 No. PA-4-11/25567). |

| SZV-M | 500 rub. for each insured person, information about which must be reflected in the late form (Article 17 of Law No. 27-FZ). |

| SZV-STAZH | 500 rub. for each insured person, information about which must be reflected in the late form (Article 17 of Law No. 27-FZ). |

| 4-FSS | 5% of the amount of injury contributions accrued for payment on a late payment for the last three months, for each full or partial month of delay. The maximum fine is 30% of the calculated amount of contributions, the minimum is 1,000 rubles. (Clause 1, Article 26.30 of Law No. 125-FZ). |

| Financial statements | For failure to submit to the Federal Tax Service – 200 rubles. for each unsubmitted form that is included in the reporting (clause 1 of Article 126 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service dated November 21, 2012 No. AS-4-2/19575). For failure to submit to the statistics body - from 3,000 to 5,000 rubles . (Article 19.7 of the Code of Administrative Offenses of the Russian Federation, Letter of Rosstat dated February 16, 2016 No. 13-13-2/28-SMI). |