Who must submit reports in the form of 2-NDFL

The Tax Code gives a clear definition of this issue - the following organizations are required to submit a certificate on this form:

- registered on the territory of the Russian Federation;

- individual entrepreneurs;

- privately practicing notaries;

- lawyers (founders of the relevant offices);

- divisions of foreign enterprises in Russia (separate).

At the same time, they need to act as a tax agent, that is, by cooperating with them, an individual must receive income.

How to fill out a 2-NDFL certificate when your salary is delayed

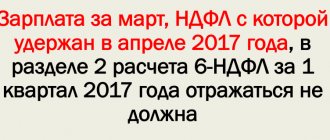

Let's assume that the salary for December of last year will be issued only in April or May. By this time, the deadline for submitting information on form 2-NDFL with attribute 1 will have already expired. Let us recall that form 2-NDFL “Certificate of income of an individual for the year 20_” was approved by order of the Federal Tax Service of Russia dated November 17, 2010 No. ММВ-7-3/ [ email protected] Certificates in form 2-NDFL with sign 1 for the previous year must be submitted no later than April 1 of the current year (Clause 2 of Article 230 of the Tax Code of the Russian Federation).

Ambiguous explanations for filling out form 2-NDFL

At the end of 2013, specialists from the Federal Tax Service of Russia issued a letter explaining that if last year’s salary is issued after the deadline for filing Form 2-NDFL, it can be included in next year’s income. We are talking about a letter dated 10/07/2013 No. BS-4-11/ [email protected] (hereinafter referred to as the letter dated 10/07/2013).

Independent experts disagreed on the new clarifications. If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

Salaries not received; do not include in last year’s report. Some experts agreed with the position of the Federal Tax Service of Russia, arguing that it is impossible to include in the income of the expired tax period amounts that the employee may never receive. Include the accrued salary in the report for the previous year. Other experts considered that the letter dated October 7, 2013 contradicts tax legislation, namely paragraph 2 of Article 223 of the Tax Code. If the salary was accrued, for example, for work in December last year, it must be included in income for December last year.

Undisputed official recommendations for filling out form 2-NDFL

Recommendations for filling out form 2-NDFL were approved by order of the Federal Tax Service of Russia dated November 17, 2010 No. ММВ-7-3/ [email protected] Section II of the Recommendations states the following: “In the column “Month”, in chronological order, the serial number of the month of the tax period corresponding to the date of actual receipt of income, determined in accordance with the provisions of Article 223 of the Tax Code.” As we noted above, in accordance with paragraph 2 of Article 223 of the Tax Code, the date of receipt of income in the form of wages is considered to be the last day of the month for which wages are accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation). Consequently, in section 3 of form 2-NDFL, the accountant must also indicate the accrued, but not yet paid, wages to the employee for December of last year.

Two certificates in form 2-NDFL

If the salary for the previous year was paid after the deadline for filing Form 2-NDFL with a delay in salary with sign 1, the report will have to be submitted twice.

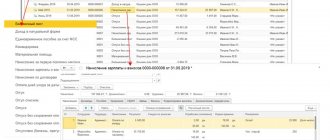

Form 2-NDFL must be submitted for the first time no later than April 1. When filling it out, in paragraph 5.3 you should indicate the amount of calculated personal income tax, including the amount of accrued but unpaid wages for December 2013. Since the salary has not been paid, tax cannot be withheld from it (clause 4 of Article 226 of the Tax Code of the Russian Federation). Therefore, different amounts will appear in paragraphs 5.3 and 5.4 of form 2-NDFL. The calculated tax will be greater than the withheld tax. The amount of unwithheld personal income tax must be reflected in paragraph 5.7 of form 2-NDFL. If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

In order to avoid claims from the tax inspectorate, we recommend attaching a covering letter to Form 2-NDFL explaining the indicator in paragraph 5.7 of Form 2-NDFL. A sample first cover letter is provided below.

The second time after repaying wage arrears, clarifying certificates should be sent to the tax office in form 2-NDFL. In the updated report, the indicator in paragraph 5.3 “Amount of tax calculated” will coincide with the indicators in paragraph 5.4 “Amount of tax withheld” and paragraph 5.5 “Amount of tax transferred”, and the cell in paragraph 5.7 will become empty. When drawing up a clarifying form 2-NDFL in place of the previously submitted one, you should indicate: – in the “No. ____” field - the number of the previously submitted form 2-NDFL; – in the “from ____” field - the new date of preparation of form 2-NDFL. This is stated in paragraph 8 of Section I of the Recommendations for filling out Form 2-NDFL. We also recommend attaching a cover letter to the 2-NDFL clarification form explaining the reason for the change in the indicators. An example of it is shown below.

In what cases is there a lack of payroll?

If a company operates, it is obliged to pay its employees. In this case, they need to submit 2-NDFL. However, there are a number of reasons why a company does not pay wages during the year:

- if the employee is on maternity leave;

- going on unpaid leave;

- absence of other employees, not counting the director, who is also a founder.

If the salary was not accrued, then you do not need to submit 2-NDFL. Organizations acting as tax agents for several employees should simply not submit certificates using this form for those who did not receive income during the reporting period. 2-NDFL with zeros in all columns is not provided for by law. Moreover, most accounting programs will generate an error when trying to draw up such a certificate.

Salary nuances

Let's now move on to standard charges. Here, difficulties with reflecting information in a certificate may arise in various situations. For example, if, at the end of the year, excessively withheld amounts were discovered.

Refund of personal income tax to full-time employees: general procedure

Let's illustrate this situation with an example.

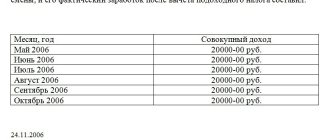

Let’s assume that an employee, a mother of three children, worked in an organization from February to May. Accordingly, she could receive a monthly deduction in the amount of 5,800 rubles. (1,400 rubles each for the first and second children and 3,000 rubles for the third). In February she received an income of 800 rubles, in March - 12,000 rubles, in April and May - 2,000 rubles each. As a result, on the date of dismissal, the amount of deductions turned out to be more than the income received. But due to the uneven distribution of income across months, personal income tax was withheld in March. And this amount, accordingly, became excessively withheld. Let's see how all this should be reflected in the certificate.

Let us say right away that the order of reflection depends on when the excess withheld amount will be returned.

The fact is that in accordance with the Procedure for filling out Section 5 of Certificate 2-NDFL (approved by order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11 / [email protected] ) in the field “Amount of tax over-withheld by the tax agent” is indicated excess tax amount not returned by the tax agent. That is, this field is filled in when, at the time of submitting the certificate, the indicator in the “Tax amount calculated” field is less than in the “Tax amount withheld” field.

From the systemic interpretation of the specified Procedure for filling out Section 5 of Certificate 2-NDFL, it follows that if adjustments were made to the withheld amounts during the year, including the return of over-withheld tax to the taxpayer, the already adjusted amounts will be included in the certificate drawn up based on the results of a given tax period. This means that if the amount of personal income tax that was excessively withheld in March was returned to the taxpayer in 2015, the 2-NDFL certificate should have already included the corrected data.

In this case, the certificate should have been completed as follows. In Section 4, in the “Deduction Amount” field for the corresponding codes (114, 115, 116), it was necessary to indicate the amount of the standard tax deduction provided for the first, second and third child in February - May. The total amount of the deduction by virtue of clause 3 of Art. 210 of the Tax Code of the Russian Federation cannot exceed the amount of income, so the certificate had to indicate 16,800. Further, in Section 5, in the “Total amount of income” field, it was necessary to indicate the total amount of accrued and actually received income without taking into account the deductions specified in Sections 3 and 4 That is, in the case under consideration - 16,800.

The “Tax base” field indicates the tax base from which the tax is calculated. The indicator indicated in this field corresponds to the amount of income reflected in the “Total amount of income” field, reduced by the amount of deductions reflected in sections 3 and 4. In the case under consideration, it is equal to zero. In the fields “Tax amount calculated”, “Tax amount withheld”, “Tax amount transferred” and “Tax amount excessively withheld by the tax agent”, zero should also be indicated.

A certificate is filled out in a similar way if the return of excessively withheld personal income tax was made in 2021, but before the organization submitted certificates for 2015 to the Federal Tax Service.

If the refund of the overly withheld tax will take place in 2016 after the submission of the 2-NDFL certificate, then the accountant will have to enter the actual data into the certificate, that is, indicate the overly withheld tax. Therefore, Section 5 will be filled out differently: in the “Total amount of income” field, 16,800 will also be indicated. In the “Tax base” field, there will be zero. The “Tax amount calculated” field will reflect the personal income tax amount for the March salary, and it will also appear in the “Tax amount withheld”, “Tax amount transferred” and “Tax amount over-withheld by the tax agent” fields.

And most importantly: after the tax refund, you will need to submit to the Federal Tax Service a new (corrective) certificate 2-NDFL, in which there will no longer be excessively withheld tax, and the amounts of personal income tax calculated, withheld and transferred will be equal to zero (see General requirements for the procedure filling out the certificate form approved by order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/ [email protected] , and letter of the Federal Tax Service of Russia dated September 13, 2012 No. AS-4-3/15317).

We return tax to workers on a patent

Excessively withheld amounts may arise not only due to deductions, but also due to the fact that the organization employs employees on patent. Moreover, the amount of overpayments here can be significant due to the fact that the notification of the possibility of offset was received from the Federal Tax Service with a delay.

Let us remind you that the Tax Code of the Russian Federation says that tax that is excessively withheld from an individual is returned at the expense of the “common pot”, that is, personal income tax withheld from other employees of the organization (clause 1 of Article 231 of the Tax Code of the Russian Federation). In this regard, the question arises: how will such a refund be reflected in the certificates of those employees whose personal income tax was used to reimburse the overpayment? What to write in the “Tax amount transferred” field if personal income tax did not go to the budget, but actually ended up in the account of a foreign employee?

In fact, the current Procedure for filling out the 2-NDFL certificate does not distinguish between the amounts transferred by the tax agent to the budget and the amounts transferred in accordance with Art. 231 of the Tax Code of the Russian Federation to the bank account specified in the application for the refund of excessively withheld tax. Both amounts apply to those listed. At the same time, neither the certificate itself nor the procedure for filling it out clarifies that we are talking specifically about transfers to the budget.

Thus, it can be stated that for the purposes of personal income tax reporting, personal income tax amounts returned from the “common pot” are also recognized as listed and are reflected in Section 5 of the certificate in the general manner. Simply put, there will be no distortions in the certificates of those employees whose personal income tax was actually transferred not to the budget, but to the account of another individual on account of the excessively withheld tax amount.

There is another problem associated with workers working on the basis of a patent. For them, the certificate provides a separate status - 6. But at the same time, many of them are also tax residents of the Russian Federation, since they worked in Russia for more than six months. And for residents, as you know, a different status is established - 1. How to combine these two statuses in a certificate?

To answer, please refer to the Procedure for filling out Section 2 “Data about an individual - recipient of income” of the 2-NDFL certificate. It states that if during the tax period the taxpayer is a tax resident of the Russian Federation, then the number 1 is indicated. And then - in parentheses - a note is given: except for taxpayers carrying out labor activities for hire in the Russian Federation on the basis of a patent.

It turns out that “patent” workers are a kind of exception: regardless of whether they have residency in the certificate, they always appear under code 6. This rule also applies in a situation where the employee got a job while already a resident, and some at that time he worked without a patent (for example, under a work permit issued earlier), and later within a year he received a patent. After all, the status of a taxpayer is determined as of the end of the year for which the tax agent submits a 2-NDFL certificate (letter of the Ministry of Finance of Russia dated November 15, 2012 No. 03-04-05/6-1305). If an employee is dismissed before the end of the year, his status is determined as of the date of dismissal.

Remote workers from other countries: what payments are subject to

Finally, another situation that accountants sometimes have to deal with is registering employees from other countries to work remotely.

The wages of such employees are not subject to personal income tax, since remuneration for performing work for a Russian company from the territory of another state relates to income received from sources outside the Russian Federation (subclause 6, clause 3, article 208 of the Tax Code of the Russian Federation).

At the same time, vacation pay is not such a reward, because it is not payment for work, but saved average earnings. Consequently, such payments received from a Russian organization are classified as income from sources in the Russian Federation and on the basis of Art. 209 of the Tax Code of the Russian Federation are subject to taxation in the Russian Federation (letter of the Ministry of Finance of Russia dated April 2, 2015 No. 03-04-06/18203).

Accordingly, when paying this amount, the Russian organization is recognized as a tax agent (clause 1 of Article 226 of the Tax Code of the Russian Federation) and is obliged to calculate, withhold and transfer the amount of personal income tax to the budget. And as a result, it is obliged to keep records of paid income and submit information about it to the tax authority (clauses 1 and 2 of Article 230 of the Tax Code of the Russian Federation).

It turns out that for remote foreign employees, the organization must also submit information to the tax authorities in Form 2-NDFL (with sign 1). In this case, the certificate indicates only the amount of vacation pay paid. Wage amounts as not subject to personal income tax are not indicated in form 2-NDFL, and a separate certificate with item 2 is also not submitted for them.

What to do if the CEO is the only employee of the organization

The CEO can be an employee or a founder. If the only employee of the company is also its founder, then he will not need to send an information letter to the tax office.

The situation is more complicated if the director of the company is an employee. In this case, the company is obliged:

- conclude an employment contract;

- to pay salary;

- withhold income tax;

- transfer contributions to the Social Insurance Fund and the Pension Fund.

In such a situation, it is almost impossible to do without filing 2-NDFL.

Procedure for filling out zero 2-NDFL

If there is still a need to provide a zero 2-NDFL certificate, then it must be filled out in a certain way:

- All information about the employer must be noted on the title page;

- in the certificate indicate information about the employee, but without wages and withheld tax;

- the certificate is signed by an authorized person and certified by the employer’s seal:

Can a manager not pay himself a salary?

Many organizations have a single employee on their staff - the director. This can happen if the company has just been formed and has not yet had time to recruit a full staff of employees. Also, this situation often arises during periods of financial crises, when the organization’s income does not allow it to support employees. In order to avoid making contributions to various funds, managers often do not pay their own salaries. How legal is this?

Tax inspectors argue that it is necessary to pay the manager’s work even in such conditions. He is obliged to calculate and pay himself a salary. However, the tax service does not have legislative measures to influence companies in which wages have not been accrued for an entire year or more. As a rule, inspectors invite managers to conversations where recommendations are given on how to pay them for their work at the minimum wage provided for in the region. If the director does not listen to the opinion of the government representative, the company may face a complete financial audit by the Federal Tax Service.

The official’s opinion is based on the following arguments:

- the director of the enterprise is obliged to conduct activities;

- he must maintain documentation;

- They must submit reports to regulatory authorities.

Tips for managers on how to avoid problems in 2021

There are several options on how to avoid problems with tax authorities and at the same time reduce the cost of paying contributions to the state.

- Reduce the director's salary and replace him with one of the company's founders. This method is good in that it is not necessary to submit 2-NDFL annually when using it, as well as to pay taxes on the income received by the director, because there is no basis for their accrual. Without an employment contract, it is impossible to determine the level of wages.

- If it is impossible to lay off a director, then you can send him on leave at your own expense, for example, with the wording “for family reasons.” It is only worth considering that submitting reports remains his direct responsibility. Inspectors may consider such leave to be fictitious if it continues for a long enough time. It is safest to take it for just a year.

- The most reliable method, but a little more troublesome, is to reduce the director’s working hours. In this case, you will need to submit reports in the form of 2-NDFL. However, the transition to part-time work and hourly wages must comply with regional earnings standards. The inspector needs to explain that the manager only needs a few hours a month to perform his duties. To document changes in income on which tax is calculated, a new employment contract must be concluded. It necessarily reflects changes in working conditions and remuneration. Additionally, it is necessary to maintain documentation of the time worked by the director.

If the company does not plan to expand in the near future and it is impossible to reduce the position of the manager, then the founders should choose the most reliable method - saving on salaries. In this case, a 2-NDFL certificate will be required, but there will be no suspicions or claims against the organization’s activities from the tax office.

Reflecting dividends

Separately, it is worth mentioning dividends.

Let's start with the fact that only limited liability companies must submit 2-NDFL certificates for individuals to whom dividends were paid. Joint-stock companies reflect personal income tax on dividends paid to individuals in the income tax return (clauses 2, 4 of Article 230 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated 02.02.2015 No. BS-4-11 / [email protected] ).

LLC, the amount of dividends paid is reflected in section 3 of the certificate indicating the tax rate - 13%. Income in the form of a paid dividend is always reflected in the 2-NDFL certificate for the year in which the actual payment of dividends was made. The amount of dividends is indicated in full, without reduction by the amount of withheld tax. The income code for dividends is 1010. Moreover, if, when calculating personal income tax, the organization took into account dividends received from other organizations (clause 2 of article 210, clause 5 of article 275 of the Tax Code of the Russian Federation), in the same line in Section 3 of the certificate where it is indicated amount of dividends, you need to indicate the deduction amount with code 601. That is, deductions for dividends are also reflected in Section 3. Please pay attention to this!

There is another problematic issue related to dividends.

In accordance with paragraph 1 of Art. 224 of the Tax Code of the Russian Federation, income from equity participation in the activities of organizations received by tax residents in the form of dividends is subject to personal income tax at a rate of 13%. But at the same time, according to clause 3 of Art. 226 of the Tax Code of the Russian Federation, the tax base for them is considered separately and is not included in the tax base determined by the cumulative total for other income taxed at the rate provided for in paragraph 1 of Art. 224 Tax Code of the Russian Federation.

As a result, if the recipient of dividends is also an employee of this organization, then personal income tax on dividends must be calculated separately, and on wages - separately. However, the Procedure for filling out the 2-NDFL certificate does not regulate this situation in any way: it is not clear whether separate Sections 3 and 5 need to be filled out for dividends or whether these incomes are indicated in conjunction with others taxed at a rate of 13%.

We believe that in this situation the taxpayer can independently decide how to fill out the 2-NDFL certificate. You can indicate all amounts in one Section 3 and Section 5. Or you can fill out two different Sections 3 and 5 in relation to income in the form of wages and in relation to income in the form of dividends, because the Procedure for filling out Form 2-NDFL does not contain a direct prohibition on completing separate Sections 3 and 5 in relation to income taxed at the same rate, but in respect of which the procedure for calculating the tax base differs (on an accrual basis or separately for each amount).

Note that the second option is also preferable because it eliminates possible discrepancies in amounts that arise during summation due to rounding. The fact is that, by virtue of clause 6 of Art. 52 of the Tax Code of the Russian Federation, the tax amount is always determined in full rubles, by rounding, in which the tax amount of less than 50 kopecks is discarded, and the tax amount of 50 kopecks or more is rounded to the full ruble. As a result of this rounding, the amount of personal income tax calculated separately from dividends and from wages may not converge with the amount of personal income tax calculated from total income.

Example

The salary of an LLC employee for the year amounted to 257,942 rubles, personal income tax calculated, withheld and transferred - 33,532 rubles.

Dividends paid to an employee who is also a member of the LLC amounted to 35,593 rubles. Personal income tax calculated, withheld and transferred - 4,627 rubles.

As a result, we find that in Section 5 the total amount of income is 293,535 rubles, and personal income tax is 38,159 rubles. But this amount obviously does not coincide with the one we get if we take 13% of the total income indicated in Section 5. Due to rounding, 1 ruble is “underpaid” to the budget.

However, in our opinion, the mechanism for calculating personal income tax laid down in the Tax Code directly assumes the possibility of a discrepancy as a result of rounding the amount of tax calculated on each individual amount and the amount of tax calculated on gross income for the tax period. Therefore, in this case, the tax agent does not have the amount of unwithheld tax, that is, in the corresponding field “Amount of tax not withheld by the tax agent” of Section 5, you must enter 0. Moreover, neither the Tax Code of the Russian Federation nor the Procedure for filling out form 2-NDFL contain a requirement for ensuring that the amount in the “Calculated tax amount” field of Section 5 corresponds to the product of the amount specified in the “Tax base” field of Section 5 and the tax rate.