Why is an endowment needed?

“The advantage is that there is an opportunity to use the money in 10 years. This is some kind of airbag. If the organization is liquidated or reorganized, it is guaranteed to receive this money,” says Daria Miloslavskaya, lawyer and expert at the Lawyers for Civil Society association.

Also, according to her, if a fine is imposed on an organization, then it can be collected from the deposit, but “no one can take anything from the endowment.”

As a rule, the yield on an endowment is slightly higher than on a regular bank deposit.

Economist Sergei Guriev, within the framework of the joint project of the Potanin Foundation and The Bell “Bringing the Future Closer,” said that philanthropic organizations are among the key institutions of civil society.

One of the guarantors of an organization’s financial stability is the AVAILABILITY of its target capital

“In Russia, we see that the third sector is often ahead of public and private organizations in terms of the standards of their work. Philanthropic organizations need to create conditions for systematic activities. This requires the right modern management structure, outcome measurement, mission definition, and a strategic plan to achieve this mission. Of course, we need economic growth and income growth. And, naturally, long-term stability in all respects - the ability to understand what will happen in society, in the economy, in the country in five or ten years, as well as the stability of the organization itself,” the expert notes.

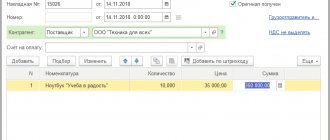

Donations from a commercial organization for the statutory activities of an NPO

The main activity of a non-profit organization (NPO) is the activities of other public organizations. The NPO has entered into an agreement with a commercial organization and receives monthly funds for the implementation of statutory activities with the wording “Targeted contribution for the implementation of statutory activities. NDS is not appearing". The agreement does not provide for any other use of funds. The funds received are spent by the NPO according to the approved budget - for wages, taxes, rent of premises, communications, office maintenance, and travel expenses. The NPO has no other income or expenses and does not conduct business activities. Are these funds subject to accounting when determining the tax base for income tax and VAT?

Content

In accordance with paragraph 8 of Art. 250 of the Tax Code of the Russian Federation (hereinafter referred to as the Code) income in the form of gratuitously received property (work, services, property rights), except for the cases specified in Art. 251 of the Code are recognized as non-operating income.

Income not taken into account when determining the tax base for corporate income tax is determined by Art. 251 of the Code, and their list is exhaustive.

Targeted revenues for the maintenance of non-profit organizations and the conduct of their statutory activities, received free of charge on the basis of decisions of state authorities and local governments and decisions of governing bodies of state extra-budgetary funds, as well as targeted revenues from other organizations and (or) individuals and used by these recipients according to purpose, not taken into account when determining the tax base for corporate income tax, are defined in paragraph 2 of Art. 251 Code. At the same time, taxpayers who are recipients of these targeted revenues are required to keep separate records of income (expenses) received (incurred) within the framework of targeted revenues.

Yes, pp. 1 item 2 art. 251 of the Code provides that targeted receipts include donations recognized as such in accordance with the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation).

Article 582 of the Civil Code of the Russian Federation establishes that a donation is the gift of a thing or right for generally beneficial purposes.

Donations can be made to citizens, medical, educational institutions, social protection institutions and other similar institutions, charitable, scientific and educational institutions, foundations, museums and other cultural institutions, public and religious organizations, other non-profit organizations in accordance with the law, as well as the state and other subjects of civil law specified in Art. 124 Civil Code of the Russian Federation.

Donations of property to legal entities may be conditional on the donor's use of this property for a specific purpose. At the same time, the purpose of the use of property determined by the donor must meet the criterion of focus on achieving a generally beneficial goal, necessary for recognizing property as a donation in the sense given by the Civil Code of the Russian Federation.

Based on Art. 7 of the Federal Law of May 19, 1995 N 82-FZ “On Public Associations” (hereinafter referred to as the Law), one of the organizational and legal forms of a public association is a public organization.

According to Art. 8 of the Law, a public organization is a membership-based public association created on the basis of joint activities to protect common interests and achieve the statutory goals of united citizens.

Article 31 of the Law determines that the property of a public association is formed, inter alia, on the basis of entrance fees and donations.

Expenses for conducting statutory activities include expenses aimed at carrying out activities designated in the charter of a public association as the goal and subject of its activities.

Thus, donations received by a public organization for the implementation of its statutory tasks are recognized as targeted receipts, not subject to corporate income tax, only if the funds received are aimed at achieving a generally beneficial purpose and the organization keeps separate records of such receipts.

In other cases, receipts in favor of a public organization are taken into account when determining the tax base for corporate income tax as gratuitously received property as part of non-operating income on the basis of clause 8 of Art. 250 Code.

As for value added tax, based on paragraphs. 2 p. 1 art. 162 of the Code, funds received by a taxpayer and not related to payment for goods (work, services) sold by this taxpayer are not included in the tax base for value added tax.

Reason: Letter of the Ministry of Finance of the Russian Federation dated April 20, 2012 N 03-07-11/121

A selection based on materials from the Financier information bank of the ConsultantPlus system. Compiled by Kashirskaya E.V.

Legal documents

- Art. 250

- Art. 251

- Article 582

- Art. 124

- dated May 19, 1995 N 82-FZ “On Public Associations”

- Art. 162

- Letter of the Ministry of Finance of the Russian Federation dated April 20, 2012 N 03-07-11/121

What are the risks?

The management company’s task is to ensure that the NPO’s endowment has income, says Irina Kuznetsova, an expert at the Lawyers for Civil Society association. According to her, this is a difficult task, since the company cannot invest in all assets, but only in those specified by the endowment law.

“These are traditional financial instruments that do not bring high returns. The legislator sought to secure and preserve the endowment so that the management company would not lose it,” says Irina.

Types of voluntary contributions and receipts.

I'll start with general definitions and the simplest ones. Important! The tax authorities and the Ministry of Justice primarily determine the type of receipt based on the payment order, this is very important. All receipts with an incorrect basis are recognized as taxable, and then it will be necessary to prove the opposite as part of the audit. It is difficult to react and defend your position in time. It is much easier to avoid mistakes with payment grounds. I’ll answer the question right away about how this happens. The Tax Office or the Ministry of Justice have online access to view bank accounts. In shadow mode, they constantly check the structure of the movement of funds and, based on the reasons, can roughly determine what relates to revenue and what to voluntary contributions and donations. If the analysis shows a gross discrepancy with the provided accounting and tax reporting, government agencies will initiate an audit of the organization. The exception is for charitable foundations; within the framework of the law on charitable activities, all proceeds, by default, are recognized as donations. Only a direct commercial basis will form their tax base. Important! These risks directly depend on the competence of the NPO accountant; the application of standard accounting rules in commercial organizations will lead to additional charges of a huge amount of taxes, fines and penalties. Now let's look at each type of receipt and an example of the correct basis.

Contribution for statutory activities.

This is the most general basis; if you don’t know how to determine admission, use it. According to it, the contributor can be any individual or legal entity. It applies to any form of NPO. The donor fully trusts the NPO to use the funds within the framework of its charter. After payment, the depositor does not need to provide any closing documents. Basis of payment: » Voluntary contribution for the development of the statutory goals of a non-profit organization. sum . NDS is not appearing". Usually this is how small amounts are paid with great trust in the NPO.

Event fee.

The NPO publishes the event program on the website, leaflets or in any available way. Which usually consists of a description of the goals/problem, how they will be achieved/solved, and the required amount of funds. The event ID must be indicated. Examples of the basis for payment: Contribution for non-profit event No. 131 “Cleaning up Izmailovo Park”, in accordance with the statutory goals of the non-profit organization. A general report on the event, usually the actual cost estimate, is published on the website or other accessible place so that all donors can familiarize themselves with it. Publishing the report is not required, but is highly recommended. Its absence indicates the opacity of the use of funds, the status of a high-risk activity appears, which significantly increases the risk of inspections by government agencies and a drop in the level of trust on the part of contributors.

Special-purpose financing.

Direct targeted financing, one or a limited list of payers. The essence of this form is that even before providing financing, both parties discuss all the conditions for its provision and use. They are fixed in the target financing agreement. This agreement can be called differently, for example: • Charitable assistance agreement • Non-profit event financing agreement • Donation agreement • NGO assistance agreement • Other But all these agreements are a different interpretation of the targeted financing agreement and contain the following description: • Indication of the payer of targeted financing. • Description of the subject of the agreement, for what purposes the funding is provided, within the framework of the statutory goals of the NPO. • Financing schedule • Cost estimate for the implementation of the subject of the agreement • Description of the conditions for confirming the intended use of funds: payment documents, acts, invoices, etc. • Form of an act on the intended use of the funds received. Important! The “Act on the intended use of funds received” cannot be accepted as a cost, do not confuse it with the “Act of services rendered”.

Grants.

They also refer to targeted revenues, very similar to targeted financing, but the regulations for working with this financing are stricter and often occur through digital signatures on Internet sites. Grants are described in detail in a separate article: NPO Grants.

The types of income described can be in any form of non-profit organization. But there are additional types of income that are characteristic only of certain types of NPOs. I will describe the main forms of NPOs and their special income.

Receipts to Charitable Foundations.

Donations. A distinctive feature of the charitable foundation is that any receipts, even without indicating the payer and the basis for the payment, are recognized as a donation. This allows charities to accept “face-to-face” payments or simply collect funds in a box.

Income to NPOs is based on membership.

Membership-based NPOs: Public organizations, Associations, Unions.

Mandatory membership fees . They are a requirement for members of a membership-based organization. Primary, the amount and terms of payment of membership fees are regulated by the annual meeting. A membership regulation could also be created that would detail the rights and obligations of NPO members. Separately, we can say that in these organizations there are two more grounds for admission: Voluntary membership fee . When a member of an organization proactively contributes additional funds to its statutory activities. Voluntary contribution from third parties. The same as a regular contribution to statutory activities, but with the clarification that it was not made by a member of the organization.

Control over the expenditure of membership dues

According to Art. 32 of Law No. 7-FZ, the activities of NPOs are controlled by the state and society. Information about the property of an NPO and its expenditure cannot be a commercial secret. All information about the flow of funds (if during the year the NPO received no more than 3 million rubles in the form of property and cash) is presented in the NPO report, which is submitted annually to the Ministry of Justice (clause 3 of Article 32 of Law No. 7-FZ).

The NPO confirms the intended use of funds to the tax authorities by annually submitting in the reporting package a report form on the intended use established by clause 2 of Art. 4 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ. Members of the organization can independently control the expenditure of funds by establishing a mandatory procedure for reporting by the executive body by decision of the collegial body.

***

Contributions to an NPO are one of the forms of financing a non-profit organization, but their spending must be treated with the utmost care.

Members of the organization have the right to control it and the tax authorities are obliged. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Formation of an autonomous non-profit organization

To create a public organization and register with government agencies, you must submit the following package of documents:

- Statement.

- Constituent documents (charter and decision to create an organization).

- Information about the founders.

- Document confirming payment of state duty.

From the moment of registration, a public organization has no further restrictions on the period of activity.

The law determines the status of a non-profit organization. These include foundations, religious and socially oriented associations and unions, state corporations, societies and communities of small peoples.

Even a small public organization has a balance sheet and assets as a material asset. An NPO is founded at the expense of the property of the founders. A public organization must not use the property it owns for purposes other than those specified in its charter, nor sell or bequeath it.

The basis of an autonomous NPO is targeted contributions, and accounting is carried out according to a simplified system. Receipts in the form of contributions are regarded as subsidies. Voluntary contributions and targeted donations are not taken into account when paying income tax.

The basis of an autonomous NPO is targeted contributions.

Payment of contributions: procedure and consequences of delay

When transferring funds by members of NPOs - legal entities, in payment orders it is necessary to indicate the intended purpose of the funds as a membership fee. This will serve 2 purposes:

- tax, proving the targeted nature of the payment;

- corporate, confirming the very fact of payment, which will also become necessary evidence in court in the event of a dispute with a participant.

An individual has the right to pay membership fees to the organization's cash desk by issuing a cash receipt order. The charter of an NPO may establish a procedure for paying penalties in case of late payment of funds. In practice, when collecting arrears in payment of contributions, the NPO also asks to collect interest for the use of other people's funds and these demands are satisfied (see resolution of the 9th Court of Appeal dated 02/07/2014 No. A40-76488/2013).

Debt in payment of overdue membership fees cannot become the basis for an NPO to submit demands to initiate bankruptcy proceedings, since, according to clause 2 of Art. 4 of the Law “On Insolvency (Bankruptcy)” dated October 26, 2002 No. 127-FZ, they do not belong to the type of monetary obligations that are taken into account when determining the signs of bankruptcy of a debtor (see the resolution of the Arbitration Court of the North Caucasus District dated July 18, 2014 in the case No. A53-854/2014).