What kind of reporting do individual entrepreneurs submit on a patent?

To use the PSN system, you must meet certain requirements:

- This system can only be used by individual entrepreneurs;

- Individual entrepreneurs cannot employ more than 15 people;

- The area of the premises used for business or for rent should not exceed 50 square meters. m.;

What does an individual entrepreneur pass on PSN?

- A total of 63 areas of activity have been identified for which PSN can be issued. The full list is contained in paragraph 2 of Art. 346.2 These services include: tailoring, repair of clothes and shoes, designer services, retail trade, etc.;

- For each patent, a book of income and expenses is prepared;

- annual income cannot exceed 60 million rubles*;

- The cost of the patent is not reduced by insurance premiums.

Important! Despite a large number of restrictions, according to statistics, 3.5% of individual entrepreneurs choose the patent system.

The PSN mode has the following advantages:

- taxes have been significantly reduced. The tax is calculated as 6% of potential income, which is calculated by the state;

- the validity period of the patent can be determined independently;

- Contributions to extra-budgetary funds are made only to the Pension Fund. They make up 20%;

- the list of permitted activities for use of the patent system cannot be changed by the authorities.

To switch to the PSN system, you must fill out the appropriate application.

Reporting on PSN without employees is significantly reduced, in contrast to reporting with a workforce. There is also an increase in the tax burden.

Important! The greatest difficulty for individual entrepreneurs is confirmation of the type of activity in the Social Insurance Fund. This must be done by April 15th after the current year ends.

Individual entrepreneurs and employees must provide the following reports on the patent:

- income journal;

- information on the number of employees on staff;

- certificate 2-NDFL and 6-NDFL;

- forms 4-FSS and SZV-M;

- calculation of insurance premiums;

- SZV-Experience.

After an individual entrepreneur has hired an employee, he must register with the Social Insurance Fund and the Pension Fund. Information must be provided to the first organization within 10 days, and to the second - within 30 days.

Individual entrepreneurs and employees must pay personal income tax contributions, the Pension Fund and the Social Insurance Fund. Payment of personal income tax is carried out every month. In addition, reports that must be submitted to the Pension Fund include RSV-1, ADV-6-5, SZV 6-4. They are provided every quarter.

What reporting is provided for on PSN

What you need to know about reporting

Tax returns are not provided for patent holders (Article 346.52 of the Tax Code of the Russian Federation). This is the main advantage of the mode. However, only entrepreneurs who do not use hired labor can count on complete exemption. All they need to do is keep a book of income and monitor the validity of the patent. There is no requirement to submit reports to extra-budgetary funds. Businessmen need to pay insurance premiums “for themselves” in a timely manner.

Other rules apply to the PSN payer and the employee. The conclusion of at least one employment contract or civil agreement with an individual gives rise to new responsibilities. Availability of personnel involves filling out a number of payment forms.

| Name | a brief description of | Link to normative act |

| 2-NDFL | Entrepreneurs must submit a certificate to the Federal Tax Service by April 1 of the year following the reporting year. The document reflects the amount of personal income tax withheld from employee benefits. | Chapter 23 of the Tax Code of the Russian Federation, orders of the Federal Tax Service of the Russian Federation No. ММВ-7-3/ [email protected] from 09.16.11, No. ММВ-7-11/ [email protected] from 10.30.15, No. ММВ-7-11/ [email protected] ] from 01/17/18. |

| If the number of employees exceeds 25 people, payments are accepted only in electronic format (Article 230 of the Tax Code of the Russian Federation). However, in this case the right to use PSN will be lost. | ||

| If it is impossible to withhold tax, the merchant is obliged to send a corresponding message to the inspectorate. This must be done before March 1st. | ||

| 6-NDFL | The declaration is submitted quarterly and contains information about the personal income tax of employees. The deadlines for sending reports are established by paragraph two of Article 230 of the Tax Code of the Russian Federation. The entrepreneur must provide information before the end of the month following the reporting quarter. | Chapter 23 of the Tax Code of the Russian Federation, order of the Federal Tax Service No. ММВ-7-11/ [email protected] dated 10.14.15 |

| SZV-M | Employers must send calculations to the Russian Pension Fund every month before the 15th. The forms reflect the INN, full name, and SNILS of each employee. | Clause 2.2. Article 11 of Law No. 27-FZ dated 04/01/96, Resolution of the Pension Fund of the Russian Federation No. 83p dated 02/01/16. |

| Calculation of insurance premiums | Information is submitted to the territorial tax authority quarterly within 30 days from the end of the period. | Clause 7 of Article 431 of the Tax Code of the Russian Federation, order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/551 dated 10.10.16 |

| Average headcount | All employers are required to provide information to the tax office. The condition is to attract hired employees during the reporting period. The document must be submitted annually before January 20 at the place of registration. | Article 80 of the Tax Code of the Russian Federation, order of the Federal Tax Service of Russia No. ММВ-3-25 / [email protected] dated 03.29.07. |

| 4-FSS | Reporting deadlines depend on the format. Entrepreneurs with up to 25 employees can submit information to the FSS of Russia on paper. This fully applies to patent holders. They must submit the forms quarterly by the 20th of the following month. | Article 24 of Law 125-FZ of July 24, 1998, order of the Federal Tax Service of the Russian Federation No. 381 of September 26, 2016. |

It is difficult to discuss the advantages and disadvantages of reporting on PSN. Businessmen do not submit declarations directly related to the acquisition of a patent. The need to fill out approved forms arises only when personnel are involved.

When should this be done?

Individual entrepreneur on OSNO what kind of reports does he submit without employees and with them?

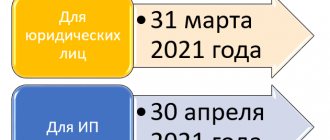

An individual entrepreneur working on a patent submits reports within the following deadlines:

- income journal: submitted once for the entire period, at the end of it;

- information on the number of staff: provided once a year until January 20;

- Certificate 2-NDFL must be submitted once a year before April 1. Information is provided to the tax office at the place of registration;

- Certificate 6-NDFL: must be submitted quarterly. In the first quarter until April 30, in the first half of the year - until July 31, 9 months before October 31, for the year - until January 31;

- 4-FSS is submitted every quarter: the report must be submitted by the 20th of the month following the reporting month;

- SZV-M: provided every month before the 15th day of the month following the reporting month;

- Insurance premiums are calculated every quarter. In the first quarter until April 30, in the second half of the year until July 31, 9 months before October 31, per year - until January 30;

- The SZV-experience report is submitted every year before March 1 of the year following the reporting year.

- Picture 3. What are the deadlines for submitting patent reports?

Conditions for the use of PSN

Only if certain conditions are simultaneously met, the individual entrepreneur has the right to apply the PSN:

- The type of activity of the entrepreneur is contained in clause 2 of Article 346.43 of the Tax Code of the Russian Federation;

- The activities of individual entrepreneurs are carried out on their own, or with the hiring of employees, with the total number of employees not exceeding 15 people;

- The activities of individual entrepreneurs are not carried out under a property trust or partnership agreement.

If one of the listed conditions is violated during the validity of the PSN, the entrepreneur must switch to the general taxation system (

Methods for filing a declaration on PSN

There are several ways to submit patent reporting:

- providing documents independently. This is the simplest method, but the most expensive;

- presentation of papers through a proxy by proxy. The power of attorney must be certified by a notary;

- transfer of papers by mail. An inventory of the documents sent must be included in the envelope. According to experts, it is better to include two copies of the inventory. The letter must be sent by registered or certified mail;

Individual entrepreneur on a patent - what taxes to pay, mandatory contributions

Important! The date of submission of the report will be considered the date of sending the letter.

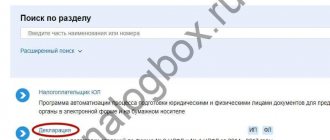

- Sending reports using the Internet. This is done through the official tax website. The “Taxpayer Yul” program is installed on the website. You also need to get the subscriber ID.

Tax return: when and where to submit

A tax return under the patent tax system is not submitted to the tax authorities . This exemption for individual entrepreneurs on a patent is enshrined in Article 346.52 of the Tax Code of the Russian Federation. Exemption from mandatory reporting to the Federal Tax Service is the main advantage of this system - the entrepreneur does not need to delve into the intricacies of filling out a tax return or hiring a specialist accountant for this.

But if an entrepreneur conducts other business activities in parallel with the activity on the patent, then he has an obligation to submit reports under a different taxation system.

For example, in a simplified form he will have to submit a tax return under the simplified tax system.

Is it necessary to conduct KUDiR

Carrying out KUDiR for PSN is mandatory. It is a reporting journal in which the receipt of money is entered. The form of the book is established by the Ministry of Finance. To maintain a book, you simply need to fill in the income received in chronological order. Only those procedures that are confirmed in the form of an accounting document are entered.

Individual entrepreneur reporting on the simplified tax system - what and when needs to be submitted using a simplified procedure

Important! The ledger is completed only during the life of the patent. With a new patent, a new book is started.

There are two ways to maintain a book:

- paper form: purchased from a printing house and filled out manually;

- electronic form: has the form of an electronic program and is filled out using online services. Upon expiration of the patent, the book is printed and certified by the tax authority.

The book must be stored for four years.

Do I need to keep a ledger of income and expenses?

An individual entrepreneur is required to keep records of income received from activities on the PSN. To reflect them, a special form was approved by Order of the Ministry of Finance dated October 22, 2012 No. 135n.

Ledger

Until 2021, if an individual entrepreneur had several patents for different types of activities, then he must fill out an income book for each of them. As of 2021, this requirement has been removed from the Tax Code, and one register can be maintained for all patents.

What to do if an individual entrepreneur combines activities on the PSN and the simplified tax system? Is it possible in this case to fill out one book of income and expenses? The answer is negative. This is explained by the Ministry of Finance in Letter dated 09/03/2013 No. 03-11-11/36264. For each taxation system, an independent form of accounting book has been established. And when combining activities on different systems, an entrepreneur is obliged to keep separate records of income and expenses and fill out two books for their accounting.

About the author of the article

Alla Kotova Accountant, chief accountant, tax specialist.

Author of specialized articles in electronic media.

Zero reporting 3-NDFL: how to fill out as an individual entrepreneur

Is it necessary to submit 3-NDFL for individual entrepreneurs on UTII and how to do it correctly

A 3-NDFL declaration will have to be drawn up, even if during the reporting period there was no activity and no income serving as an object of taxation. But all indicators in the document in this case will be zero. The process of filling out 3-NDFL reporting for 2019 for individual entrepreneurs has its own characteristics that must be taken into account.

Checking information about individual entrepreneurs on the tax website

It is mandatory to fill out three sheets - title sheet, Section 1 and Section 2, this is necessary for any individual. face.

It is advisable to fill out the sheet with section 2 first. It contains the following information:

- Applicable tax rate. The correct option can be obtained from the tax office.

- Full name of the entrepreneur, even if he is the only employee.

- Assigned TIN code, any important certificate contains this designation.

If the remaining columns are not filled in, dashes must be placed in them; empty spaces cannot be left.

Next, fill out section 1, where you enter sequentially:

- OKTMO code - it can be calculated automatically.

- KBK CODE by which tax is transferred. It is also important if a mortgage is taken out.

- Code 3, confirming the absence of tax payments.

- Information on TIN and other personal data.

All empty columns are dealt with in the same way - they are simply crossed out.

After this stage, the registration of the declaration can be considered complete. The main thing is to number the sheets in the correct order. After this, the entrepreneur puts a personal signature confirming the accuracy of the information.

Payment of VAT after loss of the right to use PSN

When switching to OSN, the entrepreneur is required to calculate and pay VAT. The deadline for submitting declarations for the period of use of PSN is not specifically established. After filing the declarations, penalties for late payment of VAT are not charged. Required:

- Calculate the tax by calculation (clause 4 of Article 164 of the Tax Code of the Russian Federation).

- Issue invoices to customers. For retail trade and the provision of services to the public, it is not necessary to generate a document.

- Generate reports, pay taxes.

- Submit declarations to the territorial body of the Federal Tax Service.

Particular importance is attached to the use of the right to exemption in VAT taxation. A payer who has revenue of no more than 2 million rubles for 3 consecutive calendar months has the right to apply for tax exemption.

Failure to submit notification on time is not an obstacle to granting exemption (position of the Arbitration Court of the Ural District). However, an individual entrepreneur’s exemption may be denied on the basis of clause 7 of Art. 346.45 Tax Code of the Russian Federation. The article states that if the right to a patent is lost, taxes are paid by the enterprise as a newly registered individual entrepreneur.

Modes available to individual entrepreneurs upon loss of the right to PSN

The transition due to the loss of PSN is carried out to one of the permissible modes. In accounting, general and special systems are not used simultaneously.

| Mode type | Transition base | Add-ons |

| Generally installed system | The system is applied unconditionally, unless the entrepreneur declares a special regime | An obligation arises for personal income tax, VAT, property tax used for business activities |

| Simplified system | The possibility of a transition arises when the individual entrepreneur has previously notified the Federal Tax Service of his intention to apply the simplified tax system | You will need to pay a single tax calculated from the date of validity of the patent |

| Unified agricultural tax | The transition is made if the individual entrepreneur has the characteristics of an agricultural producer and the right received earlier on the basis of a notification | Individual entrepreneurs have obligations under the Unified Agricultural Tax |

In case of early termination of the use of PSN in accounting, the previously paid tax is not recalculated, and the balance of the mandatory payment for the patent does not need to be repaid. The outstanding amount in the individual entrepreneur’s personal account card is reversed. To pay the main taxes when switching to other regimes (personal income tax, single tax under the simplified tax system, unified agricultural tax), you can offset the fee for using a patent (clause 7 of article 346.45 of the Tax Code of the Russian Federation) against future payments.

The offset is made on the basis of a written application from the taxpayer. The application is reviewed within 10 days. The taxpayer is notified of the refusal or adoption of a positive decision.

Where are advance payments made?

For personal income tax, the standard tax period is 12 months. Any advance payment is transferred depending on the issued notifications from the tax service throughout the entire specified year. When the period ends, the total amount of the total tax is calculated.

The basis is notifications. The advance involves setting specific deadlines:

- For January-June. The maximum is paid until July 15 of the current year, in the amount of half of the total amount. All funds must be deposited.

- For July-September. Until October 15 of this year maximum. One fourth of the annual amount.

- October-December - until January 15 of the next year, also one fourth. The sample documents remain virtually unchanged.

Notifications always include a mandatory attachment - payment orders. It describes the details where the money should be transferred. The form of such notices is designated as No. PD. It makes things easier for those who are going to pay the fee.

There are several options for transmitting tax notices. The list looks like this:

- Personally to an entrepreneur or an official representative of interests. The general order of the procedure is maintained in any case.

- By mail, with a registered letter. The message is considered to have been received a maximum of six days after it was sent. A simultaneous list with applications is also sent.

- Via telecommunication channels, electronically. Such technologies have long been available to those who apply for deductions in various directions.

The entrepreneur does not become obligated to pay tax until he receives a notice. Until this moment, no action needs to be taken. Arbitration practice proves the legitimacy of the approach when a declaration is meant.

Reporting on PSN

If you want to switch to PSN, you need to fill out an application and submit it no later than 10 days before the start of the system.

Important! Particular attention should be paid not only to reporting, but also to changes in legislation in order to prevent mistakes during tax audits.

Reporting without employees

If a company does without employees, it still needs to keep a book of accounts. Also, an entrepreneur who does not have employees is obliged to pay fixed payments to the Pension Fund and the Compulsory Medical Insurance Fund.