To whom and where to submit reports on contributions

The functions of insurers for compulsory social insurance are assigned to employers (organizations, individual entrepreneurs, ordinary individuals without entrepreneurial status) who enter into employment contracts or civil contracts with individuals and pay them remuneration.

When calculating benefits, policyholders must calculate insurance premiums from them, pay these premiums, and then report them to regulatory authorities. Organizations are required to submit reporting forms for insurance premiums, regardless of whether income was paid to individuals or not. That is, if there are no payments, zero reports are submitted.

The situation is different with individual entrepreneurs - an individual entrepreneur who is not registered as an employer without employees does not submit reports on insurance premiums.

There are different types of contributions:

- for insurance against temporary disability and in connection with maternity (VNiM);

- compulsory pension insurance (OPI);

- compulsory health insurance (CHI);

- insurance against accidents at work and occupational diseases (insurance and occupational diseases).

The first three types are administered by the tax service, the fourth by the Social Insurance Fund. But for all types, the reporting periods are: quarter, half-year, 9 months. The billing period is one year. After the completion of each of these periods, inspectors must be presented with reports on the basis from which contributions were calculated and in what amount, as well as which payments were not subject to taxation.

Do I need to submit a zero RSV?

The calculation of insurance premiums contains information about the insurance premiums calculated and paid for employees during the reporting period. The DAM, both zero and with accruals, is surrendered in relation to:

- employees with whom employment contracts have been concluded;

- citizens working under civil law contracts;

- individuals with whom agreements have been concluded on the alienation of the exclusive right to certain results of intellectual activity, publishing license agreements, as well as license agreements on granting the right to use the results of intellectual activity;

- authors of works within the framework of an author's order agreement.

Persons required to submit the DAM include:

- organizations - regardless of the presence of employees;

- separate divisions of Russian companies (OP) - if they independently transfer salaries to their employees and pay insurance premiums from them;

- OP of foreign companies - if they operate on the territory of the Russian Federation;

- Individual entrepreneur - if there are employees;

- heads of peasant farms - regardless of the presence of employees;

- individuals without individual entrepreneur status - if they have employees.

The fact of payment of income to employees and payment of insurance premiums from it does not matter for the delivery of a zero RSV. The report is always submitted when there are employees. If contributions from income have not been paid, you need to submit a zero RSV to the Federal Tax Service.

What form should you use to report to the Social Insurance Fund in 2021?

For contributions from accidents and occupational diseases, a report is submitted to the Social Insurance Fund. The 4-FSS form, valid in 2020-2021, was approved by Order No. 381 of the FSS of the Russian Federation dated September 26, 2016, and was last edited in 2021 (Order No. 275 of June 7, 2017).

The report states:

- On the title page - information about the policyholder: his name, TIN, registration number in the Social Insurance Fund, contact details, information about the reporting period - reporting period number and year. The title card is certified by an authorized person and a seal (if any).

- Table 1 shows the basis for calculating contributions; amounts not subject to taxation; tariff rate, which is set depending on the type of activity performed at the beginning of each year based on the results of the previous year.

- Table 2 shows calculations for contributions, including the balance of debt owed to the fund or to it; the amount of accruals on contributions for the reporting period, including for the last three months of the reporting period; transferred contributions with details of payment orders; the amount of expenses reimbursed by the fund and not accepted for offset. Based on all this data, the balance of debt owed to or behind the fund is displayed.

- Table 5 contains data on the special assessment of working conditions and medical examinations.

The listed parts of the report must be submitted even if there is no data to fill out. In this case, all empty columns are crossed out.

Tables 1.1 (on the calculation of contributions from payments to outsourced employees), 3 (on costs associated with industrial accidents), 4 (on the number of victims) are included in the calculation only upon the occurrence of the events noted in them - transfer of personnel or accidents .

You can see samples of filling out Form 4-FSS for different reporting periods, as well as a line-by-line algorithm for filling out a report in ConsultantPlus. If you do not have access to this legal system, a full access trial is available for free online.

Section 3 “Personal Data”

Section 3 as part of the calculation of insurance premiums for the 2nd quarter of 2017 must be completed for all insured persons for April, May and June 2021, including in favor of whom payments were accrued in the first half of 2017 within the framework of labor relations and civil contracts.

Subsection 3.1 of Section 3 shows the personal data of the insured person - the recipient of the income: Full name, Taxpayer Identification Number, SNILS, etc.

Subsection 3.2 of Section 3 contains information on the amounts of payments calculated in favor of an individual, as well as information on accrued insurance contributions for compulsory pension insurance.

For persons who did not receive payments for the last three months of the reporting period (April, May and June), subsection 3.2 of section 3 does not need to be filled out (clause 22.2 of the Procedure for filling out calculations for insurance premiums). Below is an example of a completed calculation of insurance premiums for the 2nd quarter of 2021. Here's a sample you can download. It includes the required sections:

Copies of Section 3 for employees

Copies of section 3 of the calculation must be given to employees. The period is five calendar days from the date when the person applied for such information. Give each person a copy of Section 3, which contains information only about them. If you submit calculations in electronic formats, you will need to print paper copies. Give the extract from Section 3 to the person also on the day of dismissal or termination of the civil contract. The extract must be prepared for the entire period of work starting from January 2021.

When to submit a report to social security

For 4-FSS, submission deadlines vary depending on the method of submitting the calculation.

If it is submitted on paper (this option is available to employers whose average number of employees over the past year did not exceed 25 people), then the report must be submitted no later than the 20th day of the month following the reporting period. That is, for the reporting periods of 2021, the due dates were April 20, July 20, October 20, 2021 and January 20, 2021 for the annual report for 2021. For the periods of 2021 - April 20, July 20, October 20, 2021 year and January 20, 2022 - for the annual report for 2021.

Be more careful with deadlines if they fall on weekends, since Law No. 125-FZ, unlike the Tax Code, does not clearly stipulate the rules for postponement. Although the FSS is loyal in this matter and allows the transfer.

The paper report can be personally brought to the territorial body of the Social Insurance Fund at the place of registration, submitted through an authorized representative, having previously written out a power of attorney for it, or sent by Russian Post with a list of the contents.

If the report is submitted electronically (those persons whose SSC/number of employees exceeds 25 people are required to report this way), then the deadlines are extended by 5 additional days. Taking into account the “exit” transfer allowed by the Social Insurance Fund in 2021, we reported until April 27, July 27, October 26, 2021 and January 25, 2021 - according to the annual report for 2021; in 2021 - until April 26, July 26, October 25, 2021 and January 25, 2022 - according to the annual report for 2021.

We described how to submit an electronic version of the report here.

In what form is the report on insurance premiums for 2020-2021 submitted to the Federal Tax Service?

Reporting on insurance premiums for compulsory medical insurance, compulsory medical insurance and VNiM this and next year is carried out on an updated form. Starting with the reporting campaign for 2021, a new form is used, as amended by Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected]

ConsultantPlus experts explained in detail what changes have been made to the form. Get free demo access to K+ and go to the review material to find out all the details of the innovations.

A single calculation consists of a title page, three sections and appendices to them. Let us briefly describe them:

- The title book is filled with information about the policyholder, the tax authority, and the reporting period. Always presented, even if the calculation is zero.

- Section 1 provides summary data on the obligations of the reporting entity - the total amount of accruals for each type of contribution and broken down monthly for the last three months of the reporting period. There are 9 appendices to this section, which provide calculations for contributions to compulsory health insurance, compulsory medical insurance, VNiM, for additional social security for certain categories of insured persons, calculations of compliance with the conditions for applying the reduced rate of insurance premiums; insurance costs for VNiM and payments made from federal budget funds are reflected. Each appendix is included in the report if there is data to fill it out; if there is none, only section 1 itself is presented.

- Section 2 is a summary of the obligations of heads of peasant farms. Appendix 1 provides a calculation of such obligations. Subject to surrender by the relevant types of insureds.

- Section 3 with personalized information about the insured persons consists of two subsections: 3.2.1 - filled out and submitted by all policyholders, 3.2.2 - only by those who make payments subject to additional tariff contributions.

You will find samples of filling out the ERSV for different reporting periods, as well as a line-by-line algorithm for filling out the report in ConsultantPlus, having received free trial access.

Innovations in 2021

The innovations that employer-taxpayers will face relate, first of all, to the transfer of control from such structures as the Pension Fund of the Russian Federation and Social Security. fear, to the tax authorities.

Based on Federal Law No. 212 of 2009, the Pension Fund of the Russian Federation and the Social Insurance Fund were authorized to accept contributions and reports from employers. But from December 31, 2020, this provision will no longer be in force, so the tax authorities will be responsible for reconciliations and monitoring of policyholders.

The question arises, where to submit the last report on the calculation of RSV-1, who will verify the data and accept payment, to which accounts should insurance premiums be transferred?

What are the deadlines and methods for submitting 2020-2021 reports on insurance contributions to the tax office?

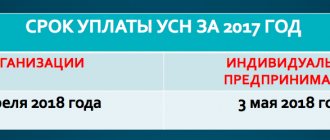

Policyholders submit a single calculation of contributions to the tax office by the 30th day of the month following each reporting period.

In 2021:

- until February 1 - for 2021 (postponed from Saturday January 30);

- until April 30 - for the 1st quarter of 2021;

- until July 30 - for half a year;

- until November 1 - 9 months in advance (postponed from Saturday October 30).

Note! Separate deadlines are set for heads of peasant farms without employees. They report once a year until January 30th.

The deadline for submitting reports on insurance premiums to tax authorities does not depend on the method of presentation. You can also submit it on paper or electronically. Moreover, the requirement to submit a paper report is much stricter here than for 4-FSS. This requirement has been in effect since 2021 and implies that the insured’s social capital (or the number of employees for newly created organizations and individual entrepreneurs) does not exceed 10 people. Employers with larger numbers are required to report exclusively electronically.

How to punish for violating deadlines for submitting reports on insurance contributions to extra-budgetary funds

Reporting on insurance premiums to both the Social Insurance Fund and the tax office is submitted within the strictly allotted time frame. All delays are fraught with fines.

The policyholder who did not submit the 4-FSS calculation to the FSS on time will be punished under clause 1 of Art. 26.30 of Law No. 125-FZ. The fine is calculated as 5 percent of the amount of contributions payable for the last three months of the reporting (calculation) period. It will have to be paid for each full or partial month of delay. The upper and lower limits of punishment are determined by law. The maximum amount will be 30 percent of the amount of contributions according to the calculation, and the minimum will be 1000 rubles.

For late submission of calculations for contributions to compulsory medical insurance, compulsory medical insurance and VniM, the punishment is determined by Art. 119 of the Tax Code of the Russian Federation also in the form of a fine in the amount of 5% of the timely unpaid amount of contributions for each overdue month. The maximum fine should not exceed 30% of the specified amount, the minimum is 1000 rubles.

Important! ConsultantPlus warns The fine is calculated separately for each type of compulsory social insurance (Letter of the Federal Tax Service of Russia dated June 30, 2017 N BS-4-11 / [email protected] ). A fine of 1,000 rubles. distributed... Read more about calculating the fine for the DAM in K+. You can do this for free.

In addition, an official of the organization can also be fined 300–500 rubles. already according to Art. 15.5 Code of Administrative Offenses of the Russian Federation.

Delay in submitting a single calculation to the tax office by more than 10 days threatens the suspension of transactions on bank accounts (clause 3.2 of Article 76 of the Tax Code of the Russian Federation).

Results

Reporting forms for insurance premiums for 2020-2021 include 4-FSS and a unified calculation of insurance premiums. The first report is intended to calculate the base and contributions for insurance from personal injury and personal injury and is submitted to the Social Insurance Fund, which regulates its form. In the second, contributions for pension insurance, medical insurance and in case of disability are calculated. It is submitted to the tax office, the form is approved by the tax department.

The reporting deadlines vary: 4-FSS must be submitted by the 20th or 25th of the month after the end of the reporting period, a single calculation - by the 30th of the same month. Late submission or failure to submit reports may result in fines calculated depending on the amount of accrued or unpaid contributions. In certain cases, it is also possible to block a current account.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/ [email protected]

- Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected]

- Federal Law “On compulsory social insurance against accidents at work and occupational diseases” dated July 24, 1998 No. 125-FZ

- order of the Federal Insurance Service of the Russian Federation dated September 26, 2016 No. 381 (as amended on June 7, 2017) “On approval of the form of calculation for accrued and paid insurance contributions for compulsory social insurance against industrial accidents and occupational diseases, as well as for expenses for payment of insurance coverage and The order of filling it out"

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Due dates for the DAM for the 1st quarter of 2021

In paragraph 7 of Art. 431 of the Tax Code of the Russian Federation states that the DAM must be submitted within 30 days after the end of each reporting period (quarter, half-year, 9 months, year). But, due to the introduction of a non-working days regime, most reports for the 1st quarter of 2021 can be submitted to the Federal Tax Service later. New dates are indicated in clause 3 of the Government of the Russian Federation of 04/02/2020 No. 409. Declarations and calculations for the 1st quarter of 2021, with the exception of VAT, invoice journals and DAM, are allowed to be submitted 3 months later. The rule applies to reports that companies and individual entrepreneurs were supposed to submit in March-May 2021.

For the DAM, the deadline for submission has also been extended, but it is much shorter: for the 1st quarter of 2021, all companies and individual entrepreneurs must report no later than May 15, 2021.

Regions are given the right to determine for themselves when coronavirus restrictions are lifted. However, Resolution No. 409 specifies a specific date for submitting the Calculation for all policyholders, and this means that the territorial period of self-isolation does not affect the deadline for submitting the DAM.

An example of filling out the new Insurance Premium Calculation form for the 1st quarter of 2021 can be found here.