From the history of the issue: the purpose of SZV-M

As part of the anti-crisis measures taken by the Government for 2021, Art. 26.1. It established a new procedure for the payment of insurance pensions and the fixed part to it in relation to working pensioners (Part 2 of Article 3 of the Law “On the suspension of certain provisions of legislative acts” dated December 29, 2015 No. 385-FZ):

- the amounts of the insurance pension and its fixed payment are paid without taking into account indexation during the period of work of the pensioner;

- after he stops working, the ban on indexation of these amounts will be lifted.

For monthly monitoring of information about working pensioners, the Pension Fund of Russia introduced the SZV-M reporting form. It also allowed pensioners not to independently submit information about their employment to the Pension Fund; this responsibility is now assigned to the employer.

However, the pensioner still retains the right to submit to the Pension Fund a statement about the fact of his employment (termination). He can use it to speed up the process of starting to index his pension after dismissal.

Sample application to the pension fund for a pension calculation

- passport and photocopy of all pages of this document;

- work book and a photocopy of all its pages;

- military ID and its photocopy;

- an application written in the prescribed form on the letterhead of the pension fund;

- information about the payment document where the money will be credited;

- a certificate from the place of employment, which will indicate the amount of average monthly earnings;

- documents confirming place of residence;

- a certificate stating that the citizen has a dependent minor child (the child’s birth certificate, the child’s insurance certificate and a certificate from the child’s place of study may also be required);

- in case of change of surname, documents confirming this fact;

- other documents requested by the pension fund specialist.

Non-standard situations that arise when filling out the SZV-M form

Let's look into situations that are non-standard for such cases, which are why policyholders have most of the questions.

The main principle when deciding whether to include information about individuals in the SZV-M is the following:

- individuals work in an organization under employment contracts or GPC agreements, author's orders, publishing license agreements and other agreements listed in the form itself;

- the validity of such contracts falls on the reporting period (separately or in aggregate: concluded, continue to operate, terminated in such a period);

- payments under contracts in favor of individuals may potentially be subject to insurance contributions to the Pension Fund (Clause 1, Article 7 of the Law “On Compulsory Pension Insurance” dated December 15, 2001 No. 167-FZ; Clause 2.2 of Article 11 of the Law “On Personalized Accounting” dated 04/01/1996 No. 27-FZ).

Thus, for the purposes of filling out the form, the following does not matter (letters from the Pension Fund of the Russian Federation dated May 6, 2016 No. 08-22/6356, dated July 27, 2016 No. LCH-08-19/10581):

- the fact that there were no payments to an individual in the reporting period if there were such accruals to him;

- an employee being on sick leave, on maternity leave or in similar situations;

- the employee is on vacation (including vacation at his own expense in the absence of activity in the organization);

- the presence in the organization of only a manager (who is the sole founder), with whom neither an employment contract nor GPC agreements have been concluded.

Such features of concluding contracts with an individual, such as part-time work / combining professions, also do not matter.

The only people not included in the form are foreign citizens - highly qualified specialists temporarily staying in the Russian Federation who are not insured in the compulsory pension insurance system (Article 7 of Law No. 167-FZ of December 15, 2001).

IMPORTANT! From the above it follows: a report in the SZV-M form cannot be zero (with an empty table).

Read about one of the non-standard situations that arise when submitting reports in the article “Should I submit SZV-M to the manager - the sole founder?”

Who takes SZV-M for December 2021

The SZV-M report is submitted by:

- Employers for employees - with whom labor and civil law contracts have been concluded, as well as copyright and licensing agreements.

Individual entrepreneurs, lawyers, notaries do not rent SZV-M without employees.

- Organizations with several founders - if one of them is the CEO.

The report is submitted even when an employment contract has not been concluded with the director (Letter of the Ministry of Labor dated March 16, 2018 No. 17-4/10/B-1846).

- Companies with a single founder and director in one person.

The existence of an employment contract does not matter. Until March 2021, the Pension Fund allowed such companies not to submit SZV-M, citing the fact that there are no persons with whom labor and civil law contracts have been concluded, as well as payments accrued on their basis. And since there are no contracts and payments, then there is no need to submit a report (Letter of the Pension Fund of the Russian Federation dated July 27, 2016 No. LCH-08-19/10581).

Since March 2021, the Pension Fund has radically changed its position and obligated all companies, including those in which the only founder works as a director without an employment contract, to submit SZV-M. The reason is that labor relations without a properly executed contract arise when an employee is actually allowed to work (Letter of the Ministry of Labor dated March 16, 2018 No. 17-4/10/B-1846).

- SNT, DNT, HOA.

Submitted to the chairman if he is paid remuneration for the work performed. If the chairman works on a voluntary basis and does not receive anything for his work, the SZV-M does not need to be taken. But in this case, it is necessary to submit to the Pension Fund a charter that confirms the gratuitous activities of the chairman.

- Charity organisations.

They rent for volunteers, who are reimbursed for food costs in amounts exceeding the daily allowance if GPC agreements have been concluded with them.

- Separate units.

They are fined for not submitting SZV-M, submitting it at the wrong time (late) or with errors.

Art. 17 of Law No. 27-FZ establishes liability for the following violations in the SZV-M form:

- failure to submit a report;

- violation of the deadline for its submission;

- failure to provide information about the insured person;

- incomplete or unreliable presentation of information about the insured person.

For any of these violations, a fine of 500 rubles is provided. for each employee whose information is to be included in the form for the reporting period.

IMPORTANT! Any minor error when filling out the form, interpreted by the Pension Fund of Russia authorities as unreliability in the presentation of information, will lead to a fine assessed on the entire number of insured persons indicated in the reporting. In case of non-payment or incomplete payment of financial sanctions, the Pension Fund of the Russian Federation collects the debt in court (Parts 15, 16, 17, Article 17 of Law No. 27-FZ).

Thus, significant penalties for the policyholder may arise due to an accidental error, which is simply impossible to exclude due to a technical or human factor.

To learn about the mandatory indication of certain information when filling out the form, read the article “TIN in the SZV-M form has become optional”

For cautious policyholders, we can recommend using the resources of the online service “Find out your/other people’s INN” on the Federal Tax Service website at: https://service.nalog.ru/inn.do.

See also “Error in the period - is the fine for SZV-M legal?”

An example of an explanatory note to the Pension Fund about the employee’s length of service

To do this, fill in the fields Number , Insurance part and Savings part in the following lines:

Table 1.

| Print line no. form | Line name in the system | Description | Notes |

| 1 | According to previously provided information | Amounts of insurance premiums accrued based on previously submitted information for the reporting period. All types of information are taken into account: initial, pension assignment, corrective | If explanatory notes have already been submitted for the reporting period, then the accrual amounts indicated in them are added to the total amount for the previously submitted information. |

| 1a | Amount according to forms such as PENS (pension assignment) | Filled out if the “pension assignment” form (PENS) was submitted during the reporting period, and the employee to whom the pension was assigned continues to work until the end of the reporting period. | If such information was not provided, leave the line blank. |

| 1b | According to forms of ISHD (initial) or KORR (corrective) types, provided based on the results of a documentary check | The total value of accrued insurance premiums according to the “initial” (ISHD) or “corrective” (KORR) forms, which are submitted based on the results of a documentary audit. | |

| 1c | Amount according to forms of ISHD (initial) or CORR (corrective) types provided to the policyholder for correction | Amounts of accrued insurance premiums for the reporting period based on returned sets of copies of erroneous individual information |

| an Additional tariff was selected when setting up the system (employees with the code “AVIA”), indicate the amounts in the column By additional tariff . |

- Click the Add canceling information link. Additional fields to fill out appear.

- Enter data in the fields that appear.

- Click Next .

At the end of reporting, print out the explanatory note (link Download printed form opposite the explanatory note).

SZV-M was not submitted on time

Providing personalized information about all insured persons working in the organization, including freelance, allows the Pension Fund to monitor working pensioners and timely update decisions on pension payments.

Reports in form SZV-M must be submitted to the Pension Fund no later than the middle of the month following the reporting month. This is established in paragraph 2.2 of Art. 11 Federal Law dated 01.04.96 No. 27-FZ. A late organization will face punishment in accordance with Art. 17 of Law No. 27-FZ.

Download documents from the article

Example of filling out the SZV-M form for April 2021DOC fileTable of fines for 2021DOC file

The fine for late submission of SZV-M is aimed at maintaining strict reporting discipline. Let us remind you that in the event of dismissal, a pensioner can independently inform about this in order to initiate the indexation procedure and increase his income. The report is sent to the territorial branch of the Pension Fund. The certificate form was approved by resolution of the Pension Fund number 83 in February 2019.

SNILS cards have been cancelled: Where can I get information for SZV-M now?

From April 2021, the Pension Fund no longer issues green cards. Now you will have to take the employee’s SNILS from different documents. Where exactly it comes from depends on when the person registered in the compulsory pension insurance system. For a mistake you will be fined 50 thousand rubles. What to do now with SNILS when applying for a job, read the article in the magazine "Human Resource Officer's Handbook".

SZV-M due date for December 2021

SZV-M is submitted no later than the 15th day of each month (clause 2.2 of Article 11 of the Law of 01.04.1996 No. 27-FZ “On individual (personalized) accounting..."). If the deadline for submitting the report falls on a weekend or holiday, it is postponed to the first working day (Letter of the Pension Fund of the Russian Federation dated December 28, 2016 No. 08-19/19045).

The deadline for submitting SZV-M for December 2021 is no later than 01/15/2021.

Considering that there are not many working days in January 2021 due to the New Year holidays, the Pension Fund recommends submitting this report in December 2021. And he reminds that the territorial bodies of the Pension Fund of the Russian Federation accept reports on the TCS on weekends (holidays).

What to do: judicial practice

Let's consider what decisions the court makes when considering claims for fines related to SZV-M. Although this reporting began to be used not so long ago, a certain practice has already been developed. You can rely on it to understand the essence of analyzing problem situations in order to avoid a fine.

Errors are considered: lack of reporting, late submission, incomplete and/or unreliable information about insured employees. In the first case, the punishment is inevitable, it will not be possible to challenge it. And if, for good reasons, the SZV-M was not submitted on time, then you can try to prove it.

It is often difficult to understand locally who should be included in the certificate. The Pension Fund clarifies this issue in letters dated 05/06/2016 No. 08-22/6356, dated 07/27/2016 No. LCH-08-19/10581.

So, if a company has only one manager (aka founder), working without a contract, the report still needs to be filled out. Also included in the form are maternity leavers, sick people, vacationers and those who were actually absent from the workplace and did not receive payments during the reporting period. There are no exceptions for part-time workers.

Perhaps the only exception can be considered only those who have foreign citizenship and do not have a Russian SNILS (Article 7 of Law dated December 15, 2001 No. 167-FZ). Therefore, it will not be possible to submit an empty form under any circumstances. Unlike other forms of reporting, this cannot be “zero”.

► Who will be punished for the fact that the branch did not report

There is no ranking of punishments depending on the violation; any mistake is punishable by the same penalty: 500 rubles per person. The fines for a failed SZV-M and an absent one are equal.

Compared, for example, with tax legislation, which has a developed differentiated system of penalties, this seems unusual. Many hope that later, when an extensive database of appeals to the court and decisions on them has been accumulated, the amount of fines will be revised downward depending on the violation.

Try for free, refresher course

Documentation support for work with personnel

- Meets the requirements of the professional standard “Human Resources Management Specialist”

- For passing - a certificate of advanced training

- Educational materials are presented in the format of visual notes with video lectures by experts

- Ready-made document templates are available that you can

Error in the original SZV-M form

The most common option is when the certificate was submitted on time, but errors crept into it. Moreover, the flaws were noticed in the organization, and not in the Pension Fund. According to clause 39 of the Instructions for maintaining personalized records (approved by order of the Ministry of Labor No. 766n), such errors should not be punished. However, fines are still issued regularly.

The court decisions in such cases are clear: cancel the monetary penalty, and it does not matter in what form the reporting was submitted, paper or electronic (resolutions of the arbitration courts of the Far Eastern District dated 04.10.17 No. F03-924/2017, Povolzhsky dated 01.17.18 No. F06-28745 /2017, North Caucasus dated 09.20.17 No. A20-3775/2016, Sverdlovsk region 09.12.2016 A60-33366/2016 09.12.16, etc.).

► What reports to submit using new forms starting from February 2019

Forgotten employees

It sometimes happens, especially in organizations with a large staff, that one or more insured employees are not included in the report. The Pension Fund of Russia will impose a fine, can it be challenged if the adjustments are sent later than the 15th?

Legal practice in such situations, unfortunately, does not have a uniform focus. Some judges believe that the supplementary form represents a single text with primary reporting, therefore the application of punishment is unlawful: see, for example, Resolution of the Administrative Court of the East Siberian District dated October 5, 2017 No. A78-1989/2017. But there may also be the opposite option, when the Pension Fund is recognized as right, since there was no information about these persons in the original document (Resolution dated December 25, 2017 No. F03-5001/2017).

► When you cannot do without an employee’s signature on a document

Incorrect data for several employees

Difficulties are also raised by the question on what basis the amount of the fine is calculated. Is the basic penalty of 500 rubles per insured person multiplied by the number of all insured workers or only those for whom incorrect information was submitted? Once again, judicial practice does not provide a precise, unambiguous answer.

Some people believe that reports with errors are still considered passed, so the punishment should take into account the volume of errors. Therefore, if, for example, SZV-M contains information on 50 employees, of which 3 have incorrect SNILS numbers, then the fine should be 3 * 500 = 1500 rubles (resolution of the AS of the West Siberian District dated 08.23.17 No. A27-22235/ 2016).

But the opposite option also occurs, when the judge clearly takes the side of the Pension Fund of Russia (resolution of the Far Eastern District Court of 11.21.17 No. F03-4421/2017).

► Electronic document management in the personnel service: when to switch and where to start

Is it possible to downsize?

So, the employer has a chance to reduce the amount of fines. But to do this, you need to provide the court with evidence of your innocence. The claim is filed at the location of the defendant - to the territorial branch of the Pension Fund of Russia. Usually it is compiled by the legal department of the enterprise or a specially hired lawyer.

There has already been a list of circumstances that traditionally mitigate guilt in such cases. They are not legalized in official documents, and one should not fully rely on them. But they will be important in the judge’s analysis of the situation. Let's list them:

1. Short period of delay, not exceeding 16 days. The fine for failure to submit the SZV-M in this case may be reduced or even canceled.

2. The violation was committed for the first time. This proves that such misconduct is not normal for the organization and is unlikely to be tolerated in the future.

3. No claims for other payments to the Pension Fund. If an enterprise never delays the payment of insurance premiums, most likely, problems with reporting arose due to force majeure, emergency circumstances, and it makes no sense to punish a generally conscientious payer.

4. Proven facts and personal circumstances justifying the delay in reporting. This could be a certificate of temporary disability of the responsible official, a certificate from the city power supply organization about emergency restoration work, a document from the telecom operator about damage to the main cable in a specific area (internet connection failure), etc.

For your convenience, we have prepared a table in which all mitigating factors are collected with links to court decisions and the difference in the initial and final amounts of fines is clearly visible. Based on the texts of the decisions, you can develop a strategy for going to court.

| Details of the court decision | Mitigating circumstances taken into account by the court | Pension Fund fine, rub. | Fine by court decision, rub. |

| Resolution of the AS of the West Siberian District dated 10.10.17 No. A81-5854/2016 |

| 34 500 | 3 450 |

| Resolution of the AS of the East Siberian District dated 09/06/17 No. A78-15400/2016 |

| 08 000 | 1 000 |

| Resolution of the AS of the West Siberian District dated March 30, 2017 No. A27-17653/2016 |

| 411 500 | 20 000 |

| Resolution of the AS of the Ural District dated May 24, 2017 No. A76-27244/2016 |

| 54 500 | 5 450 |

| Resolution of the Volga-Vyatka District Administration of July 17, 2017 No. A28-11249/2016 | lack of electricity and network equipment malfunction | 74 000 | 0 |

Additional form SZV-M

By Resolution of the Board of the Pension Fund of February 1, 2016 No. 83p, a new form SZV-M was introduced, which is designed to identify officially employed pensioners. At first glance, it is quite simple, but there are some nuances that an accountant should know. In this article we will look at the supplementary form SZV-M of the 2016 model.

Let us remind you that this report is submitted monthly to the territorial office of the Pension Fund of Russia by the 10th day of the month following the reporting one. The SZV-M indicates all individuals with whom the employer has concluded an employment contract or a civil law contract.

Read about all the important points related to submitting this form in our “SZV-M” section.

Resolution No. 83p does not clearly indicate whether this report can be submitted before the end of the current month. Therefore, an organization can theoretically submit data before the end of the calendar period. But you should always remember that if, for example, employee data for the current month changes or errors are found in the form, you must report this to the Pension Fund.

For this purpose, SZV-M provides the “Additional” form type, that is, supplementary. Let's figure out how and when to submit a form with this feature.

IMPORTANT! The supplementary SZV-M must be submitted within the same period as the original ones, that is, before the 10th day of each month, and in 2017 - before the 15th day (Law dated July 3, 2016 No. 250-FZ). Otherwise, the company will be fined 500 rubles. for each incorrectly specified employee.

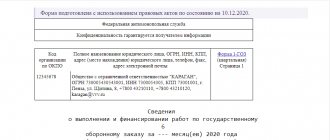

Procedure for filling out SZV-M for December 2021 - sample

The preparation of the report begins with entering information about the policyholder:

Registration number in the Pension Fund of Russia

It is assigned to each legal entity or individual entrepreneur upon registration with the Pension Fund and must be present on all reports sent to the fund. This is a 12-digit digital code, the correct filling of which can be checked, for example, on the Federal Tax Service website by requesting an extract from the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs.

Short name of the policyholder

Organizations take it from their constituent documents. If there is no “official” short name, the full name should be indicated.

Entrepreneurs indicate the abbreviation IP and their full name. An individual employer who is not an individual entrepreneur (for example, a lawyer or a notary) does not indicate anything other than his full name in this line.

TIN and checkpoint

Taken from the certificate issued by the Federal Tax Service. For a legal entity, a 10-digit TIN and a 9-digit KPP (reason code for registration) are used. Individual entrepreneurs and individuals who are not individual entrepreneurs indicate only a 12-digit TIN.

Reporting period

The month (in two-digit format) and year (in four-digit format) are indicated. For December 2021, “12” and “2020” are entered in this line, respectively.

Form type

One of the letter codes is displayed, depending on the version of the submitted report:

- “out” - if the form is submitted for the first time;

- “additional” - if the report includes information that supplements previously sent information;

- “cancel” - if the purpose of the submitted form is to cancel previously provided incorrect data.

Information about the insured persons

The report includes all employees with whom contracts related to the payment of remuneration were in effect during the reporting period (in this case, December 2021).

The data is presented in the form of a table consisting of 4 columns:

- Serial number. The order in which the insured persons are included in the report does not matter. This can be alphabetical, chronological (as contracts are concluded), or even random order.

- Full name of the insured person. We give it in the nominative case. Please indicate your middle name if available.

- ILS insurance number. We deposit on the basis of the SNILS certificate.

- TIN of an individual. This detail, unlike the previous ones, is not strictly mandatory and if the employer does not have this information, it may not be included in the report.

Next, information about the person signing the report is indicated and his personal signature is placed. For a legal entity, this is the head or the person performing his duties (in the latter case, indicate the details of the document confirming the authority of the representative). The individual entrepreneur or other individual employer signs the report personally. At the same time, in the line “Name of manager’s position” the status of the individual is indicated - entrepreneur, notary, lawyer, etc.

Possible reasons for filing an additional SZV-M report in 2021

There may be several reasons for filing a supplementary SZV-M.

| Reason for submitting supplementary SZV-M to the Pension Fund | Example | Report formatting method |

| SZV-M additional for a forgotten employee | Orange LLC submitted information on the SZV-M form on May 29, and on May 30 a new employee was hired. Since the employment contract appeared in the reporting period, information on the new employee must be transferred to the Pension Fund of Russia | It is necessary to use the SZV-M form with the “Additional” attribute in the 3rd section. However, the accountant will not fill out data for all employees. The report must include the last name, first name, SNILS and Taxpayer Identification Number of the new employee. |

| Cancelling and supplementing SZV-M in case of incorrect TIN | After submitting the reports, the accountant identified an inaccuracy in the indication of the TIN of employee P.V. Ivanov. It is necessary to correct the data for the Pension Fund of Russia | If the company has entered an erroneous TIN in SZV-M, then it is necessary to submit both the canceling and supplementing form SZV-M. In the first, the accountant will indicate the details of P.V. Ivanov with an incorrect TIN. And in the supplementary SZV-M there is also data on P.V. Ivanov, but only correct. Both forms must be submitted at the same time |

| Supplementary form SZV-M in case of an error in SNILS | After submitting the reports, the financial department of Romashka LLC discovered that the SNILS of two employees were mixed up | If the report is partially accepted, then the supplementary form will be submitted only to employees with an incorrect SNILS. If a completely negative protocol is received, then it is necessary to submit the data again as original |

Please note that indicating the Taxpayer Identification Number (TIN) in the SZV-M form is currently not necessary - you can learn about this from our selection of current changes.

This means that if the TIN in the report is not filled out for all employees, then a supplementary report will not be required.

The report on the SZV-M form is quite simple to fill out. If there is a clear record of employees indicating the correct data for each of them, the organization should not have the need to submit a supplementary form of this report.

Changes to SZV-M from 2021

We will submit the SZV-M report for December 2021 according to the same rules. And according to reporting to the Pension Fund of Russia, changes are possible from 2021. The Ministry of Labor plans to change the rules for submitting SZV-M (project ID 01/05/09-20/00107825):

- If the number of individuals is more than 10 people, SZV-M can be submitted to the Pension Fund only in electronic form (currently this number threshold is 25 people).

- There will be new rules for submitting SZV-M through authorized representatives. They will be able to submit reports for employers using an electronic power of attorney signed by the principal’s UKEP (now the power of attorney is paper).

SZV-M - supplementary form: is a fine possible?

The wording of Law 27-FZ is such that for the delivery of a supplementary SZV-M, the policyholder can actually be charged a fine of 500 rubles. for each insured person for whom individual information was not submitted on time (Article 17 of Law No. 27-FZ dated April 1, 1996). After all, submitting an adjustment for SZV-M indicates that you made a mistake in the previous report for the same month.

Let’s say the organization’s accountant forgot to include in the SZV-M report the contractor with whom the GPA was concluded in the reporting month. After the deadline established for submitting the form, she submitted the supplementary SZV-M form, indicating in it the full name, INN and SNILS of this performer. Formally, the Pension Fund of Russia has grounds to hold the organization accountable and demand payment of a fine of 500 rubles. However, some branches of the Fund have already received orders from above not to fine policyholders for supplementary SZV-M forms.

Therefore, if in a similar situation you receive from the Pension Fund a desk audit report, according to which your organization will be held accountable and asked to pay a fine for the SZV-M supplement, do not rush to comply with the Fund’s requirement. Write objections, and perhaps the act will be cancelled.

Results

In response to a notification from the Pension Fund of the Russian Federation regarding SZV-M, only clarifications are required to be submitted - if there are errors in the reporting. But it is better to respond to the fund even if there are no errors. Moreover, as you can see, this is not at all difficult to do.

Sources: instructions “On maintaining personal accounting”, approved. by order of the Ministry of Labor dated December 21, 2016 No. 766n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What is the meaning of the abbreviation SZV-M?

In thematic Internet communities there are heated debates about what the decoding of the SZV-M form is.

The most common options:

- information on earnings (remuneration) submitted monthly;

- information about the insured (incoming), submitted monthly, with explanations of the abbreviation:

- “B” - incoming information (submitted to the Pension Fund); the letter “I” is used to encode documents originating from the Pension Fund;

- “M” - indicates the frequency of reporting, i.e. monthly.

And if the first version of the decoding does not even meaningfully relate to the SZV-M form (it does not contain information about employee remuneration), then the second does not seem to be erroneous, since it carries the semantic load of the report and coincides with the name of the form indicated in the document that approved it.

But, in fact, it is not an abbreviation, but only a symbol, i.e. a unified code approved by Pension Fund documents. Evidence of this will be discussed below.

For information on the required details in the report file name, see the article “PFR territorial body code for SZV-M”.

The SZV-M form was approved by the resolution of the Pension Fund of the Russian Federation “On approval of the form “Information about insured persons”” dated 01.02.2016 No. 83p).

For other accounting documents, not only legally approved forms are provided, but also instructions for filling them out (Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 2p).

If you carefully review the instructions, in the table “List of Persuchet Document Forms” the names of the reports are located in the “Symbol” column. And an analysis of the correlation between the columns “Name of the form” and “Symbol” will not give us confirmation that the names of the Pension Fund forms are compiled by abbreviation.

Let's compare:

- SZV-M “Information about insured persons”;

- ADV-3 “Application for issuance of a duplicate insurance certificate”;

- ADI-7 “Insurance certificate of compulsory pension insurance” (a document issued by the Pension Fund of the Russian Federation, with the letter “I” in the designation).

Thus, it is obvious that in the instructions itself the Pension Fund enshrines symbols (codes) that define reporting features that correspond to certain forms of accounting and are in no way strictly related to their names. This can be confirmed in the basics of archiving.

To learn about the cases in which an accepted SZV-M report may entail the accrual of a fine, read the material “You need to open all protocols on SZV-M - if positive, a fine is also possible.”

See also: “For the wrong month in SZV-M you will be fined.”

The Fund has issued a number of documents that are included in the Unified Accounting System. All these forms have certain symbols (which are enshrined in the instructions for filling them out), which are not abbreviations. Therefore, trying to find the decryption key to their name yourself is pointless.

Explanatory note to the Pension Fund for adjustments, sample

Explanation to the Pension Fund for SZV-M: if there are fewer employees in the report

> > > July 11, 2021 An explanation to the Pension Fund regarding SZV-M may be required in different situations.

One of them, and a fairly common one, is the reduction in the number of employees in the current report compared to the previous one. See how to write such an explanation and what documents to attach to it so that the fund does not have any questions.

Inaccuracies in SZV-M are not uncommon. Therefore, having received a report from you with fewer employees than last time, the fund suspects an error. Find out what are the most common mistakes in SZV-M.

We recommend reading: Duty of the housing brotherhood

To catch you doing it or, conversely, to make sure that you did everything correctly, he will send you a notification. The frequency and criteria for sending notifications are not legally established; each department of the fund sets its own. Therefore, you can receive such notifications at least monthly - for each submitted report.

What should you do if you received a notification from the Pension Fund that errors in SZV-M have been corrected? Naturally, you need to double-check the report. And then there will be two options for action: 1.

The error was confirmed, and you really missed someone. This means you will have to submit a supplementary form and, most likely, pay a fine.

You can avoid sanctions if you complete the report before the deadline for submitting the form (the 15th). But here you are unlikely to fit into it. Let us remind you that the form with the “supplementary” type is submitted only to forgotten people, and the fine is 500 rubles.

for every loss. You will find details for paying the fine.