Currently, the construction business is developing at warp speed. New technologies and materials are emerging. Having good knowledge in this area, you can create a very successful business. There are quite a lot of options for developing your undertaking. Having chosen the one that is more suitable for you, you need to take into account all the nuances so as not to lose your invested money. This is what scares most entrepreneurs away. So what should you pay attention to so that your business does not fall into the category of unprofitable ones? The answer is simple: Accounting for construction costs. If you wisely control construction costs, the amounts spent will not only pay off, but will also turn into a good profit.

What is the idea behind cost accounting in construction?

As soon as the construction organization is registered as a legal entity, the management process begins. Management decisions can be made by managers only when there is data obtained in the course of work. The result should be an analysis of all decisions made on a particular issue. It is most convenient to monitor decisions made using indicators. They can be expressed both numerically and as a percentage.

We can conclude that competent management is possible only when all the data is reliable. To create an overall picture, it is important to take into account not only general information, but also information about the work of all departments.

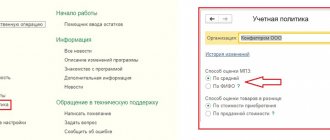

In the modern world, for a company to be successful, it is important to make the right decisions. But this cannot be achieved without planning, analysis and control. Cost accounting in construction using Finoco technologies is the method that allows you to combine all this.

Classification of direct and indirect costs

It should be understood that in each individual case, the classification of costs into direct and indirect requires an individual approach, since cost items can differ significantly even for companies operating in the same industry.

In general, the classification of direct costs can be presented as follows.

- Direct material costs:

- raw materials and materials;

- components and semi-finished products;

- energy for main production equipment.

- Direct labor costs:

- salaries of key production personnel.

- depreciation of capital production equipment;

- advertising costs for a specific product;

- fare;

- packaging costs;

- commissions to sales agents.

The classification of indirect costs in aggregate form is as follows.

- Indirect material costs:

- energy for auxiliary production equipment.

- wages of production support personnel;

- salaries of administrative and management personnel.

- depreciation of auxiliary production equipment;

- advertising costs for the company as a whole;

- administrative and general expenses;

- professional services costs;

- other expenses.

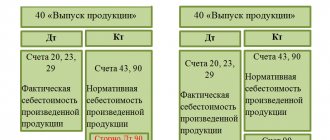

The figure below shows an example of the classification of direct and indirect costs.

Features of cost accounting in construction

The peculiarity of cost accounting in construction is that the direction itself is not simple. For example, each project in a company has its own duration, or the construction process is very unique. It is also taken into account that each project goes through more than one approval stage and there must be an estimate. The estimate is the beginning of any construction project. And there are a lot of such moments in this type of business.

According to statistics in the Russian Federation, for each director there are 2.4 legal entities. There are many reasons for this: work in different tax entities, different asset ownership structures, the desire to reduce tax payments, and much more. In this case, keeping a consolidated account of the contractor’s costs and calculating the real profit of the construction project becomes not easy.

There is no secret that it is necessary to keep track of expenses in construction. In the absence of this accounting, the organization automatically faces a high risk of becoming insolvent. As a result of such actions, bankruptcy is not far off.

Housing construction costs

The developer organizes the construction of facilities, monitors its progress, and also maintains accounting records of the costs incurred. How to ensure the completeness and reliability of expenses reflected in accounting? Let's figure it out.

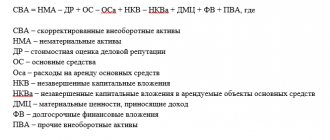

Methodology problems According to the chart of accounts and instructions for its use, account 08 “Investments in non-current assets” is intended to summarize information about the organization’s costs in objects that will subsequently be accepted for accounting as fixed assets, land plots, and intangible assets. The chart of accounts and instructions were approved by order of the Ministry of Finance of Russia dated October 21, 2000 No. 94n.

The main methodological problem is that developers who are not investors in the construction project do not form a fixed asset item on their balance sheet upon completion of construction (Debit 01 Credit 08 subaccount “Construction of fixed assets”). The capital investment object is transferred according to the acceptance certificate to investors (shareholders) (Debit 86 (76) Credit 08 subaccount “Construction of fixed assets”).