Agency agreement: types and rules

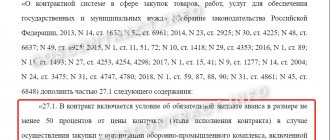

The essence of an agency (intermediary) agreement comes down to the presence between the 2 parties to the transaction (seller and buyer) of a third party (intermediary), whose role can be:

- commission agent;

- agent;

- attorney.

For a sample agreement, see the material “Agency Agreement - Sample Completion for Legal Entities.”

The activity of an intermediary is to carry out legally significant actions on its own behalf or on behalf of the guarantor (principal, principal, principal), leading to the consequences of these actions for the guarantor.

Despite the fact that in the Civil Code of the Russian Federation (Chapter 52) the agency agreement is distinguished as an independent type, it, in fact, combines two types of agreements:

- orders (Chapter 49), when the agent acts on behalf of the guarantor and the rights/obligations under the transaction arise directly from the guarantor;

- commission (Chapter 51), when an agent acts on his own behalf and he also acquires rights/obligations under the transaction.

The following features of agency agreements are important for accounting:

- income and expenses from intermediary transactions arise from the guarantor;

- the income of the intermediary becomes the agency fee paid to him by the guarantor;

- The money and property of the guarantor received by the intermediary in connection with the order assigned to him are only means for executing the order and are not reflected in the income/expenses of the intermediary;

- the intermediary's costs associated with the execution of the agency agreement and reimbursed to him by the guarantor do not constitute the income/expenses of the intermediary;

- the volumes of functions performed by the intermediary and the reimbursable costs incurred by him, confirmed by documents, are reflected in the intermediary’s report, which is the primary accounting document for the guarantor and is considered accepted if he has no objections to it.

Ready-made solutions from ConsultantPlus will help you check the agency agreement for risks:

Get free access to K+ and go to the Ready-made solution for the principal.

And this link will take you to the Ready Agent Solution if you have access to K+. If you don't have it, you can get trial access for free.

There are two main schemes of actions passing through an intermediary:

- sales;

- purchases.

When concluding agency agreements, accounting should be organized using postings through account 76 with details of the types of calculations for analytics. The intermediary’s income, depending on the accounting policy, can be generated either on account 90 or 91.

See also “How to correctly make entries under an agency agreement.”

Answers to questions on accounting for agency agreements

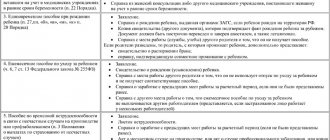

Question No. 1. Does an agent need a power of attorney to conduct mediation operations?

Conducting agency agreements on behalf of the principal requires the execution of a power of attorney. For commission agreements, when conducting transactions on behalf of the commission agent, there is no need to draw up a power of attorney.

Question No. 2. How important are the agent’s reports on fulfilled obligations and indicating them in the contract?

The presence in the agency agreement of a clause on the need to submit reports is an important provision of the document. In its absence, inspectors of the Federal Tax Service may present the transaction within the framework of a purchase and sale agreement, which entails more significant taxation.

Question No. 3. Is it possible for an agent to use any expenses arising in the performance of obligations when taxing profits?

No, only the costs listed in Chapter. 25 of the Tax Code of the Russian Federation and directly related to the transaction. If the company conducts activities other than intermediary, separate analytical accounting of expenses is necessary.

Question No. 4. How can an agent avoid paying VAT if an advance is transferred from the principal to make payments, but the reward from the transaction is not received?

Due to the fact that the principal’s funds are not the property of the agent, VAT obligations can be avoided by including in the contract a condition on payment for services after shipment of goods (fulfillment of obligations with approval of the report).

Question No. 5. How are functions distributed under subagency agreements?

When concluding a subagency agreement, the agent under the first agreement becomes a principal in relation to the subagent. The agent is responsible for the actions of the subagent.

Rate the quality of the article. We want to be better for you:

Accounting for agency agreements

Accounting for sales through an agent

Acting on behalf of the guarantor, the agent essentially provides him with the service of finding a buyer. Documents for the buyer are drawn up by the actual seller, and he also generates income/costs for the transaction:

- the implementation is shown: Dt 62 Kt 90;

- VAT is charged under an agency agreement on sales: Dt 90 Kt 68;

- the agent's services and expenses reimbursed to him are taken into account: Dt 20 (26, 44) Kt 76;

- is allocated and accepted for deduction of VAT on the agent’s services and expenses reimbursed to him:

- Dt 19 Kt 76;

- Dt 68 Kt 19;

For information about the procedure for settlements with an agent, see the article “Procedure for payment of remuneration under an agency agreement.”

- the total amount of costs, which also includes the guarantor’s own expenses, reduces the income from sales: Dt 90 Kt 20 (23, 25, 26, 41, 43, 44).

In this case, the agent has in his records:

- income from services rendered will be reflected: Dt 76 Kt 90;

- VAT will be charged: Dt 90 Kt 68;

- Reimbursable costs for the provision of services will be taken into account: Dt 76 Kt 60;

- money will be received from the guarantor for the service and reimbursement of costs: Dt 51 Kt 76.

To learn about when an agent’s services are not subject to VAT, read the article “Which intermediary services are not subject to VAT .

When an agent acts on his own behalf, he draws up documents for the buyer himself and all payments go through him. However, the goods received for sale remain the property of the guarantor. The funds received from the buyer are also the funds of the guarantor. The agent, as a rule, withholds the remuneration intended for him from the amount received from the buyer before transferring it to the guarantor.

For such agency agreements, accounting is organized according to the following rules:

- The receipt of goods intended for sale by the agent will be reflected in the balance sheet by the entry: Dt 004;

- the shipment will be shown to them at the full sales price in the correspondence of the account of settlements with the buyer with the account of accounting for settlements with the guarantor: Dt 62 Kt 76;

- at the same time the goods will be written off from the off-balance account: Kt 004;

- money received from the buyer is taken into account in the usual manner (including advances): Dt 51 Kt 62.

Moreover, the obligation to charge VAT on advances received from the buyer falls on the guarantor.

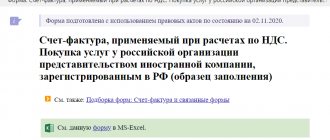

Read how to correctly reissue invoices under an agency agreement here.

Through postings to account 76, the intermediary’s income and the amount intended for transfer to the guarantor are formed:

- The intermediary's remuneration is taken into account: Dt 76 Kt 90;

- VAT is charged on remuneration: Dt 90 Kt 68;

- the intermediary's expenses reimbursed by the guarantor are reflected: Dt 76 Kt 60;

- the total amount of debt to the guarantor is transferred to him: Dt 76 Kt 51.

The guarantor's entries for sales and cost accounting will be the same as when selling on his behalf, with the only difference being that the amount of shipment will correspond to that indicated in the documents drawn up in the name of the buyer by the intermediary, the entry for payment to the intermediary will disappear and additional accounting entries will appear shipment and payment from the buyer:

- the goods were transferred for sale to the intermediary: Dt 45 Kt 41 (43);

- at the time of sale of the transferred goods: Dt 90 Kt 45;

- receipt of money to the guarantor from the intermediary (minus his remuneration and reimbursable expenses): Dt 51 Kt 62;

- accounting in the funds due from the buyer for the amounts of remuneration and reimbursable expenses withheld by the intermediary: Dt 76 Kt 62.

For information on the rules for issuing invoices for sales involving an intermediary, read the material “How to issue invoices when selling goods through an intermediary?”

Status difference

The pros and cons of working under an agency agreement begin with the status. A person with employee status submits an application for a job and signs an employment contract. It is compiled in fact according to a standard form. The employer has the right to make additions that do not detract from the rights of the employee. And from the moment of signing or actually entering work, labor legislation begins to apply.

By providing the services of an agent, a person acquires rights and obligations in accordance with civil law, and his partner has more freedom to establish the rules of cooperation.

A fairly high degree of freedom in determining the terms of cooperation is both a plus and a minus, depending on which point of view is closer.

Accounting for purchases through an agent

If the agent acts on behalf of the buyer, he actually provides him with the service of finding a supplier. The seller will issue the documents directly to the guarantor, and the buyer will incur the costs of the intermediary’s services:

- goods (work, services) received: Dt 10 (20, 23, 25, 26, 41, 44) Kt 60;

- allocated and accepted for deduction of VAT on purchases:

- Dt 19 Kt 60;

- Dt 68 Kt 19;

- Dt 19 Kt 76;

- Dt 68 Kt 19;

In such a situation, the agent’s entries for recording income will be the same as when he was involved in sales on behalf of the guarantor.

An agent acting on his own behalf during procurement will receive purchase documents issued in his own name. However, neither the purchased goods nor the funds that he will receive from the guarantor to pay for the purchase will be his property.

The goods purchased by the agent for the guarantor will be reflected on the balance sheet: Dt 002.

In the balance sheet, the purchase will be shown to them at the full cost of the purchase in correspondence between the account for settlements with the supplier and the account for accounting for settlements with the guarantor: Dt 76 Kt 60.

Money received from the guarantor and transferred to the supplier will be included in the following entries:

- Dt 51 Kt 76;

- Dt 60 Kt 51.

When the goods are transferred to the guarantor, they will be written off from the off-balance sheet account: Kt 002.

The intermediary's remuneration and the amounts to be reimbursed to him by the guarantor will be formed as follows:

- The intermediary's remuneration is taken into account: Dt 76 Kt 90;

- VAT is charged on remuneration: Dt 90 Kt 68;

- the intermediary's expenses reimbursed by the guarantor are reflected: Dt 76 Kt 60;

- funds are received from the guarantor to pay for remuneration and reimbursable expenses (if they were not initially received in an amount greater than what had to be paid to the supplier): Dt 51 Kt 76.

The guarantor's purchase and cost accounting transactions will be the same as when purchasing on his behalf, with the only difference being that the purchase amount will correspond to that indicated in the documents drawn up in the name of the intermediary by the seller, and settlements for the purchase will not be made directly with the supplier, but through an intermediary:

- goods (work, services) received: Dt 10 (20, 23, 25, 26, 41, 44) Kt 76;

- allocated and accepted for deduction of VAT on purchases:

- Dt 19 Kt 76;

- Dt 68 Kt 19.

Agency agreement with a foreign company - features of VAT payment

When a Russian organization enters into an agency agreement with a foreign company, it will have to pay VAT if intermediary services are provided on the territory of the Russian Federation. There is a separate letter from the Ministry of Finance of the Russian Federation dated December 2, 2011 No. 03-07-08/339 on this matter.

The essence of the explanations from the financial department is as follows: intermediary services under such agreements are considered to be provided in the place where the company providing them operates. In the above case, services are provided by a Russian organization in our country, and it is here that VAT should be applied at a 20 percent rate.

Results

Accounting for agency agreements has its own specifics and differs depending on whether the intermediary is involved in the calculations or not. Funds and property received by the intermediary in connection with the execution of the order are not taken into account by him in the balance sheet and do not become his income.

Sources: Civil Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Features of agent accounting

Receipts to the intermediary from partners and property received to fulfill obligations are not income of the agent. The agent may participate in settlements of the principal amounts of the contract or settlements are made directly from third parties. The procedure for making payments is established by the agreement.

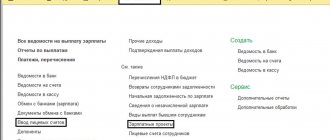

Accounting for transactions with the agent is carried out on account 76, to which sub-accounts are opened and numbered in an order convenient for accounting:

- 76/1 “Settlements of obligations” for accounting for receipts and transfers under the intermediary agreement.

- 76/2 “Calculations of remuneration” for accounting for accrued and transferred amounts of remuneration.

- 76/3 “Calculations for compensation of expenses” for conducting operations to record the agent’s expenses related to the fulfillment of obligations.

If intermediaries within the framework of agency agreements must take into account operations for the supply of inventory items, account 002 “Inventory items accepted for safekeeping” is used to account for material assets. The assets received by the agent do not become the property of the intermediary and continue to belong to the principal. In some cases, the fact of receipt for storage is formalized in a separate contract with insurance and payment.