Purchasing goods for the principal: algorithm for re-issuing an invoice

When purchasing goods for the principal, the chain of interaction for issuing an invoice differs from that described above:

- the supplier issues an invoice in your name (as an agent) and registers it in its sales book;

- you enter it in part 2 of your invoice journal;

- then, on your behalf, issue an invoice with similar indicators to the principal (indicate the actual supplier as the seller) and record it in Part 1 of the accounting journal;

- The principal records the invoice received from you in his purchase ledger.

Familiarize yourself with the position of the Ministry of Finance on the nuances of issuing agency invoices.

If an agent purchased goods for several principals and the invoice contains data for the entire purchase, when re-issuing an invoice to each principal, the agent must transfer information only on those goods (services or works) that were intended specifically for this principal (letter of the Federal Tax Service dated April 18 .2014 No. GD-4-7/ [email protected] ).

Read about deducting VAT from the principal when purchasing goods through a chain of intermediaries here.

We remind you of the rules for issuing invoices for intermediary transactions

Publication date: 12/28/2013 12:30 (archive)

Receiving an invoice by an intermediary

As a general rule, if an intermediary (agent) purchases goods, works or services on its own behalf, the seller (supplier) issues invoices in his name. Having received such an invoice from the seller, the intermediary must register it in part 2 of the log of received and issued invoices. There is no need to make an entry in the purchase book, since the goods belong to the principal, and the agent does not have the right to deduction (subparagraph “d”, paragraph 19 “On the forms and rules for filling out (maintaining) documents used in calculations of value added tax”, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137).

Re-invoicing The intermediary must then re-invoice the customer, duplicating the data from the supplier's invoice in the intermediary's name. That is, the agent does not indicate his details, but information about the real seller of these goods. Indeed, in subparagraph “c” of paragraph 1 of the Rules for filling out an invoice, it is clearly stated: when issuing invoices to the principal (principal), the intermediary (agent or commission agent), purchasing goods, work, services or property rights on his own behalf, indicates the full or abbreviated name the seller who is a legal entity, or the last name, first name and patronymic of the seller - an individual entrepreneur. In this case, the specified invoices are signed by the agent. The agent may additionally indicate his name, address and Taxpayer Identification Number/KPP in such an invoice. It is safer to enter this information after filling out all the necessary details.

The reissued invoice must be registered in part 1 of the journal of received and issued invoices (clause 7 of the journal rules). No entry is made in the sales book, because the agent has no obligation to charge VAT (clause 20 of the Rules for maintaining the sales book). In addition to the re-issued invoice, the intermediary gives the customer a copy of the original invoice issued by the supplier, certifying it with his signature (subparagraph “a” of paragraph 15 of the Rules for filling out an invoice).

Purchasing goods for several customers

It is not uncommon for an agent to purchase goods or services for several principal buyers.

In this case, in the invoice reissued to the principal, the quantity of goods (volume of services) will be less than the quantity indicated in the copy of the invoice issued to the agent by the seller. Will this create obstacles to obtaining a VAT deduction? No, it won't. Such a discrepancy is not a basis for refusing a deduction from the principal. “Consolidated” invoices The Rules do not provide for the procedure for agents to issue consolidated invoices based on several documents received from different principals. Therefore, the agent does not have the right to combine invoices into one and issue a “consolidated” invoice to the buyer.

How can an intermediary, forwarder, or developer issue an invoice?

The procedure for filling out an invoice by intermediaries (developers, forwarders) from 01/01/2019 is shown in the table:

| Line number (columns) of the invoice | Content |

| Line 1 |

The serial numbers of such invoices are indicated by each taxpayer in accordance with their individual chronology of invoicing |

| Line 1a | The serial number of the correction made to the invoice and the date of this correction. When drawing up an invoice, before making corrections to it, a dash is placed in this line |

| Line 2 |

|

| Line 2a |

|

| Line 2b |

|

| Line 3 | The intermediary indicates the full or abbreviated name of the shipper in accordance with the constituent documents. If the seller and shipper:

When drawing up an invoice for work performed (services provided), property rights, the seller puts a dash in this line. When drawing up an invoice by a commission agent (agent) purchasing goods and materials from two or more sellers on his own behalf, the full or abbreviated names of the shippers and their postal addresses are indicated (through the sign “;” (semicolon)) |

| Line 4 | The intermediary indicates the full or abbreviated name of the consignee in accordance with the constituent documents and his postal address. When drawing up an invoice for work performed (services provided), property rights, the seller puts a dash in this line. When the principal (principal) draws up an invoice issued to a commission agent (agent) selling 2 or more goods and services buyers on his own behalf, the full or abbreviated names of consignees and their postal addresses are indicated (through the sign “;” (semicolon)) |

| Line 5 |

|

| Line 6 |

|

| Line 6a | The address of the buyer indicated in the Unified State Register of Legal Entities, within the location of the legal entity, the place of residence of the individual entrepreneur indicated in the Unified State Register of Individual Entrepreneurs - when the principal (principal) draws up an invoice issued to the commission agent (agent) selling goods and services on his own behalf |

| Line 6b | The intermediary indicates the INN and KPP of the taxpayer-buyers through the sign “;” (semicolon) |

| line 7 | The intermediary indicates the name of the currency for the goods listed in the invoice and its digital code in accordance with OKV (All-Russian Classifier of Currencies) |

| Line 8 | The line is filled in when issuing an invoice under a government contract for the supply of goods (performance of work, provision of services), a contract (agreement) on the provision of subsidies from the federal budget to a legal entity, budget investments, contributions to the authorized capital (if any) |

| Box 1 |

|

| Box 1a | The column is intended to reflect the code of the type of product in accordance with the unified Commodity Nomenclature of Foreign Economic Activity of the EAEU. The data is indicated in relation to goods exported outside the territory of the Russian Federation to the territory of a member state of the EAEU; If there is no data, a dash is placed |

| Columns 2 and 2a | If there is an indicator, a unit of measurement (code and the corresponding symbol (national) in accordance with sections 1 and 2 of the All-Russian Classifier of Units of Measurement) (if it is possible to indicate it). If there are no indicators, a dash is placed |

| Column 3 | Quantity (volume) of goods (work, services) supplied (shipped) according to the invoice of the principal (principal) based on the accepted units of measurement (if it is possible to indicate them) |

| Column 4 | The price (tariff) of a product (work performed, service rendered), transferred property right per unit of measurement (if it is possible to indicate it) under an agreement (contract) excluding VAT, and in the case of using state regulated prices (tariffs) that include VAT, taking into account the amount of tax. If there is no indicator, a dash is placed |

| Box 5 | The cost of the entire quantity (volume) of goods supplied (shipped) according to the invoice of GWS without VAT |

| Box 6 | The amount of excise duty on excisable goods. If there is no indicator, the entry is made: “Without excise tax” |

| Column 7 | Tax rate |

| Column 8 | VAT amount |

| Column 9 | The cost of the entire quantity of goods and materials supplied (shipped) according to the invoice, including VAT, and in the case of receiving a payment amount, partial payment on account of upcoming supplies of goods and materials - the received amount of payment, partial payment |

| Columns 10 10a | Country of origin of the product (numeric code and corresponding short name) in accordance with the All-Russian Classifier of Countries of the World. These columns are filled in for goods whose country of origin is not the Russian Federation |

| Box 11 | This column is filled in for goods whose country of origin is not the Russian Federation, or for goods released in accordance with the customs procedure for release for domestic consumption upon completion of the customs procedure for the free customs zone on the territory of the SEZ in the Kaliningrad region |

How to keep an invoice log as a reseller

The preparation of invoices and their accounting journal by firms on the simplified tax system engaged in intermediary activities has its own characteristics. In addition, since 2015, such companies have been required to maintain a log of invoices received and issued in relation to intermediary activities.

Companies on the simplified tax system with taxable objects of both “income” and “income reduced by the amount of expenses” often participate in intermediary transactions in the role of an attorney, commission agent or agent. They sell goods (works, services) and also make purchases on their own behalf. Despite the fact that “simplified people” are not VAT payers, now in the event that they issue or receive invoices when carrying out business activities in the interests of another person on the basis of intermediary agreements providing for the sale or acquisition of goods (works, services), property rights on behalf of commission agent (agent), or on the basis of transport expedition contracts, as well as when performing the functions of a developer, are required to keep a log of received and issued invoices in relation to the specified activity. This requirement has been enshrined in the Tax Code of the Russian Federation since January 1, 2015.

GOOD TO KNOW

The essence of the intermediary agreement is that one party (the intermediary), on behalf of the other party (the customer), performs certain actions, for which the customer pays the intermediary a remuneration.

Maintaining invoice logs is carried out for the purpose of registering, storing and transmitting to tax authorities information about invoices that intermediaries issue to buyers and receive from sellers as part of intermediary activities. In relation to intermediaries, no tax obligations, as well as rights to deductions, arise for such invoices. However, guided by information from invoice logs received from intermediaries, tax inspectorates will be able to monitor the compliance of VAT amounts accrued, for example, by principals when selling goods (works, services), with the VAT amounts that their buyers accept for deduction. Or, on the contrary, the correspondence of VAT deductions declared by the principals for goods (works, services) purchased for them, with the amounts of tax accrued for payment to the budget by sellers of the specified goods (works, services).

Thus, in order to submit the necessary information to the tax office, intermediaries must register in the invoice journal:

- invoices issued by customers to buyers for goods (work, services, property rights) sold by intermediaries;

- invoices issued by sellers in the name of the intermediary when purchasing goods (works, services, property rights) for the customer. On such invoices, sellers must charge VAT, and customers have the right to deduct the tax;

- invoices issued to customers on their own behalf when selling goods (work, services, property rights) belonging to customers. On such invoices, customers must charge VAT, and buyers have the right to deduct the tax;

- invoices issued by intermediaries to customers for goods (work, services, property rights) purchased from sellers.

IMPORTANT IN WORK

A log of received and issued invoices must be kept for each tax period, that is, quarterly.

As stated in clause 1 of Appendix No. 3 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 (hereinafter referred to as Decree No. 1137), you can keep an invoice journal both on paper and in electronic form. However, the journal can be submitted to the inspectorate as tax reporting only in electronic form via telecommunication channels (clause 5.2 of Article 174 of the Tax Code of the Russian Federation). It follows from this that it is wiser for intermediaries who are not VAT payers and are not recognized as tax agents to immediately keep invoice logs in electronic format. In addition, no later than the 20th day of the month following the expired tax period (quarter), “simplified” intermediaries must submit an accounting log, and only in electronic form and via telecommunication channels through an electronic document management operator.

The procedure for filling out and submitting an invoice journal to the tax office

In accordance with clause 1 of Appendix No. 3 to Resolution No. 1137, the invoice journal consists of two parts:

- Part 1 “Issued invoices”;

- Part 2 “Received invoices”.

The procedure for filling out the log of received and issued invoices is set out in paragraphs. 3–12 of Appendix No. 3 to Resolution No. 1137. When maintaining a journal, you must use transaction type codes:

- according to the list approved by order of the Federal Tax Service of Russia dated February 14, 2012 No. ММВ-7-3/83;

- according to the additional list recommended by the letter of the Federal Tax Service of Russia dated January 22, 2015 No. GD-4-3/794.

As follows from the provisions of paragraph 3, paragraphs. “b” clause 7 of Appendix No. 3 to Resolution No. 1137 and letter of the Ministry of Finance of Russia dated May 16, 2012 No. 03-07-09/57, invoices (including corrected, adjustment ones), drawn up both on paper, and in electronic form, are subject to a single registration in the relevant part of the journal in chronological order:

- in Part 1 “Issued invoices” - by the date of issuance of electronic invoices or by the date of preparation of paper invoices, as well as by the date of preparation (correction) in cases where invoices are not transferred to counterparties;

- in part 2 “Received invoices” - by the date of their receipt.

IMPORTANT IN WORK

The law does not prohibit the inclusion of additional information in invoices. The main thing is not to violate the sequence of arrangement of the required details.

If primary invoices (including corrected ones) are registered in the journal, columns 16–19 of parts 1 and 2 of the accounting journal are not filled in. When registering adjustment invoices (including corrected ones) in columns 8–19 of parts 1 and 2 of the accounting journal, updated data should be indicated. If the data in columns 8–19 has not been clarified, it is necessary to reflect in them the indicators indicated in the invoice before corrections were made to it.

If there are no invoices issued (received) during the tax period (including adjustment, corrected, compiled, but not subject to issue), only the lines of the relevant parts of the journal (name of the taxpayer, INN/KPP, etc.), tabular parts of the journal remain empty (clauses 8, 12 of Appendix No. 3 to Resolution No. 1137).

According to the procedure provided for in paragraph 13 of Appendix No. 3 to Resolution No. 1137, no later than the 20th day of the month following the expired quarter, the journal of received and issued invoices on paper must be certified by the head of the organization (his authorized person), laced, and its pages are numbered and sealed. When maintaining a journal in electronic form, it must be certified with the electronic signature of the head of the organization (the person authorized by him) when transferred to the tax office.

In accordance with clause 5.2 of Art. 174 of the Tax Code of the Russian Federation, intermediaries who are not VAT payers (or are exempt from VAT) must submit invoice logs in electronic form to the tax inspectorate. The deadline for submission is no later than the 20th day of the month following the reporting quarter. The electronic format of the journal was established by order of the Federal Tax Service of Russia dated March 5, 2012 No. ММВ-7-6/138.

POSITION OF THE MINISTRY OF FINANCE

When selling goods (works, services), the intermediary acting on behalf of the customer does not issue any invoices. He only receives a completed invoice from the customer and transfers it to the buyer. That is, the customer himself must issue an invoice to the buyer on his own behalf. For goods (works, services) purchased by an intermediary on behalf and at the expense of the customer, invoices are issued by suppliers in the name of the actual customer, and not the intermediary.

— Letters dated October 12, 2010 No. 03-07-09/45, dated October 22, 2013 No. 03-07-14/44201.

Storing a journal of invoices and documents

The storage period for the log of received and issued invoices is four full years from the date of the last entry (clause 13 of Appendix No. 3 to Resolution No. 1137).

In addition to maintaining a journal of registration of invoices, the organization is obliged to store (file in chronological order) the invoices themselves (including adjustments, corrected ones), confirmations of electronic document management operators. In this case, invoices issued electronically can be stored without printing (letter of the Federal Tax Service of Russia dated 02/06/2014 No. GD-4-3/1984).

When does an agent need to issue an additional invoice?

In addition to shipping invoices (the procedure for issuing which is described above), the agent must issue another one to the principal. This need arises for agents who pay VAT.

This is due to the fact that for an agent - a VAT payer, income for tax purposes is the remuneration under the agency agreement (clause 1 of Article 156 of the Tax Code of the Russian Federation), therefore, for its amount the agent:

- issues an invoice to the principal (as in the normal sale of goods, work or services);

- registers it in the sales book with code 01 (Articles 168–169 of the Tax Code of the Russian Federation).

The costs transferred by the agent to the principal under the agency agreement (related to its execution) do not form an object of VAT taxation - the agent does not need to take into account their amount when calculating income tax (subclause 9, clause 1, article 251, clause 9, article 270 of the Tax Code of the Russian Federation) .

Find out when and how consolidated invoices can be issued in agency relationships.

Invoice from intermediary

The procedure for calculating VAT, drawing up invoices and reflecting them in the purchase book and sales book - this is not a complete list of issues that accountants face when processing transactions under intermediary agreements.

There are three types of intermediary relationships: under a commission agreement, commission or agency agreement. Conventionally, they can be divided into two types.

The first includes activities that the intermediary conducts on behalf and at the expense of the principal. Typically these are operations carried out under an agency agreement. Operations under an agency agreement can be carried out according to the same scheme. The second type of intermediary activity includes situations when transactions are carried out by an intermediary on his own behalf, but at the expense of the customer. Such rules are typical for a commission agreement.

In each of these cases, the procedure for drawing up invoices has its own characteristics. Recommendations for their execution can be found in Letter of the Ministry of Taxes and Taxes of Russia dated May 21, 2001 N VG-6-03/404.

Invoice and agent report: what to look for

When preparing an invoice, it is important for the agent to ensure that the information indicated there is identical to the data reflected in another important document - the agent’s report. The invoice data and the agent's report should not differ in information about the quantity of goods, their price and other indicators.

The presence of discrepancies may indicate:

- about arithmetic or technical errors made - in this case you will have to start correcting an incorrectly drawn up document;

Find out the algorithms for correcting erroneous data in an invoice on our website .

- adjustments to the price and/or quantity that have occurred that have not been taken into account by the agent, which requires the execution of an additional agreement to coordinate the changes and an adjustment invoice.

Inconsistencies in documents may be caused by:

- discounts provided by sellers and not taken into account by the agent when compiling the report;

- revision of prices in the conditions of initial shipment of goods at preliminary prices;

- in other cases (when returning goods, identifying shortages or discrepancies in quality, etc.).

The articles posted on our website will help you correctly correct errors that arise in your current business activities:

- “How to make a correction in a work book - sample”;

- “Corrections in the cashier-operator’s journal - sample”.

Agent invoice

The preparation of invoices for this type of contract depends on the procedure of the intermediary (agent), which may look like this:

- the agent purchases or sells goods, works and services on its own behalf;

- the intermediary purchases or sells products (works/services) on behalf of the customer (principal).

In each of the listed options, invoices are issued differently, including the possibility of re-issuing accounts.

The law allows for optimization of the relationship between the intermediary and the customer - if several documents for payment are generated within one day, they can be combined into a consolidated invoice. In this case, the following nuances are taken into account:

- the consolidated SF may include information on supplies and sales for several contractors at once;

- The consolidated account information may include transactions for only one day, i.e. each SF must have one registration date;

- if the accounts are dated on different days, they cannot be included in a single consolidated account, even if the contracts were concluded with the same partner.

Let's look at how customer invoicing works and what procedures the agent and customer must follow.

Who exhibits

According to the rules of Art. 160 of the Tax Code of the Russian Federation, if an agent is engaged in the sale or purchase of products on behalf of the customer, but on his own behalf, he has the right to independently issue an invoice to the buyer or seller. In order for the customer to receive timely information about upcoming payments or the need to ship products, the following rules are observed:

- the agent independently draws up the SF indicating his details;

- the first copy of the document is sent to the supplier;

- the second copy is registered in Part 1 of the invoice book, after which information about the invoice is transmitted to the customer;

- The customer (principal) issues an invoice through his own accounting department indicating the details of the intermediary, after which he registers the document in the sales book.

Having received an invoice from the intermediary, the agent must note this fact in Part 2 of the accounting log.

Exhibition procedure

The rules for registering trade unions under agency agreements have changed slightly since October 2021. Here are the requirements that must be met when filling out the SF form:

- the date of issue of the document can be: the moment the customer (principal) issues an invoice sent to the agent;

- date of issue of the SF, sent to the buyer by the intermediary;

- date of the SF drawn up by the seller to the agent;

In addition to the invoice issued directly upon the purchase or sale of products, an additional invoice is issued if the agent is a VAT subject.

In this case, the remuneration received by the intermediary from the customer for the provision of services is recognized as income and is subject to taxes.

Such additional SF is registered in the intermediary’s sales book using code 01.

Please note that information on all issued invoices must strictly comply with another mandatory document under the agency agreement - the intermediary’s report.

Sample SF for AD

The standard form of the Federation Council, which is used in relationships under an agency agreement, is regulated by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. The latest changes to these documents were made in August 2021.

A sample SF under an agency agreement, with instructions for filling it out, can be downloaded on our website.

Sample SF under an agency agreement

Reflection in 1C

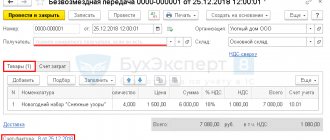

When issuing invoices under contracts involving intermediaries through the 1C system, you must make sure that the “Sale of goods and services through commission agents (agents)” functionality is enabled. When issuing an invoice in the 1C system, the operation “Transfer of goods to a commission agent for sale” is registered - for this you need to use the “Sale of goods and services” menu.

To summarize information for the month, the following operations are recorded in the 1C system:

- “Reflection of the sale of goods transferred to commission”;

- “VAT accrual on sales transactions”;

- “Write-off of sold products”;

- “Reflection of deduction of commission (agency) remuneration.”

- “Reflection and accounting of remuneration as part of costs and VAT accounting.”

Additionally, through the 1C system, an operation is carried out from the agent submitted to the report.

simplified tax system

If a business entity operates under the simplified taxation system, it is also obliged to register the SF in the accounting journal and submit them for verification to the Federal Tax Service.

If an agent works under the simplified tax system, and he is not a VAT payer, therefore he is not required to submit declaration forms for this type of tax.

In this case, the SF is issued only for the amount of the agency fee, which is not subject to registration in the invoice journal.

These rules apply if the agent provides services and acts on his own behalf. If contracts and invoices are drawn up on behalf of the customer (principal), the general rules for issuing invoices apply.

Operation code

When issuing invoices under agreements with the participation of an intermediary, the general rules for specifying transaction codes apply. In particular, code 01 covers the sale or purchase of products (works/services), including intermediary services. The only exceptions are special codes 04, 06, 10 and 13:

- code 04 – transfers for services that the intermediary performs on its own behalf;

- code 06 – for transactions in which a VAT tax agent takes part;

- code 10 – transfer of property rights and assets free of charge;

- code 13 – performing real estate overhaul.

The listed codes are indicated in the Federation Council by the person issuing and registering the document in the accounting journals.

Source: https://velereya.ru/schet-faktura-agenta/

Results

The agent, as a link between the principal and a third party (buyer or supplier), is responsible for re-invoicing. An agent selling on his own behalf the goods of the principal in invoices issued in the name of buyers indicates himself as a seller. Using such a document, the buyer can safely claim a VAT deduction. If the agent purchases goods or services on behalf of the principal, then when re-invoicing he must indicate information about the supplier on pages 2, 2a and 2b.

Download step-by-step instructions for re-invoicing here .

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Guarantor or agent: what's the difference?

Under a contract of agency, an attorney (intermediary), on behalf of the principal (seller), acts on his behalf and at his expense.

When selling goods (works, services) under such an agreement, an invoice in the name of the buyer is issued on behalf of the principal. The procedure for issuing invoices for the amount of remuneration is similar to the commission agreement.

When purchasing goods (works, services) through an attorney, the principal's basis for deducting VAT will be the invoice issued by the seller in the name of the principal.

If an agency agreement is concluded, the intermediary can act both on his own behalf and on behalf of the customer. The rules for issuing invoices also depend on this.

If the intermediary acts on his own behalf, then invoices are drawn up in the same way as for a commission agreement.

If on behalf of the customer, then invoices must be drawn up similarly to the procedure that applies to the agency agreement.