Employee remuneration

The employee who manufactured defective products is paid as follows. If the manufactured product is a complete (irreparable) defect, then in this case the employee’s work is not paid. If a partial (correctable) defect is identified due to the fault of the employee, then it is paid at reduced rates depending on the degree of suitability of the manufactured products. Such rules are established by parts 2 and 3 of Article 156 of the Labor Code of the Russian Federation.

Situation: in what documents are losses from marriage recorded?

In documents approved by the head of the organization.

Any fact of economic life, including the release of marriage, must be confirmed by a primary document (Part 1 of Article 9 of the Law of December 6, 2011 No. 402-FZ).

The forms of primary accounting documents are approved by the head of the organization (Part 4 of Article 9 of the Law of December 6, 2011 No. 402-FZ). For example, if a defect is detected in production, a report can be issued. In this case, the document must contain the mandatory details provided for in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ. In addition, the act should indicate the reasons for the defect, the quantity of defective products, the culprit of the defect, the costs of eliminating the defect and (or) the cost of the defective product, the amounts to be recovered from the culprits of the defect.

Make deductions from your salary to reimburse expenses related to the release of marriage in the same way as deductions related to compensation for material damage.

Which entry reflects non-reimbursable losses from defects?

D28-K20,21,43 - the cost of the defect was written off D10,21,41-K28 - the defect was capitalized at the price of possible capitalization D73-K28 - amounts to be recovered from the culprits were accrued D76-K28 - Amounts to be recovered from suppliers of defective materials were accrued D20 ,23-K28 – Losses from defects are included in the cost of production

10. What types of expenses are classified as representative expenses?

Planned and targeted expenses

11. Do I take into account the costs of developing new types of products on the account? (On account

08)

12. What type of account is account 25: “General production expenses”?

Active, collectively - distributive

13. Are production overheads reflected in the balance sheet? (

No)

14. Are entertainment expenses included in the account?

D20,26,44 in correspondence with section IV of accounts (60,71 and others)

15. The incremental method of accounting for production costs and costing is used in which enterprises?

In enterprises with complex use of raw materials, as well as in industrial sectors with mass and large-scale production, where raw materials go through several stages of processing in succession

16. Are analytical accounting of overhead costs carried out? (

By division in the statement “Costs by division”)

17. Are they taken into account as part of general production expenses?

Expenses for the maintenance and operation of equipment of internal divisions of the enterprise + expenses for servicing and managing internal divisions

18. Is a reserve for paying vacation pay to workers created in the account? (On account

96)

19. Accrued vacation pay from the reserve is reflected by posting?

D20,26,44,08-K96 depending on the type of workers

QUESTIONS TO PREPARE FOR TESTING on topic 5:

1. With an insured work experience of up to five years, temporary disability benefits are paid in the amount of?

(Temporary disability benefits (up to 5 years of experience) are paid in the amount of 60 percent of average earnings)

2. What kind of posting is used to document the accrual of temporary disability benefits?

(D 69.1 K 70)

3. What kind of posting is used to document retention for defects?

(deductions for marriage from wages are documented by posting D.

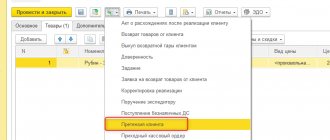

Accounting

Accounting for defects caused by an employee depends on whether the defect is partial (correctable) or complete (irreparable).

If there is a partial defect, reflect all costs for its correction in the following entries:

Debit 28 Credit 10 (70, 69, 25, 68…)

– expenses for correcting defects committed by the employee are reflected.

If there is a complete defect, reflect its amount by posting:

Debit 28 Credit 20, 21, 43

– the cost of work in progress, semi-finished products, finished products recognized as defective is written off.

The amount that is withheld from the employee for releasing a defect is reflected as follows:

Debit 73 Credit 28

– reflects the amount that will be withheld from the employee to reimburse the costs of releasing the defect.

Such wiring can be done in one of the following cases:

- the amount of the defect does not exceed the employee’s average monthly earnings (if it exceeds, make the entry for the amount of the average monthly earnings);

- the employee admitted guilt for the marriage and its amount;

- The court made a decision to withhold the amount of the marriage from the employee.

If these conditions are not met, write off the reject amount as follows:

Debit 20 Credit 28

– losses from defects are included in the costs of main production.

This procedure follows from the Instructions for the chart of accounts.

An irreparable marriage. Calculation of the cost of final marriage (account 28)

Ivanov allowed an irreparable defect in the part.

According to the calculation, the actual cost of the final defect was:

- materials - 100 rub.,

- transportation costs - 20,

- salary - 500,

- insurance premiums - 180,

- general production expenses - 30.

500 were withheld from Ivanov. Returnable waste after writing off the defective part amounted to 80 rubles. What kind of wiring do we do?

First of all, we calculate the cost of the final defect: 100+20+500+180+30=830 rubles.

Postings for accounting for irreparable defects

| Sum | Debit | Credit | Operation name |

| 830 | 28 | 20 | The cost of the defective part has been written off |

| 500 | 73 | 28 | Deducted from an employee who allowed the production of a defective part |

| 80 | 10 | 28 | Returnable waste from rejects is entered into the materials warehouse for further use. |

| 250 | 20 | 28 | The remaining losses from defects are written off to the cost of production |

Defects in production can also be grouped according to the location of the defect: internal and external.

Income tax

When calculating income tax, losses from marriage are taken into account in full as part of other expenses (subclause 47, clause 1, article 264 of the Tax Code of the Russian Federation). It does not matter at whose expense the defect is written off: at the expense of the employee or at the expense of the organization.

The amount of damage that the employee must pay must be reflected in non-operating income (clause 3 of Article 250 of the Tax Code of the Russian Federation).

Under the cash method, the amount of non-operating income will be equal to the amount of deductions from the employee’s salary in each reporting period (clause 2 of Article 273 of the Tax Code of the Russian Federation).

When using the accrual method, determine income as the amount of compensation for damage as of the date the guilty party was found guilty (for example, on the date of signing an order to withhold damage from an employee’s salary). If the organization seeks compensation for damages through the court, the date of recognition of income is the day the court decision enters into force.

This is stated in subparagraph 4 of paragraph 4 of Article 271 of the Tax Code of the Russian Federation.

The court decision comes into force within 10 days from the date of its adoption by the court, provided that it has not been appealed (Articles 209, 321, 338 of the Civil Procedure Code of the Russian Federation). In this case, income is recognized in the amount specified in the court decision.

An example of deducting the cost of a repairable defect from an employee’s salary. The organization applies a general taxation system

LLC "Proizvodstvennaya" applies a general taxation system. The contribution rate for insurance against accidents and occupational diseases is 0.9 percent. The organization pays contributions to compulsory pension (social, medical) insurance at general rates. The organization produces office furniture. In March, a correctable defect occurred in the production of products. The reason for the defect was failure to comply with the technology by worker A.I. Ivanov. The employee does not have rights to deductions for personal income tax.

The organization's expenses for correcting the defect amounted to 24,188 rubles, including:

- cost of materials used – 8480 rubles;

- the salary of employees correcting marriages is 12,000 rubles;

- the amount of contributions for compulsory pension (social, medical) insurance – 3600 rubles;

- the amount of contributions for insurance against accidents and occupational diseases is 108 rubles.

Ivanov’s average monthly salary is 27,000 rubles.

Ivanov's partial marriage was paid at reduced rates. In March, when the employee committed marriage, his salary was accrued in the amount of 22,000 rubles, personal income tax on this amount is 2,860 rubles. (RUB 22,000 × 13%).

Since the amount of the marriage is less than the average salary of an employee, Ivanov fully compensates for the damage caused to the organization. The maximum amount that can be withheld from an employee in March is: (RUB 22,000 – RUB 2,860) × 20% = RUB 3,828.

The accountant made the following entries in accounting.

In March:

Debit 28 Credit 10 – 8480 rub. – the cost of materials used to correct the defect has been written off;

Debit 28 Credit 70 – 12,000 rub. – salaries were accrued to employees correcting marriages;

Debit 28 Credit 69 “Settlements with the Pension Fund” – 2640 rubles. (RUB 12,000 × 22%) – pension contributions have been accrued;

Debit 28 Credit 69 subaccount “Settlements with the Social Insurance Fund” – 348 rubles. (RUB 12,000 × 2.9%) – contributions to the Russian Social Insurance Fund have been accrued;

Debit 28 Credit 69 “Settlements with FFOMS” – 612 rubles. (RUB 12,000 × 5.1%) – contributions to the Federal Compulsory Medical Insurance Fund have been accrued;

Debit 28 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” - 108 rubles. (RUB 12,000 × 0.9%) – premiums for insurance against accidents and occupational diseases have been calculated;

Debit 73 Credit 28 – 24,188 rub. – the costs of correcting the defect are attributed to the guilty employee;

Debit 20 Credit 70 – 22,000 rub. – Ivanov’s salary for March was accrued;

Debit 20 Credit 69 “Settlements with the Pension Fund” – 4840 rubles. (RUB 22,000 × 22%) – pension contributions are calculated from Ivanov’s salary;

Debit 20 Credit 69 subaccount “Settlements with the Social Insurance Fund” – 638 rubles. (RUB 22,000 × 2.9%) – contributions to the Russian Social Insurance Fund were accrued from Ivanov’s salary;

Debit 20 Credit 69 “Settlements with FFOMS” – 1122 rubles. (RUB 22,000 × 5.1%) – contributions to the FFOMS are accrued from Ivanov’s salary;

Debit 20 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” - 198 rubles. (RUB 22,000 × 0.9%) – contributions for insurance against accidents and occupational diseases were calculated from Ivanov’s salary;

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 2860 rubles. (RUB 22,000 × 13%) – personal income tax was withheld from Ivanov’s salary.

Debit 70 Credit 73 – 3828 rub. – losses from marriage were withheld from Ivanov’s salary.

In April:

Debit 70 Credit 50 – 15,312 rub. (22,000 rubles – 2860 rubles – 3828 rubles) – Ivanov’s salary was issued.

When calculating income tax, the accountant included in expenses the cost of the correctable defect - 24,188 rubles, and reflected the amount of compensation in income - 24,188 rubles.

An example of deducting the cost of an irreparable defect from an employee’s salary. The organization applies a general taxation system

LLC "Proizvodstvennaya" applies a general taxation system. The contribution rate for insurance against accidents and occupational diseases is 0.9 percent. The organization pays contributions to compulsory pension (social, medical) insurance at general rates. Due to non-compliance with technology in April, worker A.I. Ivanov allowed the product to be defective. Marriage cannot be fixed. The commission estimated losses from defects (cost of materials, employee’s salary, salary accruals, etc.) at 20,000 rubles.

The average salary of an employee is 15,000 rubles. Ivanov has no rights to deductions for personal income tax.

Complete marriage is not paid for. Therefore, in April, when the employee committed a marriage, his salary was accrued in a smaller amount - 10,000 rubles.

In this case, the amount of material damage (RUB 20,000) is greater than the average employee salary (RUB 15,000). Therefore, by order of the manager, the cost of losses within 15,000 rubles is withheld from the employee’s earnings.

The accountant made the following entries in accounting.

In April:

Debit 28 Credit 20 – 20,000 rub. – the actual cost of the defect is written off;

Debit 73 Credit 28 – 15,000 rub. – losses from defects have been reduced by the amount of the employee’s average monthly earnings;

Debit 20 Credit 28 – 5000 rub. (20,000 rubles – 15,000 rubles) – losses from defects are written off against the cost of similar products manufactured in the reporting period;

Debit 20 Credit 70 – 10,000 rub. – the employee’s wages are accrued;

Debit 20 Credit 69 “Settlements with the Pension Fund” – 2200 rubles. (RUB 10,000 × 22%) – pension contributions accrued;

Debit 20 Credit 69 subaccount “Settlements with the Social Insurance Fund” – 290 rubles. (RUB 10,000 × 2.9%) – contributions to the Russian Social Insurance Fund have been accrued;

Debit 20 Credit 69 “Settlements with FFOMS” – 510 rubles. (RUB 10,000 × 5.1%) – contributions to the Federal Compulsory Medical Insurance Fund have been accrued;

Debit 20 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” - 90 rubles. (RUB 10,000 × 0.9%) – premiums for insurance against accidents and occupational diseases have been calculated;

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 1300 rubles. (RUB 10,000 × 13%) – personal income tax withheld.

In April, when an employee committed a marriage, the organization can recover only 1,740 rubles at a time. ((RUB 10,000 – RUB 1,300) × 20%).

Debit 70 Credit 73 – 1740 rub. – losses from marriage are withheld from the employee’s salary.

In May:

Debit 70 Credit 50 – 6960 rub. (RUB 10,000 – RUB 1,300 – RUB 1,740) – the employee’s salary was issued.

The organization calculates income tax on a monthly basis (accrual method). In April, the accountant included in expenses the cost of an irreparable defect - 20,000 rubles, and reflected the amount of compensation in income - 15,000 rubles.

Concept, types and accounting of defects in production

The occurrence of defects is an inevitable part of any production.

Defects in production are products, items, semi-finished products, parts that do not meet established standards or technical conditions in quality and cannot be used for their intended purpose or can be used only after they have been processed or corrected.

Products, products, semi-finished products manufactured according to special increased technical requirements are not considered defective in cases where they do not meet these requirements, but meet the standards or technical specifications for similar products or products for general consumption. Losses from grading do not relate to defects, i.e.

simplified tax system

Regardless of what object of taxation the organization uses when calculating the single tax under simplification, the cost of defects paid by the employee increases the tax base (Clause 1 of Article 346.15 of the Tax Code of the Russian Federation). Take into account the amount of non-operating income at the time of deduction from wages, when depositing money into the cash register, etc. (Clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

If an organization calculates a single tax on the difference between income and expenses, then take into account losses from the production of defective products in this order.

If there was an irreparable defect, then do not include the amounts of expenses associated with the production of defective products in the tax base. These costs are not in the list of expenses that can be taken into account when calculating the single tax (Clause 1, Article 346.16 of the Tax Code of the Russian Federation).

If there was a correctable defect, then the amount of expenses associated with its correction is included in the tax base for the corresponding cost items. For example, write off the cost of additional material resources spent on correcting a defect as material expenses (subclause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation). And the salary of an employee involved in eliminating the defect (if the defect is corrected by another employee) is in the amount of labor costs (subclause 6, clause 1, article 346.16 of the Tax Code of the Russian Federation).

UTII

The object of UTII taxation is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). Therefore, the amount of compensation an employee receives for losses from marriage does not affect the calculation of the single tax.

What postings are used for deduction for defects if the products are shipped?

The debit displays the costs of funds for detected damage (correction costs, write-off of products in the event of final defects, etc.). For a loan – displaying a reduction in losses from damage, for example:

- Accounting for products at the cost of their possible use;

- Amounts that will be withheld from those responsible for the malfunction;

- Amounts of recovery from suppliers of inventories, the inadequate quality of which led to the emergence of defective products;

- Amounts displayed as part of the costs of the production process (if it is impossible to find the perpetrators).

OSNO and UTII

If an organization combines the general taxation system and UTII, it is obliged to keep separate records of income, expenses and business transactions (clause 7 of Article 346.26 of the Tax Code of the Russian Federation).

When calculating income tax, include in non-operating income the amount of compensation for damage by an employee who is engaged in activities on the general taxation system.

If the defective products were produced by an employee who is engaged in both types of activities, then when compensating the employee for damages, include the entire amount of non-operating income in the calculation of the tax base for income tax. This is stated in letters of the Ministry of Finance of Russia dated March 15, 2005 No. 03-03-01-04/1/116 and the Federal Tax Service of Russia for Moscow dated November 6, 2007 No. 20-12/105713. This position is based on the fact that the current tax legislation does not contain a mechanism for distributing non-operating income between different types of activities.

Account 28 for recording marriage

To account for defects, account 28 is used. The account is active. During the month, a debit account turnover is formed, including production costs incurred during the creation of defective products, as well as rework costs. Credit turnover - amounts received from the culprits to reimburse expenses for the defect, as well as parts of the defect that have not lost their usefulness and are subject to return to production. The final balance is the amount of losses. It is subject to write-off at the end of each month. It is written off either to the costs of manufacturing similar products or to account 25.

It is advisable for manufacturing enterprises to maintain analytical accounting on account 28. The subaccounts for which analytics will be collected must be specified in the accounting policy. A special feature of analytical accounting of marriage is the ability to collect information in accounting on the reasons for the marriage and the persons through whose fault the marriage occurred. Such analytics allows you to track the sources of defects and improve the production process, increasing its efficiency.

Accounting for manufacturing defects is important for tax purposes. It affects the two most important taxes - income tax (IP) and VAT. You should understand the intricacies of tax accounting in a separate article. Now let's look at the most common cases.

Losses due to marriage are officially expenses that reduce the tax base of an NP. When calculating the costs of losses due to defects, it should be taken into account that only that part that could not be attributed to materials or to the guilty person can be attributed to expenses. Also, all business transactions involving marriage must be documented in the prescribed manner.

When accounting for VAT on internal defects, there are often controversial issues with the tax service. In order to avoid disputes, manufacturing enterprises “restore” VAT. With an external defect in tax accounting, everything is more clear: the company reduces the amount of VAT that it previously accrued and paid by the amount of VAT on the sale of the returned product.

Accounting and tax accounting

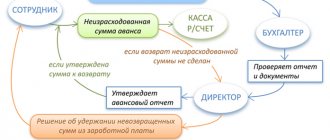

The employee's debt for accountable funds is his obligation to the employer. The amount may be transferred to the income category if the company’s management decides to forgive the debt. After the period of pre-trial settlement of the problem (1 month), insurance premiums are charged on the amount of debt. The amount of contributions can be offset or refunded if one of the conditions is met:

- the employee voluntarily returned the funds;

- the amount of debt was counted as expenses on the basis of an advance report and documents confirming the targeted nature of the expenses.

There are two ways to write off debt from dismissed employees:

- through spending part of the reserve for doubtful debts;

- through attributing the amount of debt to financial results.

In the first case, a posting is made between the debit of 63 and the credit of 71 accounts, in the second, the debit turnover is recorded for 91 accounts, and the credit entry is recorded for 71 accounts. Simultaneously with these correspondences, the amount is reflected in off-balance sheet accounting in account 007. In off-balance sheet accounting data, information about written off bad debts of this type must be displayed for 5 years from the date of closure of the debt.

Nuances of tax accounting

The fact of issuing monetary resources to an employee for reporting purposes is not the basis for the occurrence of an expense transaction in accounting. The balance of unused funds returned by the employee cannot be attributed to the income of the enterprise. The amount of accountable amounts is not taken into account when calculating income tax; it must be shown as part of accounts receivable.

Debts recognized as bad are written off in tax accounting as non-operating expenses. To transfer a debt to the category of bad debt, it is necessary to document the fact that the statute of limitations has expired. When applying the simplified tax system (with any type of taxable object) or UTII, written off bad receivables cannot reduce the tax base.

Accounts, postings

Accounting for accountable amounts is maintained in 71 accounts. If the balance of funds given to the employee in advance is not returned in a timely manner, the amount of the debt is considered a deficiency in the accounting records. Deductions of accountable amounts are carried out as a reduction in the amount of the shortfall attributed to a specific responsible person. Typical correspondence in this accounting segment is as follows:

- D71 – K50 or 51 – the issuance of money for reporting is reflected;

- D94 - K71 - unspent accountable amount not paid into the cash register on time is classified as a shortage;

- D70 - K94 - the balance of accountable funds was withheld from wages (with the written consent of the debtor);

- D73 - K94 - indicates a debt on accountable funds that cannot be repaid from the monthly earnings of an individual;

- D50 or 51 - K73 - a record is drawn up in situations where the employee voluntarily closes the debt and when the required amount is forcibly repaid by a court decision;

- D91 – K73 – recording the fact of debt forgiveness;

- D70 – K68 – income tax was calculated on the forgiven amount of debt;

- D91 - K69 - shows the accrual of insurance premiums on accountable amounts that moved from the group of debts to the category of employee income.

Deduction from wages: postings and examples

Mandatory deductions

Personal income tax is withheld from each employee’s salary at the following rates:

- 13% - if the employee is a resident of the Russian Federation;

- 30% - if a non-resident of the Russian Federation;

- 35% - in case of winning, savings on interest, etc.;

- 15% - from dividends of a non-resident of the Russian Federation;

- 9% - from dividends until 2015; interest on mortgage-backed bonds until 2007, from the income of the founders of the trust management of the mortgage coverage.

It does not matter in what form the income was received, cash or in kind. Let's look at an example:

Employee Vasilkov A.A. wages of 30,000.00 rubles were accrued, personal income tax was withheld from it at a rate of 13%, since Vasilkov A.A. is a resident.

Postings for mandatory withholding of personal income tax:

| Dt | CT | Amount, rub. | Operation description |

| 26 | 70 | 30 000,00 | Salary accrued |

| 70 | 68 | 3 900,00 | Personal income tax withheld |

According to executive documents

The amount under the writ of execution is withheld from wages, taking into account personal income tax. The amount of additional expenses under the writ of execution (for example, transfer fees) is debited from the employee.

Let's look at an example:

Employee Vasilkov A.A. wages were accrued in the amount of 20,000.00 rubles, of which 25% was withheld according to the writ of execution. Amount of deduction under the writ of execution = (20,000.00 – 13%) * 25% = 4,350.00 rub.

Deduction from wages of Vasilkov A.A. according to the writ of execution is reflected by posting:

| Dt | CT | Amount, rub. | Operation description |

| 26 | 70 | 20 000,00 | Salary accrued |

| 70 | 68 | 2 600,00 | Personal income tax withheld |

| 70 | 76.41 | 4 350,00 | The amount under the writ of execution was withheld |

| 76.41 | 50 | 4 350,00 | The amount according to the writ of execution was transferred from the cash register |

At the initiative of the employer

Deductions for the purpose of debt repayment are regulated by the Labor Code and other federal laws. In this case, it is necessary to issue an order no later than a month from the date of payment and obtain written permission from the employee.

If upon dismissal the amount of deductions is not completely written off, then, by agreement with the employee, the amount can be repaid:

- Judicially;

- By depositing funds into the cash register;

- Gift to an employee (in this case, expenses are not taken into account when calculating income tax);

- At the request of the employee, write off 20% of the salary monthly.

Typical entries for deductions from wages at the initiative of the employer:

| Dt | CT | Operation description |

| 26 | 70 | Salary accrued |

| 70 | 68 | Personal income tax withheld |

| 70 | 73.2 | The amount of compensation for the shortage is withheld |

| 70 | 71 | Unreturned accountable amount withheld |

| 70 | 73.1 | Repayment of the issued loan |

Let's look at an example:

From employee Vasilkov A.A. RUB 1,500.00 was deducted from wages to repay the loan. The salary amounted to 10,000.00 rubles. The limit amount is = 8,700.00 * 0.2 = 1,740.00 rubles.

Posting the deduction of a loan from the salary of Vasilkova A.A.:

| Dt | CT | Amount, rub. | Operation description |

| 26 | 70 | 10 000,00 | Salary accrued |

| 70 | 68 | 1 300,00 | Personal income tax withheld |

| 70 | 73.1 | 1 500,00 | Deduction for loan repayment |