04.12.2019

When maintaining accounting (budget) records, institutions are required to form a vacation reserve for the time worked by employees. This reserve is created in order to generate complete and reliable information about the institution’s deferred obligations, as well as to evenly allocate expenses to the financial result. You will learn about what entries an accountant should make when creating (using) a reserve by reading this consultation.

How is the procedure for creating a vacation reserve in accounting regulated?

The Ministry of Finance has developed a draft federal standard for public sector organizations “Payments to personnel.” It is this document, after its adoption, that will regulate the procedure for creating and using a reserve for vacation pay.

For your information:

The approval date for this standard was postponed several times.

As of today, it is expected that it will come into force in 2021 ( Order of the Ministry of Finance of the Russian Federation dated March 19, 2019 No. 45n “On approval of the program for the development of federal accounting standards for public sector organizations for 2021 – 2021”

). However, there is a high probability that this deadline will be postponed again.

Before the approval of the federal standard “Payments to Personnel”, when accounting for the vacation reserve, it is necessary to follow the provisions of Instruction No. 157n (see Guidelines for the application of the provisions of the GHS “Reserves”), in accordance with clause 302.1 of which the procedure for the formation of reserves is established by the institution as part of the preparation of its accounting policies .

What should the accounting policy disclose regarding the creation of a reserve for vacation pay?

If the rules for its reflection in accounting have not been established for any accounting object, the institution, in agreement with the founder and financial body of the public legal entity, defines them in its accounting policies (clause 7 of the GHS “Accounting policies, estimates and errors” "). In particular, accounting policies:

– the reporting date on which the reserve is formed (adjusted) must be determined (this can be the last day of each month, the last day of each quarter or the last day of the calendar year); – a methodology for determining the estimated value must be selected (personalized for each employee, for the institution as a whole, for individual groups of employees); – the working chart of accounts 0 401 60 000 “Reserves for future expenses” must be detailed.

It should be taken into account that the reserve for vacation pay is formed regardless of the source of financial support (Letter of the Ministry of Finance of the Russian Federation dated January 14, 2016 No. 02-07-10/604).

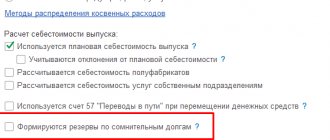

Provision for doubtful debts in tax accounting

The first type of reserve a company can create is a reserve for doubtful debts. Let's imagine a situation: a company entered into an agreement with a buyer and shipped the goods. However, the counterparty did not pay on time, and no security was provided for the debt. Such debt becomes classified as doubtful. According to Art. 266 of the Tax Code of the Russian Federation, the creditor organization can create a reserve for such a debt and accept this amount as a non-operating expense in the current reporting/tax period. The amount of funds that can be taken into account is determined during the inventory of customer debt at the reporting date.

In practice, there are situations when you have a counter-obligation to a counterparty. Accounts receivable and payable appear simultaneously in accounting. A doubtful debt here can only be that part that exceeds your obligation to the counterparty.

The reserve for doubtful debts in tax accounting in 2021 is formed depending on the number of days of delay in payment:

- more than 90 days: for the entire amount of debt;

- from 45 to 90 days (inclusive): for an amount equal to 50% of the debt;

- less than 45 days: debt is not included in the reserve amount.

Report your income tax online

Kontur.Extern will help you perform the calculations, check your declaration for errors, and submit it to the tax office. Use all the features of Kontur.Externa for free for 3 months.

Try it

If you keep your records on a cash basis rather than on an accrual basis, there are no reserves. This is explained by the fact that expenses in this case are allowed to be accepted only upon payment.

Based on the results of the tax period, the reserved amounts cannot be more than 10% of the sales proceeds for the same period. If the reserve is calculated at the end of the reporting period, the greater of two amounts is taken as the limit: 10% of revenue for the past tax period or 10% of revenue for the current reporting period.

The buyer counterparty may transfer unpaid amounts to you. In this case, the difference between the reserve for the previous and current reporting date is taken into account as non-operating income.

The reserve can only be used to cover losses resulting from recognition of a debt as bad, that is, unrealistic for return.

How to determine the estimated value when creating a reserve for vacation pay?

Recommendations regarding the procedure for determining the estimated value when creating a reserve for vacation pay are contained in Letter of the Ministry of Finance of the Russian Federation dated May 20, 2015 No. 02-07-07/28998.

According to them, the estimated liability in the form of a reserve for vacation pay for time actually worked can be determined monthly, quarterly or annually, on the last day of the month, quarter or year, respectively, based on the number of days of unused vacation for all employees on a specified date (data provided by the personnel service) .

The reserve is calculated as the amount of vacation pay for employees for the time actually worked on the date of calculation and the amount of insurance contributions for compulsory health insurance, compulsory health insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, as well as contributions for injuries.

Officials recommend determining the amount of expenses to pay for upcoming vacations in one of the following ways:

1) based on the average salary calculated individually for each employee;

2) based on the average salary calculated for the institution as a whole;

3) based on the average salary calculated for individual categories of employees (personnel groups).

Let's look at each of them in more detail.

Method 1. It is used, as a rule, if the institution does not have many employees. When using this method, the calculation is made individually for each employee using the following formula:

P1 = K1 x ZP1, where:

P1 – the amount of contributions to the leave reserve for one employee in terms of wages; K1 – the number of vacation days not used by an employee for the period from the start of work to the calculation date (end of each month, quarter, year) for one employee; ZP1 – the average daily earnings of an employee, calculated according to the rules for calculating average earnings for vacation pay as of the date of calculation of the reserve.

To determine the total amount of the leave reserve in terms of wages, the amounts of contributions to the reserve for all employees are summed up using the formula:

Vacation reserve = P1 + P2 + Pn.

Method 2. This method is used, as a rule, if the institution has many employees. In this case, the average salary is calculated for the institution as a whole using the following formula:

Vacation reserve = K x Salary, where:

K – the total number of vacation days not used by all employees for the period from the start of work to the calculation date (the end of each month, quarter, year); ZPsr. – average salary for all employees of the institution as a whole.

Method 3. When using this method, the average salary is calculated for individual categories of employees (personnel groups) using the formula:

Vacation reserve = K1 x ZPsr.1 + K2 x ZPsr.2 + K3 x ZPsr.3, where:

K1, K2, K3 – the number of all days of unused vacation for each category of employees; ZPsr. 1, ZPsr. 2, ZPsr. 3 – average salary calculated for each category of workers.

The reserve for payment of insurance premiums is calculated taking into account the methodology for calculating the reserve for payment of vacations. That is, the amount of insurance premiums when forming a reserve can be calculated:

1) for each employee individually according to the formula:

P1 = K1 x ZP1 x C, where:

P1 – the amount of contributions to the vacation reserve for one employee in terms of insurance premiums; K1 – the number of vacation days not used by an employee for the period from the start of work to the calculation date (end of each month, quarter, year) for one employee; ZP1 – average daily earnings of an employee, calculated according to the rules for calculating average earnings for vacation pay as of the date of calculation of the reserve; C (hereinafter) – the rate of insurance premiums.

Accordingly, the amount of the reserve for insurance premiums for the institution as a whole is determined by summing up contributions to the reserve for each employee, in the same way as we determined the vacation reserve in terms of wages;

2) on average for the institution according to the formula:

Reserve of insurance premiums = K x ZPsr. x C;

3) for each category of workers according to the formula:

Reserve of insurance premiums = (K1 x ZPsr. 1 + K2 x ZPsr. 2 + K3 x ZPsr. 3) x C.

It must be taken into account that the amount of insurance premiums is calculated taking into account the maximum base for their calculation.

Example 1.

The accounting policy of the institution establishes that the estimated liability in the form of a reserve for vacation pay is determined annually (on the last day of the calendar year) based on the average salary and the number of days of unused vacation for the institution as a whole. As of 12/31/2019:

– the average daily wage is 950 rubles; – the total number of vacation days not used by employees is 190; – the number of vacation days planned in 2021 is 1,400.

To simplify the example, we do not consider the reserve in terms of insurance premiums.

The reserve for vacation pay as of December 31, 2019 will be:

– regarding unused vacation for previous periods – 180,500 rubles. (190 days x 950 rub.); – the amount of monthly contributions to the reserve is 110,833 rubles. ((1,400 days x 950 rub.) / 12 months).

The procedure for recording transactions for the formation and use of reserves

State (municipal) institutions have an obligation to guarantee employees the right to receive annual paid leave. At the same time, there is no certainty about the time of execution of the upcoming vacation payment for actually worked time due, for example, to a possible change in the planned vacation dates. Moreover, the amount of such liability cannot be determined with precision.

According to clause 302.1 of Instruction No. 157n, to summarize information on the status and movement of amounts reserved for the purpose of evenly attributing expenses to the financial result of the institution, for obligations not determined by the amount and (or) time of execution of the upcoming vacation payment for actually worked time or compensation for unused vacation, including upon dismissal, including payments for compulsory social insurance of an employee (employee) of the institution, is allocated to account 0 401 60 000 “Reserves for future expenses”.

By virtue of clause 308 of the said instructions, the obligations of the institution, the value of which is determined at the time of their acceptance conditionally (calculated) and (or) for which the time (financial period) for their fulfillment is not determined, provided that a reserve for future expenses is created in the records of the institution for these obligations are deferred liabilities.

Accountants often have a question: is it possible to use the reserve for vacation pay to pay compensation for unused vacation?

If the accounting policy for accounting purposes stipulates that when creating a reserve for vacation pay, the payment of compensation for unused vacation is taken into account, the reserve can be used to pay such compensation (clause 302.1 of Instruction No. 157n, Letter of the Ministry of Finance of the Russian Federation dated August 16, 2019 No. 02-06 -10/62943).

Reserve for vacations in tax accounting

Another type of reserves created by enterprises is vacation reserves (Article 324.1 of the Tax Code of the Russian Federation). They are formed in the current period for their subsequent expenditure. The procedure for determining reserves for vacations in tax accounting must be specified in the accounting policy. The Tax Code does not provide a mandatory algorithm for calculating them.

The accrual of the vacation reserve in tax accounting is carried out monthly, and the percentage of deductions is taken based on the ratio of planned vacation expenses, including contributions, to planned labor costs. Such costs can be determined, for example, based on the corresponding costs of the past period. The resulting share is multiplied by the actual amount of labor costs.

The costs of creating vacation reserves should be charged to the accounting account where the employee’s salary is indicated. Thus, groups are distinguished: production employees, administration employees, etc.

At the end of the tax period, the accountant takes inventory of the reserve. Two situations can arise: either the reserved funds will not be enough, or they will be underutilized. Theoretically, paid vacation pay can coincide with the pre-calculated reserve. However, since it is formed on the basis of a plan, this option is unlikely.

- If the reserved amounts were not enough to cover the costs of vacations, this difference is taken into account as labor costs.

- If there is a balance in the accounts, this means that employees have not fully used their vacation entitlement. There are two options here:

- when you do not plan to create a reserve next year, the balance is simply written off as non-operating income;

- if the creation of a reserve is still advisable for the enterprise, its balance is subject to adjustment. To do this, first calculate the reserve for unused vacations. It is equal to the product of the employee’s average daily earnings and the actual number of unused vacation days. After this, the difference between the balance on the reporting day and the adjusted reserve is determined:

Adjusted reserve > Remaining reserve => the difference goes to labor costs

Adjusted reserve < Remaining reserve => the difference goes to non-operating income

Vacation reserve: posting transactions for the formation and use of reserves

The following entries must be made in the accounting of autonomous and budgetary institutions:

Vacation reserve: postings

| Contents of operation | Debit | Credit |

| Creating a reserve | ||

| A reserve has been created for vacation pay for actual hours worked: | ||

| – on employee benefits | 0 401 20 211 0 109 60 211 | 0 401 60 211* |

| - on insurance premiums | 0 401 20 213 0 109 60 213 | 0 401 60 213* |

| Reflected in accounting are expense obligations for the formation of reserves for vacation pay**: | ||

| – on employee benefits | 0 506 90 211 | 0 502 99 211 |

| - on insurance premiums | 0 506 90 213 | 0 502 99 213 |

| Using the reserve | ||

| Vacation pay accrued for time worked: | ||

| – at the expense of the reserve | 0 401 60 211* 0 401 60 213* | 0 302 11 737 0 303 xx 731 |

| – if the amount of the reserve is less than the amount of accrued vacation pay (by the amount of the excess of accrued vacation pay over the amount of the reserve) | 0 401 20 211 0 109 60 211 0 401 20 213 0 109 60 213 | 0 302 11 737 0 303 xx 731 |

| Expenditure obligations for the payment of accrued vacation pay are reflected at the expense of the previously created reserve. At the same time, previously recorded liabilities are reduced using the “red reversal” method. | 0 506 10 211 0 506 10 213 | 0 502 11 211 0 502 11 213 |

* Detailing of account 0 401 60 000 is carried out as part of the formation of accounting policies. An example of detail is contained in Letter of the Ministry of Finance of the Russian Federation No. 02-07-07/28998.

** Clarification of the previously formed reserve is reflected on the date of its calculation:

– an additional accounting entry – in case of an increase in the formed reserve; – by reversing an entry – in case of a decrease in the amount of a previously formed reserve.

The following entries will be made in the accounting of a government institution:

| Contents of operation | Debit | Credit |

| Creating a reserve | ||

| A reserve has been created for vacation pay for actual hours worked: | ||

| – on employee benefits | 1 401 20 211 1 109 60 211 | 1 401 60 211 |

| - on insurance premiums | 1 401 20 213 1 109 60 213 | 1 401 60 213 |

| Reflected in accounting are expenditure obligations for the formation of reserves for vacation pay*: | ||

| – on employee benefits | 1 501 93 211 | 1 502 99 211 |

| - on insurance premiums | 1 501 93 213 | 1 502 99 213 |

| Using the reserve | ||

| Vacation pay accrued for time worked: | ||

| – at the expense of the reserve | 1 401 60 211 1 401 60 213 | 1 302 11 737 1 303 xx 731 |

| – if the amount of the reserve is less than the amount of accrued vacation pay (by the amount of the excess of accrued vacation pay over the amount of the reserve) | 1 401 20 211 1 109 60 211 1 401 20 213 1 109 60 213 | 1 302 11 737 1 303 xx 731 |

| Expenditure obligations for the payment of accrued vacation pay are reflected at the expense of the previously created reserve. At the same time, previously recorded liabilities are reduced using the “red reversal” method. | 1 501 13 211 1 501 13 213 | 1 502 11 211 1 502 11 213 |

The clarification of a previously formed reserve is reflected by an additional accounting entry or by reversing the entry (see explanations above).

Important: the reserve is used only to cover those costs for which it was originally created.

Example 2.

Let's use the conditions of example 1. The accounting policy of an autonomous institution stipulates that a reserve for vacation pay is created annually on the last day of the calendar year based on the average salary calculated for the institution as a whole. According to the HR department:

– number of unused vacation days – 190; – number of planned vacation days in 2021 – 1,400; – average daily wage – 950 rubles.

At the same time, as of December 31, 2019, there is an unused reserve in the amount of RUB 85,000.

The amount of the accrued reserve for unused vacations as of December 31, 2019 is RUB 180,550. (190 days x 950 rub.). Since at the reporting date there is an unspent reserve on the balance sheet and its amount is less than the newly accrued reserve, the clarification of the previously formed reserve will be reflected in an additional accounting entry in the amount of the difference between the amount of the newly accrued reserve and the amount of the unspent reserve - RUB 95,550. (180,550 – 85,000). The amount of monthly contributions to the reserve will be 110,833 rubles.

The following entries must be made in accounting:

Vacation reserve: postings

| Contents of operation | Debit | Credit | Amount, rub. |

| As of 12/31/2019 | |||

| The reserve for vacation pay for actual time worked has been adjusted | 0 109 60 211 0 401 20 211 | 2 401 60 211 | 95 550 |

| Obligations for the formation of reserves for vacation pay have been adjusted | 0 506 90 211 | 2 502 99 211 | 95 550 |

| As of 01/31/2020 (and further on the last day of the month) | |||

| A reserve has been accrued for vacation pay for actually worked hours | 0 109 60 211 0 401 20 211 | 2 401 60 211 | 110 833 |

| Deferred obligations for the formation of reserves for vacation pay are reflected | 2 506 90 211 | 2 502 99 211 | 110 833 |

Reserve for claims and lawsuits

In accordance with the Methodological Recommendations for the Application of the “Reserves” Standard, a reserve for claims and claims is an obligation arising:

- From claims and lawsuits based on facts of economic life, including within the framework of pre-trial (out-of-court consideration of claims);

- From claims (claims) to a public legal entity for compensation for damage caused to an individual or legal entity as a result of illegal actions (inaction) of government bodies and officials of these bodies, including as a result of the issuance of acts of government bodies that do not comply with the law or otherwise legal act.

The reserve for claims and claims is recognized:

- on the date of receipt of the claim - for disputed claims for which pre-trial settlement is expected;

- on the date of notification of the acceptance of the claim for judicial proceedings - for contestable claims for which pre-trial settlement is not expected.

More on the topic: How to correctly enter new income codes in payment orders for public sector organizations

The reserve for claims and claims is recognized in the full amount of claims and claims.

The reserve for claims and lawsuits can be formed taking into account the expert opinion of the institution’s legal service. This possibility is established as part of the formation of accounting policies.

Example An institution is a party to legal proceedings in a claim for 300,000 rubles for violation of the terms of a contract. The probability of a successful outcome, according to lawyers, is 20%. Thus, the court decision on the claim is most likely not in favor of the institution (80%). In this case, the estimate of the reserve for claims and claims should be determined in the amount of 300,000 rubles.

In 1C:BGU 8, accounting records for the formation of a reserve are documented in the document “Operation (accounting)”. The acceptance of a deferred liability in the amount of the created reserve is also reflected in the document “Operation (accounting)”. For convenience, these operations can be reflected in one document (Fig. 1).

Rice. 1

Acceptance of obligations at the expense of the formed reserve for claims and suits in 1C:BGU 8 is reflected in the usual manner using the document “Receipt Accrual of reserves for vacations”. The acceptance of a deferred liability in the amount of the created reserve is reflected in the document “Operation (accounting)” (Fig. 2, 3).

More on the topic: Accounting for personal belongings in budgetary institutions

Rice. 2

Rice. 3

Acceptance of obligations at the expense of the formed reserve for vacations for the time worked by employees (employees) in 1C: BGU 8 is reflected in the usual manner using the document “Reflection of wages in accounting” indicating account 401 60 as a debit.

If vacation is granted in advance...

In accordance with Art. 122 of the Labor Code of the Russian Federation, paid leave must be provided to employees annually. Moreover, the right to use vacation for the first year of work arises for the employee after six months of his continuous work with this employer. By agreement of the parties, paid leave may be granted to the employee before the expiration of six months. That is, in some cases, the employer has the right to grant leave before the employee has worked the corresponding period for which the leave is granted. This is the so-called vacation in advance. No accruals are made for such payments (vacation pay) in the vacation reserve accounts.

Obligations to accrue vacation pay in the current reporting period, if the employee did not actually work the period for which vacation pay was accrued, are reflected (clause 302 of Instruction No. 157n, Letter of the Ministry of Finance of the Russian Federation dated August 16, 2019 No. 02-06-10/62943):

– on the debit of account 0 401 50 000 “Deferred expenses” (the corresponding analytics is selected); – on the credit of account 0 302 00 000 “Settlements for accepted obligations.”

Methodological basis for reserves for future expenses

From 01/01/2020, public sector institutions apply the provisions of the Standard “Reserves. Disclosure of information about contingent liabilities and contingent assets”, approved. by order of the Ministry of Finance of Russia dated May 30, 2018 No. 124n (hereinafter referred to as the “Reserves” Standard). Methodological recommendations for the application of the Standard are communicated by letter of the Ministry of Finance of Russia dated 05.08.2019 No. 02-07-07/58716.

The “Reserves” standard is applied when creating the following types of reserves:

- reserve for claims and lawsuits;

- restructuring reserve;

- reserve for warranty repairs;

- provisions for unprofitable contractual obligations;

- reserve for dismantling and decommissioning of fixed assets.

The relationships for which the Standard does not apply are specified in clause 4 of the Standard “Reserves”.

In particular, the Standard does not apply to reserves for reduction in the value of inventories, reserves for doubtful debts, reserves for vacations for time worked by employees (employees) and other reserves, the formation and maintenance of which are regulated by other regulatory legal acts.

For example, the reserve for a decrease in the value of inventories is regulated by the provisions of the Standard “Inventories”, approved. by order of the Ministry of Finance of Russia dated December 7, 2018 No. 256n.

The provision for doubtful debts is regulated by the provisions of the Revenue Standard, approved. by order of the Ministry of Finance of Russia dated February 27, 2018 No. 32n. The reserve for vacations for the time worked by employees (employees) before the approval and application of the Standard “Payments to Personnel” is regulated by the Instruction, approved. by order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n (hereinafter referred to as Instruction No. 157n).

In addition, the list of reserves for upcoming expenses is open. In this regard, general criteria for the recognition of reserves are identified (clause 9 of the Reserves Standard):

- The subject of accounting has an obligation that arose as a result of the facts of economic life that occurred.

- Disposal of assets will be required to fulfill the obligation.

- The amount of the obligation can be reasonably estimated and confirmed by calculation or documentation.

- The moment of presentation of a demand for fulfillment of an obligation and its size do not depend on the actions of the accounting entity.

More on the topic: Accounting policies of public sector institutions: posting on the website

If at least one of the criteria is not met, the reserve is not created.

To account for reserves, account 401 60 “Reserves for future expenses” is used (clause 302.1 of Instruction No. 157n).

Reserves for future expenses are formed on the credit of account 0 401 60 000 and the debit of accounts 0 106 00 000 “Investments in non-financial assets”, 0 109 00 000 “Costs for the manufacture of finished products, performance of work, services”, 0 401 20 200 “Expenses of an economic entity » (clause 124.1 of the instructions, approved by order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n (hereinafter referred to as Instruction No. 162n), clause 160.1 of the instructions approved by order of the Ministry of Finance of Russia dated December 16, 2010 No. 174n (hereinafter referred to as Instruction No. 174n), clause 189 of the instructions, approved by order of the Ministry of Finance of Russia dated December 23, 2010 No. 183n (hereinafter referred to as Instruction No. 183n)).

Simultaneously with the reserve for future expenses, deferred liabilities are formed. Transactions are reflected in the credit of account 0 502 99 000 “Deferred liabilities for other subsequent years (outside the planning period)” in accordance with clause 141.2 of Instruction No. 162n, clause 166 of Instruction No. 174n, clause 195 of Instruction No. 183n.

The acceptance of obligations for which a reserve was previously formed is reflected in the debit of account 0 401 60 000 and the credit of accounts 0 302 00 000 “Settlements for accepted obligations”, 0 303 00 000 “Settlements for payments to budgets”. At the same time, at the expense of previously formed deferred obligations, obligations of the corresponding financial periods (current, next financial year, first and second years of the planning period) are accepted.