Bank commission - postings in 1C 8.3

In the accounting system, the bank’s commission is reflected in account 91.02 “Other expenses” (clause 11 of PBU 10/99).

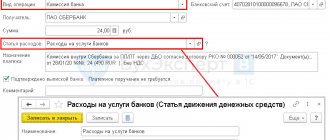

Reflect the debiting of the bank commission using the document Debiting from the current account in the Bank and cash desk - Bank statements section.

Specify the type of transaction - Bank commission .

the expense item Expenses for banking services if the item settings indicate:

- Use silently in transactions - Payment of bank commissions .

Familiarize yourself with other ways to reflect bank commissions in 1C 8.3 Accounting

Postings

When you select the type of transaction Bank Commission, a transaction with 91 accounts is generated automatically.

Bank services not subject to VAT - registration method in 1C 8.3

The formation of posting D91.02-K51 in 1C is carried out using the standard document “Write-off from the current account”. As a rule, the bank withholds the commission directly, using a payment order. Withholding information is provided in the form of a bank statement. The line in the bank statement about the write-off of the commission is actually the document “Write-off of non-cash funds”.

Most often, these documents are uploaded into the accounting system from the client bank - a special banking program, but we propose to understand in detail the features of manual generation of write-off documents, then editing the uploaded documents will not be difficult.

From the “Bank and Cash Office” section of the main interface of the system, let’s go to the document journal “Bank Statements”.

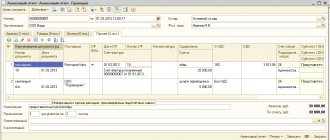

Fig.1 Bank statements

You can create two types of documents in the journal – receipt (+) and write-off (-) on the organization’s current account. Documents are created by clicking on the appropriate button.

Fig.2 Two types of documents

Let's create a write-off document and fill it out. First, select the desired type of operation. By default, Payment to Supplier will be offered. Select Bank Commission from the drop-down list (in 1C 8.3).

Fig.3 Bank commission

Next, fill in the necessary document details:

- Let's adjust the date;

- We indicate the incoming order number and date;

- We will select a recipient and organization;

- Fill in the required amount and cash flow item;

- The payment purpose is filled in automatically. Let's leave it unchanged for reference.

Let us pay special attention to the “Confirmed by bank statement” detail, which is set by default. Only its installation will allow you to generate transactions after posting the document.

Fig.4 Confirmed by bank statement

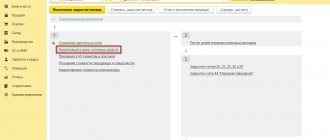

Let's go through the document and look at the postings for accounting for bank commissions.

Fig.5 Let's check the document

Fig.6 Posting for bank commission accounting

Postings in 1C exactly correspond to the required accounting records to reflect the bank commission.

Refund of bank commission - postings in 1C 8.3

It happens that the bank returns the withheld commission for various reasons: incorrect tariff, excessive withholding, etc.

The reflection of this operation depends on the moment of return:

- immediately after holding;

- after the write-off of the commission is reflected in the reporting.

Refund of commission immediately after deduction

If the write-off and return are reflected in the same period, return to the commission write-off document and correct it to:

- Type of transaction - Other write-off ;

- Debit account - 76.02 “Calculations for claims.”

Select the expense item with the type of movement Other payments for current operations .

Postings

Reflect the return of the commission in the document Receipt to the current account (Bank and cash desk - Bank statements).

Postings

Refund of commission after reporting

Since at the time of withholding it was not known that the commission was withheld unlawfully, its recognition as expenses is not considered an error, and in the return period, income is reflected in the accounting system (clause 2 of PBU 22/2010) and NU (Letter of the Ministry of Finance of the Russian Federation dated 08/13/2012 N 03-03-06/1/408, dated 01/30/2012 N 03-03-06/1/40).

If the commission has already been taken into account in expenses and the period is closed, reflect the return in the document Receipt to the current account (Bank and cash desk - Bank statements).

Postings

If the organization takes a cautious approach and believes that there is no basis for reporting in this case:

- expenses for deducting the commission (clause 1 of Article 252 of the Tax Code of the Russian Federation);

- income from the return of the commission (clause 1 of article 41 of the Tax Code of the Russian Federation),

That:

- reverse the expense to reflect the write-off of the commission in NU;

- do not reflect the income from the return of the commission in tax accounting (indicate the directory article Other income and expenses with the Reflect in tax accounting checkbox cleared);

- submit an updated declaration, because the tax is underestimated (clause 1 of article 81 of the Tax Code of the Russian Federation).

Learn more about ways to adjust your income tax return in 1C 8.3:

- Error: the amount of costs when purchasing services is overestimated. Corrections for income tax: manual completion of an updated declaration

- Error: the amount of costs when purchasing services is overestimated. Corrections for income tax: automatic completion of an updated declaration

We looked at how to reflect operations on deduction and return of bank commissions in 1C 8.3 Accounting.

Test yourself! Take a test on this topic using the link >>

Bank commission write-off: postings

Bank commissions without VAT in accounting are reflected in account 91.2 - other expenses at the time of write-off. As a rule, banks independently write off the remuneration due to him from the client’s account, and the accountant remains to check the correspondence of the written-off funds with actual transactions and current tariffs.

Postings for accounting for remuneration without VAT are recorded using posting D 91.02 K 51 based on the extract, the write-off date corresponds to the date of the extract.

| Type of bank commission | Debit | Credit | Amount, rub. |

| For RKO ruble account - monthly amount | 91.2 | 51 | 1000 |

| For making one payment in rub. | 91.2 | 51 | 200 |

| For servicing RBS, monthly amount | 91.2 | 51 | 1200 |

| For cash withdrawal - 2.5% of the amount issued (10,000 rubles) | 91.2 | 51 | 250 |

| For acquiring transactions - 1.5% of the payment amount (100,000 rubles) | 91.2 | 51 | 2500 |

| For RKO of a foreign currency account | 91.2 | 52 | 2350 |

If the bank returned the commission, the entries will be the opposite of those made when writing off: D 51 K 91.2.

When writing off bank fees for services subject to VAT, the transaction should be credited to the account of settlements with suppliers and contractors as payment for services rendered - D 60 (or 76.5) K 51 for the amount of funds written off.

Upon receipt of a document for a service provided by the bank, an entry will be made for the amount of services received D 91.02 K 60 (76) and VAT D 19.04 K 60 (76.5). Which account is used to account for settlements with the bank for services with VAT - 60 or 76 - must be fixed in the accounting policy.

Postings for accounting for bank commissions including VAT using account 76.5.

| Operation | Debit | Credit | Amount, rub. |

| Written off at the collection rate | 76.05 | 51 | 2500 |

| Charged at the rate for SMS notifications | 76.05 | 51 | 1545 |

| Written off for providing a credit history certificate at the bank | 76.05 | 51 | 300 |

| Written off at the rate for performing the functions of a currency control agent | 76.05 | 51 | 350 |

For services subject to VAT, organizations must receive an invoice from the credit institution in order to present VAT and charge the services received as expenses.

Postings for accounting for bank commissions including VAT upon receipt of an invoice.

| Operation | Debit | Credit | Amount, rub. |

| Received an invoice for collection, amount of services | 91.02 | 76.05 | 2119 |

| VAT on the invoice for collection | 19.04 | 76.05 | 391 |

| Invoice for SMS notification, services without VAT | 91.02 | 76.05 | 1309 |

| Invoice for SMS notification of VAT | 19.04 | 76.05 | 236 |

| Invoice for providing a certificate of credit history at the bank, services without VAT | 91.02 | 76.05 | 254 |

| Invoice for providing a certificate of credit history at the bank, VAT | 19.04 | 76.05 | 46 |

| Invoice for performing the functions of a currency control agent, services without VAT | 91.02 | 76.05 | 297 |

| Invoice for performing the functions of a currency control agent, VAT | 19.04 | 76.05 | 53 |

Accounting for bank commissions in 1C Accounting 8

Any enterprise is required to have a bank account. Naturally, banking institutions do not work for free and charge certain amounts for each transaction, so let’s look at how bank commissions are accounted for.

When opening a bank account, they charge a certain commission. If this account is planned to be used in production or economic activities, the organization has the right to take into account the payment for its opening as part of non-operating (other) expenses.

To open a current account, you must submit to the bank a card with sample signatures and seal impressions (form No. 0401026). Usually it is certified by a notary or an authorized person of the bank. In the second option, the bank may charge a certain fee and the organization can take this amount into account in expenses.

Despite the fact that the certification by a bank employee of the authenticity of signatures on a bank card is not specified in Article 5 of Law No. 395-1, and this service is not considered a non-operating or other expense in accordance with paragraph 25 of paragraph 1 of Article 264 or paragraphs. 15 clause 1 of Article 265 of the Tax Code of the Russian Federation, without a properly issued card, the bank will not open a current account for the company. Therefore, the costs of this service are economically justified and are taken into account as part of other expenses associated with production or sales, as well as other non-operating expenses (clause 49, clause 1, article 264, clause 20, clause 1, article 265 of the Tax Code of the Russian Federation ).

After the account is opened, various operations are reflected on it, such as receipt of funds from counterparties, receipt and withdrawal of cash, transfer of payments from the account, etc. For this, the company is charged a certain amount, payment for cash management services.

All expenses that are charged by the bank must be specified in the agreement with the bank. The terms of payment for bank services for cash settlement services are also indicated there. This is necessary so that the company can easily include the cash settlement amount in expenses.

In accounting, the cash settlement amount is reflected by the posting: Dt 91.02 Kt 51. In the 1c Accounting program 8 ed. 3.0 this operation is reflected in the document “Write-off from current account” with the transaction type “Other write-off”

In tax accounting, amounts paid for cash settlement services are classified as other or non-operating expenses only if transactions on the account being serviced are directly related to activities aimed at generating any income for the enterprise.

About accounting for bank commissions in 1C Accounting 8 under the simplified tax system, see here.

Did you like the article? Share on social media networks

Exchange with bank

To save time, you can easily set up automatic data exchange with the bank. All settlement transactions will be taken into account, there is no need to worry about this. For this purpose, the system provides special processing “Exchange with the bank”.

In 1C 8.3 there are several options for working with the client bank:

- from the “Exchange with the bank” form;

- from the magazine "Bank Statements";

- from the magazine.

Standard settings do not always take into account all the features of a company’s business processes. If you need individual customization, you can order 1C modification and maintenance services from us.

Bank commission in 1C 8.2

Hello. Please describe in detail the process of reflecting in 1C a bank commission in foreign currency (for payment to the supplier). We pay the supplier in different ways, but we always pay for the commission using a separate payment invoice. If we reflect the commission in the payment order for writing off the DS, then it must be closed independently (since the bank does not provide documents) quarterly. As for the commission in foreign currency, it is not closed by closing the period. How to write it off correctly, what to do with the resulting exchange rate difference? How can we close our overpayment to the importer, which remains from previous periods? Thank you.

answer:

CONSULTANT - CONSULTANT

Hello. Please describe in detail the process of reflecting in 1C a bank commission in foreign currency (for payment to the supplier). We pay the supplier in different ways, but we always pay for the commission using a separate payment invoice.

There are 2 options for the commission that arises when paying in foreign currency:

- The fee that the bank later indicates on the statement;

- The commission that was included in the payment amount and the supplier received the payment minus this commission.

If we reflect the commission in the payment order for writing off the DS, then it must be closed independently (since the bank does not provide documents) quarterly. As for the commission in foreign currency, it is not closed by closing the period. How to write it off correctly, what to do with the resulting exchange rate difference?

- Just like there are different types of commission, there are also different ways to close it:

If the commission amount is indicated in the statement, then it would be more correct to arrange it as a service from the bank:

In this case, transactions are generated, thanks to which expenses are deducted for the purposes of the State Revenue Service:

Then, on the same day, you need to reflect the payment to the bank that provided this service (carrying out currency transactions), a write-off payment order is very suitable for this:

The entries in this document close the debt to the bank, and the exchange rate difference is also automatically calculated:

2. If the commission amount is not included in the statement, but after payment, the money reaches the supplier minus the commission of the correspondent bank, then such a commission should be analyzed using an example:

- Goods have been received from the importer

Dt 1330 Kt 3310 1,000 rubles

- Paid to the supplier for the goods

Dt 3310 Kt 1030 1,000 rubles

Everything seemed closed, but the supplier provides a reconciliation report and we see the debt:

In this case, 50 rubles did not reach the supplier, as they ended up in the correspondent bank through which the payment went through. There are no supporting documents or extracts for such a commission. Then you have to send the amount to the supplier, taking into account the commission, and you get a similar situation:

- Goods have been received from the importer

Dt 1330 Kt 3310 1,000 rubles

- Paid to the supplier for the goods

Dt 3310 Kt 1030 1,050 rubles

Then the overpayment accumulates on the supplier’s account and the reconciliation report can no longer be signed. In this case, after payment, the supplier needs one more entry, which will cover the amount of the commission:

- Dt 7470 Kt 3310 50 rubles

In this case, all mutual settlements will be closed. In 1C, let’s look at an example, starting with the receipt of goods:

Wiring as in the example:

We make the payment taking into account the commission amount:

Posting a document to close the debt and transferring the overpayment amount to the advance:

And after that the supplier will have a debt in the amount of the overpayment:

How can we close our overpayment to the importer, which remains from previous periods?

Closing this debt, like any other, is done with the following document:

Document type:

In this case, the document is filled in automatically:

You just need to fill out the header of the document and set the currency of mutual settlements:

When writing off accounts receivable, you must indicate which account it will be written off to:

Since there are no supporting documents, we select a subaccount for the expense account, which will not be accepted by the NU and will not be reflected as a deduction in the TNF 100.00:

Mutual settlements with this counterparty:

If there is an overpayment, the company increases its accounts receivable, in other words, “requirements”, in order to write off this debt, while sending expenses for deduction, it must be recognized as doubtful:

Law “On taxes and other obligatory payments to the budget”

Article 105. Deduction for doubtful claims

- Unless otherwise established by this paragraph, doubtful claims are recognized as claims arising from the sale of goods, performance of work, provision of services to legal entities and individual entrepreneurs, as well as non-resident legal entities operating in the Republic of Kazakhstan through a permanent establishment, branch, representative office, and not satisfied within three years from the moment the claim arises.

- Claims recognized as doubtful in accordance with this Code are subject to deduction.

Taxpayers may include doubtful claims as deductions if the following conditions are simultaneously met:

- availability of documents confirming the occurrence of requirements;

- reflection of claims in accounting at the time of deduction or attribution of such claims to expenses (write-off) in accounting in previous periods.

4. Doubtful claims are deducted within the amount of previously recognized income from the sale of goods, performance of work, and provision of services.

In other words, the receivables that arise after being recognized as doubtful cannot always be written off as deductions.

Tutorial 1C: Accounting 8

At the last lesson, we continued to study the 1C Accounting 8 program and became acquainted with such elements as reference books. We reviewed the directories “Divisions”, “Cost Items”, “Other Income and Expenses”. We got acquainted with the documents. Created the first manual operation.

In this lesson we will study cash accounting. Money is the lifeblood of business! There is no business without money! Therefore, the company should always have cash accounting.

Let's look at how to keep track of cash. We will use documents such as incoming cash order (PKO), outgoing cash order (RKO). Let's see how a cash book is formed to record cash.

Let's consider accounting for non-cash funds. We will study “Payment orders”, documents “Receipt of funds” and “Write-off of funds”. In conclusion, I will show you how the 1C Accounting 8 program exchanges with the Client-Bank program, which can be installed on your computer. We will automatically upload payment orders from 1C Accounting 8 to the Client Bank and upload bank statements from the Client Bank to 1C Accounting 8.

At the end of the lesson you will be asked to do the first independent practical task.

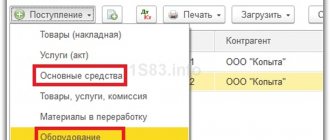

We will begin our study of accounting for transactions related to cash flow in the 1C Accounting 8 program with an overview of the possibilities. Let's go to the "Bank and cash desk" section. In this section, logs of main documents are available:

- payment orders and bank statements - by non-cash funds;

- cash documents and advance reports related to cash;

- management of fiscal registrars - we won’t manage it, so we’ll skip it;

- advance invoices.