18.03.2020

Almost every organization has fully depreciated fixed assets. What is the procedure for using an object if its useful life has expired? Is it possible to recognize expenses associated with the operation of such a fixed asset when calculating income tax? About this in the article.

The cost of an object accepted for accounting as a fixed asset will be fully repaid over time through depreciation. However, this does not mean that such an object ceases to be a fixed asset and is automatically written off from the balance sheet. After all, the acceptance of a fixed asset for accounting (both tax and accounting) is formalized by the corresponding primary documents (forms No. OS-1 and OS-6)1. Accordingly, its deregistration must also be documented. Let us remind you that all business transactions are reflected in accounting only on the basis of supporting documents. This is stated in paragraph 1 of Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” and paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

One of the conditions for including an asset in fixed assets is its ability to bring economic benefits (income) to the organization in the future (clause 4 of PBU 6/01). The expiration of the useful life of an object in itself is not grounds for its write-off. After all, it is possible that such an asset can continue to generate economic benefits in the future.

So, the organization should decide what to do with a fully depreciated fixed asset: liquidate it or sell it, repair or reconstruct (modernize).

In any case, the issue of further use of a fixed asset with zero residual value can be resolved only after its inspection by a special commission, which is created by order of the manager. In addition to the relevant officials, this commission must include an accounting employee. The commission also includes employees who are responsible for the safety of fixed assets. This procedure is provided for in paragraph 77 of the Guidelines for accounting for fixed assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n (hereinafter referred to as the Guidelines).

When inspecting a fixed asset facility, the commission uses not only the necessary technical documentation, but also accounting data. Based on the results of the inspection, the feasibility (suitability) of further use of the fixed asset, the possibility and effectiveness of its restoration are established. All decisions of the commission are documented.

Liquidation of a fixed asset It is possible that after inspecting the fixed asset, the commission will decide that the moral and physical deterioration of the object is so great that it should be liquidated. The cost of an item of fixed assets that is being retired or is not capable of bringing economic benefits (income) to the organization in the future is subject to write-off from accounting (clause 29 of PBU 6/01). This procedure fully applies to cases of write-off of fixed assets due to moral and physical wear and tear (clause 76 of the Guidelines).

If the fixed asset contains non-ferrous or precious metals, the commission is obliged to control their withdrawal, weight assessment and posting to the appropriate warehouse.

Documenting

The commission's decision to liquidate a fixed asset is formalized by an act on the write-off of a fixed asset item in form No. OS-4 (clause 78 of the Methodological Instructions). This form of the act can be used (from January 1, 2013 it is not mandatory) when deregistering all types of fixed assets, with the exception of vehicles. If you wish, you can independently develop and approve the form of the act for writing off the fixed assets. When liquidating vehicles, an act in form No. OS-4a is used.

The object being written off must be clearly identified, therefore the act indicates data characterizing the asset: the date the fixed asset was accepted for accounting, the year of manufacture or construction, time of commissioning, useful life, initial cost and the amount of accrued depreciation, revaluations, repairs. The act must indicate the inexpediency of further operation of the facility and the irrationality of its modernization. In addition, the act describes the condition of the main parts, parts, assemblies, structural elements and indicates the possibility of their further use, for example, for the repair of other objects.

The act is drawn up in two copies, signed by the members of the commission and approved by the head of the organization. One copy of the executed act for write-off of the asset remains with the financially responsible person. The second copy is transferred to the accounting department for registration of accounts. Based on this document, a mark indicating its disposal is placed in the inventory card of the item being written off. Inventory cards for retired fixed assets are stored separately for at least five years. The actual shelf life of such cards is determined by the head of the company (clause 80 of the Guidelines).

Note that the procedure for documenting the write-off of a fixed asset does not depend on the amount of accrued depreciation and applies even if the object is fully depreciated. Only when a vehicle is written off does the paperwork increase slightly. After all, a document confirming the deregistration of the car with the State Traffic Inspectorate is sent to the accounting department along with the report.

Disposal of fixed assets - how to reflect in 1C

Published 10/15/2014 20:45

Sometimes there are situations when an organization sells a fixed asset, or maybe it has to be written off due to physical/moral wear and tear or breakdown. What entries should the accountant make, and how to correctly reflect the disposal of fixed assets in 1C programs? Let's consider this situation using the example of 1C: Enterprise Accounting 8.

In our example, we will write off a fixed asset worth 100 thousand rubles due to a breakdown. This woodworking machine was registered in January 2013 and as of the end of September 2014 we see the following picture in the “Subconto Analysis” report.

Accrued depreciation is not yet equal to the original cost of the fixed assets; the residual value as of September 30, 2014 is 44,444 rubles.

Thus, when decommissioning the OS in October, we must:

— calculate depreciation for the last month of use;

— write off the initial cost to the account 01.09;

— write off the amount of depreciation accrued during the operating period also to account 01.09;

- write off the difference between the initial cost and accrued depreciation (residual value) as expenses (account 91.02).

For all these purposes, the “Write-off of fixed assets” document is intended, which is located on the “Fixed assets and intangible assets” tab.

We create a new document, indicate the reason for write-off - breakdown (you can add a new element to the directory “Reasons for write-off of OS”). Then we select the organization, write-off account - 91.02 and expense item - “Income (expenses) associated with the liquidation of fixed assets.” It is also necessary to fill out the “Location of fixed assets” field, indicating there the division in which the fixed asset is registered after acceptance for accounting. If this detail is left blank or incorrect data is specified, the program will generate an error like “Fixed asset. was not reflected in the accounting at location <>” and will not process the document.

We add the OS that should be written off to the tabular section, and the document can be processed.

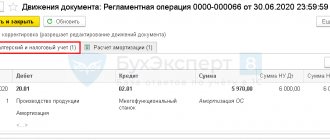

When posting a document, the following account movements are generated:

— Dt 20.01 Kt 02.01 — depreciation for October

— Dt 02.01 Kt 01.09 — accrued depreciation written off

— Dt 01.09 Kt 01.01 — the initial cost of the fixed assets was written off

- Dt 91.02 Kt 01.09 - the residual value of the fixed assets is written off as expenses

If you need more information about working in 1C: Enterprise Accounting 8, then you can get our book for free using the link.

Did you like the article? Subscribe to the newsletter for new materials

Income tax

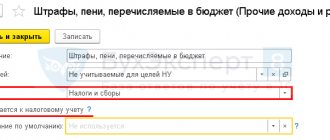

Expenses for the liquidation of fixed assets taken out of service, including the amount of depreciation underaccrued in accordance with the established useful life, are taken into account as part of non-operating expenses. The basis is subparagraph 8 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation.

When a taxpayer uses the accrual method in tax accounting, expenses accepted for profit tax purposes are recognized as such in the reporting (tax) period to which they relate (Clause 1, Article 272 of the Tax Code of the Russian Federation). Since the cost of the object has been fully repaid, the expenses associated does not arise with the write-off of underaccrued depreciation. But the organization’s expenses incurred during the liquidation of depreciated fixed assets can be taken into account when calculating income tax. Moreover, not only costs incurred by the company itself are recognized, but also those associated with payment for the relevant services of third-party organizations. After all, a company cannot always dismantle and dispose of an object being liquidated on its own.

As already mentioned, the write-off of fixed assets is carried out on the basis of the order of the manager and the write-off act signed by the members of the commission. In this case, the act of decommissioning the object can be fully executed only after the completion of the liquidation work.

When dismantling a fixed asset, materials, assemblies and assemblies often remain that are suitable for further use or for disposal for scrap or scrap metal. The cost of such material assets is taken into account as part of non-operating income (clause 13 of Article 250 of the Tax Code of the Russian Federation). The exception is the cases provided for (clause 18, clause 1, article 251 of the Tax Code of the Russian Federation). The date of recognition of such income is the date of signing the act on liquidation of depreciable property (subclause 8, clause 4, article 271 of the Tax Code of the Russian Federation). At the same time, the act reflects information about material assets obtained during the dismantling and disassembly of the object. Let us recall that the amount of the specified non-operating income is calculated as the current market value of the materials received (clause 5 of Article 274 and clause 1 of Article 40 of the Tax Code of the Russian Federation).

The fact that income arises does not depend on whether the capitalized materials received as a result of the liquidation of the asset will be subsequently used in business activities or not (see letter of the Ministry of Finance of Russia dated May 19, 2008 No. 03-03-06/2/58).

Subsequently, when using the material assets in question in business activities, the company will be able to take into account their value as part of material expenses in an amount equal to the amount of tax calculated on the income specified in paragraph 13 of Article 250 of the Tax Code of the Russian Federation (taken into account when recording these assets). This is stated in paragraph 2 of Article 254 of the Tax Code of the Russian Federation2.

How to write off a fully depreciated fixed asset

How to reflect in an organization’s accounting the write-off of a fully depreciated fixed asset item (hereinafter referred to as the fixed asset) due to physical wear and tear and the posting of materials received upon write-off? How to determine the price of the possible use of materials obtained from the write-off of fixed assets?

The organization writes off a fully depreciated asset due to physical wear and tear according to the decision of the manager. The revalued cost of fixed assets is 200 rubles, accumulated depreciation over the operating period is 200 rubles.

As a result of the write-off by the depreciation policy commission, materials (the use of which is possible for the production purposes of the organization) were credited to the warehouse at the price of their possible use in the amount of 10 rubles. The amount of the additional fund listed under OS, formed as a result of previously carried out revaluations, is 2 rubles.

Documenting

Each business transaction is subject to registration with a primary accounting document <*>.

Disposal of fixed assets as a result of write-off, including in the case of physical wear and tear, is documented in an act of write-off of property <*>.

Materials, the use of which is possible for the production purposes of the organization, are received on the basis of a primary accounting document (for example, an invoice for internal movement, an act of receipt of materials received from the write-off of fixed assets, or an act of write-off of property, etc.).

These forms of documents are developed by the organization independently in accordance with the requirements established by law and are approved by the accounting policies of the organization <*>.

Accounting

Accounting for the presence and movement of the organization's fixed assets that are in operation, stock, or conservation is carried out on account 01 “Fixed assets”, and information about their depreciation is on account 02 “Depreciation of fixed assets” <*>.

When disposing of fixed assets, the depreciation amounts accumulated on them over the entire period of operation are reflected in the debit of account 02 “Depreciation of fixed assets” and the credit of account 01 “Fixed assets”. The residual value of retiring fixed assets is reflected in the debit of account 91 “Other income and expenses” and the credit of account 01 “Fixed assets”, unless otherwise established by law <*>.

In the situation under consideration, the residual value of the written-off fixed asset is zero, since the fixed asset is fully depreciated and its revalued value is equal to the amount of accumulated depreciation. Consequently, an accounting entry for writing off the residual value of fixed assets is not made in the organization’s accounting.

The cost of materials received upon disposal of fixed assets is reflected in the debit of account 10 “Materials” and the credit of account 91 “Other income and expenses” (subaccount 91-1 “Other income”) <*>.

Income generated as a result of the capitalization of materials to the warehouse when writing off fixed assets are included in income from investment activities on the date of their capitalization <*>.

The amount of the additional fund listed on the retiring fixed assets, formed as a result of its previously carried out revaluations, is reflected in the debit of account 83 “Additional capital” and the credit of account 84 “Retained earnings (uncovered loss)” <*>.

Materials received at the warehouse from the write-off of fixed assets and intended for further use for the production purposes of the organization are accepted for accounting at the actual cost, which is determined by the prices of their possible use. In this case, the price of possible use of materials is determined based on the cost of similar materials listed in the organization’s accounting records, taking into account the degree of their suitability for use <*>.

To evaluate materials, an organization can use Regulation No. 615, which establishes the types, methods, and procedure for assessing property.

Legal entities have the right to conduct an internal assessment of the objects of assessment belonging to them <*>.

The internal assessment of the property being assessed is carried out on the basis of accounting data, information on the cost of acquisition, construction of the property being assessed or the cost of similar objects in accordance with the valuation methods specified in clause 3 of Regulation No. 615 <*>.

Based on the results of the internal assessment, an internal assessment report is drawn up, to which the documents used for the assessment are attached <*>.

In other words, according to the author, the price of the possible use of materials in the situation under consideration can be determined by the organization:

based on the cost of similar materials listed in the organization’s accounting records, taking into account the degree of their suitability for use;

based on information from manufacturers, suppliers, traders about the cost of identical or similar materials, taking into account the degree of their wear (suitability for use);

based on information posted on sites on the global computer network Internet, on identical or similar used materials, etc.

VAT

The objects of VAT taxation are the turnover of sales of goods (work, services), property rights on the territory of the Republic of Belarus <*>.

The write-off of an asset is not an alienation, and accordingly the organization does not have a subject to VAT <*>.

Income tax

The cost of capitalized materials is included in non-operating income no later than the date of their receipt <*>.

Accounting Entry Table

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| The write-off of accumulated depreciation when writing off fixed assets is reflected | 02 | 01 | 200 | Property write-off act, inventory card for accounting of fixed assets, accounting certificate-calculation |

| Reflects the posting of materials received upon write-off of fixed assets <*> | 10 | 91-1 | 10 | Property write-off act, accounting statement, invoice for internal movement, act of receipt of materials received from disassembly, etc. |

| Reflects the amount of the additional fund listed in the operating system, formed as a result of previously carried out revaluations | 83 | 84 | 2 | Accounting certificate-calculation |

| ——————————— <*> Taken into account when calculating income tax as part of non-operating income <*>. | ||||

Read this material in ilex >>*

* following the link you will be taken to the paid content of the ilex service

Accounting

Costs associated with the sale, disposal and other write-off of fixed assets and other assets other than cash (except foreign currency), goods, products are classified as other expenses (clause 11 of PBU 10/99).

The procedure for recognizing income and expenses associated with the write-off of fixed assets in accounting is similar to the procedure used for taxation of profits. In accordance with paragraph 31 of PBU 6/01, income and expenses from this operation are reflected in the reporting period to which they relate.

The cost of materials received during disassembly and dismantling of liquidated fixed assets is reflected in other income (clause 7 of PBU 9/99). The amount of other income for accounting purposes is determined in the same way as for tax purposes - based on the current market value of capital assets (clause 9 of PBU 5/01).

Method 2. Revalue your assets at fair value.

IAS 16 allows you to use 2 models for the subsequent valuation of your fixed assets: the historical cost model and the revaluation model.

[cm. paragraph IAS 16:29]

If you still plan to use the existing fixed assets in the future, their fair value will likely be greater than zero.

Revaluing an asset with a carrying amount of zero actually means that you are changing your accounting policy, and here you again need to be guided by the IAS 8 standard.

Under IAS 8, you should only change your accounting policy if:

- The change is required in accordance with IFRS. But in this case that is definitely not the case.

- This change results in financial statements providing reliable and more relevant information about the effects of transactions, events or conditions on a company's financial position, financial performance or cash flows.

[cm. IAS paragraph 8:14]

You (and your auditors) may argue that paragraph 2 accurately reflects your situation. But is this really true?

This method definitely solves the problem of having a zero book value at the end of the current accounting period - just like the pill provides immediate relief from headaches.

Accounting policies include certain rules and standards that determine how you will present certain transactions in your financial statements—not only now, but also in the future.

It's not like a pill that provides immediate relief. It is like a cure for the cause of the disease, making you healthy for a long time so that you no longer need to take pills. But what if you take the wrong pill?

So, think about it, if you change your accounting policy from a cost model to a revaluation model, will you provide better information about your fixed assets not only now, but also in the future?

Before you answer this question to yourself, think about this too:

- To determine the fair value of your machinery, you need to apply IFRS 13 Fair Value Measurement. This is very difficult, impractical and not always feasible . [cm. See also full text of IFRS 13]

- How will you estimate the market value of used production machines?

- The revaluation model is used 99.9% of the time for buildings and land because it is easy to establish the market value of these assets on a regular basis.

- Is the problem related to used production machines that are so specific that only a few companies like yours use them?

- You need to re-evaluate your technique fairly regularly . Can you estimate fair value, say, annually?

- You need to revalue the entire asset class , not individual items of fixed assets. Can you really determine fair value for all equipment? How practical is this?

If after considering all these aspects, you still want to move from a cost model to a revaluation model, then IAS 8 will make your job easier. You do not need to apply the new policy retrospectively—an assessment of prior periods is not required.

Example 1

Favorit LLC has several depreciated fixed assets on its balance sheet. Moreover, the initial cost of these objects is completely written off both in accounting and tax accounting. To clarify their technical condition and determine their possible use, a special commission was created by order of the director. The commission examined the condition of assets with zero residual value and determined that the moral and physical condition of one of the inspected objects was such that it should be liquidated. The company carried out partial liquidation on its own in June 2009. In addition, for the final dismantling and disposal of this object, Favorit LLC used the services of a third-party company. The work was carried out in two stages, which was confirmed by acts dated 06/30/2009 and 07/31/2009.

When dismantling the fixed asset, parts remained that could be used to repair the production equipment of Favorit LLC. These material assets were capitalized in the warehouse in July 2009 at a market value of 40,000 rubles. and used in August 2009.

The initial cost of the written-off fixed asset is RUB 800,000. The company's costs for dismantling the fixed asset amounted to 35,000 rubles, in addition, the cost of the work of the company hired to dispose of the write-off asset was 180,000 rubles. (excluding VAT), as well as the cost of each stage of work - 90,000 rubles. (excluding VAT).

The act in form No. OS-4 was drawn up and signed after the completion of all work on the liquidation of the facility, that is, in July 2009. According to him, this fixed asset was written off from the register.

In tax accounting, the organization takes into account the expenses for the services of a third-party company involved in the dismantling of a liquidated object on the basis of certificates of work performed in June and July 2009 for 90,000 rubles. respectively. Costs for partial disassembly of the object, carried out on our own, in the amount of 35,000 rubles. Favorit LLC recognized it on the basis of the write-off act, that is, in July 2009.

In July, the organization reflected non-operating income in the amount of 40,000 rubles. in the form of the cost of capitalized parts. When using them in business activities in August 2009, the company included 8,000 rubles in expenses. (RUB 40,000 × 20%).

In accounting, the cost of parts received during the liquidation of a fixed asset and subsequently used in production is recognized as expenses in full. According to paragraph 7 of PBU 18/02, it is necessary to reflect a permanent tax liability in the amount of 6,400 rubles in accounting. [(RUB 40,000 – RUB 8,000) × 20%]. The listed operations are reflected in the following entries:

in June 2009:

- debit 01 subaccount “disposal of fixed assets” credit 01 subaccount “fixed assets in operation” 800,000 rub. — the initial cost of the liquidated fixed asset is written off

- debit 02 credit 01 subaccount “disposal of fixed assets” 800,000 rub. — depreciation accrued on the liquidated object is written off

- debit 91-2 credit 69, 70 35,000 rub. — dismantling work done on our own is taken into account

- debit 91-2 credit 60 90,000 rub. — the first stage of dismantling and disposal work performed by the contractor was taken into account

in July 2009:

- debit 91-2 credit 60 90,000 rub. — the second stage of dismantling and disposal work performed by the contractor was taken into account

- debit 10 credit 91-1 40,000 rub. — parts received during dismantling of the fixed asset were capitalized

in August 2009:

- debit 20 credit 10 40,000 rub. — the cost of parts obtained as a result of dismantling the fixed asset is written off to production

- debit 99 credit 68 subaccount “income tax calculations” 6400 rub. — permanent tax liability is taken into account

How to write off an operating system from the balance sheet if it is completely depreciated?

Based on the rules of PBU 6/01, fixed assets can be written off from the balance sheet of an enterprise only in the process of disposal (sale, transfer) or complete loss of their ability to generate income.

It is necessary to reflect losses in connection with the write-off of fixed assets that have ceased to be profitable and cannot be restored as part of other expenses for the period to which they relate.

When calculating income tax, you need to take into account expenses for liquidation of fixed assets in non-operating expenses.

Important! depreciation cannot be regarded as a write-off of property. Even if this resource is completely exhausted, the property can be recorded on the balance sheet at zero residual value.

Moreover, if fully depreciated property consists of several components, then partial write-off is possible, since some elements of the fixed asset may be beneficial.

If the fixed assets are fully depreciated, then the company has the right to write it off the balance sheet.

Such a fixed asset has no residual value, so losses from this procedure will only be associated with payment for the process of dismantling, dismantling, and disposal.

In this case, the parts and components of a depreciated fixed asset can be taken into account if they can be used in the future.

How to write off an OS that has become unusable?

Documenting

To write off a fully depreciated asset, a commission is required, which necessarily includes an accountant and the person responsible for the object.

The commission must complete several steps, accompanied by the formation of documentary evidence:

| Steps | Characteristic |

| Inspection of a depreciated object | It is necessary to study the fixed asset in detail for technical and external condition; all data is entered into a special inspection report |

| Determining the possibility and feasibility of restoring a fixed asset | It is important to find out the cost-effectiveness of restoring or upgrading the OS for further operation |

| Determining the reasons for write-off | Indication of the reason why asset write-off is required - physical wear and tear due to the expiration of its useful life |

| Determination of perpetrators | This action is necessary if the asset is written off before the end of the operational period and full depreciation of the asset (accident, breakdown, damage) |

| Possibility of using and posting individual elements | Before complete liquidation, it is necessary to determine the feasibility of removing individual components and mechanisms of the depreciated fixed asset for further use |

After the liquidation of a fixed asset, the participants in the process must draw up a write-off act in accordance with the requirements of clause 68 of the Methodological Instructions, approved. By Order of the Ministry of Finance of the Russian Federation No. 91 of 2003.

Taking into account the current situation and the amount of funds written off, current unified forms from the following list are used:

- form OS-4 – for dismantling one object;

- Form OS-4a – for writing off vehicles;

- form OS-46 – for deleting a group of objects.

This document serves as the basis for entering information into the following documentation:

- inventory card in OS-6 format or for information on the group, unified form OS-6a;

- OS inventory accounting book according to OS-6b form.

If the decommissioned OS was disassembled and the resulting parts remained in production for further use, they must be capitalized.

For this purpose, the following documents are filled out:

- invoice in form M-11;

- act in form M-35.

In addition, in connection with the disposal of an illiquid production unit, an enterprise may incur expenses such as:

- residual value of the object (if the fixed assets are not fully depreciated), according to clause 29 of PBU 6/01;

- expenses as a result of its disassembly, clause 31 of PBU 6/01.

Accounting entries upon disposal of an object without residual value

To reflect the write-off of fixed assets, a separate subaccount 2 is opened on account 01, the initial cost of the asset is transferred to the debit of which, and the accumulated depreciation is transferred to the credit.

For fully depreciated fixed assets, these indicators will be equal, and fixed assets will not have a residual value, that is, the balance in subaccount 01.2 for such fixed assets will be zero.

Expenses from write-off are reflected in the debit of account 91. Expenses for dismantling, payment for services of third-party organizations for disassembly and disposal are collected here.

The cost of capitalized components and components of a written-off fixed asset is reflected in other income on account 91.

To enter information into accounting regarding the write-off of property that is fully depreciated, that is, has no residual value, the following entries are generated:

| Wiring | Operation description | |

| Debit | Credit | |

| 02 | 01. Disposal of fixed assets | Depreciation amounts accrued during the period of operation of the facility are indicated. |

| 01. Disposal of fixed assets | 01 | The original acquisition cost of the item being written off is transferred |

| 91.2 | 01.2 | According to the act, the residual value of the object intended for write-off is written off (for fully depreciated fixed assets, the transaction amount is zero) |

| 91.2 | 23, 68, 76, 60 | Costs for dismantling the object, if this procedure is carried out by third parties |

| 91.2 | 70, 69, 10 | Accounting for liquidation costs using the enterprise’s own employees |

This procedure is observed in accordance with the instructions to the chart of accounts 23 - 91.

To take into account materials during dismantling, the following wiring must be used:

| Postings | Operation description | |

| Debit | Credit | |

| 10 | 91.1 | Receipt of materials received as a result of dismantling |

| 62 | 91.1 | Designation of revenue received as a result of the sale of individual components or scrap |

| 91.2 | 10 | Written-off cost of products |

Important! The sale of materials is reflected in accounting as other income, and their cost is written off as other expenses.

Sale of fixed assets

The fact that a fixed asset is fully depreciated does not mean that this asset cannot be used in the organization's activities. After all, the suitability of an object for operation is determined by its technical and economic indicators. And if these indicators do not meet the requirements of one enterprise, they may suit another. Therefore, there is a chance to sell outdated equipment. In this case, the fixed asset item is also subject to deregistration (clause 76 of the Methodological Instructions).

Reasons for writing off fixed assets if depreciation has not yet ended

If an organization decides to write off a fixed asset that has not yet been depreciated (that is, has a non-zero residual value), then the reason for this is the inexpediency of further use of the asset.

As a rule, the reason for premature write-off before the end of its useful life is:

- A breakdown is one that cannot be corrected, or can be corrected at significant costs that are not economically feasible.

- Reduced productivity due to wear and tear.

- Moral obsolescence – when a model does not meet modern requirements.

We suggest you read: Write off money for a debt from friends in your apartment, how to get it back

In all of these cases, equipment or other fixed assets that have become unusable should be written off.

Documenting

The sale of a fixed asset (its disposal for other reasons) is documented with the relevant primary accounting documents (clause 7 of the Methodological Instructions).

Thus, to reflect the disposal of an asset, a transfer and acceptance certificate is used in form No. OS-1, and if a building or structure is disposed of - (clause 81 of the Methodological Instructions). The document is drawn up in at least two copies, one for each party. The usual requirements for drawing up the act are: all fields must be filled out and the document must be signed by members of the commission. Section 1 of the act, which is filled out based on the data of the transferring party, indicates information about the disposed object, including the amount of depreciation accrued from the beginning of operation.

The transfer by an organization of an object of fixed assets into the ownership of other persons is formalized by an act of acceptance and transfer of fixed assets in form No. OS-1 [comment: Sale of fixed assets] Operations for the receipt of fixed assets in the organization, their internal movement and disposal relate to operations for the movement of fixed assets [ /a comment]/

Section 2 of the act in form No. OS-1 is filled out only by the purchasing organization in one copy (that is, the seller does not fill it out).

The act must reflect information characterizing the object being sold, and also include a note from the accounting department that the disposal of the asset is recorded on the inventory card. The entry is made on the date of approval of the act by the heads of the companies of the seller and the buyer and is certified by the signature of the chief accountant of the seller’s organization. Based on this act, the seller’s accounting records the write-off of the fixed asset.

An inventory card for the sold fixed asset is attached to the transfer and acceptance certificate. A note about the seizure of the inventory card for a retired object is made in a document opened at the location of the object.

Income tax

Proceeds from the sale of fixed assets, including fully depreciated ones, are recognized as income from sales (clause 1 of Article 249 of the Tax Code of the Russian Federation). At the same time, tax legislation gives the company the right to reduce the income received by the residual value of depreciable property (subclause 1, clause 1, article 268 of the Tax Code of the Russian Federation). If the residual value of an asset is zero, this does not mean that the company has no costs when selling it. The company can reduce income for expenses directly related to its implementation (clause 1 of Article 253 and clause 1 of Article 268 of the Tax Code of the Russian Federation). Such expenses are, for example, the costs of valuation, storage or delivery of an item of fixed assets.

When selling a fixed asset, the corresponding technical documentation is transferred along with it, as indicated in the transfer and acceptance certificate. After all, the buyer will not be able to properly operate the object without the necessary instructions. Suppose the costs associated with the sale of a fixed asset exceed the proceeds from its sale, then the difference between these values can be recognized as a loss from the sale, which is taken into account for tax purposes as part of other expenses. The basis is paragraph 3 of Article 268 of the Tax Code of the Russian Federation. Let us recall that, according to this norm, the resulting loss is written off evenly over the remaining useful life of the asset. However, the useful life of the depreciated fixed asset has been fully exhausted. Consequently, the amount of loss is recognized as a lump sum.

Chapter 25 of the Tax Code allows the taxpayer to take into account as expenses part of the cost of a fixed asset at a time when it is put into operation (depreciation bonus). The relevant provisions are established in paragraph 2 of paragraph 9 of Article 258 of the Tax Code of the Russian Federation3.

Read about the specifics of using the depreciation bonus in 2009 in the article “How to apply the depreciation bonus in 2009” // RNA, 2009, No. 8. - Note. ed. Let's say an organization sells a fully depreciated fixed asset, in respect of which a depreciation bonus was previously applied. Then you need to take into account the requirements contained in paragraph 4 of paragraph 9 of Article 258 of the Tax Code of the Russian Federation. So, if the asset being sold was used by the organization for less than five years, then the depreciation bonus must be restored and included in the tax base for income tax. Naturally, we are talking about objects with a short service life, that is, included in the first - third depreciation groups.

From January 1, 2009, the amount of the depreciation bonus is for fixed assets belonging to the third - seventh depreciation groups, no more than 30%, for other fixed assets - no more than 10% of the cost. The restored depreciation bonus is included in non-operating income in that reporting (tax) period , in which the main tool is implemented. Similar explanations are given in the letter of the Ministry of Finance of Russia dated April 30, 2009 No. 03-03-06/1/291. Moreover, the amount of the restored depreciation bonus cannot be taken into account as expenses either during the restoration period or later. This opinion was expressed by the Russian Ministry of Finance in letters dated March 16, 2009 No. 0303-05/37 and dated March 16, 2009 No. 03-03-06/2/142.

When restoring the depreciation bonus, the amount of accrued depreciation for previous tax periods (before the sale of the object) is not recalculated. The considered procedure for restoring the depreciation bonus is applicable not only to the cost of a fixed asset, but also to the costs of its reconstruction, modernization and other improvements.

How to take into account the write-off of illiquid inventory items in tax accounting

The chart of accounts for the accounting of financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n (hereinafter referred to as the Chart of Accounts), for accounting for the decrease in the value of inventory and materials as a result of their damage, as well as for writing off the entire cost of valuables when they are destroyed, account 94 is intended “Shortages and losses from damage to material assets.” This account is used for interim accounting of the cost of inventory items subject to write-off.

We suggest you read: How to restore a car and its documents after disposal?

Depending on the circumstances surrounding such a write-off, the cost of inventory items can be attributed (Instructions for using the Chart of Accounts for accounting financial and economic activities of organizations (approved by Order of the Ministry of Finance of Russia N 94n)):

- for production expenses or sales expenses when writing off the cost within the limits of natural loss norms during the production, storage or sale of inventories (clause 58 of the Methodological Instructions, paragraph 3 of the Methodological Recommendations for the development of natural loss norms, approved by Order of the Ministry of Economic Development of Russia dated March 31, 2003 N 95 );

- on account of other settlements with personnel in cases where the amount of damage is attributed to the guilty persons from among the organization’s employees;

- against other expenses, if the perpetrators are not identified.

If damage to material assets is recognized as an insured event, the organization separately takes into account the amount of insurance compensation as other income (clause 7, 10.2 of section III of the Accounting Regulations “Income of the Organization” PBU 9/99 (approved by Order of the Ministry of Finance of Russia dated 06.05.1999 N 32n)). If the organization provides for the creation of a reserve for the depreciation of inventory items, their value is written off at the expense of this reserve. It should be noted that the formation of a reserve for a decrease in the cost of inventory and materials is a mandatory requirement for all organizations, except those that are granted the right to use simplified methods of accounting (paragraph 2 of clause 25 of the Accounting Regulations “Accounting for inventories” PBU 5/ 01 (approved by Order of the Ministry of Finance of Russia dated 06/09/2001 N 44n));

- directly to the profit and loss account in case of losses arising from natural disasters, if such are not subject to compensation.

Material costs include losses from shortages or damage to goods and materials during their storage and transportation within the limits of natural loss norms established by law (clause 2, clause 7, article 254 of the Tax Code of the Russian Federation).

However, expenses associated with shortages or damage to inventory items for other reasons can also be included in income tax expenses if they meet the requirements of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation on economic feasibility and documentary evidence.

Such costs can be written off by inclusion in one of the following categories: non-operating expenses (clause 20, clause 1, article 265 of the Tax Code of the Russian Federation), other expenses associated with production and sales (clause 49, clause 1, article 264 of the Tax Code of the Russian Federation) ). The lists are open. It should be noted that including the cost of damaged valuables in expenses may entail claims from the tax authorities (Letter of the Ministry of Finance of Russia dated 06/07/2011 N 03-03-06/1/332).

https://www.youtube.com/watch?v=https:accounts.google.comServiceLogin

However, with proper documentation, a positive outcome of the dispute with the tax authorities is very likely for the organization.

The Resolution of the Federal Antimonopoly Service of the North-Western District dated September 11, 2008 in case No. A56-3652/2007 considered a situation where a company wrote off physically worn-out and obsolete materials as illiquid property and included their cost in expenses. The court found that the materials were recognized as illiquid due to their long-term storage (the materials were purchased in 1980 - 1995.

for production purposes), lack of movement (income - expenditure), loss of presentation, unsuitability for use. The court came to the conclusion that the company was not able to use the decommissioned materials for their intended purpose due to the loss of their original properties, and indicated that the decommissioned materials were purchased by the company directly for production activities, their use was supposed to generate income, which is justified, in accordance with Art. 252 of the Tax Code of the Russian Federation.

The cost of physically worn out and obsolete materials at the time of their write-off as illiquid property can be attributed to the reduction of taxable profit.

Regarding the restoration of the VAT amount.

We suggest you familiarize yourself with How to write off bonuses for designers by bank transfer

According to the position of the Supreme Arbitration Court of the Russian Federation, set out in Decisions dated May 19, 2011 N 3943/11, dated October 23, 2006 N 10652/06, the obligation to pay to the budget VAT amounts previously legally accepted for deduction must be directly provided for by law, and the Tax Code of the Russian Federation does not provide for restoration VAT previously accepted for deduction when writing off expired goods.

The Federal Tax Service of Russia has a similar opinion (Letter dated 05/21/2015 N ГД-4-3/ [email protected] ).

But at the same time, there are explanations from regulatory authorities in which they insist on the restoration of VAT in such cases (see, for example, Letter of the Ministry of Finance of Russia dated January 21, 2016 N 03-03-06/1/1997). And although the decisions of the highest courts have priority over the explanations of the Ministry of Finance of Russia, the possibility of claims from regulatory authorities cannot be excluded (Letter of the Ministry of Finance of Russia dated November 7, 2013 N 03-01-13/01/47571 (sent for information and use in the work of the Letter of the Federal Tax Service Russia dated November 26, 2013 N GD-4-3/21097)).

Accounting

Proceeds from the sale of fixed assets are recognized as other income of the organization (clause 7 of PBU 9/99). In this case, the residual value of the disposed object is written off from accounting as other expenses of the organization (clause 11 of PBU 10/99). Other expenses also include costs associated with the sale of fixed assets. It is clear that when selling a depreciated object, there are no expenses in the form of residual value.

Please note: accounting does not provide for the use of bonus depreciation. Accordingly, if in tax accounting upon the sale of a fixed asset the depreciation bonus is restored, the provisions of PBU 18/02 must be applied in accounting and the permanent difference must be reflected, which leads to the emergence of a permanent tax liability (clauses 4 and 7 of PBU 18/02).

Example 2

Alpha LLC has decommissioned equipment on its balance sheet. A commission appointed by order of the general director of Alpha LLC determined that it could be sold. The specified fixed asset belongs to the first depreciation group, its initial cost is 200,000 rubles. The asset was accepted for accounting on February 1, 2009 and fully depreciated in April 2010. For profit tax purposes, the organization, when accepting the object for accounting, applied a depreciation bonus in the amount of 10%, which amounted to 20,000 rubles. Let's say a fixed asset was sold in May 2010 for RUB 82,600. (including VAT RUB 12,600).

Since at the time of sale the property had been used by the organization for less than five years, the depreciation bonus must be restored. That is, in tax accounting in May 2010, 90,000 rubles must be taken into account as income. (RUB 82,600 - RUB 12,600 + RUB 20,000).

For the amount of the restored depreciation bonus, the organization will accrue a permanent tax liability in the amount of 4,000 rubles. (RUB 20,000 × 20%).

When selling an object, the following entries will be made in accounting:

- Debit 01 subaccount “disposal of fixed assets” credit 01 subaccount “fixed assets in operation” RUB 200,000. — the original cost of the fixed asset being sold is written off

- Debit 02 credit 01 subaccount “disposal of fixed assets” 200,000 rub. — depreciation accrued on the property being sold is written off

- Debit 62 credit 91-1 82,600 rub. — income from the sale of fixed assets is reflected

- Debit 91-2 credit 68 subaccount “VAT calculations” 12,600 rubles. — VAT accrued

- Debit 99 credit 68 subaccount “income tax calculations” 4,000 rubles. — a permanent tax liability is reflected

Accounting for revaluation results when writing off an object

A special group of fixed assets consists of objects that have been revalued because their value differs from the original value (paragraph 3 of clause 15 of PBU 6/01). Therefore, when writing off such fixed assets from accounting, it is necessary to write off the amounts of their revaluation (paragraph 7, clause 15 of PBU 6/01). The procedure for writing off revaluation amounts due to liquidation or sale of fixed assets is the same.

As a rule, revaluation consists of increasing the original cost of a fixed asset and the amount of depreciation accrued on it (revaluation). It is not profitable for the company to reduce the value of assets and thereby demonstrate the use of low-quality equipment. After all, only low-quality and obsolete equipment has a market value that decreases so rapidly that it has to be discounted.

Let us remind you that when carrying out an additional valuation, no income appears in accounting, since the amount of the additional valuation is attributed to the increase in additional capital. Accordingly, when an object is disposed of, no expense arises; the amount of its revaluation is transferred from additional capital to the company’s retained earnings. Please note: the results of revaluation are reflected only in accounting, because tax legislation does not provide for such an operation. Therefore, when deregistering a fully depreciated fixed asset, no entries are made in tax accounting. The rules of PBU 18/02 also do not apply in this case, since writing off revaluation amounts does not affect income tax calculations.

Documenting

Just like other business transactions, the modernization of fixed assets is formalized with primary documents. The set of documents that must be completed when carrying out modernization is similar to the documents drawn up when carrying out repairs (see box on page 38). The only exception is that there is no need to fill out a defective statement, because the modification is carried out not in order to eliminate the breakdown of the fixed asset, but to improve its technical and economic indicators.

Upon completion of work on the modernization of a fixed asset, the amounts of costs incurred are indicated in the inventory card for this object. The procedure for maintaining inventory cards depends on the method chosen by the company for accounting for costs to improve the operational performance of fixed assets (clause 43 of the Methodological Instructions).

Income tax

The initial cost of a fixed asset changes in the case of modernization of the relevant facilities (clause 2 of Article 257 of the Tax Code of the Russian Federation). That’s why it’s so important to correctly classify the work performed—whether it’s repair or modernization. In the first case, the value of the asset does not change and all costs incurred are taken into account when calculating profit at a time. In the second, the cost of the object increases by the amount of modernization costs incurred.

Modernization operations include work caused by a change in the technological or service purpose of a fixed asset item. This follows from paragraph 2 of Article 257 of the Tax Code of the Russian Federation

After the modernization, the company can increase the useful life of a fixed asset, but only within the limits established for the depreciation group in which it was included upon commissioning. If a maximum useful life has been established for an object, then this period does not increase. The specified procedure is also applicable to fully depreciated fixed assets (see letters of the Ministry of Finance of Russia dated March 13, 2006 No. 03-03-04/1/216 and March 2, 2006 No. 03-03-04/1/168).

Increasing the useful life of a fixed asset as a result of modernization is a right, not an obligation of the taxpayer. Most likely, the organization will not increase the useful life of a fully depreciated object. This means that the amount of depreciation should be calculated according to the standards established when this facility was put into operation.

Let’s assume that after modernization, the organization nevertheless increased the useful life of the facility. Then the amount of depreciation is calculated based on the new useful life.

Depreciation on a modernized fixed asset item is accrued from the 1st day of the month following the month of completion of the modernization (paragraph 2, paragraph 2, article 259 of the Tax Code of the Russian Federation). The amount of accrued depreciation is recognized as expenses on a monthly basis (subclause 3, clause 2, article 253 and clause 3, article 272 of the Tax Code of the Russian Federation).

Accounting

In accounting, when modernizing fixed assets, their initial (replacement) cost changes (clause 14 of PBU 6/01). It is also possible to increase the useful life of the modernized facility (clause 20 of PBU 6/01). But in this case, the useful life limits are not limited; the company has the right to set them independently. Depreciation is calculated from the 1st day of the month following the month in which modernization expenses are recognized (clause 21 of PBU 6/01). The amounts of accrued depreciation are expenses for ordinary activities (clause 5 of PBU 10/99) and are recognized monthly.

In accounting, modernization is understood as an improvement (increase) of the initially adopted standard indicators of the functioning of a fixed asset object (clause 20 of PBU 6/01)

Unlike tax in accounting, the amount of depreciation is determined based on the residual value of the object, taking into account the costs of modernization and the remaining useful life (clause 60 of the Guidelines). Different accounting procedures lead to the formation of temporary differences and, accordingly, deferred income tax (clauses 8 and 9 of PBU 18/02).

How to fix the situation with the useful life?

In this situation, two possible corrective actions can be proposed.

Method 1: Review of useful lives in each financial year.

The useful resource of an asset is its accounting value. And if you find that it is different from what you originally estimated, you need to account for this change in accordance with IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors.

This means you simply establish a new remaining useful life, take the carrying amount and recognize the depreciation cost based on the carrying amount and the new remaining useful life.

Restated depreciation expense = Carrying amount (as of date of revision) / Remaining useful life

Revision of useful life for previous periods is not allowed! IAS 8 requires prospective application of changes in accounting estimates and policies (ie, now and in the future).

[cm. definition in IAS 8:5]

Now you may be asking: What should I do if the book value of my assets (net book value) is zero?

If you have regularly reviewed and reviewed the useful life of assets in the past and during the current reporting period, and find that you want to use the assets even longer, then there is nothing to do. All that remains is to leave these assets as they are and try to avoid this situation in the future.

However, if you actually forgot to revise the useful life results in an accounting error when applying IAS 16 .

If the error is material, you must correct it retrospectively in accordance with IAS 8. This means restating prior periods using the revised estimated useful life. This means a lot of work!

[cm. IAS paragraph 8:22]

Example 3

In March 2007, Fortuna LLC put the equipment into operation. In accounting and tax accounting, the initial cost of this object was 180,000 rubles, the useful life was set at 25 months (second depreciation group), and the linear depreciation method was used. In April 2009, the fixed asset was fully depreciated. As a result of examining the equipment, the commission came to the conclusion that for its further use it would be advisable to modernize it in order to improve its technical characteristics. The head of the company issued an order to carry out the relevant work by a contractor, the cost of the work is 120,000 rubles. (excluding VAT). The modernization work was completed in May 2009, which means that depreciation is accrued from June 2009.

In tax accounting, the organization after modernization did not increase the useful life of the equipment. That is, depreciation is calculated based on the norm established when putting the facility into operation - 4% (1 ÷ 25 months × 100%), as well as the new initial cost - 300,000 rubles. (RUB 180,000 + RUB 120,000). The monthly depreciation amount after modernization is 12,000 rubles. (RUB 300,000 × 4%). Thus, expenses will be taken into account for 10 months (RUB 120,000 ÷ RUB 12,000/month).

In accounting, after modernization, the useful life of the object was increased by 20 months. The monthly depreciation amount is calculated based on the residual value equal to the costs of modernization (RUB 120,000) and the remaining useful life of 20 months. Its amount is 6000 rubles. (RUB 120,000 ÷ 20 months). The following entries were made in the organization's accounting records:

in May 2009:

- debit 08 credit 60,120,000 rub. — the costs of modernizing a fixed asset facility by a third party are reflected

- debit 01 credit 08 120 000 rub. — the initial cost of a fixed asset item was increased by the amount of modernization costs; monthly from June 2009 to January 2011

- debit 20 credit 02 6000 rub. — depreciation was accrued on the modernized fixed asset item

In accounting and tax accounting, the same amount is included in expenses for different periods of time. Since depreciation is calculated in a larger amount each month for profit tax purposes, a taxable temporary difference is created in accounting. Therefore, it is necessary to reflect the deferred tax liability (clauses 12 and 15 of PBU 18/02). It is accrued monthly at 1200 rubles. [(12,000 rubles - 6,000 rubles) × 20%] for ten months, that is, until the end of depreciation in tax accounting. The total deferred tax liability will be RUB 12,000. (1200 rubles × 10 months).

From the 11th to the 12th month inclusive, the deferred tax liability will gradually decrease and will be completely repaid at the end of depreciation in accounting.

These transactions are reflected in the following entries:

monthly from June 2009 to March 2010:

- debit 68 subaccount “income tax calculations” credit 77 1200 rub. — deferred tax liability accrued

monthly from April 2009 to January 2011:

- debit 77 credit 68 subaccount “income tax calculations” 1200 rub. — deferred tax liability has been repaid

The opposite situation is also possible, when in accounting the modernized object will be depreciated faster than in tax accounting. Then deductible temporary differences and, accordingly, a deferred tax asset are formed (clauses 11 and 14 of PBU 18/02).

How to depreciate an OS after upgrading

The Ministry of Finance of Russia in letter dated July 13, 2020 No. 03-03-06/1/60600 explains that if a fixed asset is fully depreciated and modernized, the initial cost of such a fixed asset for tax accounting purposes increases by the cost of the modernization. Let's look at how this is done in detail.

Modernization of fixed assets

Modernization is an improvement in the qualitative characteristics of a fixed asset (for example, increasing its power, service life, etc.).

The costs of modernization and reconstruction of fixed assets are not included in the cost price, but are included in the increase in their initial cost.

Example.

OS modernization The organization decided to improve the technical characteristics of the computer by replacing the processor with a more powerful one and installing a CD drive. The cost of the work (including the cost of new parts) was 12,000 rubles. (including VAT - 2000 rubles). After modernization, the computer began to be used as a server.The company accountant must make the following entries:

DEBIT 60 CREDIT 51

– 12,000 rub. – the cost of the work has been paid;

DEBIT 08 CREDIT 60

– 10,000 rub. (12,000 – 2000) – modernization costs are taken into account;

DEBIT 19 CREDIT 60

– 2000 rub. – VAT included;

DEBIT 01 CREDIT 08

– 10,000 rub. – the amount of modernization costs is included in the initial cost of the computer;

DEBIT 68 SUBACCOUNT “VAT CALCULATIONS” CREDIT 19

– 2000 rub. – tax deduction has been made.

If the old processor removed from the computer will be used in the organization or sold, it must be capitalized on account 10 “Materials” at market value.

In accounting you need to make a posting:

DEBIT 10 CREDIT 91-1

– spare parts have been capitalized for further use.

Depreciation of fully depreciated operating systems after modernization

Modernization of an operating system is associated with capital costs, which increase its initial cost and are written off through depreciation, even if the operating system has been fully depreciated. Officials remind us of this in their commentary letter.

Completion, additional equipment, reconstruction, modernization, technical re-equipment - all this is capital work. Their cost cannot be written off at a time (clause 5 of Article 270 of the Tax Code of the Russian Federation). It increases the initial cost of the fixed asset (clause 2 of Article 257 of the Tax Code of the Russian Federation). And then written off gradually through depreciation.

Thus, with the linear accrual method, the amount of depreciation accrued for one month is determined as the product of the original cost of the depreciable property and the depreciation rate determined for this object (clause 2 of Article 259.1 of the Tax Code of the Russian Federation).

The Tax Code does not provide any exceptions to this procedure, even for fully depreciated objects that have undergone modernization. For tax accounting purposes, the initial cost of such a fixed asset is increased by the cost of the modernization carried out. And the amount of depreciation accrued monthly is determined as the product of the initial cost increased as a result of modernization and the depreciation rate initially determined for this object.

Moreover, if the useful life of such a fixed asset by the taxpayer was not increased in accordance with Article 258 of the Tax Code of the Russian Federation, then the cost of the modernization performed will be depreciated according to the standards that were determined when this fixed asset was put into operation.

The amount of increase in the initial cost is determined from all the costs of modernizing the facility. To do this, you need to collect all supporting documents:

- invoice requirements for the transfer of materials to the unit carrying out the modernization;

- acts for write-off of materials;

- work orders;

- acceptance certificate, which indicates the completion date of the work and its full cost.

If the work was carried out by third-party organizations, a bilateral acceptance certificate will serve as documentary evidence of the costs incurred.

Thus, after the modernization:

- add the amount of costs for its implementation to the initial cost of the operating system;

- use the depreciation rates that were initially determined when the fixed asset was put into operation.