Reporting changes in 2018

This year the reporting company will be carried out using many declarations in new forms.

Updated 4-FSS reports, tax return for transport tax, tax return for income tax. A new form of property tax reporting, 3-NDFL, and land tax declaration has been introduced.

There are no serious innovations in these reports. Most of the innovations are related to clarifications and innovations in tax legislation. Therefore, in most cases, declarations are supplemented with new lines.

In addition, new reporting forms have been developed that will need to be used starting in 2021, these are primarily:

- New calculation of insurance premiums.

- Help 2-NDFL.

- Declaration 6-NDFL.

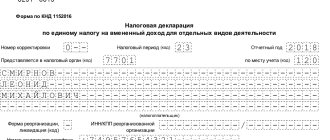

- Declaration on UTII and others.

Important!

For the first time this year, companies and entrepreneurs acting as employers will need to submit a new SZV-STAZH form to the Pension Fund. Many accountants have already received notification letters from representatives of the Pension Fund of the Russian Federation about the need to submit a new report and the deadline for its submission. Letters arrived both electronically and by post. This is due to the fact that the previously existing report is now divided into two - one needs to be sent to the Federal Tax Service, the other to the Pension Fund.

Many statistical reporting forms have also been updated. New this year was the impossibility of submitting a zero report to Rosstat.

Therefore, if a report is included in the list of mandatory forms for a company, but the company does not have the data to fill it out, then it is necessary to send letters to statistics explaining the reason for the impossibility of submitting certain reporting forms (for example, due to the lack of objects of statistical observation).

Deadlines for submitting reports for the 1st quarter of 2021 (USN, UTII, Unified Agricultural Tax, OSNO) for legal entities

The volume and composition of organizations' reporting depends on the tax regime they apply. The table groups reporting deadlines for companies operating both on OSNO and special regimes. Please note that along with the Social Insurance Fund reporting for the 1st quarter of 2021, it is not too late to submit confirmation of the type of activity of the company, which is considered the main one based on the results of last year.

The table does not indicate the deadlines for statistical reports of organizations - like entrepreneurs, legal entities can find out the list of their statistical reporting and the deadlines for its submission independently from the link above.

Accountant’s calendar – reporting deadlines (table):

| Report title | Reporting period | Deadline | Where to take it |

Deadlines for submitting reports for LLCs on OSNO | |||

| Income tax return (submitted quarterly or monthly) | 1st quarter 2018 | 28.04.2018 | quarterly to the Federal Tax Service |

| January 2018 January-February 2018 January-March 2018 | 28.02.2018 28.03.2018 28.04.2018 | monthly to the Federal Tax Service | |

| VAT declaration | 1st quarter 2018 | 25.04.2018 | quarterly to the Federal Tax Service only in electronic form |

| Calculation of advance payment for property tax (if tax reporting periods apply in the region) | 1st quarter 2018 | 03.05.2018 | quarterly to the Federal Tax Service |

| Calculation of 6-NDFL | 1st quarter 2021 | 03.05.2018 | quarterly to the Federal Tax Service |

| Calculation of insurance premiums | 1st quarter 2021 | 03.05.2018 | quarterly to the Federal Tax Service |

| Calculation of 4-FSS for insurance premiums for “injuries” | 1st quarter 2021 | 04/20/2018 – on paper 04/25/2018 - electronically | quarterly to the FSS |

| Confirmation of main activity | For 2021 | 16.04.2018 | annually in the FSS |

| Information about the insured persons SZV-M | January 2018 February 2018 March 2018 | 15.02.2018 15.03.2018 16.04.2018 | monthly to the Pension Fund |

Deadline for submitting reports of LLC USN - 2021 1st quarter | |||

| Single tax declaration under the simplified tax system | For 2021 | 02.04.2018 | annually to the Federal Tax Service |

| Calculation of 6-NDFL | 1st quarter 2021 | 03.05.2018 | quarterly to the Federal Tax Service |

| Calculation of insurance premiums | 1st quarter 2021 | 03.05.2018 | quarterly to the Federal Tax Service |

| Calculation of 4-FSS for insurance premiums for “injuries” | 1st quarter 2021 | 04/20/2018 – on paper 04/25/2018 - electronically | quarterly to the FSS |

| Confirmation of main activity | For 2021 | 16.04.2018 | annually in the FSS |

| Information about the insured persons SZV-M | January 2018 February 2018 March 2018 | 15.02.2018 15.03.2018 16.04.2018 | monthly to the Pension Fund |

Deadlines for submitting reports for the 1st quarter of 2021 for organizations on UTII | |||

| Declaration on UTII | 1st quarter 2018 | 20.04.2018 | quarterly to the Federal Tax Service |

| Calculation of 6-NDFL | 1st quarter 2021 | 03.05.2018 | quarterly to the Federal Tax Service |

| Calculation of insurance premiums | 1st quarter 2021 | 03.05.2018 | quarterly to the Federal Tax Service |

| Calculation of 4-FSS for insurance premiums for “injuries” | 1st quarter 2021 | 04/20/2018 – on paper 04/25/2018 - electronically | quarterly to the FSS |

| Confirmation of main activity | For 2021 | 16.04.2018 | annually in the FSS |

| Information about the insured persons SZV-M | January 2018 February 2018 March 2018 | 15.02.2018 15.03.2018 16.04.2018 | monthly to the Pension Fund |

Postponement of deadlines on weekends and holidays

Currently, most regulations establish that if the day the report is sent falls on weekends and holidays, then it is transferred to the next working day after non-working periods.

That is, if the form “Information on the average headcount” must be submitted to the Federal Tax Service by January 20, then in 2021, due to this date falling on a Saturday, the day of sending is postponed to January 22.

Reporting forms submitted to the Social Insurance Fund previously had to be sent to the fund only on time, without taking into account postponements due to weekends and holidays.

Attention! As of 2021, social insurance has also revised its position regarding the transfer. Therefore, when determining the days for sending forms to the FSS, you must also adjust them, and if these days fall on weekends, use the following working days as such.

What reports are submitted under the general taxation system?

One of the accountant’s priorities is to determine in advance which reports of the general taxation system for 2021 will need to be submitted, and when exactly this will need to be done, taking into account changes in the form and deadlines for submission. It should be taken into account that the general tax reporting for 2021 has undergone adjustments in the forms used for submission to the Federal Tax Service, Pension Fund, and Social Insurance Fund.

The list of documents largely depends on the availability of hired personnel, while the composition practically does not change depending on the organizational and legal form. It includes:

- A whole list of declarations for VAT, profits, property, land (submitted to the Federal Tax Service). Information on the average number of employees, balance sheet, and personal income tax certificates is also added here.

- Calculations of insurance contributions to the Pension Fund and Social Insurance Fund. Moreover, it follows that starting from 2021, some of the reports have been transferred from the federal insurance service to the tax service.

Due to the introduction of the ESSS (unified social insurance tax), the taxation and reporting system in 2021 has changed significantly. Therefore, it is worth updating all software, downloading a new accountant calendar and retraining financial service personnel. You can entrust the reporting of the general taxation system for 2021 to a visiting accountant with sufficient qualifications.

Deadlines for submitting reports to the Social Insurance Fund: table

Currently, only one form is sent to the FSS. However, its end date is determined based on how the form is sent - in paper form or electronically.

Attention! In addition, to set the rate of transfers for injuries, you need to confirm the main activity for 2021 in the Social Insurance Fund. This must be completed by April 16, 2021.

| Reporting type | Submission period | Due dates | Tax system | ||

| BASIC | simplified tax system | UTII | |||

| 4-FSS in paper format | Quarter | 2017 - 01/22/2018 Q1 2021 – 04/20/2018 1st half of 2021 - 07/20/2018 9 months 2021 – 10/22/2018 | + | + | + |

| 4-FSS in electronic format | Quarter | 2017 - 01/25/2018 Q1 2021 – 04/25/2018 1st half of 2021 - 07/25/2018 9 months 2021 – 10/25/2018 | + | + | + |

Deadlines for submitting reports under the general taxation system

Due to the huge amount of different documentation, the deadlines for the 2021 general taxation system reports are distributed over various dates. The easiest way to refer to the 2021 tax reporting tables is in your accountant's calendar. An option for this would be to set “tags” in the accounting program so that the computer “reminds” the need for specific reports in advance.

Despite periodic changes, the following general scheme applies:

- VAT returns are submitted quarterly;

- profit declarations are also submitted every quarter;

- declarations for property, transport, land plots - once a year;

- 2-NDFL – once a year (6-NDFL quarterly).

The accounting statements of the general taxation system for 2021 are compiled after the end of the next reporting period. Thus, quarterly reports of the general taxation system for 2021 are compiled in the first month of the subsequent quarter.

Deadlines for submitting financial statements

Accounting statements consist of:

- Balance sheet according to form-1.

- Profit and loss statement according to form-2.

All companies that are required to carry out accounting must submit a balance sheet and other accounting forms in 2018. For example, this includes absolutely all companies, regardless of the tax system they use - OSNO, simplified tax system, UTII or unified agricultural tax.

The organizational form of the organization is also not taken into account - they must be sent by LLC, JSC, cooperatives and other companies of private or commercial ownership.

Entrepreneurs and branches of foreign companies may not send balances in 2021. They are exempt from mandatory accounting.

The sending day is set to the same for all business entities that are required to report - until March 31, 2021. However, since this day is marked as a holiday, the final day for sending the balance is moved to April 2, 2021. For transferring the form after the specified date, a fine will be imposed on the company.

Attention! This deadline does not apply to new companies that were registered on or after October 1, 2021. For them, by law, the reporting period is set from the date of registration to December 31 of the following year. This means that they will have to send the balance for the first time in 2021.

When a company is liquidated in 2021, its final reporting period is set to be from January 1, 2021 to the date of entry in the Unified State Register of Legal Entities. Next, the closing balance must be prepared and submitted within 3 months from the closing date.

Reporting to statistics

In 2021, Rosstat has expanded the number of forms that must be submitted. It is also necessary to remember that it is prohibited to submit zero reports.

Which business entities must submit one form or another depends on the status (microenterprise, small, etc.), what kind of activity the company is engaged in, etc.

All registered companies, regardless of status, must submit financial statements by March 31, 2021. Entrepreneurs do not submit them, since they are allowed not to conduct accounting.

Firms that have above-average business status must submit:

| Form name | Term |

| P-1 | Rented every month until the 4th day of the following month |

| P-5(M) | Sent for each quarter, before the 30th day of the month following the end of the quarter |

| 1-Enterprise | Dispatched every year, until April 1 of the new year |

| P-4 | Can be rented either monthly or quarterly. In each case, the deadline for submission is until the 15th day of the month following the reporting period |

| P-2 | Annual form - until February 8 after the end of the year, quarterly - until the 20th day of the month after the end of the quarter |

If the business entity is a micro, small or medium-sized enterprise, then they are not included in the mandatory delivery. In relation to them, Rosstat conducts random observations. You can find out what forms an organization must submit in a given year on the Rosstat website https://statreg.gks.ru/.

Subjects included in the sample usually send:

| Form name | Term |

| 1-IP (for entrepreneurs) | Until March 2, 2021 |

| PM (micro) (for micro enterprises) | Until February 5, 2021 |

| PM (all other enterprises) | Until January 29, 2021 |

Penalty for failure to provide

The amount of fines does not change in 2021. However, there is a change in how the total amount of unpaid tax is calculated. Previously, a criminal case could be opened against a company when the amount of untransferred taxes reached the maximum level. However, this amount did not take into account the amount of unpaid amounts to the funds. Now, both taxes and contributions to social funds are involved in achieving the upper limit.

In addition to the general punishment for failure to provide a report, certain types of punishment are defined in some forms:

| Report title | Amount of fine |

| All tax returns | For any tax - 5% of the amount of tax not transferred on time according to this declaration for each full or partial month of delay. The maximum fine is set at 30% of the tax amount according to the declaration. The minimum amount is 1000 rubles (for example, this is paid for failure to submit a zero declaration) |

| Income tax and property tax | 200 rubles for an unsubmitted declaration or calculation of advance transfers |

| Report 2-NDFL | 200 rubles for each certificate that was sent in violation of the deadlines |

| 6-NDFL | 1000 rubles for each whole or partial month of delay |

| Calculation of insurance premiums | 5% of the amount of contributions for the previous 3 months according to the unsubmitted calculation for each whole or partial month of delay. The maximum fine amount is 30%. The minimum amount is 1000 rubles. |

| SZV-M | 500 rubles for each employee whose information was included in the report submitted late |

| SZV-STAZH | 500 rubles for each employee whose information was indicated in the late submitted report |

| 4-FSS | 5% of the amount of contributions for injuries for the previous 3 months according to the unsubmitted calculation for each whole or partial month of delay. The maximum fine is 30%. The smallest amount is 1000 rubles. |

| Accounting forms | 200 rubles for each form that needed to be submitted to the Federal Tax Service. 3000-5000 rubles for each form that needed to be sent to statistics. |