What is a payroll employee's personal account?

This is a document that is used in accounting to reflect information about monthly accruals, deductions and payments due to a specialist.

IMPORTANT!

The use of standardized forms is optional. The company has the right to independently develop the structure of the document, which fully corresponds to the features and specifics of the organization’s activities, its current remuneration system, conditionally permanent details for calculating wages and other information.

A independently developed form should be approved in the company’s accounting policy, as well as the use of a unified form. When developing a document, do not forget to take into account the mandatory details of the primary documentation (Article 9 of Law No. 402-FZ).

Use free instructions from ConsultantPlus experts to properly organize the calculation, payment and accounting of salaries. In the system you will find step-by-step guides and samples of all the documents that need to be completed.

Sample of filling out an employee's personal account

At the top of the T-54 form, data from the employee’s personal card is entered:

- department where he works;

- TIN;

- SNILS;

- code of the locality where the employee lives;

- Family status;

- amount of children;

- employment date;

- Full name;

- Personnel Number.

The tabular part of the personal account T-54 includes the following columns:

- on hiring, transfer, dismissal, changes in wages (columns 1-8) - data is entered on the basis of administrative documents;

- on vacations provided - on the basis of an order (columns 9-16);

- deductions and contributions - according to writs of execution, alimony, compensation for damage and others (columns 17-21);

- standard tax deductions - necessary for the correct calculation of income tax (column 22);

- the time worked for each billing month is entered into the personal account on the basis of the working time sheet (columns 24-27);

- accruals - wages, bonuses, compensation, vacation pay, sick leave and others (columns 28-37);

- deductions - advance, personal income tax, others (columns 38-46);

- debt owed to the employer or employee is indicated in form T-54, if any at the time of salary calculation (columns 47-48);

- the total amount to be paid to the employee is entered in the column of the personal account form.

The month for which the salary calculation is carried out is indicated in column 23, the month is indicated by a number from 01 to 12.

The personal account is signed by the accountant responsible for calculating wages to staff.

for free

personal account T-54 in excel - link.

Employee's personal account form T-54 example of filling - download.

Form T-54

A unified personal account card in the T-54 form is intended to reflect monthly information about accrued wages and other accruals for a particular employee, about all deductions made based on data from primary accounting documentation for production, about work performed, standards of time worked, as well as other orders for different types of payment.

This is what the T-54 form looks like:

The document is created separately for each specialist from the beginning of the calendar year or from the date of official employment. Information is entered monthly for one calendar year. The organization decides independently how to fill out the employee’s personal account form for the salary, enshrining the established procedure in the accounting policy. The nuances depend on the company’s field of activity and the number of employees. In separate departments, the rules may differ.

The accounting procedure is approved by the manager, and all pay slips and personal accounts are filled out exclusively by an accounting employee or another responsible person who is entrusted with accounting responsibilities in the company.

Examples of personal accounts

Below we will look at the practical side of the topic described.

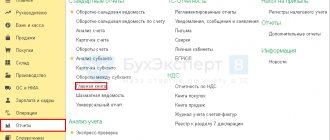

In accounting

Such an invoice is prepared by an accounting employee. It is needed to record wages in all its forms.

Documents are required to enter information. Including those containing:

- data on production volumes;

- data on the number of hours worked;

- evaluative analysis of completed work.

In practice, the real purpose of the drug is to fix the level of the employee’s salary during the year. Moreover, the indicator is recorded every month.

Data on deductions, compensation payments, commissions and taxes, bonuses, benefits and all cases of financial assistance are also reflected here. This is especially important in accounting activities, because We are talking about money, which always requires increased attention: this is in the interests of not only the individual, but also in the interests of the employer.

In banking

Bank personal account is a twenty-digit combination that gives access to client data: personal information, loan obligations, completed transactions, interest charges, active banking products in use, etc. In a word, this is the key to everything that has to do with the client’s financial activities within the framework of interaction with a particular organization.

Important! Data associated with a personal account is classified as strictly confidential. The bank is responsible for this moment. Employees of a financial institution have the right to provide any information on details only to the holder of the drug.

Note 3.

There are exceptions to confidentiality. They are regulated by the legislation of the Russian Federation. This includes requests from government agencies authorized to receive and process personal information on the financial activities of the subject.

What are the types of bank LANs? There are four types: investment, operating, settlement, savings. The names themselves already indicate the specifics of their application.

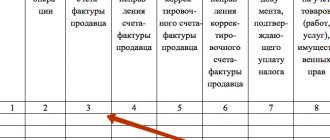

Form T-54a

This form is intended to reflect information about accruals and deductions made using automated programs and accounting systems. The form records monthly data for one calendar year on the following:

- accruals (salary, additional payments, material payments, bonuses, compensation);

- deductions (taxes, fees, alimony, penalties under writs of execution);

- payments (advances, settlements, recalculations).

This is what the T-54a card looks like:

In the accounting policy of the organization, they indicate what needs to be transferred to the settlement department of the personal account in order to transfer wages to employees.

Sample filling

Instructions for filling out an employee’s personal account T-54:

Organization: name indicated, OKPO;

Division: name of the structural division to which the employee belongs;

Personal account: document number and date;

Payroll period: write the date of employment in field “C” or another date if a personal account is opened during the work process (usually the beginning of the calendar year).

Employee: his tax identification number, SNILS number, place of residence code, marital status, number of children, date of employment, full name, personnel number and date of birth are registered. All this data is taken from the documents provided by the employee upon hiring, as well as from the employee’s personal card (T-2 form).

Filling out the table of form T-54:

Columns 1-8 – information about admission, transfer, dismissal, changes in wages.

Data about the order on the basis of which this or that event occurs with the employee is reflected.

Columns 9-16 – information about vacations provided.

All types of leave that are provided to the employee during work (educational, basic paid, without pay, maternity leave, etc.) must be reflected in these columns. The number and date of the leave order, as well as its duration, are indicated.

22 – the sum of all standard tax deductions applied to the employee.

23-27 – information about time worked in each month.

28-37 – information on accruals for each month by type of payment; column 37 displays the total amount of accruals.

38-46 – information about deductions for each month; column 46 displays the total amount of deductions.

47, 48 – debt is reflected if it exists (for the employer or the employee).

49 – amount to be paid to the employee. Paid on the basis of a payslip, a sample of which can be downloaded here.

The accountant fills out the personal account and puts his signature at the bottom.

personal account

employee personal account form T-54 – link.

Shelf life

In accordance with current legislation, information containing personal information about accruals and deductions for insured persons (citizens) must be stored for 75 years. The company is obliged to independently ensure the safety of primary documentation.

If the company does not have an archivist position on staff, then assign responsibility for storing and maintaining the archive to a specific specialist. Indicate such responsibilities in the job description, and familiarize the assigned employee with the new instructions against his signature.

What is a personal account number

The identification number covers several areas of application. Let's look at them in more detail:

- The taxpayer's personal account contains records of salary accruals, payments, and all transactions on it are carried out according to the bank's special classification. Each item of the transaction performed is designated with a unique code.

- For the tax authority, l/s is a register for analytics and accounting of tax collections made.

- For the Pension Fund, l/s is a summary of information about the receipt of pension contributions and other identification information about the insured person. Each individual personal account number has a special part - a section on the receipts of insurance investments for accumulating a labor pension.

Two forms of personal account

Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1 approved 2 forms of personal account:

1) Unified uniform T-54 - they mostly use it.

2) Form No. T-54a is used for automated processing of accounting data (on a computer) and contains only general details for the employee (it does not include monthly data on hours worked and monthly calculations for payments and deductions). Monthly data is printed separately (usually in the form of a pay slip) and added to the personal account.

Due to their cumbersome nature, personal accounts are usually maintained by the accounting services of large organizations.

Small companies and individual entrepreneurs in most cases, to account for payments and deductions, draw up settlement (Form No. T-51) and payment (Form No. T-53) statements or a single payroll statement (Form No. T-49), which includes payroll data and payroll.

In connection with the amendments to the Law “On Accounting”, which abolished the obligation to use most unified forms of primary accounting documents from January 1, 2013, many organizations are also developing their own forms of personal accounts, which are simpler compared to the unified one and do not require filling out so much number of details.

Why do you need the T-54a uniform if you have the T-54?

The Goskomstat Resolution No. 1 dated January 5, 2004, which approved the main part of the unified personnel reporting forms - including T-54 and T-54a, states that:

- Form T-54 is used to reflect all types of accruals and deductions on an employee’s salary based on the primary report related to production accounting and documents for payment;

- form t-54a is used as part of automated processing of accounting data on a computer, and at the same time includes conditionally permanent details for calculating wages.

Neither the Goskomstat norms nor any others in federal legislation directly prohibit the use of the T-54 form for automated accounting, and the T-54a for “manual” accounting. If you look at popular accounting programs with modules for personnel records - the same 1C - you can see that their interfaces provide for the use of both the T-54 form and the T-54a form.

Thus, the difference between the forms should be sought not so much in the way information is entered into them, but in their essentially content.

Both forms are indeed very similar - but there are differences (and in many ways may determine the advantages of one form over the other).

Form T-54a.

How are the documents similar?

Each of them contains:

- A block for displaying personal data about the employee, marital status, number of children, date of hiring and dismissal (at the top of the document).

- Table showing:

- information about hiring (details of the order, department, position, salary, allowances);

- information about vacations;

- information about standard deductions;

- information about deductions (this means deductions for debts to the employer, writs of execution, payment of voluntary contributions to various funds).

The block and table include the same “conditionally constant” data that:

- may not change at all from month to month (personal data about the employee, his contract);

- may change from month to month, but irregularly (only upon the occurrence of certain events that cause changes - for example, a person going on vacation, making deductions from his income, and others that are provided for in the form).

What is the difference between the T-54 and T-54a forms

Unlike the T-54 form, which is filled out manually, the T-54a document is used only in cases where the process of processing accounting data is automated and carried out using computer technology (CT).

This means that a personal account with the letter “a” must be printed on a printer, and a special accounting program is used to create and maintain it.

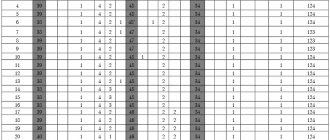

Build payment type codes

Table 3 – Filling out payment type codes

| Data_Fakt | Vall | Summ_Vall | Cost | Summ_Cost | Summ_S_Vall | Summ_S_Cost | D_Cost |

| 02.06.2001 | |||||||

| 28.11.2002 | |||||||

| 07.01.2003 | |||||||

| 12.08.2009 | |||||||

| 01.02.2009 | |||||||

| 02.02.2009 | |||||||

| 01.02.2009 |

2.4 Describe the list of primary documents and the possibility of changing them in the document “Employee’s Personal Card”

All financial and economic operations of the enterprise, including payroll, must be documented and justified.

The list of primary documents for recording the use of working time and settlements with personnel (wages) and the forms of these documents were approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1.

The primary accounting of the number of personnel of the organization is carried out on the basis of the following documents:

— order (instruction) on hiring (Form No. T-1), which is the basis for hiring. The person responsible for accounting for the personnel of the organization’s employees, in accordance with this order, fills out a personal card for each newly hired employee, makes an entry in the work book, and opens a personal account in the accounting department;

— personal card (form No. T-2), which is filled out for each employee. It contains general information about the employee (last name, first name, patronymic, date and place of birth, education, etc.), information about military registration, appointment and transfer, advanced training, retraining, leave and other additional information;

— order (instruction) on transfer to another job (Form No. T-5), which is used when registering the transfer of an employee from one structural unit to another;

— order (instruction) on granting leave (Form No. T-6), which is used to formalize annual and other types of leave provided to employees in accordance with the Labor Code of the Russian Federation, current legislative acts and regulations, collective agreements and schedules vacations;

— order (instruction) on termination (termination) of an employment contract with an employee (dismissal) (Form No. T-8), which is used when registering the dismissal of employees. Based on it, the accounting department makes settlements with the employee;

— other unified forms To record working hours and pay wages to personnel, the following unified forms of primary documentation are used:

— a timesheet for recording working hours and calculating wages (Form No. T-12) and a timesheet for recording working hours (Form No. T-13), which records the use of the working time of all employees in a given organization. The report card in form No. T-13 is used in conditions of automated data processing. Form No. T-12 is filled out manually by an accounting employee. The symbols of worked and unworked time presented on the title page of form No. T-12 are also used when filling out form No. T-13. These timesheets are compiled in one copy and submitted to the accounting department. They allow not only to take into account the time worked by all categories of employees, but also to monitor compliance by workers and employees with the established work schedule. Based on the timesheets, wages are calculated, statistical reporting on labor is compiled. The use of working time is recorded in timesheets either by the method of continuous (daily) registration of appearances and absences for work, or by registering only deviations (no-shows, tardiness, etc.). d.). Notes on the reasons for absence from work or for part-time work, for working overtime and other deviations from the established work schedule must be entered into the timesheet only on the basis of documents (certificates of incapacity for work, certificates, orders for the performance of state or public duties and etc.).

This is interesting: Sample appendix to an employment contract

Accounting for time spent on overtime work can also be carried out on the basis of lists of persons who performed this work. The lists are compiled and signed by the head of the structural unit. The overtime manager makes a note of the number of overtime hours actually worked. Based on lists with this mark, the data is entered into the timesheet. Downtime can also be taken into account in the timesheet. The relevant data is entered on the basis of downtime sheets issued by the head of the structural unit. The following forms of statements are used for the calculation and payment of wages.

— payroll statement (Form No. T-49), which is recommended for medium and small organizations. When compiling this form, it is permissible not to fill out other payroll and payroll statements;

— payroll (form No. T-51), which is used to calculate wages for all categories of workers. Recommended for use in large organizations;

— payroll (form No. T-53), which is used to record wage payments;

— personal account (forms No. T-54 and No. T-54a), which is filled out by an accountant for each employee on the basis of primary employment documents and which indicates the necessary information: last name, first name, patronymic; workshop, department of an organization; category of personnel; employee personnel number; number of children (to determine deductions when calculating personal income tax); Enrollment Date.

The personal account is filled out throughout the year, and all types of accruals and deductions made are reflected in it on a monthly basis. The data contained in the personal account is the basis for calculating average earnings when paying for vacations, accruals for sick leave, etc. The following year, a new personal account is opened for each employee.

The most important indicators reflecting labor costs are labor standards, which are established for workers in accordance with the achieved level of equipment, technology, organization of production and labor.

Labor legislation provides for the following types of labor standards:

— production rate — the amount of products that a worker (group of workers) of a certain qualification must produce per unit of working time,

- standard time - the amount of working time (in hours, minutes) that an employee (group of employees) of a certain qualification must spend on the production of a unit of product (work, service);

- service rate - the number of objects (equipment units, production areas, workplaces, etc.) that an employee (group of employees) must service per unit of time (per hour, working day, work shift, working month);

— headcount norm — the number of employees with the appropriate qualifications to perform a certain amount of work (production, management functions). Depending on the nature of production, various primary documents are used to record production output - piece work orders, route sheets, production reports, etc. In conditions of mass production, output is taken into account when accepting finished products. The output of each team member is established on the basis of output reports filled out by the foreman.

In mass production, output is taken into account using route sheets in combination with a report from the foreman or foreman, which records the acceptance of work (their volume) per shift. In individual or small-scale production, output is taken into account, as a rule, using piecework orders work. They are prescribed on the basis of technological maps. Work orders can be issued for one shift or for a longer period (up to one month), depending on the time required to complete the production task. After receiving the products from the workers, the foreman signs the work order and transfers it to the accounting department.

Bibliography

1. Andreeva V.I. Samples of documents in office work/ - M.: CJSC "Business School" Intel-Sintez", 2007.

2. Computer Science: Basic Course/Ed. S.V.Simonovich. - St. Petersburg: Peter, 2002. 400 s.

3. Kozharsky V.V., Sushkevich V.N. Accounting in enterprises and organizations: Proc. manual.- Mn.: PKF “Account”, 2005. p.127

Characteristic features of a personal account

Personal account is a fairly broad concept and it is used in several senses depending on the area of application.

The general definition of the concept of a personal account is formulated based on its main function - it is an accounting register that is maintained for a specific person (individual or legal) or for a separate organization. It must reflect all financial transactions of the person.

So, a personal account is an account that is opened by an accounting department or a bank to record settlements with individuals.

The personal account takes into account the movement of deposits according to incoming and outgoing orders, as well as interest accrued by the bank on the deposit.

Also, a personal account is a special account for keeping records of settlements with individuals and legal entities, which reflects all financial and credit transactions with a specific client.

Procedure for maintaining a personal account

To the printed form T-54a (with filled-in information about the employee) a monthly pay slip containing:

- information about how the salary was formed;

- information about all deductions made;

- the total amount of funds paid.

On the back of the personal account (or on each printout attached to it) are all the codes and codes used when accounting for salaries.

All information related to the employee’s work is entered into the personal account if it can affect the amount of salary. Thus, the document reflects:

- date and number of the employment order;

- information about vacations taken;

- information about accrued income;

- information about tax deductions or other benefits used;

- data on salary deductions.

The shelf life of personal accounts is 75 years. To ensure such long-term storage, documents must be archived. Typically, front sheets are created for a calendar year, but it is also possible to use 1 document form for a longer period of time.