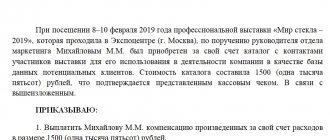

Claim with VAT or not

Question: The organization performed work for the customer.

For failure to comply with safety regulations during the execution of work, the customer filed a claim under the terms of the contract. Should the contractor, when transferring the amount of the claim to the customer, charge VAT on it, how to reflect the amount of the claim in accounting and tax accounting? Are penalties (fines, penalties) under business contracts included in the VAT tax base?

Reply from 06/18/2012:

According to Art. 146 of the Tax Code of the Russian Federation, the object of VAT taxation is the sale of goods, works, and services. In addition, based on paragraphs. 2 p. 1 art. 162 of the Tax Code of the Russian Federation, the tax base for VAT increases, in particular, by amounts associated with payment for goods sold (work, services). The amount of the claim paid by the contractor for failure to comply with safety regulations is not related to the sale of goods (performance of work, provision of services), therefore VAT is not charged on it.

In accounting, this operation is reflected by the following entries:

Dt 91.02 Kt 76.02 – claim recognized

Dt 76.02 Kt 51 – the amount of the claim has been paid

In tax accounting, the amount of the claim transferred to the counterparty is included in non-operating expenses in accordance with paragraphs. 13 clause 1 art. 265 Tax Code of the Russian Federation. According to this clause, these expenses include expenses in the form of fines, penalties and (or) other sanctions for violation of contractual or debt obligations recognized by the debtor or payable by the debtor on the basis of a court decision that has entered into legal force, as well as expenses for compensation for damage caused.

According to the letter of the Federal Tax Service for Moscow dated March 18, 2008 No. 20-12/025119, the following documents are the basis for recognizing expenses in the form of sanctions for profit tax purposes:

- an agreement providing for the payment of sanctions;

- bilateral act;

- a letter from the debtor or another document confirming the fact of violation of the obligation, allowing to determine the amount of the amount recognized by the debtor.

How to ask a question

Accounting for claims settlements

To account for settlements of claims made by the supplier, recognized (awarded) fines, penalties and penalties in accounting, subaccount 76.02 “Settlements for claims” to account 76 “Settlements with various debtors and creditors” is used. The amounts of claims made are accounted for as debit 76.02, and to account for the amount of claims, credit 76.02 is used.

Postings for claims settlements

Calculations related to claims made can be reflected in accounting using the following basic entries:

Get 267 video lessons on 1C for free:

- Free video tutorial on 1C Accounting 8.3 and 8.2;

- Tutorial on the new version of 1C ZUP 3.0;

- Good course on 1C Trade Management 11.

| Debit Account | Credit Account | Wiring Description |

| 76.02 | 20 | A claim for downtime or defects due to the fault of the contractor in the main production was recognized |

| 76.02 | 23 | A claim for downtime or defects due to the fault of the contractor in auxiliary production was recognized |

| 76.02 | 29 | A claim for downtime or defects due to the fault of the contractor in service facilities was recognized |

| 76.02 | 28 | A claim was recognized for the supply of substandard materials that resulted in defective products |

| 76.02 | 41 | A claim was recognized for errors identified for goods supplied after they were accepted into the inventory warehouse |

| 76.02 | 51(52) | A claim against credit institutions for amounts of money erroneously transferred or erroneously debited from the organization's current account was recognized |

| 76.02 | 60 | A claim was recognized for errors identified for goods delivered after goods and materials were accepted into the warehouse |

| 76.02 | 91 | Fines, penalties, etc. recognized by the payer (or awarded by the court) are reflected. subject to recovery from suppliers for non-compliance with the terms of the contract |

| 10 | 76.02 | The amount of the claim recognized by the supplier of materials is taken into account |

| 41 | 76.02 | The amount of the claim recognized by the supplier of goods is taken into account |

Let's look at some of them using wiring examples.

Example 1. A claim was received from the supplier for violation of the terms of the contract - posting to the buyer

In January 2021, an agreement was concluded between the organization JSC "VESNA" and the buyer LLC "ROMASHKA" for the supply of goods with a total cost of 500,000.00 rubles, incl. VAT 18% - RUB 76,271.19. The payment deadline under the terms of the agreement is 01/15/2016. The amount of the penalty for violation of the terms of the contract is 0.10% of the debt amount for each day of delay in payment.

The organization JSC "VESNA" received payment for the shipped goods on January 31, 2016, in connection with which a claim was made to the buyer LLC "ROMASHKA". The claim letter indicated the following calculation of the claim amount:

- RUB 500,000.00 * 0.10% * 17 days = RUB 8,500.00

The accountant of Romashka LLC generated the following entries for claims from the supplier VESNA JSC:

| Debit Account | Credit Account | Transaction amount, rub. | Wiring Description | A document base |

| 91.02 | 76.02 | 8 500,00 | The accounting reflects the penalty | Letter - complaint |

| 76.02 | 51 | 8 500,00 | The amount of the recognized penalty is transferred | Bank statement |

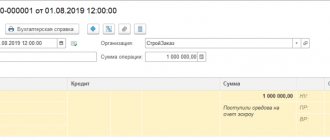

Example 2. A claim was received from the buyer - postings to the supplier for the return of the advance received

On January 10, 2016 An agreement was concluded between the organization JSC "VESNA" and the buyer LLC "ROMASHKA" for the supply of goods for a total amount of 650,000.00 rubles, incl. VAT RUB 99,152.54 Delivery time under the terms of the contract is 03/01/2016. Buyer LLC "ROMASHKA" 01/15/2016 transferred full prepayment according to the terms of the contract.

However, VESNA JSC did not ship the goods at the specified time, thereby violating the terms of the contract and the buyer sent a letter of claim demanding the return of the advance payment and termination of the contract.

The accountant of VESNA JSC reflected in the accounting of claims from the buyer Romashka LLC with the following entries:

| Debit Account | Credit Account | Transaction amount, rub. | Wiring Description | A document base |

| 51 | 62.02 | 650 000,00 | Crediting funds received from the buyer as an advance payment | Bank statement |

| 76 -AB | 68 | 99 152,54 | VAT is charged on the advance amount | Invoice issued |

| 68 | 51 | 99 152,54 | The VAT amount was transferred to the budget | Bank statement |

| 62.02 | 76.02 | 650 000,00 | The amount owed to the buyer is taken into account | Letter - claim |

| 76.02 | 51 | 650 000,00 | Funds transferred to settle the claim | Bank statement |

| 68 | 76 -AB | 99 152,54 | The VAT amount is accepted for deduction | Invoice issued |

Example 3. A claim is made to the supplier - posting to the buyer in case of shortage of goods

The organization JSC "VESNA" and the buyer LLC "ROMASHKA" entered into an agreement for the supply of goods for a total amount of 250,000.00 rubles, incl. VAT 18% - RUB 38,135.59. When accepting goods to the warehouse, the buyer discovered a shortage of goods totaling RUB 12,500.00, incl. VAT 18% - RUB 1,906.78.

- goods were actually received for a total amount of RUB 237,500.00. (250,000.00 – 12,500.00);

- The amount of VAT on goods actually received is 36,228.81 rubles. (237,500 * 18%);

- The warehouse received goods worth RUB 201,271.19. (237,500.00 – 36,228.81);

- A claim was filed for the total amount of the identified shortage.

The accountant of Romashka LLC reflected settlements on claims to the supplier VESNA JSC with the following entries:

| Debit Account | Credit Account | Transaction amount, rub. | Wiring Description | A document base |

| 10.01 | 60.01 | 201 271,19 | Posting of goods actually received to the warehouse | Consignment note (TORG-12), Acceptance certificate |

| 19 | 60.01 | 36 228,81 | The amount of VAT on actually received goods is taken into account | Invoice - invoice received |

| 76.02 | 60.01 | 12 500,00 | A claim was made for shortage of goods upon delivery | Letter - claim |

| 51 | 76.02 | 12 500,00 | Funds have been credited to settle the claim | Bank statement |

Add a comment Cancel reply

You must be logged in to post a comment.

This site uses Akismet to reduce spam. Find out how your comment data is processed.

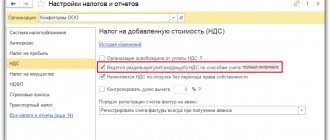

Deducting VAT on a claim - is it possible?

Our company provided cargo transportation services by chartering a car for its client from a third-party organization. The recipient of the cargo recorded the shortfall and filed a claim with us, and we filed a claim with the contractor. Now I would like to reduce the amount of the transportation customer’s debt to us by the amount of this claim, and also accept VAT from it as a deduction. However, the customer counterparty refuses to issue an invoice for this amount. What should we do?

First of all, let us remember that in accordance with paragraph 2 of Article 171 of the Tax Code of the Russian Federation, only tax amounts presented to the taxpayer when purchasing goods (services, works, property rights) can be taken into account. The basis for this is an invoice - a document drawn up by the seller upon sale.

However, filing a claim does not constitute implementation. From the point of view of the counterparty who received the cargo, issuing an invoice for the amount of the claim would be a mistake, because there is no basis for this. As well as for your company to deduct the tax included in this amount. Officials of the Ministry of Finance in their letters and judges in their rulings have repeatedly explained that sanctions related to compensation for damage do not relate to sales and are not subject to VAT.

Thus, even if the counterparty issued you an invoice for the amount of the claim, it would still not be possible to deduct VAT on its basis. This amount, including the tax included in it, must be written off as non-operating expenses.

>Claim from the transport company

Transport company claim

01.08.2011 N 03-07-11/207 Letter from the Ministry of Finance of the Russian Federation dated 01.08.2011 N 03-07-11/207

Question: LLC suffered damage from the carrier - damage to the goods. The goods invoice indicates the price of the goods including 18% VAT.

In accordance with paragraph 2 of Art. 796 of the Civil Code of the Russian Federation, damage caused during the transportation of cargo is compensated by the carrier in the event of a shortage of cargo in the amount of the cost of the missing (damaged) cargo. The carrier confirmed its agreement to compensate for damage in the amount of the cost of the goods according to the invoice, but excluding VAT.

By virtue of clause 59 of the Guidelines for accounting of inventories, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 N 119n, the actual cost of shortages and damage in excess of the norms of natural loss is taken into account as the debit of the claims settlement account and written off from the credit of the settlement account ( according to the supplier's personal account). When capitalizing missing materials received from suppliers and subject to payment by the buyer, the cost of materials, transportation and procurement costs and value added tax included in the actual cost of shortages and damage are reduced accordingly.

Is it legal for the carrier to reimburse the damage caused to the LLC based on the cost of the damaged goods excluding VAT?

Answer: MINISTRY OF FINANCE OF THE RUSSIAN FEDERATION

LETTER dated August 1, 2011 N 03-07-11/207

The Department of Tax and Customs Tariff Policy reviewed the letter on the legality of compensation by the carrier for damage associated with damage to goods purchased by the taxpayer, based on the cost of these goods excluding value added tax, and reports that the issues of determining the amount of compensation for damage are not regulated by the Tax Code of the Russian Federation.

At the same time, we inform you that in accordance with paragraph 2 of Art. 171 of the Tax Code of the Russian Federation, amounts of value added tax presented to the taxpayer when purchasing goods (work, services), as well as property rights on the territory of the Russian Federation, or paid by the taxpayer when importing goods into the territory of the Russian Federation and other territories under its jurisdiction, are subject to deductions. , in the customs procedure of release for domestic consumption, temporary import and processing outside the customs territory or when importing goods moved across the border of the Russian Federation without customs clearance, in the case of using the specified goods (work, services), property rights to carry out transactions subject to tax Additional cost. In this regard, if it is impossible to use the above goods in activities subject to value added tax, the tax amounts on these goods are not deductible.

Deputy Director of the Department of Tax and Customs Tariff Policy S.V.RAZGULIN 08/01/2011

Here is what the auditor told me about this: I see no reason to reduce the amount of the VAT claim. You must be reimbursed for the full cost of the lost item. Example:

“A contract for the supply of goods was concluded with the condition that the goods be delivered to the buyer. The contract of carriage stipulates that in the event of loss of goods, the transport company will compensate the cost of the goods. The supplier and the transport company apply a common tax regime. During transportation, the transport company lost part of the goods. Should the transport company reimburse the supplier for the cost of the goods including VAT or without VAT?

Having considered the issue, we came to the following conclusion: In the case under consideration, in our opinion, the amount that was due to be paid for the lost goods by the buyer, including the tax charged to the buyer, is subject to compensation from the carrier. In this case, the owner of the lost goods does not charge VAT on the amount of the refund and does not issue an invoice to the carrier.

Rationale for the conclusion: According to paragraph 1 of Art. 15 of the Civil Code of the Russian Federation, a person whose right has been violated may demand full compensation for the losses caused to him, unless the law or contract provides for compensation for losses in a smaller amount. Losses are understood as expenses that a person whose right has been violated has made or will have to make to restore the violated right, loss or damage to his property (real damage), as well as lost income that this person would have received under normal conditions of civil circulation if his right was not violated (lost profit) (clause 2 of article 15 of the Civil Code of the Russian Federation). In accordance with paragraph 2 of Art. 796 of the Civil Code of the Russian Federation, damage caused during the transportation of cargo or luggage is compensated by the carrier: - in case of loss or shortage of cargo or luggage - in the amount of the cost of the lost or missing cargo or luggage; - in case of damage (damage) to cargo or luggage - in the amount by which its value has decreased, and if it is impossible to restore the damaged cargo or luggage - in the amount of its value; - in case of loss of cargo or luggage handed over for transportation with a declaration of its value - in the amount of the declared value of the cargo or luggage. The cost of cargo or luggage is determined based on its price indicated in the seller's invoice or stipulated by the contract, and in the absence of an invoice or price indicated in the contract - based on the price that, under comparable circumstances, is usually charged for similar goods. Thus, in our opinion, compensation for the loss of goods is subject to an amount no less than the sum of the costs of purchasing the goods and other costs incurred by the owner of the lost goods under the supply contract. It should be taken into account that, since according to paragraph 2 of Art. 171 of the Tax Code of the Russian Federation, VAT amounts are subject to deduction only in the case of the acquisition of goods (work, services) for transactions recognized as subject to VAT, then the VAT amounts on lost property, previously legally accepted by the owner of the goods for deduction, are subject, in the opinion of the Russian Ministry of Finance, to restoration. Recovered VAT amounts are taken into account as part of other expenses associated with production and sales (letter of the Ministry of Finance of Russia dated July 20, 2009 N 03-03-06/1/480). In other words, the VAT amounts charged to the organization when purchasing lost goods are included in its expenses and must also be covered by the compensation received from the carrier. In the case under consideration, the contract of carriage establishes the amount of compensation for the loss of goods equal to its value. By the value of the lost goods we mean the amount that is (was) due to be paid by the buyer (including the tax charged to the buyer), since it is this amount that constitutes the lost income of the owner of the goods. Let us note that in similar situations, arbitration practice proceeds from the fact that the current legislation does not contain restrictions regarding the inclusion of VAT in the calculation of losses; the amount of damage is reasonably calculated taking into account VAT, which corresponds to the actual value of the lost cargo. Such conclusions are presented, for example, in the decisions of the Federal Antimonopoly Service of the Ural District dated June 28, 2011 N F09-3136/11 in case No. A76-20512/2010, dated November 3, 2010 N F09-8115/10-S5 in case N A76-3192/2010 -52-39, dated March 17, 2008 N F09-1666/08-C5, FAS Moscow District dated December 15, 2008 N KG-A40/10183-08. Thus, in the situation under consideration, VAT is not charged on top of the cost of the lost goods, but is part of this cost. Therefore, excluding VAT from the claim amount, in our opinion, does not comply with the law. Indirectly, this conclusion is confirmed by letters from the Ministry of Finance of Russia dated October 13, 2010 N 03-07-11/406 and dated October 7, 2008 N 03-03-06/4/67, in which the position is expressed that the disposal of property for reasons not related to the sale or gratuitous transfer (for example, in connection with loss, damage, battle, theft, natural disaster, etc.), based on the provisions of Art. 39 and 146 of the Tax Code of the Russian Federation, is not subject to VAT. In this regard, in case of compensation of damage by the guilty person in cash, VAT is not charged. In relation to the case under consideration, this means that the owner of the lost goods does not charge VAT for the amount of the refund and does not issue an invoice to the carrier.

Submitting a buyer's complaint to a supplier - sample

The buyer, in accordance with the Civil Code of the Russian Federation, must notify the supplier of discrepancies in the quality and quantity of goods by sending a claim (clause 1 of Article 483 and clause 1 of Article 518 of the Civil Code of the Russian Federation). The claim must contain the following data (see sample):

- date and number of delivery and delivery note;

- name and quantity of low-quality goods in accordance with the supplier’s nomenclature;

- description of marriage and its reasons;

- data on the act of identifying discrepancies in quantity and quality;

- conclusion of the supplier’s commission or an independent expert.

In addition, the complaint must clearly indicate the buyer’s requirements for a defective product: return, replacement, discount, etc. An important issue is the amount of the claim and the rules for including VAT in it, as well as the accounting of claims by the supplier.

Claim to supplier with or without VAT?

Article 475 of the Civil Code of the Russian Federation states that in the event of detection of significant violations of product quality requirements that cannot be eliminated or their elimination entails disproportionate costs, as well as in other cases, the buyer has the right:

- demand a refund for paid goods;

- require replacement of a defective product.

When requesting a refund of the cost of a product, the question arises: does the buyer need to file a claim with or without VAT? In other words, should the claim requirement include the VAT amount?

There are two options to consider:

- 1. If the amount paid included VAT, then the claim must include VAT. The buyer has the right to demand a refund of the full price he paid for the defective product, including VAT;

- 2. If the amount paid did not include VAT, then the claim does not include VAT.

But it is worth considering that the situation is different for a non-resident. In the case of a non-resident supplier, VAT is not included in the amount paid. The VAT that is paid at customs when importing goods of inadequate quality should be compensated as losses (Article 15 of the Civil Code of the Russian Federation). Sometimes an agreement with a non-resident may stipulate that the terms of delivery are not regulated by the laws of the Russian Federation, then the actions will be different - in accordance with foreign legislation.

The VAT claim was submitted by the buyer to the simplified tax system

The buyer may not be a value added tax payer if working on a simplified basis. Is it necessary to allocate VAT when returning low-quality goods in such cases?

Since companies using the simplified tax system are exempt from paying value added tax, there is no need to allocate VAT in the return documents that are included in the package of documents along with the claim. An invoice is also not needed here. Payment of the VAT claim is made by the supplier along with deduction of input VAT on the return. The basis will be an adjustment invoice drawn up by the supplier.

However, if she issues an invoice, then she is required to pay VAT. Moreover, after this she will have to draw up an electronic VAT return.

Claims to the supplier without VAT - grounds

According to Article 146 of the Tax Code of the Russian Federation, an object that is subject to VAT is the sale of goods, services or work. If the claim does not relate to the quality (quantity) of the goods, then the amount of the claim to the supplier should not include VAT.

This could be damage to the buyer’s property during delivery of goods, failure to comply with safety regulations during work, etc. The amount of compensation for damage or penalties under the contract in the event of a violation of safety regulations is not subject to value added tax. The invoice will not be issued to the guilty organization.

The supplier must account for the payment of such a claim as non-operating expenses that are not directly related to the production and sale of goods and services.

Delivery of goods with discrepancies in quantity and quality

Attention

The carrier lost 2 pieces - 20,000 rubles (including VAT 3,600 rubles). The buyer submitted a claim in the amount of 20,000 rubles (VAT 3,600) to the cargo carrier.

those. The amount of the claim includes VAT, this does not mean that you are charging the carrier VAT, you are only paying off your losses, since you must pay the supplier for the goods, the ownership of which has transferred to you, as I understand it, from the moment the goods are shipped by the supplier, including VAT.

Attention

The carrier lost 2 pieces {amp}amp;#8212; 20,000 rubles (including VAT 3,600 rubles). The buyer submitted a claim in the amount of 20,000 rubles (VAT 3,600) to the cargo carrier.

The carrier says that it accepts the claim minus VAT. Is the carrier right???? wiring 41 -60, 19-60 {amp}amp;#8212; for the amount of goods received including VAT, 76/2 {amp}amp;#8212; 60 {amp}amp;#8212; claim for the amount of missing goods including VAT, 76 -76/2 claim accepted by the cargo carrier.

Important

Is it necessary to allocate VAT when returning low-quality goods in such cases? Since companies using the simplified tax system are exempt from paying value added tax, there is no need to allocate VAT in the return documents that are included in the package of documents along with the claim. An invoice is also not needed here. Payment of the VAT claim is made by the supplier along with deduction of input VAT on the return.

The basis will be an adjustment invoice drawn up by the supplier. However, if she issues an invoice, then she is required to pay VAT.

Is the amount of compensation for damage subject to VAT?

The lessor caused damage as a result of damage to finished products stored in the leased warehouse. Is the amount of compensation for damage subject to VAT? Is it necessary to include VAT in the claim amount when calculating?

On this issue we take the following position:

In the situation under consideration, VAT should not be taken into account when determining the amount of the claim.

In accordance with paragraph 1 of Art. 15 of the Civil Code of the Russian Federation, a person whose right has been violated may demand full compensation for the losses caused to him, unless the law or contract provides for compensation for losses in a smaller amount. In this case, losses are understood as expenses that a person whose right has been violated has made or will have to make to restore the violated right, loss or damage to his property (real damage), as well as lost income that this person would have received under normal conditions of civil circulation, if his right had not been violated (lost profits).

If the person who violated the right received income as a result, the person whose right was violated has the right to demand compensation, along with other losses, for lost profits in an amount not less than such income (clause 2 of Article 15 of the Civil Code of the Russian Federation).

Clause 1 of Art. 1064 of the Civil Code of the Russian Federation establishes that damage caused to the property of a legal entity is subject to compensation in full by the person who caused the damage.

Taxation of damage compensation amount with VAT

According to paragraph 1 of Art. 146 of the Tax Code of the Russian Federation recognizes, in particular, transactions for the sale of goods (work, services) in the territory of the Russian Federation as subject to VAT.

The sale of goods, works or services is recognized as the transfer on a paid basis of ownership of goods, the results of work performed by one person for another person, the provision of services for a fee by one person to another person, and in cases provided for by the Tax Code of the Russian Federation, the transfer of ownership of goods, results of work performed works by one person for another person, provision of services by one person to another person - on a free basis (Clause 1 of Article 39 of the Tax Code of the Russian Federation).

By virtue of paragraphs. 2 p. 1 art. 162 of the Tax Code of the Russian Federation, the VAT tax base is increased by amounts received by the organization, provided that they are related to payment for goods (work, services) sold.

In this situation, the organization makes a claim to the lessor for compensation for losses incurred due to damage to the goods (finished products) located in the rented warehouse due to the fault of the lessor.

Compensation for damage caused to the organization is in no way connected with the sale and payment of goods (work, services), because in this case there is no transfer of ownership of the property on a compensated or gratuitous basis.

Since compensation for damage caused is also not related to payments for goods (work, services) sold, the amount of such compensation does not increase the VAT tax base.

Thus, there is no need to include the amount of compensation for loss in the VAT tax base.

A similar point of view is presented in the letter of the Ministry of Finance of Russia dated July 28, 2010 N 03-07-11/315, which explains that the Tax Code of the Russian Federation does not provide for an increase in the tax base by amounts not related to payment for goods (works, services) sold (see additionally letters of the Ministry of Finance of Russia dated October 26, 2011 N 03-07-11/289, dated October 13, 2010 N 03-07-11/406, Federal Tax Service of Russia for Moscow dated February 7, 2008 N 19-11/11309).

The judges are also of the opinion that the amount of compensation for losses (damage) received by the organization is not subject to VAT, since it is not related to the sale of goods, works, services (Resolution of the Federal Antimonopoly Service of the Moscow District of August 22, 2011 N F05-7956/11, resolution of the Federal Antimonopoly Service of the Ural District dated 25.05.2009 N F09-3324/09-SZ, the transfer of which to the Presidium of the Supreme Arbitration Court for review in the order of supervision was refused by the decision of the Supreme Arbitration Court of the Russian Federation dated 11.09.2009 N 12036/09, resolution of the FAS Volga District dated 05.02.2009 N A55-6696 /2008, Federal Antimonopoly Service of the Volga-Vyatka District dated February 26, 2008 N A82-40/2007-1).

In this regard, we believe that the amount of damage charged to the guilty party is not subject to VAT. Accordingly, an invoice is not issued to the guilty person (clauses 1, 3 of Article 168, clause 3 of Article 169 of the Tax Code of the Russian Federation).

Calculation of VAT on state duty refunds

Let's consider another situation. The company leasing premises in the shopping center paid a fee for state registration of the lease agreement. Subsequently, the tenant must reimburse it. Is it necessary to charge VAT in this case?

Here you can reason in the same way as the judges reasoned in the previous case. According to paragraph 1 of Article 146 of the Tax Code of the Russian Federation, the object of VAT taxation is, in particular, operations for the sale of services. If the tenant reimburses the amount of the state duty paid by the landlord, there is no question of sales, which means there is no object of taxation and there is no need to issue an invoice.

See also “Issue of work books: VAT and income tax.”

The need to restore VAT amounts accepted for deduction

A closed list of situations in the event of which VAT amounts previously legally accepted for deduction are subject to restoration is established in clause 3 of Art. 170 Tax Code of the Russian Federation. Write-off of inventory items due to their loss, damage, shortage, defects among the cases listed in clause 3 of Art. 170 of the Tax Code of the Russian Federation, does not apply. Consequently, formally, the taxpayer does not have the obligation to restore the amounts of VAT previously claimed for deduction on such goods.

Moreover, until recently, the official position of the regulatory authorities was that VAT in similar cases is subject to restoration. The argumentation of representatives of the Russian Ministry of Finance and tax authorities was as follows.

According to paragraph 2 of Art. 171 of the Tax Code of the Russian Federation, VAT amounts on goods (work, services) acquired for the implementation of transactions subject to VAT are subject to deductions. In turn, paragraphs. 2 p. 3 art. 170 of the Tax Code of the Russian Federation provides that the amounts of VAT accepted for deduction on goods (work, services) are subject to restoration in the event of further use of such goods (work, services, etc.) to carry out the operations specified in clause 2 of Art. 170 of the Tax Code of the Russian Federation (not subject to VAT). Thus, since in the event of shortage, damage, theft, defective goods can no longer be used to carry out transactions subject to VAT, the “input” VAT on them is subject to restoration and payment to the budget. At the same time, it is necessary to restore the amount of tax in the tax period when the missing values are written off from accounting (see, for example, letters of the Ministry of Finance of Russia dated 07/05/2011 N 03-03-06/1/397, dated 07/04/2011 N 03-03-06 /1/387, dated 06/07/2011 N 03-03-06/1/332, dated 04/24/2008 N 03-07-11/161, Federal Tax Service of Russia dated 12/04/2007 N ШТ-6-03/, dated 11/20. 2007 N ШТ-6-03/).

In turn, the decisions of the judicial authorities indicate that paragraph 3 of Art. 170 of the Tax Code of the Russian Federation does not provide for the need to restore VAT previously accepted for deduction, including in cases of damage to goods (see, for example, resolutions of the FAS Moscow District dated July 15, 2014 N F05-7043/14, FAS Volga District dated November 9, 2012 N F06-8238/12, FAS of the North Caucasus District dated November 18, 2011 N F08-7089/11, FAS of the Ural District dated January 22, 2009 N F09-10369/08-S2).

It should be recognized that the position of the authorized bodies on this issue has recently undergone changes.

Thus, in the letter of the Federal Tax Service of Russia dated May 21, 2015 N GD-4-3/ it is indicated that the amounts of VAT previously legally accepted for deduction are not subject to restoration upon disposal of property as a result of a fire, since this case is in paragraph 3 of Art. 170 of the Tax Code of the Russian Federation is not named.

Tax department employees make this conclusion, guided by the decision of the Supreme Arbitration Court of the Russian Federation dated October 23, 2006 N 10652/06, and also cite court decisions that take into account this decision of the Supreme Arbitration Court of the Russian Federation. In addition, tax authorities cite a letter from the Ministry of Finance of Russia dated November 7, 2013 N 03-01-13/01/47571. It, in particular, states that in the case when written explanations of the Ministry of Finance of Russia (recommendations, explanations of the Federal Tax Service of Russia) on the application of the legislation of the Russian Federation on taxes and fees are not consistent with decisions, resolutions, information letters of the Supreme Arbitration Court of the Russian Federation, as well as decisions, resolutions , letters of the Armed Forces of the Russian Federation, tax authorities, starting from the day the specified acts and letters of the courts are posted in full on their official websites on the Internet or from the date of their official publication in the prescribed manner, when exercising their powers, are guided by the specified acts and letters of the courts.

Thus, taking into account the position of the courts, including the Supreme Arbitration Court of the Russian Federation, as well as the changed position of the regulatory authorities, we believe that in the situation under consideration, VAT, previously legally accepted for deduction in the manufacture of damaged products, does not need to be restored.

It is advisable to specify in the contract the procedure for submitting a claim.

If the customer did not send the contractor a notice of recognition of the sanctions, then the date of recognition will be the date of receipt of the amount from the customer.

The opinions of the authors may not coincide with the point of view of the editors. All rights to the materials on the site are protected in accordance with the law, including copyright and related rights.

Thus, in the situation considered, the return of goods to the supplier should be considered as a sale. In this situation, the former buyer acts as the seller of the returned product, and the former supplier acts as the buyer of this product.

All trademarks and trade names are the property of their respective owners and are used herein for identification purposes only.

A closed list of situations in the event of which VAT amounts previously legally accepted for deduction are subject to restoration is established in clause 3 of Art. 170 Tax Code of the Russian Federation. Write-off of inventory items due to their loss, damage, shortage, defects among the cases listed in clause 3 of Art. 170 of the Tax Code of the Russian Federation, does not apply.

However, when interpreting the provisions of a contract, courts take into account the literal meaning of the words and expressions contained in it (Article 431 of the Civil Code of the Russian Federation).

We are a construction organization that performed construction and installation work under the Contract. We signed KS-2 acts and KS-3 certificates with the customer on a monthly basis. The work has been carried out since January 2014. until June 2015 We were paid for work on the basis of KS-2 and KS-3 minus the warranty deduction. As a result, a receivable was formed. The security deposit must be paid 12 months after the final deed is signed.

However, Inina M.V. denies the fact of receiving wages from Lincoln LLC (interrogation protocol 12/34 dated October 15, 2008).

Inclusion of VAT in the claim amount

Current legislation does not contain restrictions regarding the inclusion of VAT in the calculation of the amount of losses itself, namely the prohibition on taking into account the amount of tax in the value of lost property when determining the amount of damage (see, for example, the decisions of the Eighteenth Arbitration Court of Appeal dated November 12, 2012 N 18AP-10470/12, Fifteenth Arbitration Court of Appeal dated 04/05/2012 N 15AP-2585/12, Ninth Arbitration Court of Appeal dated 06/24/2010 N 09AP-12587/2010).

The amount of loss in the form of VAT, if it is part of the price (cost) of the property subject to compensation, must be reimbursed in full by the counterparty responsible for these losses. This is precisely the position taken by some federal arbitration courts (resolutions of the Federal Arbitration Court of the Ural District dated 08/14/2012 N F09-6939/12, dated 06/28/2011 N F09-3136/11-S5, dated 04/08/2011 N F09-1173/11-S5, FAS North-Western District dated June 22, 2012 in case No. A56-44279/2011, dated February 22, 2011 in case No. A21-8004/2009).

At the same time, we draw attention to the conclusions contained in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 23, 2013 No. 2852/13 in case No. A56-4550/2012. In it, the judges noted that losses in the form of expenses, including VAT, can be reimbursed to the victim if the latter proves that the tax amounts presented to him represent his uncompensated losses. According to the court, the existence of the right to deduct VAT amounts established by Art. 171 of the Tax Code of the Russian Federation, excludes a reduction in the property sphere of the person who suffered damage, and, accordingly, in this case excludes the application of Art. 15 Civil Code of the Russian Federation. The Presidium of the Supreme Arbitration Court of the Russian Federation concluded that a person who has the right to a deduction must know about its existence, must comply with all legal requirements to obtain it, and cannot shift the risk of non-receipt of the corresponding amounts to his counterparty, which in fact is an additional public liability for the latter. legal sanction for violation of a private law obligation.

Thus, an organization does not have the right to demand compensation for losses taking into account the amount of VAT if it has the right to deduct the amount of tax, which excludes a decrease in its property scope. That is, the reimbursement of the amount of VAT by the person who caused the damage and the receipt of a tax deduction from the budget, according to the court, leads to the unjust enrichment of the “victim” by receiving the tax twice - from the budget in the form of a tax deduction and from its counterparty in the form of compensation for damage.

Since in the situation under consideration, VAT on inventories used in the production of products was previously accepted for deduction, and it is not required to restore it when writing off goods, we believe that VAT amounts should not be taken into account in determining the amount of the claim.

The burden of proving the existence of losses and their composition is placed on the victim (resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 23, 2013 N 2852/13, dated July 17, 2012 N 2683/12, dated April 24, 2012 N 16327/11, dated August 29, 2000 N 8926/99 ), and he, as we indicated earlier, on the basis of Art. 15 of the Civil Code of the Russian Federation has the right not only to compensation for the cost of lost goods, but also to compensation for lost profits.

If the tenant determines the amount of damages independently and the landlord agrees with it, then the parties do not need to go to court for judicial protection. Therefore, whether the losses caused are compensated, including VAT, or whether the loss is calculated from the cost of the lost goods excluding VAT, the parties determine independently. In the settlement document, the VAT amount is a separate line, based on clause 4 of Art. 168 of the Tax Code of the Russian Federation, there is no need to separate it, since compensation for losses is not subject to VAT.

Answer prepared by: Expert of the Legal Consulting Service GARANT, professional accountant Molchanov Valery

The answer has passed quality control

September 5, 2021

The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service.

>Reflection of a claim from the Buyer in accounting

Compensation for losses, including VAT // Analysis of the resolution of the Presidium of the Supreme Arbitration Court

Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 23, 2013 N 2852/13 in case N A56-4550/2012 “The victim may be compensated for losses in the form of expenses, including VAT, but only if he proves that the tax amounts presented to him represent his uncompensated losses” .

1. The essence of the dispute

Between Gazpromtrans LLC (hereinafter referred to as the forwarder) and Gazprom Neft OJSC (hereinafter referred to as the client) a transport expedition agreement (hereinafter referred to as the agreement) was concluded, according to which the forwarder undertook to carry out and (or) organize the transportation of the client’s oil and petroleum products by rail at the client’s expense transport.

According to the contract, the obligation to clean tank cars is assigned to the client, and in case of failure to fulfill this obligation, the contract provides for liability in the form of a fine for each car.

Violation by the client of this condition of the contract served as the basis for the forwarder to apply to the arbitration court with a claim to recover from the client the amount of losses not covered by penalties. The forwarder also included in the claim the amount of VAT presented to him by the contractor cleaning the wagons and the carrier who transported the wagons to the cleaning site.

The courts of all three instances satisfied the stated demands of the forwarder in full, based on the following.

The forwarder incurred real expenses for paying the cost of work to third parties, including VAT, which must be fully compensated by the client by virtue of Art. 15 Civil Code of the Russian Federation. The cassation court came to the conclusion that the fact that the freight forwarder has the right to apply a VAT deduction for the amount paid to service providers does not exempt the person who caused the losses from compensation for them, including VAT. The court also noted the absence in the case materials of information about the forwarder’s exercise of the right to a tax deduction.

When considering this case before the Presidium of the Supreme Arbitration Court of the Russian Federation, the question arose about the admissibility of including real expenses, including VAT, as losses caused by improper performance of the contract.

2. The issue of the admissibility of including VAT in the calculation of losses caused by improper performance of the contract

In the provisions of paragraph 2 of Art. 15 of the Civil Code of the Russian Federation gives the concept of losses subject to compensation and determines their composition. Losses include two components - expenses (real damage) and lost income (lost profits), which can be recovered by the victim from the tortfeasor in full, unless the law or contract provides for compensation for losses in a smaller amount (clause 1, article 15 Civil Code of the Russian Federation).

| Expanding the concept of losses... | |||

| Actual damage may be expressed in the expenses that a person has incurred or will have to incur to restore the right. The need for future expenses and their estimated size must be confirmed by a reasonable calculation, evidence, which can be an estimate (calculation) of the costs of eliminating deficiencies in goods, works, services; an agreement defining the amount of liability for violation of obligations, etc. (Clause 10 of the Resolution of the Plenum of the Supreme Court of the Russian Federation and the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 1, 1996 N 6/8 “On some issues related to the application of part one of the Civil Code of the Russian Federation”). At the same time, the latest practice of the Presidium of the Supreme Arbitration Court of the Russian Federation is based on the fact that the lack of evidence of the amount of losses cannot serve as a basis for refusing compensation. The court cannot completely reject a claim for damages solely on the grounds that the amount of damages cannot be established with a reasonable degree of certainty. In this case, the amount of damages to be compensated is determined by the court, taking into account all the circumstances of the case, based on the principle of fairness and proportionality of liability (see Resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 09/06/2011 N 2929/11 in case N A56-44387/2006, dated 04/16/2013 N 17450/12 in case N A56-55948/2011). Actual damages may also arise from loss or damage to property. The loss of property should be considered the termination of a right if it cannot be restored. The recovered damages in these cases represent a sum of money that compensates for these losses. When property is damaged, the derogation of the property sphere of the victim consists of the amount of the difference between the value of the thing before its damage and its value after damage (see Civil Code of the Russian Federation: Article-by-article commentary to chapters 1, 2, 3 / B.M. Gongalo, A.V. Konovalov, P.V. Krasheninnikov, etc.; edited by P.V. Krasheninnikov. - M.: Statute, 2013. - 336 p.). Lost profits represent lost income that the injured party would have received in the normal course of events (under normal conditions of civil circulation) if the right had not been violated. | |||

As you can see, neither Art. 15 of the Civil Code of the Russian Federation, nor the Resolution of the Plenum of the Supreme Court of the Russian Federation and the Plenum of the Supreme Arbitration Court of the Russian Federation dated 01.07.1996 N 6/8 “On some issues related to the application of part one of the Civil Code of the Russian Federation” do not contain any indication of the possibility of including expenses including VAT in damages , paid to third parties to eliminate defects in goods, works, services.

| Object of VAT taxation... | |||

| The object of VAT taxation on the basis of paragraphs. 1 clause 1 art. 146 of the Tax Code of the Russian Federation recognizes transactions for the sale of goods (works, services) on the territory of the Russian Federation. The sale of goods, works or services by an organization is recognized as the transfer on a paid basis (including the exchange of goods, works or services) of ownership of goods, the results of work performed by one person for another person, the provision of services for a fee by one person to another person, and in cases provided for Tax Code of the Russian Federation - transfer of ownership of goods, results of work performed by one person for another person, provision of services by one person to another person - free of charge (clause 1 of Article 39 of the Tax Code of the Russian Federation). The sale of goods (work, services) also recognizes the transfer of ownership of goods, the results of work performed, and the provision of services free of charge (paragraph 2, subparagraph 1, clause 1, article 146 of the Tax Code of the Russian Federation). | |||

In arbitration practice there is no unity on the issue of the admissibility of including VAT amounts in the calculation of losses. In general, two opposing positions can be distinguished.

2.1. Inclusion of VAT in the calculation of losses is illegal

Arbitration courts that take the position that it is unlawful to include VAT in the calculation of losses proceed from the following.

Real damage primarily includes expenses arising from civil legal relations. Civil legislation does not apply to property relations based on administrative or other power subordination of one party to the other, including tax and other financial and administrative relations (clause 3 of Article 2 of the Civil Code of the Russian Federation). VAT is the subject of tax legislation, so its reimbursement cannot be regulated by civil law.

| Judicial practice (argument about the inapplicability of civil legislation to tax relations)… | |||

| — Determination of the Supreme Arbitration Court of the Russian Federation dated February 18, 2009 N 15922/08 in case N A55-15637/2007; — Determination of the Supreme Arbitration Court of the Russian Federation dated February 26, 2009 N 1250/09 in case N A55-3802/2008; — Resolution of the Federal Antimonopoly Service of the Volga District dated August 15, 2008 in case No. A55-15637/07; — Resolution of the Federal Antimonopoly Service of the Volga District dated January 30, 2009 in case No. A55-5841/2008; — Resolution of the Eleventh Arbitration Court of Appeal dated 08/06/2013 in case No. A55-1213/2013; — Resolution of the Eleventh Arbitration Court of Appeal dated 09/07/2010 in case No. A65-37164/2009; — Resolution of the Nineteenth Arbitration Court of Appeal dated November 23, 2010 in case No. A64-1690/2010. | |||

In a number of cases, courts additionally point out that if the plaintiff brings for recovery the amount of expenses, including VAT, incurred in connection with the elimination of deficiencies in the work, and such work is not aimed at the plaintiff’s own consumption, then the completion of the work cannot be recognized as the sale of goods (work, services) subject to taxation. In this case, based on the content of Art. 146 of the Tax Code of the Russian Federation, VAT cannot be charged on the amount of damage.

| Judicial practice (if the work is not aimed at satisfying one’s own needs, VAT cannot be charged on the amount of damage)… | |||

| — Resolution of the Federal Antimonopoly Service of the Ural District dated March 14, 2007 N F09-1677/07-C4 in case N A60-6651/06; — Resolution of the Eleventh Arbitration Court of Appeal dated May 22, 2013 in case No. A55-32903/2012. | |||

In a similar way, the courts justify the illegality of including the amount of VAT on the price of the goods in the calculation of costs. According to the courts, the transfer of funds by the supplier of goods of inadequate quality in accordance with the claim made by the buyer is not the sale of goods (work, services), but compensation for expenses (losses) incurred by the buyer due to the fault of the seller. Consequently, there is no VAT subject to taxation.

| Judicial practice (compensation for damages is not the sale of goods (works, services))… | |||

| — Resolution of the Federal Antimonopoly Service of the Volga District dated January 12, 2009 in case No. A55-7791/08; — Resolution of the Federal Antimonopoly Service of the Ural District dated May 25, 2009 N F09-3324/09-C3 in case N A60-34244/2008-C10. | |||

You should also pay attention to the position according to which the fact that the plaintiff (applying the general taxation system and being a VAT payer) has the right to deduct VAT amounts paid to third parties indicates that he has no losses in these amounts. In this case, VAT cannot be included in losses (see Resolution of the Federal Antimonopoly Service of the Ural District dated July 21, 2009 N F09-5054/09-S4 in case N A50-17107/2008-G12).

Let us note that a similar conclusion was made by the Presidium of the Supreme Arbitration Court of the Russian Federation in the Resolution under consideration.

When considering the admissibility of including VAT in the calculated amount of lost profits, arbitration courts are guided by the following.

Lost profits as an element of losses of a business entity are not considered by the legislator as an object of VAT taxation, regardless of the fact that compensation for such losses is related to the production activities of the applicant. Compensation for losses in the form of lost profits is not an operation for the sale of goods (works, services). Indication of the amount of compensation in the primary documents, including VAT, as well as the payment by the applicant of this amount of tax to the party to the contract have no legal significance and are not a reason for applying a tax deduction, since they do not change the operation of tax legislation. Amounts of lost profits should not be included in the VAT tax base.

| Judicial practice (lost profits are not considered by the legislator as an object of VAT taxation)… | |||

| — Resolution of the Federal Antimonopoly Service of the Moscow District dated July 4, 2013 in case No. A40-123538/12-140-783; — Resolution of the Federal Antimonopoly Service of the Moscow District dated January 31, 2011 N KA-A40/17003-10 in case N A40-169926/09-115-1286. | |||

At the same time, in practice there are cases when the inclusion of VAT in the calculated amount of lost profits is permitted and does not lead to unjust enrichment of the applicant (see Resolution of the Fifteenth Arbitration Court of Appeal dated August 12, 2013 No. 15AP-10587/2013 in case No. A53-32003/2012 ).

From the above judicial practice, in particular, it follows that in the provisions on the procedure for compensation of losses contained in civil contracts, as a rule, there is no provision for the inclusion of VAT amounts in losses.

However, the presence of such a provision in the contract cannot clearly indicate the legality of including losses in the VAT tax base. Thus, some courts indicate that the parties do not have the right to independently decide on the payment of VAT or its refund, bypassing tax legislation.

| Judicial practice (the terms of the contract for compensation of losses including VAT are void)… | |||

| — Resolution of the Federal Antimonopoly Service of the Volga District dated December 9, 2008 in case No. A55-1282/2008; — Resolution of the Federal Antimonopoly Service of the Volga District dated October 23, 2008 in case No. A55-18152/07; — Resolution of the Federal Antimonopoly Service of the Volga District dated October 28, 2008 in case No. A55-3802/08. | |||

Nevertheless, in some cases such terms of the contract are recognized by the courts as appropriate.

| An example from judicial practice... | |||

| Thus, in the contract, the parties established that if the contractor fails to eliminate defects within a specified period of time or refuses to draw up or sign a complaint report, the customer is given the right to eliminate them independently or with the involvement of third parties with reimbursement of his expenses, increased by the amount of VAT, at the expense of the contractor . The customer entered into contract agreements with third parties in order to eliminate identified deficiencies with reimbursement of its expenses from the contractor’s guarantee amount. Such actions of the customer were recognized by the courts as legal and justified (see Resolution of the Federal Antimonopoly Service of the Far Eastern District dated October 22, 2009 N F03-5276/2009 in case N A24-5205/2008). | |||

2.2. Inclusion of VAT in the calculation of losses is legal

The position according to which the current legislation does not contain restrictions regarding the inclusion of VAT in the calculation of losses is most often found in judicial acts when courts consider disputes regarding the recovery of losses under supply contracts and the provision of transport and forwarding services.

In support of this legal position, arbitration courts provide the following arguments.

If VAT was not charged on top of the cost of the lost cargo, but is part of this cost, then when compensating for losses in the form of the cost of the cargo, its value including VAT is subject to compensation. The calculation of the amount of damage to be recovered, including VAT, corresponds to the actual value of the lost cargo.

| Judicial practice (calculation of losses including VAT corresponds to the actual value of lost property)… | |||

| — Resolution of the Federal Antimonopoly Service of the Moscow District dated December 28, 2012 in case No. A41-13588/12; — Resolution of the Federal Antimonopoly Service of the Moscow District dated December 15, 2008 N KG-A40/10183-08 in case N A40-1989/08-24-10; — Resolution of the Federal Antimonopoly Service of the Moscow District dated May 6, 2008 N KG-A40/2229-08 in case N A40-49078/07-22-443; — Resolution of the Federal Antimonopoly Service of the Ural District dated June 28, 2011 N F09-3136/11-C5 in case N A76-20512/2010; — Resolution of the Federal Antimonopoly Service of the Ural District dated 04/08/2011 N F09-1173/11-C5 in case N A76-11424/2010-61-431; — Resolution of the Eleventh Arbitration Court of Appeal dated January 31, 2013 in case No. A55-21288/2012. | |||

If payment under the supply agreement in part of the goods lost due to the fault of the carrier was made by the plaintiff, taking into account VAT, then the losses are subject to compensation, taking into account the amount of VAT.

| Arbitrage practice… | |||

| — Resolution of the Federal Antimonopoly Service of the Ural District dated February 28, 2012 N F09-10087/11 in case N A76-5469/2011; — Resolution of the Federal Antimonopoly Service of the Ural District dated May 28, 2008 N F09-2963/08-C5 in case N A76-3541/07; — Resolution of the Eighteenth Arbitration Court of Appeal dated November 12, 2012 No. 18AP-10470/2012 in case No. A76-10129/2012. | |||

The amount of VAT is part of the price payable for the goods transferred under the consignment note, and is subject to consideration when determining the amount of damage as the value of the lost cargo.

| Judicial practice (VAT amount as part of the product price)… | |||

| — Resolution of the Fifteenth Arbitration Court of Appeal dated 04/05/2012 No. 15AP-2585/2012 in case No. A53-21067/2011; — Resolution of the Fifteenth Arbitration Court of Appeal dated November 1, 2011 No. 15AP-10810/2011 in case No. A53-24857/2010. | |||

The courts adhere to a similar position when considering cases for the recovery of losses resulting from improper execution of a storage agreement. The courts note that the value of the property (goods) lost by the custodian must be determined in the amount of expenses incurred by the bailor (buyer). If the amount of VAT was for the buyer part of the price for the purchased goods, then the amount of losses is subject to recovery including VAT.

| Arbitrage practice… | |||

| — Resolution of the Federal Antimonopoly Service of the Ural District dated August 14, 2012 N F09-6939/12 in case N A76-15929/2011; — Resolution of the Federal Antimonopoly Service of the Ural District dated November 3, 2010 N F09-8115/10-C5 in case N A76-3192/2010-52-39. It should be noted that this conclusion of the courts is based on the interpretation of the position of the Presidium of the Supreme Arbitration Court of the Russian Federation, set out in Resolution No. 5451/09 of September 22, 2009 in case No. A50-6981/2008-G-10. In this Resolution, the Presidium of the Supreme Arbitration Court of the Russian Federation indicated that public legal relations regarding the payment of VAT to the budget are between the taxpayer, that is, the person selling goods (work, services), and the state. The buyer of goods (works, services) does not participate in these relations. The inclusion by the seller of the amount of VAT in the price of the sold goods (works, services) payable by the buyer follows from the provisions of clause 1 of Art. 168 of the Tax Code of the Russian Federation, which are mandatory for the parties to the agreement by virtue of clause 1 of Art. 422 of the Civil Code of the Russian Federation, and reflects the nature of the said tax as indirect. Consequently, the amount of VAT presented to the defendant for payment is for the defendant part of the price payable to the plaintiff under the contract. | |||

The courts also note that the current legislation does not contain restrictions regarding the inclusion of VAT in the calculation of losses in the case of entrusting work to eliminate the consequences of improper provision of services to a third party (see Resolution of the Twelfth Arbitration Court of Appeal dated September 19, 2012 in case No. A12-9019/2012).

In conclusion, one cannot help but pay attention to judicial acts, where the courts indicated the legality of including the amount of VAT in the calculation of losses due to the fact that Art. 15 of the Civil Code of the Russian Federation establishes the principle of full compensation for losses. Another interpretation of Art. 15 of the Civil Code of the Russian Federation, according to the courts, is erroneous.

| Arbitrage practice… | |||

| — Resolution of the Federal Antimonopoly Service of the North-Western District dated 08/02/2011 in case No. A56-72270/2009; — Resolution of the Federal Antimonopoly Service of the Ural District dated 04/08/2011 N F09-1173/11-C5 in case N A76-11424/2010-61-431; — Resolution of the Federal Antimonopoly Service of the Ural District dated October 19, 2010 N F09-8176/10-C5 in case N A76-4338/2010-6-326; — Resolution of the Federal Antimonopoly Service of the Ural District dated April 8, 2010 N F09-2289/10-C5 in case N A76-12168/2009-10-659; — Resolution of the Seventh Arbitration Court of Appeal dated September 19, 2011 No. 07AP-5511/11 in case No. A45-3769/2011; — Resolution of the Eighteenth Arbitration Court of Appeal dated January 26, 2012 No. 18AP-12201/2011 in case No. A76-12886/2011. | |||

3. Position of the Presidium of the Supreme Arbitration Court of the Russian Federation

The Presidium of the Supreme Arbitration Court of the Russian Federation canceled the judicial acts of lower courts regarding the recovery of the amount of VAT, refusing to allow the forwarder to recover the amount of tax from the client.

The Presidium of the Supreme Arbitration Court of the Russian Federation drew attention to the fact that a person entitled to a tax deduction must be aware of its availability, must comply with all legal requirements to obtain it and cannot shift the risk of non-receipt of the corresponding amounts to his counterparty, since this is actually an additional public law sanction for violation of a private law obligation.

The Presidium of the Supreme Arbitration Court of the Russian Federation has formulated the following legal position.

The legal position of the Presidium of the Supreme Arbitration Court of the Russian Federation: the fact that the victim has the right to deduct VAT amounts excludes the possibility of compensation for losses that include VAT (Article 15 of the Civil Code of the Russian Federation). Tax deductions can be used as a special mechanism for compensating the expenses of a business entity. The victim may be compensated for losses in the form of real expenses, including VAT, but only if evidence is presented that the amounts of tax charged to him were not and cannot be taken for deduction, that is, they represent his uncompensated losses.

Comment: enshrined in paragraph 1 of Art. 15 of the Civil Code of the Russian Federation, the principle of full compensation for harm, as well as the composition of losses subject to compensation, established in paragraph 2 of this article, ensure the restoration of the property sphere of the victim in the form that it had before the offense. In this case, as a general rule, both incomplete compensation for losses incurred and the enrichment of the victim at the expense of the tortfeasor are excluded.

This means that losses cannot include expenses that, although incurred by the victim as a result of the offense, are compensated to him in full from other sources. Thus, the existence of the right to deduct VAT amounts excludes a reduction in the property sphere of a person and, accordingly, compensation for losses in this part. Otherwise, grounds would be created for the unjust enrichment of the victim by receiving amounts paid as VAT twice - from the budget and from his counterparty - without any reciprocal provision.

The Presidium of the Supreme Arbitration Court of the Russian Federation drew attention to the fact that “tax deductions are provided for by the norms of tax, and not civil legislation, does not prevent their recognition as a special mechanism for compensating the expenses of an economic entity.”

4. Reservation on the possibility of reviewing judicial acts that have entered into force due to new circumstances

This Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation does not indicate the possibility of revising judicial acts of arbitration courts that have entered into legal force in cases with similar factual circumstances on the basis of clause 5, part 3 of Art. 311 Arbitration Procedure Code of the Russian Federation. In this regard, the considered Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation is not a basis for reviewing judicial acts based on new circumstances.

VAT on compensation for damages on a claim

Quote (Armandy1987): Good afternoon! In the event of loss (shortage or damage) of cargo, the forwarder must compensate the client for actual damage, as well as previously paid remuneration, if it is not included in the price of such cargo (That is, you are given sanctions for improper execution of the contract. Here is how the Ministry of Finance explains: Situation: you need Is it possible to pay VAT on penalties in the form of fines and penalties received from the buyer (customer) No, it is not necessary if the penalty is not related to payment for goods supplied (work performed, services rendered). As a rule, receiving a penalty is due to the fact that the buyer ( customer) does not fulfill or improperly fulfills the terms of the contract. An example of improper fulfillment of the contract may be the untimely payment of the buyer to the supplier. In such cases, the resulting penalty is not related to payment for goods (work, services). It is considered as a penalty for late fulfillment of obligations and the tax base for VAT is not included.Such clarifications are contained in the letter of the Ministry of Finance of Russia dated March 4, 2013 No. 03-07-15/6333, which was communicated to the tax inspectorates by the letter of the Federal Tax Service of Russia dated April 3, 2013 No. ED-4-3 /5875. The legality of this approach is confirmed by arbitration practice (see, for example, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 5, 2008 No. 11144/07). And there are situations when the penalty is directly related to payment for goods supplied (work performed, services rendered). For example, a penalty for excess transport downtime, the amount of which is agreed upon by the parties in the transport expedition or transportation agreement. If the customer delays transport beyond the predetermined time, he pays the forwarder (carrier) a fine, the amount of which depends on the duration of the downtime. Such penalties are associated with payment for services rendered, so they must be included in the VAT tax base. This is stated in the letter of the Ministry of Finance of Russia dated April 1, 2014 No. 03-08-05/14440. It should be noted that in some cases, the funds received from the buyer in the contract are called a penalty (fine, penalty), but in essence they are an element of pricing - a hidden form of payment. When such amounts are received, they must also be included in the VAT tax base. This was stated in the letter of the Ministry of Finance of Russia dated March 4, 2013 No. 03-07-15/6333. Olga Tsibizova, Deputy Director of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia Material from the BSS "System Glavbukh"

Recognition of sanctions and rights to damages

Legislation or an agreement may provide, for example, the following types of sanctions for violation of obligations: penalties (fines, penalties), interest for late payment, etc. This follows from Articles 329 and 395 of the Civil Code of the Russian Federation.

In addition, the counterparty may demand that the culprit compensate for losses associated with violation of contractual obligations, including lost profits (Article 15 of the Civil Code of the Russian Federation). For example, if a sales contract is terminated due to the fault of the seller, the buyer has the right to apply the provisions of Article 524 of the Civil Code of the Russian Federation. Namely, to demand that the counterparty compensate him for losses incurred due to the need to purchase goods from another seller at a higher price. If a new contract is concluded within a reasonable time and at a reasonable price, the failed seller must compensate the buyer for the difference between the cost of the goods under the terms of the terminated and the new contract.

How to reflect in accounting and taxation the amounts of penalties recognized by the organization (fine, penalties, etc.), see How to take into account the legal interest, penalties and interest for late fulfillment of obligations presented to the organization. Compensation for losses of counterparties is reflected in a similar way.

An example of how to reflect in accounting and taxation the payment of a penalty on a counterparty's claim for violation of the terms of an agreement. The organization applies a general taxation system

In February, Alpha LLC received goods worth 120,000 rubles from Torgovaya LLC. (including VAT – 18,305 rubles). The due date for their payment under the contract is February 21.

In case of late payment for the delivered goods, the buyer, according to the terms of the contract, must pay a penalty. The amount of the penalty is 0.1 percent of the amount of debt to pay for goods for each day of delay.

Alpha transferred payment for the goods delivered to Hermes only on March 24. On March 25, Alpha received a claim from Hermes for payment of a penalty for late payment under the contract (the delay was 31 days).

The amount of the penalty presented by Hermes was: 120,000 rubles. × 0.1% × 31 days = 3720 rub.

Alpha acknowledged Hermes' claim and paid a penalty.

In Alpha's accounting, the accountant made the following entries:

Debit 91-2 Credit 76-2 – 3720 rub. – a penalty was recognized for violation of the deadline for payment for goods;

Debit 76-2 Credit 51 – 3720 rub. - the penalty was paid.

Alpha pays income tax monthly and uses the accrual method. The accountant included the amount of the penalty (3,720 rubles) as part of the organization’s non-operating expenses.