Shortage, defects, assortment: we understand the reasons for the return

The reasons why goods may be returned from the buyer to the supplier are listed in the contract or provided for by law.

The materials on our website will help you understand how to take into account legal requirements in various business situations:

- “How many days before vacation are vacation pay paid by law?”;

- “What is the legal deadline for responding to a claim?”.

Possible reasons for returning goods are listed in the figure below:

In the following sections, we will tell you how the accounting procedure is affected by the type of returned goods (whether they are of high quality or defective), as well as the fact that the goods to be returned are reflected in the buyer’s accounting.

How to prepare documents for returning goods to a supplier in 2019

The claim and the act of returning goods of inadequate quality must be properly completed.

To file a claim, use the company's letterhead. It must be signed by a person authorized to do so. In most of these cases, the organization is represented by an accountant.

The claim must indicate:

- Full exact name of the organization.

- Legal address.

- Address of actual location.

- Information about the customer.

- Customer details.

- The number of the contract in respect of which the claim is being made and the date of its conclusion.

- A detailed list of identified shortcomings and defects regarding quality characteristics, scope of supply, staffing, etc. The claim will be more significant if it contains clear indications of the laws governing the return of purchases.

- Clearly stated requirements, for example, return of products, or replacement, or transfer of money back to the buyer, etc.

- The time given to the supplier to consider the letter of claim and send a notice to the customer outlining its decision.

- Supporting documentation that may be required.

The document that officially confirms the validity of the requirements set forth in the claim is an act specially drawn up for this purpose. Several people should be involved in its preparation; a preliminary examination is carried out, data on its results are set out in the report.

The act specifies:

- Date of its preparation.

- The place where it was compiled.

- Information about the seller (details).

- Information about the customer (details).

- The number of the official document (if any) in which the requirements are presented to be fulfilled in connection with the facts stated in the act.

- A step-by-step description of the procedure for returning goods to the supplier.

- A statement of the procedure for transferring money spent on paying for an order back to the client’s account.

- If any compensation is agreed upon, then its size and timing are clearly stated.

- Each party puts its seal and signs the document.

Not only the head of the company, but also a person vested with such authority can draw up and sign the act. In the latter case, a power of attorney is issued in the name of the representative.

Defective goods returned from the buyer: postings from the buyer and seller

A product will be considered defective if it has defects (removable or irreparable) in one or more indicators. For accounting, it does not matter how many product characteristics do not meet quality requirements. But the moment the defect is discovered plays a significant role: before the goods are accepted for registration or after that. Let's look at an example of how to reflect the return of low-quality goods in the accounting of the seller and buyer.

The small retail chain Optima Fabrics purchases a variety of fabrics from the Bolshevichka LLC factory: from ordinary chintz to ultra-modern curtain materials (organza, blackout, flock, etc.). Acceptance of fabrics occurs for each batch of fabric according to all characteristics.

When receiving the next batch of fabrics, rolls with an undyed pattern and a damaged structure were identified. They did not accept such goods. Until the supplier took back the defective fabric, Optima Fabrics LLC took into account its value in off-balance sheet account 002 “Inventory and materials accepted for safekeeping”, since by law it is obliged to ensure the safety of the goods (Clause 1 of Article 514 of the Civil Code of the Russian Federation).

After the supplier picked up the defective batch, the buyer made the following entry in his accounting:

The seller’s chain of transactions when returning goods from the buyer will reflect the correction (reversal) of the records made during shipment:

If the buyer does not discover a defect during acceptance, he records the receipt of goods according to the usual scheme:

| Accounting entries | Contents of operation | |

| Debit | Credit | |

| 41 | 60 | A batch of fabrics has been received |

| 19 | 60 | VAT allocated |

| 68.2 | 19 | VAT is accepted for deduction |

Once a defect is discovered, the product is returned to the supplier.

Postings for returning goods from the buyer:

| Accounting entries | Contents of operation | |

| Debit | Credit | |

| 41 | 60 | Records reflecting the receipt of goods were reversed ─ fabric with identified defects was returned to the supplier |

| 19 | 60 | VAT reversed |

| 68.2 | 19 | VAT previously accepted for deduction has been restored (reversal) |

The seller's transactions for returning goods from the buyer will consist of reversing records related to the sale.

Thus, when returning a product that has not been accepted for registration, the original sale is considered void, and the buyer has no obligation to pay for the product. And if the goods have already been paid for, then the buyer has the right to demand a refund from the seller or negotiate the terms of repayment of the debt incurred (for example, offset against payment for the next delivery).

Return of defective goods to the supplier after acceptance

There are situations when you cannot return a defective product to the supplier immediately, although the defect was discovered at the time of acceptance. For example, the delivery was from another region, and the transport company - the seller's delivery contractor - does not accept anything back. Everything is more complicated here, including documenting the return of defective goods to the supplier. Despite the defects, you will have to accept the products according to the TORG-12 invoice, draw up a statement of discrepancies in quantity and quality, and place the inventory items in your warehouse. And only after that write a claim and wait for it to be reviewed by the supplier. Let's take a closer look at the process.

To begin the procedure for the documented return of defective goods, you must, with a representative of the supplier or transport company, fill out an Act on the established discrepancy in quantity and quality upon acceptance of inventory items in the TORG-2 form. It confirms the illiquidity of the product and is the basis for writing a complaint to the supplier.

The TORG-2 form is very complex. If you do not want to waste time filling out its numerous fields, then you can draw up an act in any form, indicating the details of the documents under which the goods arrived (delivery agreement and TORG-12 invoice).

Next, after the supplier has reviewed and satisfied the claim for the returned products, you need to draw up a TORG-12 invoice. It will already be returnable for you and creditable to the supplier, because he will already buy from you the goods that you are returning. Buy it because you previously received ownership of it. This is called "reverse implementation".

A return TORG-12 is also issued in two copies, in the “Bases” column you must write: “Return of low-quality goods.” All details are indicated from the contract and the invoice on which the defect was originally received.

Return of quality goods: how to record them

The return of quality goods occurs as part of a normal purchase and sale transaction. In this case, the goods are sold at the cost of acquisition. In this situation, no reversal entries are made.

An example will help us understand the transactions for returning a quality product to a supplier.

Shop No. 7 LLC received a batch of men's suits from the supplier Tekhnologiya LLC. However, it later turned out that the suits were shipped in the wrong size range: instead of the ordered running sizes M and L, all the suits turned out to be size 5XL. The costumes “for giants” had to be returned to the supplier ─ there was no demand for them.

The following entries were made in the accounting of LLC “Magazin No. 7”:

| Accounting entries | Contents of operation | |

| Debit | Credit | |

| 41 | 60 | A batch of men's suits has been received |

| 19 | 60 | VAT allocated |

| 68 | 19 | VAT is accepted for deduction |

| 62 | 90 | Revenue from the return of quality goods is reflected |

| 90 | 41 | The cost of the returned goods is written off |

| 90 | 68 | VAT is charged on the cost of the returned goods |

| 60 | 62 | Debt to supplier offset |

The accounting of the supplier (Technology LLC) will also have two blocks of postings:

- sale of costumes to the buyer;

- receipt of returned suits from the buyer (as part of reverse sales).

How to fill out a return invoice is described in this publication.

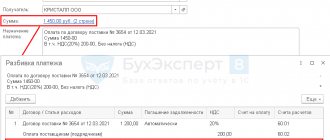

Returning goods to the supplier in 1C (8.3) in 2021

The 1C 8.3 and 1.C 8.2 programs provide a whole list of reasons why products can be returned back to the seller. These include expired shelf life, defects, quality characteristics (for example, the wrong material) or, if this is specified in the contract, an unsold part of the product.

The return of goods to the supplier is reflected in a document named the same as this procedure is indicated in the postings 1C: Accounting 3.0. It is generated either entirely manually or on the basis of a document of receipt of products to be returned.

Situations vary, as do the work procedures of accountants. Therefore, here are action diagrams for implementing both methods. Although in general, if you carry out the procedure based on receipt, it takes less time, and in general it is simpler.

1. Registration procedure

.

Open the “Purchases” tab, where you can see the returns that have already been made up to this point.

The name of your own organization, for example “Store No. 23,” is written in the header of the form. There is also a “Division” field, but it can be left blank if such a division is not provided.

The counterparty from whom the products to be returned are also indicated here, with the procedure completed through 1C. You also need to find in the selection list and click on the document by which the goods were received, but if you filled out something incorrectly in the header, then the document you are looking for may not be reflected.

The next step is entering data into the table. Choose the method of performing the procedure (manual or automatic). The latter is much simpler, opens through the “Fill” tab and can be done in two ways.

You can select the option “Fill in upon receipt” - then the data from the document entered at the very beginning in the header will appear in the table. There is also an option “Add from receipt” - then in an additional selection window all available receipts from the counterparty to whom you are issuing a refund will be reflected.

In other words, in the first case, information on deliveries is taken only from the document declared in the header, and in the second - from everything else that is in the database. In the example under consideration, the first method will be used.

We recommend

“Why product presentation is a key stage of sales” Read more

In the table on the screen, for example, a row with data appears entitled “Candy “Bar”. If you need to send back to the seller only part of the delivery for this item, the table data is edited, this action is available.

Now all that remains is to enter information about the container into the table. If, for example, you return drinks in metal kegs, then a return will be issued for them, as well as for the products themselves. The last step is to indicate in the “Calculations” section the account numbers that will be involved in the procedure. There is also an “Additional” field, in which you can specify information about the shipper and consignee.

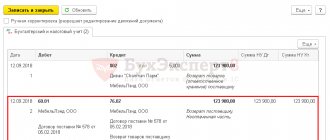

2. Nuances of postings in 1C

.

When the document is generated and posted, three transactions are created in 1C 8.3.

- Filling out an invoice

To generate an invoice in the name of the counterparty, there is a special button in the lower left corner of the document.

- Registration based on receipt

This method is more convenient to use, and at the same time there is less risk of accidentally entering erroneous data.

Go to “Purchases”, there you need the “Receipts (acts, invoices)” tab.

A list of documents will appear. You need the one for which you are going to carry out the return procedure. Open it and through the “Create based on” tab go to the first position “Return of goods to supplier”.

If you go this way, then all the information that you entered into the document in the first example will automatically be reflected here. All information on products is available for correction - delete what you do not need, or enter missing items. Click “Fill” again, select “Add from receipt” and take the data from the receipt documents.

Results

The return of goods by the buyer is always accompanied by entries in the accounting accounts. If the item is defective, the buyer's return entries will reflect the item being taken off-balance sheet until the supplier picks it up. In this case, ownership of the defective product does not pass to the buyer, but the law requires its safety to be ensured. If the buyer managed to capitalize the defective goods, then both parties to the transaction need to make reversal entries.

If the buyer returns a quality product, the entries for the goods returned to the supplier reflect the reverse sales transaction.

Sources: Civil Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Supplier Returns Law 2021

The law (Civil Code of the Russian Federation) clearly stipulates the grounds under which the buyer can insist on returning the purchase back to the seller:

- low quality;

- inconsistency with the assortment list;

- incompleteness;

- complaints about packaging and containers.

Moreover, each of the above cases does not necessarily have to mean a return, because the seller has the right to package it differently, supplement the package, or replace the defect without any statements or documents. However, if circumstances require it, it would be nice to have an idea of what documents are needed to return goods to the supplier and how to fill them out correctly.

By law, the contract between the buyer and seller is considered terminated if the above grounds are present, but the seller refuses to issue a return. Moreover, according to current legislation, it is not at all necessary that the contract be drawn up in writing or that the possible reasons for termination should be clearly stated in it. The procedure will simply drag on if the seller considers your claims unfounded and insists that he is right.

We recommend

“Sales outsourcing: 7 stages of transferring the sales department” Read more

Here is an exact list of reasons prescribed in the Civil Code for which the buyer may insist on returning the goods to the supplier:

- Accompanying documents, additional instructions and other necessary accessories were not provided for the purchased products (or were provided in violation of the deadlines) (Article 464 of the Civil Code).

- Completeness is violated (Article 480 of the Civil Code).

- Unreliability of information regarding quality characteristics or refusal to provide this information (Article 495 of the Civil Code).

- The purchased products were found to be defective, defective, or of poor quality (Article 475 of the Civil Code).

- The packaging is damaged or not there at all, which adversely affects the properties of the product (Article 482 of the Civil Code).

- Mis-grading or non-compliance with the declared assortment (Article 468 of the Civil Code).

- The scope of delivery is reduced, that is, it does not correspond to the quantity specified in the contract (Article 466 of the Civil Code).

- Delivery deadlines were not met (Article 523 of the Civil Code).

Other circumstances may also be specified in the text of the contract.

The buyer has the right to refuse purchased products throughout the entire shelf life if any defects were discovered later, and not at the time of purchase. By law, if there is no expiration date, two years are given to complete the return procedure.

The procedure for returning goods to the supplier under the simplified tax system

Companies operating under the simplified tax system (simplified taxation system) are exempt from paying VAT. However, Chapter 21 of the Tax Code of the Russian Federation does not prescribe special conditions for determining deductions for them. Then there can be two situations:

- The delivery has been returned in full. Once the right to a tax deduction is obtained, an adjustment invoice is registered.

- Only part of the supply was returned.

There are fewer products, which means their cost has also decreased. In this case, an adjustment invoice is issued only when part of the goods is received back from the enterprise (operating under the simplified tax system).According to paragraph 5 of Art. 171 of the Tax Code of the Russian Federation, the seller is required to issue a deduction.

Termination of the contract at the time of filing a claim

If the contract does not provide for a different procedure, it will be considered terminated on the date when the buyer contacted the seller with the corresponding demand (Clause 2 of Article 450.1 of the Civil Code of the Russian Federation). Therefore, even in a situation where the buyer returns previously purchased low-quality products, it is considered that ownership has transferred from the seller. In this case, when low-quality products are received from the buyer, a new transfer of ownership occurs.

Therefore, reflect in accounting the receipt of products with the obligation to return previously received money as an independent business transaction.

Receipt of products back from the buyer should be reflected as receipt of goods or materials, depending on the nature of the further use of the returned products. Do this based on:

- shipping documents issued by the buyer of the product (who purchased it retail or wholesale), for example, on the basis of a consignment note in form No. TORG-12;

- an act that the buyer draws up when identifying defects in the purchased products.

Return products should not be received at the cost indicated in these documents (the price at which the buyer purchased the product), but at book value, that is, in the amount of real costs associated with the production of these products (letter of the Ministry of Finance of Russia dated June 16, 2011 No. 03 -03-06/1/351, Federal Tax Service of Russia dated July 17, 2009 No. 3-2-06/77).

When returning products, the buyer has the right to demand from the seller a refund of the cost of the purchased products, including VAT. However, this right of the buyer does not depend on the terms of the contract. This is explained by the fact that in the case when the seller is a VAT payer, he is obliged to present the amount of tax to the buyer as required by tax legislation (clause 1 of article 146, clause 1 of article 168 of the Tax Code of the Russian Federation). This obligation does not depend on the will of the parties to the transaction. This position is supported by arbitration courts (see, for example, the rulings of the Supreme Arbitration Court of the Russian Federation dated May 27, 2009 No. VAS-3474/09 (submitted for consideration to the Presidium of the Supreme Arbitration Court of the Russian Federation), dated January 26, 2009 No. 17507/08, resolution of the FAS Povolzhsky District dated September 18, 2008 No. A55-12314/2007).

Reflect the return of products with the following entries:

Debit 10 (41) Credit 60 (76) – reflected in the composition of materials (goods) are finished products returned by the buyer at book value;

Debit 19 Credit 60 (76) – VAT on returned finished products is reflected;

Debit 60 (76) Credit 50 (51) – money was transferred to the buyer for the returned products (at the cost specified in the contract);

Debit 91-2 Credit 60 (76) - other expenses are recognized between the return amount and the cost of products sold.

This procedure follows from the Instructions for the chart of accounts (accounts 10, 41).

An example of reflecting in accounting the return of finished products by the buyer in cases provided for by law. Ownership of the product is transferred to the buyer

LLC "Proizvodstvennaya" is engaged in the production of awning materials. On March 15, in accordance with the purchase and sale agreement, “Master” sold finished products to LLC “Torgovaya” in the amount of 118,000 rubles. (including VAT – 18,000 rubles).

After the products were purchased and paid for by Hermes, it turned out that the entire batch of products did not meet the quality characteristics stipulated by the terms of the contract. Therefore, Hermes, in accordance with the terms of the agreement, returned it to the Master on April 22. The cost of the returned products was 118,000 rubles. (including VAT – 18,000 rubles).

Since at the time of return the products were already the property of Hermes, he formalized the return as an independent business transaction. At the same time, he issued an invoice in form No. TORG-12, a statement and an invoice, which he handed over along with the returned products to the “Master”.

The “master” took into account the returned finished products as materials (later they will be used in the production of tent structures for summer cafes) on the basis of an invoice in the form No. TORG-12 and an act. The cost of the products that were sold to Hermes is 90,000 rubles.

In accounting, the “Master” accountant reflected these transactions as follows.

March 15th:

Debit 62 Credit 90-1 – 118,000 rub. – revenue from sales of finished products is reflected;

Debit 90-2 Credit 43 – 90,000 rub. – the cost of production is written off;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 18,000 rubles. – VAT is charged on product sales;

Debit 51 Credit 62 – 118,000 rub. – payment has been received from Hermes for the products.

20 April:

Debit 68 subaccount “Calculations for VAT” Credit 51 – 18,000 rubles. – VAT on the sale of finished products is transferred to the budget.

April 22:

Debit 10 Credit 60 – 90,000 rub. – returned products are taken into account as part of materials;

Debit 19 Credit 60 – 18,000 rub. – VAT on returned products is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 18,000 rub. – accepted for deduction of VAT on returned products;

Debit 60 Credit 51 – 118,000 rub. – money was returned to the buyer;

Debit 91-2 Credit 60 – 10,000 rub. (RUB 118,000 – RUB 18,000 – RUB 90,000) – other expenses are recognized between the return amount and the cost of finished products.

What evidence do you need to have to return money from the supplier of the goods?

Suppliers do not always willingly agree to take back products.

Collect evidence that you received defective goods:

- Take a photo.

- Make a video recording.

- Register the fact of receiving the marriage notarized.

- Send your appeal to the Chamber of Commerce and Industry.

- Order an independent examination.

If you have evidence, it will be easier for you to defend your interests in court.

We recommend

“Examples of SMART goals - in life and in business” More details

Send a letter to the supplier’s address (both legal and actual, if they are different). Be sure to make an inventory of the attachment and order a delivery notification. To be sure, send a courier with the same letter and have him ask for a receipt.

Reverse implementation and return

For VAT accounting purposes, these transactions are reflected almost identically.

The difference between these procedures lies in one nuance, namely, whether the contract has been executed or not. Delivery of low-quality products is clearly a violation of the terms of the contract. This means that we are talking about a return. If they return a quality product, the situation is more complicated.

According to the Ministry of Finance, reverse sales are possible if the main activity of the seller and buyer is purchase and sale.

Let's say he sells a batch of goods for sale. “Beta”, after a period of time determined by the contract, returns the unsold balance of goods, in accordance with the terms of the contract between “Alpha” and “Beta”.

The returned product has no quality issues. That is, there is no condition for non-fulfillment of the contract. For this product, “Beta” issues a tax return, which “Alpha” can submit for deduction.

The main condition is that the buyer must be a VAT payer. In this case, he issues an invoice for the returned goods to the supplier and this invoice is registered by “Alpha” in his purchase book.

There are court decisions that allowed the seller to accept VAT reimbursement in a situation where the buyer applied the simplified tax system or was an individual. But these decisions were based on evidence that it was a return, not a reverse implementation, that took place.

Accounting: return is provided for in the contract

If, after receipt, the buyer has the right to return the products on the grounds provided for in the contract (for example, when after the expiration of the established period the products are not resold by the buyer), the return occurs in accordance with the terms of the agreement reached (Article 421 of the Civil Code of the Russian Federation). If the contract does not provide for a special transfer of ownership, at the time of return of the products, their owner is the former buyer. Therefore, when the product arrives from the buyer, a reverse transfer of ownership occurs.

In accounting, reflect the receipt of products with the obligation to return previously received money as an independent fact of economic activity.

Receipt of products back from the buyer should be reflected as receipt of goods or materials, depending on the nature of the further use of the returned products. Do this on the basis of shipping documents issued by the buyer of the product (who purchased it at retail or wholesale), for example, on the basis of a delivery note in form No. TORG-12.

In this case, the returned products should not be received at the cost indicated in these documents (the price at which the buyer purchased the product), but at the book value, that is, in the amount of real costs associated with the production of these products (letter from the Ministry of Finance of Russia dated June 16, 2011. No. 03-03-06/1/351, Federal Tax Service of Russia dated July 17, 2009 No. 3-2-06/77).

Reflect the return of products with the following entries:

Debit 10 (41) Credit 60 (76) – reflected in the composition of materials (goods) are finished products returned by the buyer at book value;

Debit 19 Credit 60 (76) – VAT on returned finished products is reflected;

Debit 60 (76) Credit 50 (51) – the cost of the returned products (specified in the contract) was paid to the buyer;

Debit 91-2 Credit 60 (76) - other expenses are recognized between the return amount and the cost of products sold.

This procedure follows from the Instructions for the chart of accounts (accounts 10, 41).

An example of reflecting in accounting the return of finished products by the buyer in cases not provided for by law. Ownership of the product is transferred to the buyer

LLC "Proizvodstvennaya" is engaged in the production of awning materials. The organization uses the accrual method and pays income tax monthly. One of the organization’s clients is Torgovaya LLC. In accordance with the purchase and sale agreement, Master supplies products to Hermes on a monthly basis, while Hermes makes an advance payment towards future deliveries.

In March, in accordance with the agreement, Hermes transferred an advance in the amount of 59,000 rubles. (including VAT – 9000 rubles). On April 15, Master shipped products worth RUB 118,000 to Hermes. (including VAT – 18,000 rubles). Its cost was 65,000 rubles.

By April, some of the products purchased from Master were not sold, as the product was no longer in demand among buyers. Therefore, “Hermes”, in accordance with the terms of the contract, returns it to “Master” on April 22. The cost of the returned goods was 23,600 rubles. (including VAT - 3600 rubles).

Since at the time of return the goods were already the property of Hermes, it registered its return in accounting as a “reverse sale.” At the same time, he issued an invoice in form No. TORG-12 and an invoice, which he handed over along with the returned goods to the “Master”.

The “master” took into account the returned products as goods based on the invoice in form No. TORG-12. The cost of the products that were returned by Hermes is 13,000 rubles. The amount of the advance payment based on the agreement is counted against future payments.

In accounting, the “Master” accountant reflected these transactions as follows.

In March:

Debit 51 Credit 62 subaccount “Advances received” – 59,000 rubles. – an advance was received from Hermes for the upcoming delivery of products;

Debit 76 subaccount “Calculations for VAT on advances received” Credit 68 subaccount “Calculations for VAT” - 9,000 rubles. (RUB 59,000 × 18/118) – VAT is charged on the prepayment amount.

April 15:

Debit 62 Credit 90-1 – 118,000 rub. – revenue from sales of products is reflected;

Debit 90-2 Credit 43 – 65,000 rub. – reflects the cost of finished products sold;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 18,000 rubles. – VAT is charged on sales of products;

Debit 68 subaccount “Calculations for VAT” Credit 76 subaccount “Calculations for VAT from advances received” – 9,000 rubles. – VAT accrued on prepayment is accepted for deduction.

20 April:

Debit 68 subaccount “Calculations for VAT” Credit 51 – 9000 rub. – transferred to the VAT budget.

April 22:

Debit 41 Credit 60 – 13,000 rub. – product returns are reflected;

Debit 19 Credit 60 – 3600 rub. – VAT is reflected on returned products;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 3600 rub. – accepted for deduction of VAT on returned products;

Debit 60 Credit 62 – 23,600 rub. – accounts payable for returned products are offset against Hermes’ accounts receivable for accepted products;

Debit 91-2 Credit 60 – 7000 rub. (RUB 23,600 – RUB 3,600 – RUB 13,000) – other expenses are recognized between the selling price and the cost of finished products sold.

When returning products, the buyer has the right to demand from the seller a refund of the cost of the purchased products, including VAT. However, this right of the buyer does not depend on the terms of the contract. This is explained by the fact that in the case when the seller is a VAT payer, he is obliged to present the amount of tax to the buyer as required by tax legislation (clause 1 of article 146, clause 1 of article 168 of the Tax Code of the Russian Federation). This obligation does not depend on the will of the parties to the transaction. This position is supported by arbitration courts (see, for example, the rulings of the Supreme Arbitration Court of the Russian Federation dated May 27, 2009 No. VAS-3474/09 (submitted for consideration to the Presidium of the Supreme Arbitration Court of the Russian Federation), dated January 26, 2009 No. 17507/08, resolution of the FAS Povolzhsky District dated September 18, 2008 No. A55-12314/2007).