We process accountable money correctly

There are three ways to issue accountable money to an employee of an organization:

- from the cash register in cash;

- through a debit card issued by TOUFC for cash payments;

- through the employee’s personal bank card.

Moreover, it is important to comply with the intended purpose of accountable funds: expenses for the economic needs of the institution, travel or entertainment expenses.

IMPORTANT!

A report can be issued on a card or in cash only to an employee of an organization with whom an employment and civil law contract has been concluded. The timing, maximum amount and reporting period must be established by a separate order of the manager.

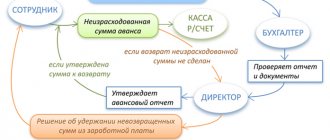

The procedure for filing a report on an employee’s card from a current account:

- The employee prepares a written statement indicating the amount, purpose, justification and reporting period. We forward the completed appeal to the manager.

- The employer makes a decision on the submitted application. The decision is formalized in a separate order (order) or an application is endorsed.

- The accountant, on the basis of an order or endorsed application, prepares a payment order for issuance of a report on the employee’s card and sends it to the bank.

The employee must report for the money received within the prescribed period, providing the responsible accountant with a completed advance report and supporting documents.

Issuing money for a business trip in cash and on a card

Application for advance payment for travel expenses 2.

Application for issuing a report from the director 3. Application for issuing an advance on a card 4. Issuing travel expenses from the cash desk 5.

Postings for advance payment for travel expenses 6. Business trip without advance payment So, let's go in order. If you don't have time to read a long article, watch the short video below, from which you will learn all the most important things about the topic of the article.

(if the video is not visible clearly, there is a gear at the bottom of the video, click it and select Quality 720p) We will discuss the topic of advance payment for a business trip in more detail than in the video later in the article. So, if an employee is going on a business trip, then he needs to be given money.

But you can’t just take the money and give it to the employee.

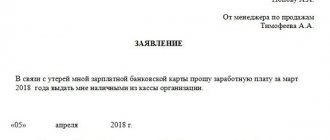

The first step that needs to be taken, and which we are told about in clause 6.3 of the Central Bank Directive dated March 11, 2014.

No. 3210-U, this is writing a statement.

Since the issuance of money for a business trip is carried out with the preparation of an expense cash order (RKO), and it is issued only according to the application, on its basis.

Travel allowances to an employee’s card: transfer rules, whether and how to transfer money to a salary card, purpose of payment in the payment slip

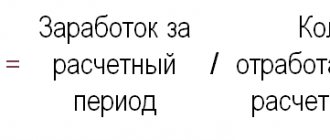

It should be remembered that the day of crediting funds to the accounts of subordinates is the day of payment of remuneration for work. The payment document for transferring wages to staff is easy to fill out, but when sending it to a credit institution, you must adhere to the following requirements:

- in the “payment amount” field, the amount calculated by the accounting department for transferring the advance or final payment of wages is entered;

- in the “payment purpose” field, the period of the money transfer is reflected, for example, “transfer of advance payment (salary for the first half of the month) for November 2021 according to statement No. 56 dated December 15, 2021.”

- in the “payee” field, the details of the bank indicated in the agreement between the bank and the company, the current account number in accordance with the signed salary project are recorded;

A register indicating the amounts for each employee serves as a strict attachment to the payment order.

Fill out a payment order for reporting

Step-by-step instructions for filling out a payment order are clearly presented in the article “Sample of filling out a payment order in 2021.” Let's look at how to fill out a payment slip in a sub-report using a specific example.

Secretary of State Budgetary Educational Establishment of Children's and Youth Children's Institution "ALLUR" Pechatina I.A. wrote an application for the issuance of accountable money for the purchase of office supplies (5000.0 rubles) and payment for Internet services (1500.0 rubles). Based on the manager’s order, the accountant drew up payment orders.

Please note that when generating a payment in a public sector institution, the procedure for filling out field 24 “Purpose of payment” is somewhat different from the generally accepted rules. That is, state employees are required to indicate the budget classification expense code in the field.

Payment of financial assistance – what should an employee pay attention to?

Any person experiences circumstances when financial support becomes necessary.

So, this is usually associated with unfavorable life situations, as well as joyful events that become no less costly. The assistance paid by the institution to employees in such cases is one of the social guarantees used by the organization’s management in its relationship with the employee. Since support in the form of financial assistance is a transfer of funds, special attention should be paid to the competent and legally correct execution of documents, as well as the system of their taxation.

We’ll talk more about the reasons for paying financial assistance to employees and the preparation of the relevant documents below.

Who can count on receiving financial support

The type of support in question that is provided has a special focus - to financially support an employee who is in a difficult financial situation.

Since the main purpose of assistance is to provide the necessary material conditions to solve the employee’s financial problems, such a payment does not depend in any way on the employee’s own achievements; any employee who finds himself in a difficult situation can receive it.

Financial assistance is social and exclusively individual in nature, therefore it is accrued only upon the application of the employee, to which he attaches documents confirming the occurrence of circumstances that led to the need for this payment.

Please note that material support is not taken into account when calculating an employee’s average earnings, which is important when providing him with vacation or maternity benefits.

List of grounds for making payments to an employee

The current labor and civil law does not regulate the procedure and reasons for which financial assistance is accrued by the employer, therefore the circumstances upon the occurrence of which this type of financial support is paid are determined only by the organization itself in local regulations developed by the employer.

Thus, the grounds for receiving financial assistance may be listed in the relevant Regulations or collective agreement. Also, some organizations stipulate such grounds directly in the employment contract or in the Regulations on bonuses.

At the same time, this is not an entirely correct approach, since the type of payment in question does not depend on the employee’s labor achievements and is a social support measure.

Most often, financial support is provided for the following reasons:

- The need for expensive treatment. At the same time, such treatment must be truly necessary, that is, it cannot be replaced by a more inexpensive option.

- Significant monetary damages. Such damage usually includes the consequences of emergencies, natural disasters, accidents, theft, and robbery experienced by the employee. The nature of material support in the listed situations can be not only monetary, but also material in nature - it is allowed to provide necessary things or products to the injured employee.

- Family circumstances (wedding, birth of a child, funeral).

- Retirement or employee going on vacation. In these situations, the payment is provided at a time to each employee.

- Other difficult life situations. Such circumstances include raising children with disabilities; temporarily unemployed spouse; raising children by a single mother or father and other similar situations that the employee can document.

It is worth noting that upon the death of an employee of an organization, his immediate relatives have the right to financial assistance (if they have a death certificate and documents that can confirm the relationship).

Amount and types of assistance provided

This type of financial support, such as material assistance, can be divided into the following types:

- (one-time) and periodic (depending, respectively, on the accrual periods);

- monetary (rubles) or material (goods, food, etc.);

- targeted (related to certain circumstances that arose for the employee) and non-targeted (does not require a specific purpose supported by documents, and is therefore limited to a limited amount).

The amount of financial assistance can only be established directly by the head of the organization and determined based on the specific case and financial capabilities of the organization.

Material financial support can be paid from funds that are profits received when the company carries out its activities. The decision on the need to accrue cash benefits in an organization is made directly by management.

At the same time, it is necessary to pay attention that this type of social support cannot necessarily be provided in monetary form. According to the local regulations of the organization that regulate this issue, financial assistance can be provided with necessary items or goods. Also, at the discretion of management, financial assistance can be provided by providing any services free of charge or paying bills for these services.

Documents that must be provided to the employee

As noted above, the procedure for paying such monetary assistance as material assistance is fixed in the internal regulatory documents of the organization.

To receive financial support, an employee must submit an application addressed to the head of the enterprise, which must reflect the reasons for receiving this type of payment, as well as attach the relevant documents.

Let's take a closer look at what documents you will need to present to your manager in each of the above situations.

The need for expensive treatment:

- a doctor's note;

- agreement for the provision of paid services with the clinic;

- documents confirming payment for medications;

- prescriptions certified by the signature and seal of the attending physician;

- documents about the need for expensive treatment.

Significant monetary damage:

- Documents that confirm the fact of the situation and were issued by an authorized organization.

- A copy of the certificate of material damage, certified by the relevant authority.

Wedding, birth of a child:

- marriage certificate (copy);

- birth certificate (copy).

Death of close relatives:

- Death certificate (copy).

- A document that can be used to confirm relationship with the deceased.

Other difficult life situations:

- single mother's certificate;

- document confirming the presence of disability;

- documents confirming another difficult situation of the employee.

Procedure for consideration of the application

In the process of considering a personal employee with a request to pay financial assistance, the head of the organization endorses a document indicating further actions - to satisfy this application or to refuse social payment.

After approval of the employee’s application, an order is prepared to transfer cash or other payment to the employee. The manager's order must indicate, among other things, the basis, amount and timing of payment of the support provided, and the source of this payment.

The order, due to the absence of a legal requirement for the execution of this document, is issued in a free form developed and applied by a specific organization, and is also registered in the internal document flow journal.

Features of the design of the Regulations on financial assistance

The possibility of making financial assistance payments to employees from the employer is provided, as mentioned above, by the local regulations of a particular organization.

The current legislation does not regulate the procedure for approving this document, therefore, on financial assistance (hereinafter referred to as the Regulations) is drawn up in free form in compliance with the requirements of Art. 8 of the Labor Code of the Russian Federation. At the same time, if there is a trade union body in the organization, coordination with it for the approval of the Regulations is mandatory.

The procedure for drawing up and approving the Regulations can be presented as follows:

- The head of the organization must issue an order to create a draft Regulation at the enterprise, appointing persons responsible for this and indicating the deadlines for completing the work.

- Preparation of the draft Regulations by responsible employees.

- Coordination of the draft Regulations with the trade union body of the enterprise.

- Approval by order of the head and entry into force of the Regulations.

- Introducing employees, against personal signature, to the approved Regulations.

The approved Regulations must contain the following main points:

- list of grounds for payment;

- amounts to be paid for each of the grounds;

- procedure for applying for financial support;

- a list of necessary documents to be submitted by the employee;

- deadlines for consideration of the employee’s application;

- sequence of assignment and transfer of financial assistance;

- rights and obligations of employees and the head of the organization regarding the issue of accrual of material support.

The manager can also indicate in the Regulations that the decision to approve an employee’s application for payment or to refuse it is made depending on the specific situation and financial situation of the company.

Taxation

The issue of taxation of material support paid to an employee is of interest to almost all employers. At the legislative level, the specifics and taxation of material assistance are regulated by the Tax Code of the Russian Federation in Articles 270 and 217.

As a general rule, financial support for employees, the amount of which does not exceed 4,000 rubles per calendar year, is not subject to taxation (clause 28 of article 217 of the Tax Code of the Russian Federation).

Special grounds for calculating personal income tax are established for payments made under the circumstances listed in Art. 217 Tax Code of the Russian Federation. Let's take a closer look at the most common of them:

- The birth, as well as the adoption of a child.

- Death of close relatives of an employee, assistance to the family of a deceased employee (including former and retired employees).

- Significant financial loss (emergency, natural disaster).

Based on the foregoing, material support can be provided to any employee of the organization who finds himself in a difficult financial situation for various reasons and in the manner prescribed by the local regulatory act of the enterprise.

Since this issue is settled quite formally at the level of current legislation, significant importance is given to the development and approval of internal regulations, in which the employer needs to regulate in detail all the nuances of calculating material payments to employees, including taking into account the characteristics of a particular organization.

You can learn how to apply for financial assistance to employees in the following video:

What are the dangers of errors in payments for reporting?

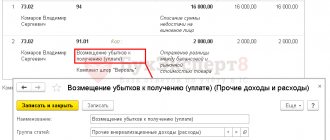

When transferring accountable amounts to an employee’s card, fill out the purpose of payment correctly, otherwise the government agency will have problems:

- An error in a payment order is sufficient grounds for a banking or financial institution to cancel a payment. Untimely transfer of accountable amounts may cause the disruption of a business trip or other violations.

- An incorrectly drawn up payment slip is the basis for tax authorities to issue a fine. Why? Some employees of the Federal Tax Service qualify the sub-report listed on the card as wages and require the money paid to be subject to taxation (personal income tax and insurance contributions).

The Russian Ministry of Finance fundamentally disagrees with the tax authorities’ claims; officials presented their position in letter dated 04/08/2010 No. 03-04-06/3-65. However, it is easier to convince the tax inspector of the correctness of accounting with correctly executed documents.

Nuances in issuing travel allowances

Final payments are made upon the employee’s return from a business trip, after he has drawn up an advance report and transferred all expenses that were incurred. If the advance payment issued before the trip does not cover these expenses, then the remaining amount is paid to the employee.

But this happens after the advance report is approved by the director of the organization or an authorized person, because there are often expenses that are not justified from the point of view of commercial activity.

Let's say that while on a business trip, an employee had lunch for a large sum at a restaurant and attached a check to the expense report. The director may consider these expenses unreasonable, therefore the expenses in this case will not be reimbursed to the employee.

In this case, both options are possible.

If money is issued from the cash register, a note is made that it was issued for travel expenses.

In addition, a statement from the employee is attached to the cash order, in which he asks to pay him money.

Rules for transferring travel allowances to an employee’s card. Sample payment order

However, there is not always enough money, then compensation for overspent funds is transferred by payment order. Based on a special provision, the employee’s card receives daily allowance, compensation for travel expenses and rental housing. Important!

A prerequisite is that the payment purpose field of the payment order must contain the phrase “travel needs.” In order to correctly fill out a payment order to transfer amounts for a business trip, you must adhere to the following algorithm of actions:

- have details of the account to which funds will be transferred in order to control the sending of money to the required details;

- the purpose of the payment must be stated as “accountable amounts for travel expenses”

It is the correct display of the purpose of payment that will protect the company from claims during inspections. The purpose of payment can be formulated in different ways.

The main thing that