What standard tax deductions are established by Art. 218 of the Tax Code of the Russian Federation for 2021

The procedure for providing standard tax deductions is regulated by Art.

218 Tax Code of the Russian Federation. I would like to immediately note that the main difference between standard tax deductions and other personal income tax deductions is not the presence of specific expenses on the part of the taxpayer, but his direct membership in certain groups of persons. So, what are the standard tax deductions today?

- For certain categories of citizens, standard tax deductions can be 3,000 or 500 rubles.

- All citizens with children can be provided with a so-called child deduction.

What is a tax deduction?

A tax deduction is an amount of money that reduces the amount of income on which 13% income tax is paid, the so-called tax base. In addition, with the help of a tax deduction in certain cases, you can return part of the tax paid to the budget. Which option to use depends on the type of deduction applied.

Any taxpayer receiving wages or other income is required to remit personal income tax (PIT), or income tax as it is also called, to the state budget, which amounts to 13% of the amount of income. As a rule, tax calculation, withholding and transfer is carried out by the employer. The amount of income tax can be reduced; this right is established in the Tax Code of the Russian Federation and is called a tax deduction , which has various types and features of application.

Who is entitled to a deduction of 500 rubles.

These are persons awarded state awards, participants of the Great Patriotic War, former prisoners of concentration camps, disabled people of the 1st and 2nd groups and others. The full list can be found in sub. 2 p. 1 art. 218 Tax Code of the Russian Federation.

IMPORTANT! In the case where the taxpayer falls into both categories, the deductions are not summed up, but the maximum of them is provided. The taxpayer's income limit for receiving such deductions is not established by law.

If you have access to ConsultantPlus, check whether you have correctly determined the amount of the standard “for yourself” deduction. If you don't have access, get trial of online legal access.

Deduction for individual entrepreneurs on the simplified tax system and patent

If you are an individual entrepreneur using the simplified tax system or a patent and you have a child, then you will not be able to get a deduction. Your income is not subject to personal income tax at a rate of 13%, so a deduction cannot be applied to it.

But if there is an individual entrepreneur, for example, who simultaneously works for hire, he will receive a deduction from the employer, but this no longer has anything to do with the individual entrepreneur.

Submit reports in three clicks

Elba will calculate taxes and prepare business reports based on the simplified tax system and patent. It will also help you create invoices, acts and invoices.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

Deduction for children

Now let's look at the standard child tax credit. The deduction is provided to each parent (adoptive parent, guardian, trustee, adoptive parent, spouses of parents) for each child aged:

- up to 18 years old;

- up to 24 years old - when studying full-time (letter of the Ministry of Finance of the Russian Federation dated December 16, 2011 No. 03-04-05/8-1051).

See also “The spouse of the child’s mother has the right to receive a “children’s” deduction.”

IMPORTANT! If the form of education is the decisive factor in granting a deduction, then the country in which the child receives education does not matter (letter of the Ministry of Finance of the Russian Federation dated April 15, 2011 No. 03-04-05/5-263).

Starting from 2021, deductions for children are set in the following amounts:

- 1,400 rub. - for the 1st child;

- 1,400 rub. - for the 2nd child;

- 3,000 rub. - for the 3rd and each subsequent child.

And deductions for a disabled child from the same year became different depending on the type of person receiving the deduction:

- 12,000 rub. given to the parent, spouse of the parent, adoptive parent;

- 6,000 rub. receives a guardian, trustee, adoptive parent, spouse of an adoptive parent.

The deduction for a disabled child has the following features:

- it is applied simultaneously with a deduction that takes into account the order of birth of the child, i.e. it is summed up with it (letter of the Ministry of Finance of Russia dated March 20, 2017 No. 03-04-06/15803, Federal Tax Service of the Russian Federation dated April 6, 2017 No. BS-2-11 / [email protected] );

- For a disabled child of the 3rd group under the age of 24, studying full-time, this deduction cannot be obtained, but you can use the usual child deduction, which takes into account the order in which the child appears.

Read more about the possibility of summing up deductions in the following articles:

- “RF Armed Forces: the deduction for a disabled child does not absorb the usual “children’s” deduction, but complements it”;

- “Personal income tax deduction for a disabled child: the Ministry of Finance has changed its position.”

The standard tax deduction can be provided in double amount in the case where the child has only one parent (guardian, trustee, adoptive parent) for the following reasons:

- death of one of the parents (letter of the Ministry of Finance of the Russian Federation dated 08/06/2010 No. 03-04-05/5-426);

- recognition of one of the parents as missing (letter of the Ministry of Finance of the Russian Federation dated December 31, 2008 No. 03-04-06-01/399);

- if the paternity of the child has not been established (letter of the Ministry of Finance of the Russian Federation dated April 2, 2012 No. 03-04-05/3-413) - in this case, the deduction is provided before the parent enters into an official marriage.

A double deduction is also possible if the second parent refuses to receive the deduction. At the same time, it is important that he has income subject to personal income tax at a rate of 13% (letter of the Ministry of Finance of the Russian Federation dated 04/20/2017 No. 03-04-05/23946, dated 02/10/2012 No. 03-04-05/8-147).

See also “A spouse cannot receive a double “children’s” deduction for personal income tax if the spouse is on parental leave.”

The deduction is provided from the moment of birth of the child (adoption, guardianship) or from the date of entry into force of the agreement on the transfer of the child to be raised in a family until he reaches the age of 18 years (24 years) or until the death of the child or until the date of termination of the agreement.

IMPORTANT! The standard tax deduction for a child is given regardless of the provision of other standard tax deductions and is valid until the month in which income from the beginning of the year (excluding dividends) exceeds RUB 350,000.

Position of the RF Armed Forces: deductions are allowed to be summed up

The Supreme Court of the Russian Federation in 2015 made an interesting conclusion that has a decisive impact on the size of the tax deduction for a disabled child. According to paragraph 14 of the Review of the practice of consideration by courts of cases related to the application of Ch. 23 of the Tax Code of the Russian Federation (approved by the Presidium of the Supreme Court of the Russian Federation on October 21, 2015), the amount of such a deduction should be calculated taking into account two circumstances, namely:

- what kind of child is he?

- does he have a disability?

But the most important thing that the review notes is that these circumstances should not be considered mutually exclusive or alternative. In other words, the amounts of deductions can be added up for those children who have disabilities. The amount of deduction for a child with a disability with this approach will be equal to 13,400 rubles. (1,400 rubles + 12,000 rubles) in the case when such a child is the first or second in the family, and 15,000 rubles. (3,000 rubles + 12,000 rubles) if the child with a disability is the third child and further.

For details, see the material “The Armed Forces of the Russian Federation: the deduction for a disabled child does not absorb the usual “children’s” deduction, but complements it.”

The deduction for a disabled child is reflected in a special way in the 2-NDFL certificate. Which one? ConsultantPlus experts spoke about it. Get free trial access to K+ and find out which codes you need to use.

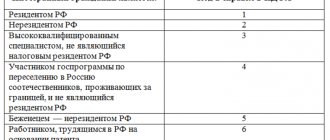

The procedure for providing standard deductions for personal income tax

Standard tax deductions are provided to the taxpayer at his choice by one of the employers based on an application and supporting documents, which include:

- child’s birth certificate - when receiving a deduction for the 3rd and subsequent children, certificates are needed for all the employee’s children, regardless of their age and whether a deduction is provided for them or not (letter of the Ministry of Finance of Russia dated February 10, 2012 No. 03-04 -05/8-146, Federal Tax Service of the Russian Federation dated January 24, 2012 No. ED-4-3/ [email protected] );

- document on adoption, establishment of guardianship;

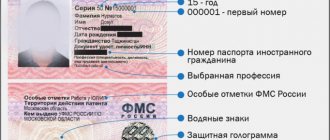

- certificate of disability;

- certificate from an educational institution.

To learn about what documents are needed to receive a tax deduction for education, read the material “What documents are needed for a tax deduction for education?” .

If an employee does not start work from the beginning of the year, the question arises: is a certificate of his income from his previous place of work required for deduction? Today there are 2 opposing opinions:

- provision of deductions is possible without a certificate from the previous place of work (letter of the Federal Tax Service of Russia dated July 30, 2009 No. 3-5-04 / [email protected] , resolution of the Federal Antimonopoly Service of the North Caucasus District dated April 14, 2010 in case No. A32-19847/2008-33/ 333);

- the employer does not have the right to provide a deduction without such a certificate (resolution of the Federal Antimonopoly Service of the North Caucasus District dated June 17, 2014 in case No. A32-11484/2012).

Therefore, if the employee has income from his previous place of work in the current year, it is advisable to still have a 2-NDFL certificate in order to avoid claims from controllers.

If the employer has not provided the taxpayer with a standard tax deduction, then the latter has the right to receive it from the Federal Tax Service at his place of residence. To do this, at the end of the year you need to submit a personal income tax return and documents confirming your right to deduction. By virtue of clause 7 of Art. 78 of the Tax Code of the Russian Federation, this can be done within 3 years. It is advisable to attach a 2-NDFL certificate to the declaration, which will speed up receipt of the deduction and refund.

For information on how to obtain a certificate, read the article “Where can I get (get) a 2-NDFL certificate?” .

Personal income tax benefits for disabled people

Disabled people of groups named one, two, three need to know that they can apply for benefits for property, land and transport taxes.

In addition, citizens with disabilities may be exempt from paying certain state fees.

Tax benefits are given to:

- Citizens of Russia;

- Foreigners residing in the Russian Federation for at least 183 days and officially employed.

1 group

To improve the quality of life of disabled people of group 1, the state provides appropriate benefits for this segment of the population. During the year they can receive:

- One-time payment for travel for a disabled person and accompanying relatives to the place of receiving medical services.

- Increased scholarship for full-time students;

- Free receipt of medicines and medical equipment, subject to an appropriate medical certificate;

- Free travel on intracity and suburban routes;

- Free voucher for a sanatorium holiday.

2 groups

The tax deduction for disabled people of group 2 in 2021, in addition to property, transport and land, includes the following types of state support:

- Opportunity to buy medicines and necessary medical equipment using budget money.

- The right to payment for travel to the place of health procedures.

- Possibility of purchasing orthopedic shoes and specialized prosthetics for limbs at discounts.

- The right to travel on public transport at public expense.

- With excellent passing of the entrance tasks, enrollment in higher and secondary specialized educational institutions takes place, without competitive tests.

- The right to part-time work and increased vacation.

In addition, disabled people of the second group will be provided with additional payments to their pensions. In 2021, the monthly additional payment will be 4959 rubles 85 kopecks.

3 groups

According to the latest population surveys, almost every 14 workers living in Russia are disabled in the third group. Certain benefits are also provided for this category of citizens.

Their types include:

- Utilities - a disabled person of group 3 pays 50% of the cost of housing and communal services.

- Tax - an employee with a disability is completely exempt from payments for registering property that is in his full or partial ownership.

- Transport – free travel on public transport; a 50% discount on the purchase of tickets for trains running throughout the country; If you have a vehicle with a power of less than 100 horsepower, there are no tax payments.

Additional payments for disabled people of group 3

Additional benefits include:

- the right to receive free medical care, including vouchers to sanatoriums, or their payment with a 50% discount;

- the opportunity to enroll in educational institutions located at the place of residence free of charge;

- reimbursement of cash costs for transport services.

Examples

In conclusion, here are some illustrative examples of the use of standard tax deductions.

Example 1

Citizen Krasnov I.A. is a liquidator of the consequences of the disaster at the Chernobyl nuclear power plant, in addition, he was awarded the Order of Glory, 3rd degree. He has a son aged 22 who is studying full-time. Krasnov I.A.’s monthly salary in 2021 is 65,000 rubles. What deductions can he expect?

He claims monthly deductions in the amount of 3,000 rubles. and 500 rubles, but according to current legislation these deductions do not add up, the maximum of them will be selected. Over the course of a year, this deduction will save Krasnov I.A. the amount of 4,680 rubles. (3,000 × 12 months × 13% = 4,680). As for the deduction for the child, since the son is a full-time student, Krasnov I.A. has the right to count on this deduction, however, it is worth noting that the deduction will no longer be provided as soon as Krasnov I.A.’s income exceeds 350,000 rubles. With the salary we indicated, this will happen in the 5th month. So, the amount of tax that Krasnov I.A. will save on his child’s education will be 728 rubles. (1,400 × 4 months × 13% = 728).

Let's summarize: Krasnov I.A. will save money in the amount of 5,408 rubles in 2021. (4 680 + 728).

Example 2

Ivanova A.A., due to the death of her husband, became the only parent for 3 children aged 25, 17 and 14 years. A. A. Ivanova’s monthly salary is 21,000 rubles. What deductions will she be entitled to?

The provision of a standard tax deduction for children in 2021 is limited to an income of 350,000 rubles. With her salary, Ivanova A.A. will be able to receive deductions throughout all 12 months of the year.

1st child aged 25 years - no deduction will be provided for him, however, he will be taken into account when counting children.

2nd child aged 17 years - the deduction for him will be 2,800 rubles. due to the fact that Ivanova A.A. is the only parent and has the right to receive a double deduction (1,400 × 2 = 2,800).

3rd child aged 14 years - the deduction for him will be 6,000 rubles, since starting from the 3rd child, the usual deduction is 3,000 rubles, and A. A. Ivanova has the right to double it as the only parent ( 3,000 × 2 = 6,000).

So, the amount of money saved by Ivanova A.A. will be: for the 2nd child - 4,368 rubles (12 months × 2,800 × 13% = 4,368), for the 3rd child - 9,360 rubles (12 months × 6,000 × 13% = 9,360).

The total amount of money saved by A. A. Ivanova for the year will be 13,728 rubles. (4,368 + 9,360).

ConsultantPlus experts reviewed even more examples with various nuances of providing a standard deduction for children. Learn the material by getting trial access to the system for free.

Tax deduction for disabled people: what tax benefits and compensations are available in 2021

What is a deduction and what can you get it for?

A tax deduction is a way to return tax on income, primarily from wages under an employment contract.

The rate for this income is 13%. Let's look at the most popular types of deductions. Standard deductions.

This is a fixed amount, regardless of taxes paid. Those who, in the opinion of the state, need support receive such a deduction:

- 3,000 rubles - liquidators of the accident at the Chernobyl nuclear power plant, NPO Mayak, victims of nuclear tests, military personnel who became disabled as a result of military operations in defense of the USSR and the Russian Federation;

- 500 rubles - disabled people since childhood and disabled people of groups I and II;

- 1,400 rubles - parents for the first and second child;

- 3,000 rubles - parents for the third and each subsequent child;

- 12,000 rubles - family of a disabled child.

If a parent is raising a child alone, the deduction amount doubles. When your annual income reaches 350,000 rubles, the deduction will be cancelled.

Property and social deductions.

The state will return this money if the citizen spent it for purposes that it approves:

- bought an apartment or other real estate,

- paid for treatment

- paid for education for yourself or your child,

- a child was born in the family.

Other deductions.

There are also investment, professional and deductions for transactions with securities. Read more about them in our other article.

Can a non-working disabled person receive a deduction?

No. If a citizen with a disability does not work and does not pay taxes on his income to the treasury, there is simply nothing to return the money from. Only those who paid personal income tax are entitled to a deduction - 13%.

How is the tax deduction for disabled people different from others?

Only working citizens with disabilities can receive a standard deduction of 500 rubles. They also have the right to other deductions, like everyone else.

What is the deduction amount?

The refund is calculated using the formula:

Amount to be deducted × 13%

For example, a citizen filed a deduction for studies in the amount of 83,000 rubles. The state will return 13% of this amount - 10,790 rubles.

But there are restrictions on each tax deduction; let’s look at them using the example of popular deductions.

Standard deduction.

A disabled person of groups I or II has the right to 13% of 500 rubles, or 65 rubles per month, regardless of how much taxes he paid per year. This money is added to your take-home pay.

For treatment.

15,600 rubles can be received for paying for medicines, an additional health insurance policy, treatment in a private clinic, including a dental one.

The amount may be higher if the citizen paid for treatment from the list of expensive ones. For example, for knee replacement in Moscow you will have to pay 283,000 rubles. This operation is included in the list, so you can submit the entire amount for deduction and receive 36,790 rubles. You can receive a deduction for treatment once a year.

For studying.

15,600 rubles can be received for paying for education: your own, a child under 24 years old, a brother or sister. You can also receive a tuition refund once a year.

For buying an apartment.

A citizen will receive 260,000 rubles if he bought an apartment alone, and spouses will receive 520,000 rubles if they bought an apartment while married. You can also deduct the interest that the borrower overpaid to the bank for using the loan if the apartment was taken out on a mortgage. You can submit a tax refund for the previous three years. The law allows you to receive this refund only once in your life.

What are the personal income tax benefits for disabled people of groups 1, 2 and 3?

There is none of them. The interest rate is the same as for others - 13%. A working disabled person receives a salary minus personal income tax. This tax has already been paid by the employer before the salary is paid.

Instructions: how to apply for a deduction for a disabled person

Standard deduction.

To receive a deduction of 500 rubles in the form of a salary increase, a disabled person must send a completed application to the employer’s accounting department.

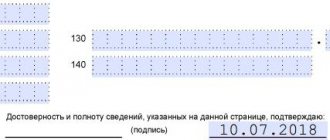

If you decide to file a deduction for last year with a one-time payment, and not as an increase in salary, you can do so through your personal account on the tax office website. Documents needed:

- Declaration 3-NDFL - can be filled out on the Federal Tax Service website;

- certificate of disability - it is given after a medical and social examination;

- Certificate 2-NDFL - obtain from your employer.

Deductions for treatment.

Documents needed:

- certificate in form 2-NDFL - take it from an accountant at work or save it from your account on the tax website, in the “Income” section;

- contract from the clinic;

- certificate of payment from this clinic. You can obtain this document from the reception or accounting department of the clinic. Show your passport, TIN, contract, receipts;

- a copy of the institution's license.

If you bought medications, find the form on which the doctor wrote the prescription and the receipt for the purchased medications.

You will not be able to receive a deduction for treatment through your employer - only on your own:

- by registered mail,

- in person at your local branch,

- through your personal account.

Study deduction.

Collect documents from this list:

- application for deduction;

- a copy of the license for educational services;

- if we are talking about a university - a certificate stating that the studies are full-time;

- a copy of the agreement on paid services;

- copies of checks or originals. Canceled receipts are also suitable;

- if you paid for kindergarten - a copy of the birth certificate, if it is a paid kindergarten. If the university is a copy of your passport;

- certificate 2-NDFL;

- Declaration 3-NDFL.

If you apply for deduction through your employer, you will receive a certificate in your personal account of the Federal Tax Service. Go to the “Life Situations” section, and then to “Documents and Certificates”:

Attach documents from the list above and receive the result within a month

Housing deduction.

Gather these documents:

- application for property deduction - send through your personal account on the tax website;

- a certificate from Rosreestr stating that the housing is registered in your name;

- a copy of the share participation or purchase and sale agreement;

- an act confirming that the apartment has been accepted;

- copy of passport;

- if the apartment was taken out on a mortgage, scan the loan agreement, the repayment schedule and a certificate of interest paid.

If you plan to return personal income tax through your employer, give your accountant a notice of the deduction. Complete the document on the Federal Tax Service website in your personal account. Don't forget to attach scans from the list above.

If you plan to receive the deduction yourself, it is most convenient to do this in the taxpayer’s account. Fill out the 3-NDFL declaration there, attach scans of the necessary documents and send for verification. The answer will be within three months.

Where to go if your refund is denied or delayed

To complain about a decision or inaction of a tax officer, go to the Federal Tax Service website in the “Complaints” section. To do this, on the main page, find the “Life Situations” section.

Select "Other situations":

There you will see “Complaint about acts, actions (inaction) of officials.” Go ahead and fill out the fields.

The tax authorities will give a response within 15 days.

Remember

- Only those who paid income tax can receive a tax refund. Most often, this is a payroll tax.

- Working disabled people of groups I and II can receive a standard deduction. The amount is fixed - 65 rubles per month.

- The maximum refund amount for treatment or training is 15,600 rubles.

- If you buy an apartment alone, the deduction will be up to 260,000 rubles. If spouses bought - 520,000 rubles. You can also get a deduction for interest paid to the bank.

- If you are not satisfied with the deduction decision, you have the opportunity to complain. The most convenient way is through the tax website.

- There are no personal income tax benefits for disabled people.