Individual entrepreneur without employees: SZV-M

Any businessman has the right to run his own business or hire hired personnel. The law allows the conclusion of both labor and civil agreements with such persons.

The law does not establish that an individual entrepreneur without employees must pass the SZV-M. This rule also applies in 2021. There are two reasons for this:

- a businessman has no employees, as well as performers, contractors, etc.;

- the merchant is not registered as an insurer in the Pension Fund system.

If the above conditions are simultaneously met, the SZV-M form for individual entrepreneurs without employees loses all meaning, since there is no one to show in it.

The issue of zero SZV-M for individual entrepreneurs who conduct business on their own is resolved by itself. Pension Fund employees do not need empty forms of this report that do not contain any useful information. Thus, for individual entrepreneurs, zero SZV-M in 2021 is a closed question.

There is no need to submit a zero individual entrepreneur report only for yourself!

Penalties

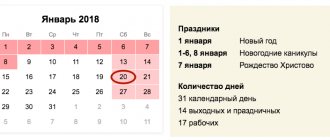

Policyholders must submit a report for each past month. The form must be submitted no later than the 15th day of the month following the reporting month. If the last day for submitting the SZV-M falls on a weekend, the deadline is moved to the first working day following the weekend. That is, if the reporting day falls on Saturday or Sunday, then the deadline for filing is moved to Monday, unless this day is a holiday.

Despite the extension of deadlines and the fact that the accountant now has more time to prepare reports, many delay submitting the document to the Pension Fund and prefer to do it on the very last day. Such behavior is risky, since a Pension Fund employee may discover an error or inaccuracy in the report and for this reason refuse to accept it.

As for submitting a report before the end of the reporting period, such an action is permitted under the current legislation, however, it is also undesirable. This is due to the fact that a new employee can be hired not only at the beginning or middle of the month, but also on its very last day. In this case, you will have to submit repeated supplementary reports to the Pension Fund.

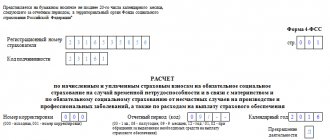

Form SZV-M

If the reporting documents are not submitted to the Pension Fund within the established terms, the legislation provides for the imposition of administrative liability on the organization for this. In such a situation, you will have to pay a fine of 500 rubles, and this amount will be assigned for each employee whose information is not provided on time.

Failure to submit a report is not the only action of the employer that entails unpleasant consequences: a fine is also threatened if the report is submitted, but the information provided is not true or is erroneous. It will be possible to avoid punishment only if the inaccuracy is noticed by the head of the company before it is discovered by the Pension Fund employees.

Only individual entrepreneurs without employees are exempt from the obligation to submit such reports. If the company has a general director and its founder at the same time, and there are no other employees, then the report should be submitted only to him.

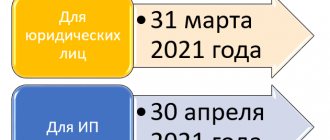

All firms must provide SZV-M no later than the 10th day of the month following the one for which data is included in the report. That is, for example, information to the Pension Fund for September 2021 is provided until October 10.

The report must be completed by a responsible person, appointed by the manager, who has access to contracts concluded by the organization. As a rule, this is an employee of the accounting or human resources department.

The form includes 4 sections, each of which must be completely filled out.

- Details of the insuring organization.

- Indication of the reporting period.

- Code designation of the form.

- Information about the insured persons.

For erroneous or incomplete data presented in the report, the organization faces a fine of 500 rubles. This amount is accrued for each hired citizen whose details are not indicated in the SZV-M. Thus, if a company employs 10 individuals, the fine will be 5,000 rubles.

There are no instructions from the Pension Fund for entering data into the SZV-M form, but some clarifications are provided in the sample.

This is a required section of the report. Information about the organization is indicated here, namely:

- number assigned upon registration with the Pension Fund;

- short name of the company;

- TIN;

- Checkpoint.

The reporting period is the calendar month for which information about insured persons is submitted. The figure is entered in accordance with the generally accepted report. For example, when submitting reports for June, you should enter the value “06”.

The deadline for providing data is no later than the 15th day of the month following the reporting month, unless this date falls on a weekend or holiday. See the table for the deadlines for submitting a report in the SZV-M form in 2016-2017.

| Month for which the report is submitted | Deadline for submitting the report |

| December 2016 | 16.01.2017 |

| January 2017 | 15.02.2017 |

| February 2017 | 15.03.2017 |

| March 2017 | 17.04.2017 |

| April 2017 | 15.05.2017 |

| May 2017 | 15.06.2017 |

| June 2017 | 17.07.2017 |

| July 2017 | 15.08.2017 |

| August 2017 | 15.09.2017 |

| September 2017 | 16.10.2017 |

| October 2017 | 15.11.2017 |

| November 2017 | 15.12.2017 |

| December 2017 | 15.01.2018 |

There is no law prohibiting filing reports earlier. However, if the completed SZV-M is sent before the end of the reporting month, and the company during this period hires or enters into a civil contract with the insured person and does not include him in the report, this will be considered a violation.

Block "Form type"

Here you need to write a code that indicates the type of report provided. There are only three such codes for designating the SZV-M form:

- Initial (the code “source” is entered) – the initial report. This code is written if information is provided for the first time in the reporting month.

- Supplementary (the code “additional” is entered) is a report that contains information about those insured individuals who were not listed in the original form. This code must also be entered if the first report contained inaccurate information about individuals.

- Cancellation (the code “cancel” is entered) is a form that indicates that all the data provided in the initial report is incorrect and should be written out from the Pension Fund database. For example, this may indicate a private person with whom the employment agreement was terminated before the beginning of the reporting month, and data about him was mistakenly included in the initial report.

The insured persons and their personal data are listed here. The report states:

- Full name of the individual (filling in the middle name, if it appears in the passport, is required);

- SNILS (required);

- TIN (registered if the organization has this data).

Explanations for the SZV-M form in 2016-2017 do not have instructions regarding putting dashes in the form if the company does not have any data about the individual. Therefore, if the TIN is not known, this field should be left blank.

When submitting SZV-M reports on paper, the head of the organization must affix a personal signature and the company seal (if there is one). When reporting is submitted electronically, an electronic signature of the head of the company or individual entrepreneur is required.

The SZV-M report form implies an indication of the position of the manager. If the form is filled out by an individual entrepreneur, there is no clarification as to whether he needs to enter anything in this field. However, the entrepreneur’s personal signature with a transcript is required.

It is logical to assume that individual entrepreneurs must submit a zero SZV-M if there are no employees, and contributions to the Pension Fund are paid in a fixed amount “for themselves.” But this assumption is wrong: if an individual entrepreneur does not have employees, he should not submit a zero report to the Pension Fund at all.

You can fill out the SZV-M on the PFR website online or on other online services of accounting software developers - Moe Delo, Kontur, Nebo and others. Some sites allow you to do this freely, but usually the services require a small fee (up to 1000 rubles).

If you look at the contents of this form, among the required details you can see:

- registration number with the Pension Fund;

- name of organization/individual entrepreneur;

- tax identification number;

- checkpoint;

- the period for which the report was submitted;

- form type.

It is logical to believe that in fact an organization cannot exist without employees. Therefore, it must reflect information at least about its general director.

Economic entities may be faced with a situation where they need to suspend activities. In this case:

- there is staff;

- he does not perform labor functions;

- The accounting department does not calculate insurance premiums.

As a result, it is not clear whether it is necessary to submit a zero SZV-M in 2018, in which the “Information about insured persons” block should be left empty.

1. Those working under an employment or civil contract.

2. Receiving income from the enterprise.

In July 2021, additional clarifications from the Pension Fund appeared on whether zero reporting is submitted to SZV-M for the general director. According to them, if a company, for certain circumstances, does not conduct financial and economic activities, there is no need to submit a zero SZV-M to the general director without an agreement.

As was said, the question of whether the “Information about insured persons” section can be left blank did not have a clear answer for a long time. Companies still submitted a zero SZV-M, which reflected information only about the general director.

According to the letter of the Ministry of Labor dated July 7, 2021 No. 21-3/10/B-4587, which was signed by Deputy Minister A.N. Prudov, officials considered the situation when the general director does not enter into an employment contract with the organization and does not receive income.

Based on these explanations, we can conclude: when the general director - who is also the founder and the only employee - did not sign an employment contract with the enterprise and did not receive cash payments, the organization does not file reports on the insured persons.

The central office of the Pension Fund responded to the position of the Ministry of Labor and changed its mind. According to the PFR letter No. LCh-08-26/9856 dated July 13, 2016, in such situations the SZV-M report does not need to be submitted.

- for each employee with whom an employment contract was concluded or continues to be valid in the month for which the SZV-M is submitted;

- for each individual with whom, in the month for which the SZV-M is submitted, a civil contract for the performance of work and provision of services (author’s order agreements, agreements on the alienation of the exclusive right to works of science, etc.) was concluded/continues to be valid/terminated. Information is provided on such persons if the remuneration paid to them is subject to insurance premiums in accordance with the legislation of the Russian Federation.

| Position 1 | Position 2 |

| There cannot be a zero SZV-M in principle. If not a single person is included in the form for December, then submitting such an empty SZV-M loses all meaning. No one needs blank forms because they do not contain the necessary information. | The PFR branch in the Altai Territory on August 1, 2017 said this: even when there are no hired employees, the policyholder still submits SZV-M. But without a list of insured persons. |

- If there are incorrect data, you need to send a cancellation form.

- Late submission of the report to the Pension Fund.

Individual entrepreneur with employees: SZV-M

If you have hired personnel (even just one person), whether you need to take the SZV-M IP is beyond doubt. Of course yes. In this case, a businessman becomes an insured when:

- there are employees under an employment contract;

- and/or makes payments and rewards under civil agreements.

Please note: previously it was necessary to independently register with extra-budgetary funds as an employer-insurer. The law gave 30 calendar days for this from the date of conclusion of the individual entrepreneur agreement with the first of the hired employees. Which automatically gives an understanding of whether individual entrepreneurs submit the SZV-M form. But since 2017 the rules have changed. During state registration, the relevant tax office will itself report to the Pension Fund the data on the businessman from the Unified State Register of Individual Entrepreneurs (USRIP) within three working days (new edition of Article 11 of the Law on OPS No. 167-FZ).

We found out whether IP SZV-M is accepted. Now let's talk about filling out this report.

It depends only on the existence of concluded labor and civil law agreements whether individual entrepreneurs must take the SZV-M. Whether payments are made for them, whether duties are fulfilled, whether the individual entrepreneur conducts business at all does not matter.

What will filling in a zero SZV-M look like?

Step-by-step instructions for filling out the SZV-M.

The first part assumes the presence of details about the employer, they are available and filling out in a special software product occurs automatically.

Next comes the second part, which indicates the reporting period. It is usually formed when selecting from the provided directory in the program. Please note that the data must be filled in when generating the report itself.

In the third part you need to select the form type. Even if you indicate the original type, there is no data to fill out the fourth section, that is, a table indicating working individuals. This is due to the fact that the employer has no employees, so there is no one to show.

The program itself assumes that the employee table must be filled out. Otherwise, the report simply will not be saved. This means that you need to show at least one employee, and if they are not there, then the report should not be generated.

How to fill out SZV-M for individual entrepreneurs in 2021

According to our information, the sample for filling out the SZV-M form for individual entrepreneurs will not undergo major changes in 2021. The form and rules remain the same. It is only necessary to take into account some features of the individual entrepreneur status.

So, it should be noted that it is the entrepreneur who submits the report. For this:

- in the column “Name (short)” you must remember to make a note - “IP”;

- in the column about the position - indicate that the report is signed by the individual entrepreneur.

All hired personnel of the individual entrepreneur are listed in the fourth section of the report. At the same time, there is no need to include yourself in SZV-M, since the individual entrepreneur does not enter into an employment contract with himself! Otherwise, there are no fundamental features of filling out an individual entrepreneur’s report.

For more information about this, see the article “SZV-M: filling out information about the insured persons.”

Here is a sample of a completed report.

Below is a sample of filling out the SZV-M for individual entrepreneurs.

Read also

20.10.2016

Does it make sense to take SZV-M without employees in 2021

The SZV-M report will be practically empty in the absence of employees. It makes no sense to take it and hand it over to the Pension Fund. Although not everything is so simple.

At the legislative level, the situation is not directly regulated if there are no employees: is it necessary to take the SZV-M?

If you look at the contents of this form, among the required details you can see:

- registration number with the Pension Fund;

- name of organization/individual entrepreneur;

- tax identification number;

- checkpoint;

- the period for which the report was submitted;

- form type.

Of course, the first 3 sections cannot be left empty:

In the 4th section of the SZV-M form, a list of insured individuals with whom an employment or civil law contract has been concluded and is valid. And also personal information for each: SNILS and INN. An example is shown below:

It is logical to believe that in fact an organization cannot exist without employees. Therefore, it must reflect information at least about its general director. However, this approach still does not give an unambiguous answer to the question of whether it is necessary to take the SZV-M if there are no employees, or not.

Features of delivery of SZV-M to the Pension Fund of Russia

You can submit a report:

- By personal contact with the Pension Fund. Only those organizations and individual entrepreneurs whose average number of employees does not exceed 24 people submit a report on paper.

- By mail: the report must be sent by registered mail with a list of attachments. The date of submission of the SZV-M will be the date the letter was sent.

- In electronic form. If the number of employees is 25 people or more, the report can be sent to the Pension Fund only in electronic form via TCS (telecommunication channels) through EDI (electronic document management) operators. Signed by SZV-M with a qualified electronic digital signature.

SZV-M must be sent in xml format. If it is generated in a different format, the Pension Fund will not accept it.

When submitting a report in electronic form, it is considered accepted after receiving confirmation from the Pension Fund. If confirmation is not received, the report is not considered accepted.

Who submits a report on the SZV-M form in 2021

SZV-M is required to be submitted by employers who have full-time employees drawn up under contracts, from whose payments insurance premiums for pension insurance (PII) are paid.

Such agreements include, in particular:

- employment contracts;

- civil contracts, the subject of which is the performance of work or provision of services;

- copyright agreements;

- agreements on the alienation of exclusive rights to works of science, literature, and art;

- publishing licensing agreements;

- licensing agreements granting the right to use works of science, literature, and art.